Hey!

I think it is becoming my annual tradition to question American Express’s growth aspirations. Last year, I challenged their revenue growth targets. I was right about the revenue, it did decelerate by the end of the year below the target, but Amex over-delivered on earnings growth and the stock rallied 60%.

Since then, the company held an Investor Day to reassure investors that their growth aspiration of 10%+ revenue growth and “mid-teens” EPS growth still stands. I still don’t understand how they will get there. Didn’t understand a year ago, and don’t understand now. What am I missing?

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

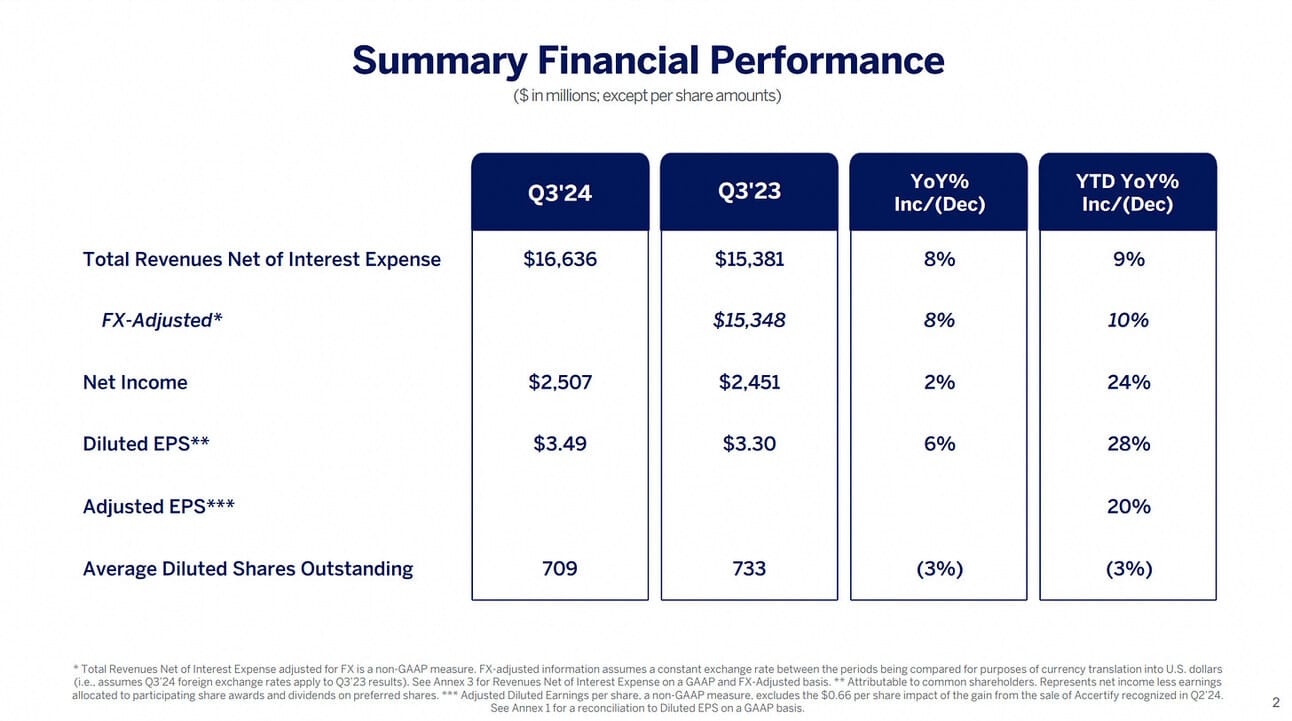

A year ago, I wrote that American Express’s aspiration for 10%+ revenue growth, which they had presented during their 2022 Investor Day, was not achievable. I was right…the revenue growth decelerated to 8% YoY in Q3 2024, and analysts estimate that the full-year 2024 revenue grew by 9% YoY. However, the company’s stock was up 60% in 2024.

What did I miss? American Express delivered higher-than-expected EPS growth, and the multiples expanded. P/E multiple went from 15.7x at the end of 2023 to 20.6x at the end of 2024 (P/Book multiple increased from 4.7x to 7.0x). They also bought back stock. The market ignored their revenue miss and rewarded the earnings beat.

In April last year, American Express held another investor day….and they reiterated the 10%+ revenue growth and “mid-teens” EPS growth targets. Compared to the 2022 Investor Day, American Express’s management gave themselves some flexibility by calling these targets “aspirations”. However, these were strong commitments to get there.

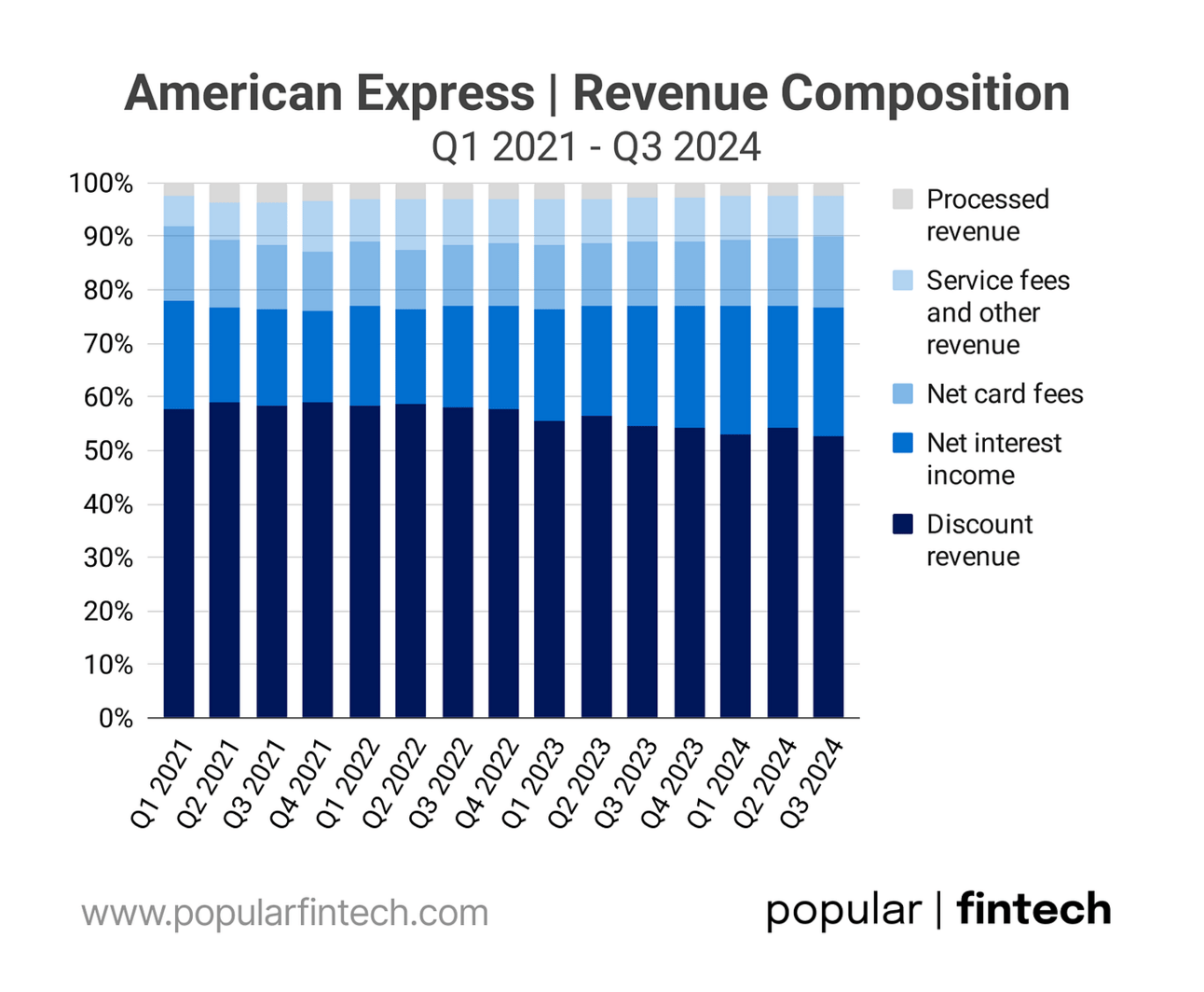

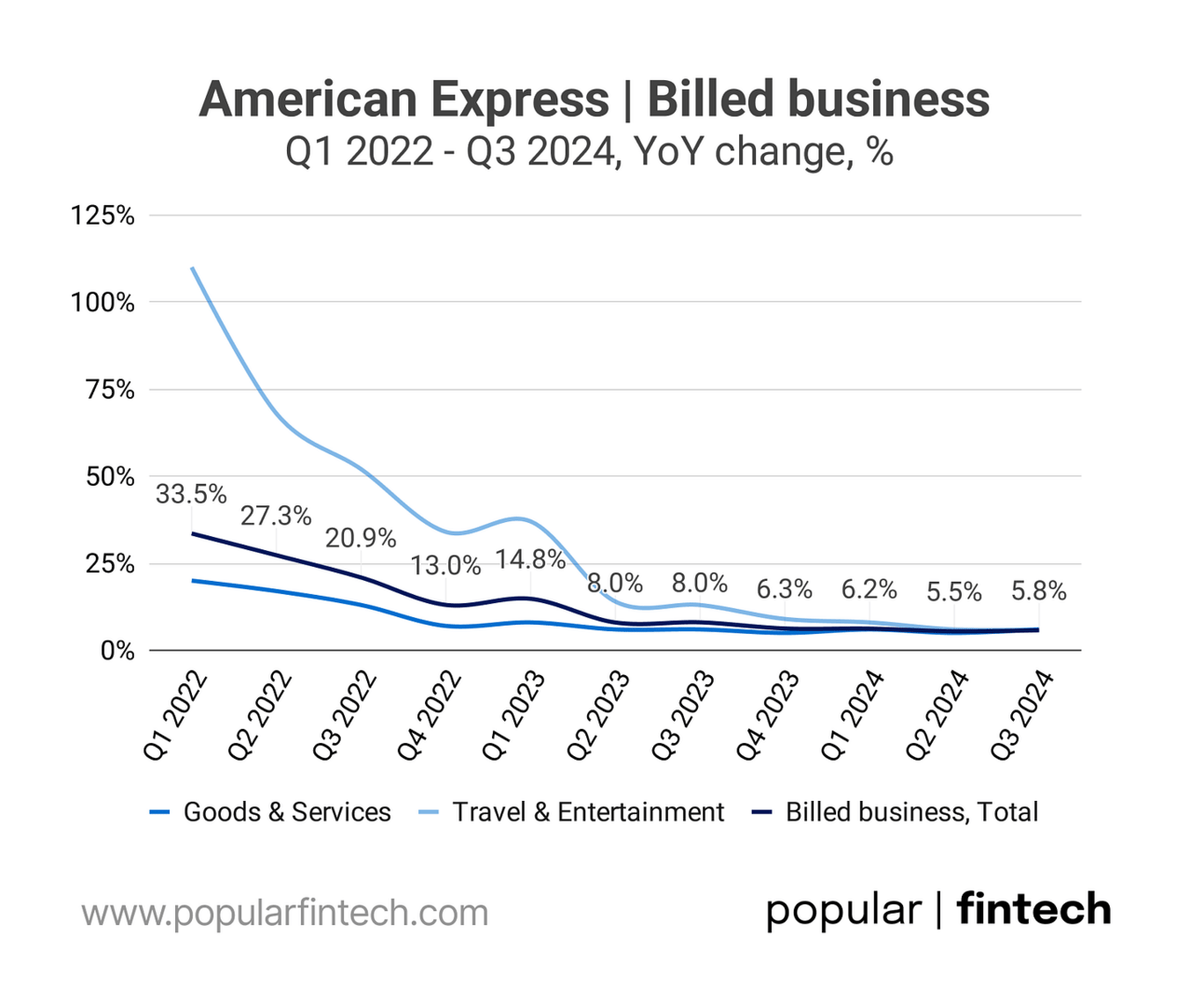

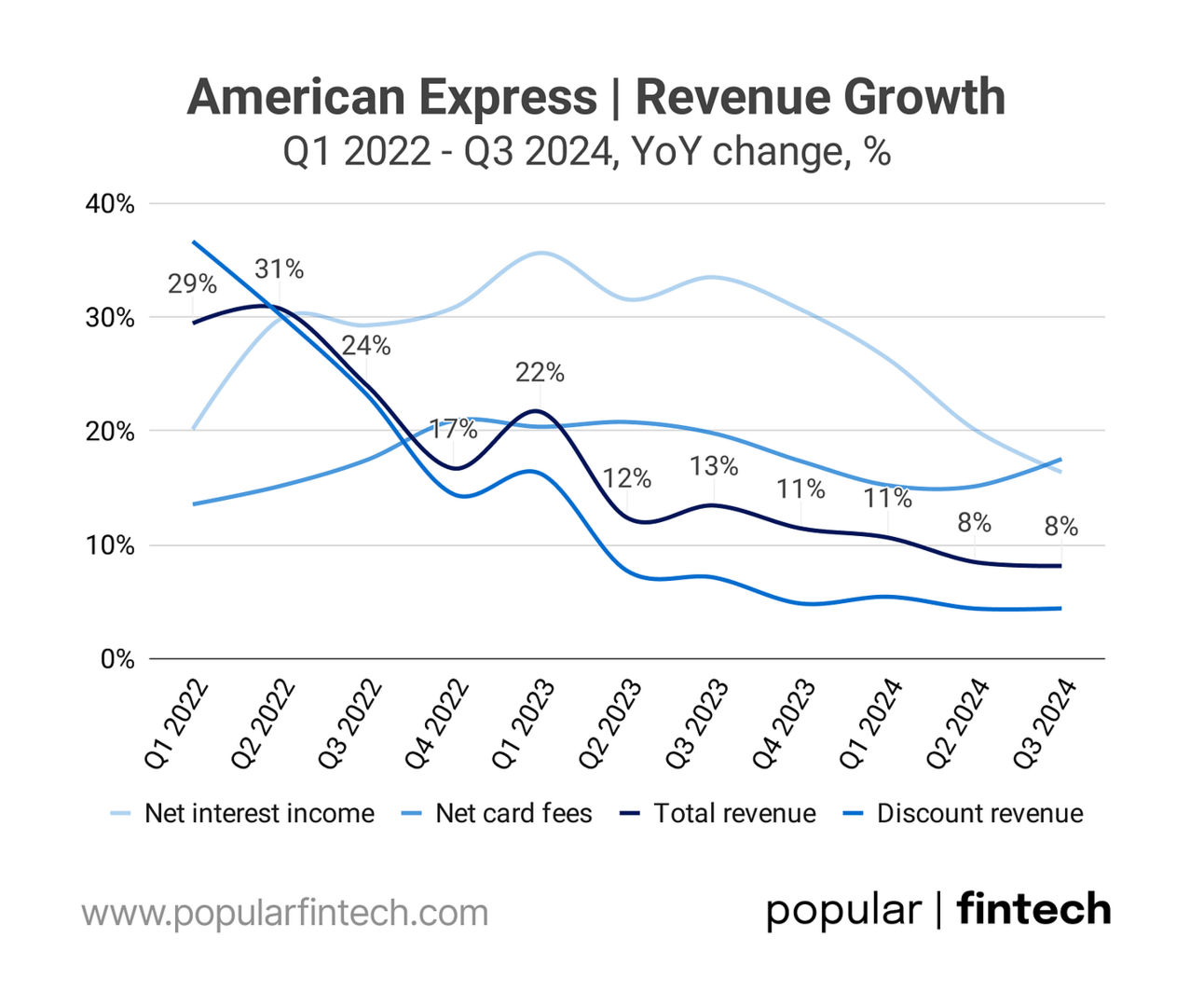

A year passed since my previous article. I learned a lot about the company (and its competitors) in this period…and I still don’t understand how the American Express team plans to deliver on the 10%+ revenue growth and “mid-teens” EPS growth targets. Let’s revisit my reasoning. More than 50% of Amex revenue comes from Discount revenue, which is primarily driven by the payment volumes (referred to as “billed business”).

In Q3 2024, billed business decelerated to 6% YoY in both core categories, Travel & Entertainment (T&E) and Goods & Services (G&S). Discount revenue growth decelerated to 4.4% YoY. A year ago, in Q3 2023, billed business increased 8% YoY, and Discount revenue grew 7% YoY. Amex CEO commented at a recent conference that billed business volume has to grow in “high single digits” for the company to hit the 10% revenue growth aspiration.

I think the 10% is the correct aspiration. So what has to happen to have all that right? Well, you probably need high single-digit billings, and we're not there at this point. You need to continue to have card fee growth, we've now been 10% or more for 25 straight quarters. And I think lending needs to grow just slightly more than billings, and we're growing in line with the industry. You put all that together and you will get to your 10% revenue.

Stephen Squeri, American Express CEO

American Express Q3 2024 earnings call

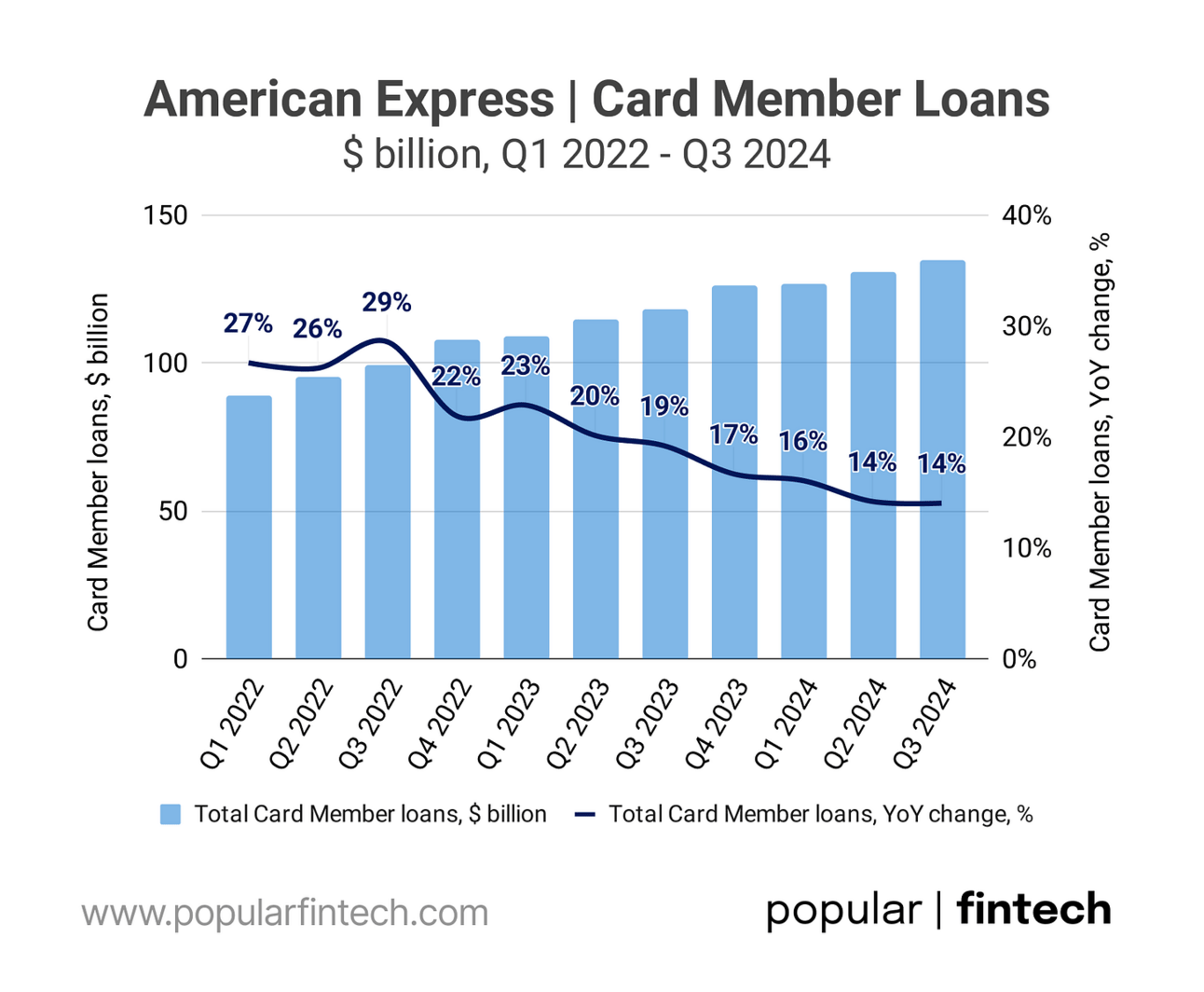

Net Interest Income is the second largest revenue component. Over the last year, card member loan growth decelerated from 19% YoY in Q3 2023, to 14% YoY in Q3 2024, while the net interest yield on card member loans was flat at around 12%. Before the pandemic (2016-2019), card member loans grew in low double-digits (10-12%), which is where loan growth seems to be heading now.

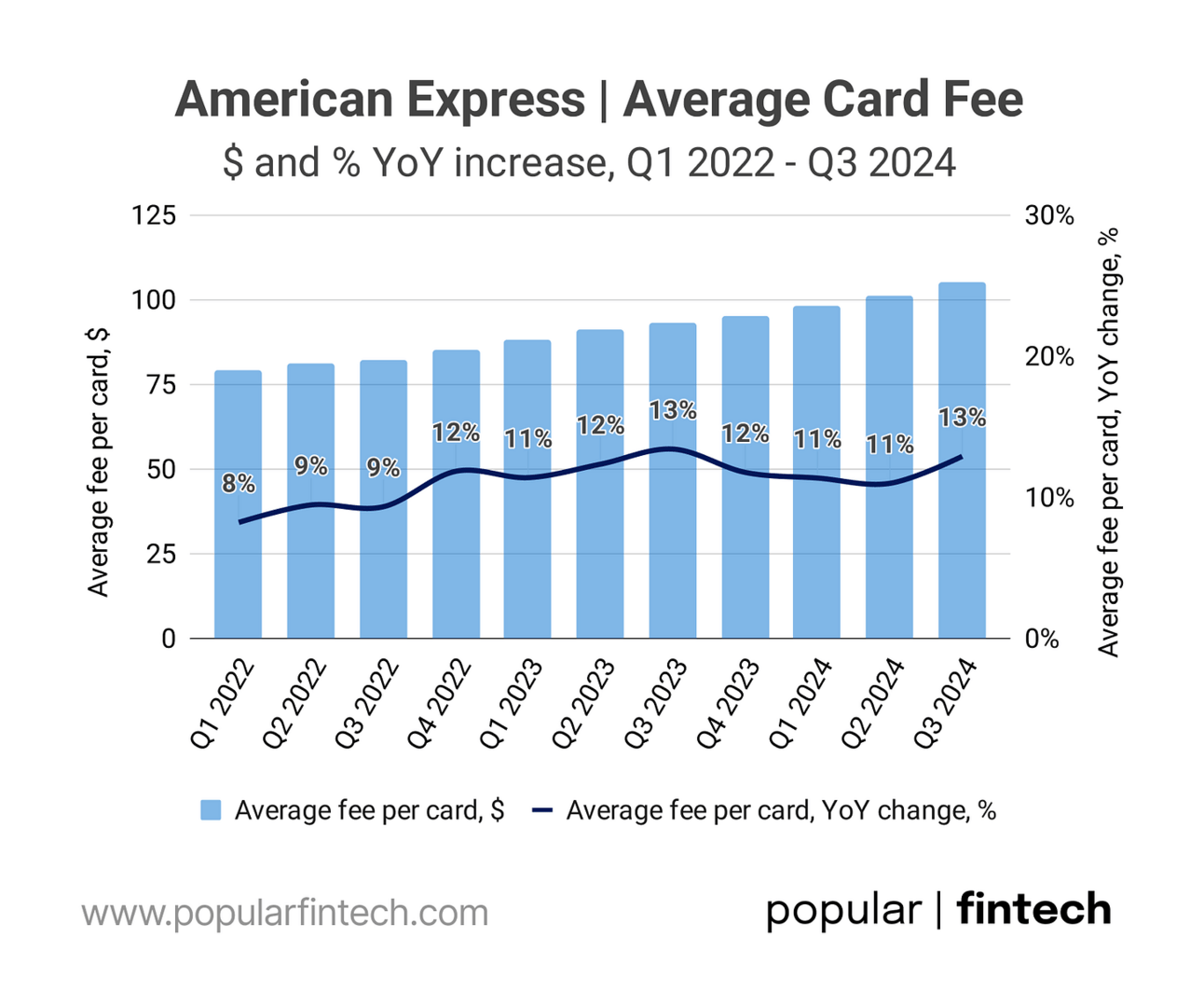

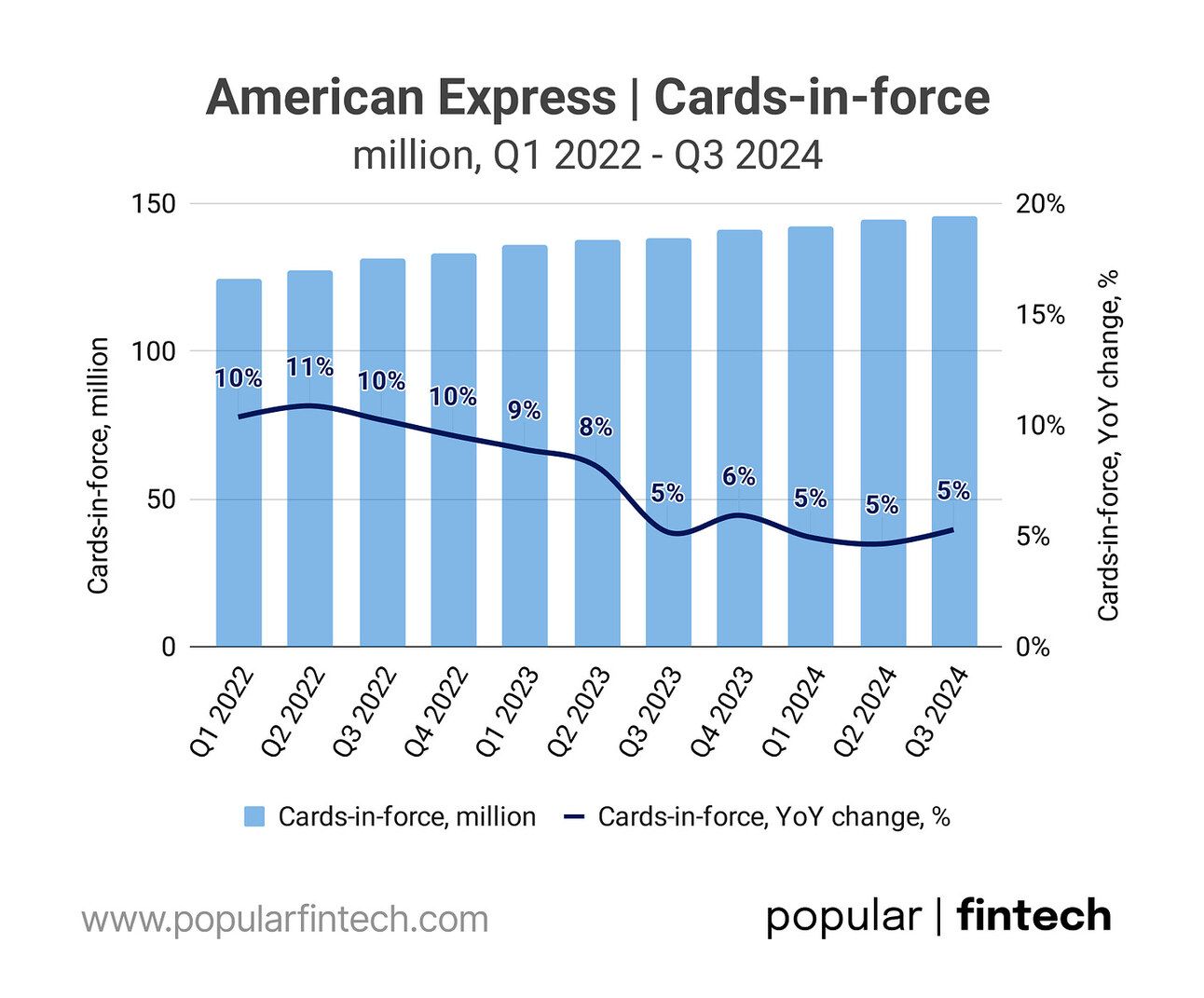

The third revenue component is Net card fees, which is the output of the number of cards in force and the average card fee. Amex has been very successful in doing card “refreshes”, where they add more rewards to a card and increase its annual fee. So while growth in the number of cards decelerated to 5% YoY, the average card fee continues to grow in double digits.

Gold Card is a workhorse product for us.….from a Gold Card perspective, which is also interesting, we launched a white Gold Card. So there was a rose gold, there was a gold gold and there's a white gold. And I'm just hoping there's another color of gold because people went nuts.

Stephen Squeri, American Express CEO

Goldman Sachs 2024 U.S. Financial Services Conference

Putting it all together: the largest component of Amex’s revenue, discount revenue is growing in the low single digits (4.4% in Q3 2024), and there are no signs of acceleration. The second largest component, net interest income, is quickly decelerating and will probably return to its historic growth of 10-12%. Net card fees continue to grow in “high teens”, but is the smallest of these three. It is clear that unless discount revenue magically accelerates, American Express cannot achieve its 10%+ revenue growth aspiration.

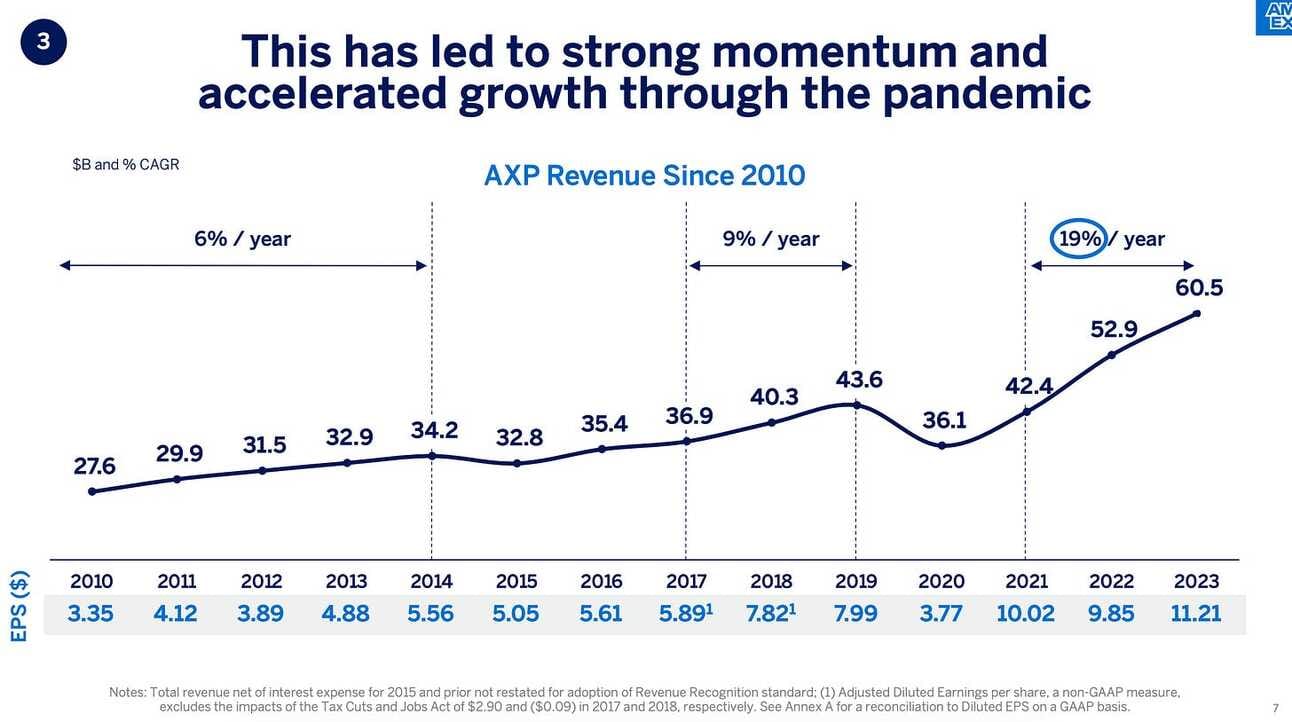

And, by the way, 10%+ revenue growth “on a sustainable level” is not something very common for American Express. As you can see in the chart below, the pandemic triggered a period of rapid growth (off the low base of 2020), but over the past 10 years (2013-2024), the CAGR for the adjusted revenue was around 6%.

…if you're off on any of those things [ billings, card fees and lending growth ], the scale that we have right now, whether we grow 8%, 9% or 10% revenue, I'm very, very confident we will continue to grow mid-teens EPS, and we're proving that this year by exceeding mid-teens EPS.

Stephen Squeri, American Express CEO

Goldman Sachs 2024 U.S. Financial Services Conference

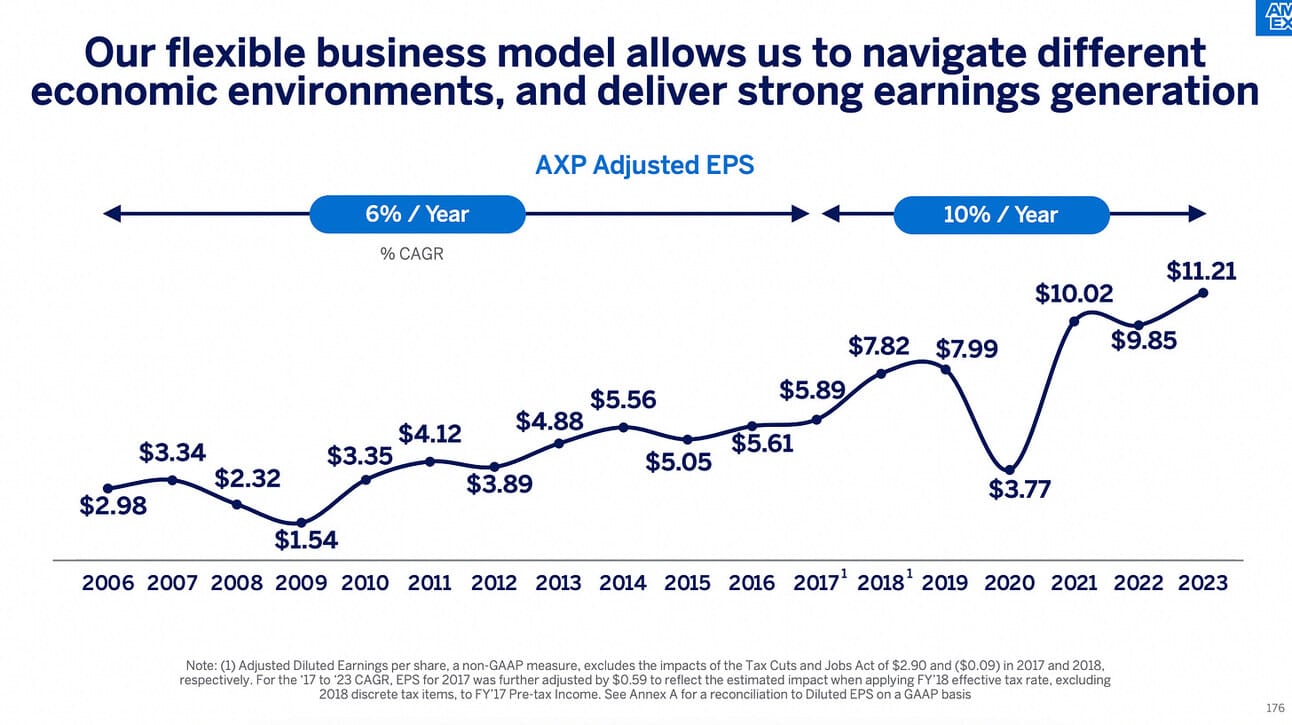

Alright, but….can they deliver “mid-teens” EPS growth? Perhaps, the market will forgive them slower revenue growth like it did in 2024. Let’s start with the fact that there was no “sustainable” period of even 10% EPS growth. During their Investor Day, the Amex team showed a slide that highlighted a 10% EPS growth period (see below). However, excluding the “bump” of 2018 this growth is less impressive (8.7% CAGR over the 10-year period).

So can this time be different? Perhaps, the growth drivers going forward are different from what they were in the past. Let’s review the theses behind the expected growth acceleration that were presented during the investor day: 1) Premium growth through the membership model, 2) Winning the SME recovery, and 3) Runway for growth in international.

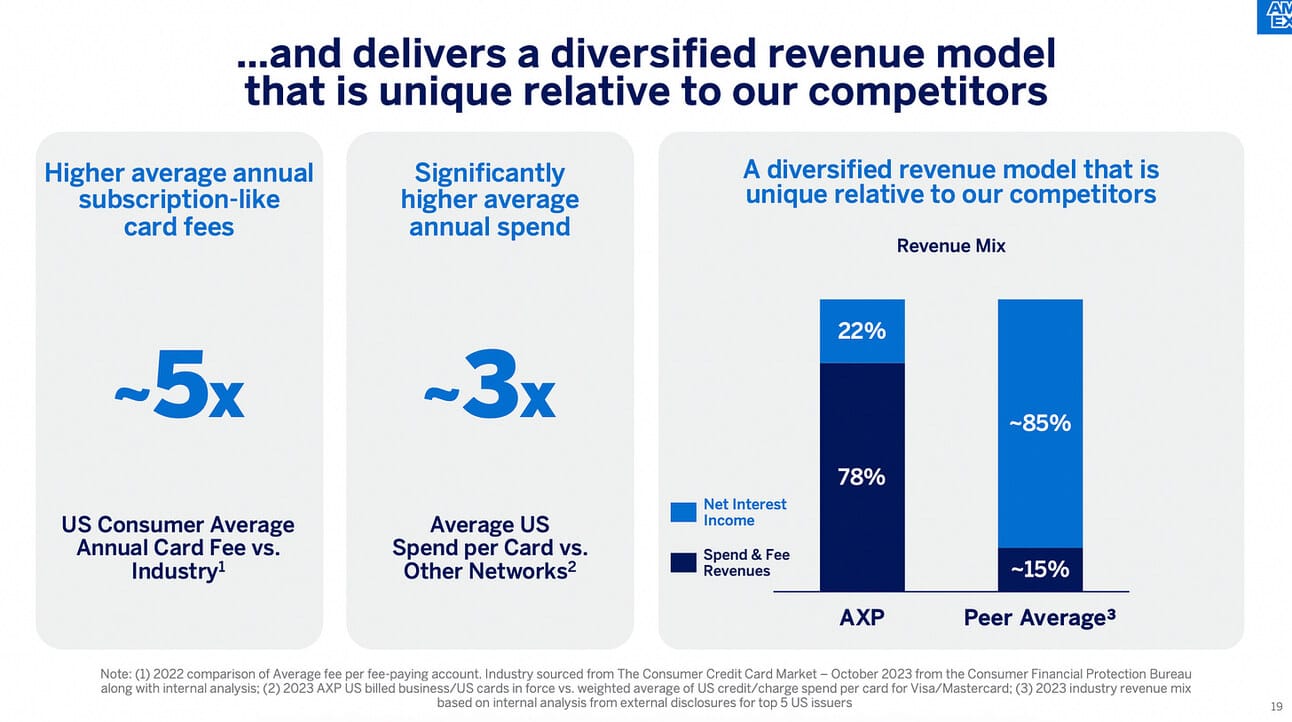

When it comes to the “premium growth”, Amex executives pretty much reiterated the company’s business model. An average Amex cardholder is very loyal, spends more, and is happy to pay for their card. This allows American Express to generate a high share of non-interest revenue which is not typical for a credit card company. They are also succeeding in bringing Millennials and Gen Z customers into their ecosystem.

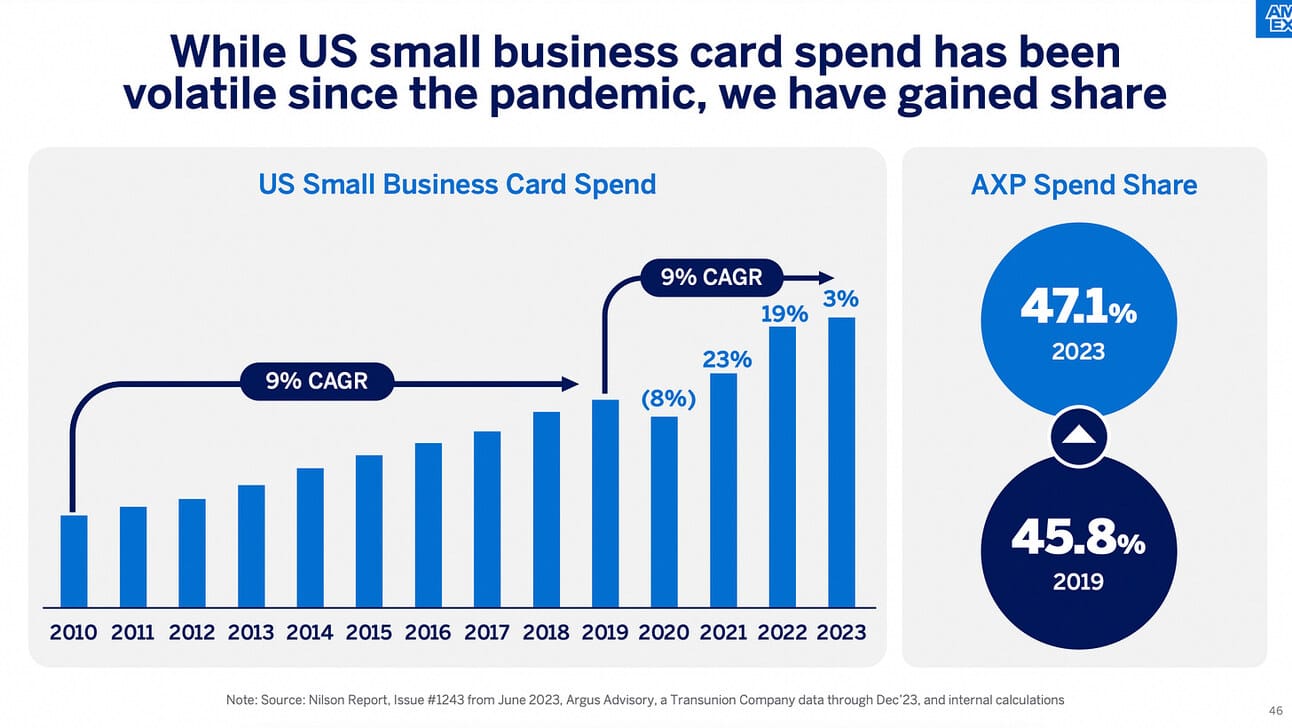

Over 45% of U.S. SME spending goes through American Express cards. SME spend decelerated heavily in 2023, so “winning the SME recovery” for Amex simply means that once small businesses return to their normal spend growth (9% CAGR prior to the pandemic), the company’s revenue will recover. Again, nothing new.

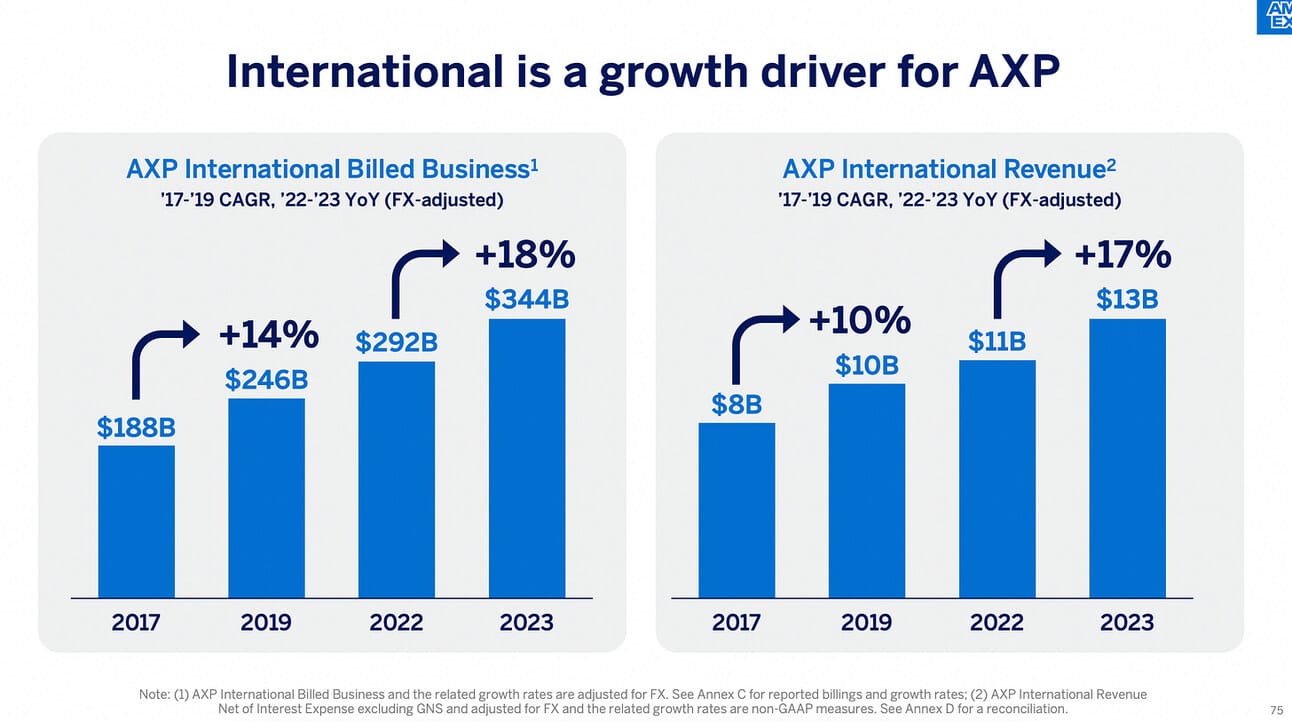

Finally, American Express continues to deliver double-digit growth from its international markets. Amex operates in large markets (the top 5 largest international markets are the UK, Japan, Australia, Canada, and Mexico) and their membership model works internationally, but the take rate in international markets is lower and the company needs to invest in expanding its network coverage.

…international is growing at a faster clip than the U.S. And as you probably know, the discount rate in international is lower than in the U.S. So that creates a little bit of a disconnect between the growth you see in discount revenue and on billed business globally.

Christophe Le Caillec, American Express CFO

American Express Q3 2024 earnings call

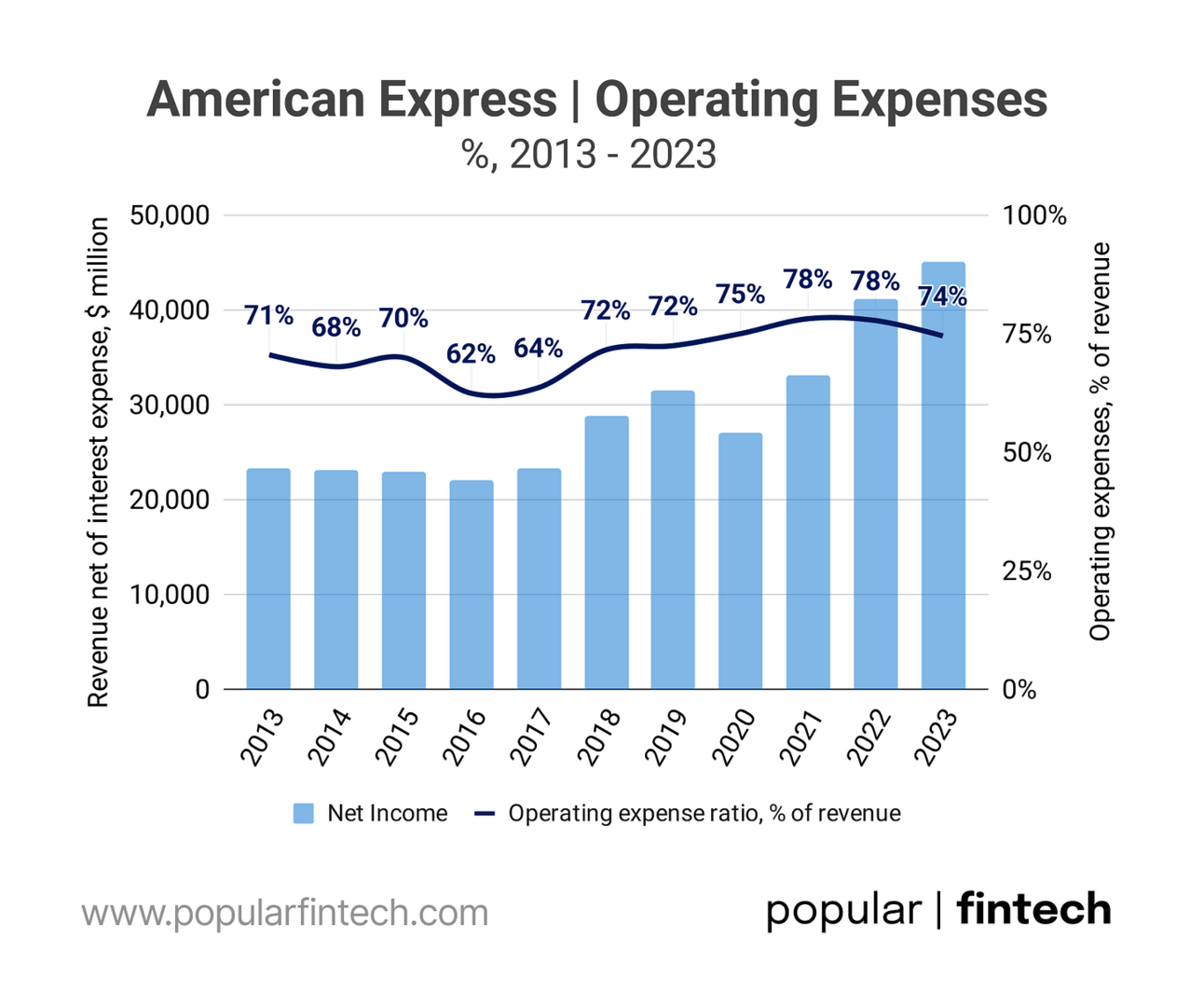

So if the business is not expected to change fundamentally, why would it start generating higher earnings growth? Amex’s management argued that their scale drives operating leverage. Looking at the operating expense ratio (operating expenses divided by the revenue, see the chart below), one can see that it peaked in 2021 at 78.1% and was declining in 2022 and 2023…

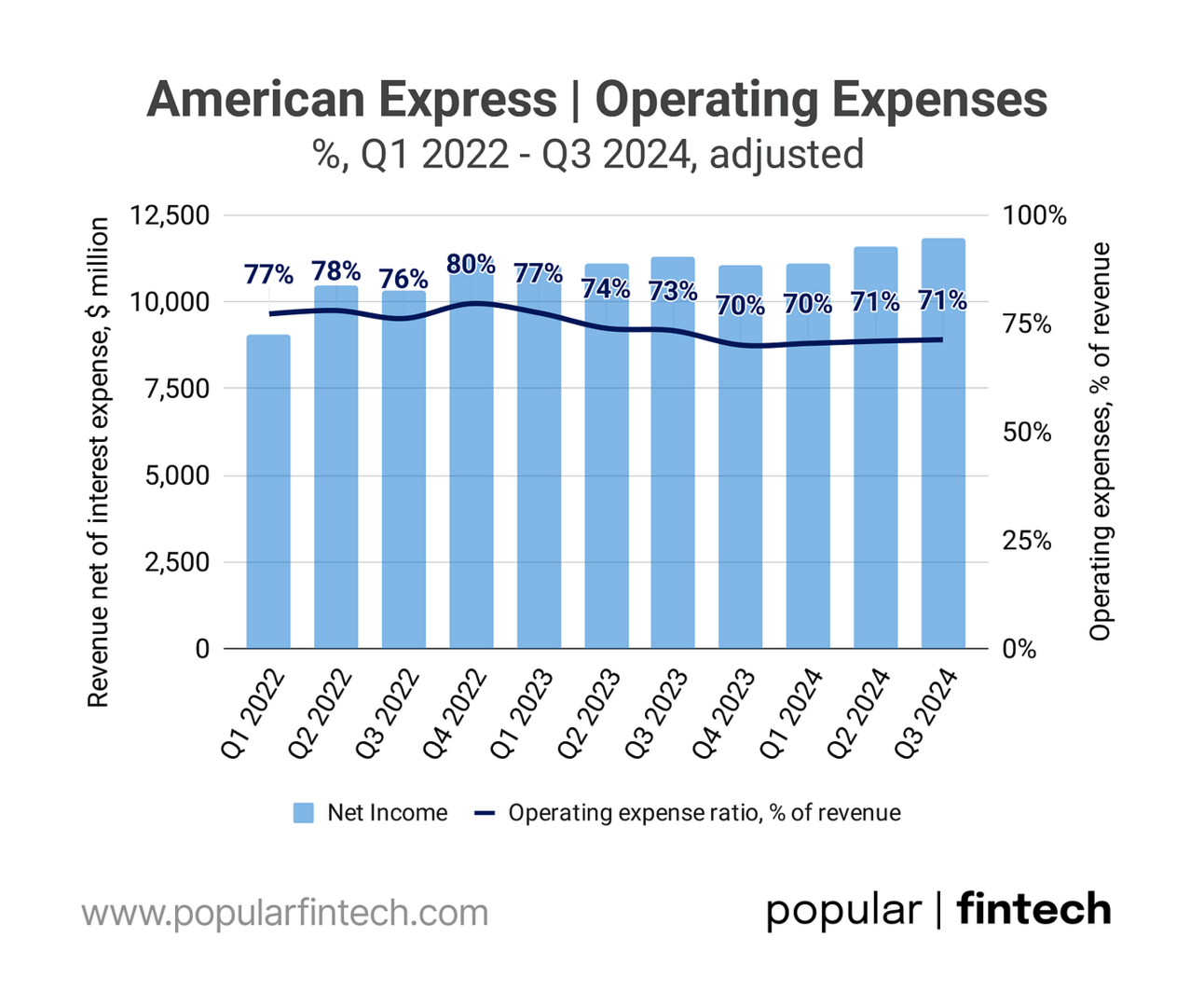

However, looking at the latest quarters, it is seen that the operating ratio flattened out at 70-71% (see the chart below). It is the lowest expense ratio for American Express in many years, so it’s questionable whether the company can achieve further improvements.

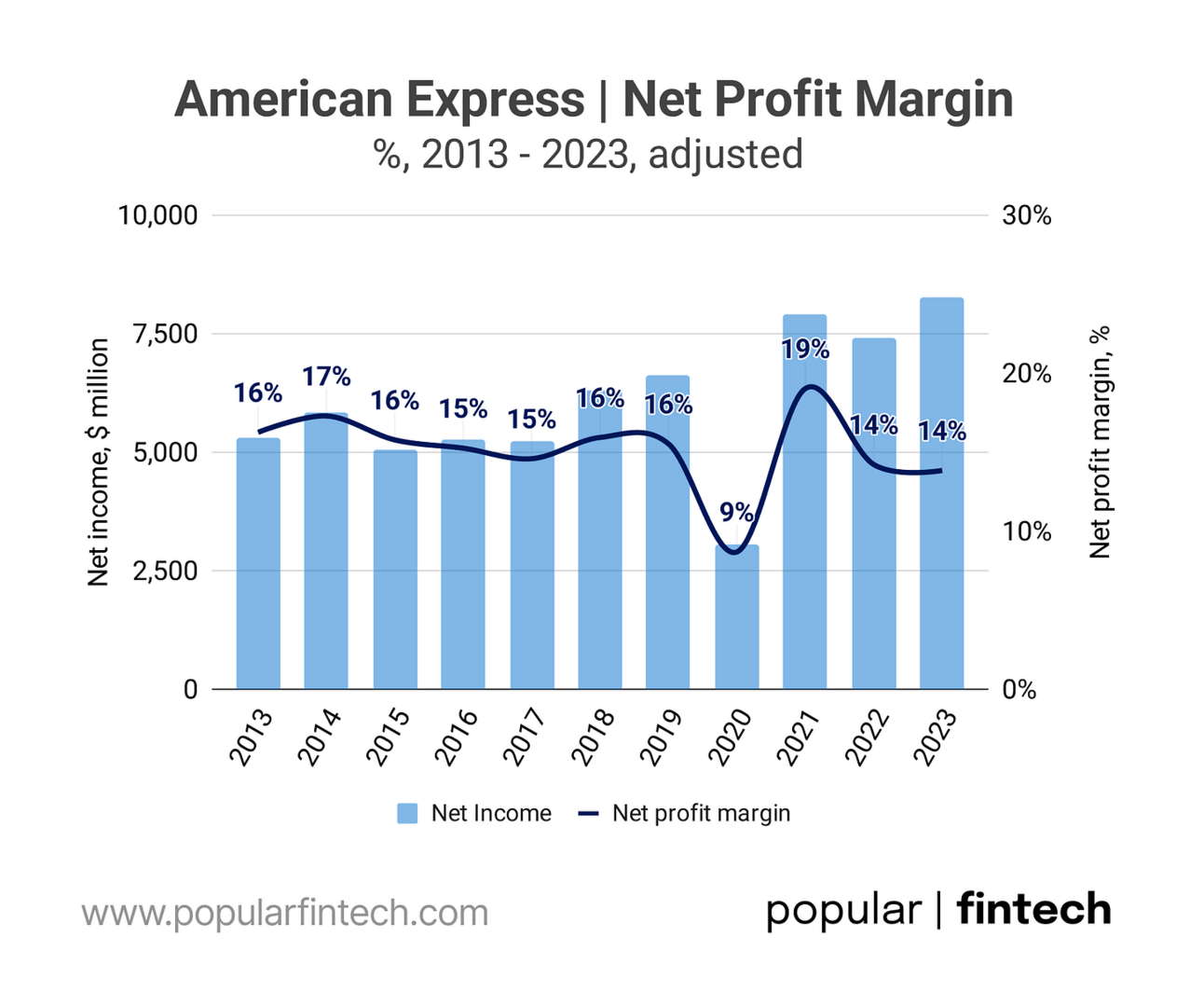

Another way of looking at operating leverage is net profit margin (after all, in addition to operating expenses, American Express also has provisions for credit losses, which are not accounted for in the operating expense ratio). As you can see from the chart below, the company delivered a 15-16% net profit margin before the pandemic.

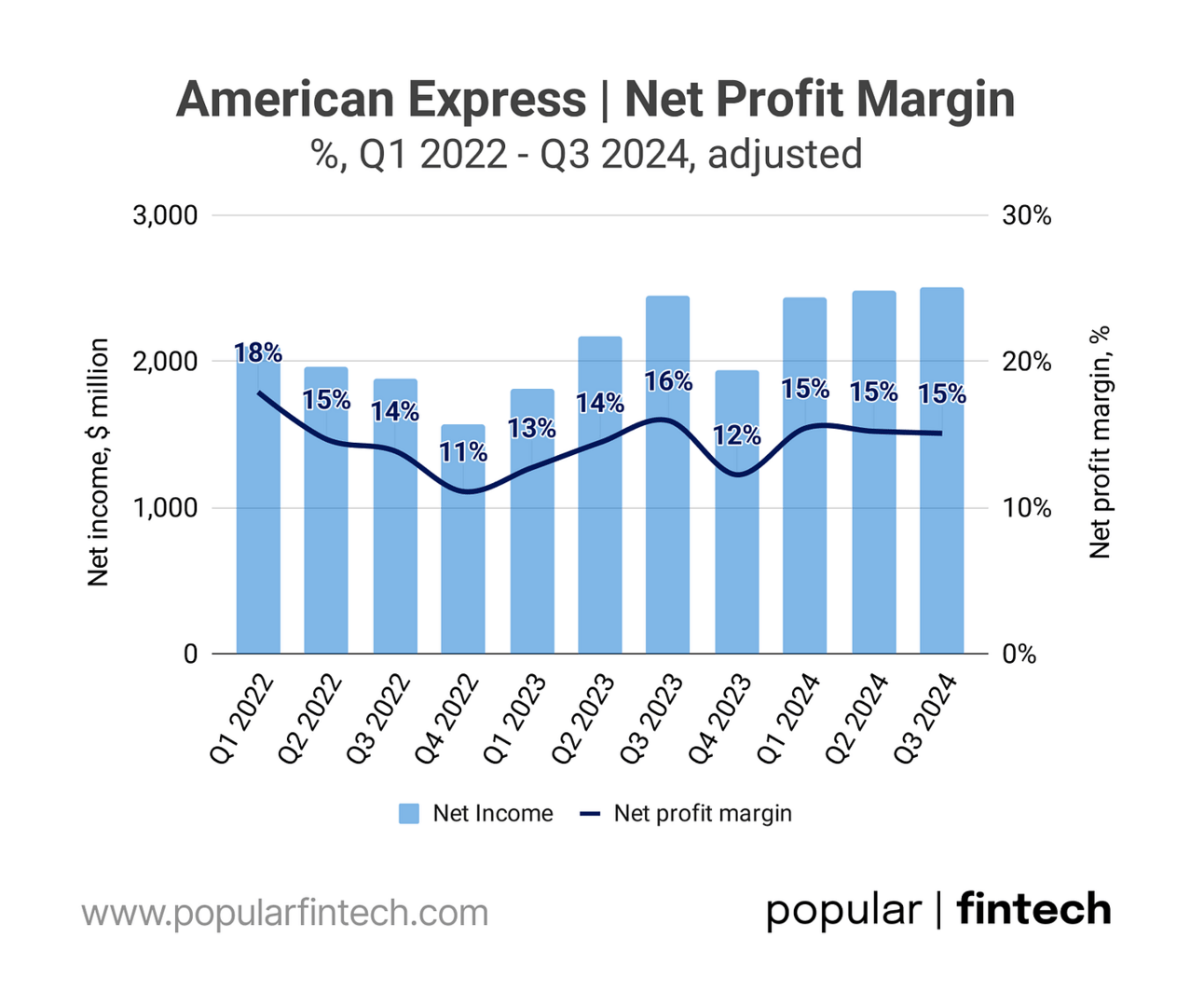

After the pandemic, the net profit margin fluctuated a lot, but finally stabilized in 2024 at 15% (see the chart below). In summary, American Express's operating efficiency has returned to pre-pandemic levels both in terms of operating expenses and in terms of net profit margin. The pandemic introduced volatility, but the business has returned to its normal state. Can American Express achieve further improvements? Why would it, if the growth levers are the same as in the past?

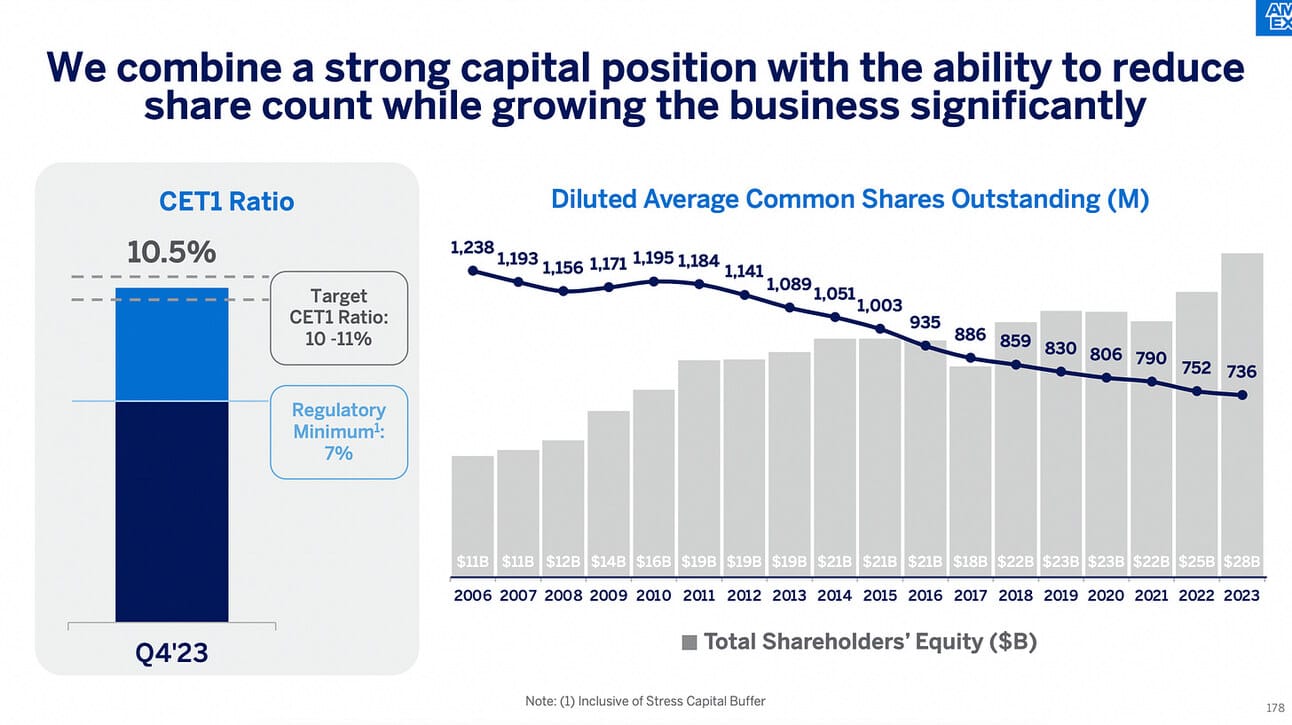

Finally, over the past 10 years, the company has been actively buying back its shares, resulting in an average annual decrease of 3.8% in the outstanding diluted share count. This obviously adds to the EPS growth. So if we assume no earnings growth from operating leverage (meaning earnings would grow in line with revenue growth), then the total EPS growth would be revenue growth divided by the reduction in the share count.

In summary, American Express's revenue growth has decelerated to 8% YoY. If the billed business does not accelerate (e.g. consumers and SMBs start spending more), the revenue will decelerate even further. That is because the growth in member loans (and thus, net interest income) continues to return to its historic levels. This makes the company’s aspiration for 10%+ revenue growth unachievable.

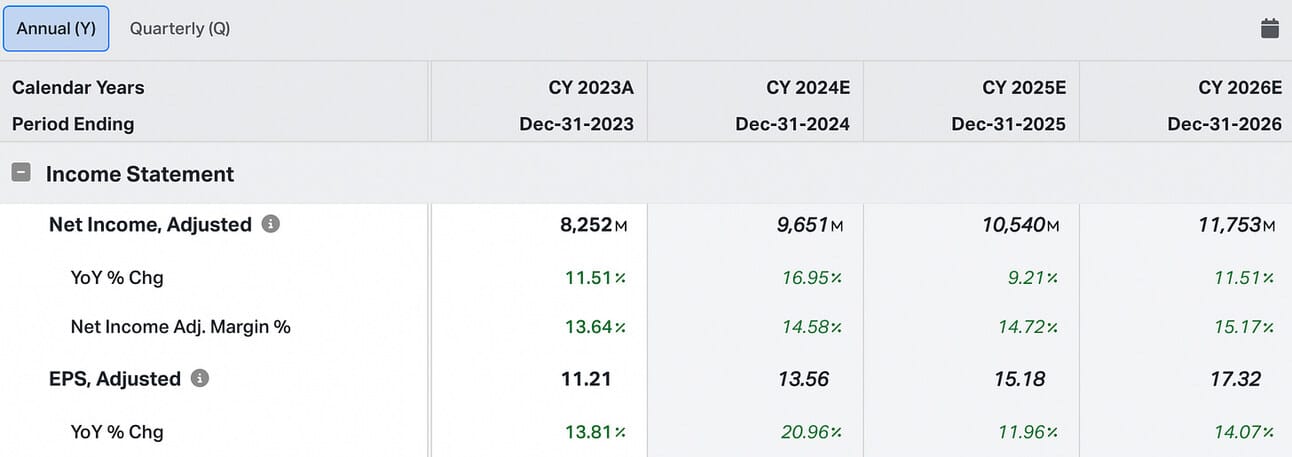

When it comes to EPS growth aspiration, it is hard to see further improvement in the operating leverage, so earnings would grow in line with the revenue growth. However, American Express is buying back stock, which contributes to EPS growth. If the revenue growth is under 10%, then historic levels of buybacks will probably take EPS growth to 10%, maybe low teens, which is below the company’s target aspiration of “mid-teens EPS” growth.

Wall Street analysts seem to disagree with me and expect American Express to deliver 14% EPS growth in 2026. So what am I missing here?

Cover image source: American Express

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.