Hi!

A venture capital firm QED Investors published a report recently, projecting a sixfold growth in Fintech revenues by 2030, and calling last year’s correction “a plunge in an otherwise long-term positive trajectory.” Now they want to put some money into this opportunity:

Venture firm QED Investors raises $925 million to invest in Fintech startups,

Airbnb partners with Stripe to enable paying for stays with bank payments, and

Visa plans to open a technology and product hub in Poland

Thank you for reading and see you tomorrow!

Jevgenijs

Please help me spread the word about the “Popular Fintech” newsletter 👇🏻

QED Investors Raises Nearly $1 Billion to Invest in Fintech Startups

Venture capital firm QED Investors announced raising two new funds, totaling $925 million, for investing and early-stage and growth Fintech startups. The investments will primarily focus on startups in the United States, the United Kingdom, Europe, Latin America, India, Southeast Asia, and Africa. QED Investors, a firm founded in 2007 by Capital One (NYSE: COF) veterans, Nigel Morris and Frank Rotman, has a history of backing successful Fintech companies, including such names as Nubank (NYSE: NU), Klarna, Credit Karma, and Remitly (NASDAQ: RELY). With these new funds, QED's total assets under management will surpass $4 billion.

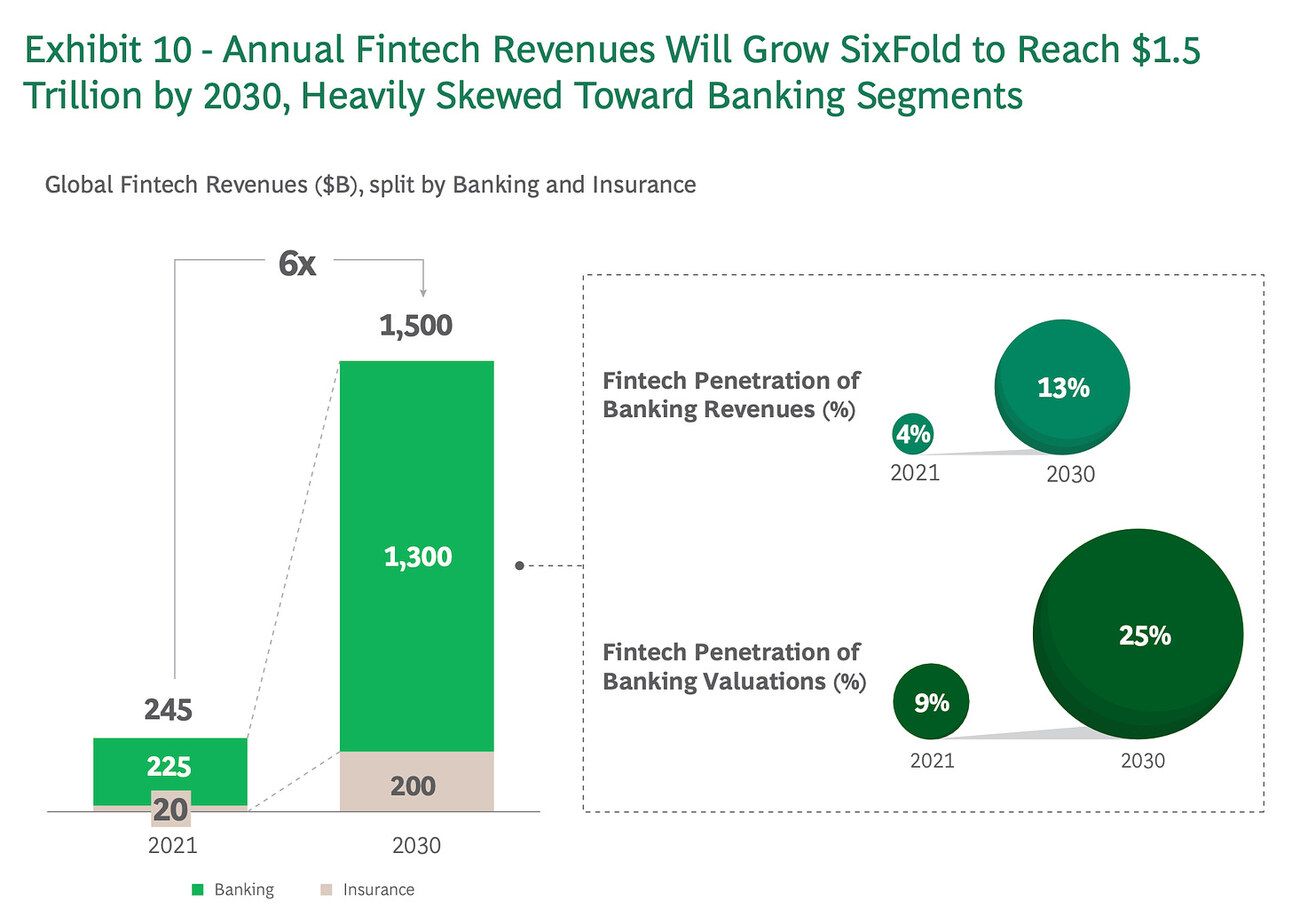

Earlier in May, QED investors, in cooperation with Boston Consulting Group, published a report “Global Fintech 2023: Reimagining the Future of Finance”, projecting a sixfold growth in Fintech revenue to $1.5 trillion by 2030. The venture firm admits in the report that Fintech companies, on average, lost more than half of their market value in 2022, but still believes that this is “a short-term correction in an otherwise long-term positive trajectory, as the industry’s fundamental growth drivers haven’t changed.” The report projects the fastest growth in the APAC region, followed by the US, Europe, and Latin America. If you’re in Fintech, it’s a must-read.

Source: Global Fintech 2023

✔️ Venture Firm QED Raises $925 Million for Fintech Investing

✔️ QED closes on $925M to back fintech startups globally

✔️ Global Fintech 2023: Reimagining the Future of Finance

✔️ QED co-founders again named among world’s best investors

Airbnb Partners with Stripe on Bank Payments

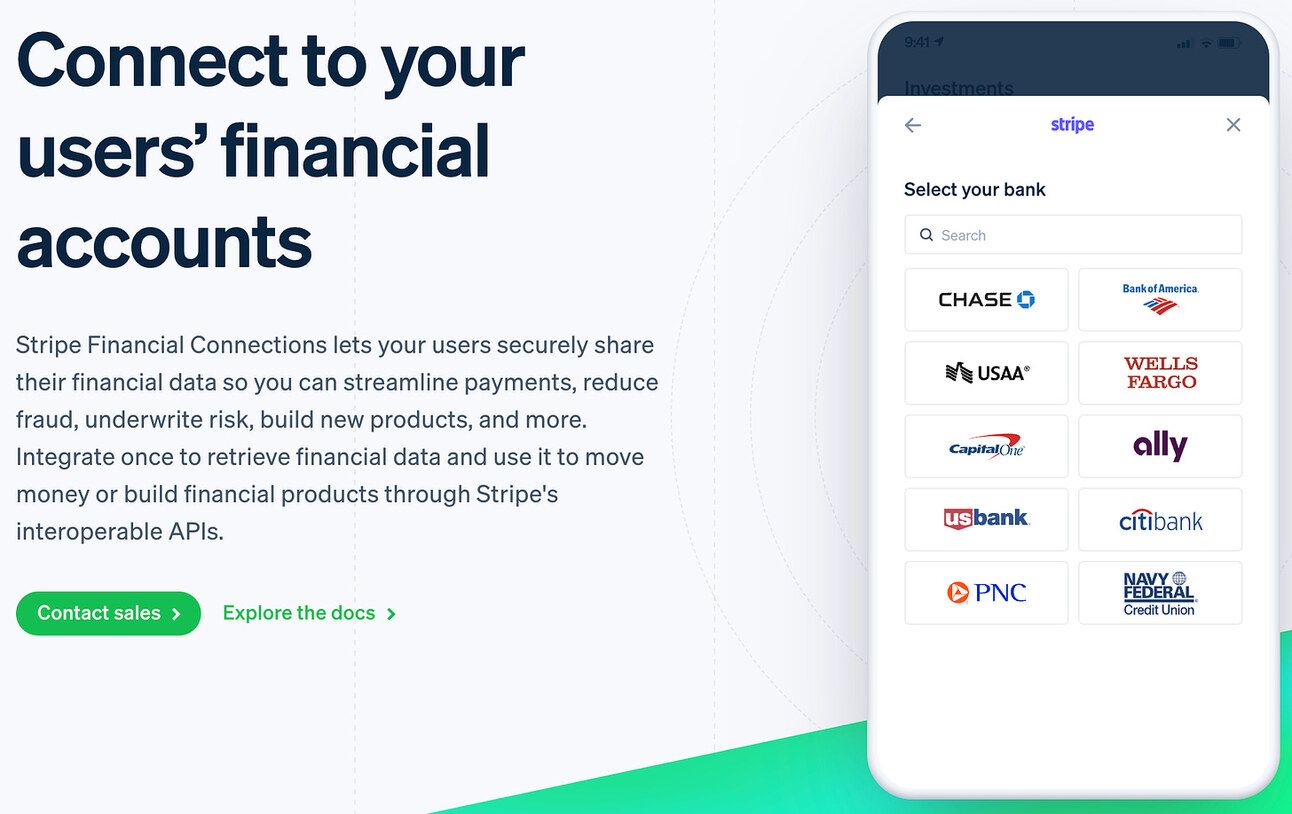

Airbnb (NASDAQ: ABNB) has teamed up with Stripe to enable its guests to pay for stays with their bank accounts, as an alternative to using credit or debit cards. This partnership allows Airbnb guests in the United States to link their bank accounts to the Airbnb app using Stripe’s Financial Connections product. By securely adding their bank accounts as a payment method through Stripe, guests can conveniently make bank payments for all future reservations using Stripe’s one-click checkout feature. This partnership marks another win for Stripe, which previously announced signing deals with Uber, WhatsApp, and Microsoft.

Stripe’s Financial Connections service enables merchants to directly connect with their customers' bank accounts, granting access to financial data for faster and smoother transactions. The service was launched a year ago in the United States and works with the majority of bank accounts. By launching this service, Stripe went into direct competition with its former partner Plaid (and will compete with Visa’s Tink once the company expands the service to Europe). “We’re thrilled to partner with Airbnb to offer bank payments as an option that’s just as fast and convenient as anything else,” commented Stripe’s CRO, Mike Clayville.

Image source: Stripe

✔️ Airbnb partners with Stripe to power bank payments

✔️ Stripe Powers Pay by Bank for Airbnb

✔️ Stripe flexes its fintech muscle with Financial Connections to pull banking data automatically

✔️ From partners to competitors: What Stripe’s latest move means for Plaid

Visa to Open a Technology Hub in Poland

The payments giant Visa (NYSE: V), has announced its plans to open a new global Technology and Product Hub in Poland, which will be Visa’s first hub in Central and Eastern Europe. The hub, which will support Visa's initiatives in digital commerce and payments, is expected to employ up to 1,500 tech and product professionals. Poland was chosen as the location due to its skilled workforce and thriving IT sector, as Visa views the country as an ideal location to recruit emerging talent in Artificial Intelligence, cybersecurity, and network resilience. Visa has been operating in Poland since 1995 and played a pivotal role in advancing digital payments in the country. The company has five strategic global Technology and Product Hubs around the globe.

Image source: Visa

✔️ Visa Plans New Global Technology and Product Hub in Poland

✔️ Why Visa chose Poland as site of first technology and product hub in CEE

✔️ Careers at Visa: Poland

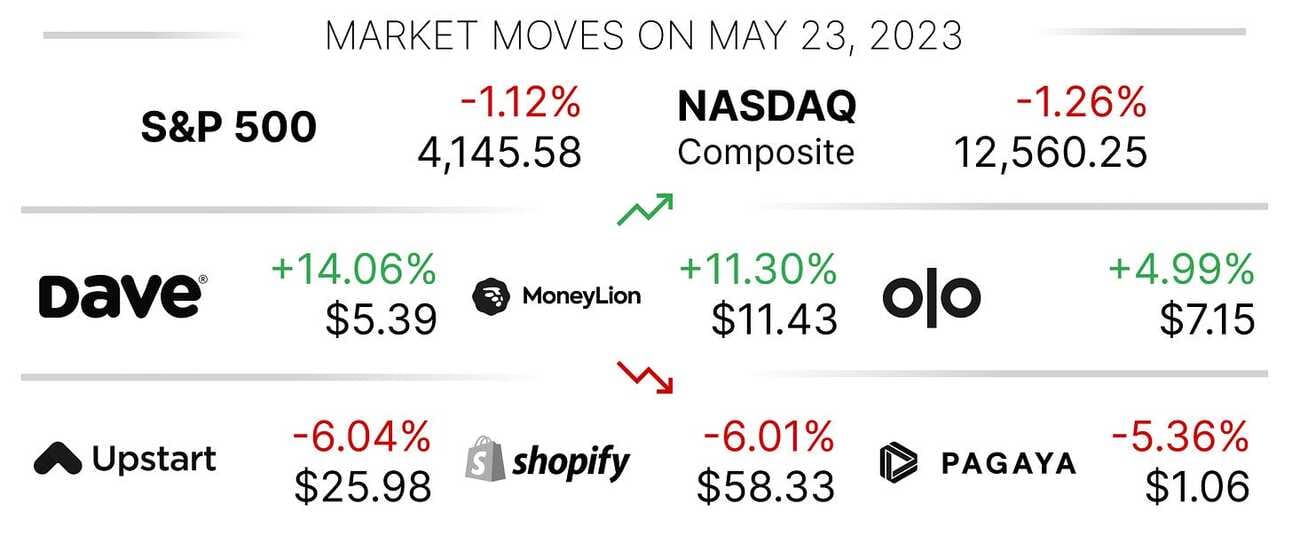

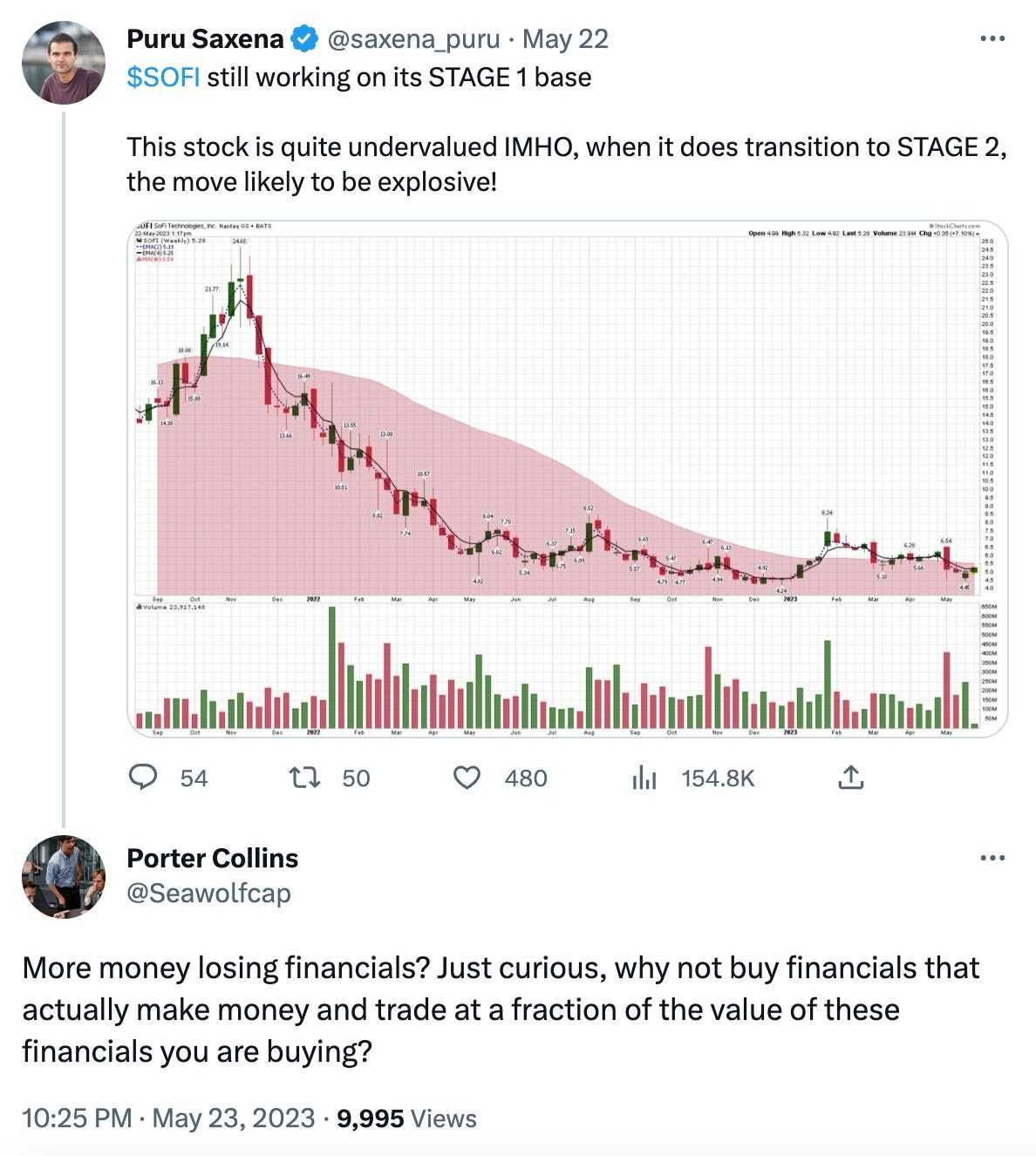

Sharing a tweet instead of a chart today. Porter Collins, an investor, whom you might have seen in “The Big Short” movie, wrote a tweet that stuck in my head. “More money losing financials? Just curious, why not buy financials that actually make money…” commented Collins about SoFi (NASDAQ: SOFI). He’s kind of right….🙊

Director of Software Engineering

@ Visa

🇵🇱 Warsaw, PolandCybersecurity Director

@ Visa

🇵🇱 Warsaw, PolandProduct Strategy and Operations Manager, Payments

@ Stripe

🇵🇱 Remote, United StatesProduct Manager, Money Movement and Storage Experiences

@ Stripe

🇨🇦 Toronto, Canada, Chicago, IL, United States, or RemoteEngineering Manager, Global Debits

@ Stripe

🇮🇪 Dublin, Ireland

Cover image source: QED Investors

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.