Hey!

Circle’s IPO will go down in the history books. Priced at $31 a share at the IPO, the stock almost touched $300 before settling just under $200.

And yet, all I hear are bear cases with most of them centered around interest rates falling and Circle paying half of its revenue to Coinbase for the distribution of USDC.

No one is standing up for Circle, despite USDC’s central role in finally pushing financial infrastructure onchain.

So here’s my bull case. Feel free to throw stones at me on Twitter.

Jevgenijs

p.s. this article was first published in “This Week in Fintech” newsletter

What is Circle?

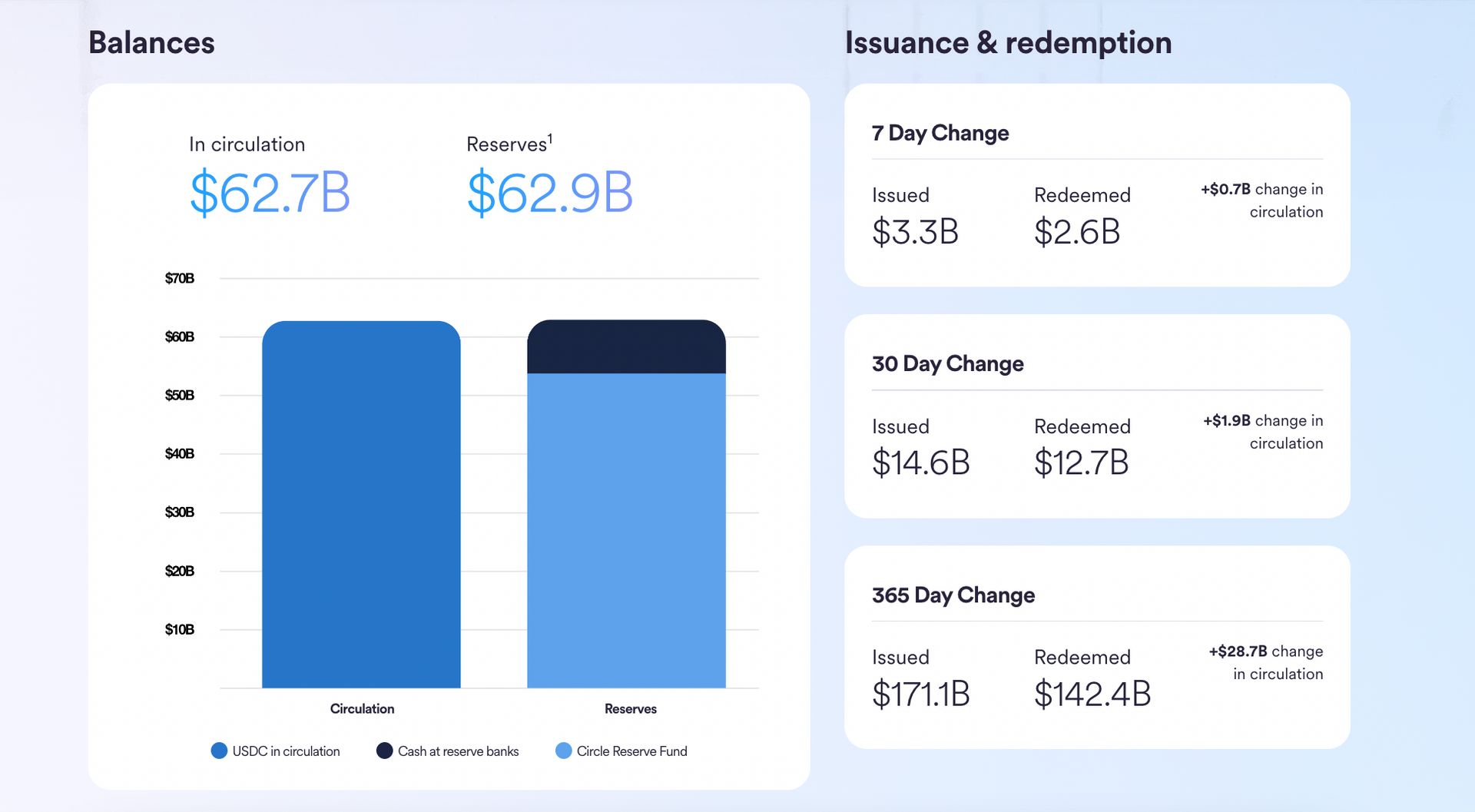

Circle $CRCL ( ▼ 3.62% ) is the company behind USDC, a digital dollar, or stablecoin, used in DeFi, trading and payments. With more than $60 billion in circulation, USDC ranks as the second-largest stablecoin globally.

Image source: Circle

Circle was founded in 2013 with the idea of making Bitcoin easier to use for everyday payments. At the time, it launched a consumer-facing app that let people buy, sell, and send Bitcoin. But as crypto evolved, so did Circle’s vision.

In 2018, the company partnered with Coinbase to launch USDC, a regulated, dollar-backed stablecoin. That marked a major pivot toward infrastructure and financial services, with Circle focusing on building the plumbing for an onchain economy.

"We envisioned the development of an “HTTP for Money,” a protocol for dollars and other fiat digital currency tokens that would provide an open and programmable infrastructure to rebuild the global financial system in the image of the internet."

In 2022, Circle also launched EURC, a euro-backed stablecoin.

What is a stablecoin?

Stablecoins are digital tokens that track the value of real-world currencies, like the U.S. dollar. USDC, for example, is always redeemable 1:1 for dollars and backed by cash and U.S. Treasuries.

Image source: Circle

The transition from cash to digital payments, made possible by the Internet and modern banking infrastructure, opened up a world of new possibilities such as using a debit card anywhere in the world, shopping online, or sending money to friends with Venmo.

Similarly, institutions come to Circle and exchange fiat money for USDC to access the world of blockchains, crypto, and Decentralized Finance. Circle doesn’t work directly with consumers, so distribution partners like Coinbase typically handle onboarding and access.

"Built for rapid global payments and 24/7 financial markets, USDC is a regulated digital currency that is redeemable 1:1 for US dollars."

As you may have noticed from the screenshots, Circle presents itself as the most compliant and regulated stablecoin issuer, while USDC is positioned as the safest and most trusted digital dollar.

How does Circle make money?

Circle’s primary source of income is the interest earned on stablecoin reserves. When it receives fiat in exchange for USDC or EURC (the process called "issuing" or "minting"), it either deposits the funds with partner banks or invests them in short-term debt securities like U.S. Treasuries.

Image source: Circle

"As of March 31, 2025, we held approximately 90% of USDC reserves in the Circle Reserve Fund, a government money market fund managed by BlackRock, one of the world’s largest asset managers, and available only to us."

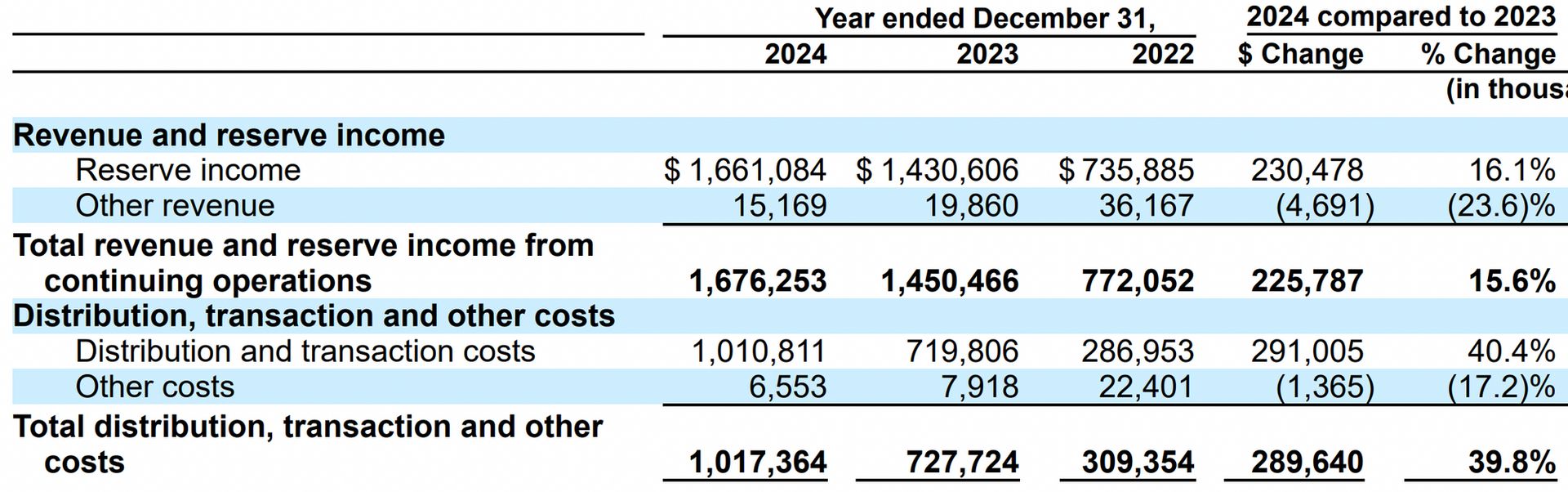

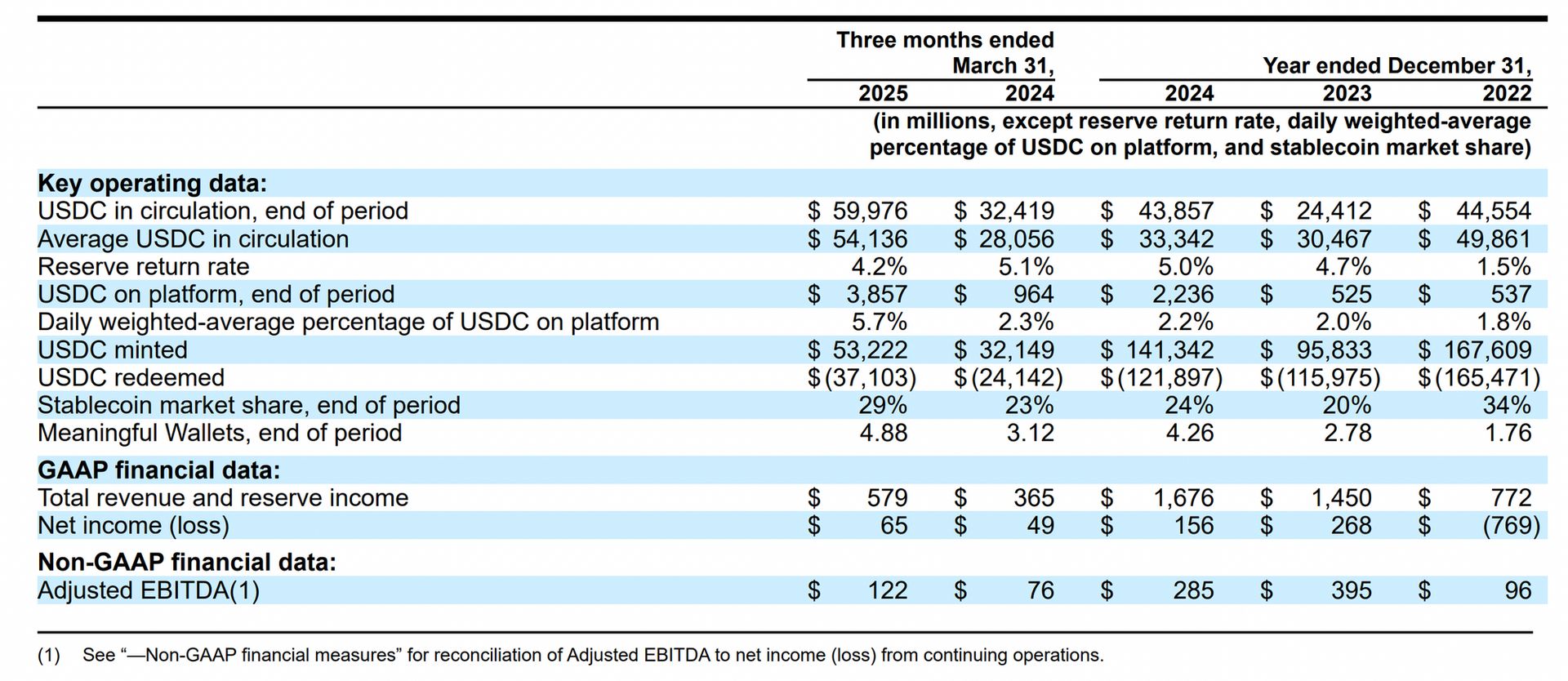

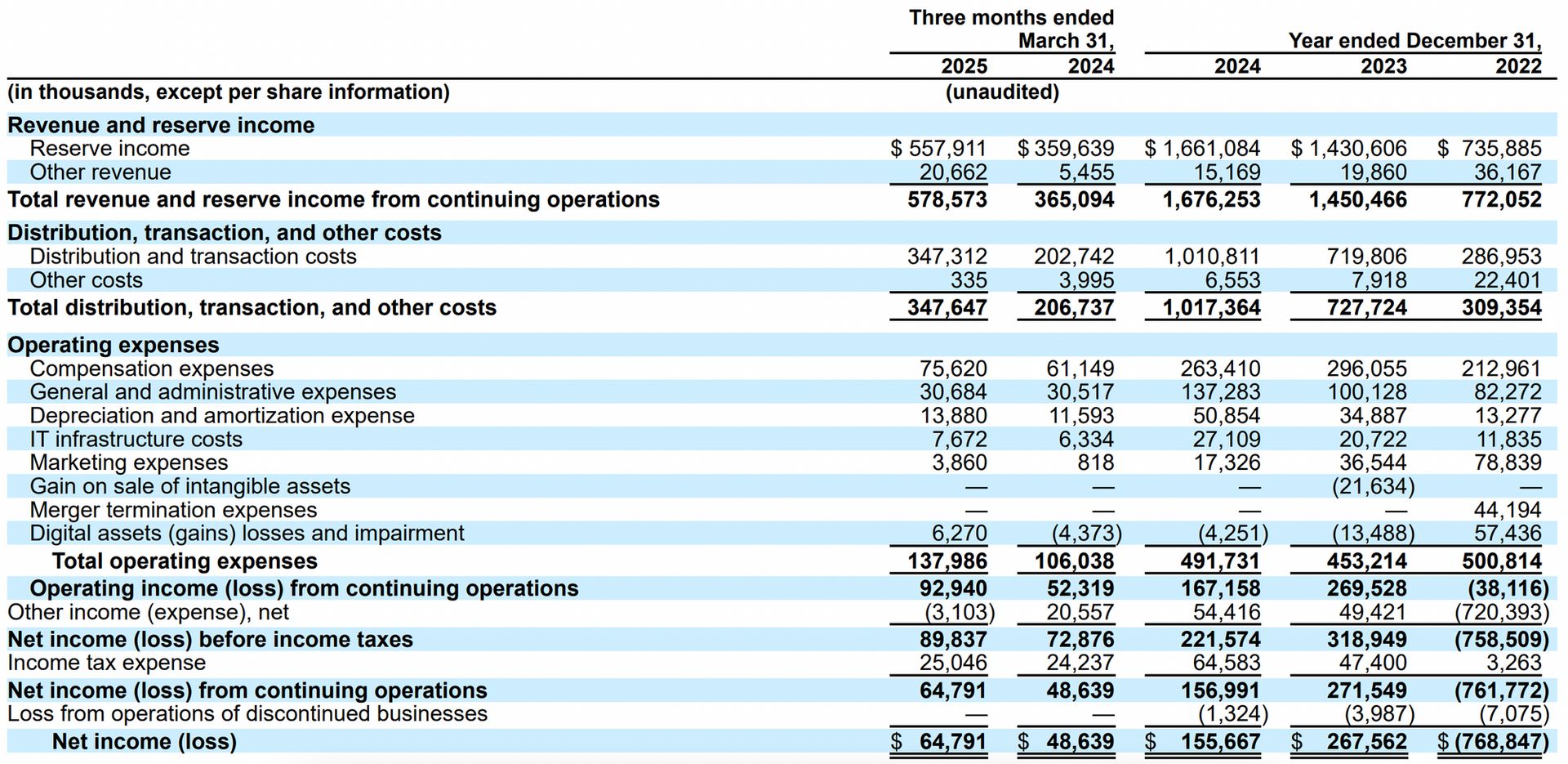

At the moment, Circle’s revenue depends on two factors: the total amount of stablecoins it has issued (USDC and EURC "in circulation") and the interest it earns on the reserves backing those stablecoins. In 2024, this “reserve income” contributed $1.66 billion, accounting for 99% of the company’s total revenue.

Image source: Circle, Form S-1

"The monetization of the Circle stablecoin network is driven by its growth and our introduction of new products that expand its utility. Today, we monetize the amount of money on the network (i.e., the amount of Circle stablecoins in circulation). We earn reserve income on USDC reserve assets."

As an example, in 2024, the average USDC in circulation was $33.3 billion, and Circle earned the average "reserve return rate" of 5.0% (The amount of EURC in circulation is minimal and can be disregarded for now). As shown in the table below, while USDC circulation was higher in 2022, Circle earned a much higher return on reserves in 2024, resulting in more than double the revenue.

Image source: Circle, Form S-1

"Circle earns reserve income on reserve assets, historically at rates at a discount to the prevailing SOFR [ Secured Overnight Financing Rate, a benchmark interest rate based on the cost of overnight borrowing using U.S. Treasuries as a collateral] during the applicable periods. We term the rate of return generated on assets held in reserve as the “reserve return rate.”

Circle does generate non-interest revenue, but it’s currently minimal, less than 1% of total revenue. This limited diversification of revenue is central to the bear case against Circle, and, as I’ll argue below, also a key part of the bull case.

"In addition, we may seek to monetize the activity on our network with products that earn fee-based revenues based on transactions and usage in the future."

Circle’s largest expense is distribution. Since it relies on partners, primarily Coinbase, to market and distribute its stablecoins, a significant share of revenue goes to them. In 2024, distribution and transaction costs totaled $1.01 billion (60% of revenue), with $908 million (54% of revenue) paid to Coinbase.

Image source: Circle, Form S-1

"For the years ended December 31, 2024, 2023, and 2022, we incurred $907.9 million, $691.3 million, and $248.1 million, respectively, of distribution costs in connection with our agreements with Coinbase."

In 2024, Circle reported $156 million in net income and $285 million in adjusted EBITDA, down from $268 million and $395 million, respectively, in 2023. The decline was primarily driven by higher distribution costs following the renegotiation of terms with Coinbase (more on that below).

What is Circle's agreement with Coinbase?

Circle partnered with Coinbase to launch USDC in 2018, with governance handled by the Centre Consortium until 2023. That year, the consortium was dissolved, and Circle and Coinbase signed a new distribution agreement.

Under this agreement, Circle shares the income generated from USDC reserves, after deducting third-party fees (e.g., from BlackRock), with Coinbase. Circle’s S-1 indicates that the agreement applies only to the associated reserve income and covers all stablecoins launched or to be launched by Circle.

"In August 2023, we and Coinbase entered into a Collaboration Agreement, under which we make payments to Coinbase for its role in the distribution of USDC and growth in the USDC ecosystem. These payments are determined based on the daily income generated from the reserves backing USDC, less the management fees charged by nonaffiliated third parties and certain other expenses, which is referred to as the “payment base.”

The revenue split has several components. First, Circle receives a fee, ranging from a "low double-digit basis point to a high tenth of a basis point", for its role as the issuer of USDC. The fee is designed to cover indirect administrative costs.

"(i) we retain a portion ranging from an annualized low-double-digit basis point to high tenth of a basis point based on the amount of USDC in circulation on such day, in consideration of our role as stablecoin issuer (the “issuer retention”)"

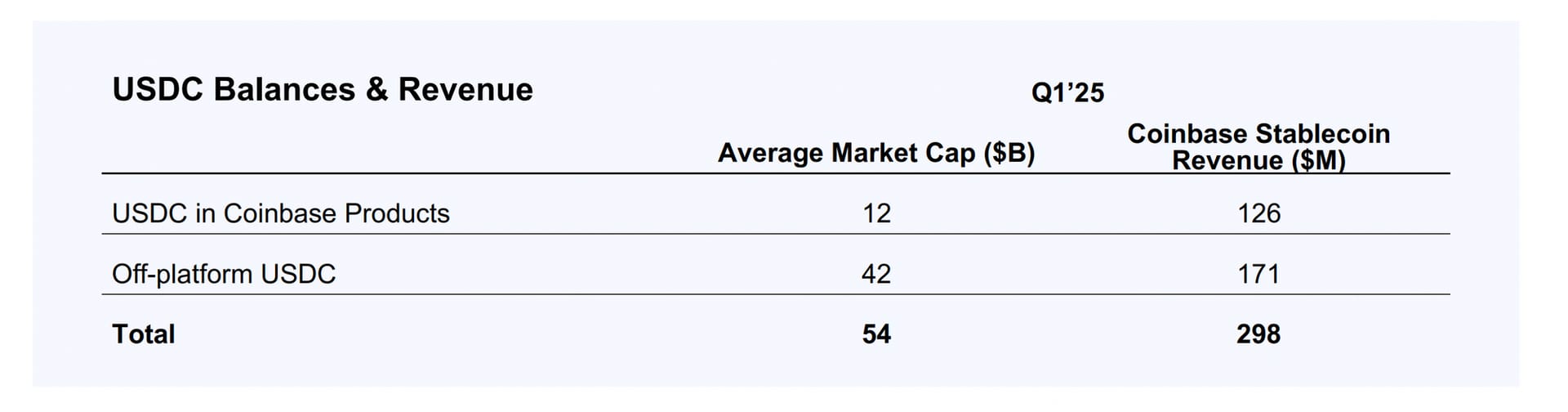

After that, Coinbase receives 100% of the reserve income from USDC held on its platform (under its custody), while Circle keeps 100% of the income from USDC held on its own platform. In Q1 2025, the average USDC balance on Coinbase’s platform was $12 billion, compared to $3.1 billion on Circle’s platform.

Image source: Coinbase, Q1 2025 Shareholder Letter

"(ii) we and Coinbase each receive an amount equal to the remaining payment base multiplied by the percentage of such stablecoin that is held in the applicable party’s custodial products or managed wallet services at the end of such day, and"

Finally, Circle and Coinbase evenly split any remaining reserve income.

"(iii) after deducting amounts payable to other approved participants in the USDC ecosystem, Coinbase receives 50% of the remaining payment base."

The agreement was originally signed for a three-year term and will automatically renew unless Circle and Coinbase choose to terminate or modify it, provided both parties meet their obligations. Coinbase has performance obligations under the agreement, referred to as “reseller thresholds”, but these are not detailed in the S-1.

"If we and Coinbase cannot agree on such modifications, so long as we and Coinbase have met our ongoing obligations under the Collaboration Agreement, the Collaboration Agreement will renew for an additional three-year term."

In summary, Circle and Coinbase split the reserve income from all Circle-issued stablecoins. Coinbase can receive more than 50% if a larger share of the stablecoins is held on its platform compared to Circle’s. As long as Coinbase meets its obligations, Circle has no way to exit the agreement.

What is the Bear Case?

The bear case on Circle rests on three key tenets:

Circle operates like a bank but can’t lend money

Falling interest rates will reduce its revenue

Half of its revenue goes to Coinbase

All three arguments are valid.

Stablecoin reserves are similar to deposits. Banks take deposits and issue loans, boosting their return on capital. In contrast, under the requirements of the GENIUS Act, Circle can hold stablecoin reserves only in bank deposits, Treasury bills, repos, and money market funds. Circle has also applied for a national trust charter, which prohibits lending.

Lower interest rates pose a headwind for Circle’s revenue. As shown above, the majority of its income comes from reserves, so when rates fall, Circle's reserve income will decline accordingly. According to the CME FedWatch Tool, the market assigns a 74% probability that the Fed funds rate will fall below 3.5% by the end of 2026 (from 4.25 - 4.50% today).

Finally, Circle does pay more than 50% of its reserve income, which makes up most of its revenue, to Coinbase for distribution. And there’s no way out of the arrangement unless Coinbase agrees to it.

So why are investors willing to pay a 147 P/E for Circle stock?! Circle priced its IPO at $31 per share, and the stock briefly approached $300 before settling around $195.

Image source: Koyfin

What is the Bull Case?

My guess is that the investors driving Circle’s stock higher are focused on the bull case, which is built on:

Unlike banks that fight over deposits, Circle faces limited competition

Coinbase offers unmatched reach at the same cost that banks pay to acquire deposits

Rate cuts have a floor, and Circle can counter this headwind with fee-based revenue

Let's unpack this.

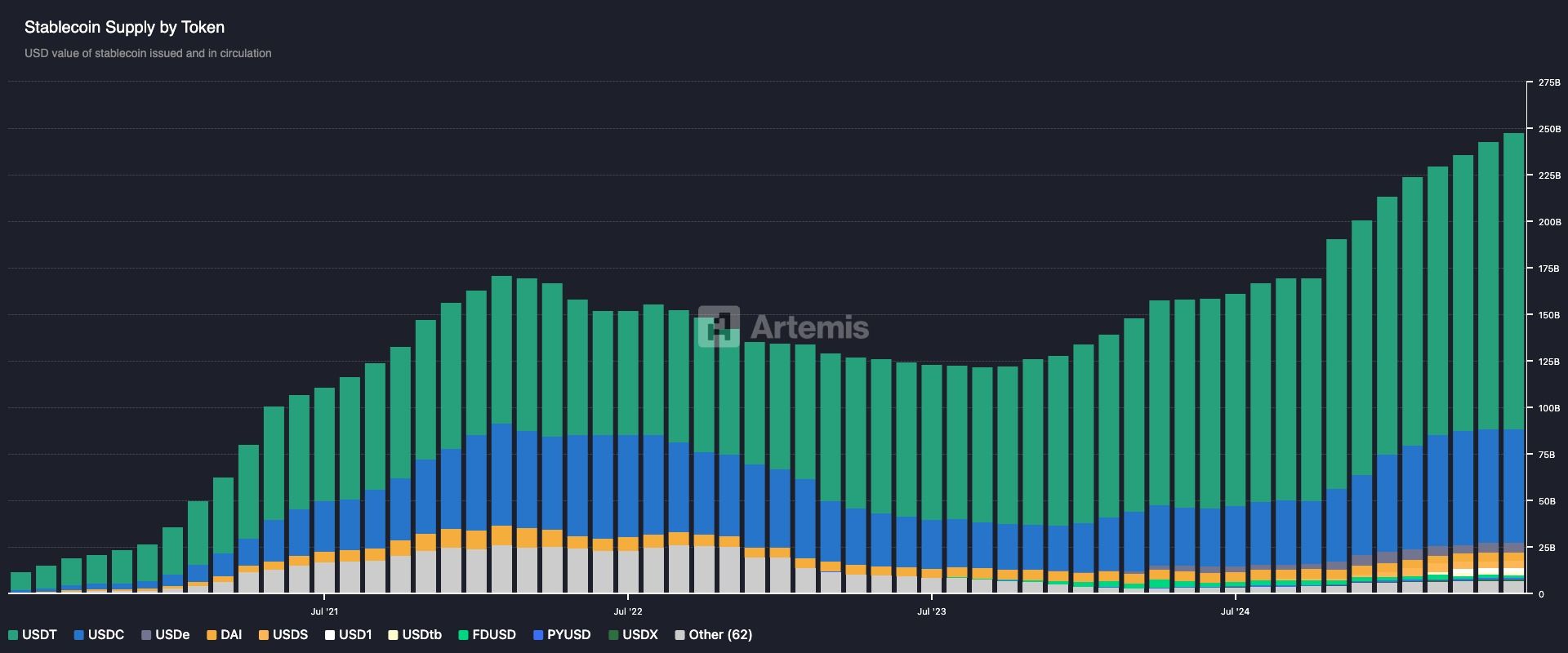

Stablecoins have seen rapid growth over the past five years, rising from under $12 billion in July 2020 to over $250 billion today. USDC now accounts for nearly a quarter of all U.S. dollar-denominated stablecoins.

Image source: Artemis

As of today, this is pretty much a competition between Circle's USDC ($63 billion) and Tether's USDT ($159 billion). The third closest competitor, USDS (formerly DAI) stands at about $7 billion (USDS also maintains a soft peg to the U.S. dollar, it's an "algorithmic" stablecoin).

Now consider Circle’s positioning as the most regulated and compliant stablecoin issuer: it’s effectively a monopoly when it comes to serving regulated institutions and large corporates looking to move onchain.

Tether has chosen not to comply with MiCA regulations in Europe and, in its current form, would not meet the requirements of the GENIUS Act in the U.S. (and neither will USDS).

“Operating as a U.S.-listed public company represents our continued dedication to transparency and accountability, as we will become subject to the reporting, corporate governance, and other requirements that are applicable to a public company listed on the New York Stock Exchange.”

So yes, Circle may not be able to leverage its capital like banks do, but no bank operates in a rapidly growing deposit market while also enjoying a near-monopoly position.

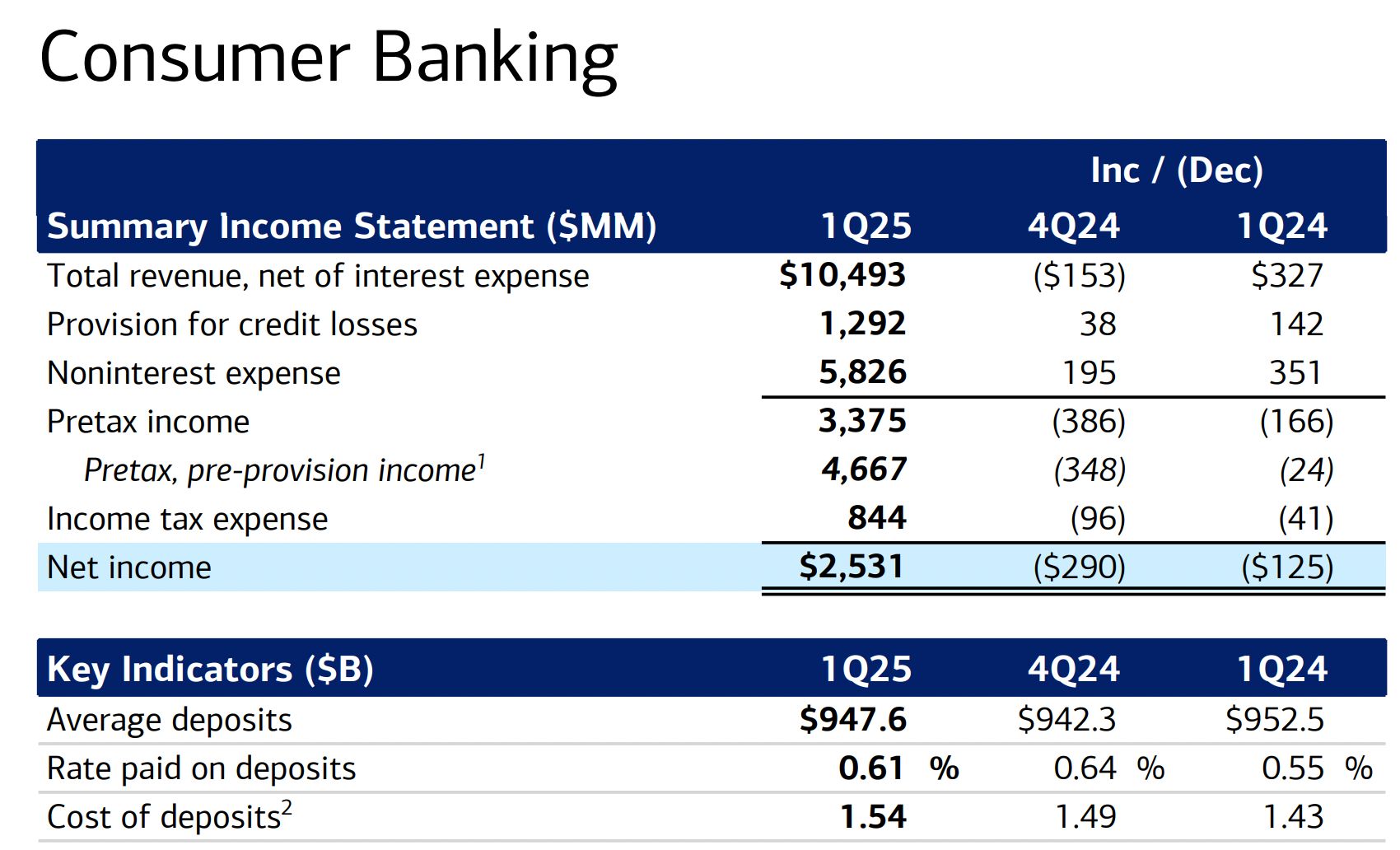

Circle pays more than half of its revenue to Coinbase for distributing its stablecoins. But if you compare this to how banks acquire deposits, it’s not unusual. Banks don’t get deposits for free: they spend on customer acquisition (ads, sign-up bonuses), maintain branches and ATMs, and still have to pay some interest on deposits.

For example, in Q1 2025, Bank of America’s Consumer Banking segment (serving consumers and small businesses) paid 0.61% in interest and 1.54% in non-interest costs. That’s roughly equivalent to half of the SOFR, about what Circle pays to Coinbase for distribution.

Image source: Bank of America, Q1 2025 earnings presentation

In return, Circle gains Coinbase, one of the largest crypto exchanges globally and the largest exchange in the U.S., as a key distribution partner. While USDC is available on many exchanges, Circle only shares revenue in select cases. For example, it has partnered with Binance and is reportedly in talks with Ant Group about a potential distribution deal.

Partnering with Binance, and possibly Ant Group, is Circle’s way of going after Tether’s USDT, and Coinbase is on board with this plan. Thus, Coinbase has agreed to share distribution fees with Binance, even though it cuts into its own revenue. A deal with Ant Group would likely work the same way.

“While each of Circle and Coinbase may enter into distribution and incentive arrangements directly with third parties at their own discretion that do not impact the payment base, from time to time, Circle and Coinbase together may enter into arrangements with third parties approved by both us and Coinbase that provide incentives to such approved participants to increase the circulation of stablecoins.”

So, yes, Circle pays more than half of its revenue to Coinbase and will likely have similar deals with a few major distribution partners. But the terms seem fair, and they give Circle unmatched global reach and distribution that will help it gain market share.

Finally, let’s talk about the coming rate cuts. While lower rates will reduce reserve income, Circle can offset this by growing its non-interest revenue, a stream it’s only just beginning to build and doesn’t have to share with distribution partners.

Some services are exclusive to Circle, such as minting USDC and EURC, while in others, like fiat-to-stablecoin conversion, Circle has an advantage over other companies offering similar services. Below is a list of no-brainer ways Circle can generate non-interest income through various products and services:

Circle Mint (issuing and redeeming USDC, EURC, etc.)

Cross-chain transfers (burning and minting on a new chain)

FX, including fiat <-> USDC and USDC <-> other stablecoins

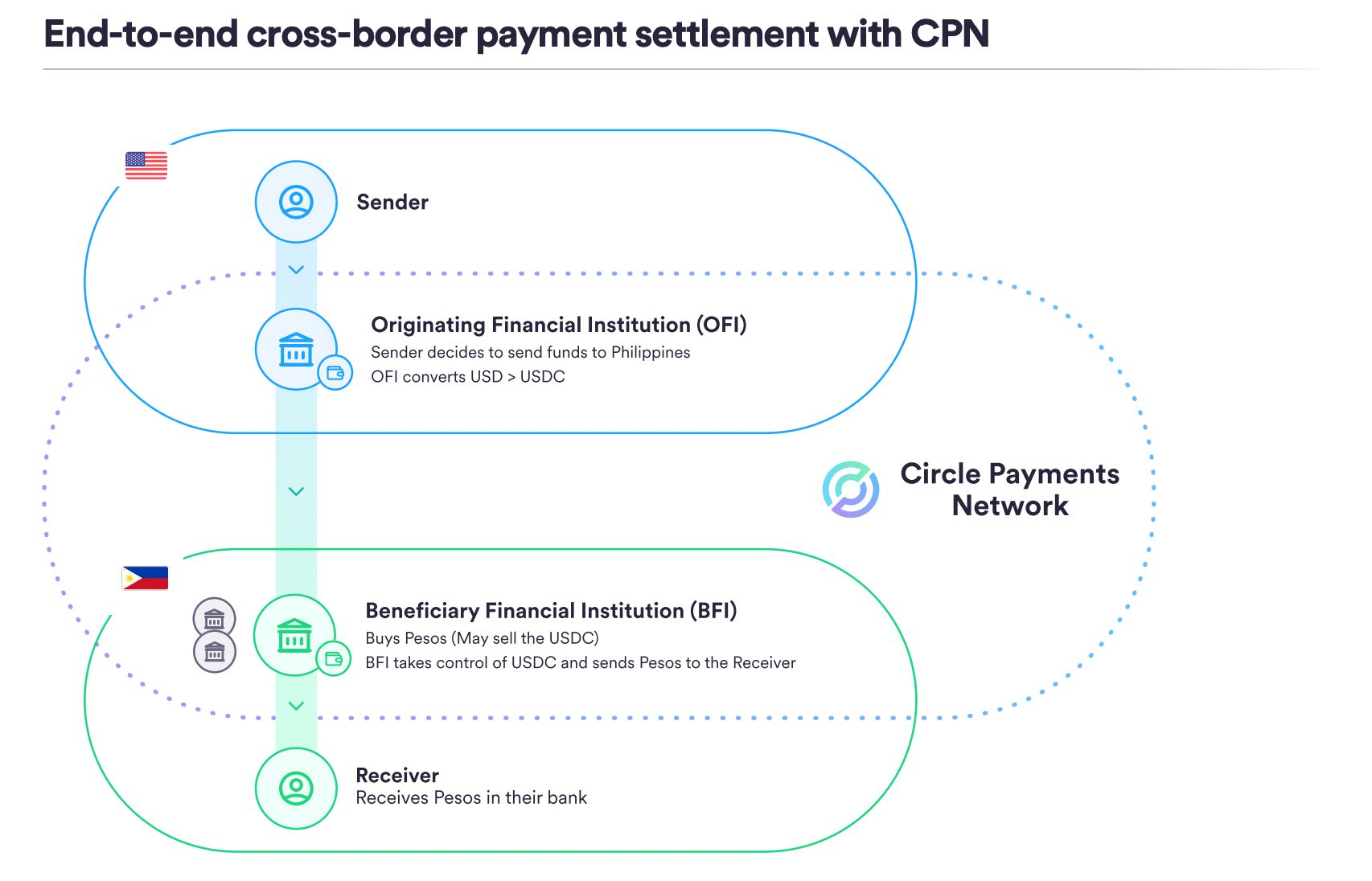

Circle Payments Network (payments between financial institutions)

Circle Platform (wallet, smart contracts)

Custody of stablecoins

“Only Circle issues USDC and EURC. With Circle Mint, distributors can avoid extra fees, added risk and transaction time of third-party channels.”

The Circle Payment Network shows how Circle can grow beyond interest income. It lets financial institutions send and receive fiat over the USDC rail, with tools for payments, payouts, and treasury. This turns Circle into a payment platform, or a modern correspondent bank, opening up new fee-based revenue streams.

Image source: Circle

“[ Circle Payments Network ] will evolve into an onchain FX routing infrastructure, enabling efficient and instant stablecoin-to-stablecoin exchanges while still orchestrating transaction settlements between [ financial institutions ].”

In summary, Circle holds an almost monopolistic position in a rapidly growing market, has top-tier distribution partners to expand its market share, and has barely begun to tap into non-interest revenue streams.

So, what does the bull case look like in numbers? While the bear case is relatively easy to price, the bull case is more complex. It requires forecasting stablecoin market growth, assessing the impact of new partnerships on Circle’s market share, and estimating the ramp-up of non-interest revenue.

Current analyst estimates project $5.5 billion in revenue and $918 million in adjusted EBITDA by 2027. Hitting those targets would imply a stablecoin market cap of around $760 billion, a 27% market share for USDC, a 3.25% reserve yield, and minimal contribution from non-interest income.

Image source: Koyfin

A 27% market share and minimal non-interest income by 2027 seem pretty modest, given the bull case outlined above, don’t they? More importantly, Circle could become a cornerstone of the onchain economy, meaning the real growth may only be beginning in 2027, not ending.

Circle is a bet on financial infrastructure moving onchain. Do you really want to bet against that?

Cover image source: Circle

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.