Hey!

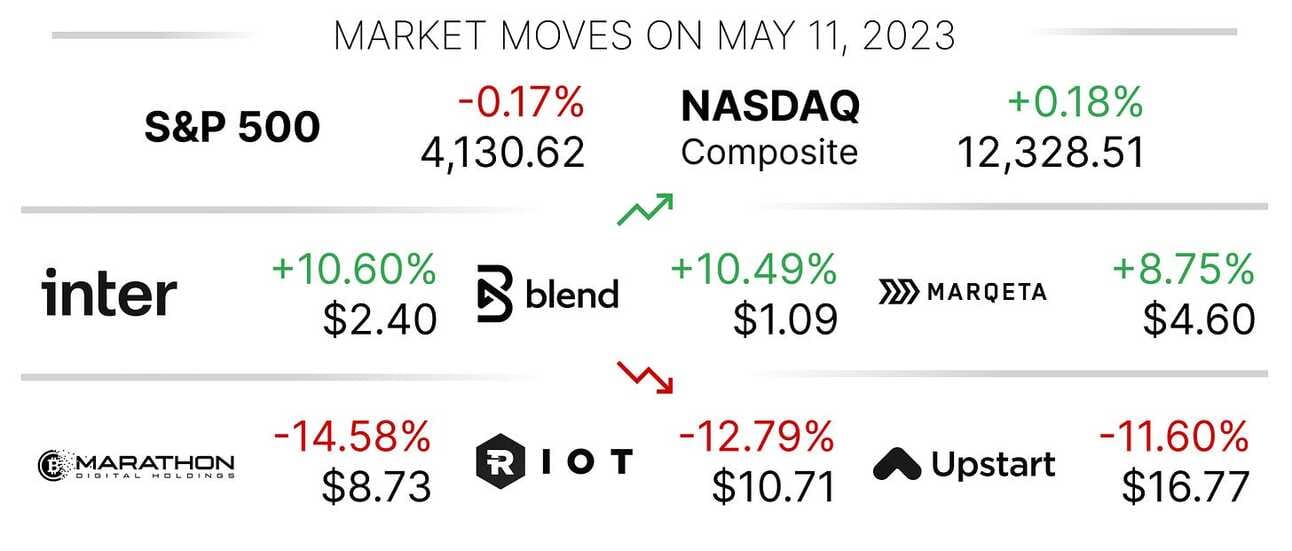

Yesterday was quite an uneventful day in the Fintech world (the calm before the storm?), so only two stories from me today:

MoneyLion and Dave’s valuations were decimated since the companies went public. What’s next for these neobanks?

Bitcoin miners Marathon Digital and Riot Platforms reported their first-quarter earnings, revealing that they work more, but earn less

That’s it for today and, as always, thank you for reading!

Jevgenijs

MoneyLion and Dave’s Valuation Were Decimated. What’s Next for These Neobanks?

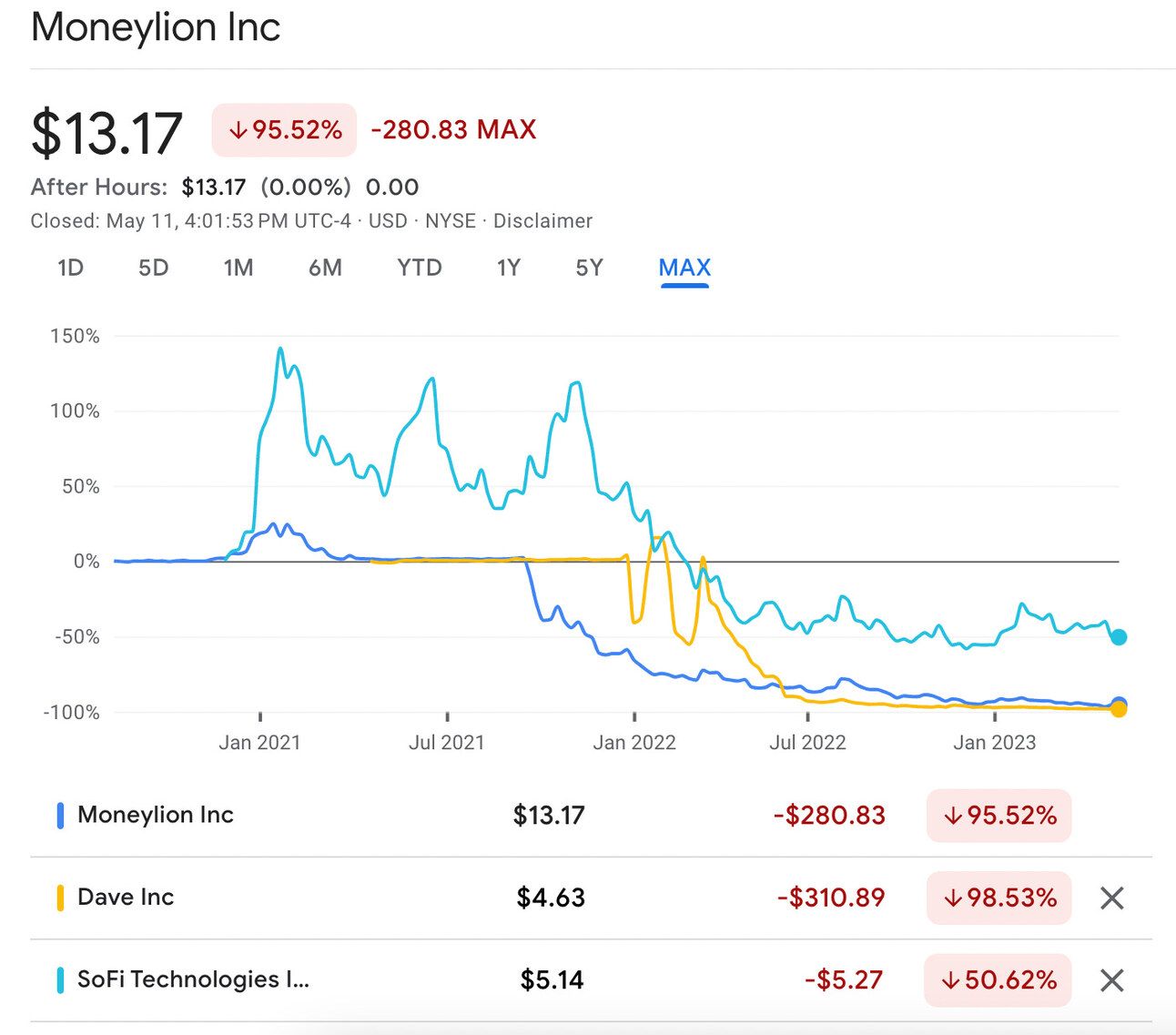

MoneyLion (NYSE: ML) and Dave (NASDAQ: DAVE) have so much in common: both companies serve the lower-income segment of the US population, their core product is a free cash advance of up to $5000 (Instacash and ExtraCash), both companies went public by merging with SPACs, and both companies had to do reverse stock splits after their stock prices plummeted below the listing requirement of $1. At the time of this writing, the market cap of MoneyLion was $115 million, and the market cap of Dave was $55 million (SPAC mergers valued the companies at $2.88 and $3.95 billion respectively). Such a decline in stock price naturally begs a question: what’s next for these two companies?

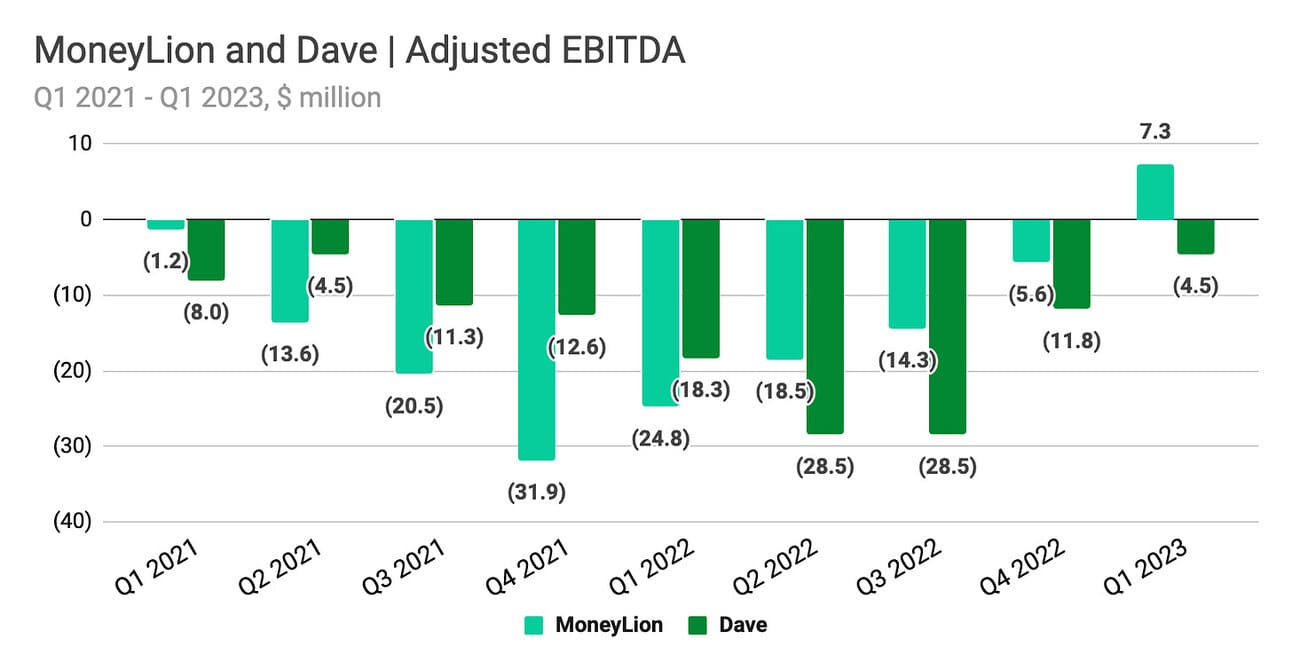

For the first quarter of 2023, MoneyLion reported a 34% YoY growth in revenue to $93.7 million. The company posted a positive Adjusted EBITDA of $7.3 million, as well as reiterated its plans to deliver positive Adjusted EBITDA for the full year 2023. The company’s client base reached 7.8%, up from 3.9 million a year ago. Dave reported a 38% YoY growth in revenue to $58.9 million, and a negative Adjusted EBITDA of $4.5 million. The company aims to achieve profitability on an Adjusted EBITDA basis in “4 to 6 quarters” per the founder’s interview in March. The company reported 8.7 million customers. MoneyLion and Dave finished the quarter with $114 million and $196 million in cash and cash equivalents respectively.

In 2021, MoneyLion used the IPO proceeds to acquire a content agency Malka Media and an affiliate marketplace EVEN Financial. The acquisitions became the foundation of the company’s Enterprise segment, which contributed a third of the company’s revenue in the first quarter of 2023. MoneyLion even partnered with Japanese conglomerate Aeon to launch a bank in Malaysia but later exited the deal. On the contrary, Dave continues to focus on serving consumers, and launched checking accounts in 2022 with the ambition to become a “full-on neobank.” It is too early to tell, which strategy will prove to work better, but both companies have sufficient cash to continue experimenting.

✔️ Dave Announces First Quarter 2023 Results

✔️ MoneyLion’s Q1 2023 Results Highlight Growth and Steady Path to Profitability

✔️ The story of how Dave took the long road to become a neobank

✔️ Dave CEO says it's on track to return to profitability

✔️ Aeon to proceed with Malaysia digibank despite MoneyLion exit

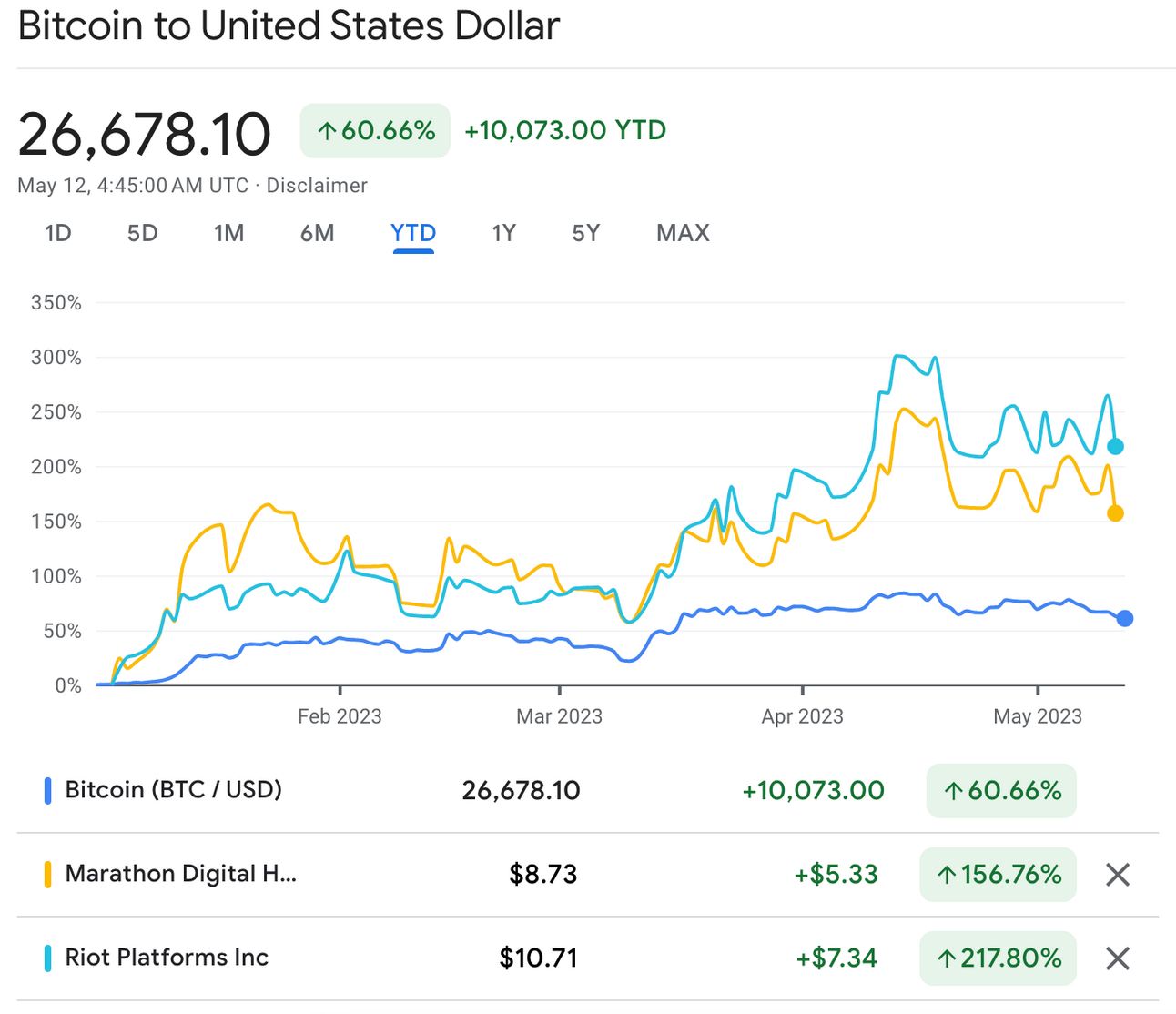

Bitcoin Miners Marathon Digital and Riot Platforms Work More, Earn Less

Marathon Digital and Riot Platform, two leading US Bitcoin miners, reported their first quarter results this week. Both companies reported an increase in Bitcoin production compared to the first quarter of 2022 (+74% for Marathon, and 51% for Riot), but lower Bitcoin prices drove a decline in revenue. Bitcoin prices averaged $22,704 in the first quarter of 2023, a decrease of 44% as compared to the average of $41,241 in the first quarter of 2022. A reminder, exactly a year ago, in May 2022, Terra, the company behind the stablecoin UST and cryptocurrency Luna, collapsed, triggering a series of bankruptcies (Three Arrows Capital, BlockFI, Voyager), and, eventually culminating in an epic blow-up of FTX.

Marathon Digital’s revenue for the quarter declined by 1% YoY to $51.1 million. The company reported a Net loss of $7.2 million and an Adjusted EBITDA of $18.6 million, which compares to a Net loss of $12.8 million and an Adjusted EBITDA of $9.8 million in the first quarter of 2022. Riot Platforms reported revenue of $73.2 million, which represents an 8% decline compared to a year ago. The company posted a Net loss of $55.7 million and an Adjusted EBITDA of $7.5 million, compared to a Net income of $36.6 million and an Adjusted EBITDA of $12.7 million in the first quarter of 2022. The decline in Bitcoin price was partially offset by lower production costs.

✔️ Marathon Digital Holdings Reports First Quarter 2023 Results

✔️ Riot Platforms Reports First Quarter 2023 Financial Results

✔️ Bitcoin Miner Marathon Digital First-Quarter Earnings Beat Expectations

✔️ SEC Serves Bitcoin Mining Firm Marathon Digital With Subpoena, Again

When I wrote that the valuations of MoneyLion and Dave were decimated, I really meant it. The chart below looks totally brutal, and it is hard to imagine how it feels for the founders. Fingers crossed great things are yet to come for these companies! 💪🏻

Director of Product

@ MoneyLion

🇺🇸 New York, NY, United StatesDirector of Engineering

@ MoneyLion

🇲🇾 Kuala Lumpur, MalaysiaDirector, Product Design

@ Dave

🇺🇸 Remote, United StatesEngineering Manager, Member Intelligence

@ Dave

🇺🇸 Remote, United StatesDirector, Financial Planning and Analysis

@ Riot Platforms

🇺🇸 Austin, TX, United States

Cover image source: MoneyLion

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.