Hi!

Hope you had a great weekend! There are two kinds of people: those, who spent this weekend watching the coronation of King Charles III, and those who spent this weekend watching Warren Buffett and Charlie Munger speak at Berkshire Hathaway’s Annual Shareholder Meeting. I went with Buffett and Munger. Anyways, here is what to expect this week:

US regional banking crisis did not end with the acquisition of First Republic Bank, and Warren Buffet expects more turbulence ahead,

PayPal, Robinhood, and Affirm are among many Fintech companies to report their first quarter 2023 results this week, and

The U.S. Labor Department will release inflation data for April.

Warren Buffett Expects More Turbulence in US Banking Sector

The US regional banking crisis has already claimed its three victims, Silicon Valley Bank, Signature Bank, and First Republic Bank. It seemed that the acquisition of First Republic Bank by JPMorgan last Monday would have ended the turbulence, but the story was far from over. Thus, a number of smaller banks, such as PacWest (NASDAQ: PACW) and Western Alliance (NYSE: WAL) became targets of short-sellers later in the week, reviving speculations about more failures. In contrast to Silicon Valley Bank and First Republic Bank, PacWest and Western Alliance did not experience deposit outflows, yet their shares plunged on Thursday, and are now down 78% and 64% respectively since early March.

When asked on the topic at Berkshire Hathaway’s Annual Shareholder, Warren Buffett commented that the impact of the US government's failure to guarantee deposits of the Silicon Valley Bank would be “catastrophic”. He also criticized regulators, politicians, and the media for creating confusion among the public about the safety of U.S. banks and warned that the situation could deteriorate further. “The situation in banking is very similar to what it’s always been in banking, which is that fear is contagious,” Buffett said. Buffet owned banks through Berkshire Hathaway since the 1960s and even served as the CEO of Salomon Brothers in the 1990s. In addition to positions in Bank of America, Citigroup, and Bank New York Mellon, Berkshire Hathaway owns stock in Visa, Mastercard, American Express, and Nubank.

✔️ Warren Buffett says American banks could face more turbulence ahead, but deposits are safe

✔️ PacWest stock jumps 80% as regional banks rebound on Friday, but still down sharply for the week

✔️ Short Sellers Flocking to US Banks Are Risking a Painful Squeeze

✔️ PacWest Stock Surges 82%, Regional Banks Recover After Selloff

PayPal, Robinhood, and Affirm to Report First Quarter 2023 Earnings

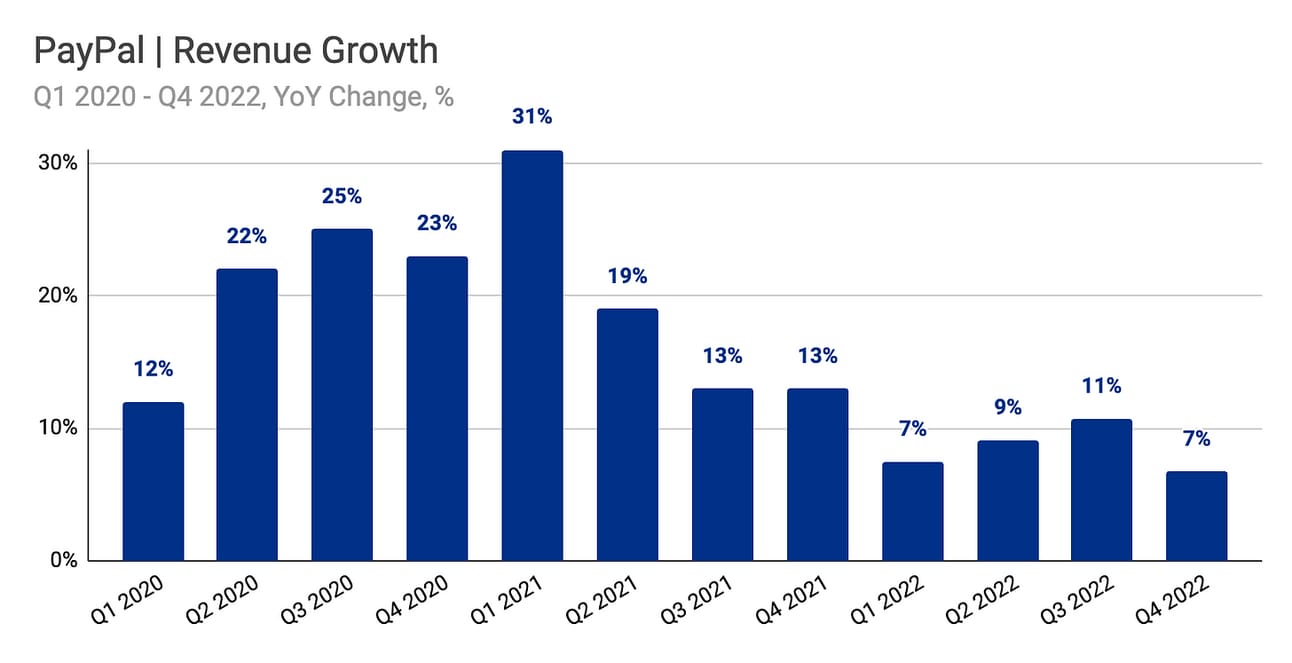

This will be a busy week with sixteen Fintech companies reporting their first quarter 2023 results. We will hear from PayPal (NASDAQ: PYPL), Marqeta (NASDAQ: PYPL), and Paymentus (NYSE: PAY) today (May 8), Affirm (NASDAQ: AFRM), Toast (NYSE: TOST), Upstart (NASDAQ: UPST), Flywire (NASDAQ: FLYW) and a few others on Tuesday (May 9) and Robinhood (NASDAQ: HOOD) on Wednesday (May 10). Personally, I will be watching closely the results of PayPal, Affirm, and Robinhood.

Visa, Mastercard, as well as other payment processors, such as Fiserv, FIS, and Global Payments, reported better-than-expected results on the back of strong consumer spending. Thus, I would expect PayPal to beat earnings estimates too (not investment advice!). However, investors will be looking for news about the company’s plans to find a new CEO, after its current chief, Dan Schulman, steps down at the end of the year. The company also doesn’t have a permanent CFO, as Blake Jorgensen unexpectedly stepped down just a few months after taking the role.

Affirm reported weak fourth-quarter 2022 results in February, admitting pressure from the rising rates and a failure to reprice client agreements to accommodate the higher cost of funding. Operating loss for the quarter came in at $359.5 million (compared to the $196.2 million loss a year ago), which made investors question the viability of the Buy Now Pay Later business in the non-zero interest rate environment. The company was forced to lay off 19% of its workforce and promised to focus on profitable growth. Let’s see what progress they have achieved.

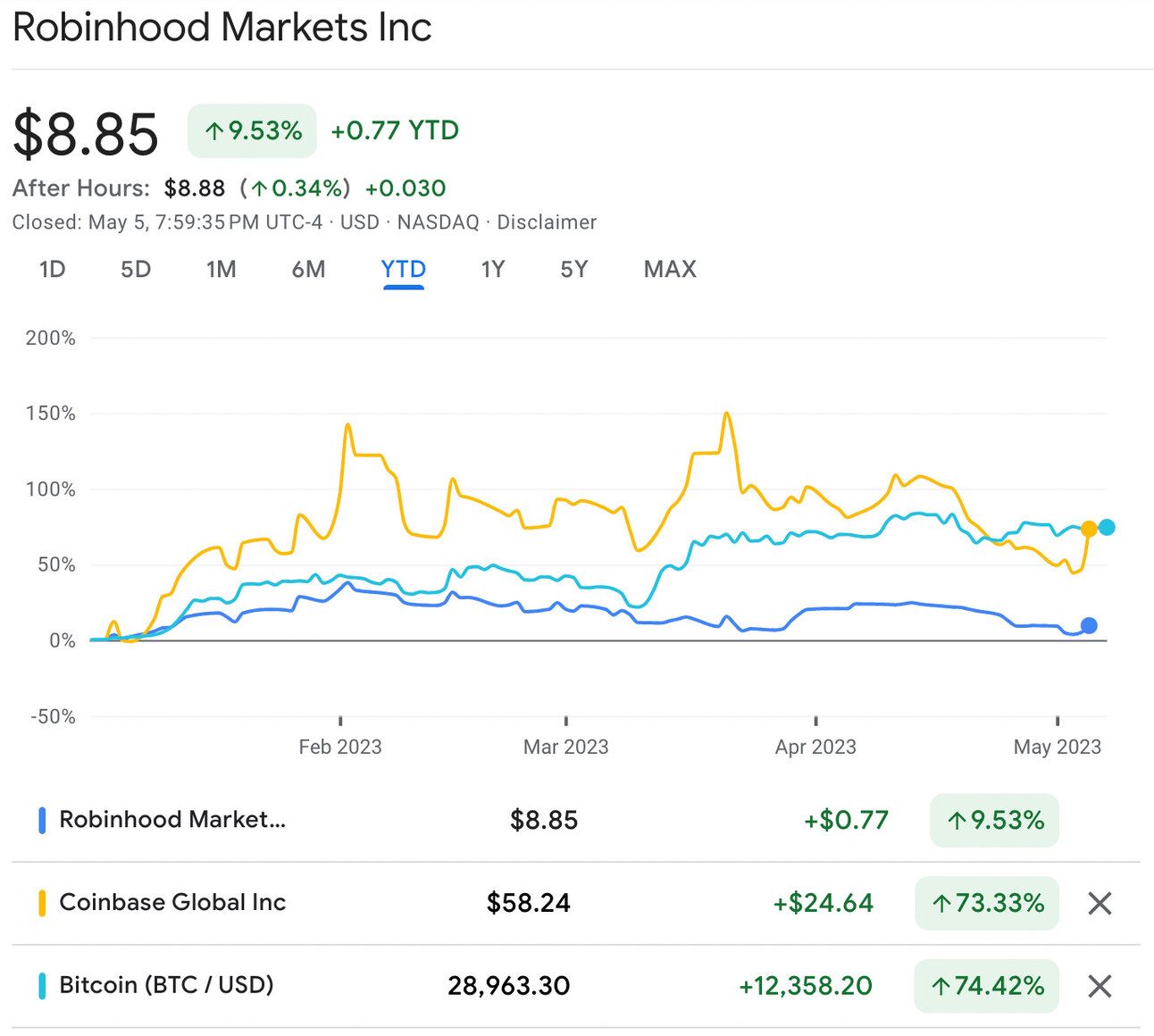

Finally, Robinhood is doing better than expected and even returned to profitability (although on an adjusted basis for now) in the third quarter of 2022. The company executed two rounds of layoffs to cut operating costs, its customers are not leaving and keep depositing more funds, while higher interest rates started contributing meaningfully to the interest income. Robinhood had $6.3 billion in cash and cash equivalents at the end of 2022, so it has plenty of capacity to pursue acquisitions and expand to new markets. Excited to learn more about their 2023 agenda!

✔️ President and CEO Dan Schulman Announces Intention to Retire from PayPal

✔️ PayPal CFO Blake Jorgensen Steps Down

✔️ Affirm cuts 19% of workforce; shares tank on earnings miss

✔️ Affirm lays off one in five workers as company resets strategy

✔️ Robinhood Markets, Inc. Reports February 2023 Operating Data

US Labor Department to Release April Inflation Data

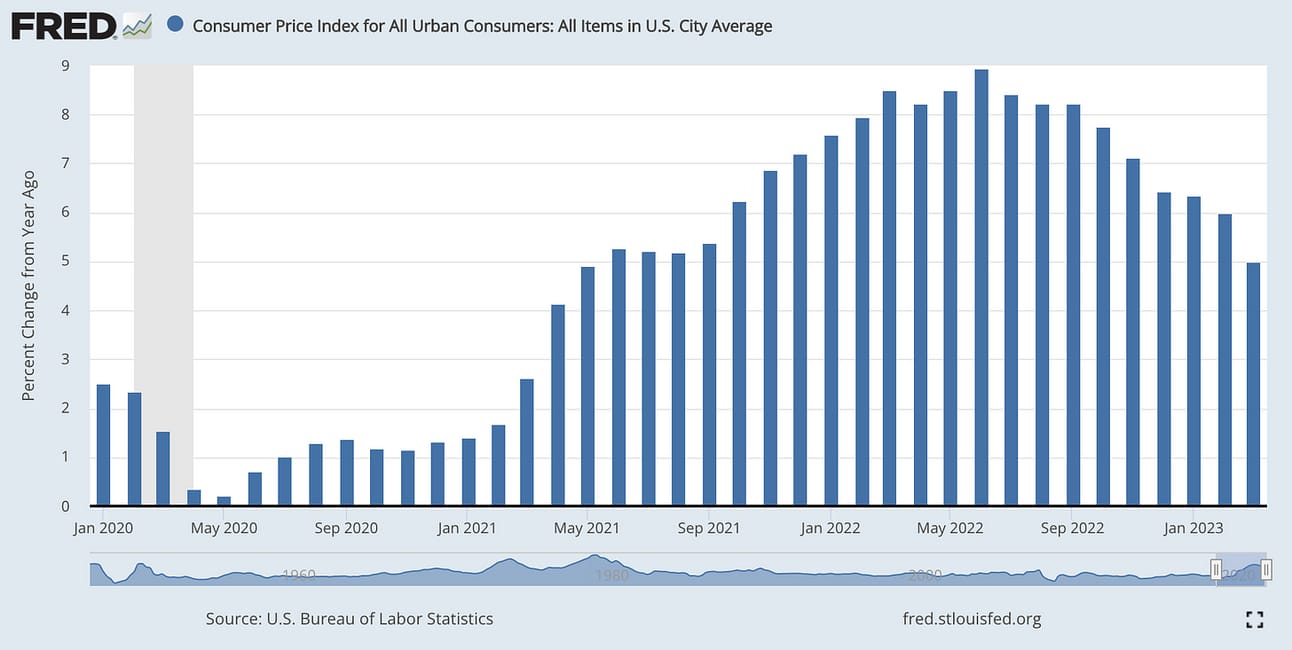

On Wednesday, before markets open, the US Labor Department will release the Consumer Price Index data for April 2023. On a year-over-year basis, CPI increased by 5% in March and 6% in February. The inflation peaked at 8.9% in June last year. While US inflation is on the decline, it is still far away from the Federal Reserve’s target of 2%. Thus, investors will be watching the inflation results closely, making their conclusions about further Fed’s actions. Last week, the Federal Reserve raised the federal funds rate by another 25 basis points to 5.00 - 5.25% despite the turbulence in the banking sector and the signs of a slowing economy.

According to the CME FedWatch Tool, there is only an 11.4% probability of a further rate increase at the Federal Open Market Committee’s meeting in June. Investors assign a 99.6% probability that the Federal Reserve will have to cut rates by the end of the year, on the expectations of a weakening economy. While lower interest rates should be a good thing for Fintech companies in theory (the value of a company is the discounted value of future cash flows), rate cuts would indicate severe deterioration of the economy. A bad economy means lower consumer spending and higher default rates, which is not something to look for in financial services.

Source data: FRED

✔️ Federal Reserve issues FOMC statement

✔️ Fed Hikes Rates by Quarter Point, Powell Hints at Possible Pause

✔️ Fed Raises Rates Another 25 Basis Points—Signals Pause May Come If Greater ‘Risks Emerge’

✔️ Federal Reserve Raises Rates, Signals Potential Pause

With Coinbase (NASDAQ: COIN) facing regulatory scrutiny, I decided to look into the performance of Robinhood stock, as a proxy bet on crypto. After all, Robinhood is a fully licensed brokerage, so SEC’s call to crypto companies to “come forward and register” is not addressed to them. However, as the chart below suggests, the best bet on crypto this year remains...crypto itself!

Head of Product Data Science, Venmo

@ PayPal

🇺🇸 New York, NY, and San Jose, CA, United StatesProduct Manager, Web3

@ Robinhood

🇺🇸 New York, NY, and Menlo Park, CA, United StatesSr. Manager, Social Media Marketing & Communications

@ Robinhood

🇺🇸 New York, NY, and Menlo Park, CA, United StatesHead of Product Marketing

@ Affirm

🇺🇸 Remote, United StatesSenior Product Manager, Communications Platform

@ Affirm

🇵🇱 Remote, Poland

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image source: The White House

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.