Hi!

Welcome to the fifth issue of the “Popular Fintech” newsletter! Nothing newsworthy happened yesterday, so, instead, let’s take a look at what will be making headlines next week. A number of Fintech companies will report their Q1 2023 results, setting the stage for the rest of the earnings season:

Visa and Mastercard results will provide insights into consumer financial health in the U.S. and across the globe

FIS and Fiserv will shed light on what’s happening in the merchant acquiring industry, and we will hear more about the Worldpay spin-off

LendingClub’s loan origination volumes will provide a gauge of the state of consumer lending

5D change, April 14 - April 21, 2023

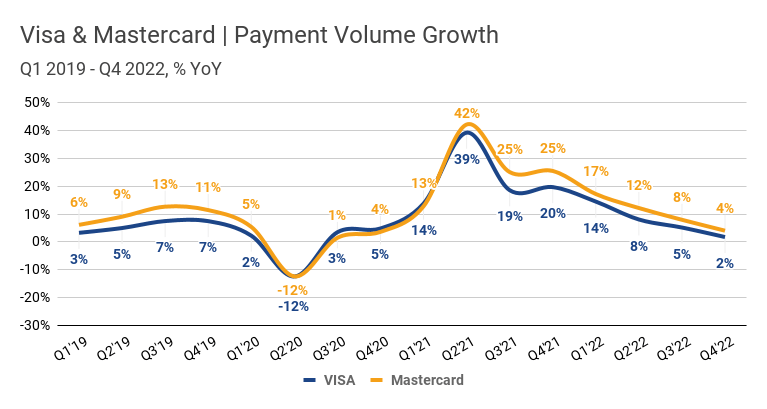

Visa and Mastercard Results to Provide Insights into Consumer Financial Health

Visa (NYSE: V) and Mastercard (NYSE: MA) will report their results on Tuesday, April 25, and Thursday, April 27, 2023, respectively. Both companies report operating metrics, including payment volumes with the split by card type of geography, which usually provide meaningful insights into spending trends and consumer financial health. Last quarter, Visa reported a 1.7% YoY growth in payment volume (6.8% in constant prices) and a 1.9% YoY growth in payment transactions. Payment volume growth was fueled by credit card spending, which increased 10.7% YoY in constant prices, while debit card spending increased only 3.2% YoY. Mastercard reported a 4.0% YoY growth in payment volume (10.6% YoY growth in constant prices) and a 3.3% YoY in payment transactions. In the case of Mastercard, payment volume growth was primarily driven by credit card spending in the U.S. (13.9% YoY in constant prices) and debit card spending internationally (15.1% YoY).

Data source: Visa and Mastercard Investor Relations

✔️ Visa Inc. Reports Fiscal First Quarter 2023 Results✔️ Mastercard Incorporated Reports Fourth Quarter and Full Year 2022 Financial Results

Worldpay Spin-Off Takes Center Stage as FIS and Fiserv Report Q1 2023 Results

Two out of the three largest U.S. merchant acquirers, Fiserv (NASDAQ: FISV) and FIS (NYSE: FIS) will report their Q1 2023 results next week (on April 25 and April 27, 2023, respectively). In Q4 2022, FIS GAAP revenue grew by 1% YoY to $3.71 billion, while Fiserv’s revenue grew by 9% YoY to $4.63 billion. FIS guided for a 0.5-2.2% decline in revenue in 2023, while Fiserv guided for a 7-9% revenue growth. Besides the financial results, investors will be looking to hear more about the spin-off of Worldpay. In February, FIS announced plans to spin off its merchant business, Worldpay, which it acquired in 2019. The merchant business provides payment processing services to merchants and retailers, and FIS had hoped to integrate it with its banking and wealth management offerings. However, the company now believes that spinning off the business will allow it to unlock greater value for shareholders. FIS will list the merchant business as a separate publicly traded company and expects to complete the spin-off within a year.

Image source: Nilson Report

✔️ FIS Reports Fourth Quarter and Full-Year 2022 Results✔️ FIS Announces Plans to Spin Off Merchant Business✔️ FIS’s Worldpay Spinoff Is Jumbled by Tough Outlook✔️ Fiserv Reports Fourth Quarter and Full Year 2022 Results✔️ Investors press FIS, Fiserv for divestitures

LendingClub's Q1 Results Will Set the Tone for the Earnings Season of Online Lenders

LendingClub (NYSE: LC) will report its Q1 2023 results on Wednesday, April 26, 2023, after markets close. In the fourth quarter of 2022, the company reported $2.5 billion in loan originations, down from $3.1 billion in Q4 2021 and $3.5 billion in Q3 2022, as the company started tightening lending standards, and investors’ appetite for personal loans soured. LendingClub’s management guided for a further decline in loan originations in Q1 2023, expecting to underwrite $1.9 to $2.2 billion, the lowest volume since Q1 2021. Other lenders, such as Upstart (NASDAQ: UPST) and SoFi (NASDAQ: SOFI) also reported declines in origination volumes, indicating the industry-wide impact of the rising rates and deteriorating economic environment. SoFi will report its Q1 2023 results on May 1, 2023, and Upstart will report on May 9, 2023.

Data source: LendingClub, Upstart, and SoFi Investor Relations

✔️ LendingClub Reports Fourth Quarter and Full Year 2022 Results✔️ LendingClub cuts 14% workforce to pare costs✔️ Upstart Laying Off 365 Employees as Loan Originations Decline✔️ SoFi Buys Wyndham for Mortgage Loans

Chart of the Day

While writing today’s issue, I decided to look at the returns that Visa and Mastercard produced for their shareholders. It turns out that over the last 10 years, Mastercard delivered a total return (share price appreciation and dividends) of 663.79%, compared to 512.17% by Visa, 198.88% by Discover, and 181.37% by American Express. Warren Buffett made his first investment in Mastercard in Q1 2011…and in Q3 2011 he also invested in Visa.

Chart made with Koyfin

Jobs in Fintech

Director of Software Engineering - Payments & Platform Engineering@ VisaAshburn, VA

Director, Visa Direct Product Management & Go-to-Market / Mexico, Central America & The Caribbean@ VisaMiami, FL, United States

Director, Mastercard Send, Product Development@ MastercardO’Fallon, MO, Purchase, NY or New York, NY, United States

Director, Bill Pay, Product Development@ MastercardO’Fallon, MO, Purchase, NY or New York, NY, United States

Senior Director, Product Design@ LendingClubSan Francisco, United States

That’s it for today! Thank you for reading and see you next week!

Jevgenijs

Cover image source: Visa

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.