Over the last two years Block, Inc. has showcased an arsenal of growth drivers: it was Bitcoin trading in late 2020 and early 2021, which was followed by Square in the latter part of 2021, and then by Cash App in 2022. Bitcoin mania seems like a forgotten past, and Square’s revenue is decelerating, so in my previous review, I posed the question of whether Afterpay can fuel the next phase of growth. However, Afterpay revenue plateaued in Q3 2022, and Block will stop reporting Afterpay results separately after the anniversary of the acquisition.

Block doesn’t have other candidates, so the company’s management is making a bet that Cash App’s growth will continue into 2023. Cash App boasts 49 million monthly active users and is expected to overtake Square in terms of gross profit as soon as the next quarter. “We want to work toward being primary [bank account] because everything that you need in your financial life, you can find within Cash App. So that is the goal,” said Jack Dorsey, the company’s chief, during the Q3 2022 earnings call. That’s an ambitious, multi-year goal. In the meantime, let’s review the company’s Q3 2022 results.

If you are new to Block, Inc., I recommend reading my previous reviews:

Revenue

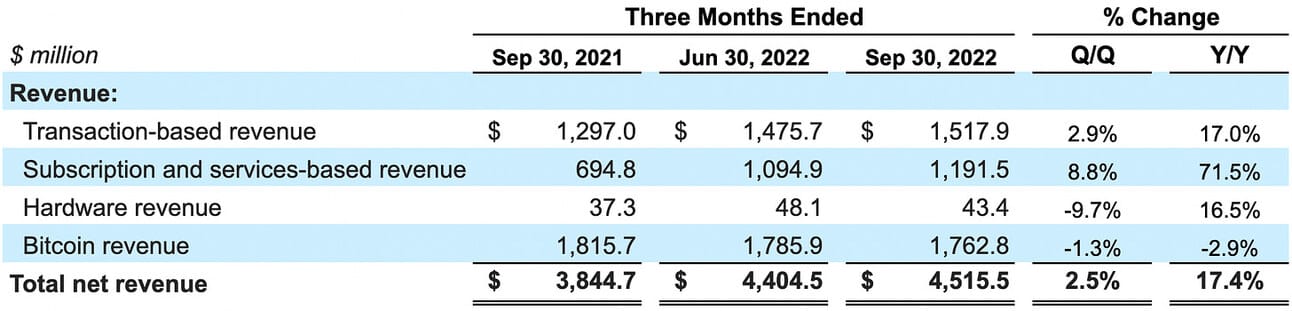

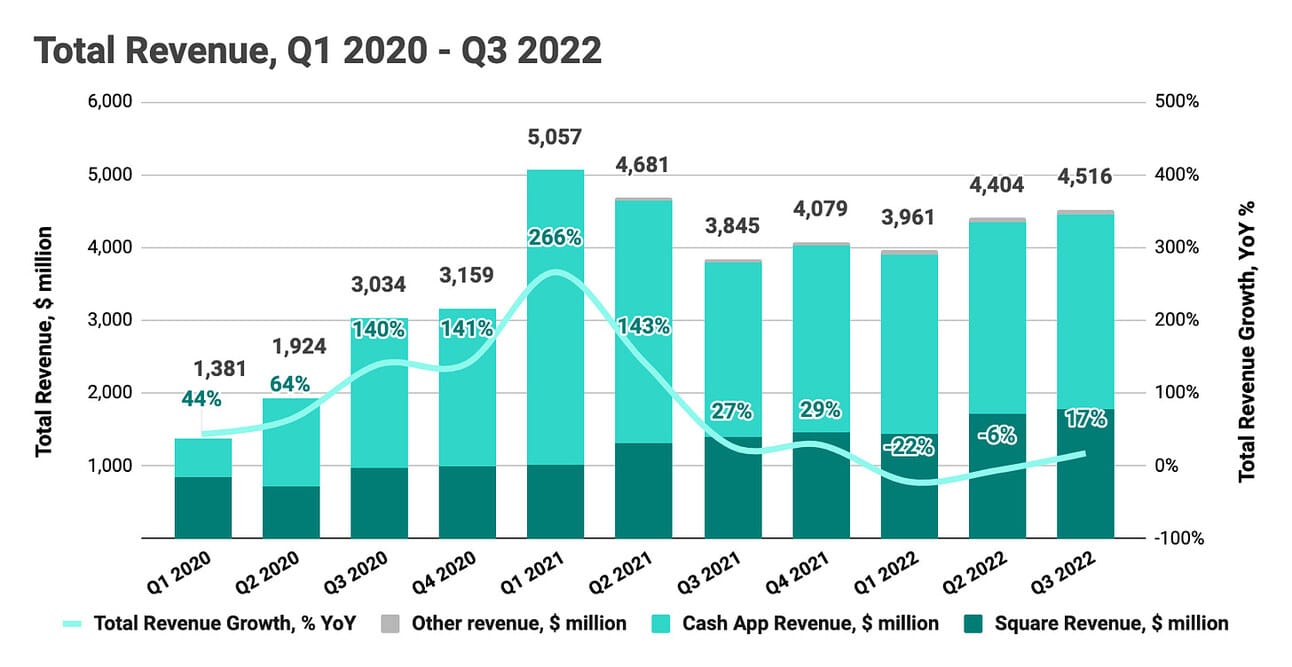

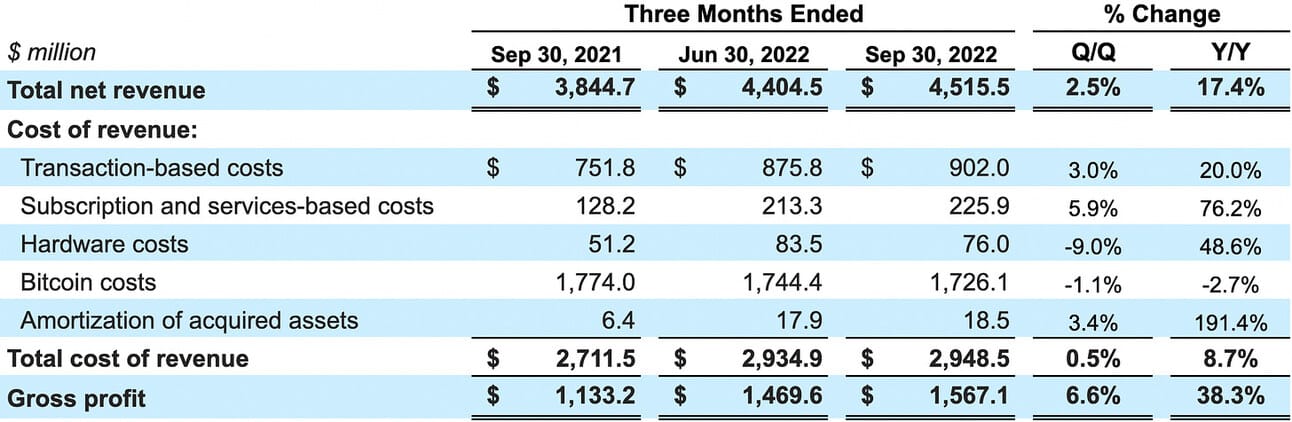

Block, Inc. reported revenue of $4.52 billion in Q3 2022, which represents a 17.4% growth compared to Q3 2021, and a 2.5% growth compared to Q2 2022. Excluding Bitcoin, the company’s revenue was $2.75 billion, representing a 35.7% growth compared to Q3 2021, and a 5.1% growth compared to Q2 2022. Bitcoin revenue is “the total sale amount of bitcoin to customers”, not Block’s commission for selling Bitcoin, so it is worth excluding it when analyzing the company’s results.

In Q3 2022, Afterpay contributed $209.9 million to the total revenue, compared to $208.2 million in Q2 2022, and $129.8 million in Q1 2022 (which only includes the months of February and March following the acquisition at the end of January). Afterpay growth, both in terms of revenue and gross profit, plateaued in Q3 2022.

Transaction-based revenue grew 17.0%, and subscription and services-based revenue grew 71.5% compared to Q3 2021. Excluding Afterpay contribution, subscription and services-based revenue grew 41.3% compared to Q3 2021 (Afterpay revenue is fully allocated to the subscription and services-based revenue). Bitcoin revenue, which was a drag on revenue growth in a previous couple of quarters, was $1.76 billion and remained relatively flat, declining just 2.9% YoY and 1.3% QoQ.

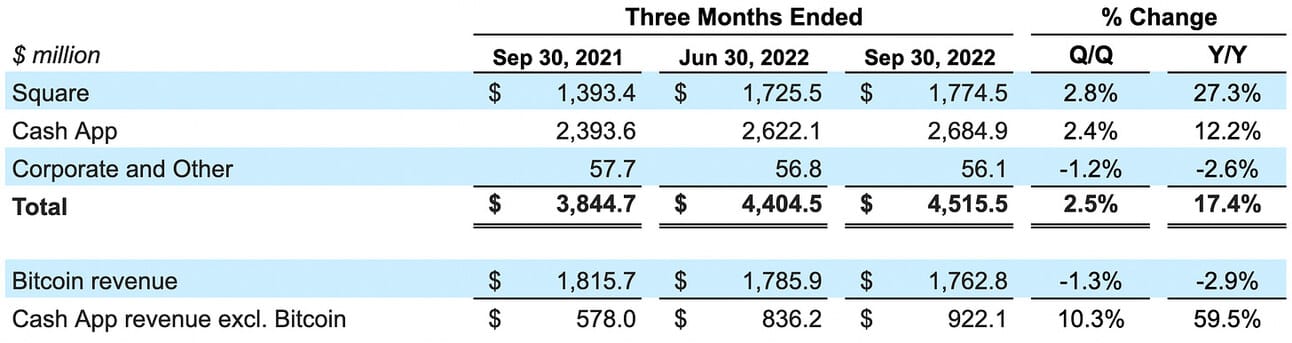

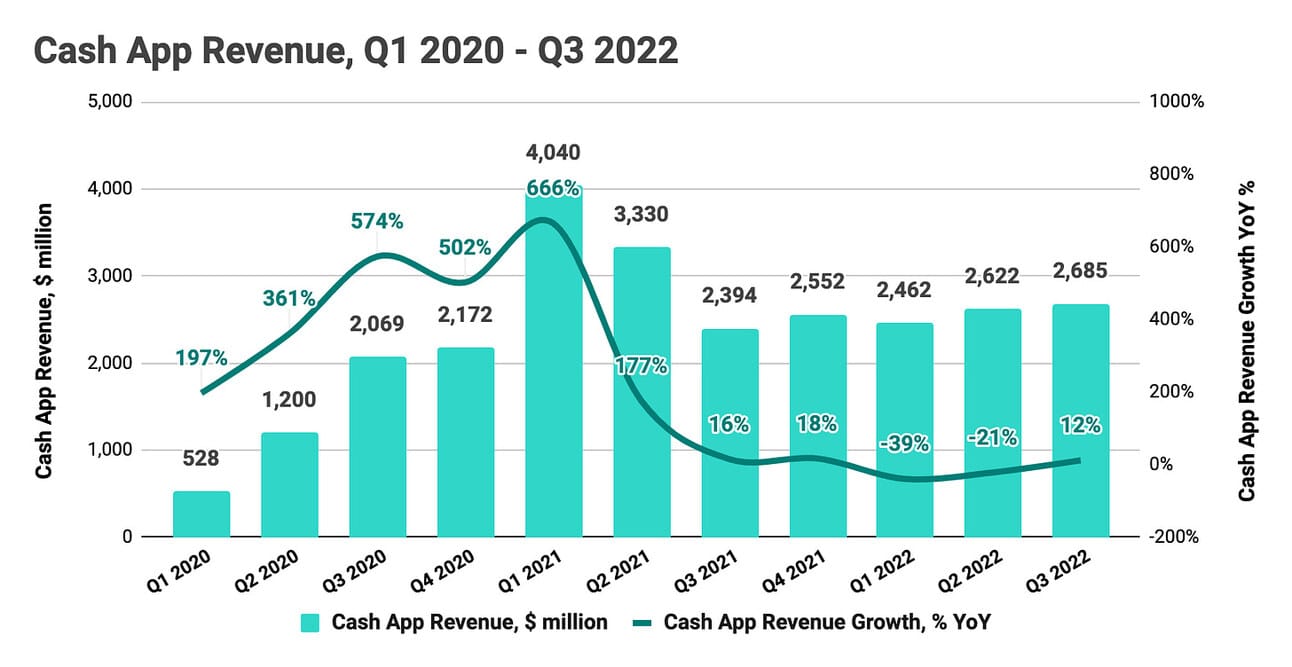

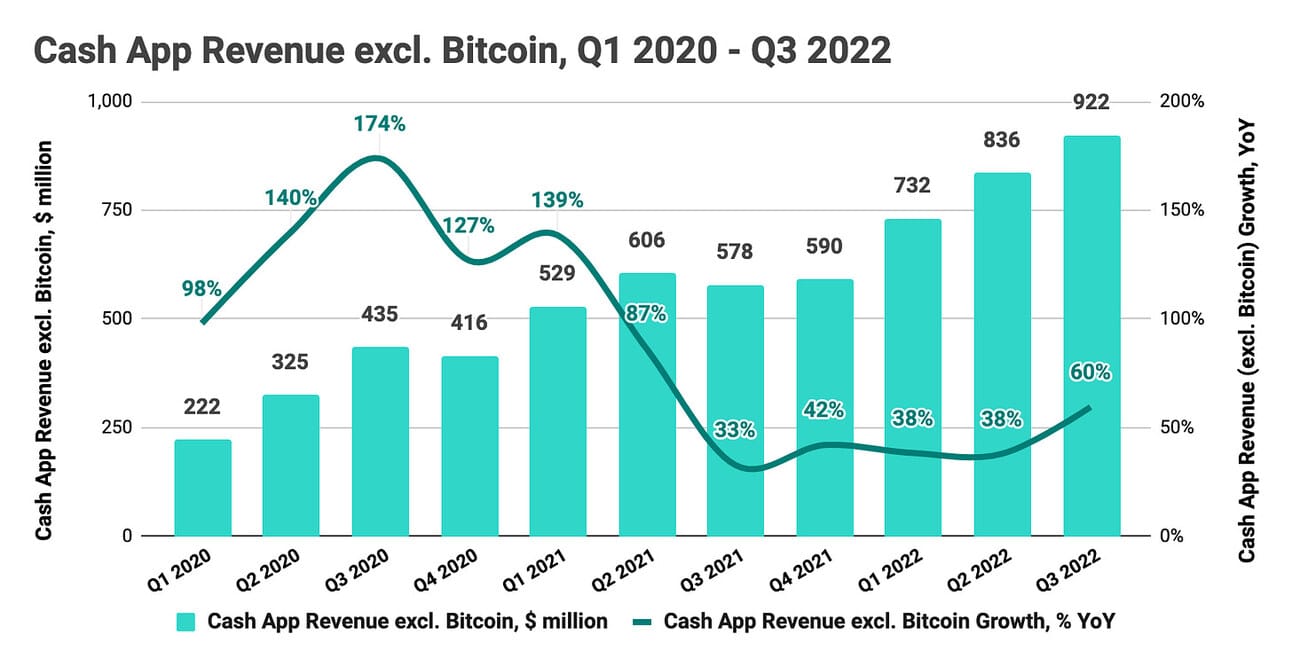

On the segment level, Square’s revenue reached $1.78 billion, representing a 27.3% growth compared to Q3 2021, and a 2.8% growth compared to Q2 2022. Cash App’s revenue reached $2.69 billion, representing a 12.2% growth compared to Q3 2021, and a 2.4% growth compared to Q2 2022. Excluding Bitcoin, Cash App revenue for the quarter was $922.1 million, which represents a 59.5% growth compared to Q3 2021 and a 10.3% growth compared to Q2 2022. Afterpay revenue of $209.9 million was equally split between the Square and Cash App segments.

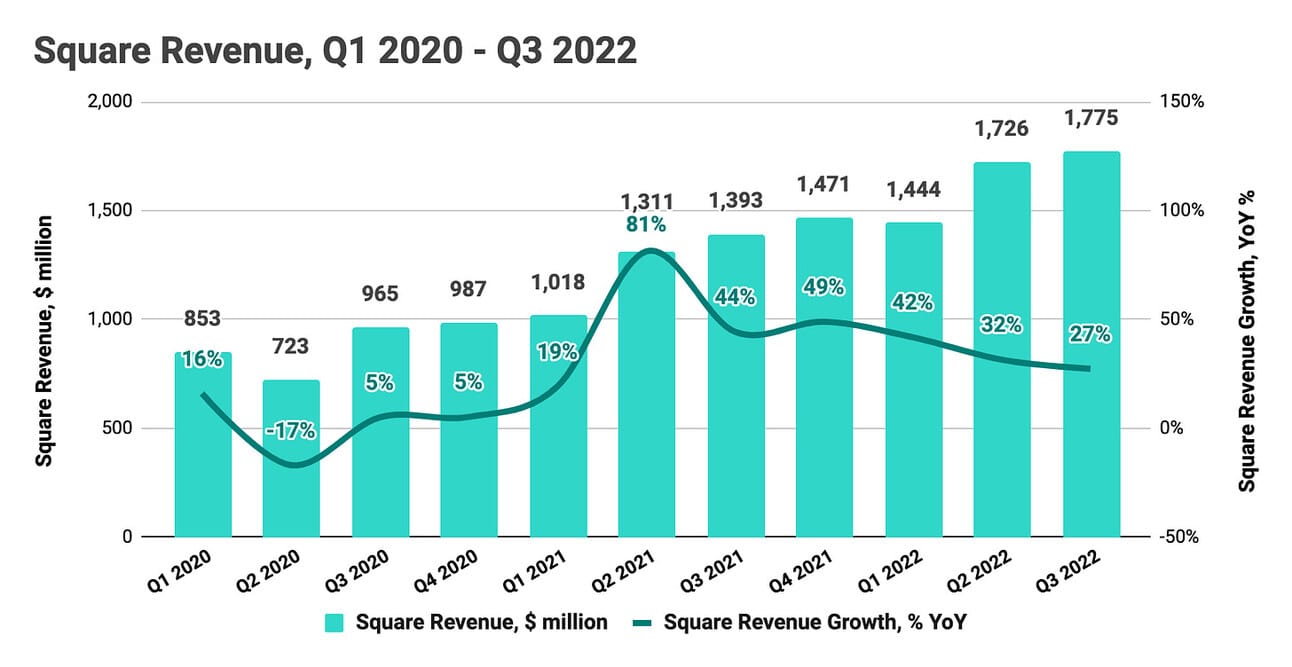

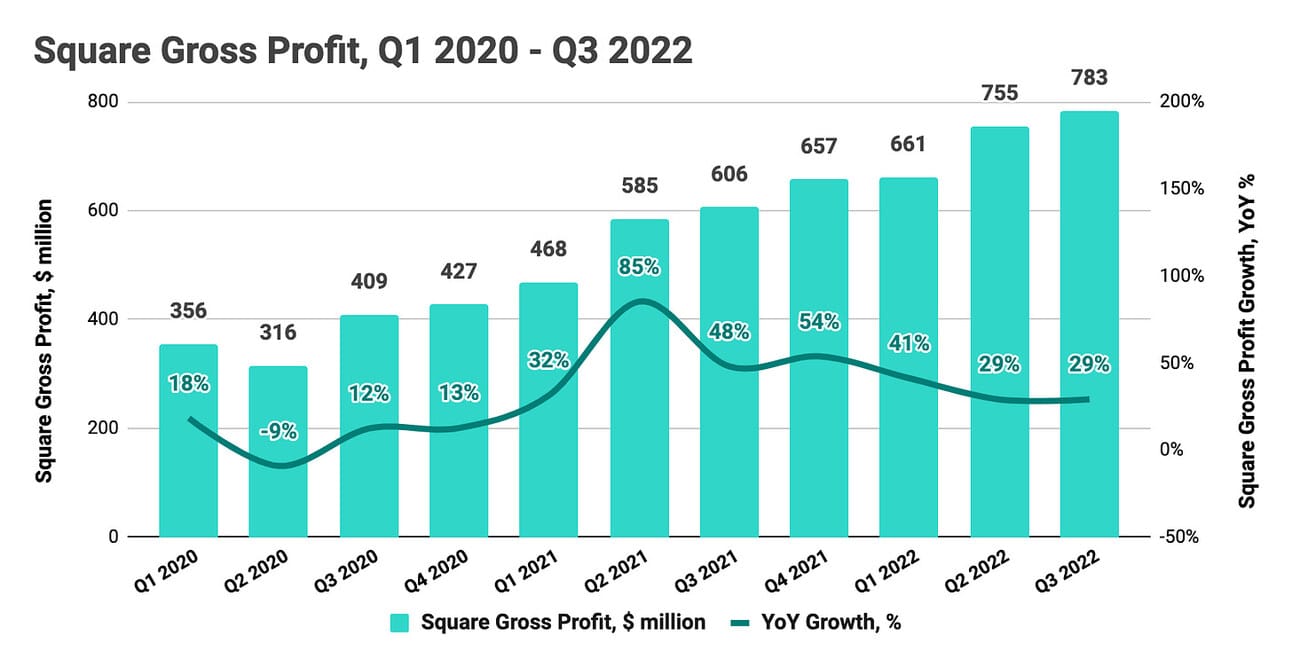

Square

Square’s total revenue of $1.78 billion included $1.40 billion in transaction-based revenue (78.9% of the segment’s total revenue), $0.33 billion in subscription and services-based revenue (18.7%), and $0.04 billion in hardware revenue (2.4%). Transaction-based revenue grew 17.2%, and subscription and services-based revenue grew 104.3% compared to Q3 2021. Excluding Afterpay contribution, subscription and services-based revenue grew 39.7% compared to Q3 2021.

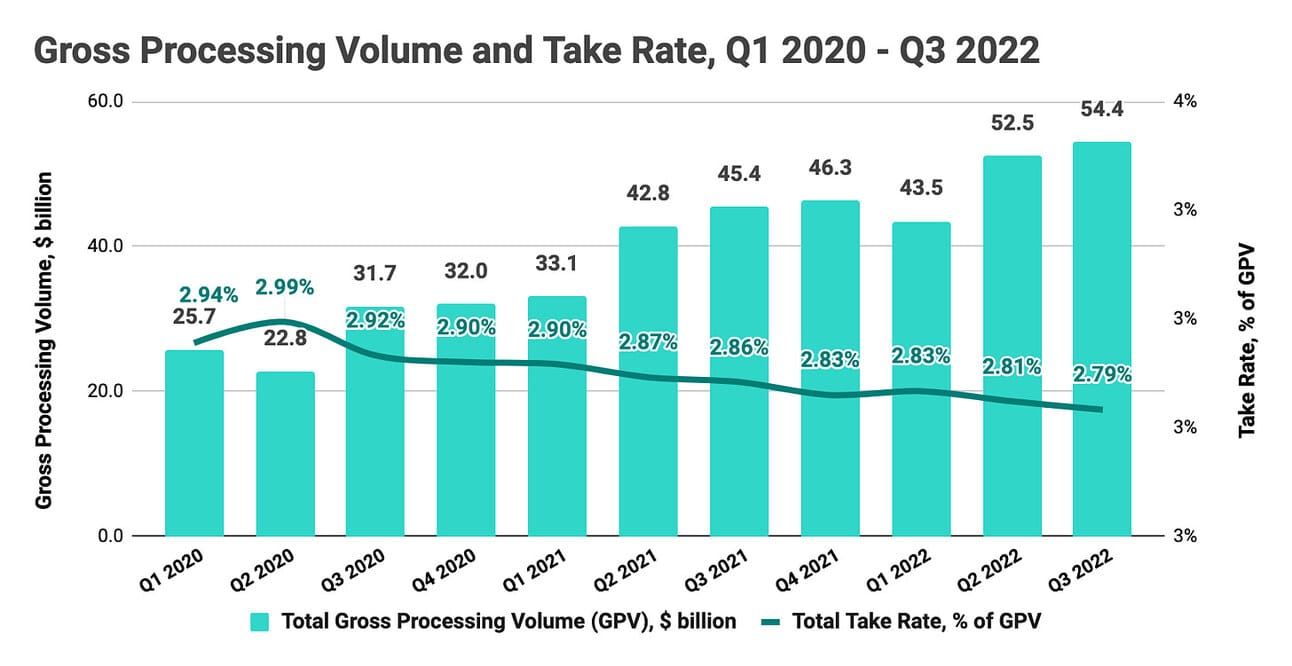

Square’s largest revenue component, transaction-based revenue, is a function of Gross Processing Volume and Take Rate. Gross Processing Volume was $54.4 billion in Q3 2022, which represents a 19.7% growth compared to Q3 2022 ($4.3 billion of GPV was contributed by Cash App peer-to-peer transactions received by businesses). U.S. Inflation in Q3 2022 was above 8%, which means that Square’s Gross Processing Volume growth was in the low double digits in real terms.

During the earnings call the company signaled a slowdown in GPV growth in October due to a “meaningful slowdown in year-over-year GPV growth in our international markets.” Moreover, the gross take rate declined, from 2.86% in Q3 2021 to 2.79% in Q3 2022. As can be seen from the chart above, the take rate has been steadily declining for the past two years since its peak in Q2 2020, and currently is below the pre-pandemic levels.

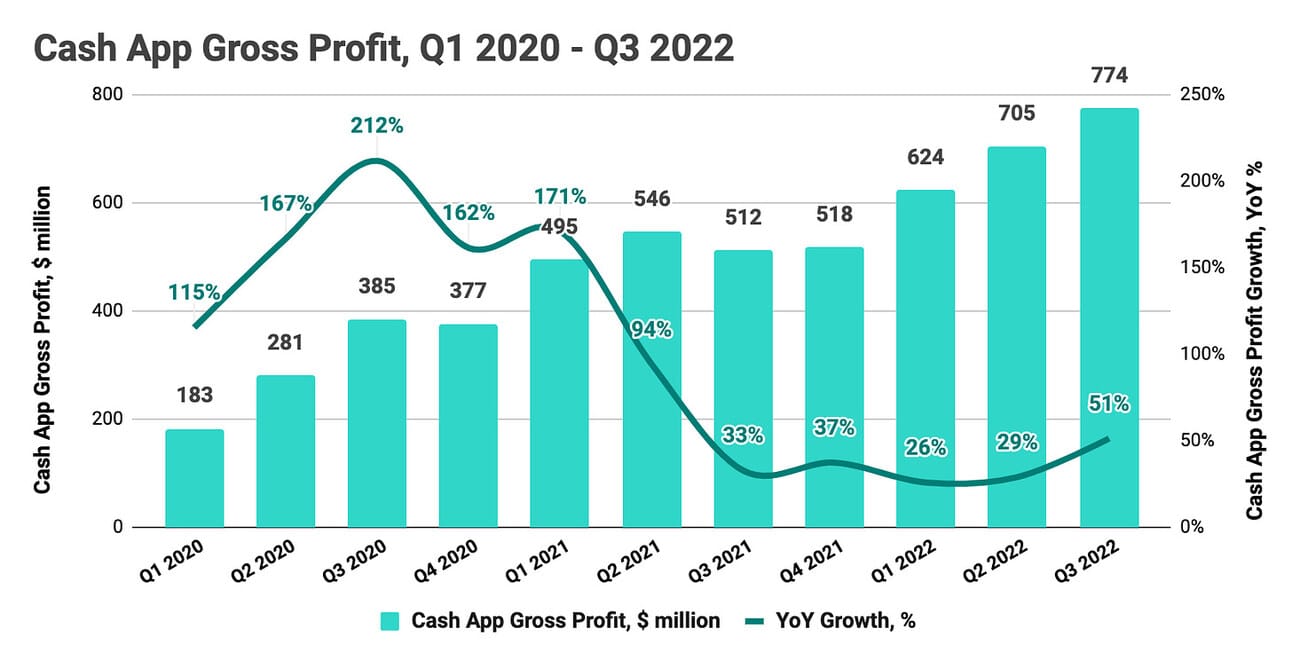

Cash App

Cash App’s total revenue of $2.69 billion included $0.12 billion in transaction-based revenue (4.4% of the segment’s total revenue), $0.80 billion in subscription and services-based revenue (29.9%), and $1.76 billion in Bitcoin revenue (65.7%). Segment’s transactions-based revenue grew 14.8%, and subscription and services-based revenue grew 69.3% compared to Q3 2021. Excluding Afterpay, subscription and services-based revenue grew 47.2% compared to Q3 2021.

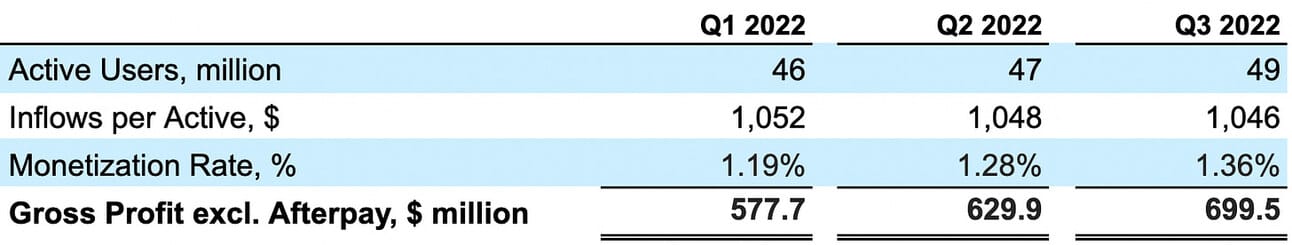

At Block, Inc. 2022 Investor Day, the company introduced a framework of inflows per active user. Thus, Cash App’s gross profit equals Active Users x Inflows per Active x Monetization Rate. The idea is that the more funds Cash App customers deposit to their accounts (inflows), the more they use the company’s services, generating additional revenue and gross profit (monetization rate). Some products are better drivers of inflows and have better monetization rates than others, which guides the company in prioritization of its efforts (i.e. Cash App Card users deposit 2.2 times more funds than P2P payments users).

In September 2022, there were 49 million monthly transacting customers (up 20% from a year ago), of which 18 million used a Cash App Card (up 35% from a year ago). Inflows per active user averaged $1,046 in Q3 2022, which was consistent with $1,048 in Q2 2022, and $1,052 in Q1 2022 (see the table below). In Q3 2022, the company’s management emphasized the impact of Cash App Card and Instant Deposit products on driving segment revenue and gross profit growth.

As noted earlier, Bitcoin revenue wasn’t much of a drag on the segment’s revenue in this quarter; however, its share in the segment’s revenue did hide the true growth dynamics. Thus, Cash App revenue excluding Bitcoin provides a better view of the segment’s growth (see the chart below). Cash App’s revenue seemed to stagnate in 2021, but it returned to the growth path in 2022.

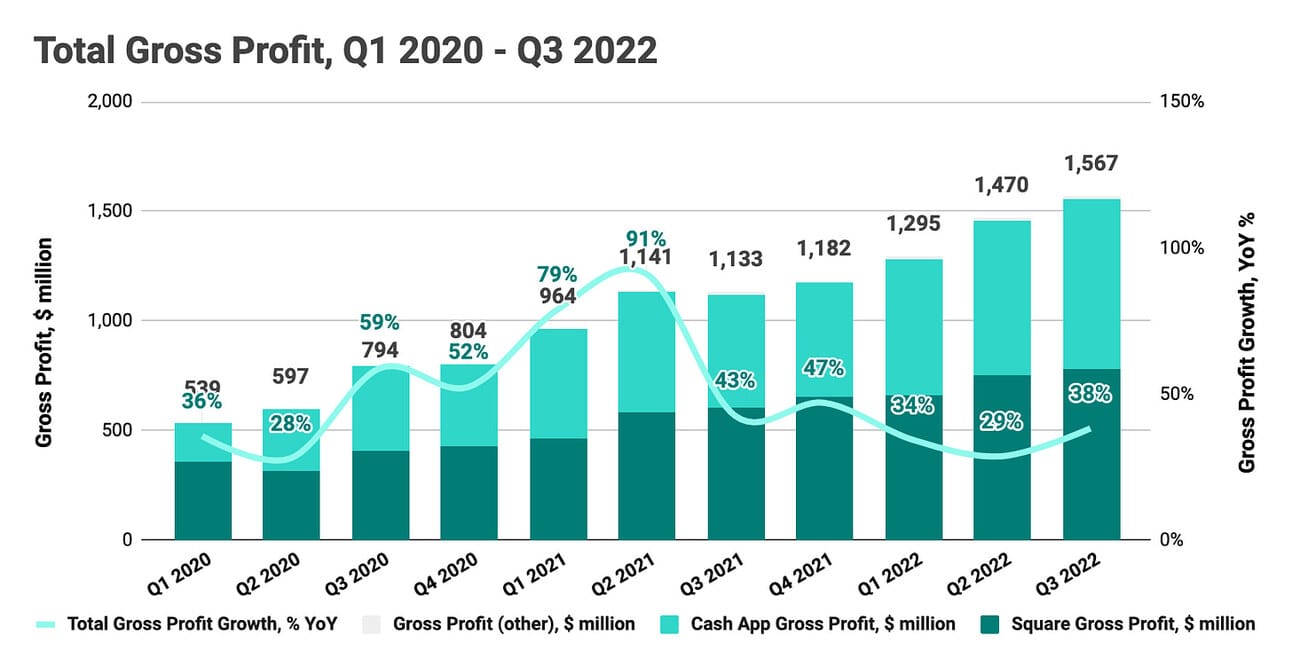

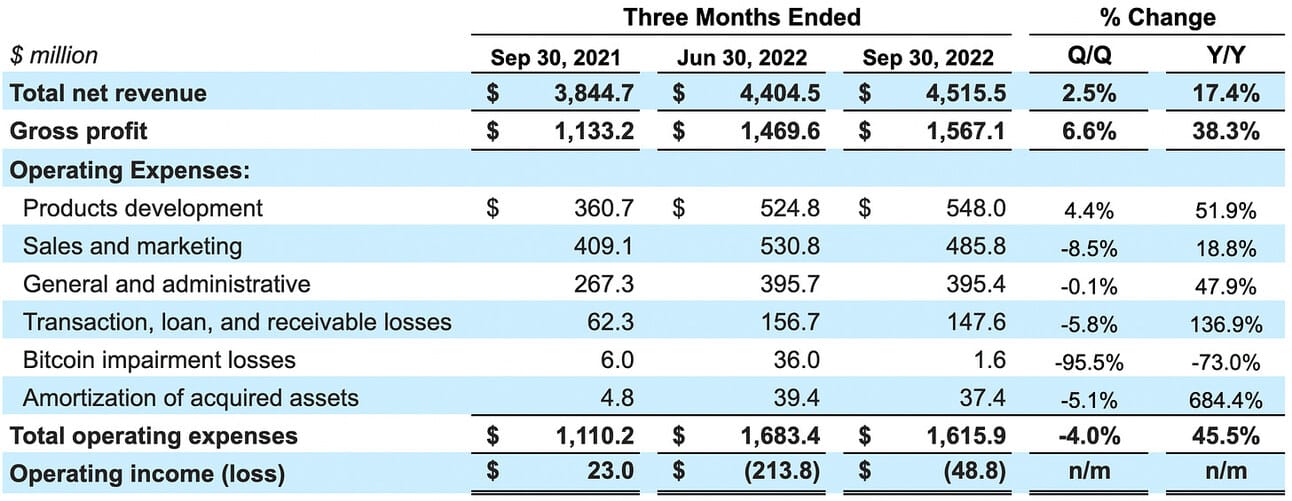

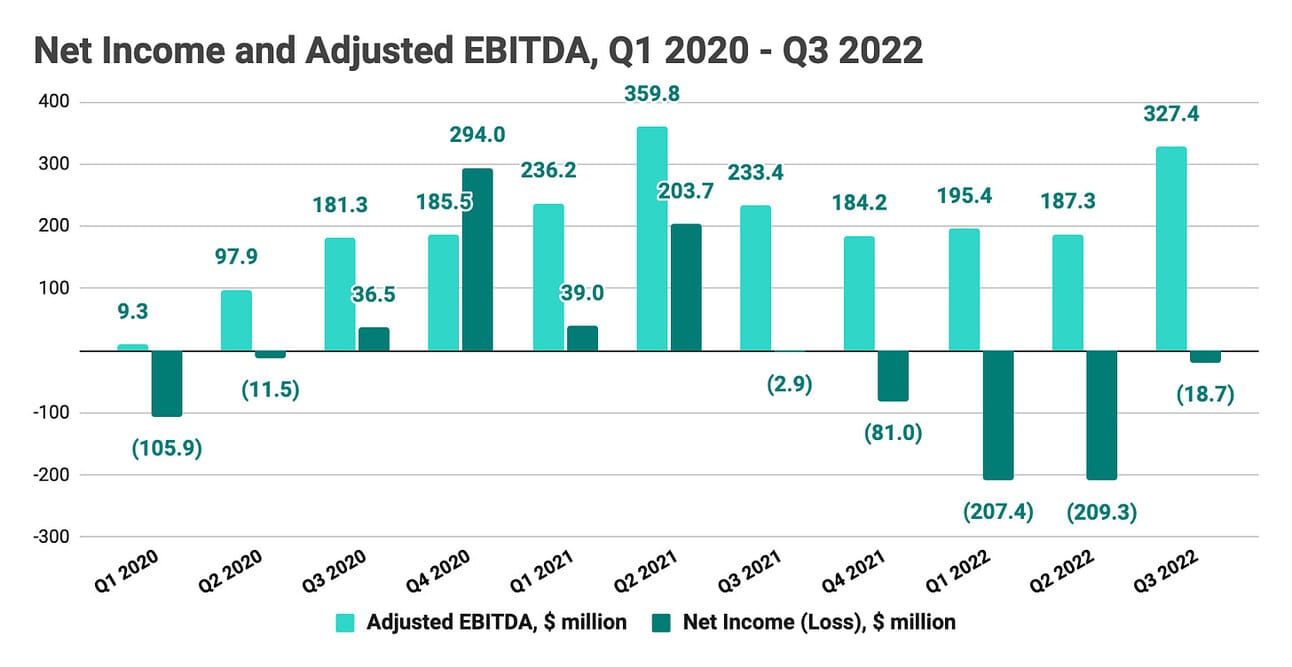

Gross Profit

Block, Inc. reported $1.57 billion in gross profit in Q3 2022, which represents a 38.3% increase compared to Q3 2021, and a 6.6% increase compared to Q2 2022. Afterpay contributed $149.8 million in gross profit, compared to $149.6 million in Q2 2022, and $92.2 in Q1 2022 (February and March). Thus, excluding Afterpay, gross profit increased by 25.1% compared to Q3 2021. Gross profit grew faster than the company’s revenue compared to both Q3 2021 and Q2 2022 (see the table below).

In absolute terms, gross profit growth was driven by a $70.7 million increase in transaction-based gross profit and a $399.0 million increase in subscription and services-based gross profit (incl. $149.8 million from Afterpay), and was offset by an increase in negative hardware contribution, a decrease in Bitcoin gross profit, and an increase in amortization costs of acquired technology assets. Compared to Q3 2021, gross profit from transaction-based revenue increased by 13.0%, and gross profit from subscription and services-based revenue increased by 70.4%.

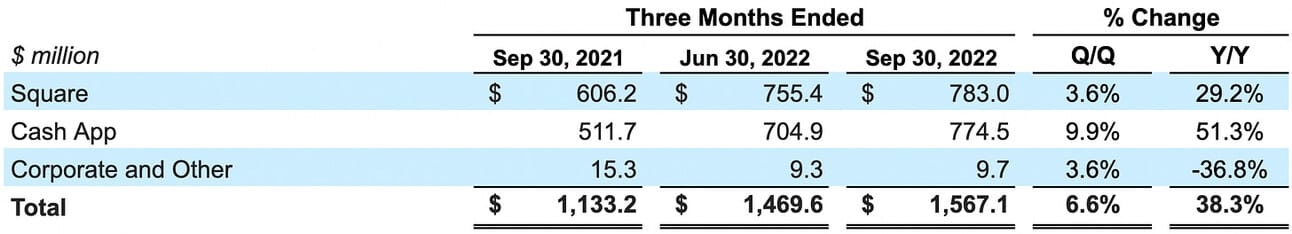

On the segment level, Square generated $783.0 million in gross profit, representing a 29.2% increase compared to Q3 2021, and a 3.6% increase compared to Q2 2022, while Cash App generated $774.5 million in gross profit, representing a 51.3% increase compared to Q3 2021, and a 9.9% increase compared to Q2 2022. The gross profit of $149.8 million from Afterpay was equally split between the Square and Cash App segments. Excluding the Afterpay contribution, Square gross profit grew 16.8%, and Cash App's gross profit grew 36.7% compared to Q3 2021.

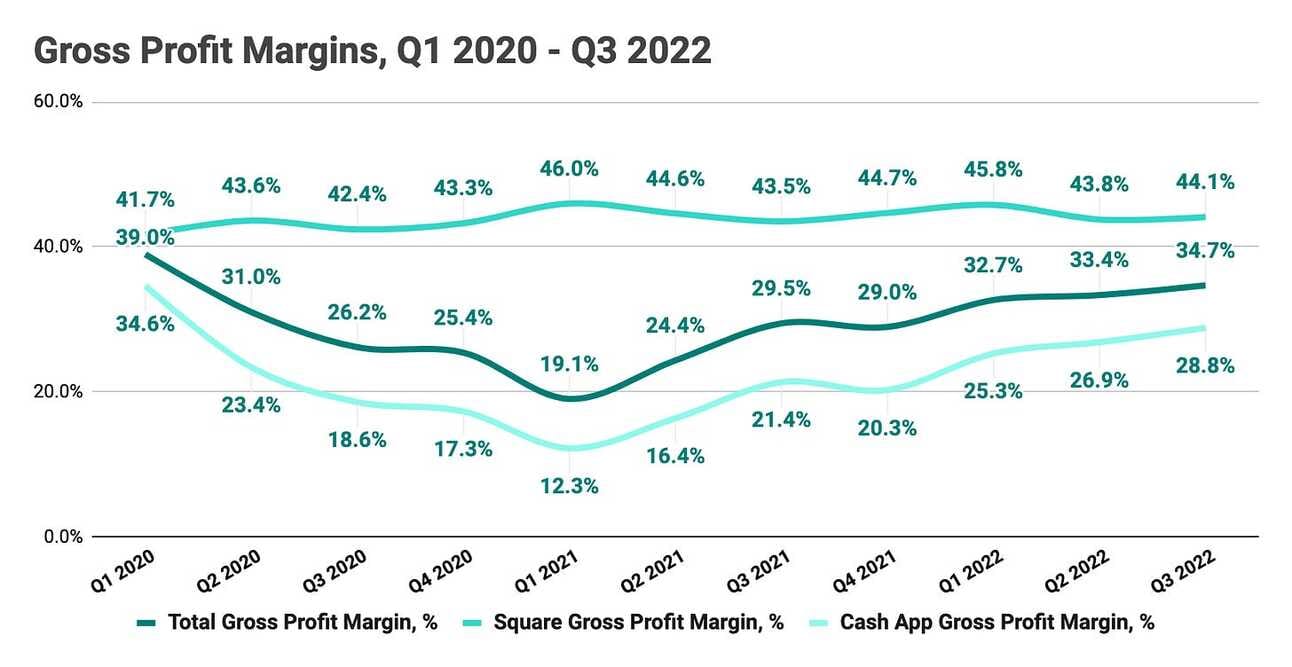

Gross profit margins kept improving in Q3 2022, especially in the Cash App segment. As can be seen from the chart below, Cash App’s gross profit margin increased from 21.4% in Q3 2021 to 28.8% in Q3 2022 due to a smaller share of Bitcoin revenue in the total segment’s revenue (excluding Bitcoin, Cash App’s gross profit margin declined from 81.3% in Q3 2021 to 80.0% in Q3 2022). As the result, the total gross profit margin for Block increased from 29.5% in Q3 2021 to 34.7% in Q3 2022. If Bitcoin revenue remains flat (or declines) we should expect both Cash App’s and Block’s margins to continue improving into 2023.

Let’s put all of the above together: Square’s revenue is heavily geared towards transaction-based revenue (78.9% of the segment’s revenue), transaction-based revenue grew modestly (17.2% YoY), and the gross profit margin remained relatively stable (44.1% in Q3 2022 vs. 43.5% in Q3 2021).

Growth in the segment’s gross profit in Q3 2022 was boosted by contribution from Afterpay, an impact that will disappear next year (as the acquisition laps one year). The segment’s transaction-based revenue will, most likely, experience headwinds from a weaker economy, and thus, we should not expect Square to be the gross profit driver next year.

Let’s do the same exercise for Cash App: the segment’s revenue is driven by Bitcoin (65.7% of the segment’s revenue) and subscription and services-based revenue (29.9%). Bitcoin is almost a non-factor in terms of gross profit at the company’s scale ($36.7 million or 4.7% of the segment’s gross profit in Q3 2022).

The segment’s subscriptions and service-based revenue (excluding Afterpay) grew 47.2% compared to Q3 2021, which was partially offset by margin compression. As the result, Cash App delivered strong gross profit growth even without the Afterpay contribution. The question is if Cash App can sustain growth momentum (meaning continue growing the user base and adoption of revenue generating products) to compensate for the headwinds in the Square segment.

The company’s management does not provide guidance, but they shared some insights into October trends and how those might translate into Q4 2022 results:

Thus, the company’s management expects the “fourth quarter gross profit growth to remain relatively consistent with the third quarter.” This guidance is based on the expected improvement in the gross profit growth rate for Cash App, and the moderation of the gross profit growth rate for Square. The company cited a slowdown in GPV growth and lapping of gross profit from the Paycheck Protection Program, as the reasons for the moderation of Square’s growth rates. If this guidance holds, Cash App will overtake Square in terms of gross profit.

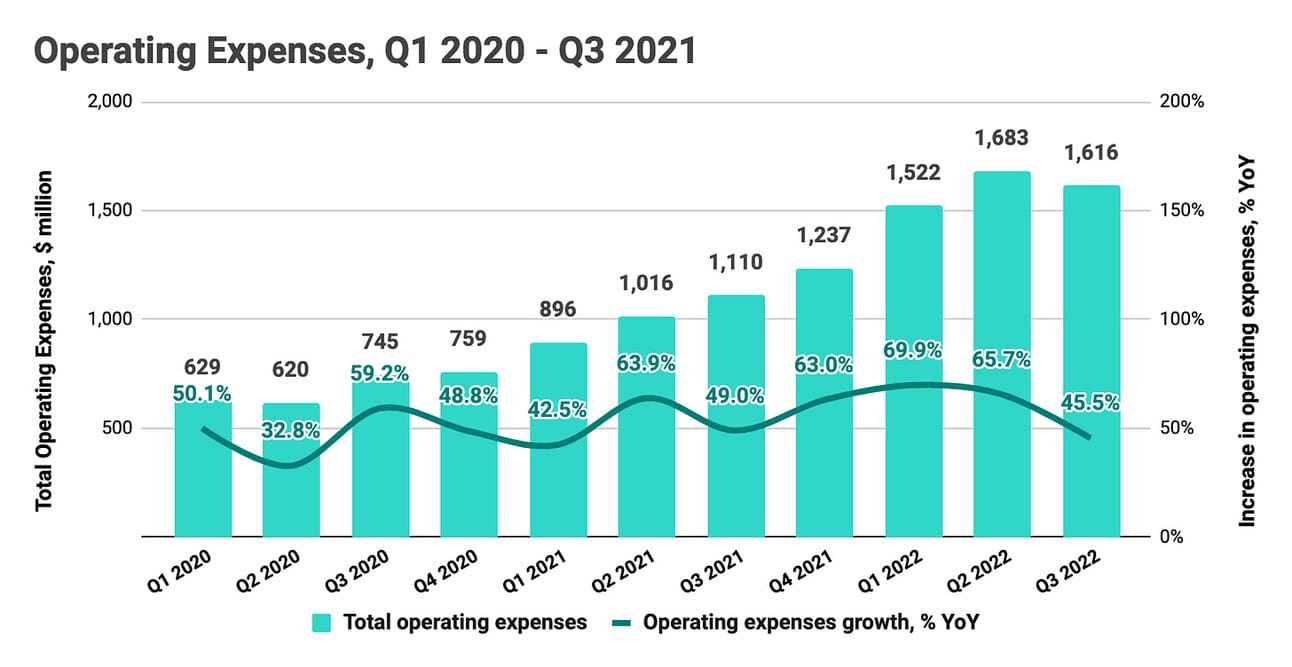

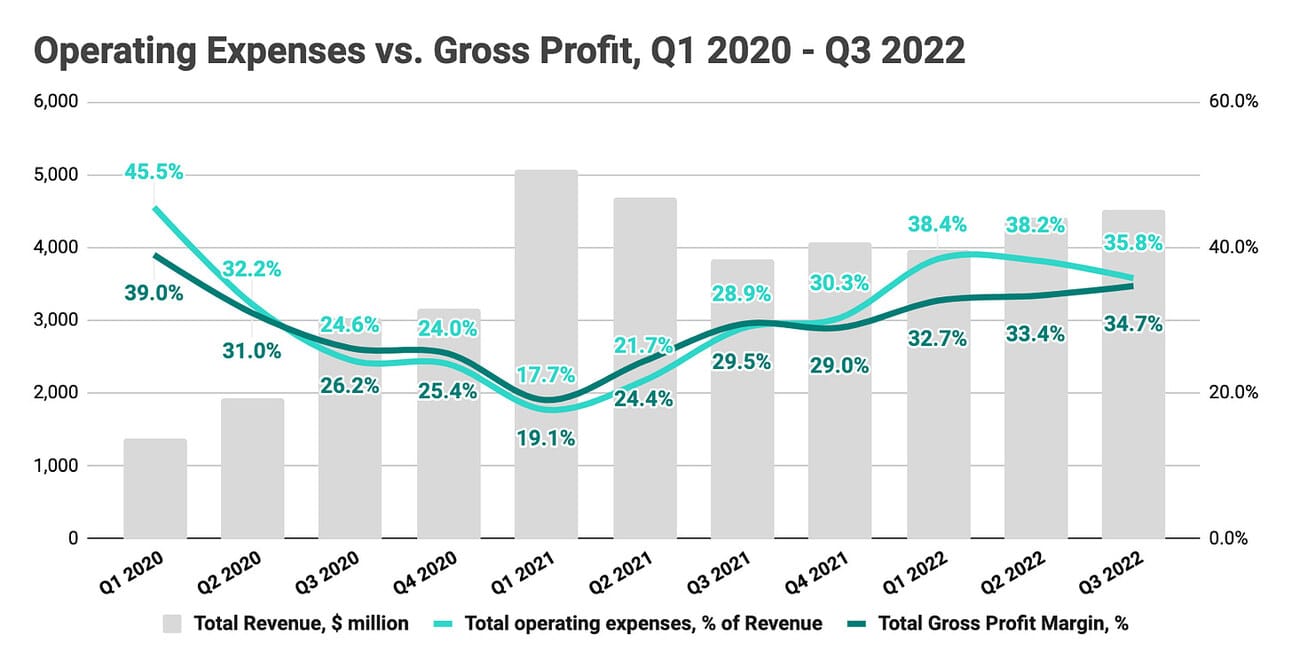

Operating Expenses

The company reported $1.62 billion in operating expenses, which resulted in an Operating loss of $48.8 million in Q3 2022. Operating expenses increased 45.5% compared to Q3 2021, and declined 4.0% compared to Q2 2022. The sequential decline in operating expenses was primarily driven by the pullback in marketing spending, lower losses on consumer receivables, and minor (compared to the previous quarter) Bitcoin impairment losses.1

Block started the year with ambitious investment plans, but started pulling back on those plans last quarter citing a weakening economic outlook. The chart below illustrates that the company continued to increase its operating expenses throughout the first half of 2022 despite a meaningful slowdown in revenue and gross profit growth. The company’s management now estimates a full-year pullback in non-GAAP operating expenses of $590 million against the original budget. Non-GAAP operating expenses are operating expenses adjusted for stock-based compensation, depreciation and amortization, and a few one-off expenses.

The company’s management guided for a $206 million increase in non-GAAP operating expenses in Q4 2022 compared to Q3 2022, and, per the shareholder letter, “the share-based compensation expense [ will ] increase quarter over quarter on a dollar basis.” Thus, GAAP operating expenses (presented on the chart above) will increase in Q4 2022 as well. Operating expenses for the quarter included $262.7 million in share-based compensation, an increase from $165.0 million in Q3 2021, and $256.6 million in Q2 2021.

If you think of gross profit as the money left to cover operating expenses, as well as pay taxes, interest, and dividends, then it is worth comparing gross profit margin to operating expenses expressed as a percentage of revenue (see the chart below). As you can see, Block has been consistently reinvesting all gross profit it generated (meaning operating expenses, as a percentage of revenue, were almost the same as gross profit margin), and even “overspent” in the Q4 2021 - Q2 2022 period. Thus, the “pullback” in spending mentioned above was essentially returning to the state, where operating expenses match gross profit (which almost happened in Q3 2022).

“Looking to 2023, we’re focused on operating more efficiently, and we expect to slow our pace of expense growth meaningfully compared to prior years,” - said Amrita Ahuja, the company’s CFO, during the Q3 2022 earnings call. My read of this comment is that the company’s management is signaling an expected slowdown in gross profit growth; and, thus, the need to slow down expense growth to maintain profitability (or rather “break-even” level illustrated above).

Net Income and Adjusted EBITDA

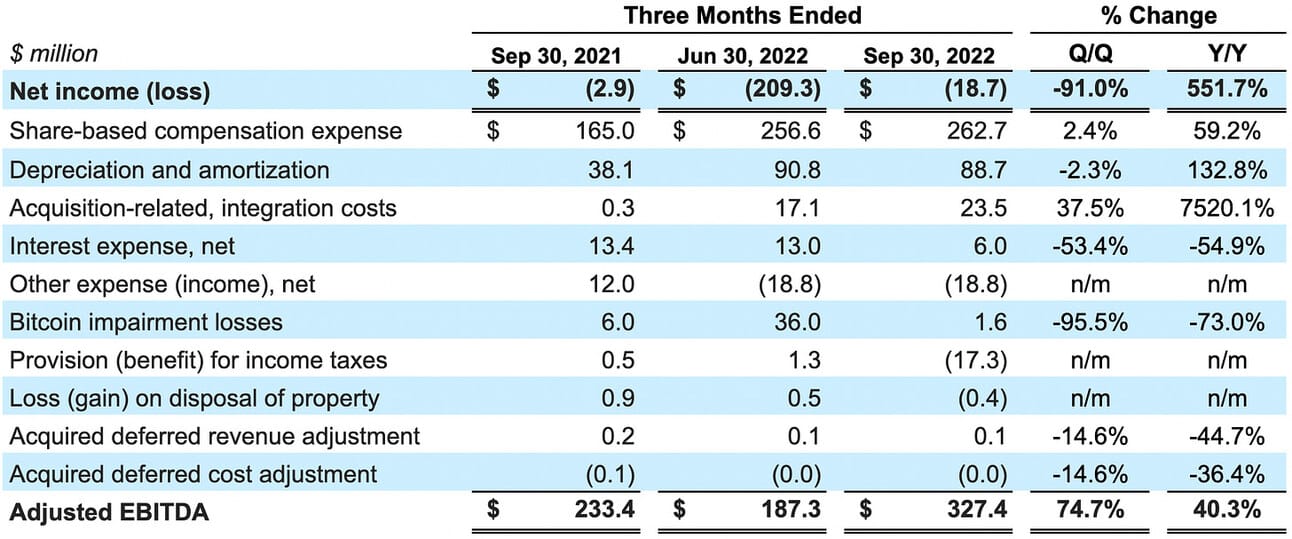

Block, Inc. reported a Net loss of $18.7 million for the quarter, compared to a Net loss of $2.9 million in Q3 2021, and a Net loss of $209.3 in Q2 2022. The company reported an Adjusted EBITDA of $327.4 million, compared to an Adjusted EBITDA of $233.4 million in Q3 2021, and $187.3 million in Q2 2022. Adjustments in Adjusted EBITDA calculation include share-based compensation ($262.7 million), depreciation and amortization ($88.7 million), as well as acquisition-related costs ($23.5 million).

In summary, Block cut operating expenses this quarter, which allowed the company to (almost) reach break even on a non-adjusted basis ($18.7 million in Net Loss). However, if you exclude the share-based compensation and the costs related to the Afterpay acquisition (increased amortization, acquisition-related costs, etc), then the company was profitable ($327.4 million in Adjusted EBITDA). An optimist in me sees the share-based compensation and the costs related to the Afterpay acquisition as an investment in growing the company. A pessimist in me sees a company spending everything that it earns.

NB! Don’t get confused by the Net Income in Q4 2020 and Q2 2021 on the chart above. Profitability in those two quarters was driven by gains on Block’s equity investments, not its operational activities (i.e Block selling Caviar to DoorDash in a stock deal, and then DoorDash going public in Q4 2020).

Block had $6.5 billion in cash and cash equivalents, restricted cash, and investments in marketable debt securities at the end of Q3 2022. In addition, it had an undrawn amount of $0.6 billion available under the revolving credit facility, and $1.2 billion available under the warehouse funding facilities.

Things to Watch Ahead

Cash App. Cash App was a bright spot this quarter showing strong revenue and gross profit growth (even excluding the contribution from Afterpay). The service boasts 49 million monthly transacting users, of which 18 million use Cash App Card. The segment’s revenue trajectory will depend on the company’s ability to increase its user base, adoption of paid services, or both like it did in Q3 2022 (20% YoY in users, and 35% YoY growth in Cash App Card users). One of the services to look for in the coming quarters is Cash App Pay.

Square. Square’s revenue growth has been decelerating throughout the year, and worsening economic conditions do not leave hope for a reversal of this trend. The company is already flagging GPV growth deceleration in its international markets, and it would be reasonable to expect a similar deceleration in Square’s home market, the United States. It will be interesting to see if, given the deceleration of revenue, Square decides to shelve its plans to continue expanding internationally or pushes forward.

Afterpay. Despite providing a decent boost to this year’s results, Afterpay revenue and gross profit plateaued in Q3 2022. The company’s management said that they do not plan to report Afterpay results separately from the Square and Cash App segments following the anniversary of the acquisition. Block paid $13.8 billion2 for Afterpay, so it is a disappointment that its results will be “blended” into other segments. I guess we will have to deduce the company’s results from secondary metrics (i.e. losses on credit receivables).

Profitability. Block can turn to profitability on a non-adjusted, GAAP basis if the company decides to (just look at how quickly they cut on operating spending without any layoffs). I believe such a move would be appreciated by investors. However, the company’s management might decide to continue reinvesting all gross profits back into the business and operating at “breakeven”. It is not an easy decision for the company, so let’s see, which way they decide to go.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.