Hey!

Affirm is not just a lender, it’s also a network connecting merchants with consumers. One can study two companies to understand what the future holds for Affirm, American Express and Discover Financial Services. Both companies are lenders, but they also operate proprietary networks that compete with Visa and Mastercard.

I started writing about my long-term hypothesis for Affirm, and whether it will become the next American Express or Discover, but in the process, I realized that the difference between American Express and Discover is a topic of its own. Although the business models are fundamentally similar, they lead to different financial outcomes.

Not only American Express is a bigger company (in terms of revenue or net income), but its stock also trades at much higher multiples than Discover’s. This suggests that investors view American Express as a less risky business (or more defensible over the long term). This is my attempt to understand why.

Jevgenijs

p.s. if you have feedback or questions, just reply to this email or ping me on X/Twitter

Before we dive into discussing the differences, let’s briefly talk about what unites American Express and Discover. Both companies operate so-called “three-party schemes”, with the three parties being “the cardholder”, “the merchant” and “the issuer and the acquirer”.

Both American Express and Discover issue cards (acting as “the issuers”), and have direct agreements with merchants for acceptance of those cards (acting as “the acquirers”). In contrast, Visa and Mastercard do not issue cards themselves (cards are issued by financial institutions, or “the issuers”), and do not deal directly with merchants, instead relying on “the acquirers”, such as Worldpay or Fiserv.

American Express licenses its brand to other issuers (e.g. Square issues Amex cards for its sellers) and sometimes relies on acquirers to ensure acceptance at smaller merchants, but at the core, “three-party schemes” make money on both sides of the transaction (charging merchant for card acceptance, and charging cardholders all kinds of card-related fees) and everything in between (e.g. lending to cardholders).

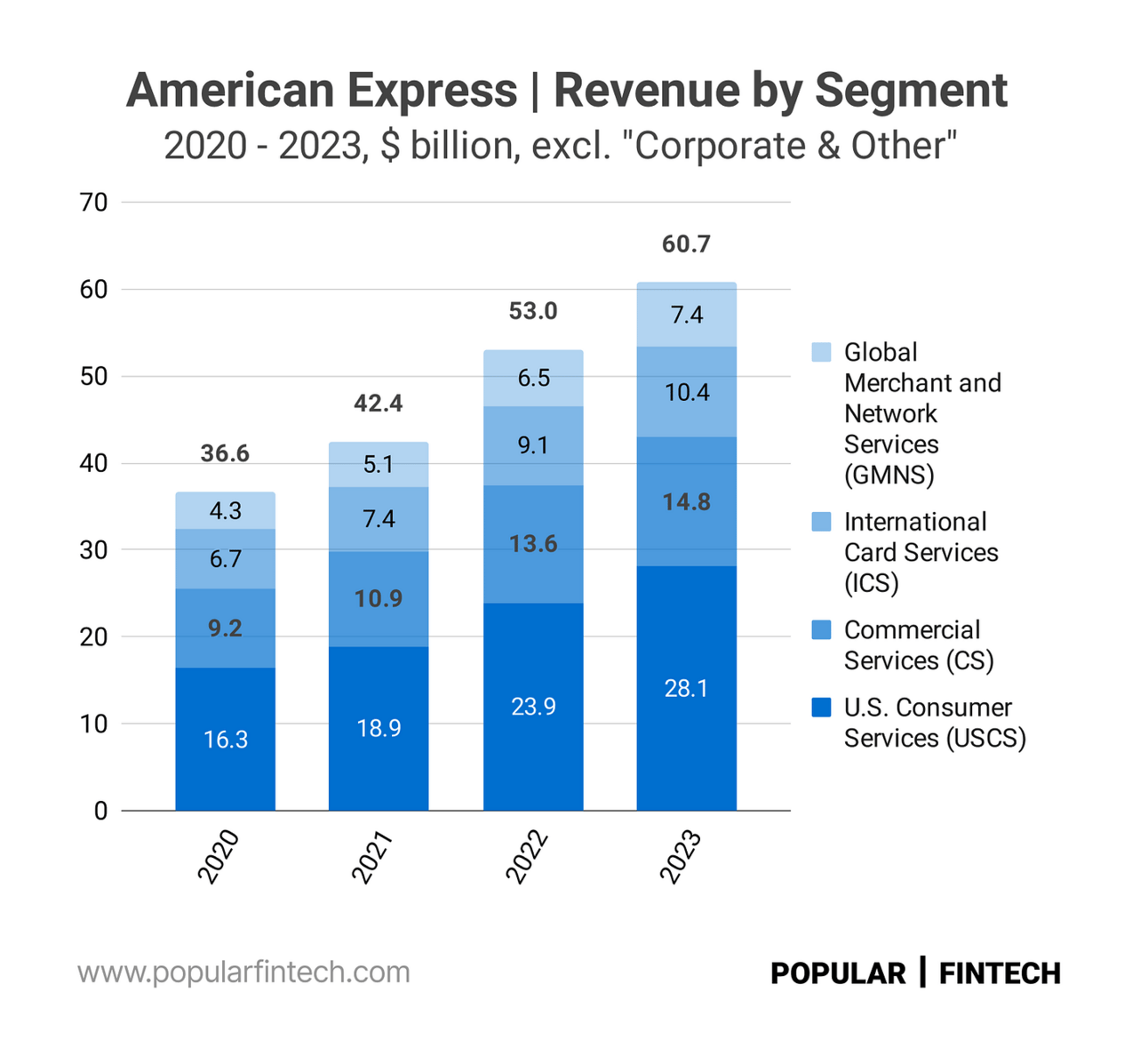

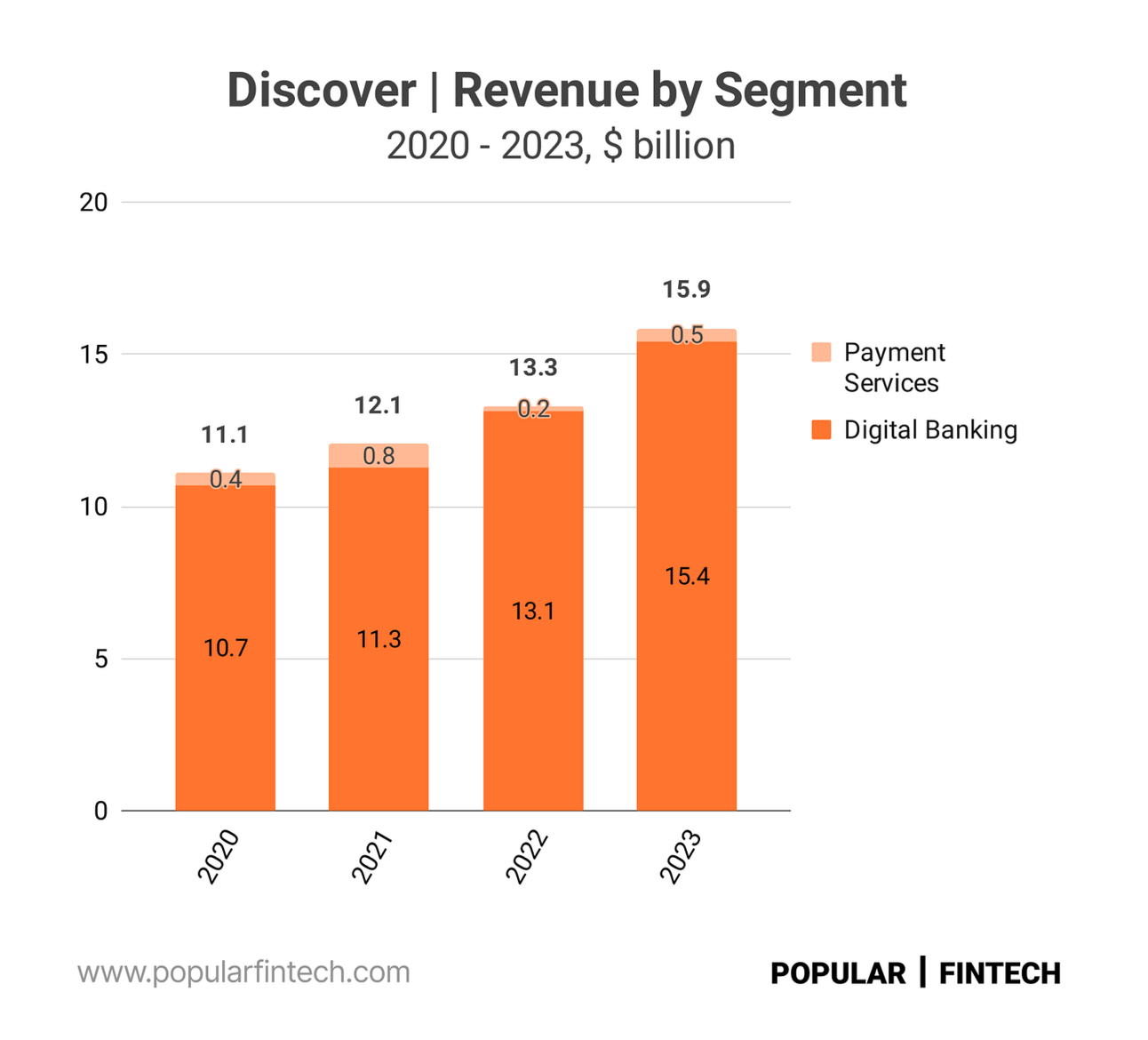

Now let’s get to the differences. American Express is a much bigger business than Discover. Thus, in 2023 American Express reported net revenue of $60.5 billion, which compares to $15.9 billion for Discover. From 2014 to 2023, American Express's revenue increased at a CAGR of 6.60%, while Discover’s revenue grew at a CAGR of 7.21%.

The first difference between American Express and Discover is pretty straightforward. Discover issues cards only to consumers and only in the United States, while American Express issues cards to consumers, small businesses, and corporate customers, as well as operates across multiple geographies.

As the chart below illustrates, American Express’s International Card Services (the company’s issuing business outside of the U.S.) and Commercial Services (the company’s commercial issuing business in the U.S.) segments contributed $25.2 billion, or almost 42% of the total net revenue in 2023.

Thus, when comparing American Express to Discover, we can only compare its U.S. Consumer Services (the company’s consumer issuing business in the U.S.) and Global Merchant and Network Services segments (the acquiring and the network part of the business). These two segments contributed $35.5 billion in revenue in 2023, or more than double Discover’s revenue.

Discover reports its results under two segments: Digital Banking and Payment Services. The Payment Services segment includes the PULSE and Diners Club networks, as well as the company’s Network Partners business, while the Digital Banking segment includes everything else (including the acquiring part of the business and the Discover network).

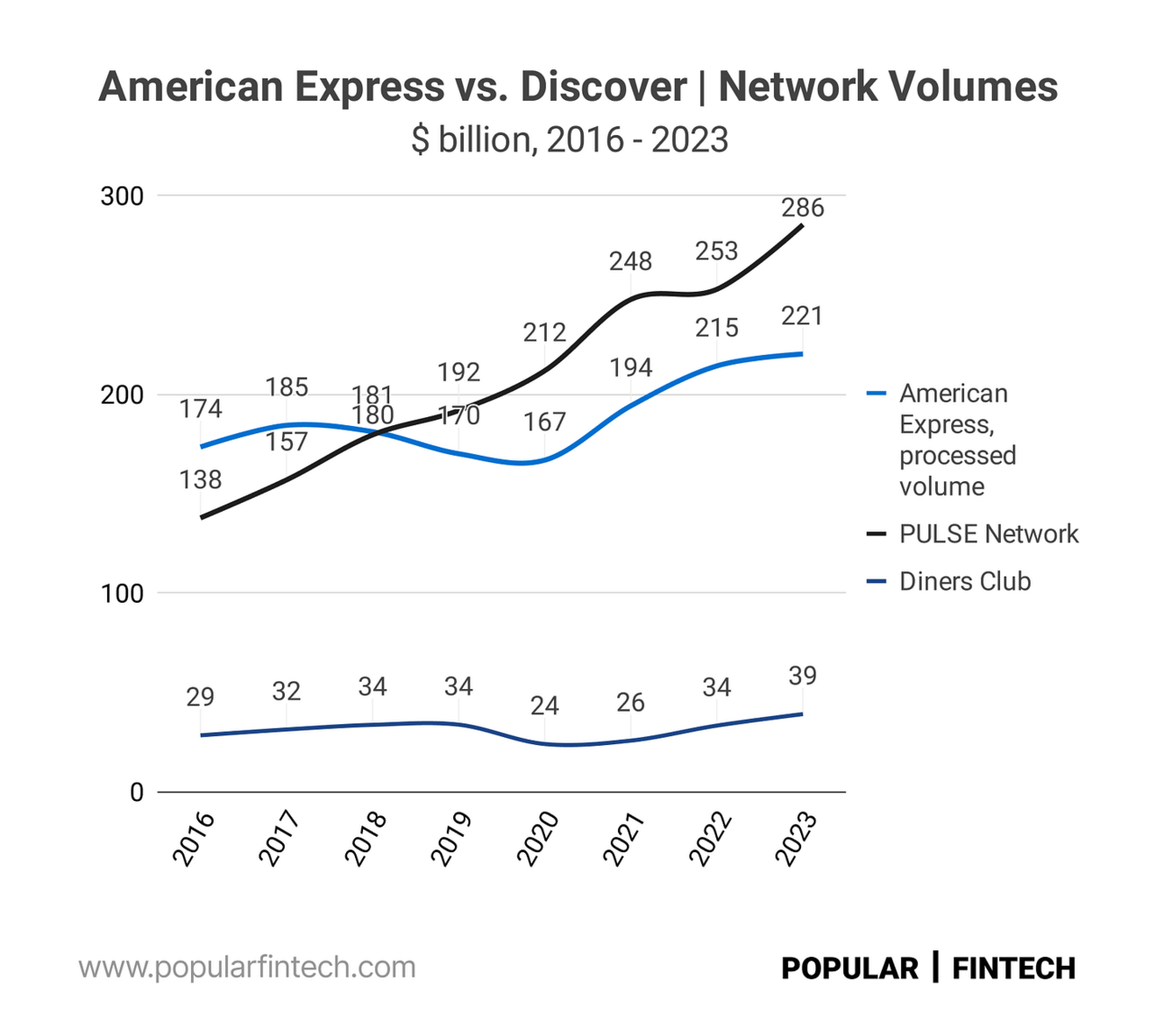

PULSE network provides debit card merchant acceptance in the United States (and ATM access globally), and Diners Club is a global payments “network of licensees, which are generally financial institutions, that issue Diners Club branded charge cards and provide card acceptance services.” Thus, PULSE is a business that is unique to Discover, while Diners Club is similar to American Express’s third-party licensing.

“We do not directly issue Diners Club cards to consumers, but grant our licensees the right to issue Diners Club-branded cards and/or provide card acceptance services.”

Discover Financial Services, 2023 Annual Report

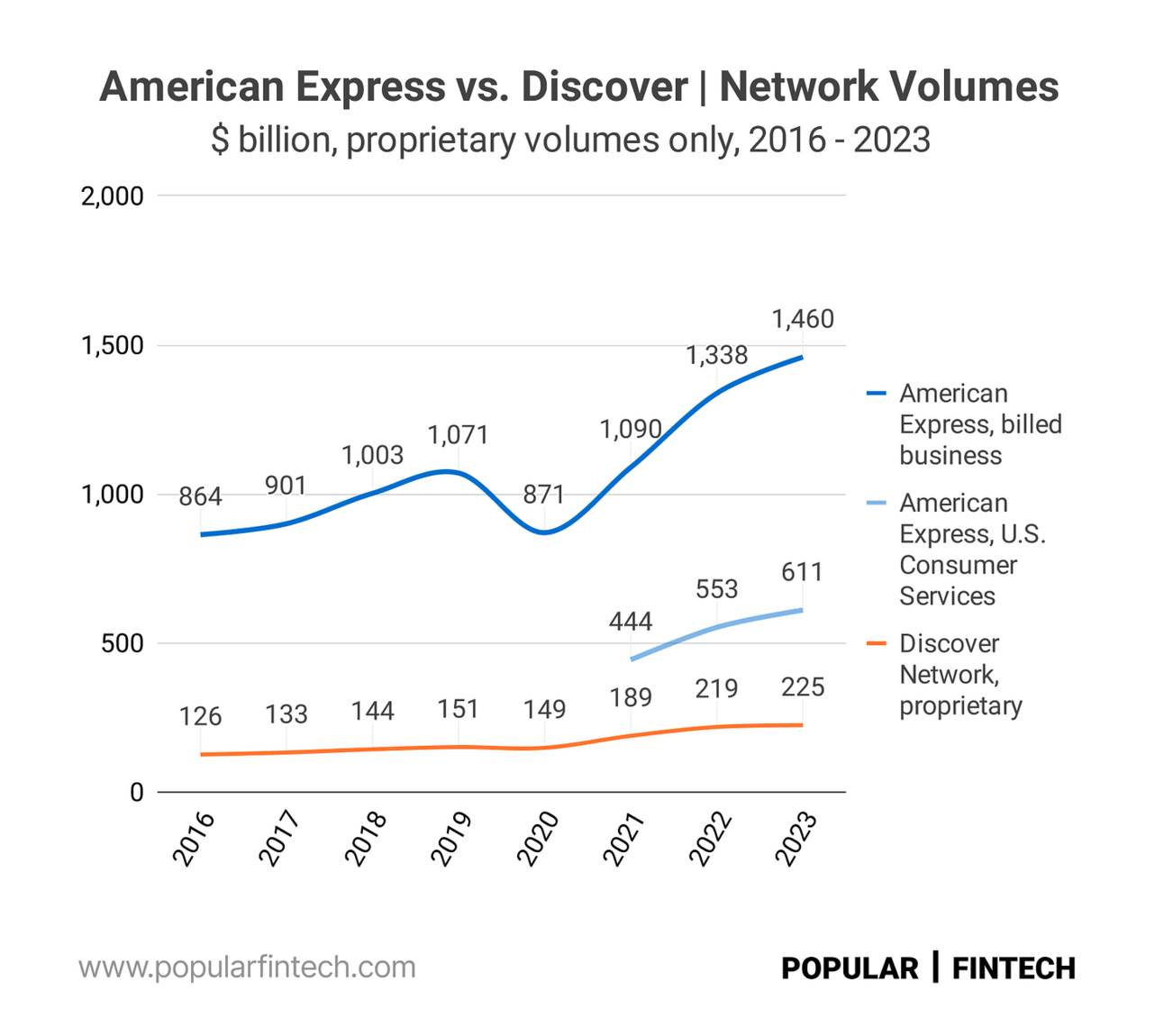

American Express is also a bigger company in terms of network volume, which is the value of processed card transactions.

As you can see on the chart below, in 2023, American Express’ “billed business” volume (payment volume with American Express proprietary cards) was $1.46 trillion, compared to $225 billion of proprietary volumes on the Discover network.

Payment volume contributed by Amex’s U.S. Consumer Services segment (proprietary U.S. consumer cards) was $611 billion, which is 2.7 times larger than the payment volume on the Discover network.

American Express reports payment volume generated by cards issued by third-party issuers as “processed volume”. Thus, in 2023, third-party issuers contributed $221 billion the Amex’s network volume. For comparison, Diners Club card issuers contributed only $39 billion (see the chart below).

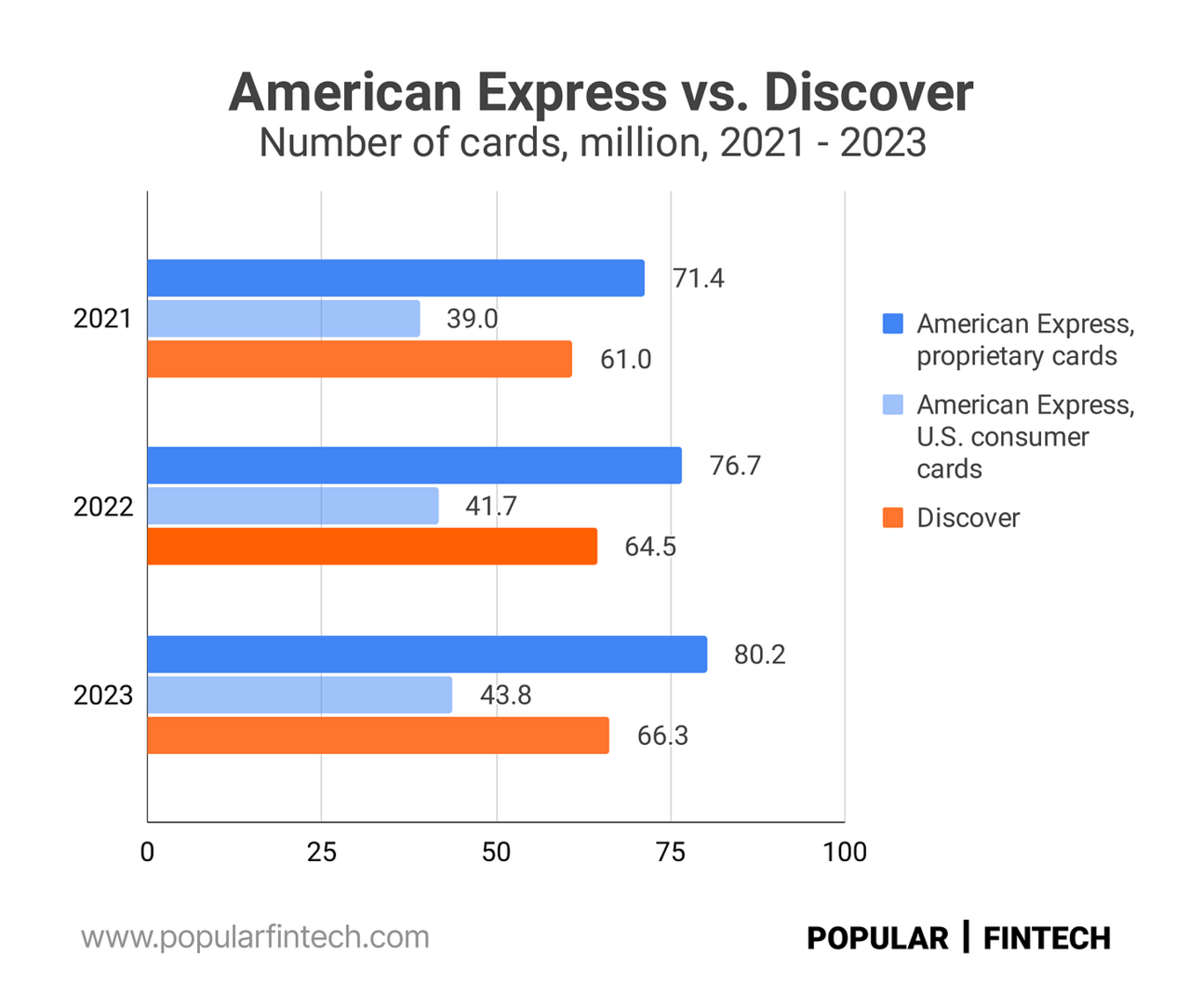

When it comes to the number of cards, American Express has more proprietary cards than Discover. Thus, in 2023, American Express had 80.2 million proprietary cards, while Discover had 66.3 million cards (per The Nilson Report data). However, if we exclude international, small business, and corporate cards, then Discover’s U.S. consumer cards portfolio is larger (43.8 million cards for Amex vs. 66.3 million cards for Discover).

Now let’s get to the valuation. As of this writing, American Express had a market cap of $174.3 billion compared to Discover’s market cap of $35.6 billion. This is not surprising given the fact that American Express, as discussed above, is a bigger business than Discover. However, there is more.

Thus, over the past 10 years, American Express stock has been trading at almost double the Price / Tangible Book, and a much higher Price / Earnings multiple (see the “mean” in the chart below).

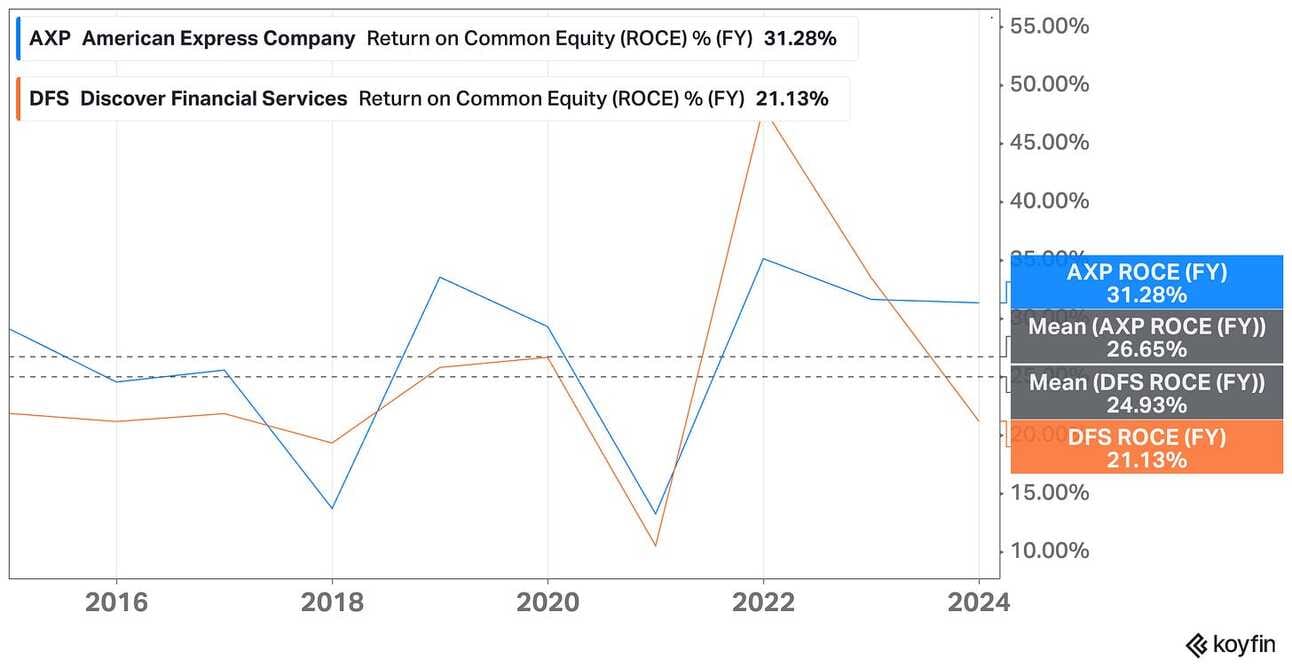

…and that is despite the fact that, over the past 10 years, Discover has delivered a similar return on common equity (ROCE) to American Express. Thus, American Express delivered an average ROCE of 26.7%, compared to Dicover’s 24.9% (see the chart below).

The difference in the multiples suggests that investors see American Express as a less risky, or more sustainable business in the long term, which, obviously, got me curious. After all, if I want to understand how investors will eventually value Affirm, I need to understand, why they value Amex and Discover so differently.

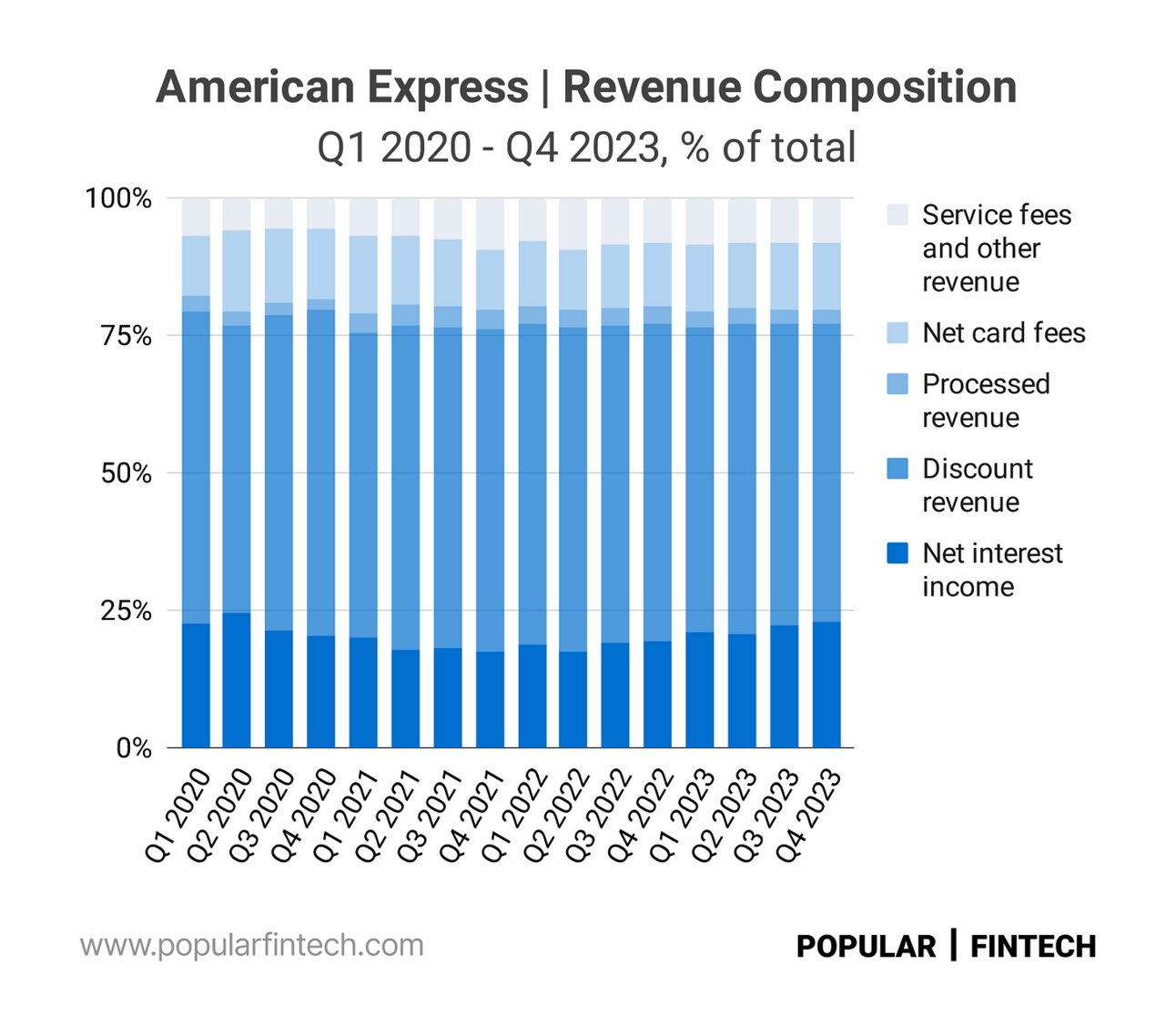

Let’s start with the revenue composition, which I believe is one of the key reasons for the difference in valuation multiples. Less than 25% of American Express’ net revenue comes from Net Interest Income (see the chart below). First and foremost, American Express is a network, that generates revenue from merchant and card fees.

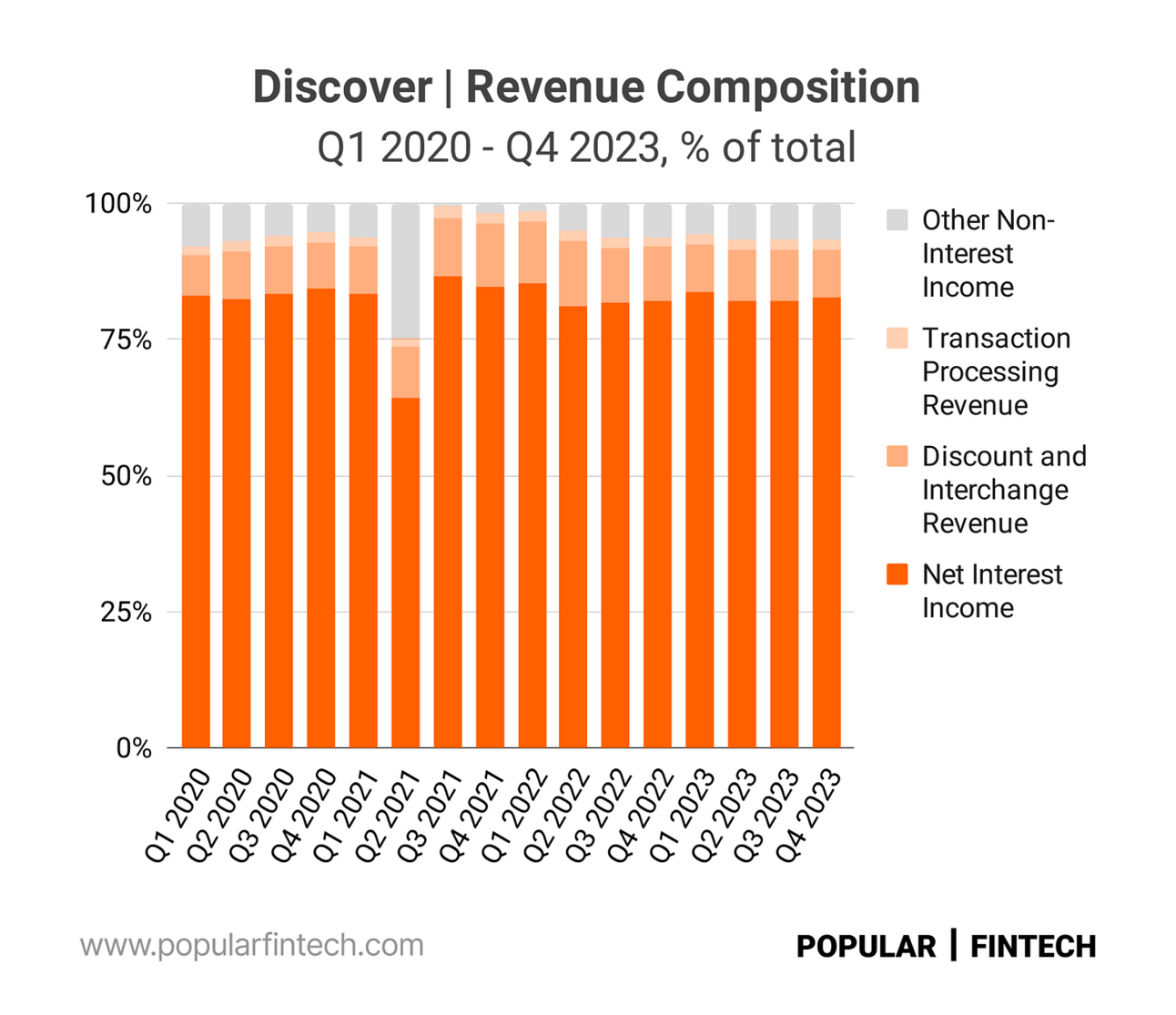

In the case of Discover, Net Interest Income contributes over 80% of the company’s net revenue, suggesting that it is, first and foremost, a lender (see the chart below). Noninterest revenue is valued higher, which explains, for example, why Visa and Mastercard trade at even higher multiples.

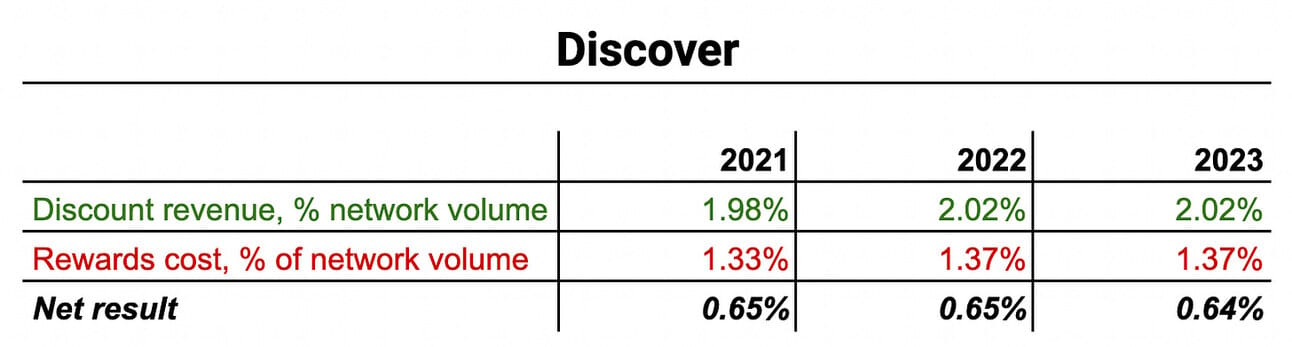

Naturally, I wanted to understand the reason for such a stark difference in the revenue composition. After all, as explained above, American Express and Discover operate fundamentally similar businesses. Discover charges merchants less than American Express. Thus, in 2023, Amex’s average merchant discount rate was 2.29%, compared to 2.02% for Discover (see the chart below).

The difference in merchant discount rates cannot fully explain the difference in the revenue composition. However, the difference in the average spend per card can. Thus, as can be seen in the chart below, in 2023, Amex cardholders (U.S. consumers only) spent, on average, $13,945 per year, or almost 4 times more than Discover cardholders.

“Our research says that our price and our offer was very competitive to competitive networks. It also says that our card members have much higher transaction size to the magnitude of 2x than our competitors. And therefore, we feel good about the value that we bring. And it's important for us to stay true as well to our pricing discipline.”

American Express CFO, Christophe Le Caillec

Morgan Stanley US Financials, Payments & CRE Conference 2024

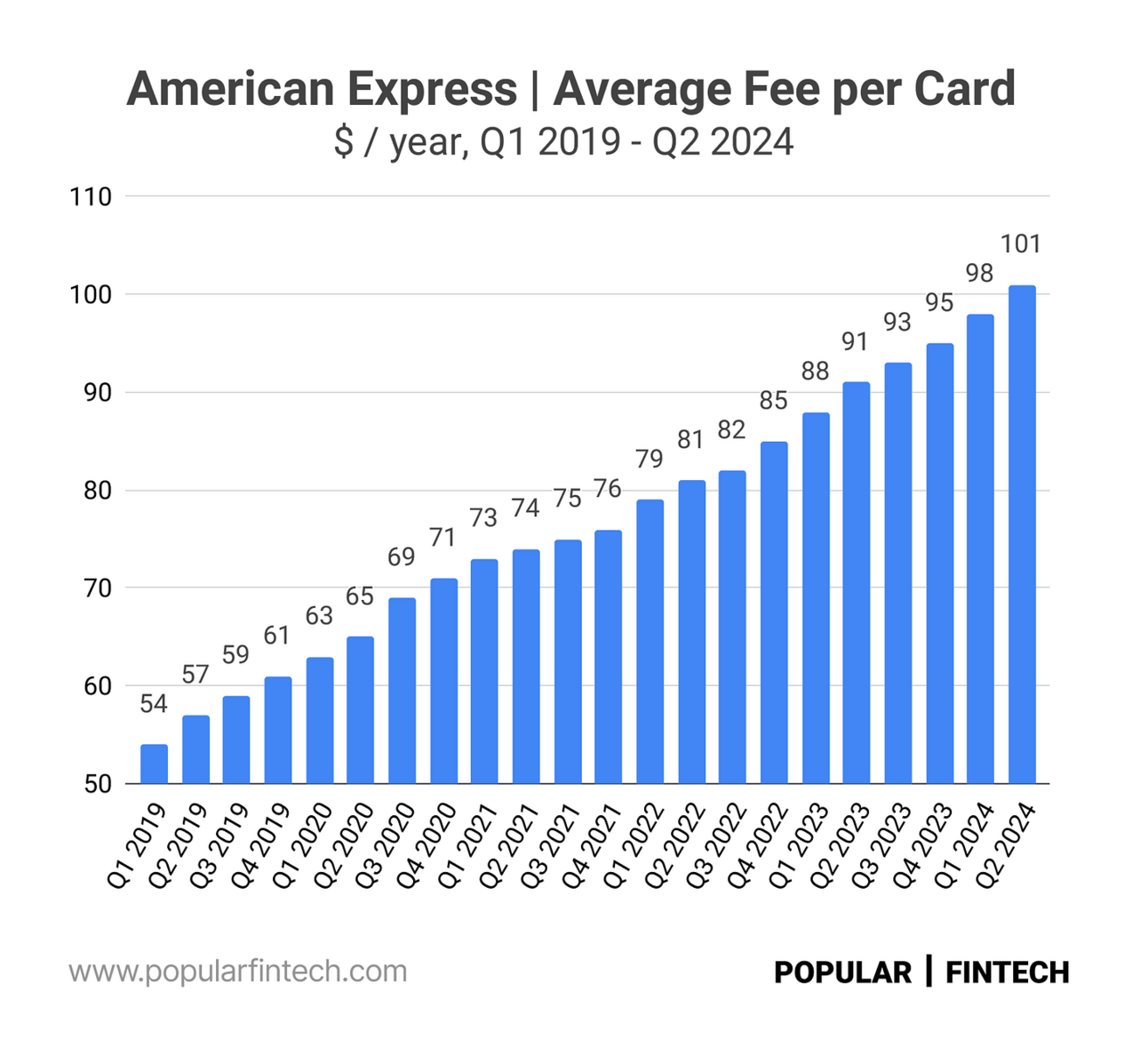

Moreover, Discover cards come with no annual fees, while American Express keeps increasing its card fees with every card “refresh”. As a result, on top of the “Discount revenue” (fees that the company charges merchants), American Express has a meaningful contribution to its revenue from “Card fees” (annual card fees that the company charges cardholders).

Over the last 5 years, Amex’s average fee per card almost doubled from $54 / year in Q1 2019, to $101 / year in Q2 2024. As a result, in 2023, American Express booked $7.3 billion in “Net card fees”, which represented 15% of the company’s total net revenue. Card fees are nowhere to be found in Discover’s financials.

“[ If you look at Platinum card fees across the world ]…The U.S. is still very far behind in terms of the price point. So I do feel that we have not hit the ceiling.”

American Express CFO, Christophe Le Caillec

KBW Fintech & Payments Conference 2024

So to summarize the above, for every $1 dollar spent by its cardholders, American Express earns 2.29% in merchant fees and 0.50% in net card fees (card fees are paid annually per card, so for this example, I divided card fees with the payment volume). It then spends 1.32% on rewards for its cardholders and keeps the 1.46% difference as gross profit.

At the same time, Discover earns 2.02% in merchant fees, spends 1.37% on merchant rewards, and keeps 0.64% as gross profit. Combine that with almost 4 higher spend per card, and you see the reason for such a stark difference in the revenue composition between Amex and Discover. The businesses might be similar, but the customer segments that these businesses serve are completely different.

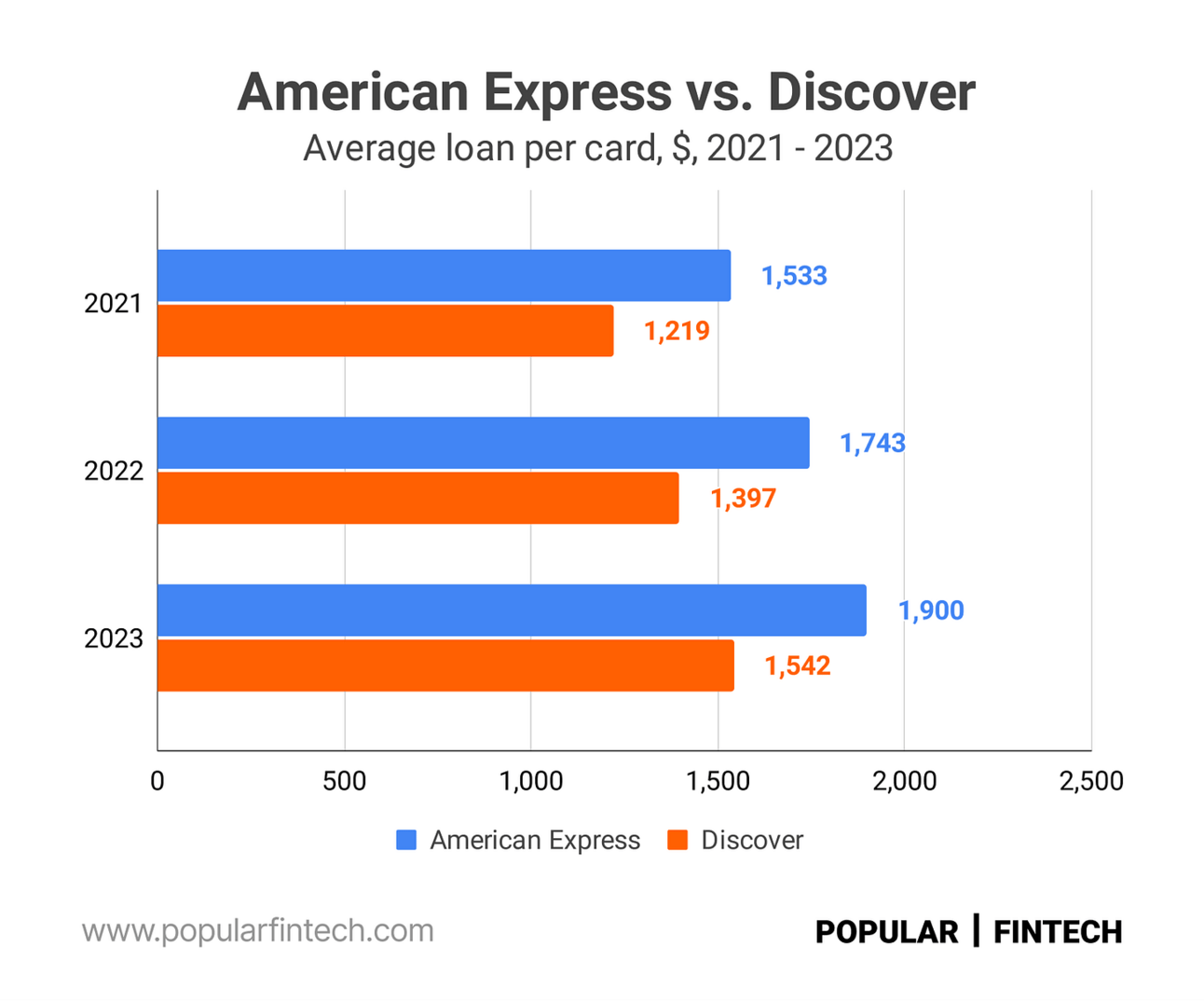

The average spend per card illustrates clearly that American Express’s cardholders are higher earners (or spenders) than Discover’s cardholders. But there is more to that…they are also better borrowers. In 2023, American Express cardholders carried an average loan balance of $1,900, compared to $1,542 for Discover.

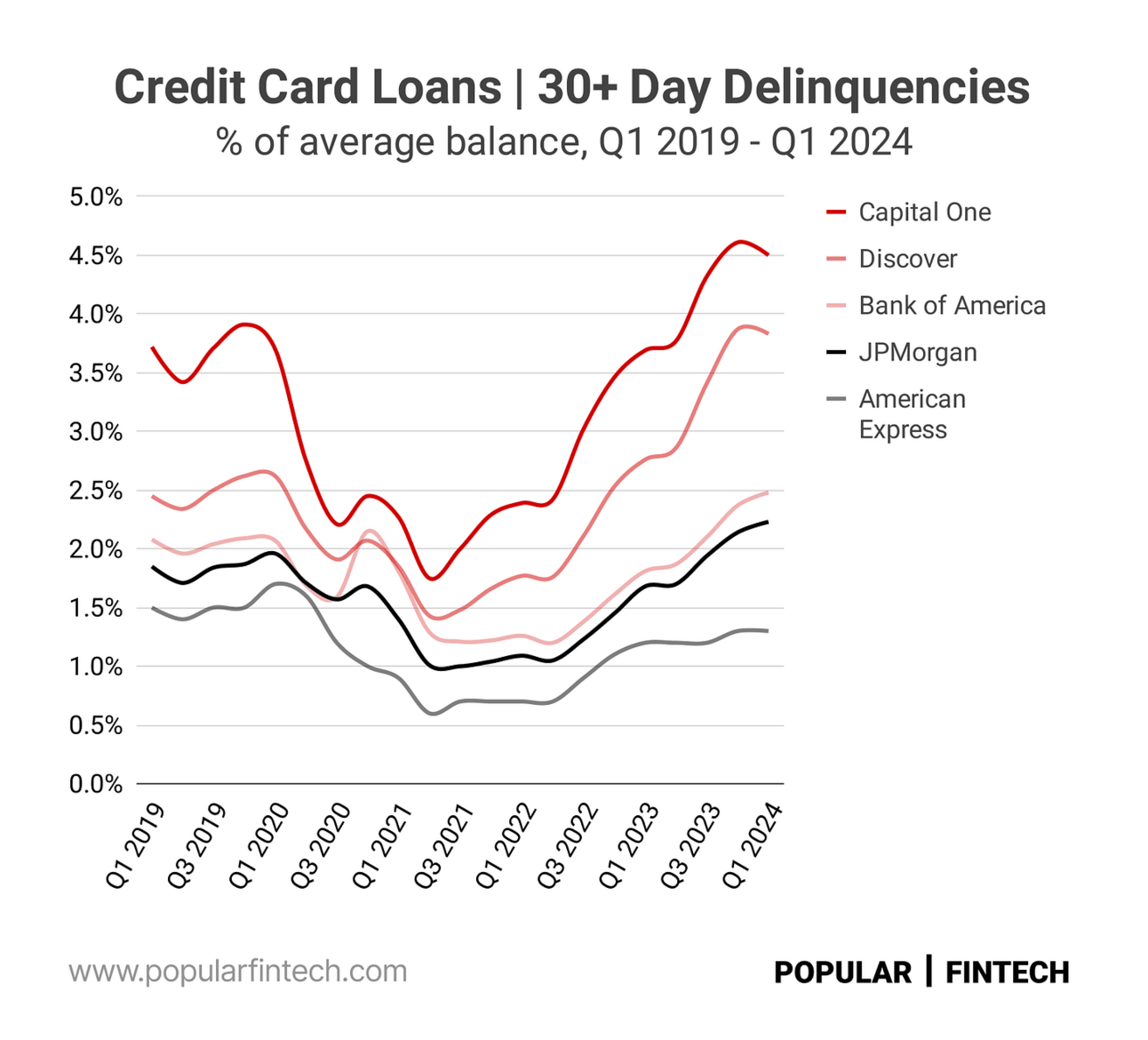

However, if you look at loan performance metrics, then you will notice that Discover has the second highest (and Amex has the lowest) charge-off and delinquency rates amongst the largest U.S. credit card lenders. The only lender that has higher charge-off and delinquency rates is Capital One…which is acquiring Discover.

Getting back to the revenue composition…The loan performance of Discover and Amex suggests that, on top of having a higher share of noninterest income, Amex's net interest income is less risky. I would even say that if there is a benchmark for the least risky credit card business, then it is American Express’s portfolio.

“We have learned that card members who have an Amex card and a competitor’s card, they actually tend to pay us first before they pay the competitor because of the loyalty to the brand and to the product even in times of stress.”

American Express CFO, Christophe Le Caillec

UBS Financial Services Conference 2024

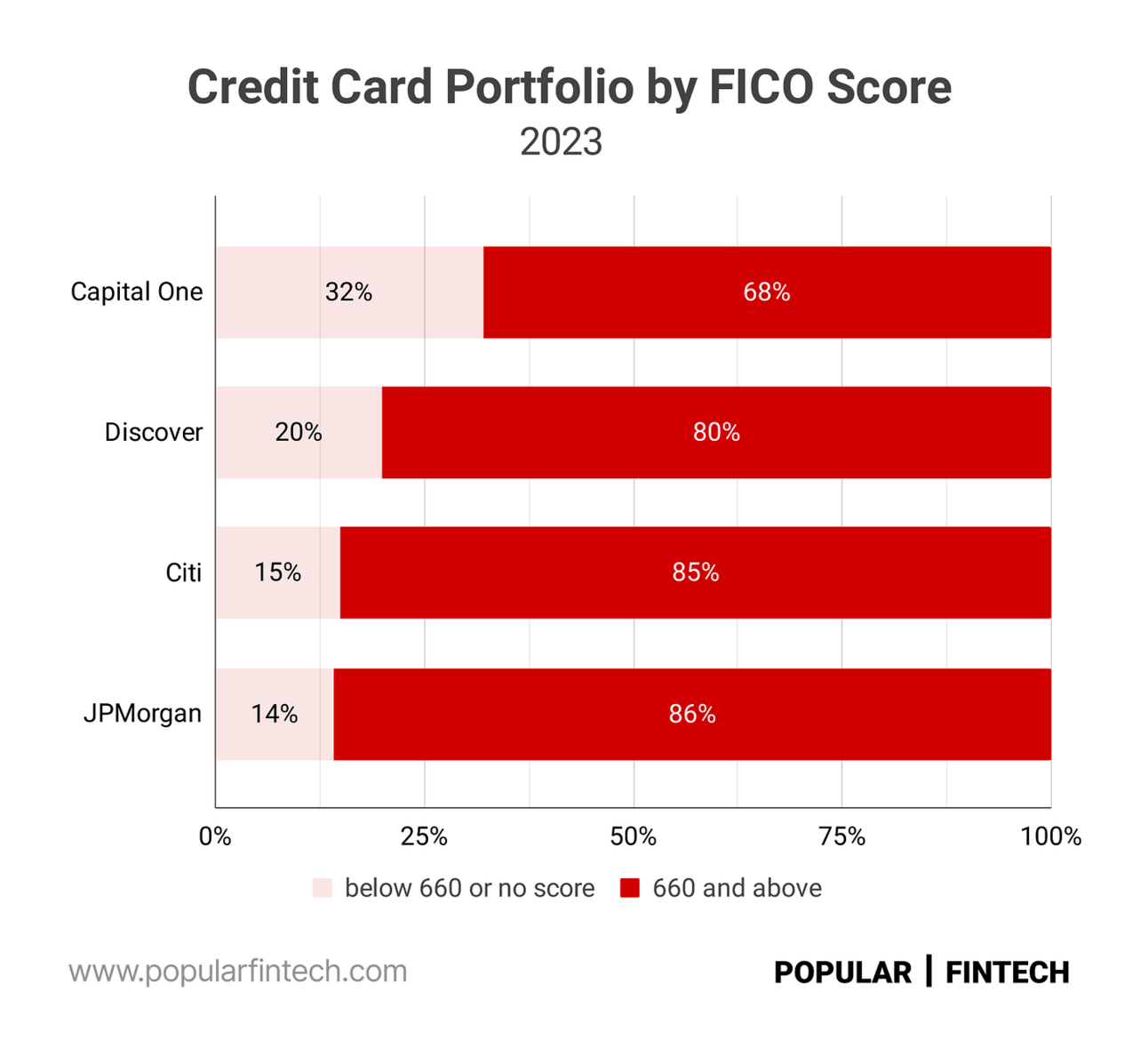

What is interesting, is that the pending acquisition of Discover by Capital One will not change the risk profile of the combined company. If you look at the borrower composition by FICO score (see the chart below), Capital One is de-risking its own business by acquiring Discover. So from this perspective, the risk in the combined loan portfolio will be even higher.

Of course, there is more to the valuation than the revenue, like the efficiency ratio (Discover’s efficiency ratio is lower, meaning better, than Amex’s) and funding source (Discover has a higher share of deposits, again, meaning better, than Amex)…but, at the end of the day, Discover delivers similar return on shareholder capital.

Thus, I would conclude that the key difference in the valuation of these two companies comes from the difference in the served customer segments. Amex’s customers just spend more and are better at repaying their debts.

I learned a lot while writing this. I hope you learned something new too!

Cover image source: American Express

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.