Blend, the company helping banks with the digitalization of the mortgage lending process, is going through challenging times: the rise in mortgage rates is translating into lower origination volumes, and the company’s pay-as-you-go pricing model creates pressure on its revenues. Mortgage Bankers Association keeps lowering the forecasts for both purchase and refinancing originations, so one should not expect Blend to return to the growth mode in the short term.

Source: Mortgage Bankers Association

In the meantime, the company is optimizing its cost structure, and, hopefully, will reach profitability, at least on an adjusted basis (excluding stock-based compensation) by the end of this cycle. Blend has gone through two rounds of layoffs, is offshoring some of its functions to India, and is prioritizing the development of products that can provide a boost to the revenues in the short term. I am still of the opinion, that once the mortgage market returns to growth (and it always does), Blend will be a major beneficiary. Let’s review the company’s Q2 2022 results!

If you are new to Blend, I suggest reading my previous reviews:

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

Customers

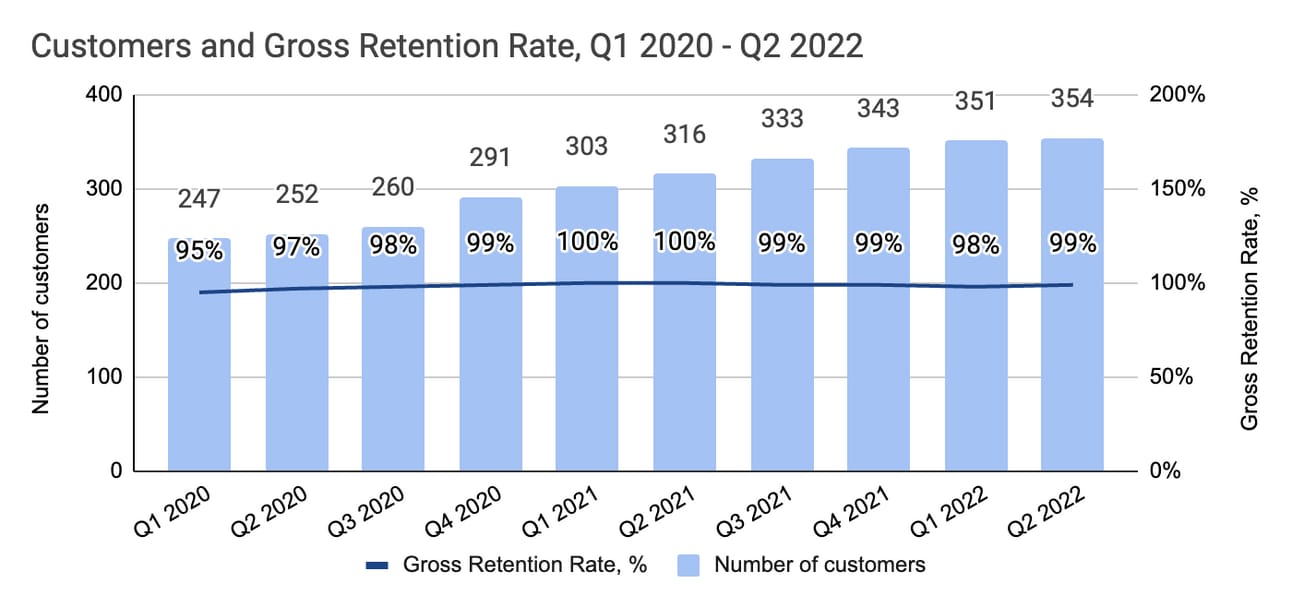

Blend reported 354 customers at the end of Q2 2022, up from 316 customers at the end of Q2 2021 and 351 customers at the end of Q1 2022. The pace of customer onboarding seems to have slowed down in the last couple of quarters (the company onboarded only 3 customers in Q2 2022). The topic was not discussed during the earnings call, but drawing parallels to other companies serving the banking industry, I would guess that Blend’s prospective customers are delaying or putting on hold the go lives to concentrate on short-term profitability.

Blend continues to maintain close to a 100% Net Retention Rate (meaning the customers that the company served a year ago generated the same revenue in the reporting quarter) despite the deterioration of the lending volumes. Per the Mortgage Bankers Association data the total purchase and refinancing volume decreased from $1,050 billion in Q2 2021 to $678 billion in Q2 2022 (a decrease of 35%).

For some reason, the company did not publish the market share data this quarter. Blend reported a 15.2% market share (based on the total number of transactions) in H2 2021, and was aiming to capture 24.9% of the market based on the signed agreements.

Revenue

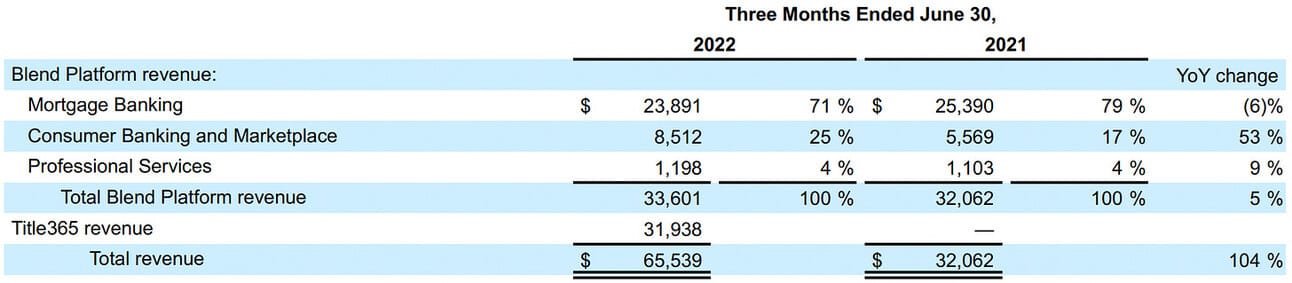

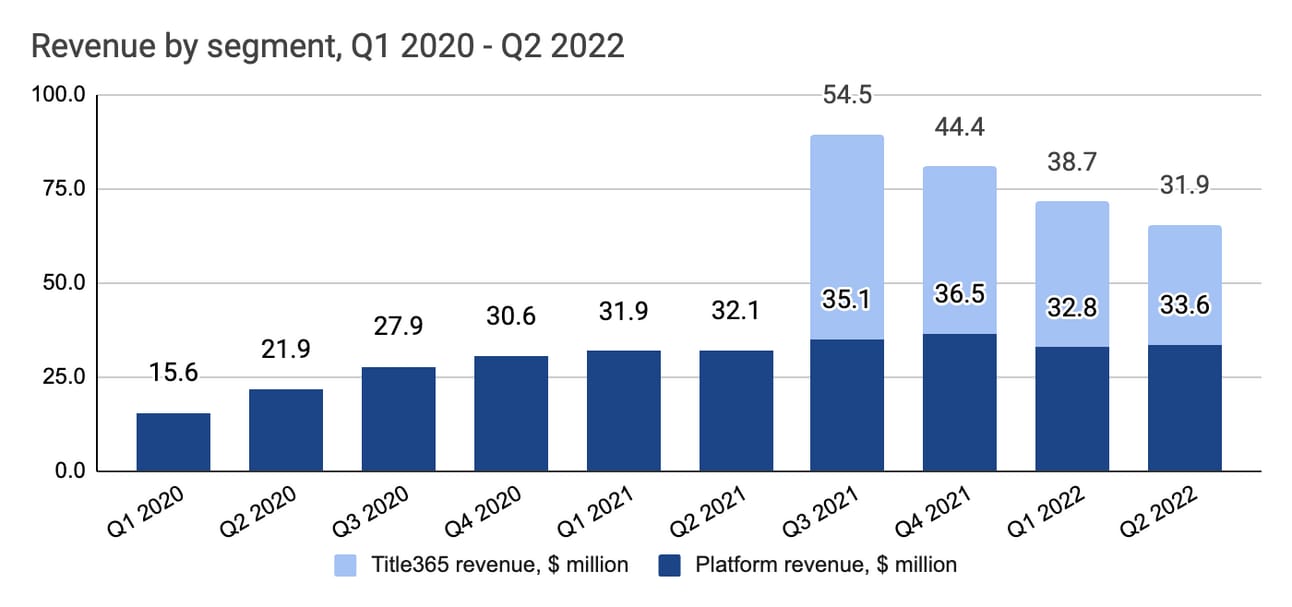

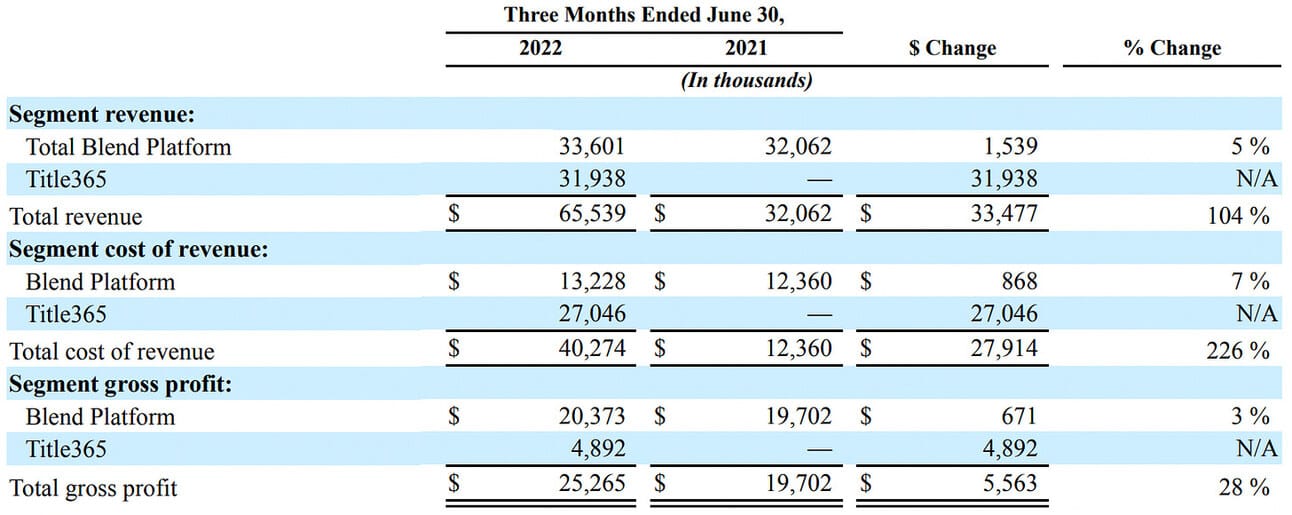

Blend reported €65.5 million in total revenue for the quarter, of which €33.6 million was contributed by the Blend Platform and €31.9 million was contributed by Title365. As a reminder, Blend completed the acquisition of Title365 on June 30, 2021; hence, Q2 2021 does not include Title365 contribution. Blend Platform revenue grew 5% compared to Q2 2021, and 2.5% sequentially.

Title365 revenue declined sequentially (18% QoQ) driven by the lower refinancing volumes, and given the forecast by the Mortgage Bankers Association and the company’s guidance, will continue declining for the rest of the year. As a result of the declining revenue from Title365, Blend’s management decided to recognize a $392 million impairment to the acquired intangible assets and goodwill. Blend paid approximately $422 million for a 90.1% stake in Title365, and now is writing off most of this value.

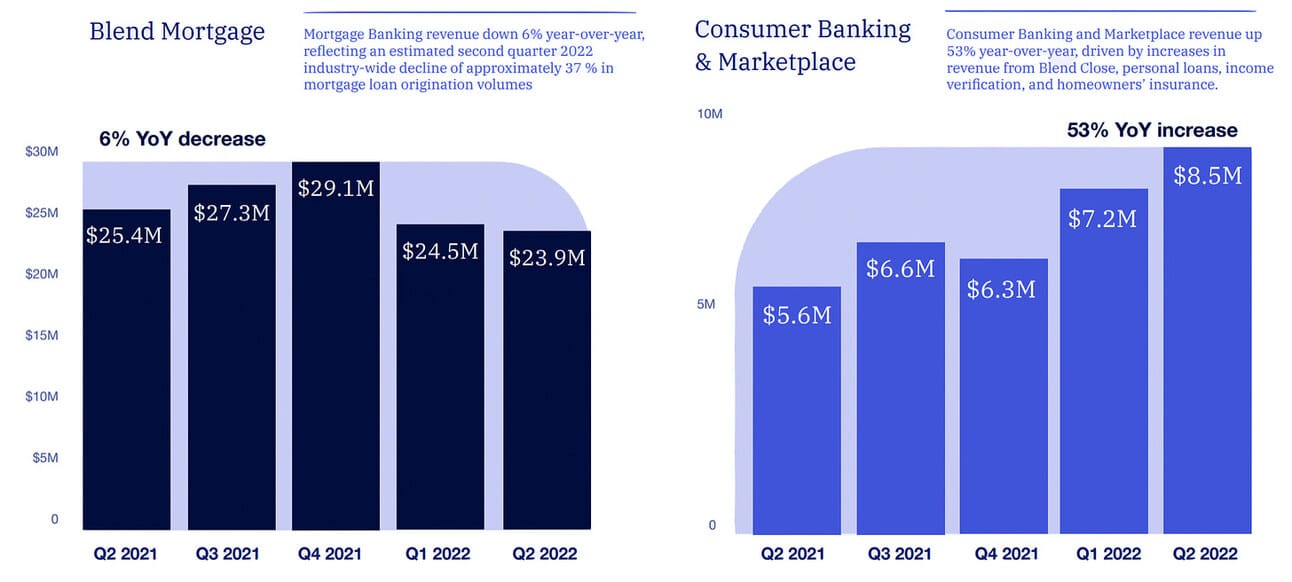

On a positive note, revenue from the company’s Consumer Banking platform grew 53% YoY, and 18% sequentially. Blend’s Consumer Banking platform powers non-mortgage products such as personal loans and provides the company’s clients with ancillary services, such as Blend Close and borrower income verification. I don’t know what is the potential of Blend’s Consumer Banking platform, but it is clearly becoming a larger component of the company’s revenues.

The company’s management reiterated the revenue guidance of $230-250 million for the full year. Blend Platform revenue guidance was revised downwards to $135-145 million, and Title365 revenue guidance was revised upwards to $95-105 million. The guidance implies an average revenue of $34-39 million for Blend Platform, and $12-17 million for Title365 in each of the remaining quarters.

Gross Profit

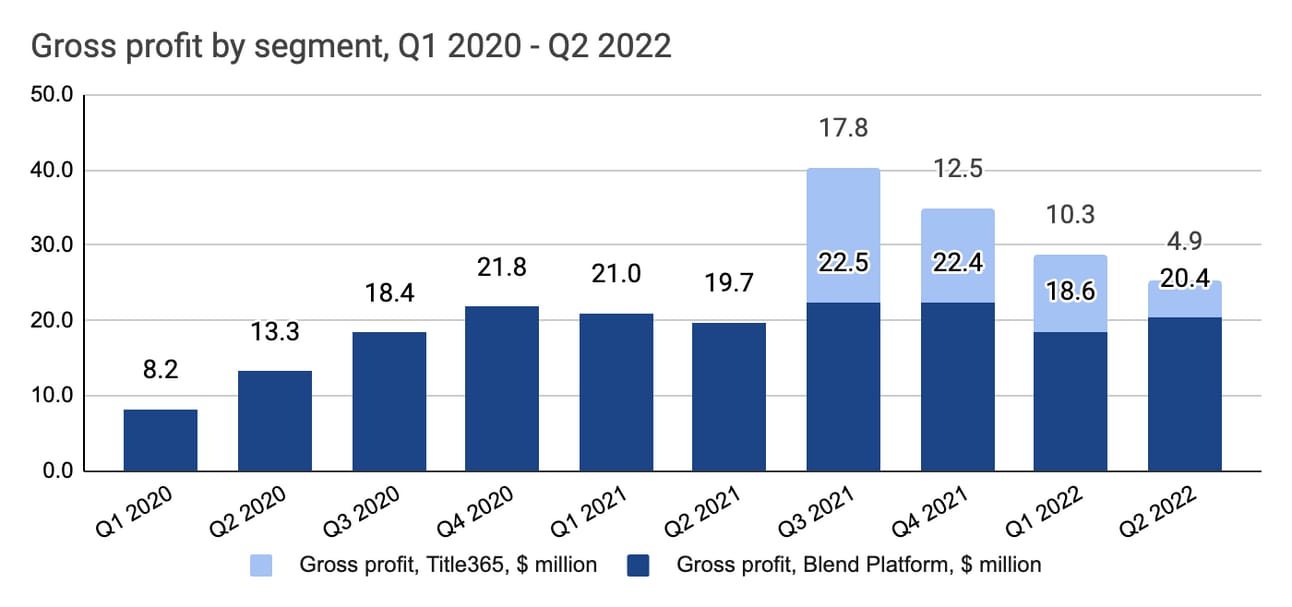

The company reported $25.3 million in gross profit for the quarter, $20.4 million of which was contributed by the Blend Platform, and $4.9 million was contributed by Title365. Blend Platform’s gross profit contribution grew 3% compared to Q2 2021, and 10% sequentially.

Gross profit contribution from Title365 declined to $4.9 million in the quarter (see the chart below). I don’t want to dunk on Blend’s management for doing this acquisition; after all, the refinancing market collapsed over a few quarters, but…Blend still has a $225 million loan on its books due to this acquisition. The write-off of the Title365 acquisition was a non-cash item, but the interest on this loan (“a base rate plus an applicable margin of 6.50%”) will hinder the company’s profitability for a while.

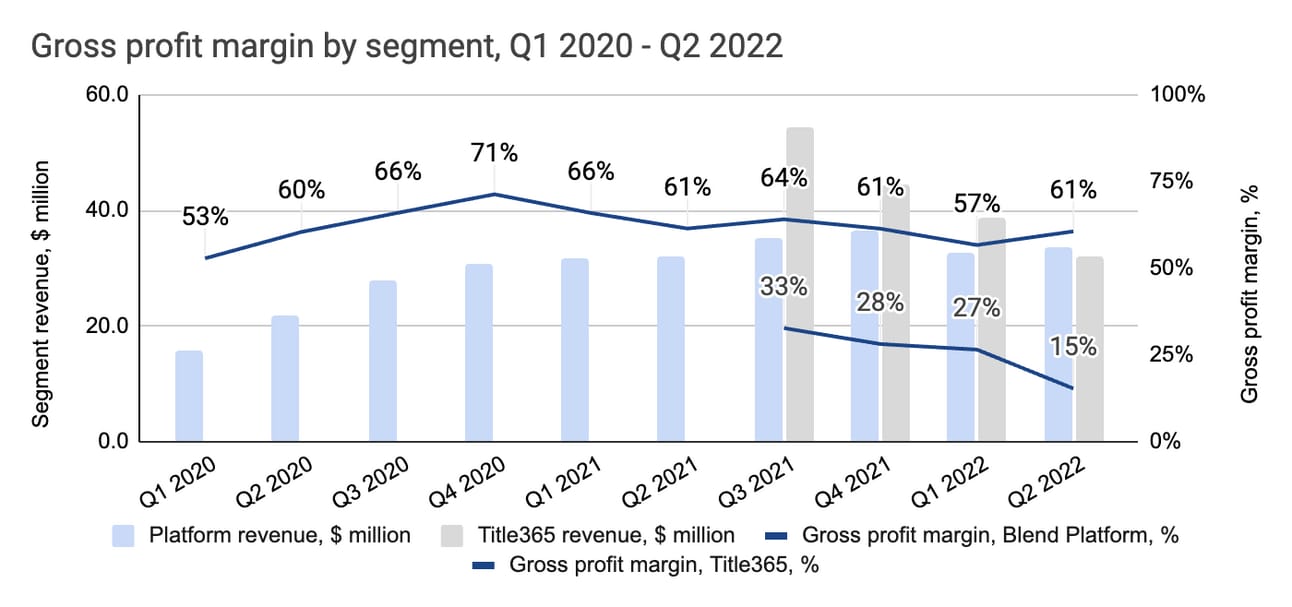

Blend’s management expects the “medium-term non-GAAP Blend platform gross margins to be in the low 60% range.” Blend calculates non-GAAP gross profit by deducting stock-based compensation from GAAP gross profit. However, stock-based compensation within the “cost of revenue” is negligible (i.e. $0.55 million in Q2 2022); thus, the target of the “low 60% range” applies to the GAAP gross profit as well. As you can see from the chart below, Blend Platform's gross profit margin in Q2 2022 stood at 61%, which was similar to Q2 2021.

Operating Expenses

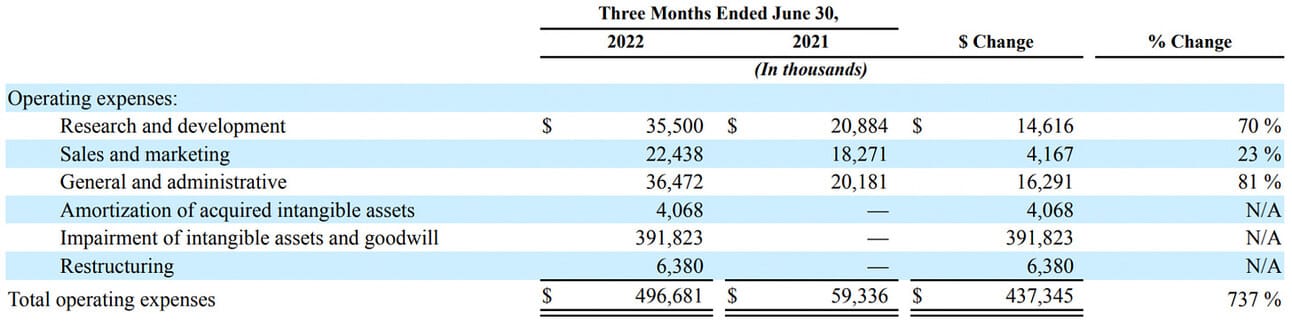

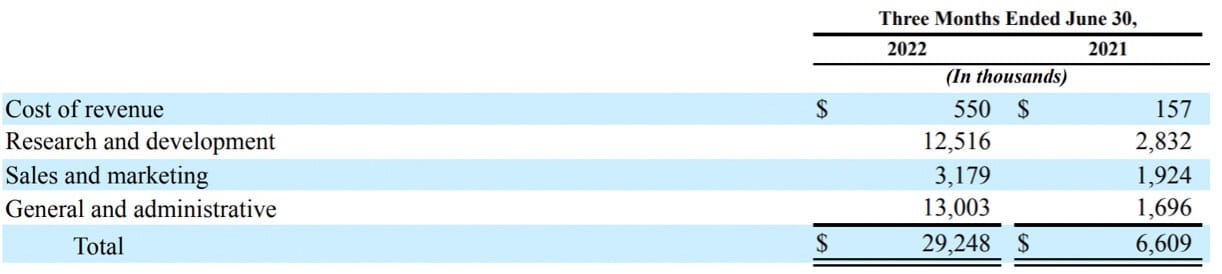

The company reported $496.7 million in operating expenses for the quarter. However, two of the items, “Impairment of acquired intangible assets and goodwill”, as well as “Restructuring” were one-time items related to the write-off of the Title365 acquisition (“impairment”), and April layoffs (“restructuring”). Excluding these items, the company reported $98.5 million in operating expenses, which represents a 66% increase compared to Q2 2021 ($59.3 million).

The increase in the operating expenses came from a) consolidation of Title365 costs, b) an increase in stock-based compensation, and c) extra headcount. Title365 acquisition brought in an extra $1.6 million in sales and marketing expenses, $8.3 million in general and administrative expenses, as well as resulted in amortization expenses of $4.1 million. Stock-based compensation increased by $22.6 million compared to Q2 2021. The rest of the increase came primarily from the increased headcount and the costs resulting from the public listing.

Given the market conditions and deterioration of revenue, the management spoke at large about optimizing the costs. Thus, the company executed two layoffs, one in April 2022 and one in August 2022, eliminating over 400 positions or 25% of the company’s workforce. The layoffs are expected to reduce Blend’s annualized expenses by approximately $60 million. The company is also planning to use its office in India (which the company acquired with Title365) to offshore corporate support functions and “shift work where we historically relied on third-party vendors.”

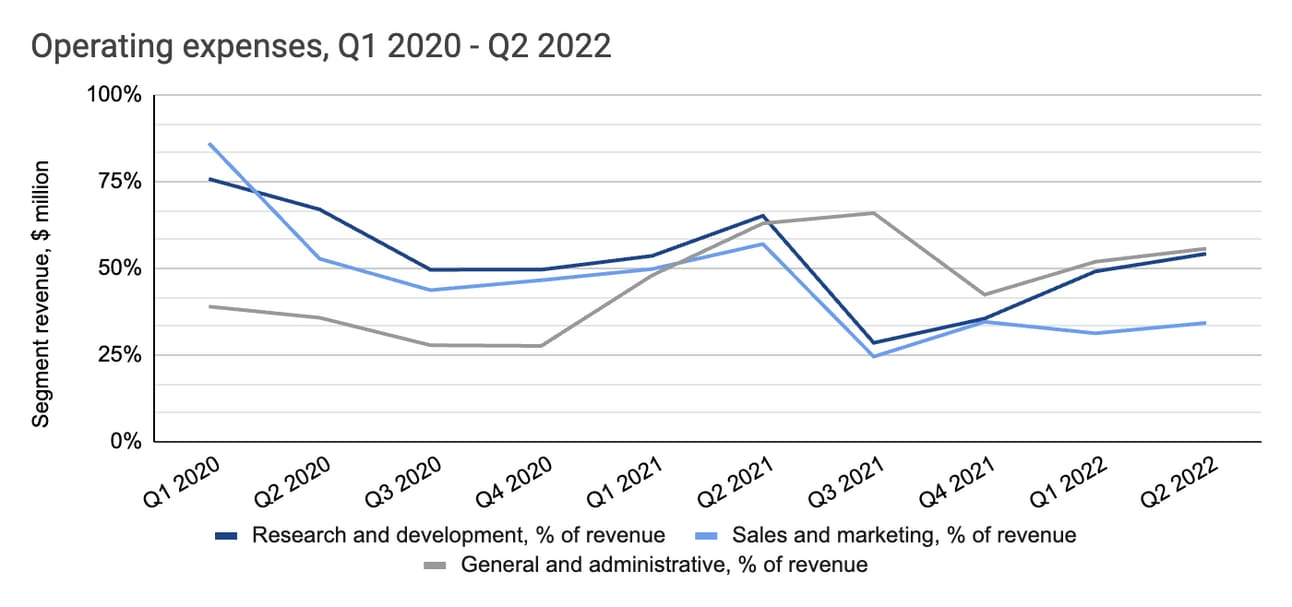

As the mid-term target, the company’s management expects general and administrative expenses to get “to the low teens as a percentage of annual revenue” (56% in Q2 2022), sales and marketing expenses to “land in the 20s as a percent of revenue” (34% in Q2 2022), and research and development expenses “to be in the high teens to low 20s” (54% in Q2 2022).

Even at the low range of this guidance, operating expenses will add up to 50% of the revenue. The target gross profit margin of the Blend platform (“in the 60s”) can support such a level of expense; however, the “blended” gross profit margin (Platform + Title365) stood at 38.5% in Q2 2022. My understanding is that the company needs a bigger scale to reach profitability, and this scale will not come until the mortgage market is in a down cycle.

Net Loss and Adjusted Net Loss

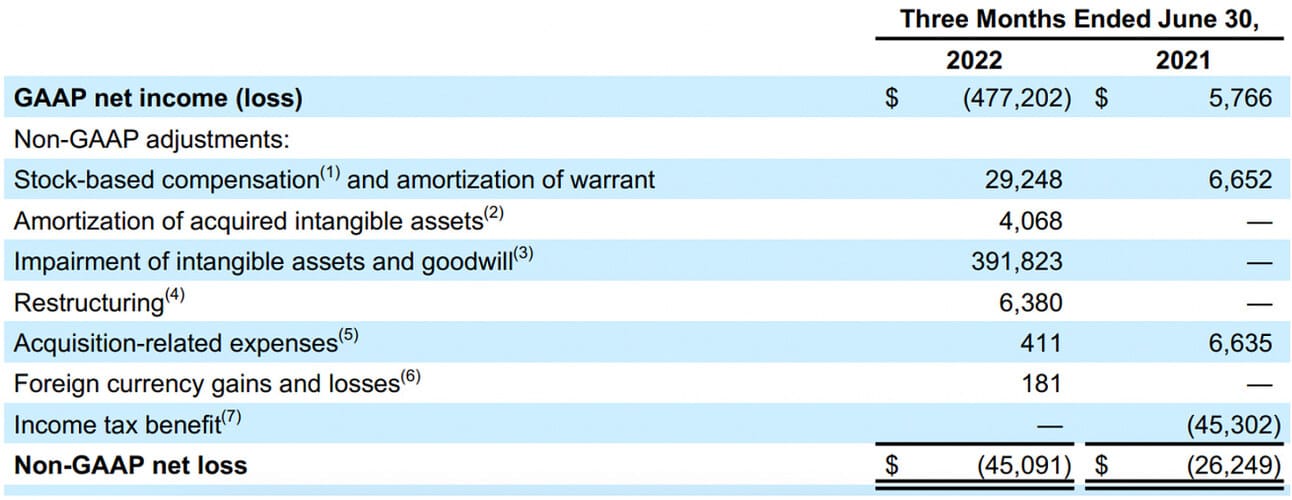

The company reported $477.2 million in Net Loss. Excluding the impairment of the Title365 goodwill, the Net loss was $85.4 million (compared to a Net Income of $5.8 million in Q2 2021, and a Net loss of $72.4 million in Q1 2022). Non-GAAP net loss was $45.1 million (compared to a non-GAAP Net loss of $26.2 million in Q2 2021, and a non-GAAP Net loss of $45.1 million in Q1 2022).

The company’s management announced the ambition to “reduce the non-GAAP net operating loss by 50% from current levels by the end of 2023.” As you can see from the chart below, the “current levels” were probably meant to be $44-45 million. Stock-based compensation will be the main adjustment of the net income going forward, as the company wrote off most of the Title365 goodwill (hence no amortization).

The company had approximately $450 million in cash, cash equivalents, and marketable securities at the end of the quarter, so I wouldn’t worry about Blend running out of money. However, it doesn’t look like it can reach profitability (on an adjusted or non-adjusted basis) before the mortgage market recovers.

Things to Watch in 2022

Customer wins. My thesis in the case of Blend is that the company is struggling while the mortgage origination volumes are in decline, but should be a major beneficiary once the market returns to growth. Therefore, it is important to monitor if Blend keeps onboarding new customers and increasing its market share.

Reaching profitability. Probably the biggest win for Blend in this market would be reaching profitability, at least on an adjusted basis (excluding stock-based compensation). At the latest earnings call the company’s management outlined numerous cost optimization measures, but we are yet to see if those will suffice for reaching profitability.

Growth of the Consumer Banking Platform. While the revenue generated by the Mortgage Platform and Title365 business is declining, the revenue generated by the Consumer Banking Platform keeps growing. Blend is investing in building new capabilities (Home Equity, Blend Close), and they have a sizeable customer base to upsell. A year ago this business looked like an experiment, but now it is a meaningful contributor to the company’s top line.

The Federal Reserve keeps hiking rates, and the Mortgage Bankers Association keeps revising downwards mortgage origination forecasts. Therefore, we should not expect Blend to deliver revenue beats anytime soon. However, at some point the market will return to growth and Blend will definitely be a major beneficiary.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your own research.