Hey!

I listen to every Capital One earnings call because every one of them is like a free lecture on the financial services business. The company’s chief, Richard Fairbank, is very generous with his time and provides elaborate commentary on the market and industry trends. It seems that I am not the only one who’s been listening to these calls:

Capital One becomes Warren Buffett’s latest bet on financial services,

Square published a random presser about its Square for Restaurants offering, and

Paysafe reiterated its full-year guidance, expecting to return to growth

Thank you for reading and see you tomorrow!

Jevgenijs

Warren Buffett Bets on Capital One

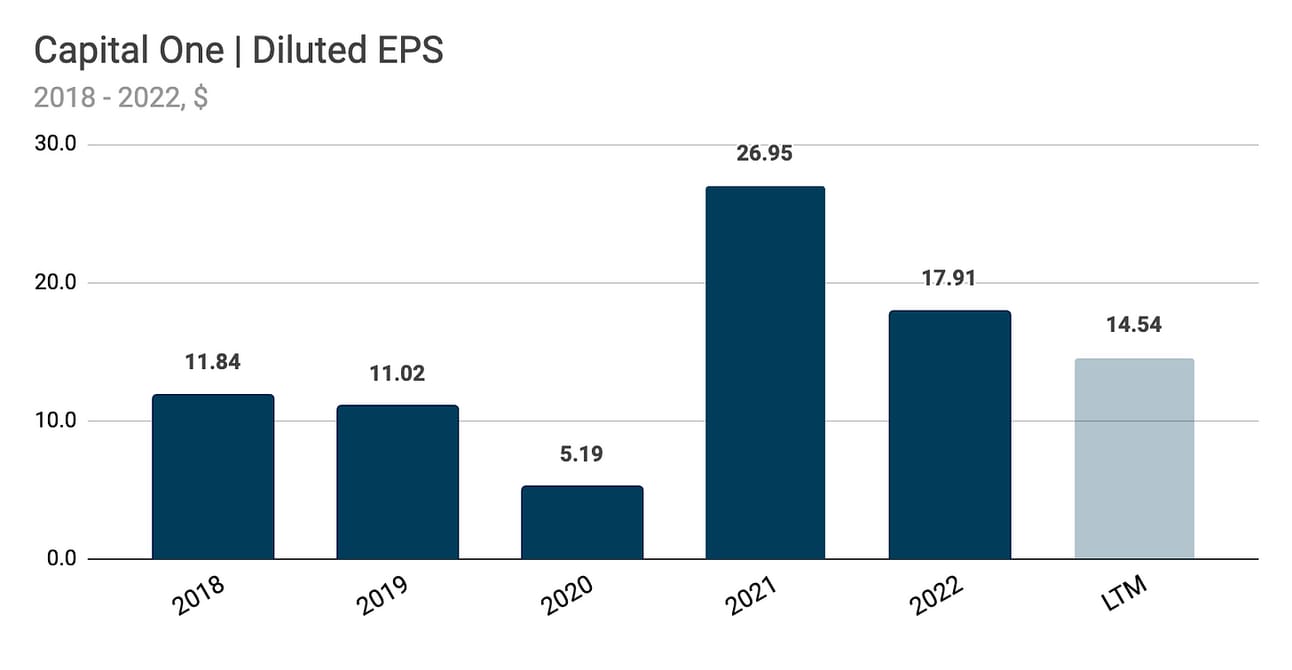

Warren Buffett’s Berkshire Hathaway disclosed on Monday an investment in Capital One (NYSE: COF). Berkshire Hathaway now owns 9.92 million shares, which as of yesterday’s closing price were worth around $0.9 billion. The original Fintech, as the company’s co-founder and CEO, Richard Fairbank, calls Capital One, is a bank holding company that specializes in credit cards, auto loans, and commercial credit. At the end of the first quarter of 2023, the company had $471.7 billion in assets, including $137.1 billion in credit card receivables, $93.5 billion in commercial credit, and $76.7 billion in auto loans. Capital One reported a net income of $960 million, or $2.31 per diluted share, for the quarter, on a total net income of $8.9 billion.

In addition to Capital One, Berkshire Hathaway now holds shares in the following financial services companies: Ally Financial (NYSE: ALLY), American Express (NYSE: AXP), Bank of America (NYSE: BAC), Citigroup (NYSE: C), Jefferies Financial Group (NYSE: JEF), Mastercard (NYSE: MA), Moody’s (NYSE: MCO), Visa (NYSE: V), Aon (NYSE: AON), as well as Brazil’s Nubank (NYSE: NU) and Stone (NASDAQ: STNE). The company fully sold its holdings in Bank of New York Mellon (NYSE: BK) and US Bancorp (NYSE: USB). Capital One shares were up as much as 5.30% yesterday, but eventually finished the day up 2.05% (Berkshire filed its holdings on Monday evening).

✔️ Warren Buffett sells stakes in two banks, buys into Capital One

✔️ Buffett’s Berkshire Hathaway bet almost $1bn on credit card issuer Capital One

✔️ Capital One shares rebound after Warren Buffett makes near $1 bln bet on bank

Square Publishes a Random Presser on its Square for Restaurants Offering

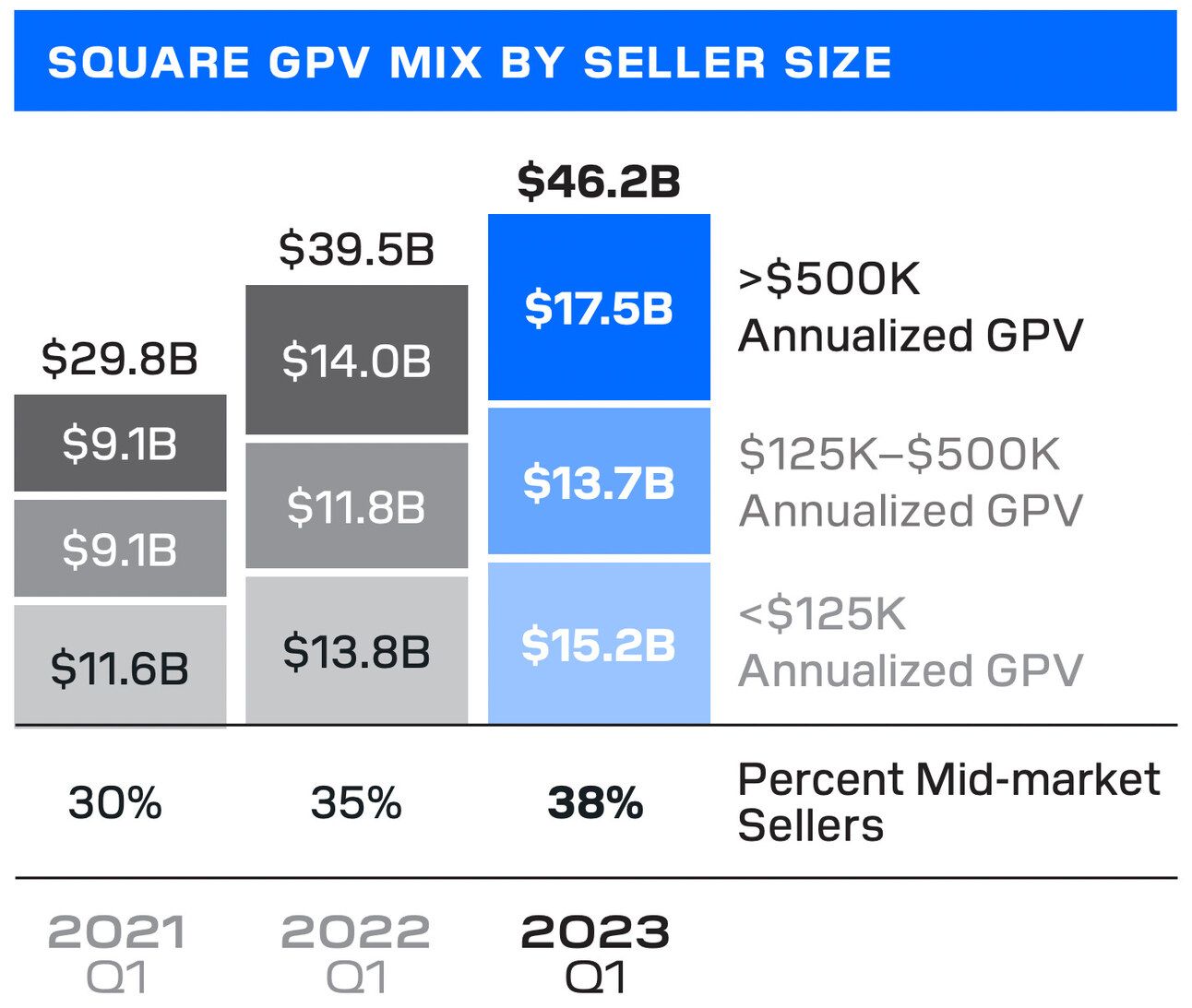

Square (NYSE: $SQ) published a random press release about its Square for Restaurants offering. That was a hodgepodge of business metrics, product updates, and salesy slogans. Square has numerous open positions in marketing (see below), so if you are good at this, please take a look, as they clearly need help. Anyways, let’s try to digest this presser. GPV generated by the upmarket food and beverage sellers increased by 47% YoY. Square defines upmaket seller as a merchant that generates more than $500,000 in annualized GPV. In the first quarter, the whole upmarket seller segment generated $17.5 billion in GPV, up 25% YoY, which suggests that the company is growing faster in the restaurant sub-segment.

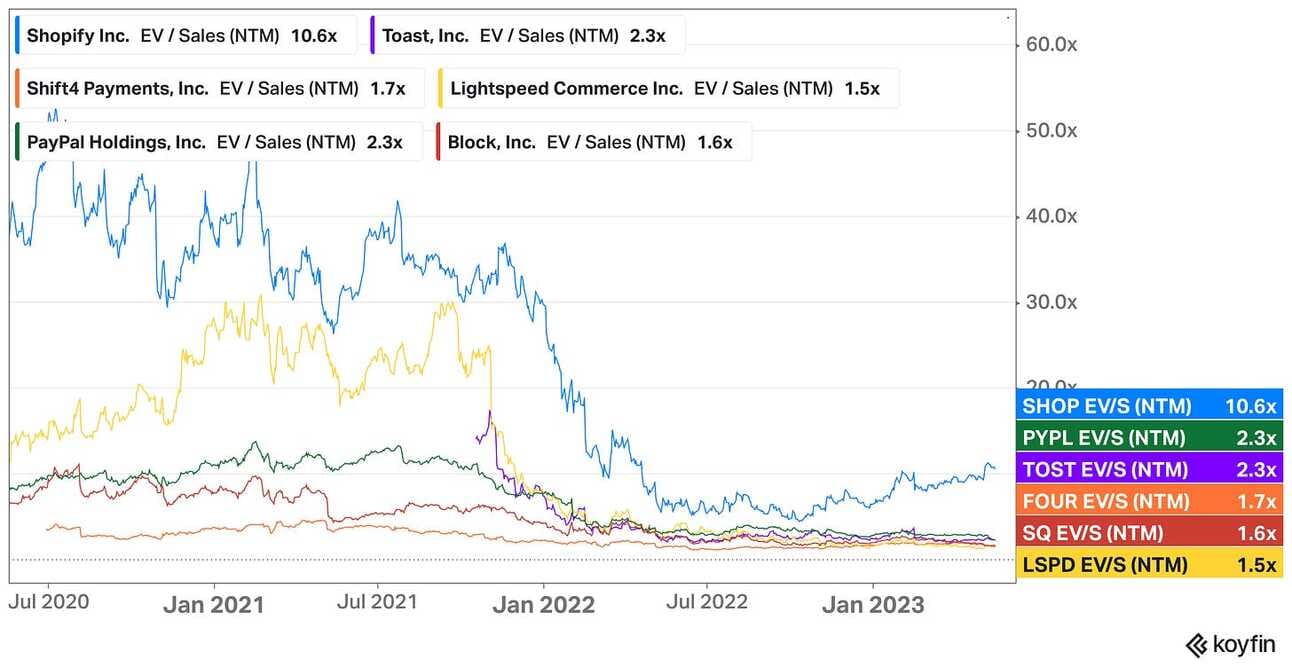

The company disclosed that, on average, sellers that use Square for Restaurants also “use around 4 other Square products”, and upmarket sellers “use around 6 additional products from the Square ecosystem.” Square also announced the launch of Kitchen Display System for Android, Square for Franchises, as well as partnerships with Flash Order and Soundhound to enable drive-through ordering. My understanding is that the press release was a response to the growing competition from Toast (NYSE: TOST), Shift4 Payments (NYSE: FOUR), Lightspeed Commerce (NYSE: FOUR) and Fiserv’s Clover (NASDAQ: FISV), that have been actively launching new products and aggressively acquiring new customers.

✔️ Square for Restaurants Continues Growth Upmarket

✔️ Block beats earnings expectations, shakes off short seller report

✔️ Block’s Earnings Beat Expectations, Driven by Cash App

Paysafe Reiterates Full-Year Guidance, Expecting to Return to Growth This Year

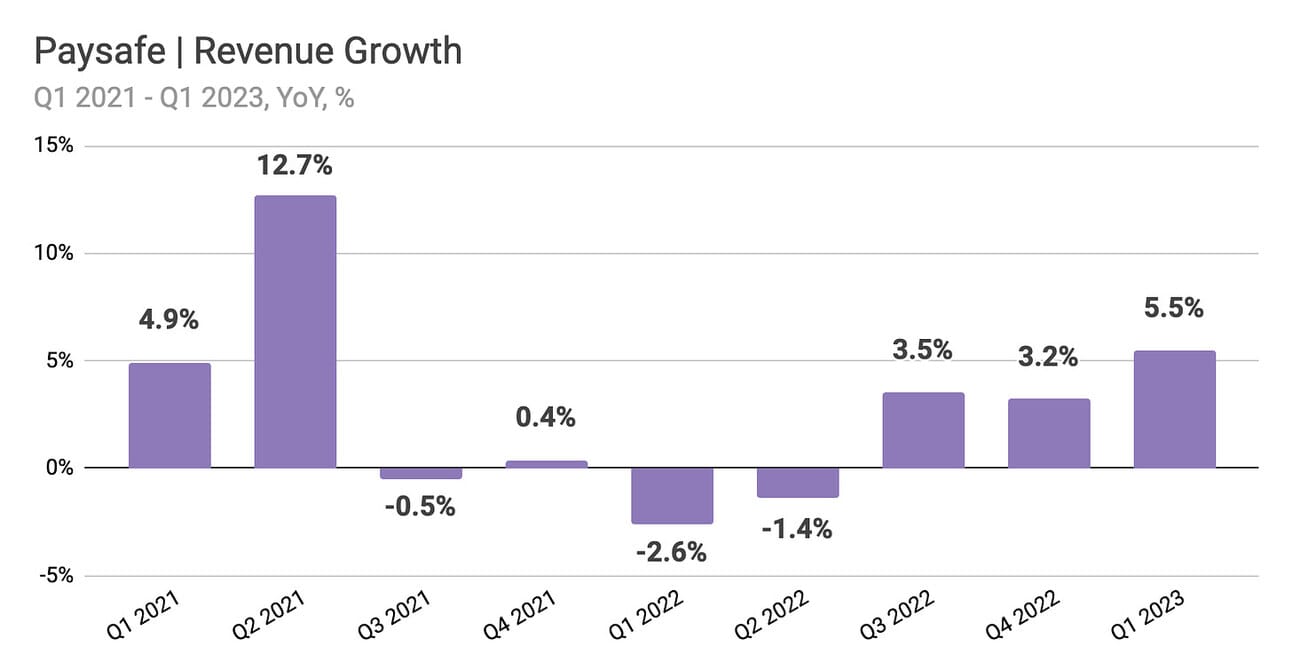

Paysafe, a merchant acquirer catering to online gaming and entertainment industries, reported its first quarter 2023 results yesterday, Total Payment Volume increased 8.3% YoY to $33.8 billion, and revenue increased 5.5% YoY to $387.8 million. Revenue growth was driven by an 8% YoY revenue increase in the Merchant Solutions segment and a 2% YoY revenue increase in the Digital Wallets segment. The company posted a Net Loss of $3.8 million and an Adjusted EBITDA of $107.8 million, which compares to a Net Loss of $1.17 billion and an Adjusted EBITDA of 104.0 million a year ago. The company’s Net loss in the first quarter of 2022 included a $1.2 billion impairment of goodwill (write-off of acquired assets).

Paysafe reiterated its guidance for the full year 2023, expecting $1.58 to 1.60 billion in revenue, and $452 to $462 million in Adjusted EBITDA. The guidance implies a 6% YoY growth in revenue and would represent a major improvement from the 0.6% revenue growth in 2022. A year ago, the company’s Board hired a new CEO, Bruce Lowthers, with the goal to reignite growth. Lowethers, who came from FIS, reorganized the company into two segments, as well as rebuilt his C-suite, including hiring a new CFO, CRO, and Chief Strategy and Innovation Officer. The results (or the guidance) seem to have disappointed investors, and the stock declined 12.28%.

✔️ Paysafe Reports First Quarter 2023 Results; Reaffirms Full Year Outlook

✔️ Paysafe Says Digital Wallet Use Helped Q1 Revenue Jump 7%

✔️ Paysafe reaffirms full-year guidance after record Q1

After selling its logistics business, Shopify's business will be about payments and platform subscription fees. So why do investors price the stock at 10.6 EV/NTM Sales, while other payment companies trade at 1.5 - 2.3 EV/Sales multiple?! 👇🏻

Editorial Strategist, Restaurant

@ Square

🇺🇸 San Francisco, CA, United StatesProduct Marketing Manager, Square Restaurants

@ Square

🇺🇸 Remote, United StatesIntegrated Marketing Manager, Restaurants

@ Square

🇺🇸 Remote, United StatesSenior Director of Product, Merchant Experience

@ Paysafe

🇬🇧 London, United KingdomSenior Product Manager, iGaming

@ Paysafe

🇺🇸 Jacksonville, FL, United States

Cover image source: Capital One

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.