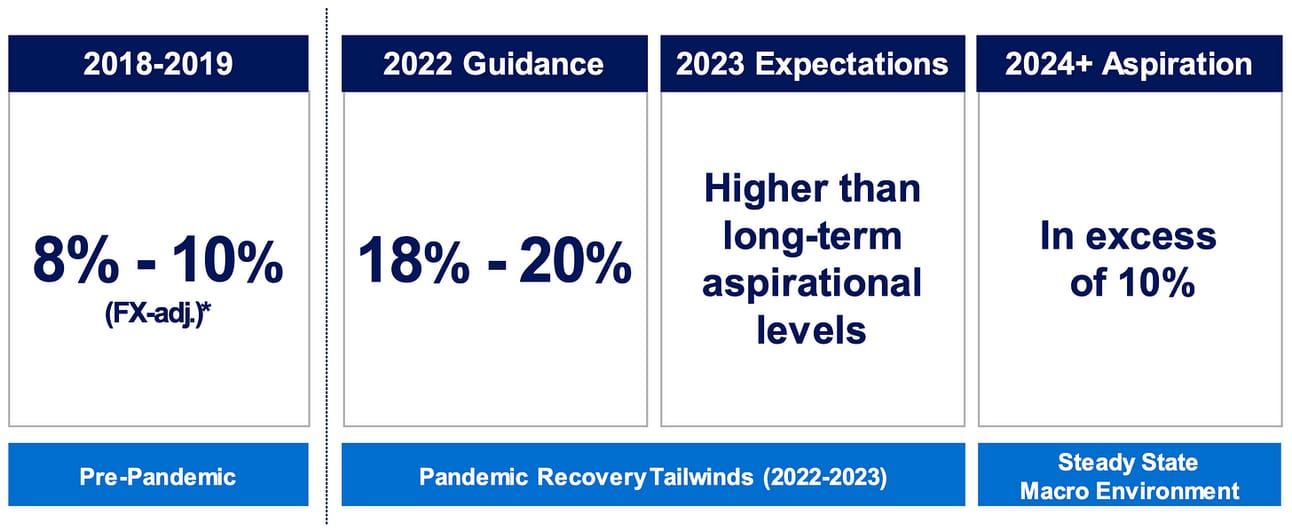

In March 2022, during the Investor Day, American Express outlined its revenue goals for 2022-2023 and beyond. They promised to exceed 10% growth in 2024 and committed to achieving even higher growth in 2022 and 2023, as part of the company’s recovery from the pandemic.

To instill confidence in these targets, American Express executives laid out the underlying growth drivers and described how each revenue stream (such as “Discount revenue”) contributed to the overall growth. “The combination of these factors drive our confidence in the Revenue components of our Growth Plan,” said a slide in the presentation.

As we have finally reached 2024, I decided to take a look at what happened since the Investor Day and if the outlined growth drivers still hold…what I have found is that American Express might need to continue growing Card Member loans at unprecedented rates to meet the promised 10%+ revenue growth in 2024.

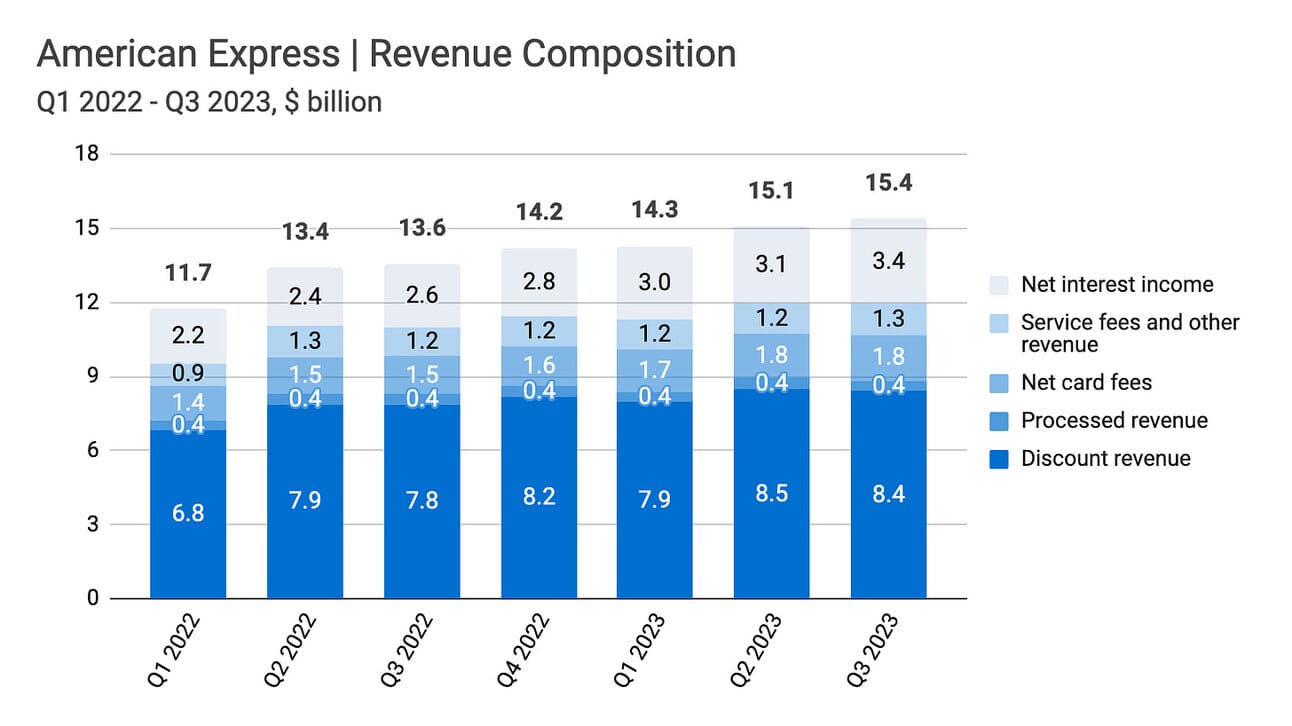

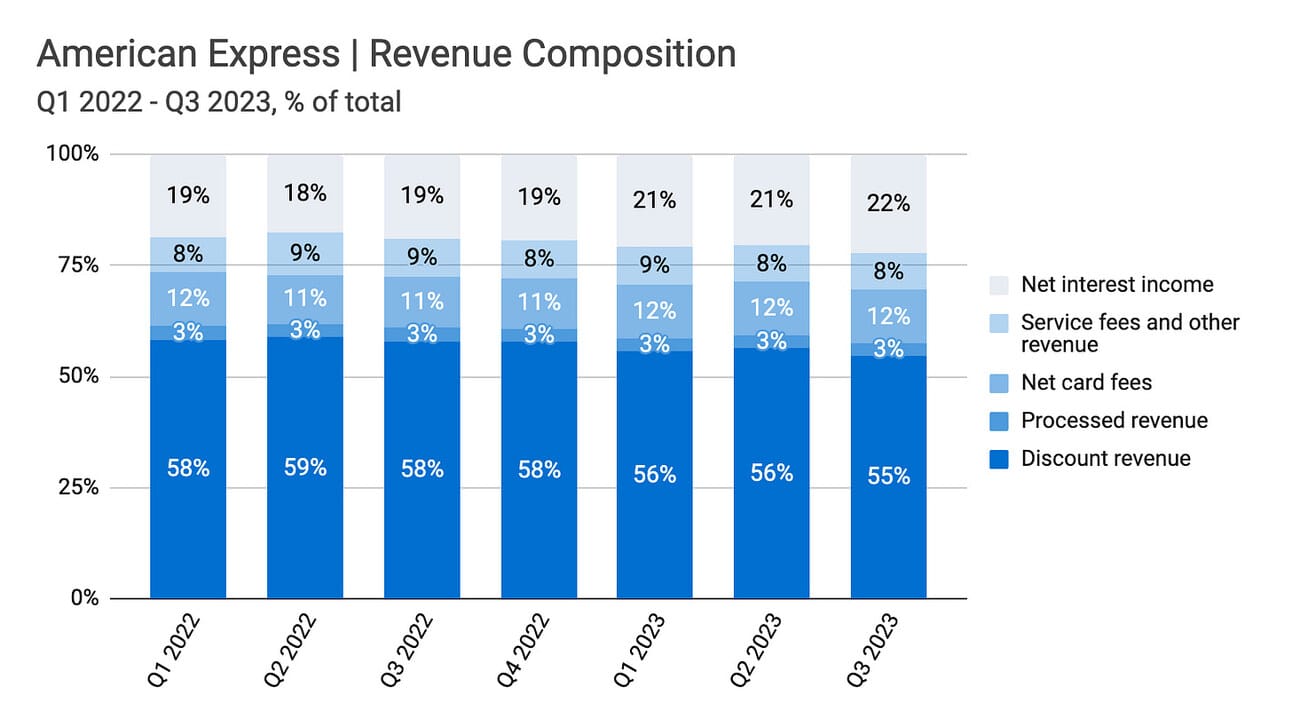

Let’s start by looking at the composition of American Express revenue. The company reports five distinct revenue components and groups them into “Spend revenue” (“Discount revenue” and “Processed revenue”), “Fee revenue” (“Net card fees”, “Service fees and other revenue”), and “Lend revenue” (Net interest income).

In Q3 2023, American Express reported total revenue of $15.38 billion, of which 55% was contributed by “Discount revenue”, 22% by “Net interest income”, 12% by “Net card fees” and 3% by “Processed revenue”. The rest of the revenue came from various fees (travel commissions, delinquency fees, foreign currency-related fees, etc) reported under “Service fees and other revenue”.

In 2022, American Express delivered 25% YoY revenue growth, well above the 18%-20% guidance presented at the Investor Day. However, as you can see from the chart below, growth in 2023 started decelerating. The company continues to guide (as per the Q3 2023 earnings presentation) for 15-17% YoY revenue growth in 2023, and 10%+ revenue growth in 2024 and beyond.

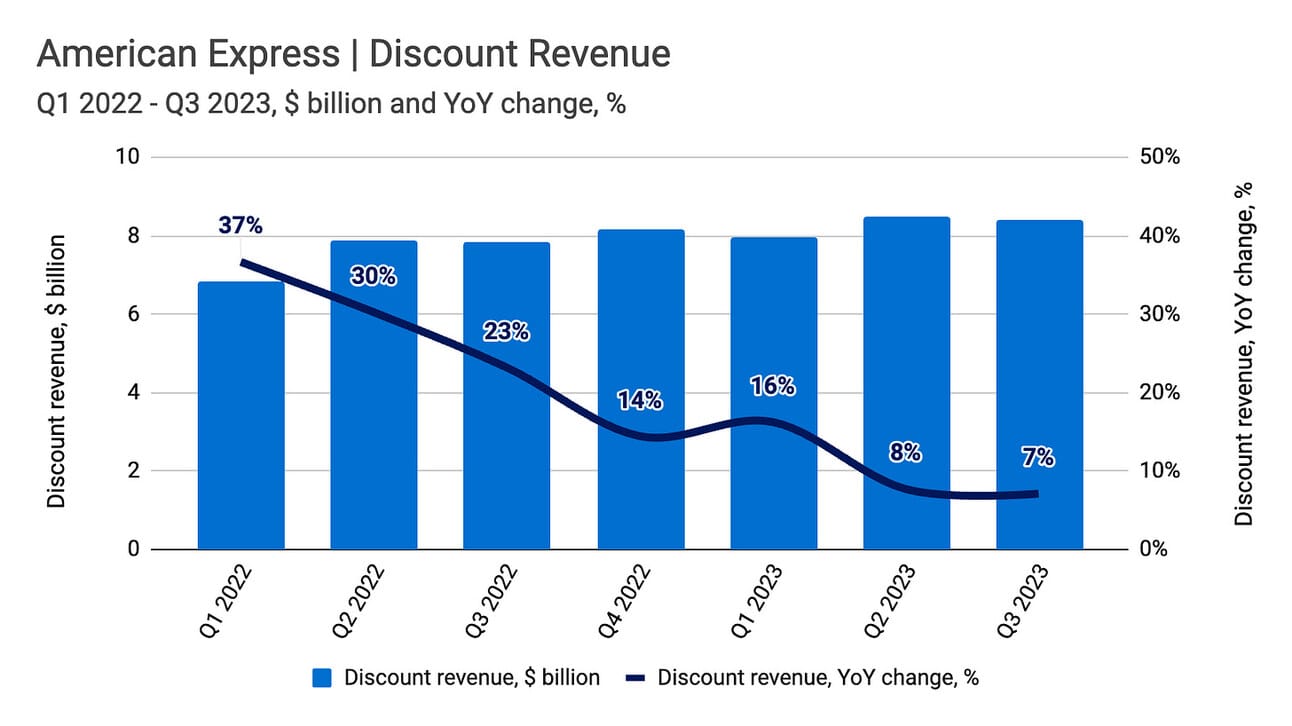

So let’s get to the growth drivers discussed at the company’s 2022 Investor Day. American Express expected “Net Discount Revenue”, the largest component of its revenue to experience tailwinds in 2022-2023 (meaning grow at elevated rates), and grow above the pre-pandemic levels in 2024 and beyond. As the reference point for the “pre-pandemic level”, the company indicated 7% growth in Fiscal Year 2019.

Discount revenue, our largest revenue source, represents the amount we earn and retain from the merchant payable for facilitating transactions between Card Members and merchants on payment products issued by American Express.

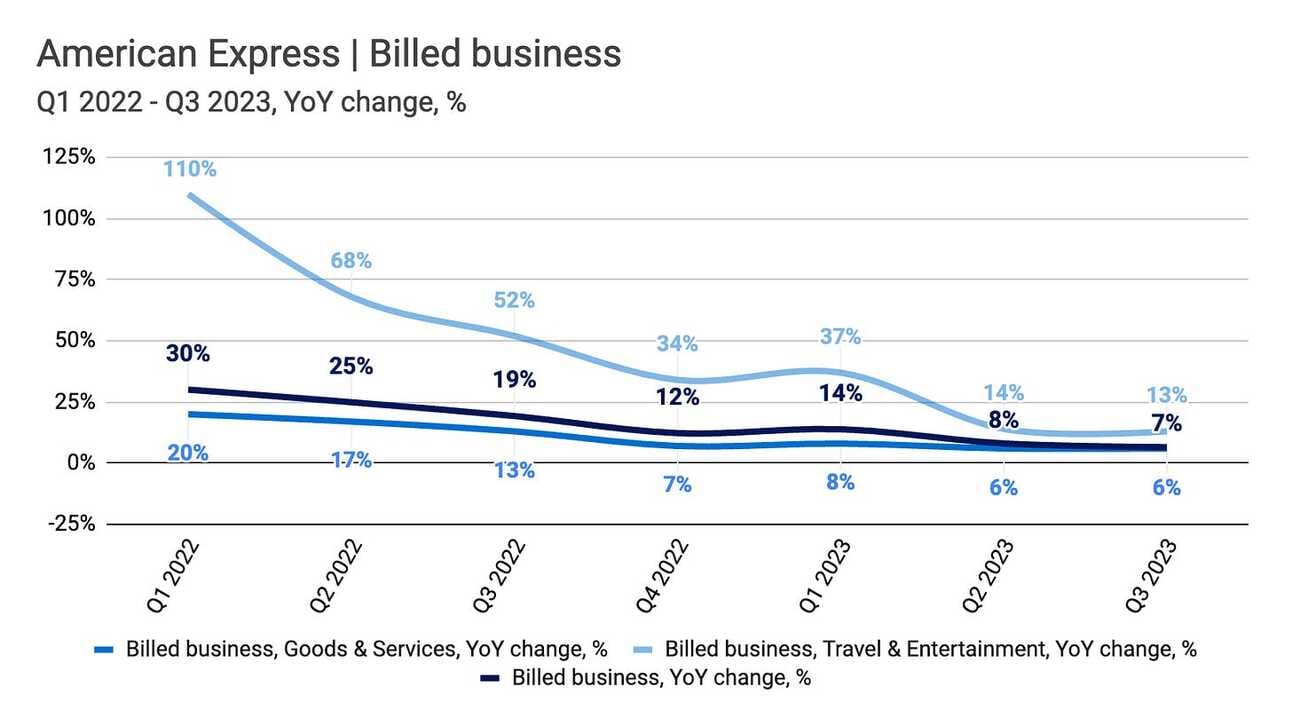

The “Discount revenue” did grow at elevated levels in 2022, but as the chart below suggests the growth is quickly decelerating. Thus, in Q3 2023, “Discount revenue” increased 7% compared to Q3 2022. The drivers for the “Discount revenue” are the transaction volume (“Billed business”) and the merchant discount rate.

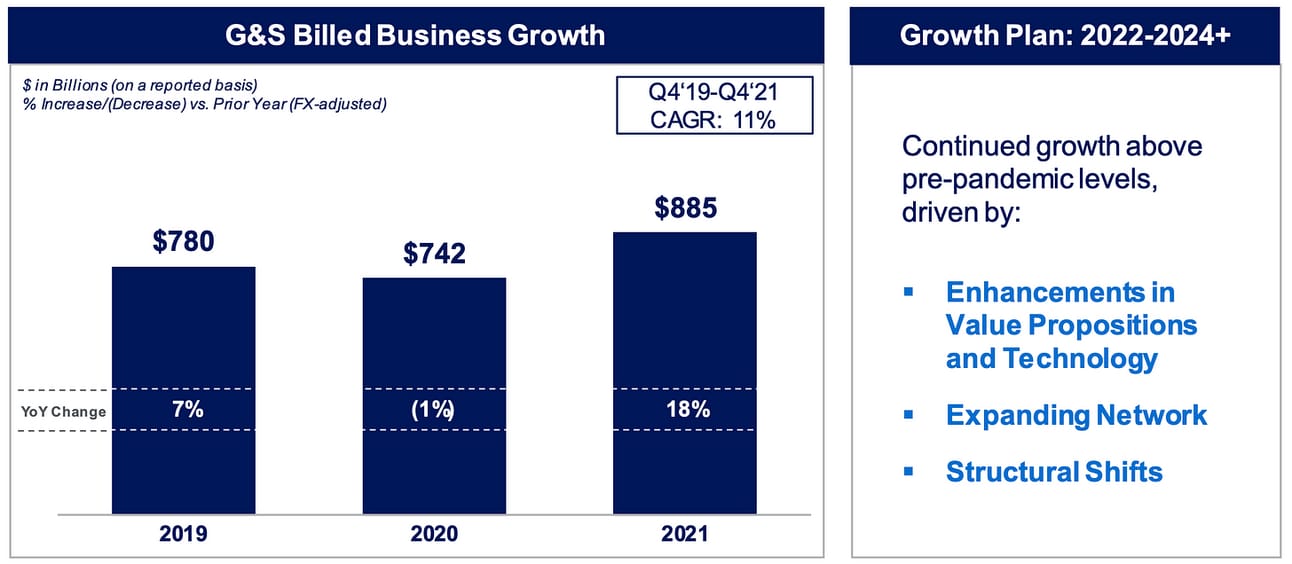

American Express discloses the growth rate of its Billed business by two transaction categories: Goods & Services (G&S) and Travel & Entertainment (T&E). Thus, at the Investor Day, the company’s management argued that its G&S billed business will grow above the pre-pandemic levels (7%+ YoY) due “to enhanced value proposition, expanding network and structural shifts.”

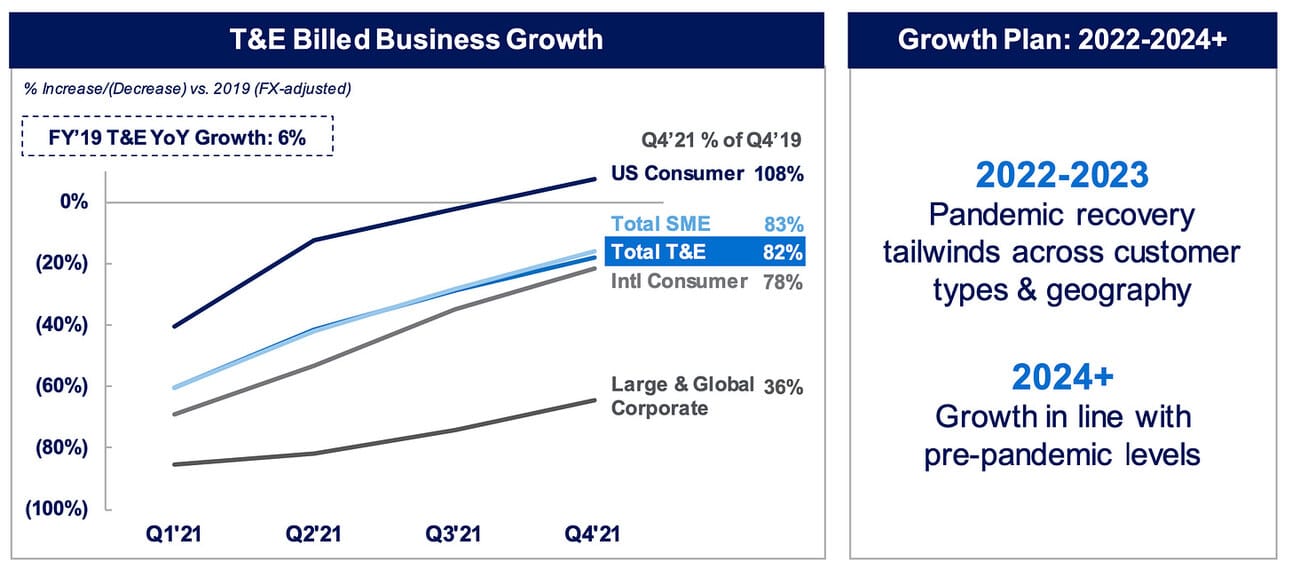

As for the T&E billed business, the company expected elevated growth rates in 2022-2022 due to recovery from the pandemic, and the growth rate that would be “in line with the pre-pandemic levels” in 2024 and beyond (which would be 6% YoY).

However, as you can see from the chart below, the growth rate of the G&E billed business has decelerated to 6% YoY in Q3 2023, and the growth rate of the T&E billed business was rapidly decelerating from its 2022 levels. In Q3 2023 G&S billed business represented 73% of the total billed business, and T&E billed business represented the remaining 27%.

👉🏻 Takeaway #1: The growth rate of “Discount revenue”, American Express largest revenue component, has already decelerated below the target level outlined during 2022 Investor Day. I would not be surprised if the growth rate was already under 7% in Q4 2023.

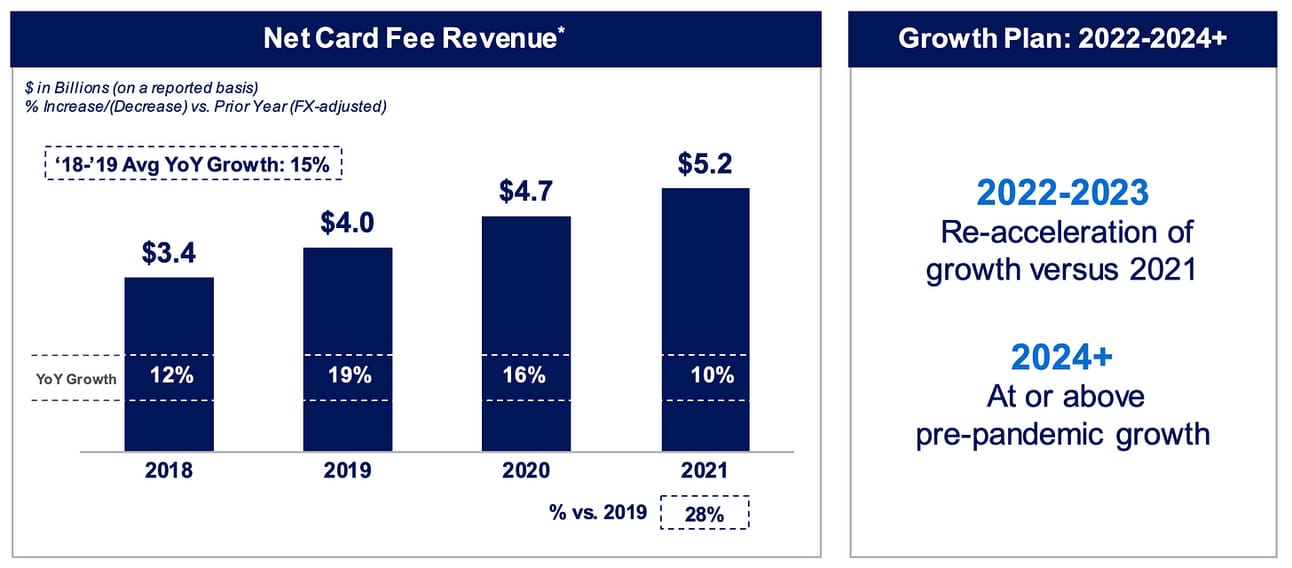

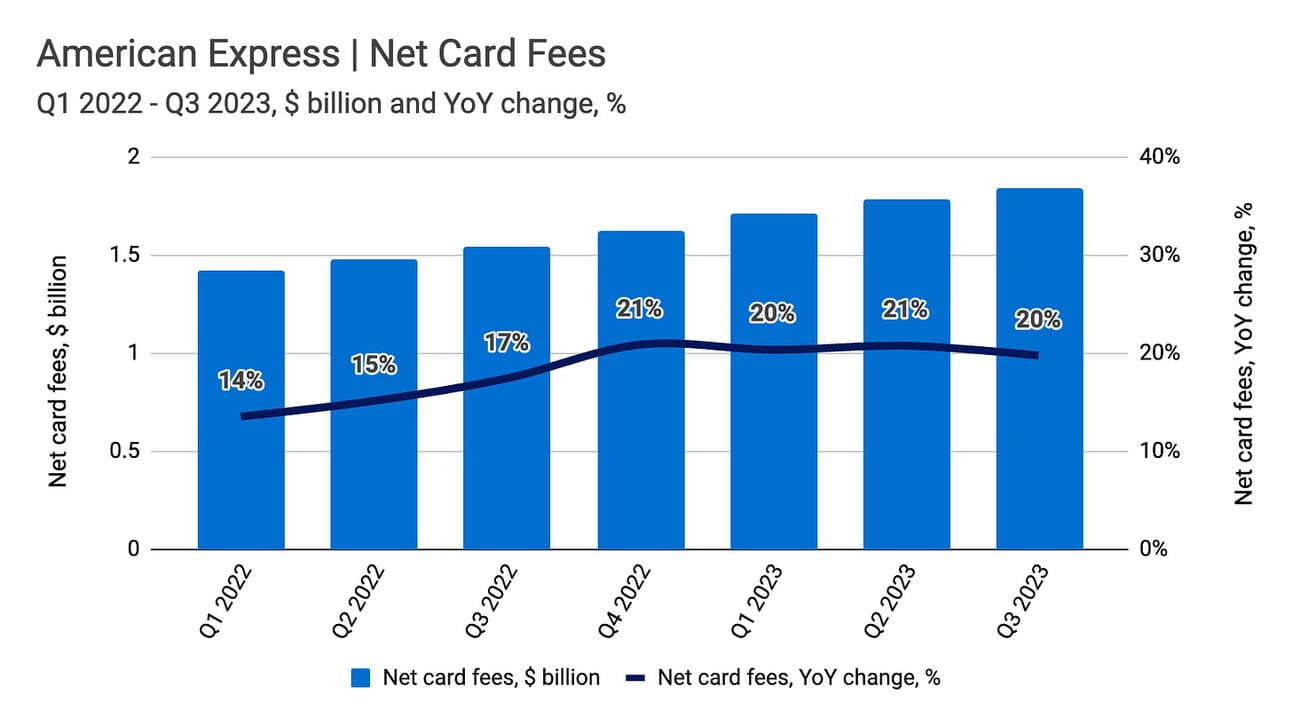

Let’s look at the next component, “Net card fees”. During the Investor Day, American Express management expected a re-acceleration of card fee revenue growth in 2022-2023 (from 10% YoY growth in 2021). The management also expected “Net card fees” to grow “at or above" the pre-pandemic levels in 2024 and beyond (that is above 15% YoY).

Net card fees, represent revenue earned from annual card membership fees, which vary based on the type of card and the number of cards for each account.

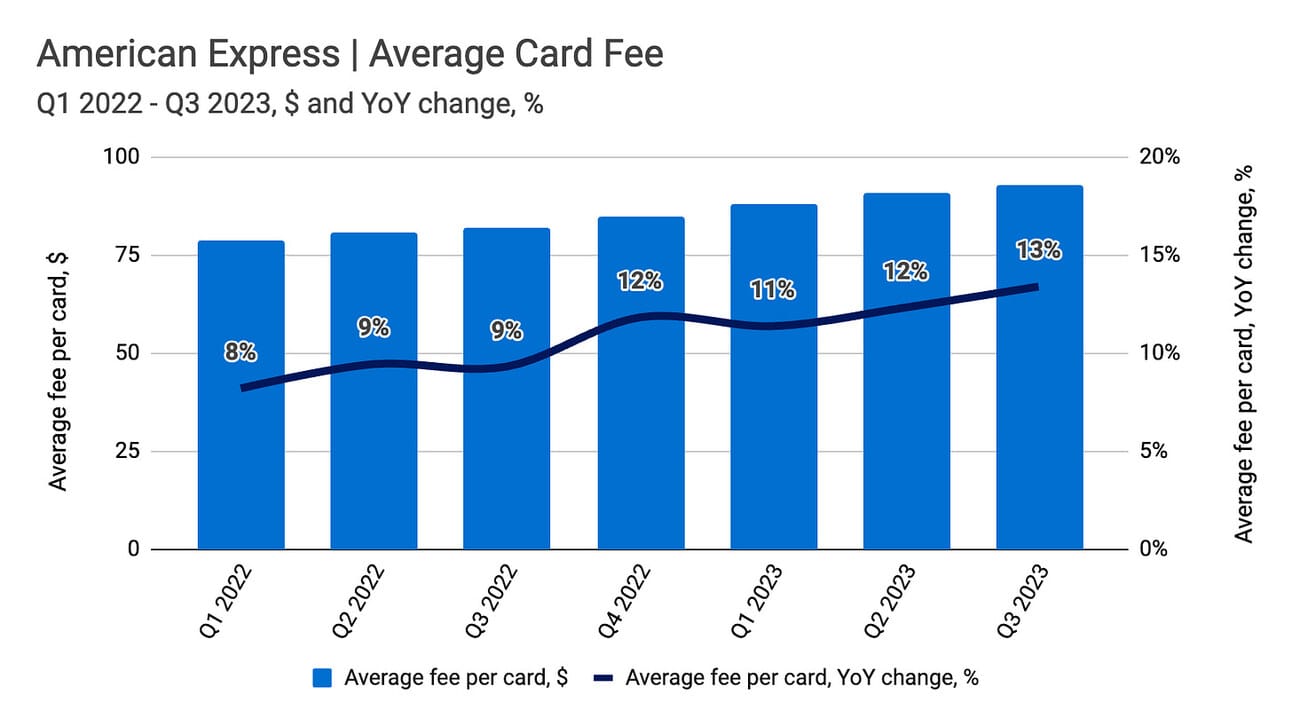

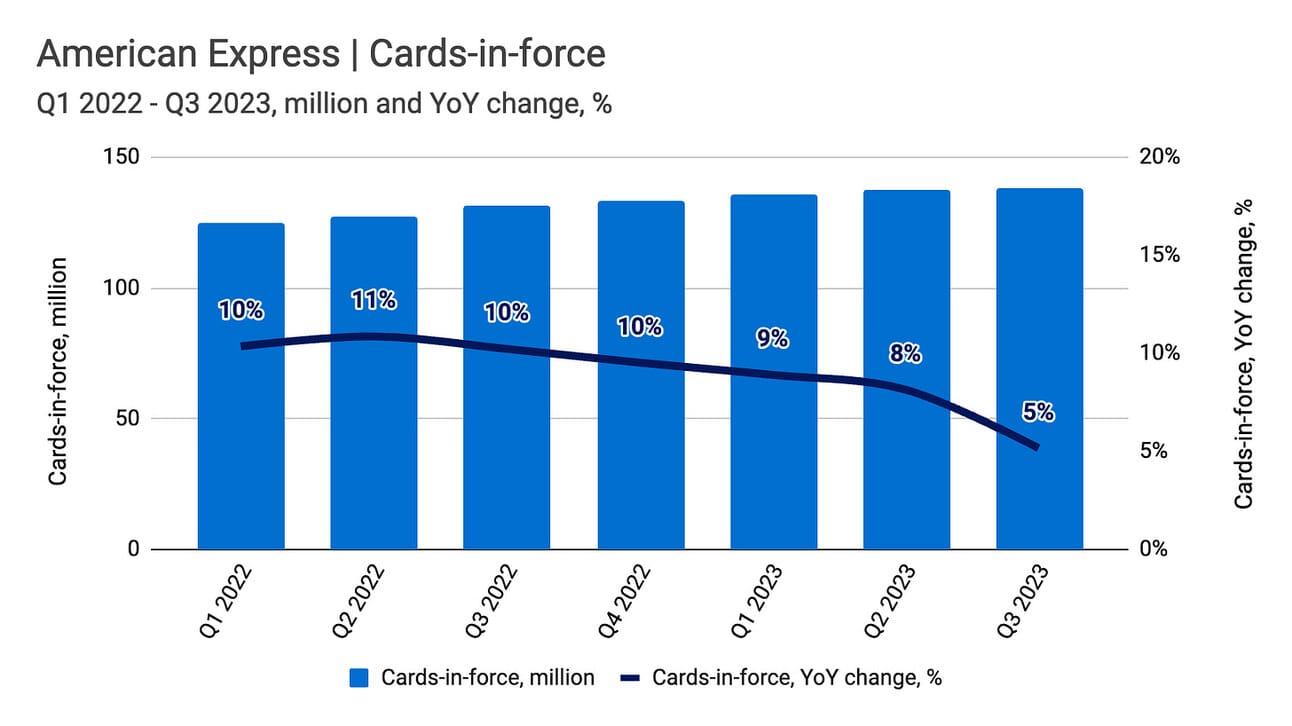

The growth rate of “Net card fees” indeed accelerated in 2022, and continued accelerating in 2023 reaching 20% YoY in Q3 2023. There are two drivers of “Net card fees”: a) the average fee per card, and b) the number of fee-paying Card Members.

As the chart below illustrates, the average fee per card has been increasing…at an accelerating pace. Thus, the average fee per card increased by 13% YoY in Q3 2023. American Express has been adding rewards to justify fee increases and the strategy seems to work for now (at least for now). The average card fee continued to increase, while the cost of rewards (relative to the revenue) remained the same.

However, if you look at the data on cards-in-force (which is the best proxy for fee-paying members that the company discloses), then you will notice that the growth in cards-in-force has been rapidly decelerating reaching 5% YoY in Q3 2023. I believe it would be a safe bet to assume, that deceleration in cards-in-force growth, is the result of the rising fees (after all, you cannot increase the price indefinitely).

👉🏻 Takeaway #2: “Net card fees” continues to grow at a rate, which is above the pre-pandemic level and is in line with the Investor Day guidance. However, deceleration of cards-in-force growth suggests that American Express might be constrained in rising annual card fees further to support this growth.

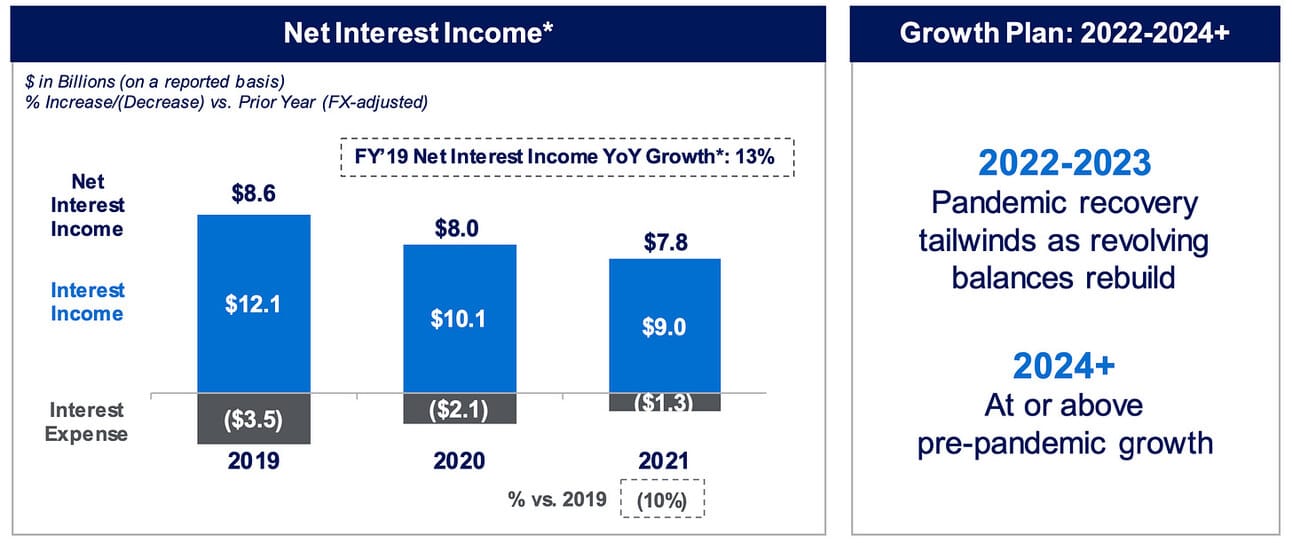

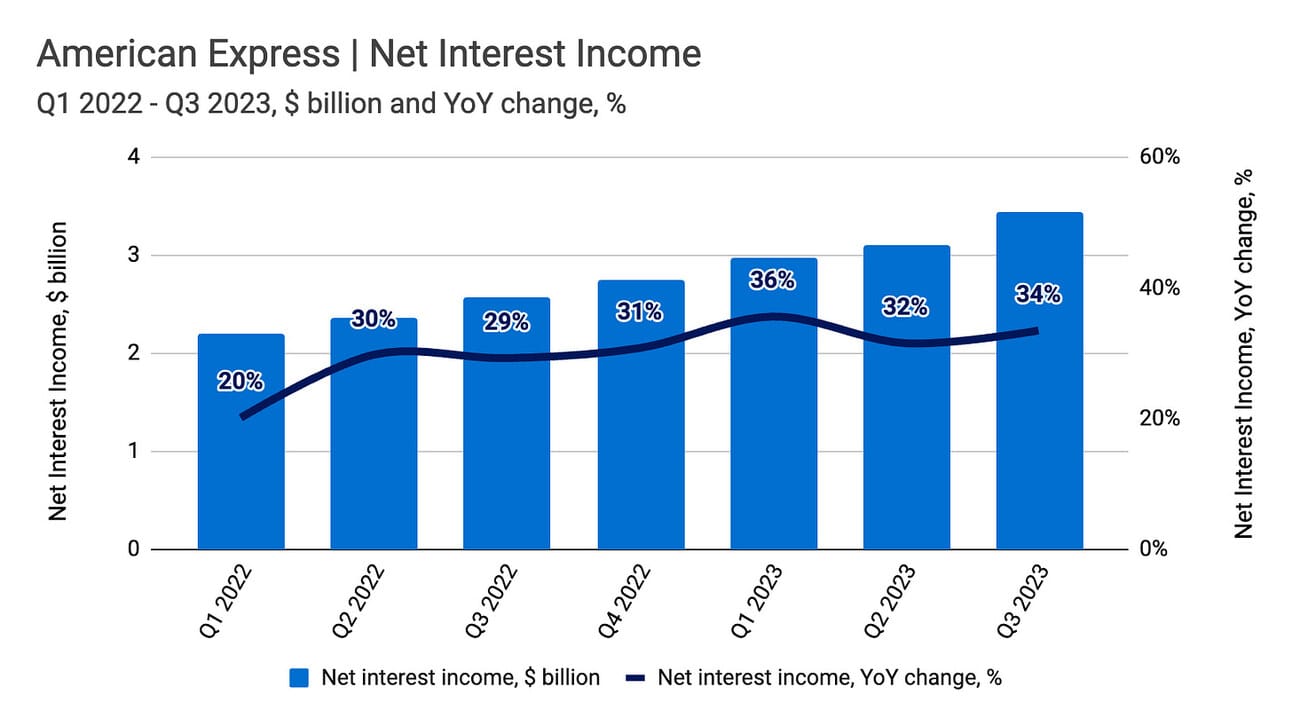

Finally, let’s take a look at “Net interest income”. At the Investor Day, American Express executives expected “pandemic recovery tailwinds” during 2022-2023 (meaning, NII would return to growth), and “at or above pre-pandemic” growth levels in 2024 and beyond (which would be 13% YoY or above).

Interest income, principally represents interest earned on outstanding loan balances.

Net interest income, as per the guidance, started growing in 2022. Moreover, the growth accelerated in 2023 (see the chart below). Thus, in Q3 2023, NII increased by 34% compared to Q3 2022. There were two factors driving growth in NII: 1) growth in Card Member loans, and 2) growth in the Net Interest Margin.

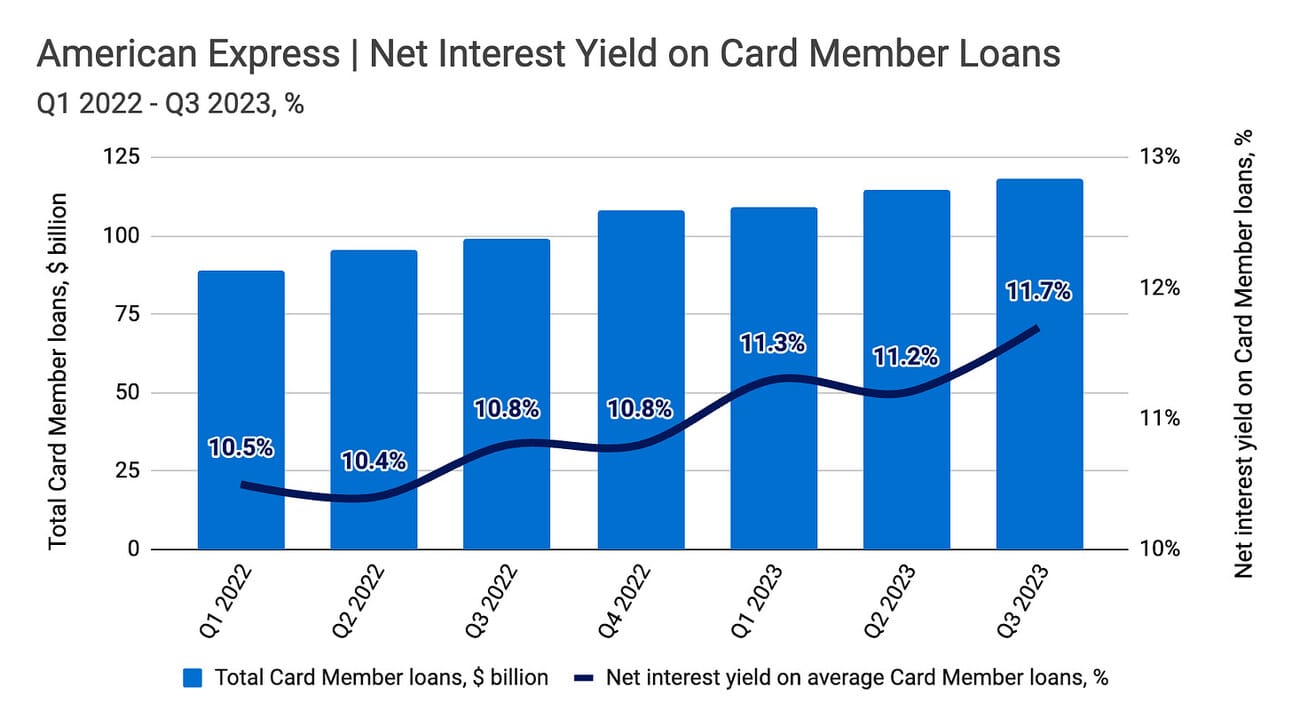

American Express finished Q3 2023 with $118.0 billion in Card Member loans on its balance sheet, up 19% compared to Q3 2022, and up 53% compared to Q3 2021! The growth in Card Member loans started decelerating in 2023 (see the chart below); however, it is still well above its historic average.

Before the pandemic (2016-2019), Card Member loans grew at 11% per year, which was above the industry average, but still considerably below that current growth level.

In addition to growth in loan balances, American Express benefited from rising interest rates. Thus, Net interest yield on Card Member loans (which is part of the Net interest income attributable to Card Member loans divided by the average balance of Card Member loans), increased from 10.3% in Q4 2021 to 11.7% in Q3 2023.

👉🏻 Takeaway #3: “Net Interest Income” growth is (at least for now) well above the levels discussed during 2022 Investor. The growth is driven by the growth in Card Member loans and net interest yield increase. However, this growth in Card Member loans is unprecedented for the company.

In summary, it doesn’t look like American Express will be able to deliver on the promised 10%+ growth in 2024 and beyond, unless they continue growing their loan book at an unprecedented rate:

✔️ “Discount revenue” (55% of total revenue): 7% YoY growth in Q3 2023 vs. 7%+ growth in 2024 discussed during the Investor Day. Growth is rapidly decelerating and should fall below the target presented at the Investor Day.

✔️ “Net card fee revenue” (12% of total revenue): 20% YoY growth in Q3 2023 vs. 15%+ discussed during the Investor Day. Growth is still in line with Investor Day targets, but might be constrained by the company’s ability to raise annual fees further.

✔️ “Net interest income” (20% of total revenue): 34% YoY growth in Q3 2023 vs. 13%+ YoY growth in 2024 discussed during the Investor Day. The growth rate is still above the guidance, but the company never grew its loan book so fast.

American Express will report its Q4 2023 results (and should provide 2024 guidance) on January 26. Let’s see if they maintain the 10%+ revenue growth for 2024. Wall Street analysts don’t believe that anymore and expect the revenue to grow 9% YoY in 2024.

Cover image source: American Express

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.