Last week Blend reported Q4 2021 and Full Year 2021 results. This was the first time the company reported full-year results after going public in July, 2021, and that turned out to be a tough year given the market conditions. The company provides software for mortgage lenders, and thus, was directly impacted by the rising interest rates and the slowdown in the housing market. Revenue generated by Blend’s main product, Mortgage banking platform, grew only 14% YoY in the last quarter. In addition, the company guided for almost flat revenue growth in 2022 despite the introduction of new products and the acquisition of a title insurance company, Title365.

The short-term outlook for the company looks grim, but there are many things to be positive about. The company continues to acquire new customers and expects to reach a 20%+ market share in the mortgage segment by the end of the year. In addition, Blend’s software business generates 60%+ gross margin, and the company is working on expanding its solution capabilities beyond mortgage lending. When the mortgage market returns to growth (and it always does), the company might become a strong winner, and the currently depressed stock price might represent a good investment opportunity. Let’s take a deep dive into Blend’s financials.

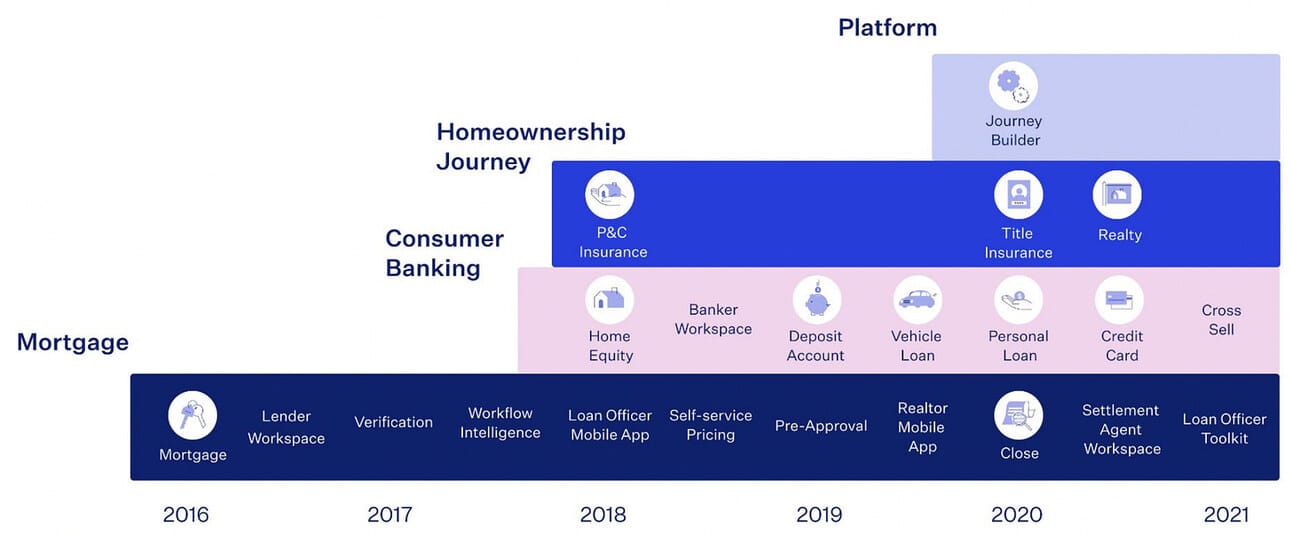

Image source: Q4 2021 Quarterly Supplement

How Blend makes money

Back in 2016, Blend started by offering mortgage lenders a suite of products that digitized their loan application and underwriting processes (referenced in the company’s reporting as “Mortgage Banking”); however, since then started expanding its solution capabilities to support such services as deposit accounts, auto and personal loans, as well as credit cards (referenced as “Consumer Banking”).

Finally, in the summer of 2021, the company took a sidestep from its pure software play and acquired a title insurance agent, Title365 (referenced as “Title365”). The reasoning behind the acquisition of Title365 was to expand on Blend’s ambition “to build a single, cloud-based platform to power the full consumer homebuying journey”.

Lending, especially mortgage lending, involves many steps that used to be done manually and required the borrower to show up at the branch in person. Blend founders timely identified the problem and rode the wave of digitalization and automation of lending processes, which was further accelerated by the pandemic.

The company went primarily after the most “handicapped” customer base (smaller banks and credit unions that have limited IT capacity and budgets), and the product (mortgages) that is not heavily contested by Fintechs (fintech lenders primarily focused on personal loans). Blend’s growth strategy has been working so far and besides a few big-name clients, such as Wells Fargo, US Bank, BMO Harris Bank, and PennyMac, the company serves over 300 lenders across the United States.

What is more impressive than the number of customers, is the company’s market share. Thus, the company reported processing 15.2% of all mortgage originations in the US in the second half of 2021. During the latest earnings call, the management indicated the ambition to grow the company’s market share by another 5% in 2022, surpassing 20% market share by year-end.

As it is unreasonable to anticipate indefinite market share growth, Blend started expanding its offering beyond mortgages (launching the “Consumer Banking” range of products). At the moment, the “Consumer Banking” suite makes a minor contribution to Blend’s revenue (~10% of total revenue), but is expected to pick up the slack once Blend reaches market saturation in its mortgage business.

Blend monetizes its Mortgage Banking and Consumer Banking products by charging its clients a fee for accessing the platform “under subscription arrangements, in which customers commit to a minimum number of completed transactions at specified prices over the contract term, or under usage-based arrangements, in which customers pay a variable amount for completed transactions at specified prices”. As per the company’s filings, “revenue from usage-based arrangements represented 29% of the Blend Platform revenue for the year ended December 31, 2021. The company also makes a bit of money from professional services (less than 2% of the total revenue) - helping their clients with the implementation of the platform.

Blend’s title insurance business, Title365, generates revenue through the “fees for placing and binding title insurance policies with third-party underwriters that ultimately provide the title insurance policy to its customers”.

Revenue

Blend reported $81.0 million in revenue for Q4 2021, and $234.5 million for the full year 2021. Blend Platform revenue grew 19% YoY for the quarter ($36.5 million vs. $30.6 million), and 41% YoY for the full year ($135.6 million vs. $96.0 million).

In the summer of 2021 Blend completed the acquisition of Title365; thus, comparing total revenue numbers with previous periods is not meaningful, as both Q4 2021 and full year 2021 numbers include revenue from Title365 operations. It should also be noted, that Title365 was consolidated into Blend reporting only starting from Q3 2021; thus, annual revenue was larger (but Blend does not report full-year results).

Most of Blend Platform’s revenue is generated by Blend Mortgage (80% of segment revenue), and the slowdown in the mortgage originations started impacting the company’s growth in 2021. As the company notes in its earnings presentation, Blend Mortgage revenues grew 14% YoY despite the “industry-wise decline of 35% decline in mortgage originations”. Consumer Banking segment revenues grew 46% YoY despite several delays with the product rollout by the company’s customers.

Blend guided for $140-150 million in Blend Platform revenue and $90-100 million for Title365 revenue in 2022, which would result in total revenue for the company of $230-250 million. This guidance essentially means single-digit growth for Blend Platform revenue and something like a 50% decline in Title365 revenue (Title365 generated $98.9 in revenue in Q3-Q4, 2021, while being part of Blend).

However, if you take into account a further estimated decline of 35% in industry-wide mortgage originations (and 60-70% in mortgage refinancing), then the numbers suggest that Blend is planning to compensate for market contraction with new client onboarding. Market downturn exposes the weakness of Blend’s transaction-based pricing model, and at the same time, the strength of the company’s offering, as it fairs much better than the rest of the market.

Until the mortgage market returns to growth, it is worth watching Blend’s progress in market share and customer base (see above), rather than revenue growth.

Gross Profit and Gross Profit Margin

Blend reported a total Gross Profit of $34.9 million for Q4, 2021, and $116.0 million for the full year of 2021. Similarly to revenue, it is not meaningful to compare YoY growth of the total gross profit due to the consolidation of Title365 results in the middle of 2021. Blend Platform Gross Profit grew 2.7% YoY for the quarter, and 38.7% for the full year of 2021.

As can be seen from the table above, Revenue generated by the Blend Platform in 2021 grew at a slightly lower rate than the Cost of revenue (41% vs. 46%); thus, the Gross Margin decreased from 64.3% in 2020 to 63.2% in 2021. The gross margin for Blend Platform was 61.4% in 2019, which is probably an indication that the company can operate with a 60%+ gross margin in both the years of market growth and the years of a market downturn. Title365 business operated with a Gross margin of 30.7%.

For reference, “Cost of revenue” for Blend Platform business “consists primarily of costs of subscribed hosting [hosting, software licenses, third-party costs related to income verification of borrowers, and amortization of internal-use software], support, and professional services [personnel expenses, including stock-based compensation, travel, and allocated fixed costs].”

“Cost of revenue” for the Title365 business “consists of costs of title, escrow, and other trustee services, which represent primarily personnel-related expenses of our Title365 segment as well as title abstractor, notary, and recording service expense provided by external vendors.”

Operating Expenses

Blend reported an Operating Loss of $59.9 million for Q4 2021 (an increase from $16.1 million in Q4 2020), and $197.2 million for the full year 2021 (an increase from $75.3 million in 2020). It should be noted that in 2021 the company acquired Title365 and went public, resulting in an ongoing or one-off cost increase.

In its financials, Blend groups its operating expenses into four main categories:

Research and development (“primarily of personnel-related expenses, including stock-based compensation expense, associated with our engineering personnel responsible for the design, development, and testing of new products and features”)

Sales and marketing (“primarily of personnel-related expenses, including stock-based compensation expense, costs of general marketing activities and promotional activities, travel-related expenses, and allocated overhead costs”)

General and administrative (“primarily of personnel-related expenses, including stock-based compensation expense for the finance, accounting, legal and compliance, human resources, and other administrative teams”), and

Amortization of acquired intangible assets (“Amortization of acquired intangible assets relates to customer relationships acquired in connection with the Title365 business combination”)

As the company reports in its annual report, increase in the “Research and development”, as well as “Sales and marketing” expenses was primarily driven by the increased spend on Bland Platform rather then by the business combination with Title365 (i.e. “Sales and marketing” expenses increase by $32.7 million, of which $3.8 million was attributable to Title365). Both expense positions grew faster than both the Revenue and the Gross profit generated by the Bland Platform segment (+41% YoY and +39% YoY respectively).

“General and administrative” costs seem to have ballooned in 2021; however, $47.4 million increase (out of the total increase of $98.7 million) was related to the “stock-based compensation, of which $38.8 million related to the stock option award granted to our Co-Founder and Head of Blend”. Additionally, IPO triggered “a $11.0 million increase in professional and other consulting services”, and Title365 resulted in “a $12.0 million increase in transaction and integration costs”. Such costs are one-off expenses, and thus, should not impact Blend operating expenses in the future.

As mentioned above, Operating expenses include stock-based compensation, and the company provides a break-down of such compensation by the expense group. Thus, stock-based compensation comprised $70.8 million in 2021 (or 22.3% of the total Operating expenses for the year).

Net Income (Loss) and Adjusted EBITDA

The company reported GAAP Net loss of $71.5 million in Q4 2021 (an increase from the Net loss of $16.0 million in Q4 2020), and GAAP Net loss of $169.1 million for the full year 2021. The main difference from the Operating loss came from the paid Interest expenses and the realized Tax benefit related to the acquisition of Title365 (Title365 acquisition was funded with debt).

Blend reported $44.3 million in Adjusted Net Loss (Non-GAAP) for Q4 2021 (an increase from the Net Loss of $13.3 million in 2020), and $116.2 million for the full year 2021 (an increase in the Net Loss of $63.0 million in 2020). The company makes adjustments of the Net Loss for the stock-based compensation, amortization of warrants, amortization of acquired intangible assets (Title365), as well as one-off non-case items such as acquisition-related expenses and income tax benefit.

When questioned during the earnings call, the management did not provide any guidance on when the company could reach profitability on either adjusted or non-adjusted basis.

Things to Watch in 2022

Mortgage platform revenues. A higher interest rate environment will continue being a headwind for Blend and Blend’s customers in 2021. Thus, the company cannot rely on its existing customers to deliver on the revenue guidance and needs to acquire new clients. As mentioned above, growth of the customer base might be a more important metric than revenue during the market downturn if you look at the long-term prospects of the company.

Housing market and interest rates. As the last year has shown, Blend’s revenue are highly impacted by the market conditions given its usage-based pricing model. In its current guidance, Blend assumed a 35% decline in mortgage origination volumes…but what happens if the decline turns out to be bigger?

Consumer banking platform. Company cannot grow its market share in mortgage lending indefinitely, so the Consumer Banking platform is expected to pick up the slack and become the key revenue driver at some point. On one hand, Blend has a customer base of 300+ financial institutions, which should give a strong start to its Consumer Banking platform, on the other hand, Blend is going against a new set of competitors with this offering. I guess my question is if they can scale Consumer Banking into a sizeable business.

Insurance and other financial services. Blend took a sidestep from a pure software play with its acquisition of Title365. Title365 business might be fully aligned with mortgage end-to-end journey, but it’s a different business than a SaaS platform and has much lower margins. I believe it is worth watching if Blend doesn’t start deviating further away from its software business organically or via acquisitions.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.