Hi!

JPMorgan held its Investor Day 2023 yesterday, and the company’s chief, Jamie Dimon, said that he has no plans to retire anytime soon. I want to be like Jamie, so here is my statement: I have no plans to stop writing these emails anytime soon! Anyways, enough about me:

Wise CFO will depart the money transfer firm next year,

PayPal’s Venmo introduces accounts for teens, and

Australia plans to regulate the Buy Now Pay Later industry

Thank you for reading and see you tomorrow!

Jevgenijs

Please help me spread the word about the “Popular Fintech” newsletter 👇🏻

Wise CFO to Depart Next Year

Matt Briers, the Chief Financial Officer of the money transfer firm Wise (LON: WISE), has announced that he will step down from his position by March 2024. Briers, who joined Wise in 2015 after his tenure at Google, had previously taken a leave of absence due to a bike accident, resulting in the appointment of a temporary interim CFO. The company has initiated a search for a new CFO, and Briers will continue to serve in his role until the next year. Earlier this month, the company’s co-founder and CEO, Kristo Kaarman, announced that he will take an extended sabbatical to spend time with his family between September and December this year. During his absence, Wise's Chief Technology Officer, Harsh Sinha, will assume the role of CEO on an interim basis. The company’s stock declined 3.70% on the news.

Image source: Wise

✔️ Fintech firm Wise’s shares fall after CFO resigns

✔️ Wise CFO to step down to focus on accident recovery

✔️ Money transfer firm Wise says CFO Briers to step down in 2024

✔️ April 2023 Trading Update

Venmo Introduces Teen Accounts

PayPal’s Venmo introduced Teen Accounts, which allow parents to create Venmo accounts for their teenage kids between the ages of 13 to 17-years-old. Venmo Teen Accounts will have no monthly fee and include a Venmo Teen Debit Card. With Teen Accounts, parents can monitor transactions, manage privacy settings, and send money to their teenagers. Teens themselves can send and receive money, withdraw cash, and track their spending within the Venmo app. Venmo will be rolling out Teen Accounts to select customers starting in June and expects the service to be widely available in the coming weeks. Venmo's closest competitor, Block’s Cash App, launched the service for teenagers already in November of 2021. The service saw an immediate adoption that even got the attention of Wall Street analysts.

Source: Venmo on Twitter

✔️ Introducing the Venmo Teen Account

✔️ Venmo Teen accounts are coming next month

✔️ Venmo targets young consumers and parents with new teen accounts

✔️ Square’s Cash App opens up to teens ages 13 to 17 with parental oversight

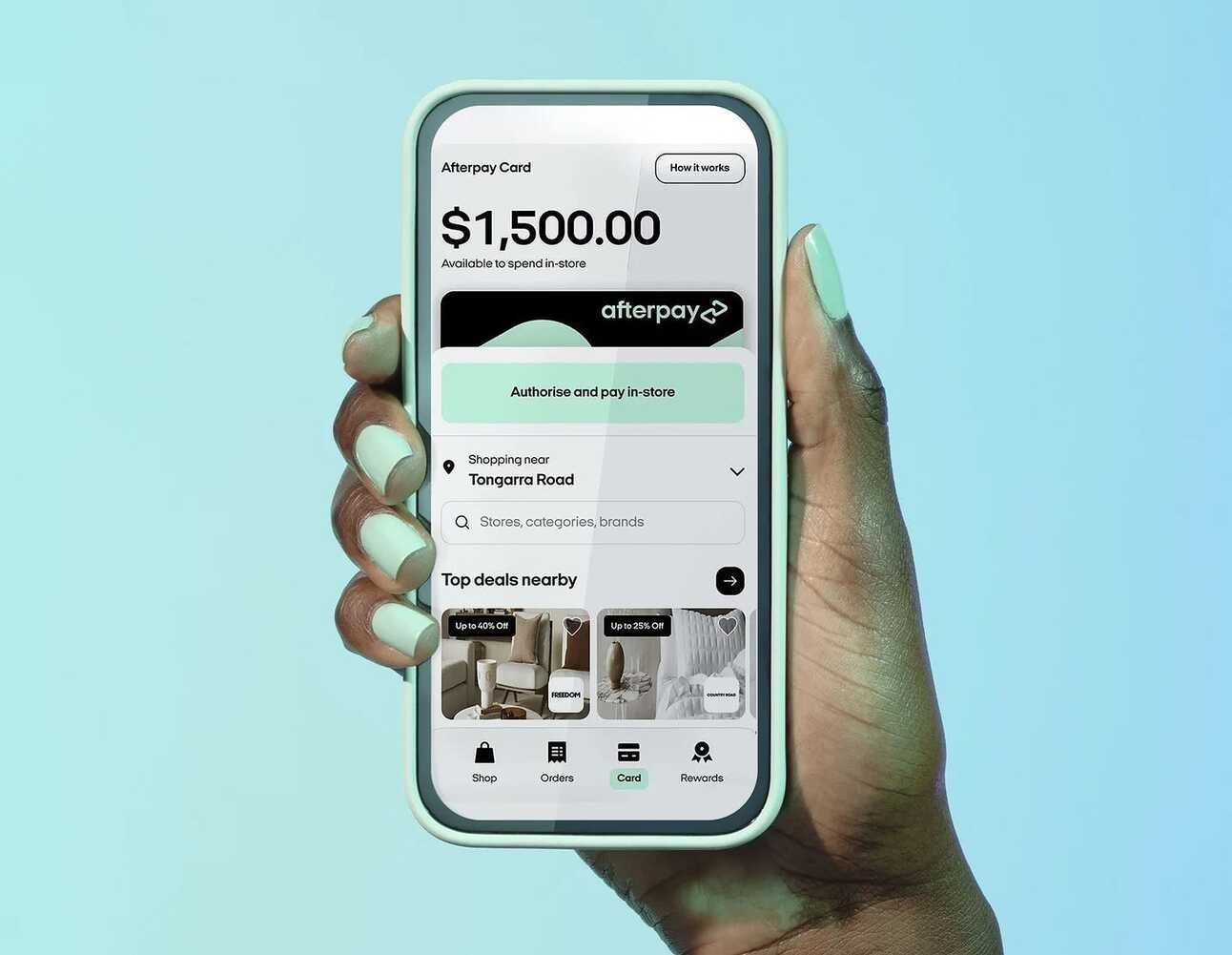

Australia Plans to Regulate BNPL Firms

The Australian government has announced plans to regulate Buy Now Pay Later finance firms under the country’s credit laws. The new regulation will require BNPL firms to adhere to responsible lending obligations, hold Australian credit licenses, and meet minimum standards on conduct and products. The new laws will affect companies like Zip, Block’s Afterpay, and Klarna. According to Bloomberg, Zip is better positioned to meet the requirements of the new regulation since it already holds an Australian credit license. The move towards regulation will put additional pressure on the business models of BNPL companies, which have been challenged by the rising cost of funding and rising defaults. The proposed regulation is expected to be introduced into the parliament by the end of the year.

Image source: Afterpay

✔️ Australia to Regulate Buy Now, Pay Later as Credit Firms

✔️ Australia hits buy-now-pay-later sector with consumer credit law

✔️ Jack Dorsey explains why he bought Afterpay

Don’t know if you’ve noticed, but Fintech companies are on a roll this year. While everyone’s discussing the rally in Nasdaq, the performance of many Fintech companies dwarfs the index. Thus, Upstart (NASDAQ: UPST) is up 114%, Nubank (NYSE: NU) is up 86%, and Coinbase (NASDAQ: COIN) is up 81%. Will they hold?

Global Head of Talent Management

@ Wise

🇪🇪 Tallinn, EstoniaGroup Product Manager, North America

@ Wise

🇺🇸 Austin, TX, United StatesHead of Product Data Science, Venmo

@ PayPal

🇺🇸 San Jose, CA, New York, NY, or Remote, United StatesUX Designer, Venmo

🇲🇽 @ PayPal Mexico City, MexicoEngineering Manager - Mobile, Afterpay

@ Afterpay

🇦🇺 Melbourne, VIC, Australia

Cover image: Wise

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.