Hey!

It looks like Capital One’s acquisition of Discover is a done deal. The acquisition will make Capital One the largest credit card lender in the U.S., will turn it into one of the largest deposit franchises, and will create a payments network equal in size to American Express. However, I don’t think this story will end with the acquisition.

American Express commands a premium valuation multiple. If Capital One's stock were repriced to a similar multiple, it would create more shareholder value than any synergies from the merger. But getting there will require Capital One to figure out how to compete with American Express in the affluent segment.

Can they succeed in this? They will certainly try! And this will be one very exciting rivalry to watch.

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

Two financial stocks rallied the day when Trump won the election: Coinbase (+31%) and Discover (+21%). The new administration brought optimism to the crypto industry and is expected to be open to M&A deals. One of these M&A deals is Capital One acquiring Discover. Discover’s stock price action suggests that investors had finally come to believe this deal would happen.

Since then, Discover has submitted restated financials (the SEC was not happy with how the company disclosed card misclassification charges), which was the final step for Capital One and Discover to put the acquisition for the shareholder vote. Thus, we should expect the merger to be completed in Q1 2025.

The SEC has asked Discover to file a restatement of their financials. When the SEC approves that, the two companies will put out a proxy and then it's about 40 to 45 days from there that there's a shareholder vote. So we're talking about the early part of next year.

Richard Fairbank, Goldman Sachs 2024 US Financial Services Conference

I think it is worth revisiting the rationale behind this acquisition because I believe the true ambition is to challenge American Express. Capital One agreed to pay 1.0192 Capital One shares for each Discover share (all-stock deal), which at the time of the announcement was about $35 billion. As of this writing, the deal is worth $45.7 billion. So why Capital One is buying Discover (as per their announcement):

✔️ Building a Globally Competitive Payments Network✔️ Combining Complementary Card Businesses✔️ Scaling our "Digital First" National Bank

Discover is a singular opportunity. It will create a consumer banking and global payments platform with unique capabilities, modern technology, powerful brands and a franchise of more than 100 million customers.

Richard Fairbank, Capital One, Q2 2024 earnings call

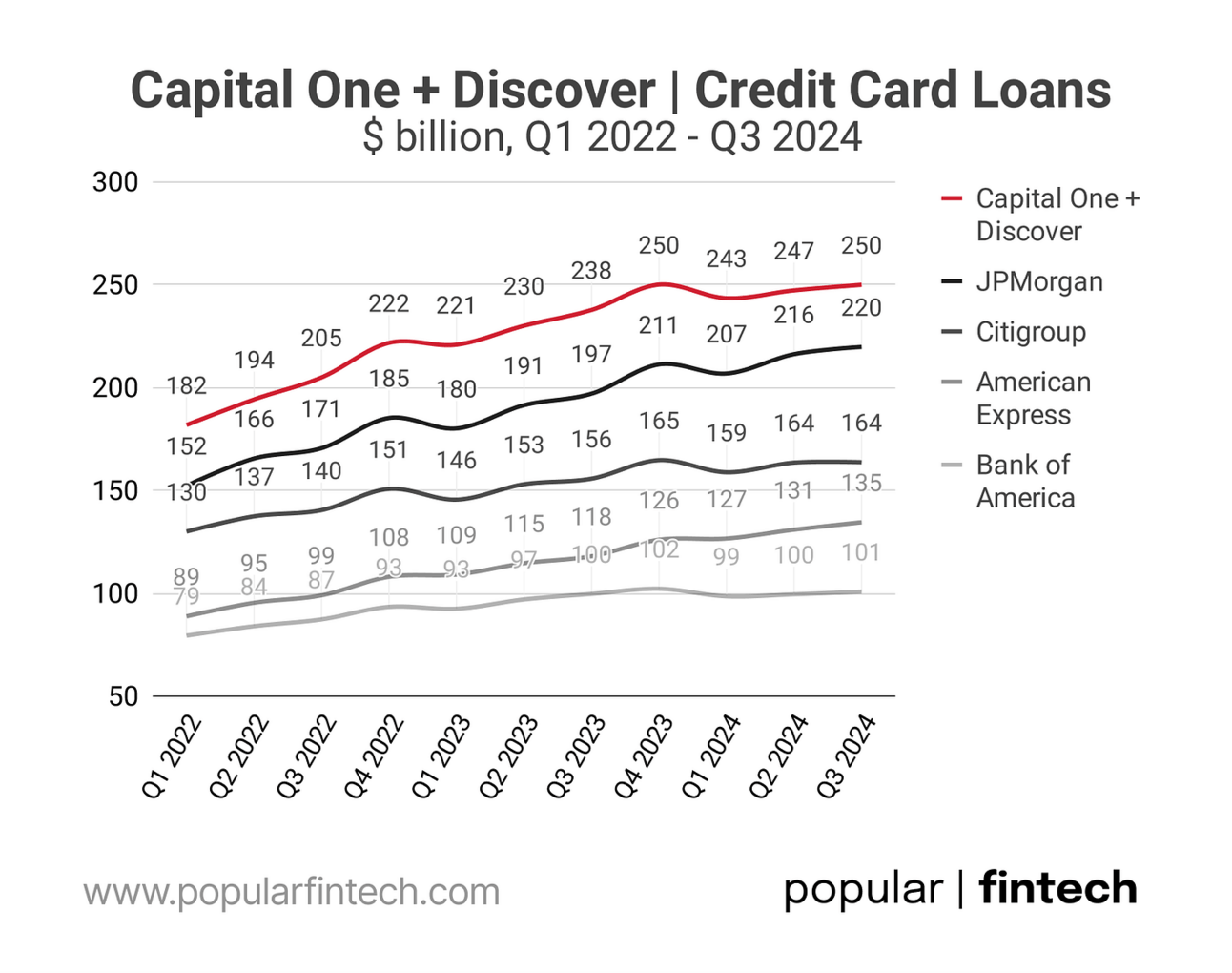

Let’s start with “complementary card businesses”. The acquisition of Discover will make Capital One the largest credit card lender in the United States. The combined credit card loan balance (only U.S. loans for Capital One) stood at $250 billion. The acquisition will dethrone JPMorgan Chase.

Discover also has a less risky loan portfolio if we use the average borrow FICO score as a measure. Thus, at the end of 2023, 32% of Capital One loans were issued to borrowers with a FICO score below 660. Only 20% of Discover loans were issued to such borrowers. Thus, the acquisition expands Capital One’s footprint in a more affluent borrower segment. It should also allow Capital One to take on more risk, as the average risk (or FICO score) for the combined portfolio will decrease.

When it comes to “building a national bank”, Discover does not operate any branches (Capital One operates 256 branches and 55 Capital One Cafes). However, it offers high-yield savings accounts, so Capital One is acquiring deposits. At the end of Q3 2024, the combined entity would have $463 billion in total deposits, which is minuscule compared to the deposits held at money center banks….

…but will make Capital One the 6th largest commercial bank in the U.S. in terms of deposits, just behind the money center banks and U.S. Bank. If they keep the momentum of deposit growth, they could overtake U.S. Bank and become the largest non-GSIB bank in the U.S. Capital One will also dwarf American Express that had $135 billion in deposits at the end of Q3 2024.

However, Richard Fairbank, Capital One co-founder and CEO, emphasized multiple times that the key reason they are buying Discover is the network. Discover is the smallest of the four major payment networks in the U.S. The thesis is that by moving its card portfolio to Discover, Capital One could help the network scale up and grow.

The network is a rare and valuable asset. When you think about this, there's so many financial companies, so many credit card companies, but in the United States on the credit card side, there are only 4 networks.

Richard Fairbank, Goldman Sachs 2024 US Financial Services Conference

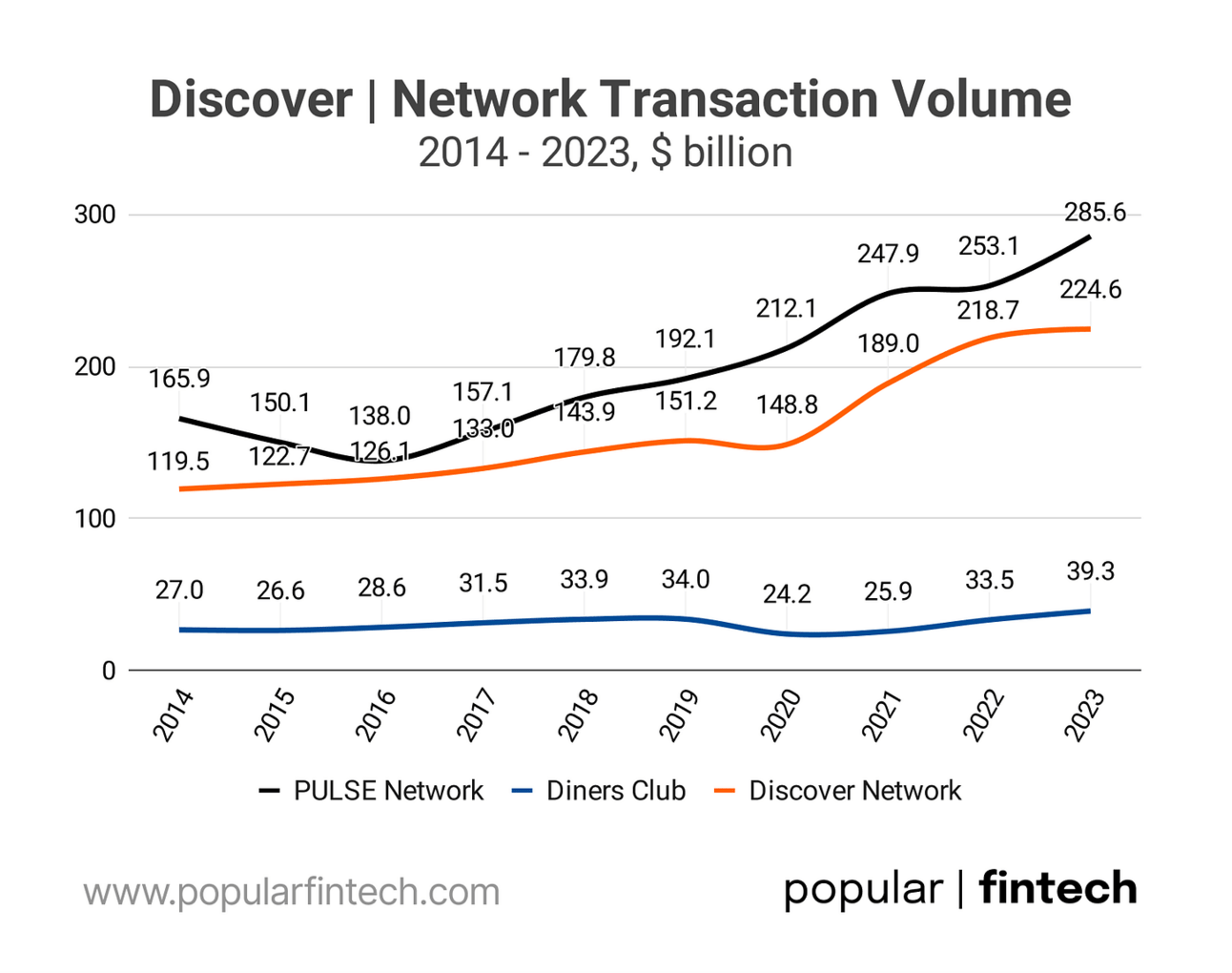

Discover actually owns three networks: credit card networks Discover and Diners Club, and a debit/ATM network PULSE. The company does not issue Diners Club cards; all debit and credit cards are issued under the Discover brand. In addition, Discover has partnered with 25 other networks, such as RuPay in India and JCB in Japan, to expand international acceptance.

In terms of the volumes, Diners Club is the smallest of the three networks. Discover licenses Diners Club to issuers outside of the U.S., so not sure what will happen to this business after the acquisition by Capital One (but I also never understood why Discover kept this brand at all).

The Discover payments network positions Capital One as a more diversified, vertically integrated global payments platform, and adding Capital One's debit spending and a growing portion of our credit card purchase volume to the Discover network will add significant scale, increasing the network's value to merchants, small businesses and consumers and driving enhanced network growth.

Richard Fairbank, Capital One, Q2 2024 earnings call

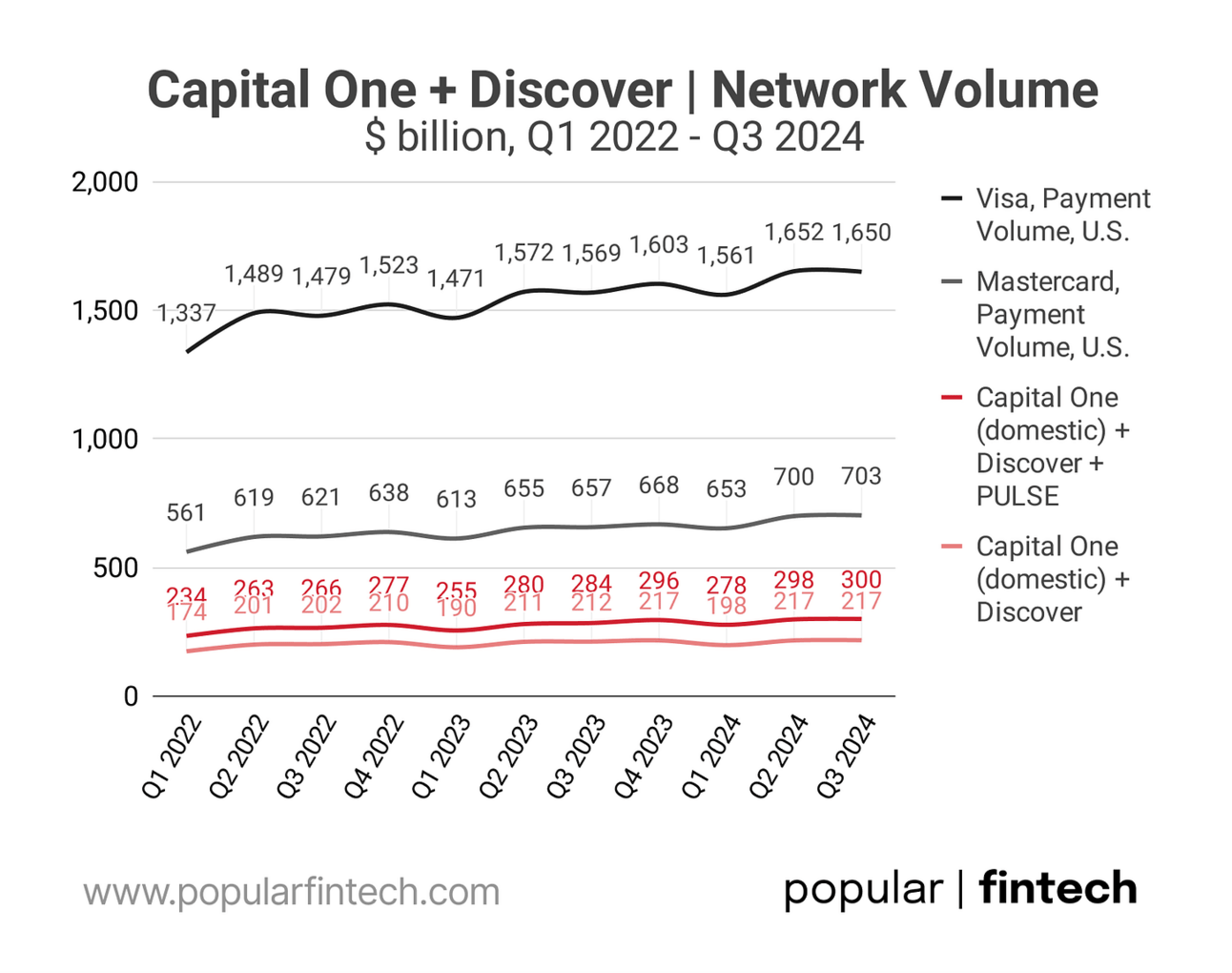

If Capital One moved all of its card volume, including debit and credit, to the Discover network, it would still be a small network compared to Visa and Mastercard. Even excluding volumes outside of the U.S., both Visa and Mastercard would dwarf the combined Capital One and Discover network. Visa and Mastercard will lose an important client when Capital One migrates to the Discover network, but I don’t believe this will pose a threat to their dominance.

However, the Discover network would be of comparable size to American Express. Thus, Capital One domestic card volume + Discover volume + PULSE volume is about the same size as American Express U.S. Consumer + Commercial Services billed business. American Express would be a bit bigger if we add the “processed volume”, or third-party issuer volume.

We love their underlying reality of acceptance. What we need to do is go out and build the network brand, the credibility and in a sense, this is a utility that's going to be accepted everywhere. We believe that's a very doable thing.

Richard Fairbank, Goldman Sachs 2024 US Financial Services Conference

The combined Capital One and Discover will be a bigger lender, a bigger deposit franchise, and a similar size network as American Express. So should the be priced as American Express? (American Express trades at 21.1.x forward P/E multiple, Capital One trades at 12.1x) I think achieving this will require more than just a bigger scale; it will require tapping into a more affluent customer segment.

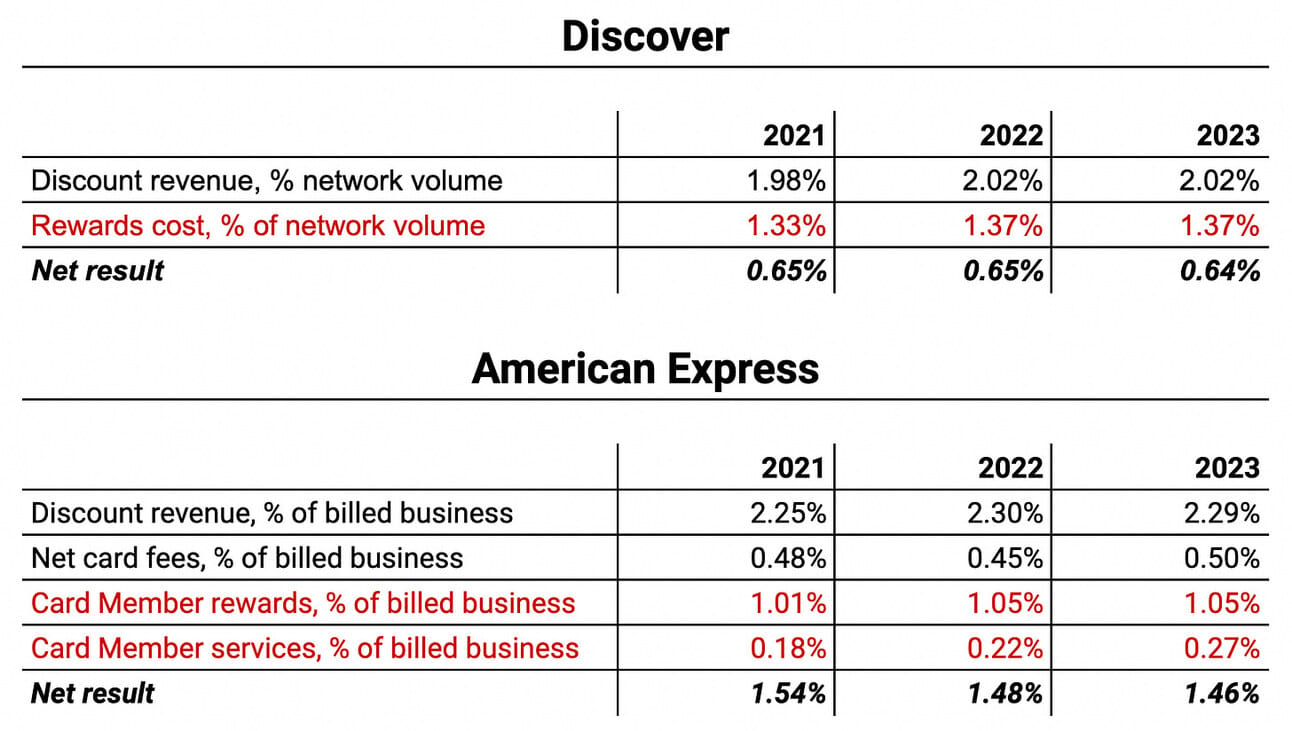

American Express charges merchants higher fees, and on top of that, generates considerable revenue from annual card fees. Capital One and Discover don’t charge annual card fees, but can they start charging merchants higher rates because of the increased volume? Probably, yes, but it might still require proving the value to merchants.

In my “Why Discover is no American Express” I argued that the magic sauce of American Express is the outrageously high average spend by its cardholders. This “feature” allows it to command higher fees paid by the merchants, and generate disproportionally higher levels (for a credit card lender) of non-interest income revenue (less than 25% of Amex’s revenue comes from interest income).

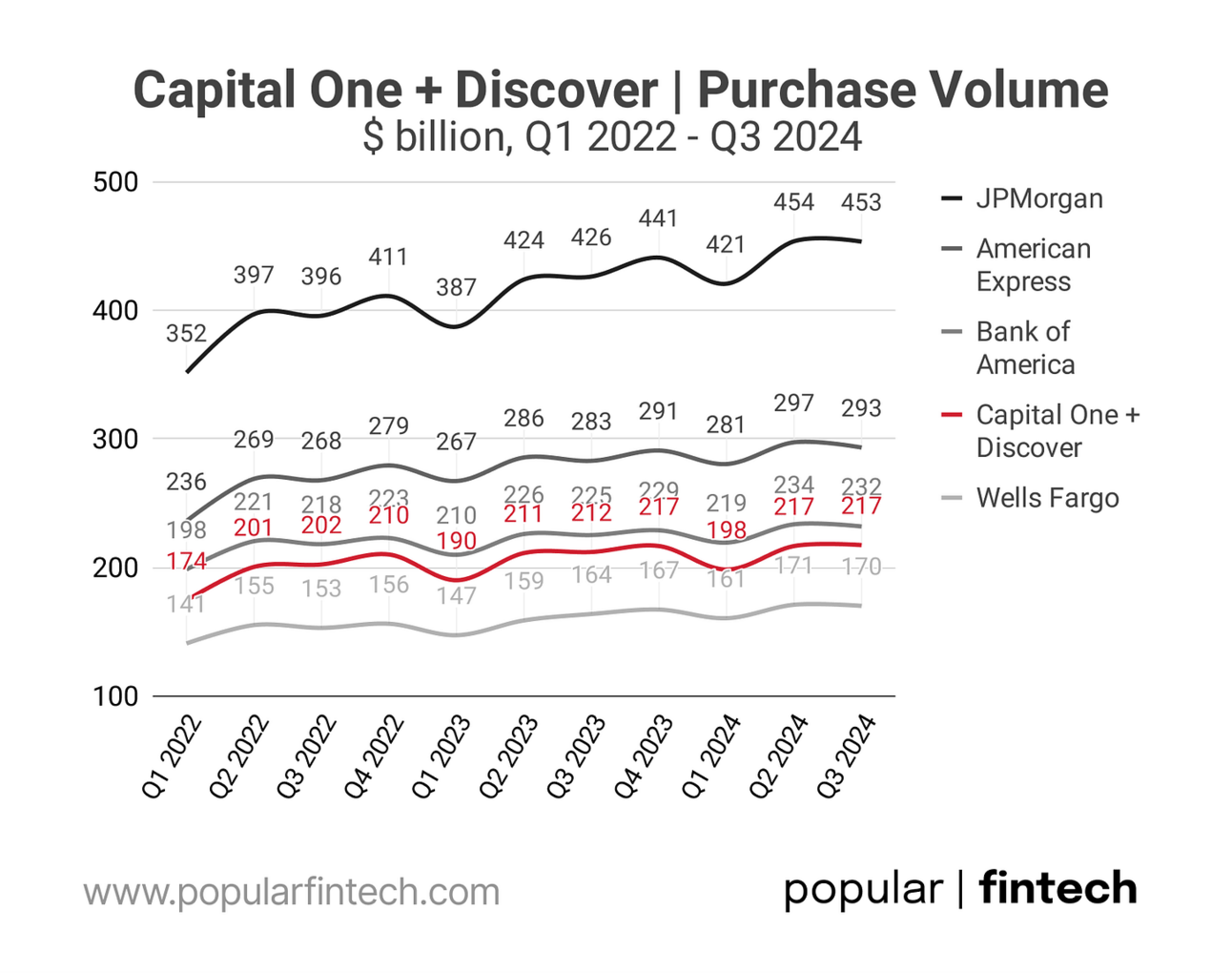

In terms of purchase volume, the combined Capital One and Discover franchise will rank 4th in the U.S. by purchase volume, behind JPMorgan Chase, American Express, and Bank of America. This gap in purchase volume is just another way to illustrate that Capital One operates in a less affluent segment.

…we are very pleased with the traction we're getting, the economics of our heavy spender business. A couple of our other competitors are very focused on the same thing. So we continue to lean into growth here, both in terms of upfront customer acquisition and our ongoing investment in brand and exclusive experiences and benefits.

Richard Fairbank, Q2 2024 earnings call

So should Capital One be valued similarly to American Express given the same business model (a three-party network), and similar scale? Absolutely not. The magic of American Express is not about its business model, but about having an affluent customer base. Can Capital One challenge American Express and steal market share in this segment? I bet they will try. Will they succeed in this? I don’t know, but this will certainly be an exciting rivalry to follow.

Cover image source: Capital One

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.