Hey!

A few weeks ago, Visa held an Investor Day. It was a very insightful event that made one thing clear: Visa has an infinite growth runway. Consumer card payments still have plenty of growth potential, and Visa is actively expanding into new areas like account-to-account and commercial payments.

Visa Investor Day lasted over 6 hours and included a 161-slide presentation. So today, instead of my traditional weekly essay, I’ve decided to offer a summary, highlighting my key takeaways from the event. While I still recommend watching the full event, this summary will give you a good sense of what was discussed.

Let’s go!

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

All images and quotes in this article are from Visa Investor Day 2025

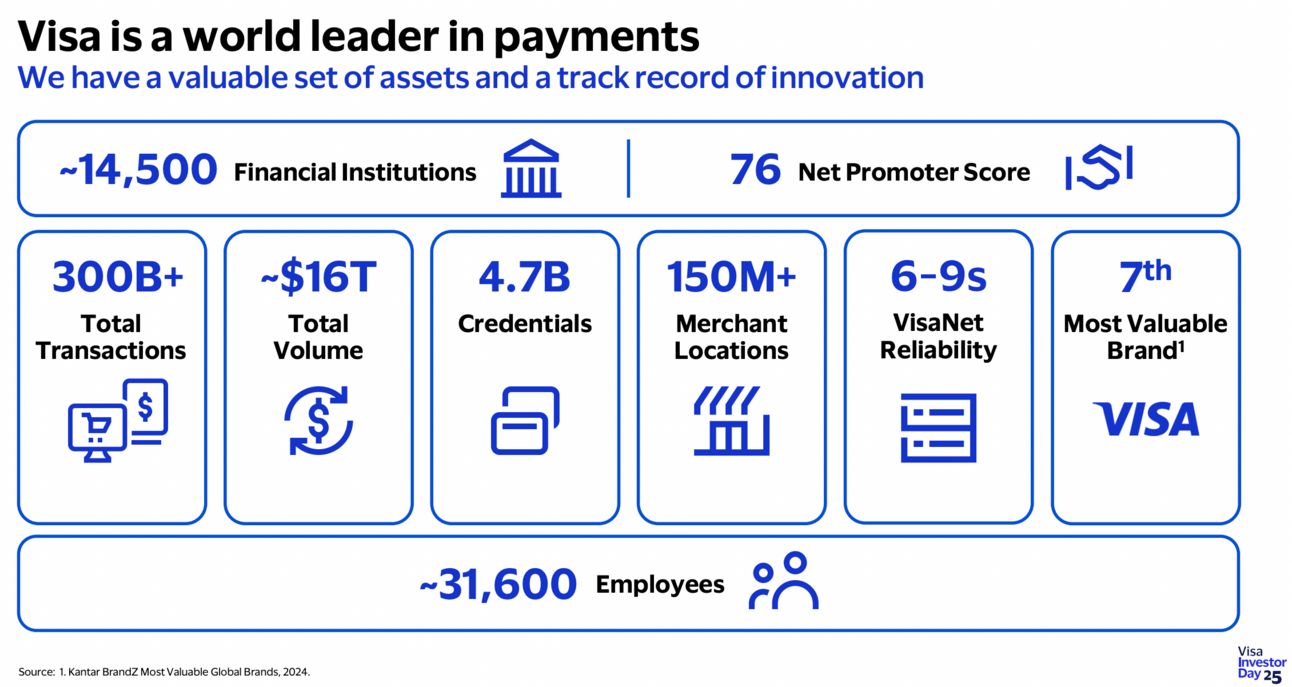

Visa $V ( ▼ 3.12% ) has become a beast. There are 4.7 billion Visa-branded cards in circulation, accepted at 150 million merchant locations worldwide. In fiscal 2024 (Visa’s fiscal year ends in September), Visa cardholders spent a total of $15.7 trillion using their cards, including both payments and cash withdrawals.

When I think about what makes Visa the leader that it is, it's our global scale, global reach, capabilities, services, network reliability, innovation brand, our people and our maniacal focus on serving and delivering for our clients.

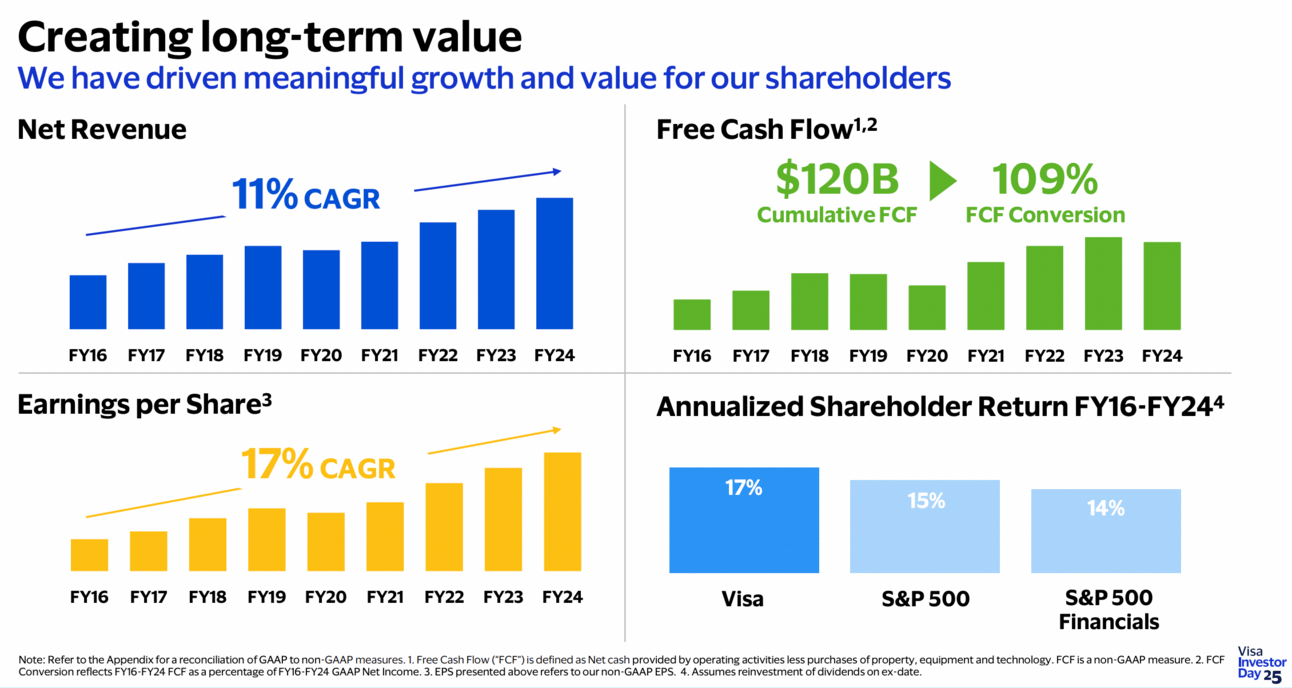

Visa is also a financial success. Over the past 10 years, Visa's market capitalization grew from $160 billion to nearly $675 billion, and its stock delivered a 449% return to shareholders, outperforming the Nasdaq 100 (+395%) and S&P 500 (+230%).

Throughout our history, Visa has driven strong financial returns with consistent double-digit revenue growth and high teens EPS growth, supported by effective capital allocation. Since fiscal 2016, we have generated more than $120 billion of free cash flow.

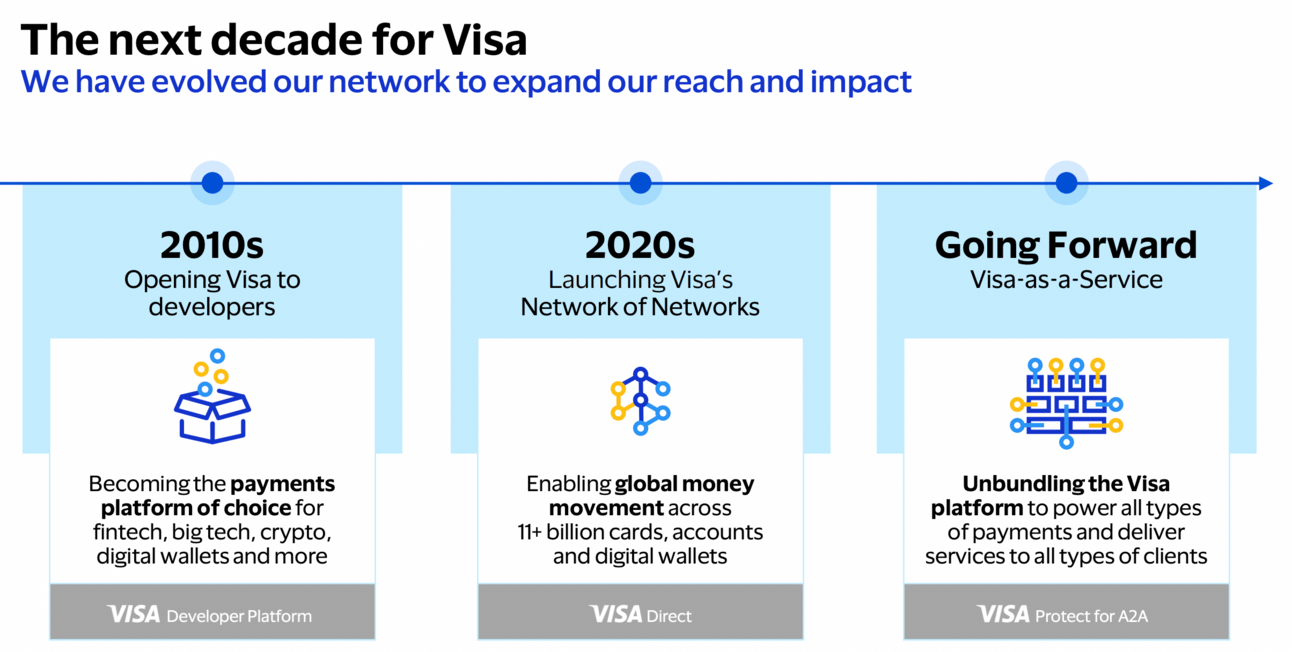

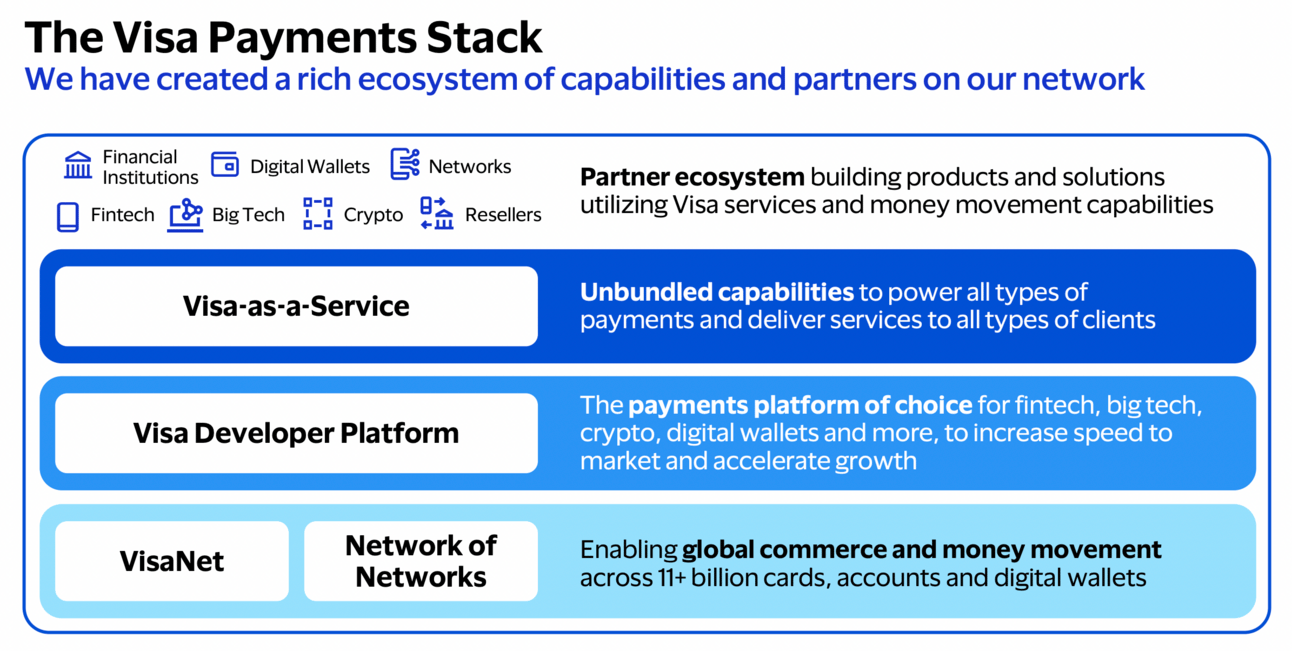

Visa continues to open up. In 2016, it launched the Visa Developer Platform, giving developers access to its network. In the 2020s, Visa introduced the "network of networks" concept, enabling interoperability with other payment networks. Looking ahead, the company aims to grow by unbundling its services and offering them as "Visa-as-a-Service".

In 2016, we made the very deliberate decision to further open up our network, this time to developers of all kinds. We launched our Visa Developer platform and Visa Fintech Fast Track, creating simple and easy ways for developers around the world to integrate Visa into their products, greatly accelerating the rise of fintech.

Over the years, Visa has built and acquired a number of services, such as fraud prevention. The "Visa-as-a-Service" model allows the company to sell these services to a broader range of businesses, even those that are not Visa card issuers or acquirers.

We are excited about Visa-as-a-Service and the opportunity to grow and continue adding new high-growth, high-margin businesses, expanding our suite of solutions and selling them into a wide array of customers and ecosystem partners that are scaling Visa globally.

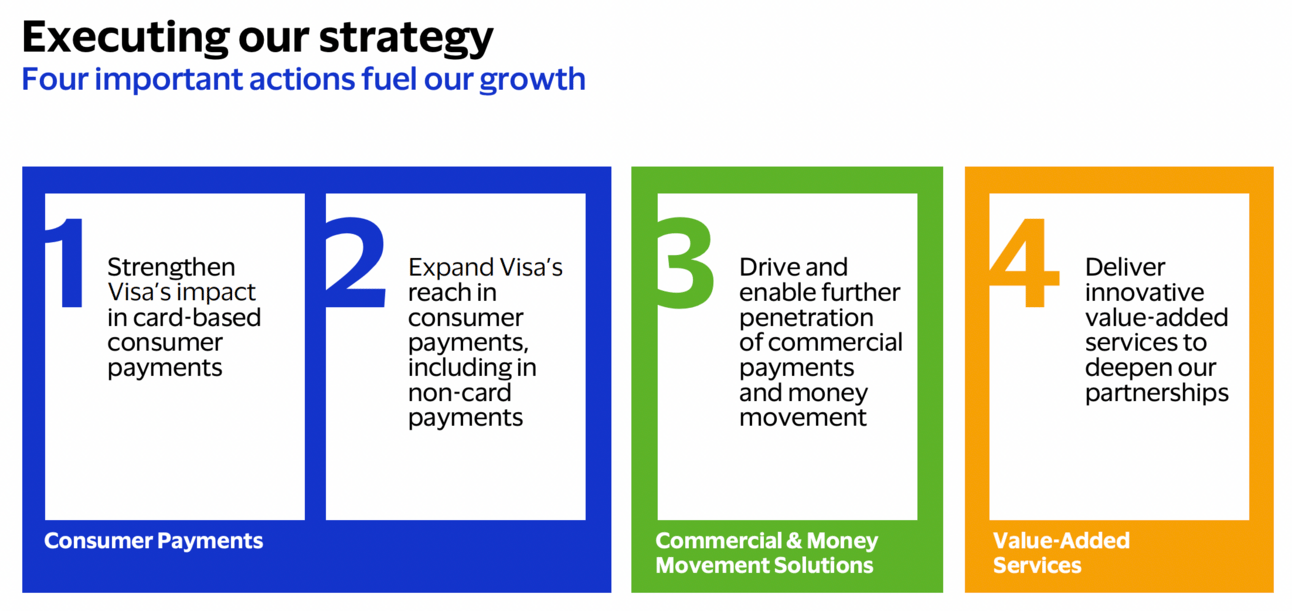

Visa has four pillars of growth: card and non-card consumer payments, commercial payments and money movement solutions (referred to as “new flows”), as well as value-added services.

Consumer payments represent the majority of Visa’s business. In fiscal year 2024, Visa generated $35.9 billion in revenue. Consumer payments accounted for 70%, value-added services contributed 25%, and commercial payments made up the remaining 5%.

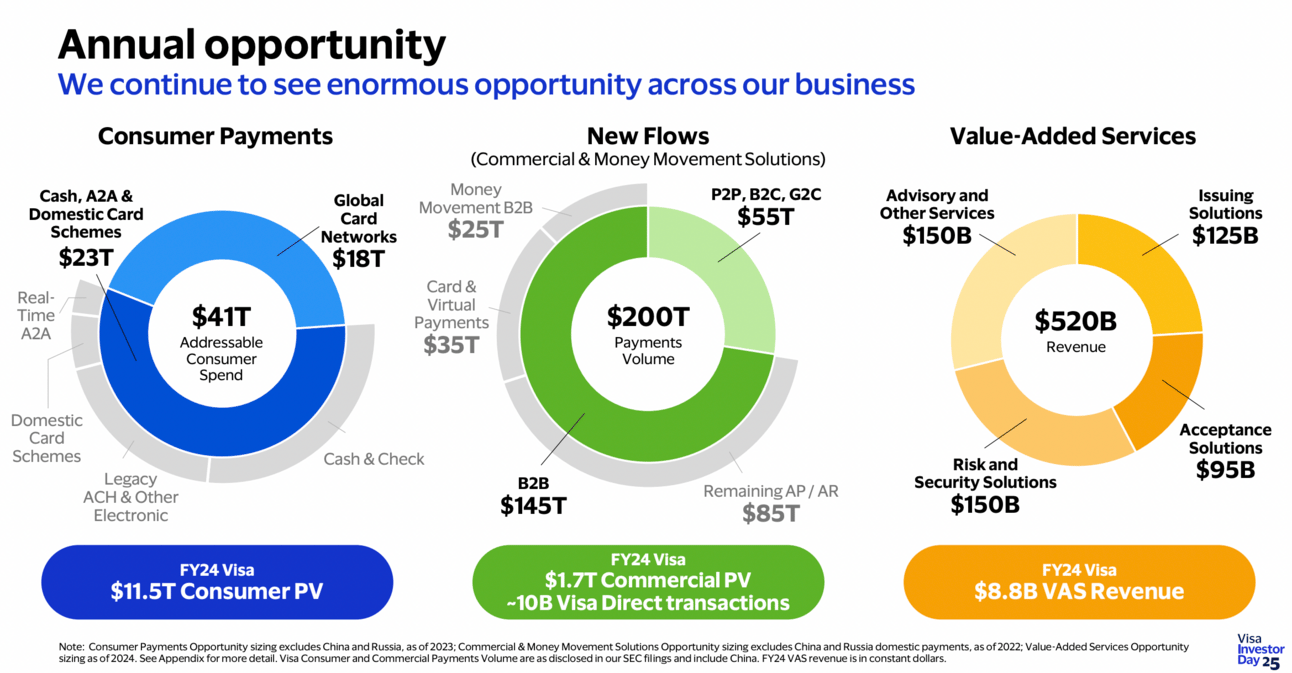

Visa estimates its market opportunity based on payment volume for consumer payments and new flows, and revenue potential for value-added services. Thus, the company estimates its TAM to be $41 trillion in annual consumer spend and $200 trillion in commercial transactions. This represents the total transaction value that could be processed through Visa’s solutions, not its potential revenue.

The opportunity ahead is enormous across consumer payments, commercial and money movement and value-added services. We continue to evolve our network and are unbundling our capabilities through Visa-as-a-Service to power all types of payments and serve all types of clients globally.

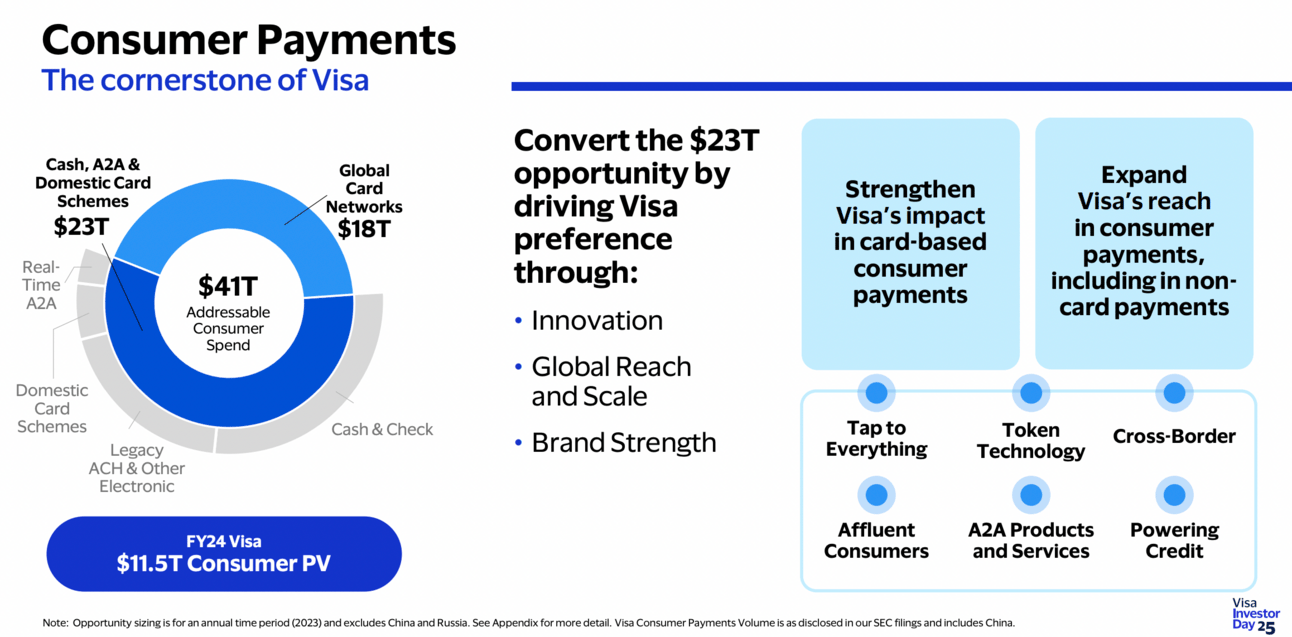

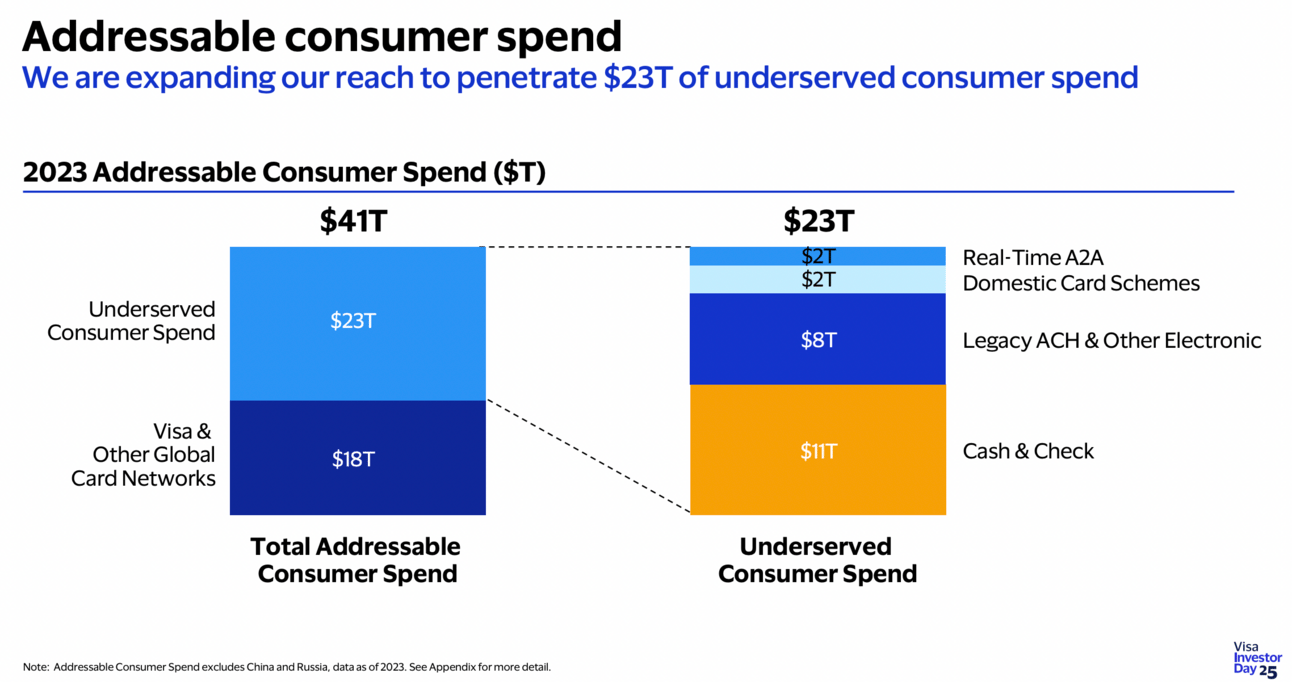

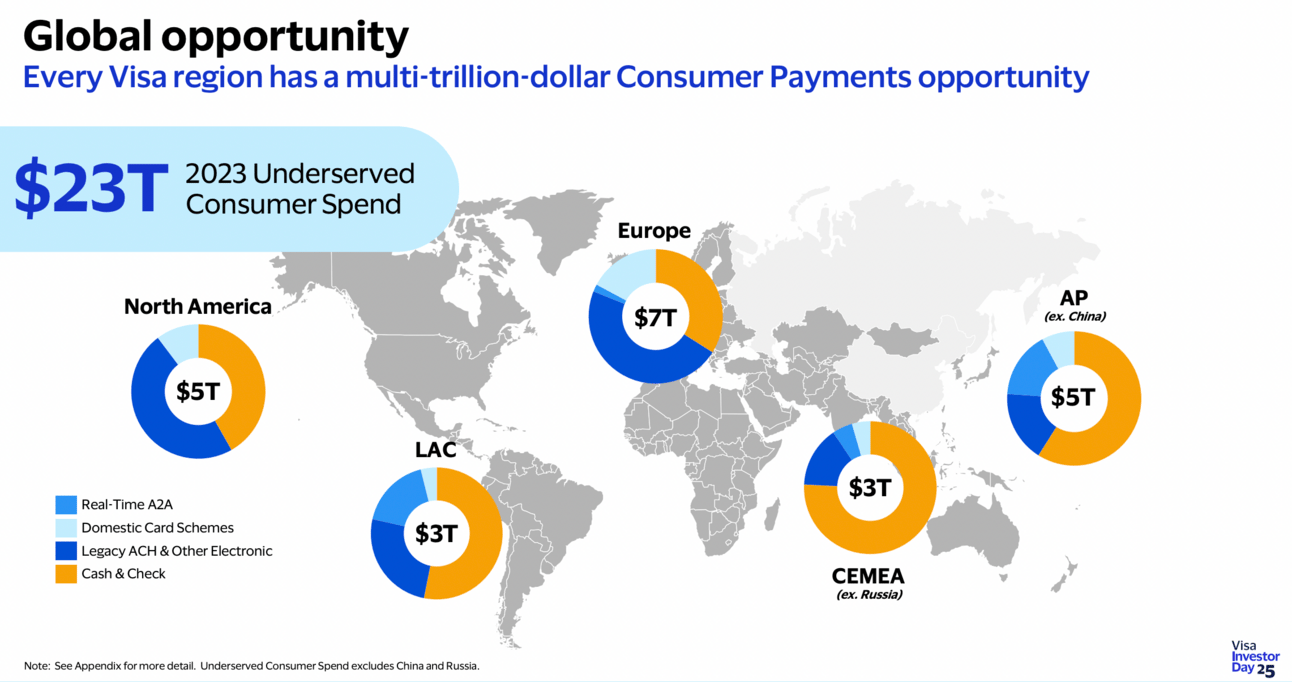

Let’s begin with consumer payments. Visa executives see growth potential in both card and non-card payments. Total consumer spending is divided into $18 trillion processed by global card networks (of which $11.5 by Visa) and $23 trillion handled through cash, checks, ACH, and domestic networks.

We estimate that just over 55% or $23 trillion represents consumers paying with cash, checks, A2A and RTP solutions or cards that run on domestic schemes. This $23 trillion annually is a significant opportunity for us.

Visa executives believe that the biggest growth opportunity for the company is in converting cash and check payments into card payments. Thus, out of $23 trillion in consumer spending that is not yet processed through Visa and Mastercard, $11 trillion is in cash and check payments.

The largest and most immediately addressable opportunity is still cash and check, which represents approximately $11 trillion worldwide. For context, this is about the same size as the consumer payments business that we've already built.

What's interesting is that cash and checks still present a significant growth opportunity, even in developed markets like North America and Europe. Despite decades of growth for Visa and Mastercard, there is still room to expand the digitalization of payments.

We're also unlocking the huge potential of other international markets, which are growing faster than North America and Europe and where there's a significant amount of cash, check and other forms of digital payment. Almost half of our target opportunity is in Latin America, Asia Pacific and our CEMEA region.

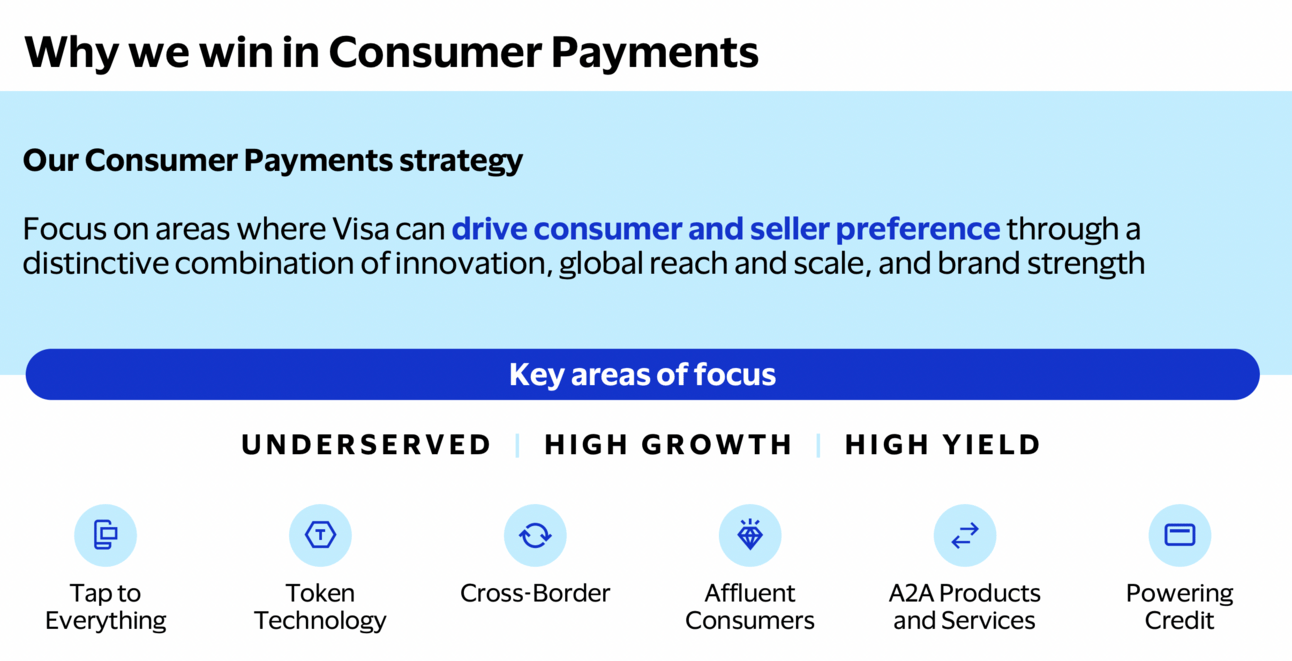

So how does Visa plan to capture this opportunity? By continuing to innovate in six areas, including Tap to Everything technology, tokenization, cross-border payments, solutions for affluent consumers, account-to-account payments and services, and consumer credit.

We will focus on areas where we can drive consumer and seller preference for Visa through a unique combination of innovation, global reach, scale and brand strength….Our Tap to Everything technology, our token technology, our cross-border capabilities, our leadership with affluent consumers, our emerging account-to-account products and services and our strength in consumer credit.

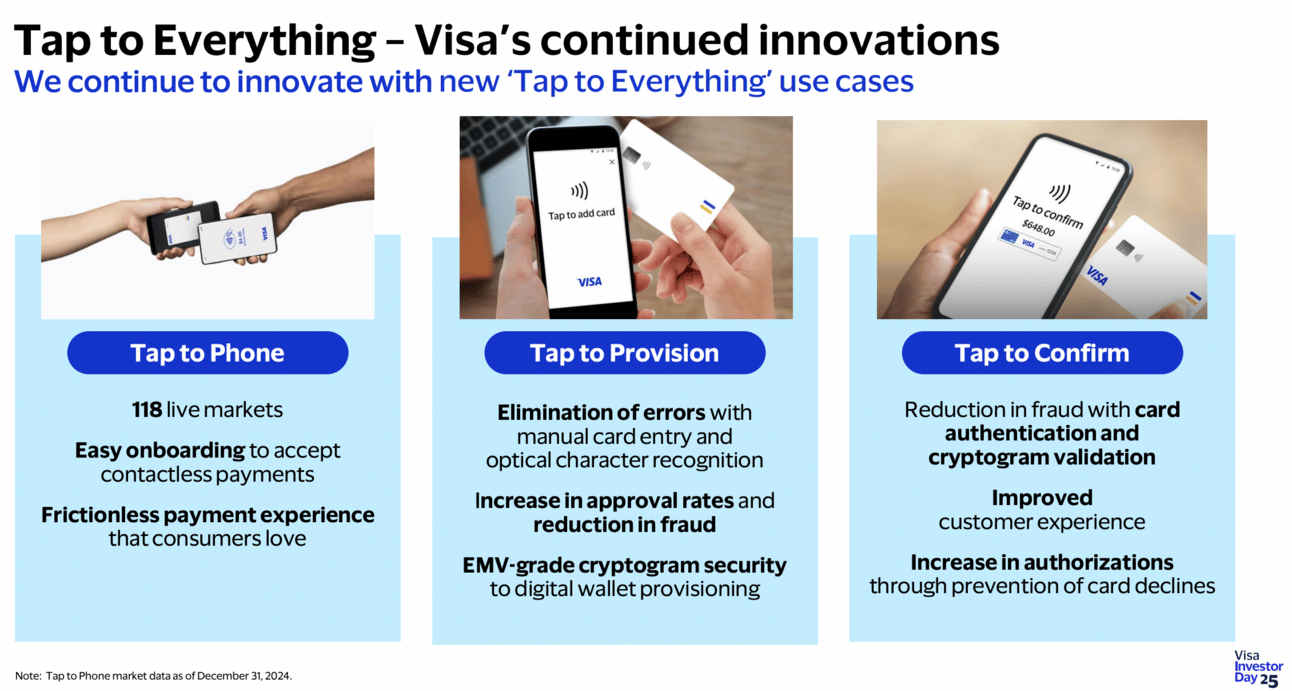

An example of how Visa is converting cash into card payments is the “Tap to Phone” technology, which allows converting smartphones into payment-accepting terminals. “Tap to Phone” technology is available in 118 markets across the globe, and there were 12 million terminals (smartphones) processing card payments in 2024.

A few years ago, we rolled out Tap to Phone for smartphones. This capability enables any mobile device with NFC capability to be converted into a payment acceptance terminal. During 2024, we had over 12 million unique Tap to Phone terminals that transacted on our network, and that number continues to grow.

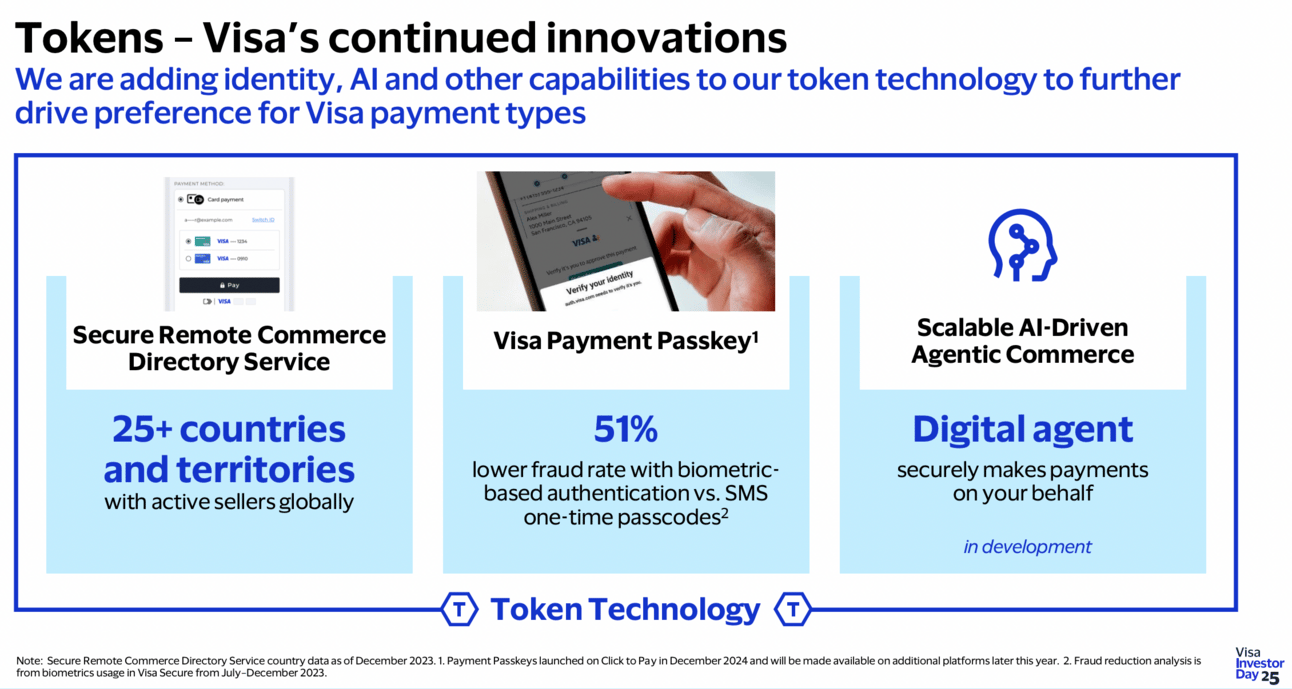

Visa continues to innovate around the tokenization technology, which has gone through impressive growth. Thus, the number of Visa card tokens has grown from 700 million five years ago to 12.6 billion tokens today.

I am not sure if tokenization helps Visa capture cash payments, but solutions such as “Click to Pay” and Visa Payment Passkeys help Visa compete with digital wallets, such as PayPal. Tokenization will also play a crucial role in the rise of agentic commerce.

We see tremendous potential for the role AI agents will play in a wide array of commerce use cases, ranging from those that require sophisticated search and decision-making like booking a vacation to those that involve mining repetitive core-like tasks like ordering groceries and paying bills.

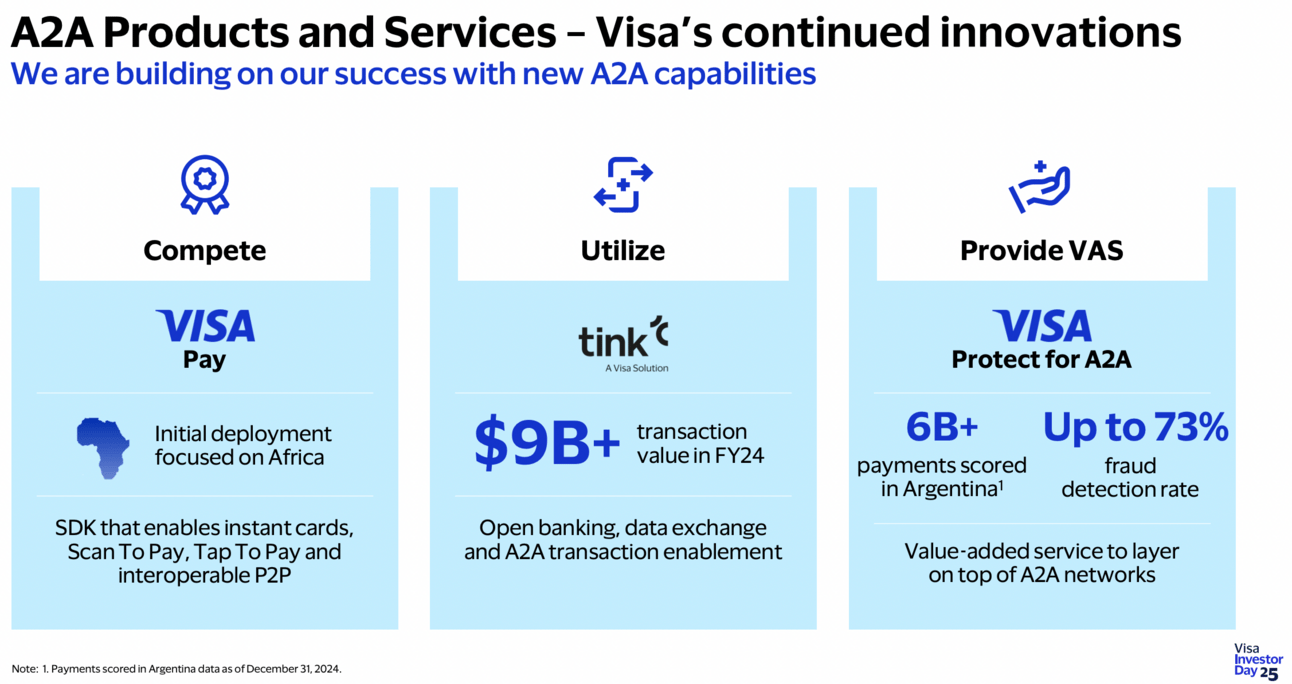

Visa is also strengthening its account-to-account payment capabilities. While regulators blocked Visa from acquiring Plaid, the company went on to acquire Plaid’s European competitor, Tink, and brought it to the U.S. Although Visa might not be processing account-to-account payments, it offers value-added services, such as open banking connectivity and fraud prevention, to capitalize on these payment flows.

…there's a small but growing pool of under $2 trillion in consumer account-to-account payments. This category includes local payment methods like Swish in the Nordics, Pix in Brazil, UPI in India as well as Open Banking and Pay by Bank in places like Europe. Here, we see opportunities to compete with our innovative card products, use these networks to deliver Visa-branded payment products like Tink and provide value-added services on top of these payment flows.

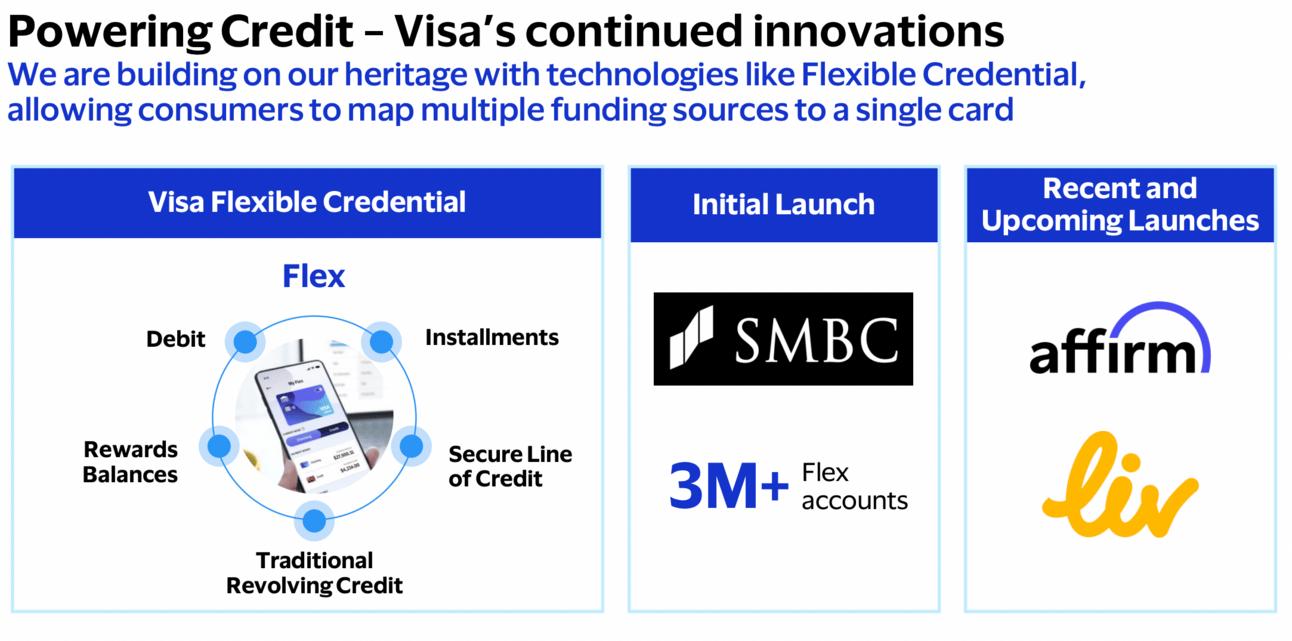

Finally, Visa continues to innovate in credit products, with one of its most notable recent launches being Visa Flexible Credential. Visa Flex allows adding credit capabilities to debit cards. Think of Affirm partnering with FIS to enable credit for all FIS debit card issuers.

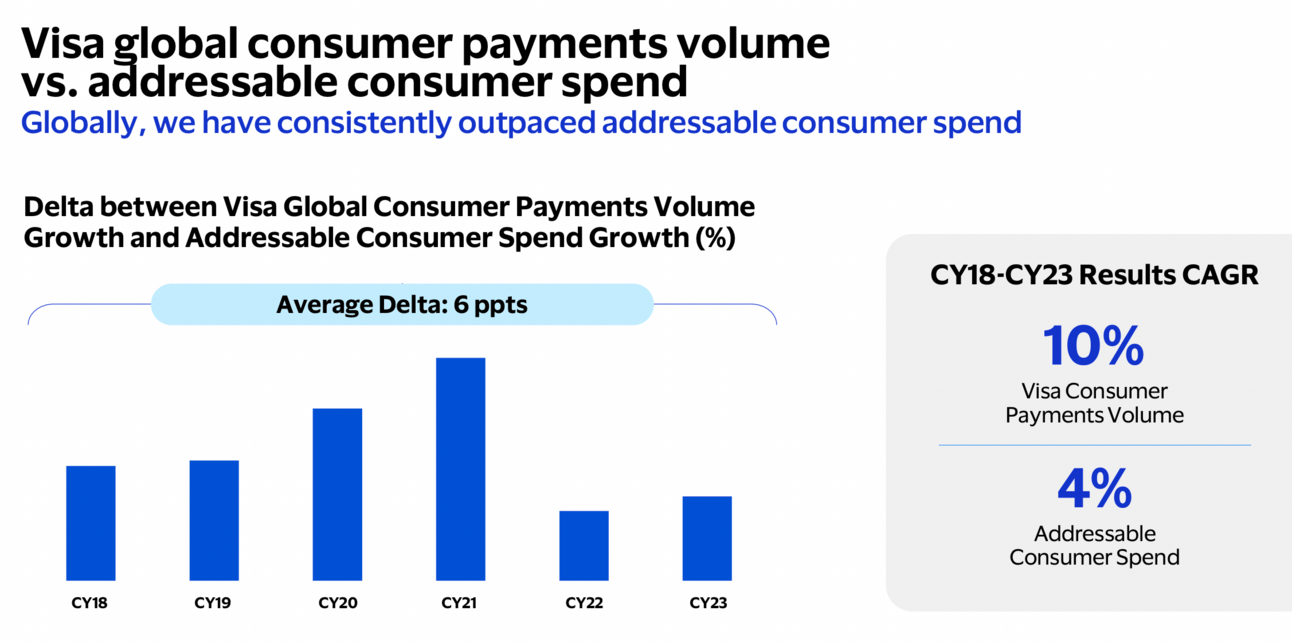

In summary, Visa's management believes there is still significant growth potential in consumer payments. The company aims to outpace overall consumer spending growth by converting non-card payments to Visa's network. And if Visa cannot convert these payments to Visa rails, they have value-added services to sell. Thus, over the last 5 years, consumer spending grew at a 4% CAGR, while Visa payment volume grew at a 10% CAGR.

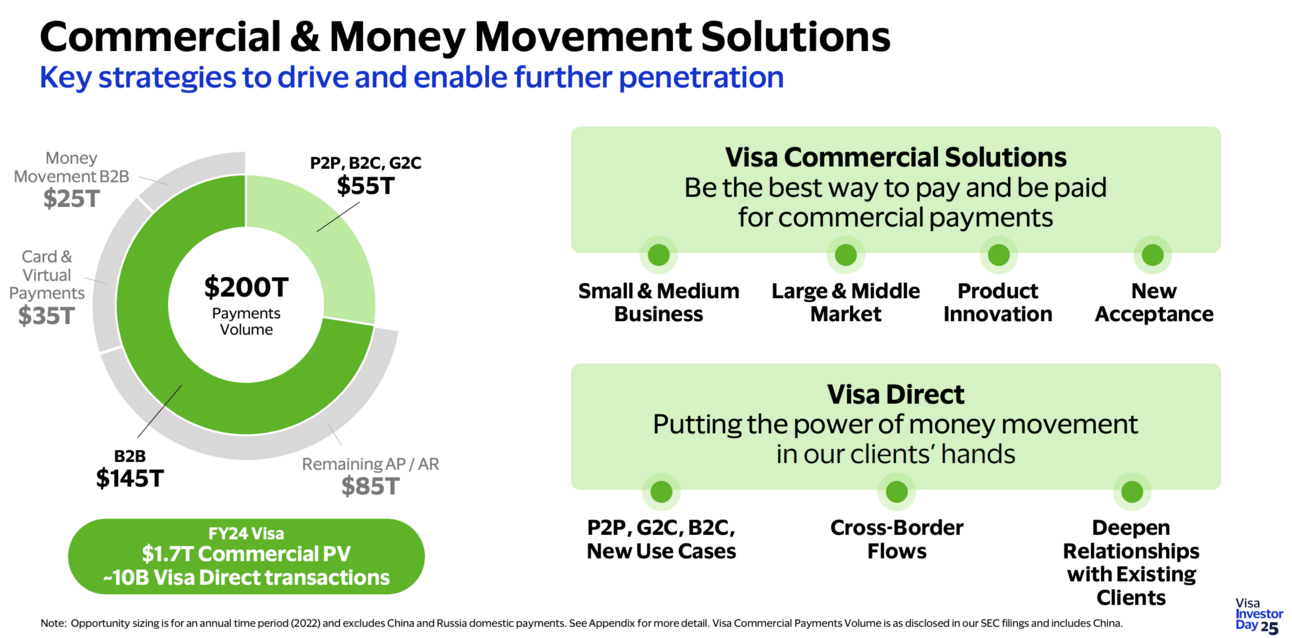

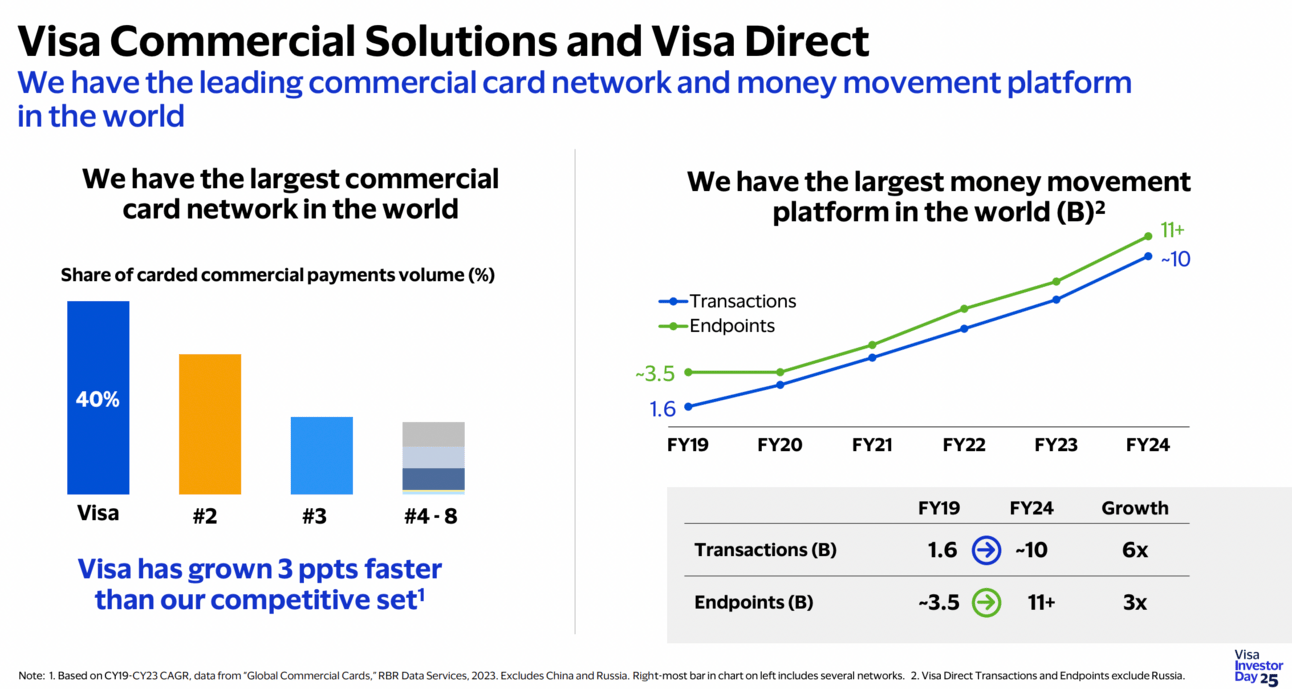

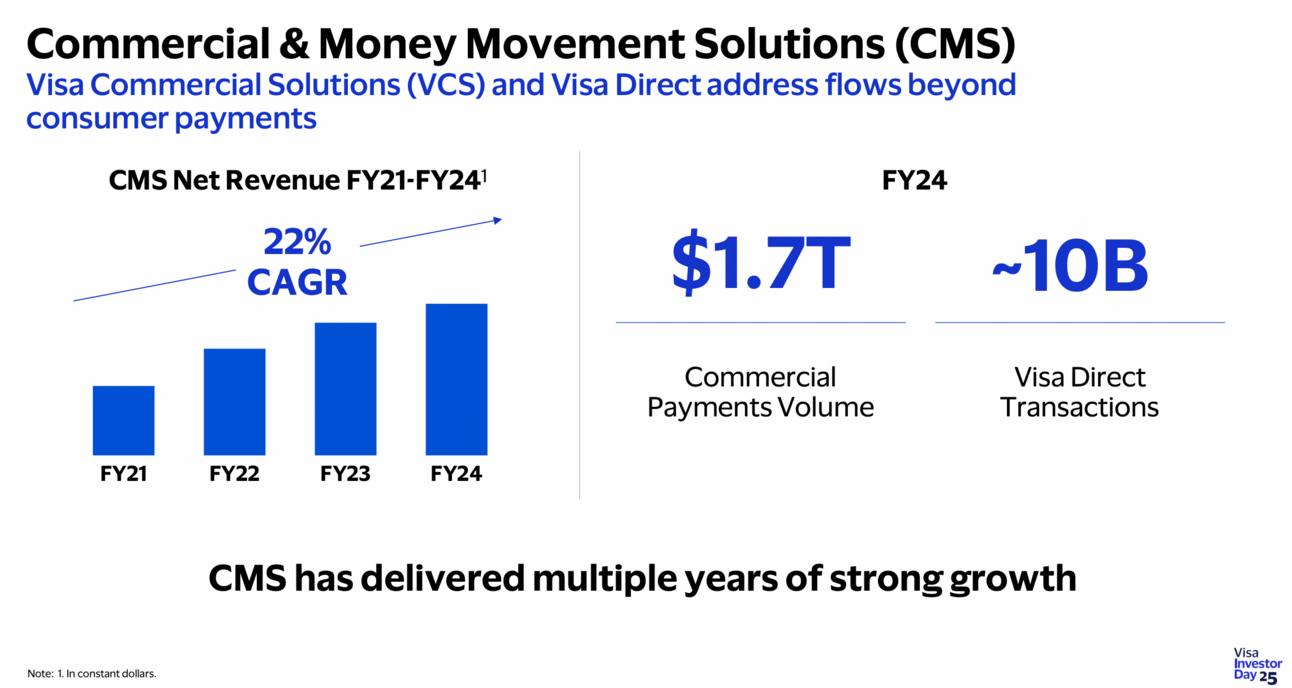

Let’s move to Commercial & Money Movement Solutions. This product family consists of commercial solutions (commercial cards) and money movement solutions (Visa Direct). Visa estimates the annual opportunity in commercial cards to be $35 trillion, and the annual opportunity in money movement solutions (B2B payments, accounts payable and accounts receivable, as well as payouts) to be $165 trillion.

In new flows, we estimate there is $200 trillion of annual payments volume, with about $145 trillion in B2B and $55 trillion in other forms of new flows. Visa today has about $1.7 trillion in commercial payments volume and nearly 10 billion Visa Direct transactions, a very small portion of the addressable opportunity.

I wrote earlier about Visa’s Commercial & Money Movement Solution in my recent essay “Visa wants a biggest slide of commercial payments”

Visa is a leading commercial card network and claims that its Visa Direct solution (which under the hood consists of multiple solutions) is the largest money movement platform in the world. However, Visa is super early in both areas. Thus, in Fiscal 2024, Visa processed only $1.7 trillion in commercial payments and around 10 billion in Visa Direct payments.

As I mentioned earlier, in Fiscal 2024, Commercial & Money Movement solutions contributed only 5% of Visa’s net revenue, so it is not surprising that this revenue is growing super fast (22% CAGR since 2021). To be honest, Visa did not disclose directly revenue from this product family, but they did disclose that CMS and Value-Added Services (VAS) contributed 30% of the net revenue (and VAS contributed $8.8 billion).

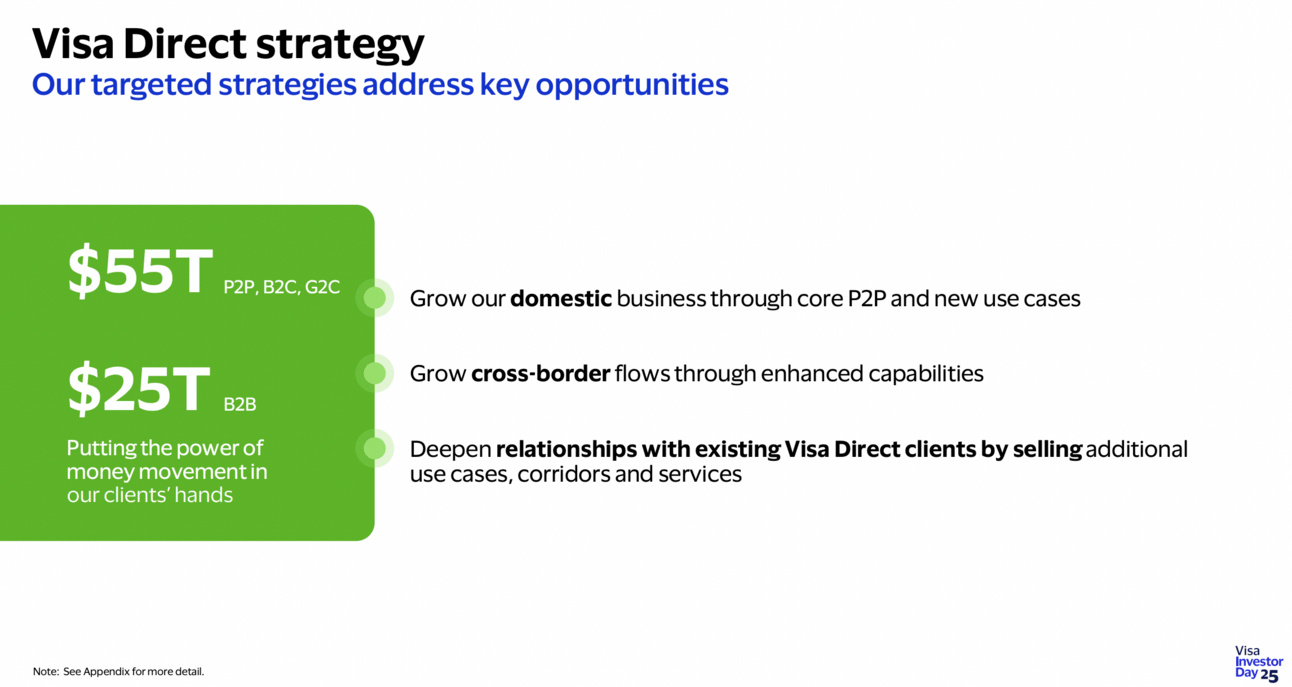

Out of the $165 trillion in annual money moment flows, Visa is actively pursuing $55 trillion in annual peer-to-peer, business-to-consumer and government-to-consumer payments, as well as $25 trillion in (mostly cross-border) annual business-to-business flows.

I know that it can be confusing so here’s the recap: while Visa estimates the total annual opportunity in Commercial & Money Movement Solutions to be $200 trillion, it actively pursues $55 trillion in P2P, B2C and G2C payments, $25 trillion in B2B cross-border payments, and $35 trillion in commercial cards (so $115 trillion in total).

We are pursuing the $55 trillion in money movement flows with our Visa Direct capabilities. Today, many of these flows, especially cross-border, are challenging for both the sender and the receiver, slow, expensive and not digitally native. We are also going after $25 trillion of mostly cross-border flows with our Visa Direct platform.

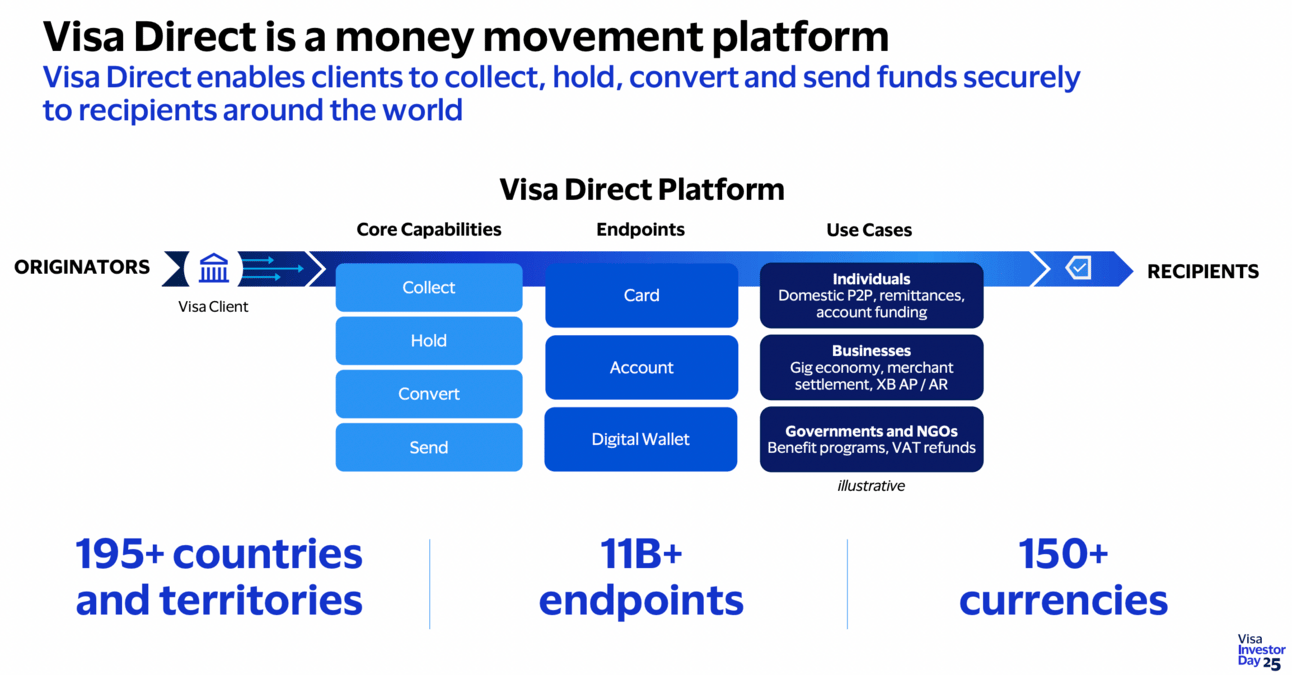

So what is Visa Direct? Visa Direct is an umbrella brand for a family of solutions that Visa built or acquired over the years. These solutions enable individuals and businesses to move money domestically and across borders using Visa rails. Visa claims that its platform “supports over 65 use cases across all types of payment flows”.

Visa Direct began with cards. We took our existing Visa network and reversed it, allowing users to receive money to their bank accounts by their debit card as an end point. But we didn't stop at cards. We expand our network of networks by adding connectivity to accounts through our Earthport acquisition. And then through further innovation, we added digital wallets. And we have continued to strengthen our position in the money movement space through additional assets we've acquired and built like Currencycloud, YellowPepper, Visa B2B Connect, our homegrown solution, which is uniquely suited for large, complex cross-border B2B transactions.

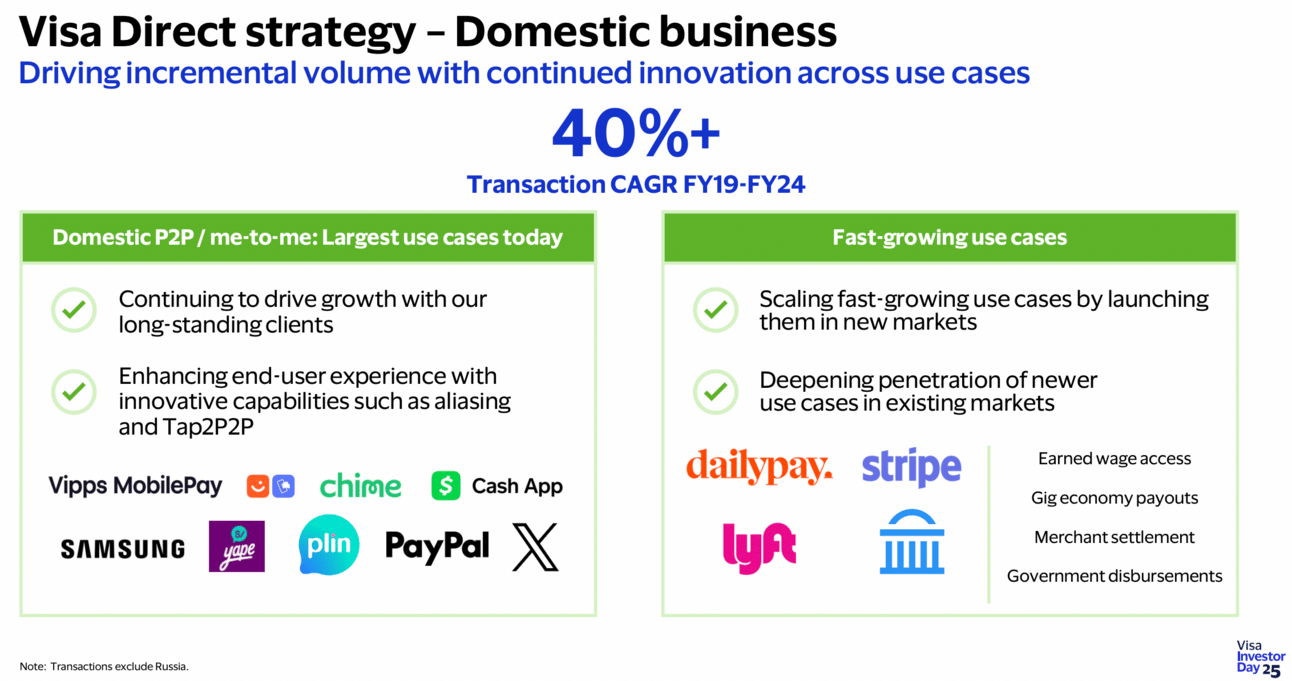

Moving money domestically is the primary use case for Visa Direct. Thus, companies like Cash App and PayPal use Visa Direct to enable pay-ins, payouts, and peer-to-peer payments. Visa expects to grow through “product innovation in existing use cases and unlocking new use cases.”

Domestic use cases make up the majority of our transactions, and they have grown at an annualized rate of over 40% over the last 5 years. Today, we work with over 300 partners globally where we help consumers move money in and out of digital wallets. Our digital wallet partners include Cash App, PayPal, Apple and more recently, X Money.

In cross-border payments, Visa Directs serves major consumer remitters including MoneyGram, Western Union, Remitly, and PayPal’s Xoom. The only company that is not on this slide is probably Wise. Visa Direct powers cross-border B2C payouts for PayPal’s Hyperwallet and Global Blue. Finally, in the B2B segment, Visa works with Payoneer, Paysend, and Tide.

We have the assets and our comprehensive Visa Direct platform to be a differentiated player in cross-border flows, providing services across a full spectrum of consumers, small businesses and large corporates.

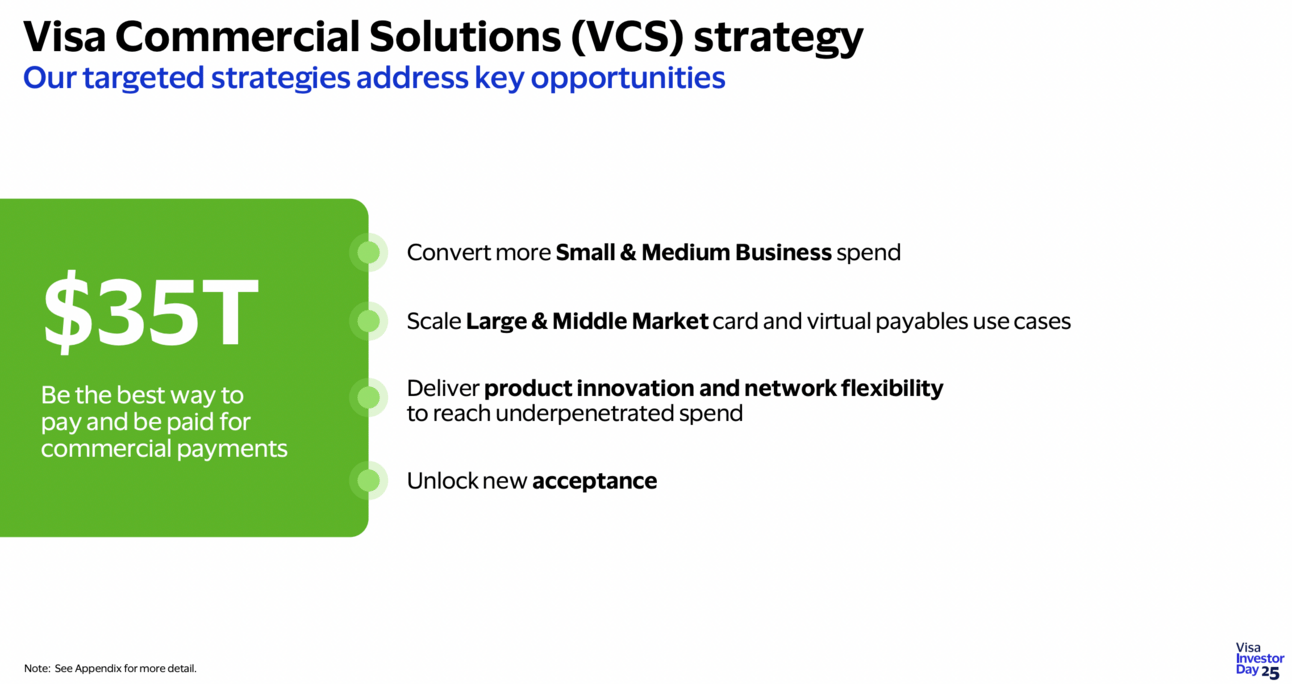

In Commercial Solutions (commercial cards), Visa expects to grow by converting more small & medium business spend to cards, better addressing the needs of large & middle market customers, and introducing more use cases for virtual cards.

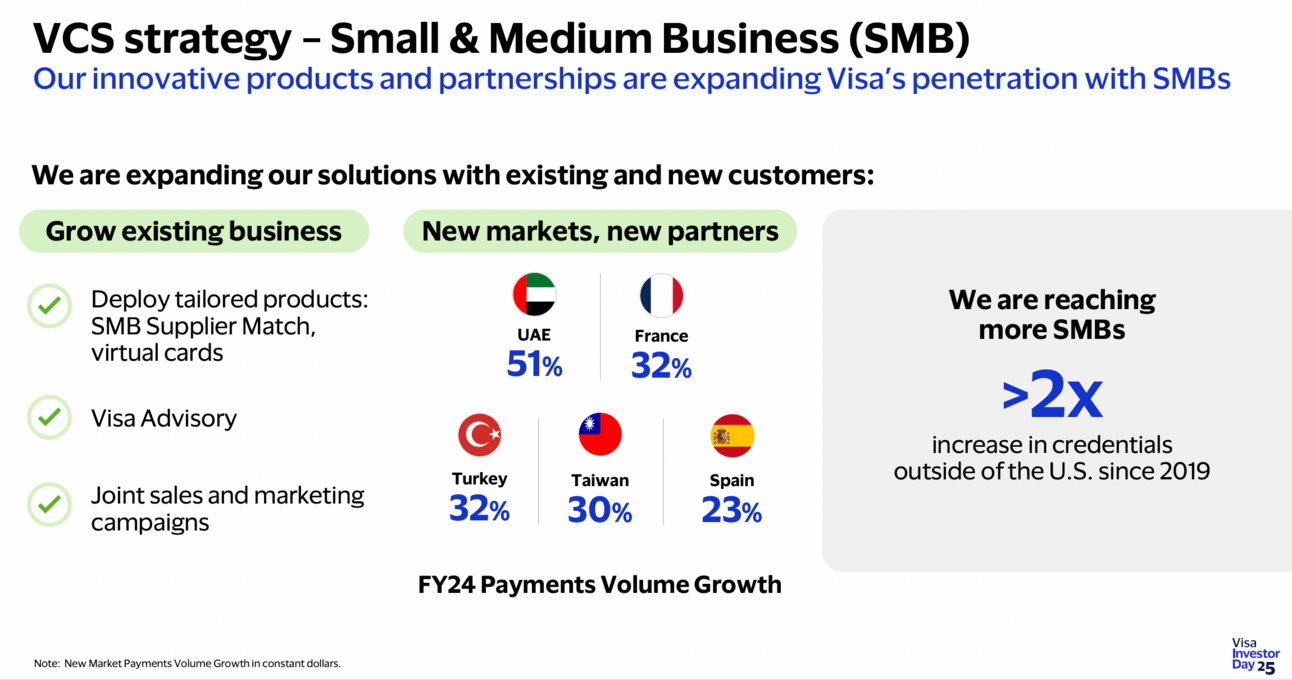

Similarly to American Express, Visa sees the opportunity in the digitalization of cash and check payments. In the U.S. small business market is dominated by American Express. This is why I believe Visa execs focused on international success cases.

A key priority in VCS is to grow our small and medium business portfolio, by both driving issuance and acceptance with our existing SMB issuers and acquirers and by partnering in more markets.

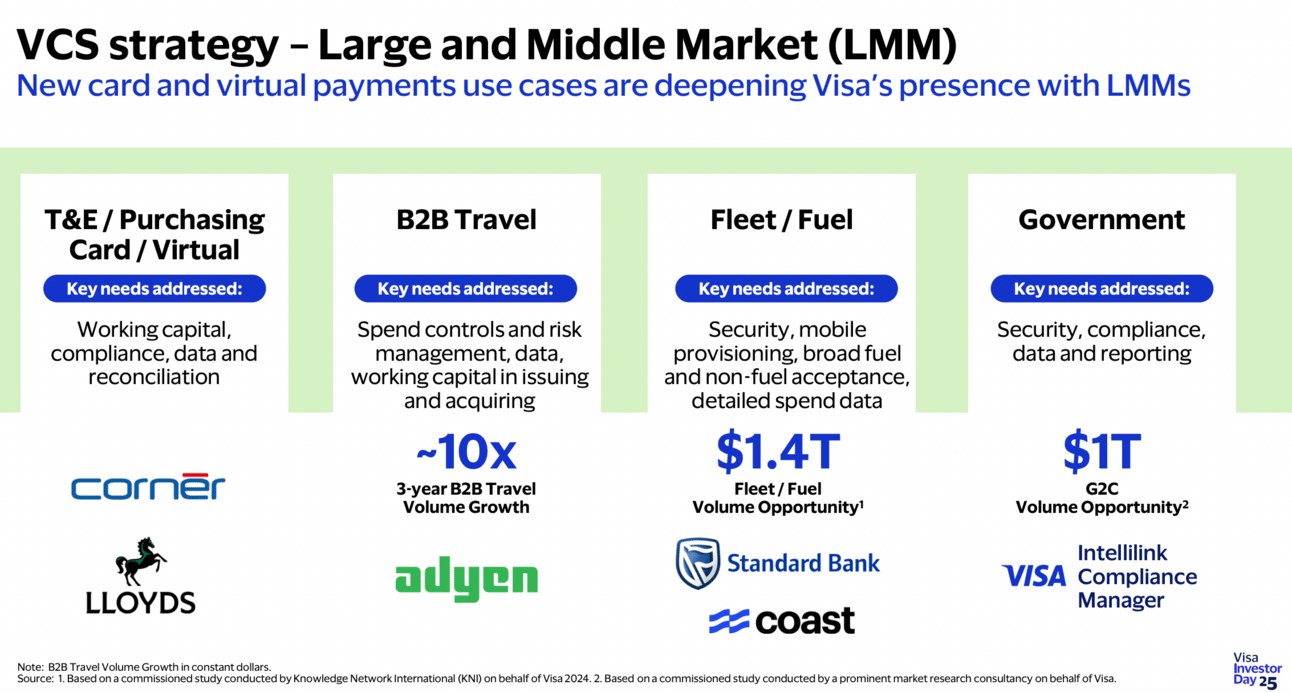

In the large and middle market segment, Visa focuses on addressing vertical-specific needs, be it corporate travel, employee healthcare and benefits, fleet and fuel, or social support programs.

Historically, this segment has been driven by corporate T&E and purchasing cards. There is continued runway for growth here and we're focused on winning large deals across key clients, like recently done with Citibank, Lloyd's, Standard Chartered and Cornèr Banca. However, a lot of corporate wire supplier LNM flows, customer challenges are vertical specific.

In summary, Visa has a long runway in commercial payments. The opportunity is massive and Visa pursues it through multiple vectors. Thus, Visa Direct helps the company capture domestic and cross-border payment flows, and its commercial cards help it pursue the opportunities in the digitalization of small business and corporate spend.

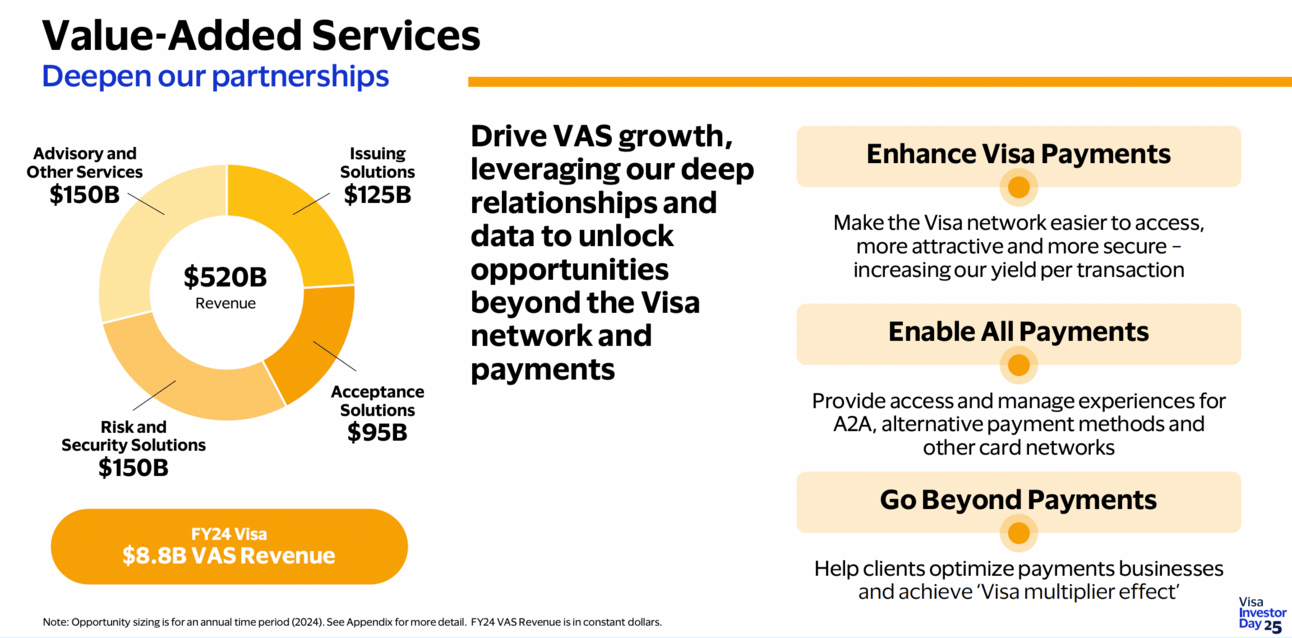

Finally, moving to Visa Value-Added Services. Visa’s management sees a $520 billion revenue opportunity in value-added services, split across issuing, acceptance, risk and security, as well as advisory services.

In value-added services, we estimate there is $520 billion in potential revenue opportunity annually. And Visa's value-added services fiscal 2024 revenue totaled $8.8 billion, also a small portion of the opportunity.

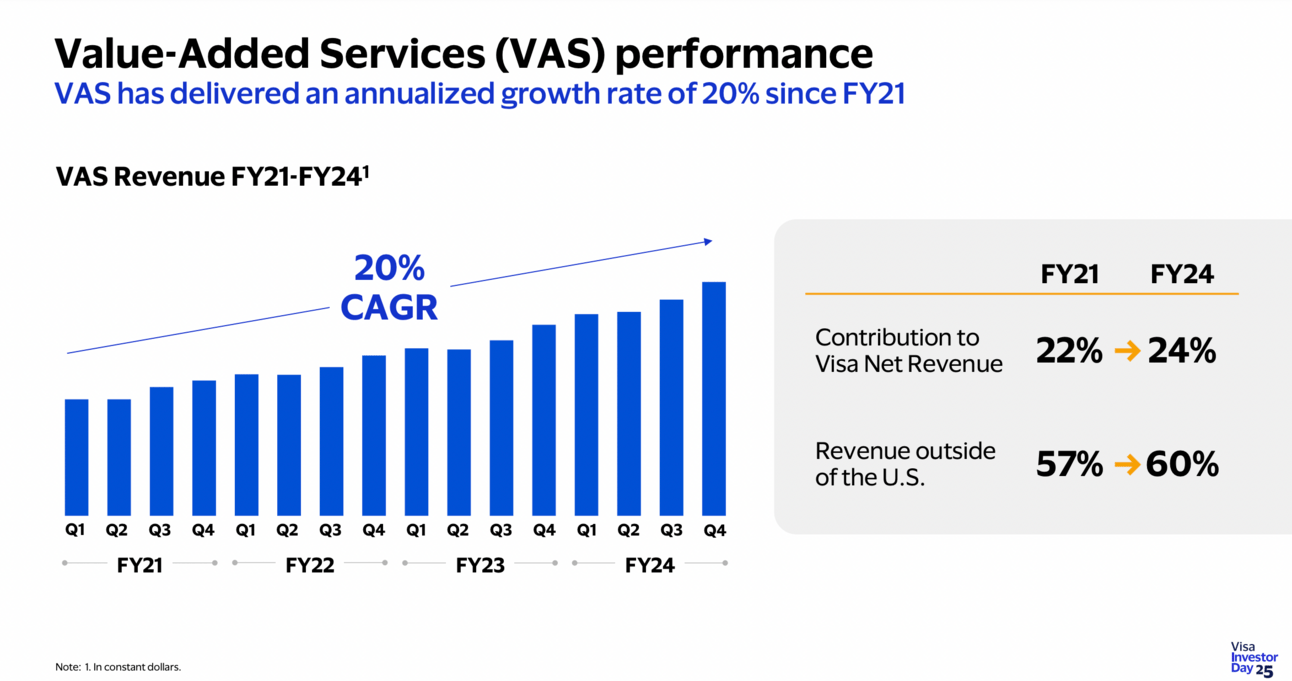

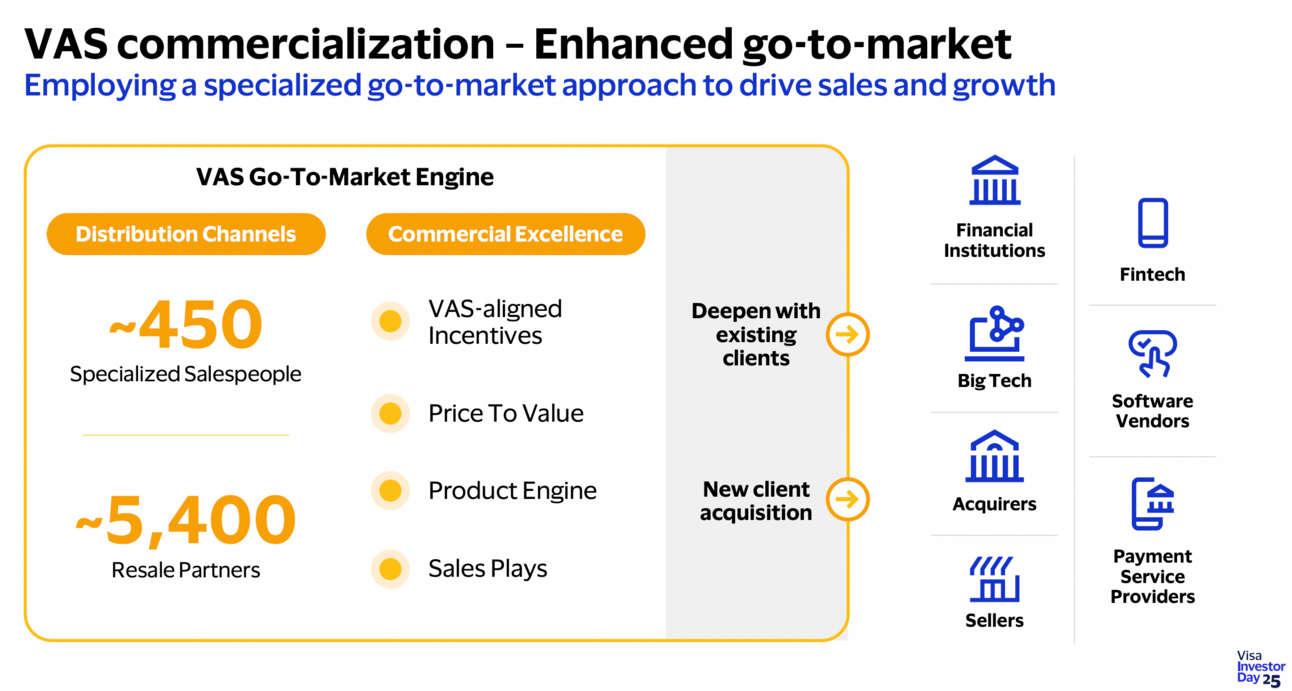

As mentioned earlier, Visa Value-Added Services (VAS) contributed $8.8 billion to Visa’s revenue in the fiscal year 2024. VAS revenue has been growing at a CAGR of 20% since 2021 and now represents almost a quarter of the company’s total revenue.

“Since 2021, VAS has consistently increased revenue, achieving a 20% annualized growth rate on a constant dollar basis. VAS revenue has increased from around $5 billion in fiscal year '21 to $8.8 billion in fiscal year '24 and now represents 24% of Visa's total net revenue compared to 22% 3 years ago.

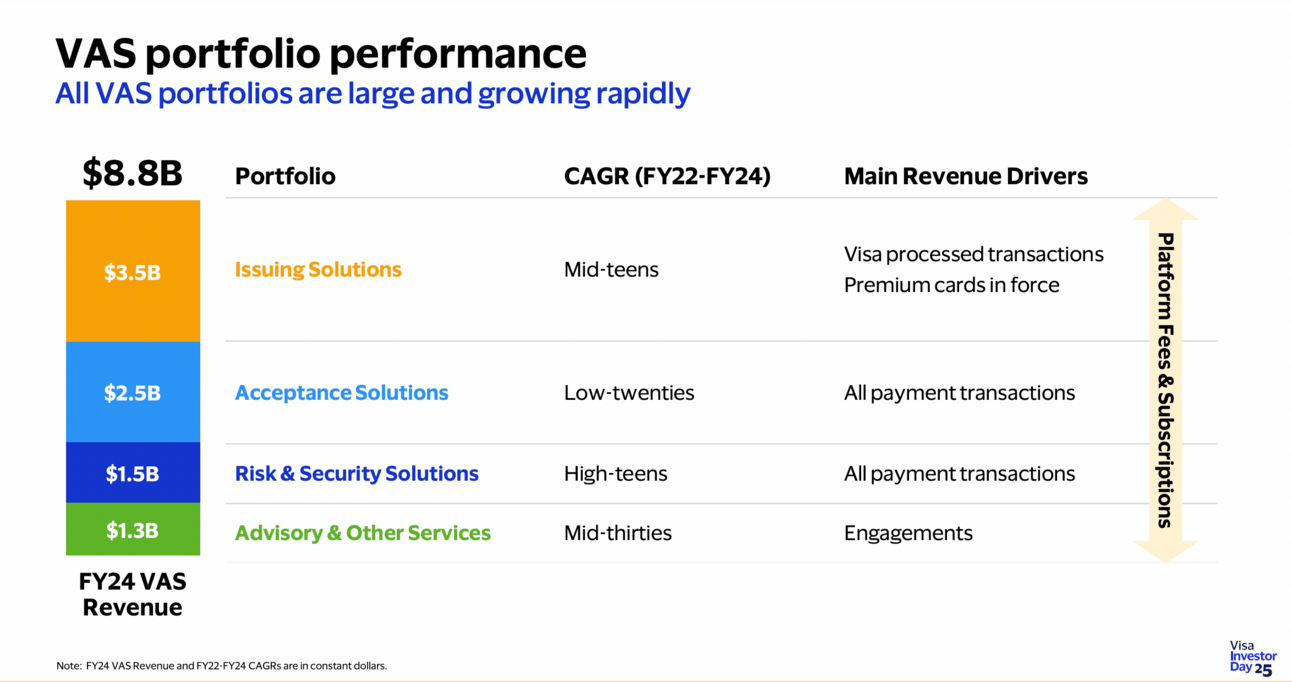

So what are Visa Value-Added Services? There are four portfolios: issuing solutions, which include such services as Visa DPS, a debit card processing service and recently acquired Pismo, acceptance solutions, including Visa Cybersource and Authorize.net gateway, risk & security solutions, including Visa Protect for A2A and recently acquired Featurespace, and advisory services (consulting).

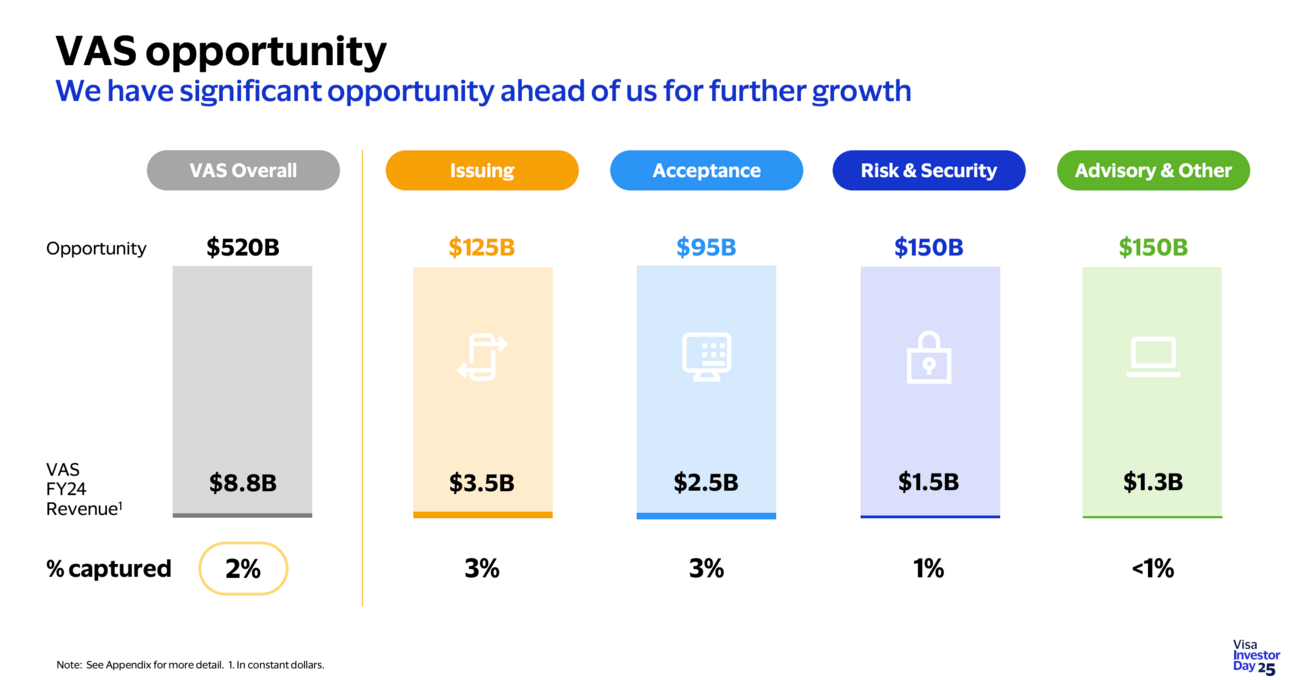

While Issuing solutions represent the largest portfolio of Visa Value-Added Services at the moment, the company’s management sees growth opportunities across all four areas. The key takeaway for me was that in value-added services Visa “captures around 2% of the overall opportunity and no individual portfolio is capturing more than 3%”.

“VAS is a high-growth area with significant recurring revenue. We believe we are well positioned for future growth as each portfolio can expand significantly with $520 billion of annual revenue opportunity available from current and planned solutions. Today, we are capturing around 2% of the overall opportunity and no individual portfolio is capturing more than 3%.

With its Visa-as-a-Service model, Visa can unbundle its services and cross-sell them to its existing customer base, including financial institutions, acquirers, P2P providers, and fintechs. And, as we’ve seen with the acquisition of Pismo and Featurespace, Visa can always acquire any competitor that stands in its way.

In summary, Visa Value-Added Service is already a meaningful contributor to the company’s top line and the opportunity for growth is vast. Visa continues to build and acquire auxiliary solutions across the whole payment stack and has a large customer base to sell those solutions to.

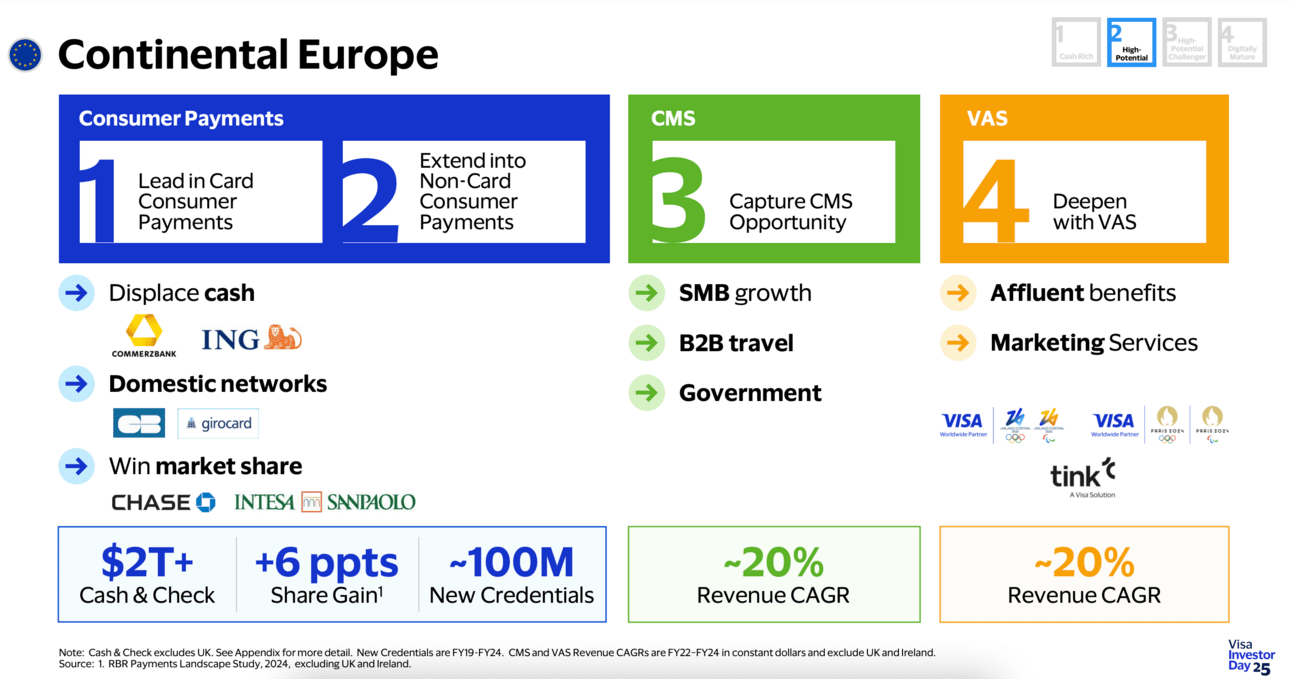

Let’s discuss Visa’s go-to-market strategies across different geographies. Thus, Visa has segmented its markets into four models: “Cash Rich”, “High-Potential”, “High-Potential Challenger” and “Digitally Mature”, and it uses different go-to-market strategies for each one of those.

An example of a “High-Potential” market is Continental Europe. In Continental Europe, Visa pursues the strategy of replacing cash (parts of Europe are still heavy in cash usage) and winning market share from smaller domestic networks.

Continental Europe has a significant cash runway. Cash and check are still over $2 trillion in consumer spend. That's 20% of the global cash runway. Most is concentrated in Italy, Germany, France and Spain.

An example of a “High-Potential Challenger” market is Brazil. The specifics of Brazil is the domination of PIX. And while Visa keeps working hard to grow the number of credentials and card acceptance, it is also pursuing growth by selling its risk and security services to support PIX transactions.

Pix has scaled, but it has capability gaps, and we see an opportunity. Consistent with our strategy, Visa is offering solutions to our issuers to support their Pix transactions. A great example is Visa Protect for A2A, which is a risk management solution uniquely built for RTPs.

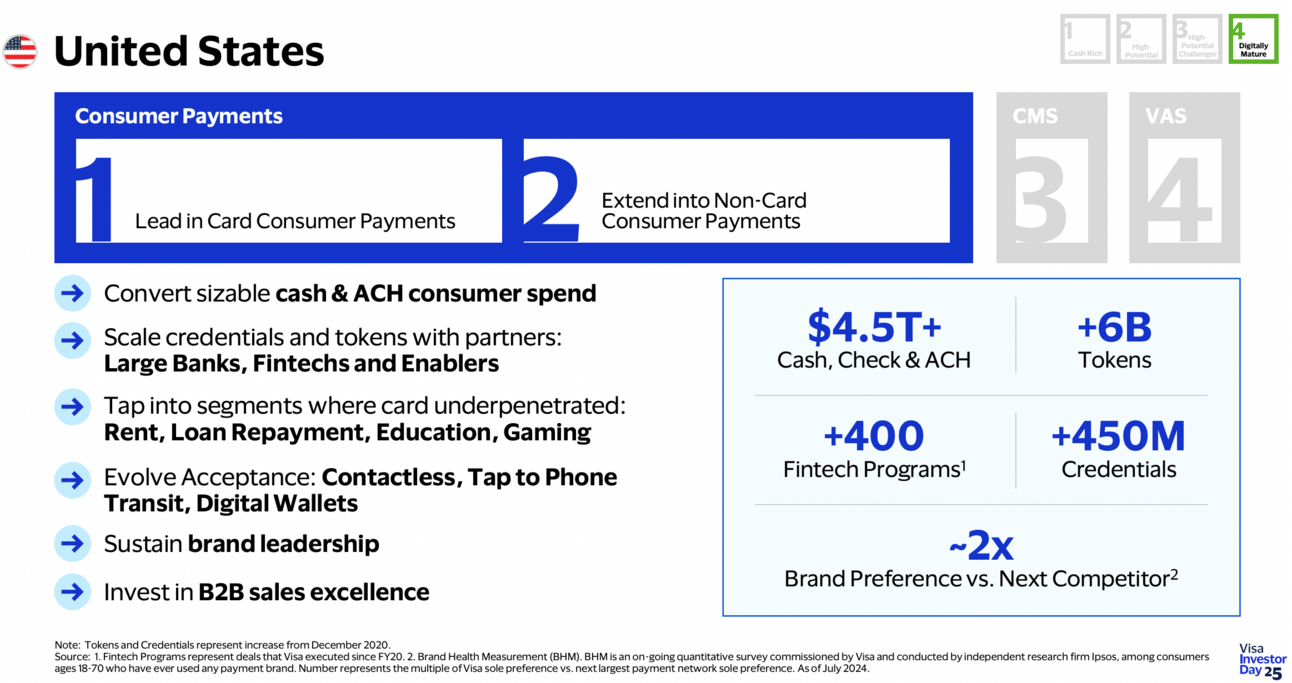

Finally, an example of a “Digitally Mature” market is the United States. The U.S. is also Visa’s largest market, so it pursues pretty much every growth strategy it has in its arsenal. This includes going after cash and check payments, partnering with high-growth Fintech companies, and continuing to introduce innovative solutions.

[ The U.S. market ] is certainly digitally mature from a level of innovation, functionality, card penetration and client sophistication. However, it still has lots of cash. Cash is in decline, but about 18% of addressable consumer spend remains on cash and check, not to mention meaningful legacy ACH volume.

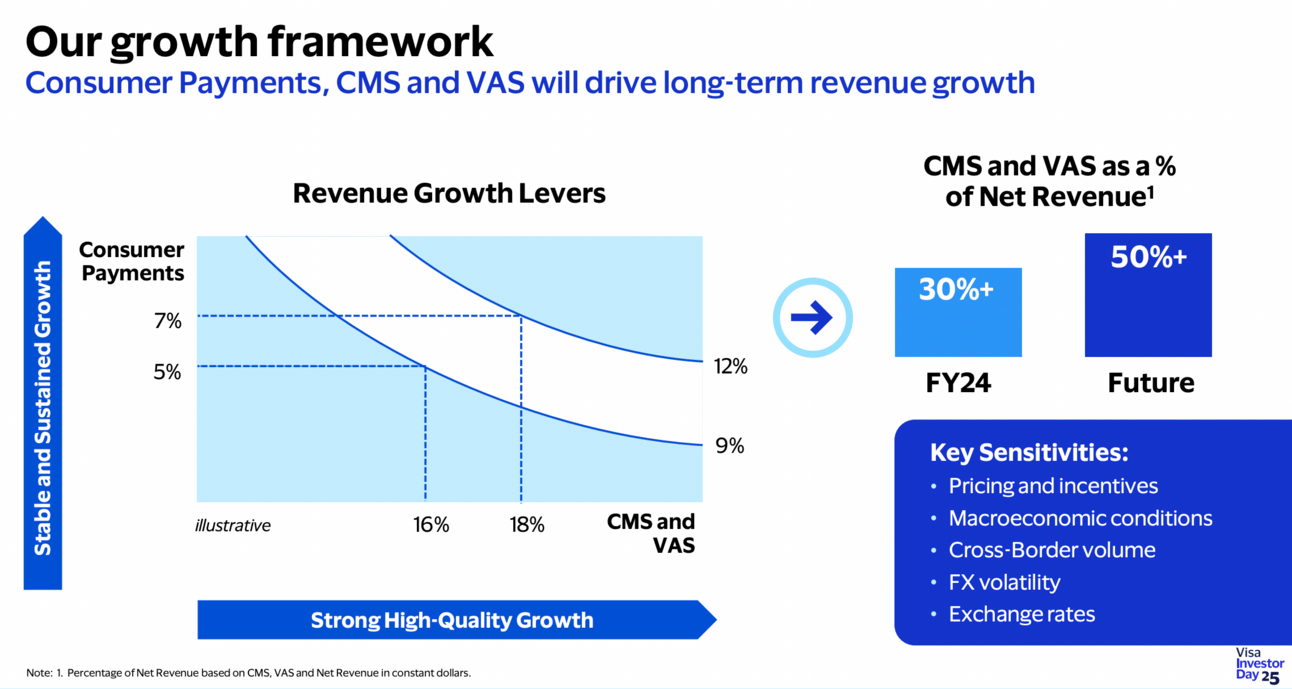

Let’s try to wrap up here….Visa expects its net revenue to continue growing at a 9-12% annual rate through a combination of single-digit growth in consumer payments, and high-teens growth in commercial payments and value-added services. The company expects commercial payment and value-added services to contribute more than half of its revenue in the future.

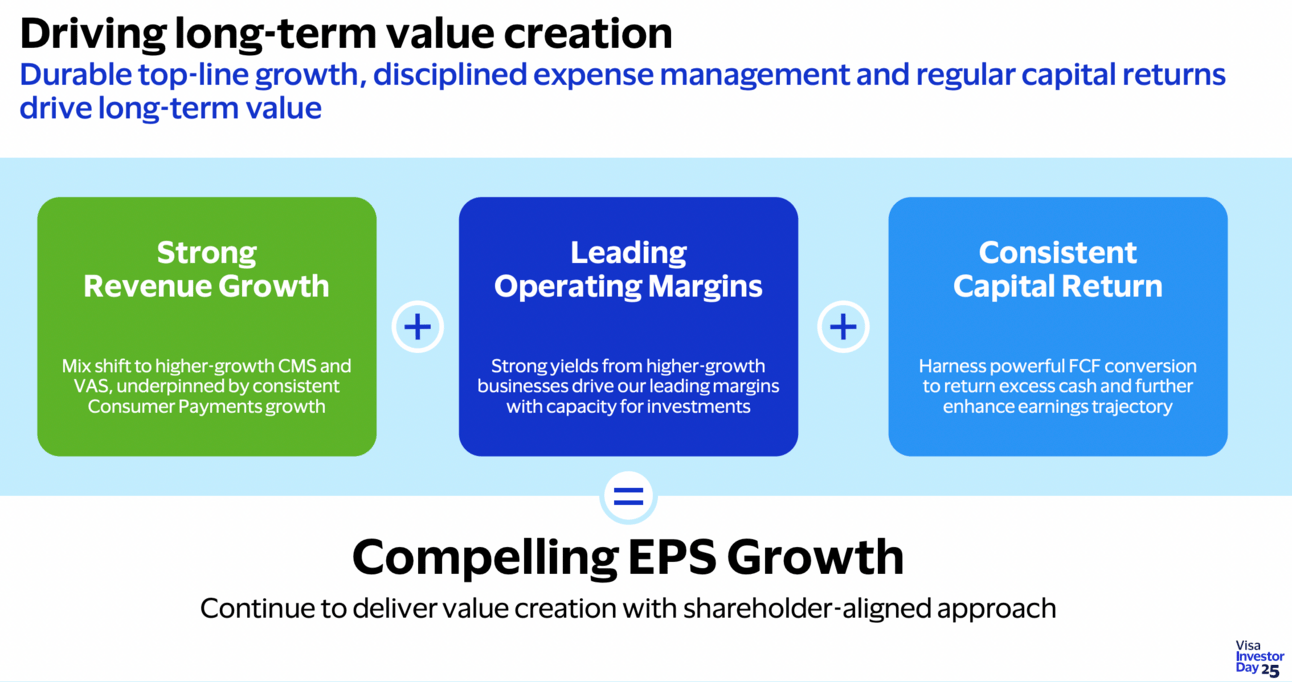

…our strong revenue growth, leading operating margins and consistent stock buybacks will generate continued compelling EPS growth. Our strong revenue growth will benefit from a mix shift to CMS and VAS, underpinned by consistent consumer payments growth.

The company did not provide guidance on longer-term EPS growth, but highlighted that commercial payments and value-added services have higher margins than consumer payments. As the revenue mix shifts toward these higher-margin services, Visa will be able to deliver “leading operating margins.”

Our strong revenue growth and operating margin drive sustainable cash flow, EPS growth and shareholder value creation. We're very excited about the next phase of our growth as we work to capture the enormous opportunities ahead of us, securing more consumer and business transactions all around the world.

Alright…I think that’s a wrap! As I mentioned in the introduction, I believe Visa has an infinite runway for growth. Visa still has growth potential in consumer payments, while new areas like commercial payments and value-added services can help offset any slowdown in that segment.

Exciting times ahead!

Cover image source: Visa

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.