Hi!

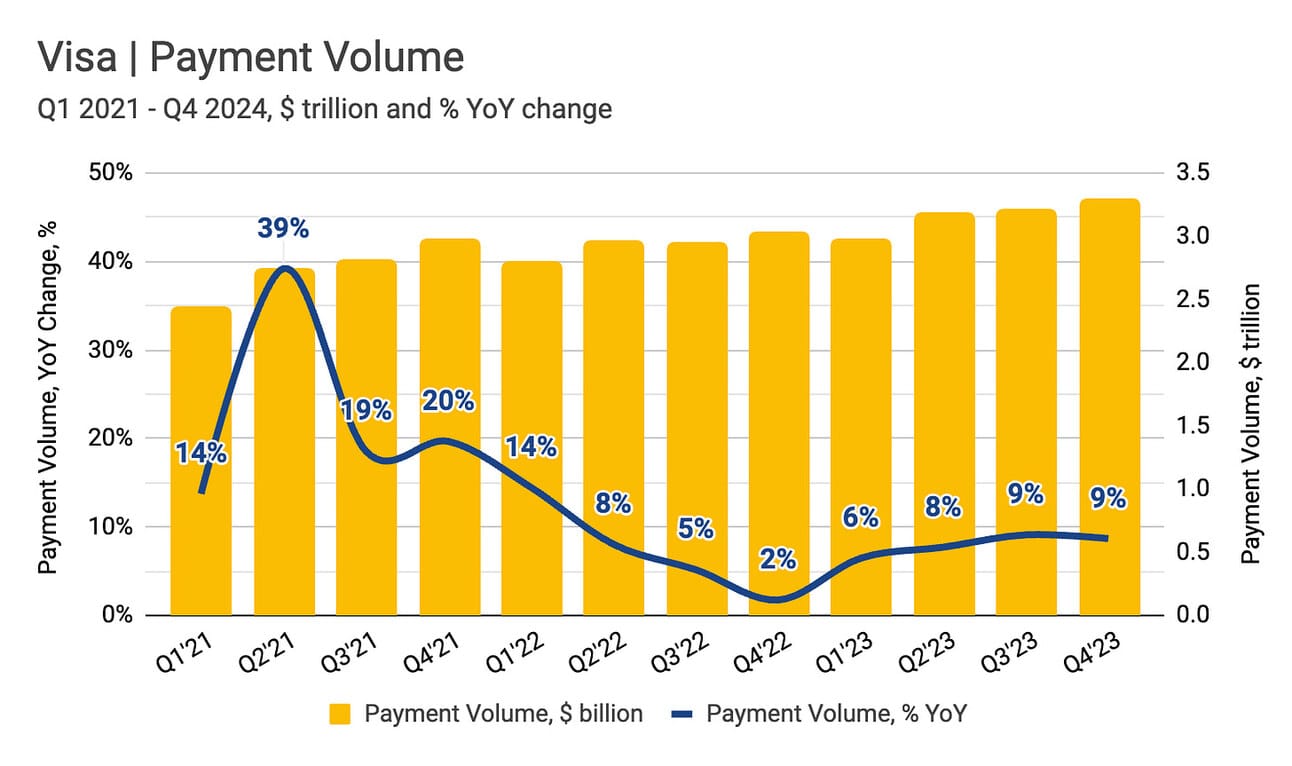

Last week, Visa reported its Q4 2023 (FY Q1 2024) results. Net revenue increased 9% YoY and GAAP EPS grew 20% YoY, “driven by relatively stable growth in overall payments volume and processed transactions”. Payment volume increased 8.6% YoY in nominal terms, and 8.4% YoY on an FX-neutral basis (that is excluding the foreign exchange rate impact).

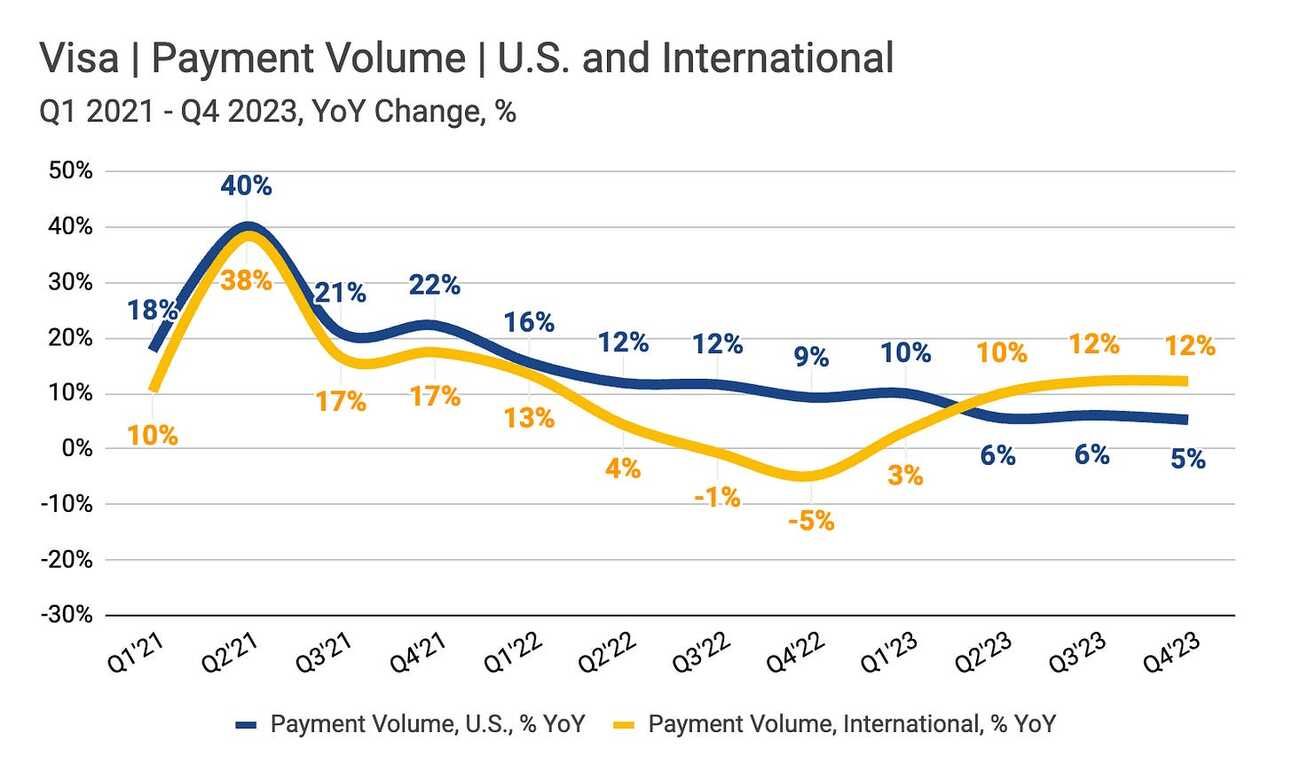

Visa stock is considered to be a bet on the economy by many analysts. The logic is that if the economy grows, consumers increase their spending, and Visa increases its revenue. And in the long term, the economy grows. What I have noticed, however, is that this was not the U.S. consumer (and the U.S. economy) who was helping Visa to maintain "stable growth in payments volume.”

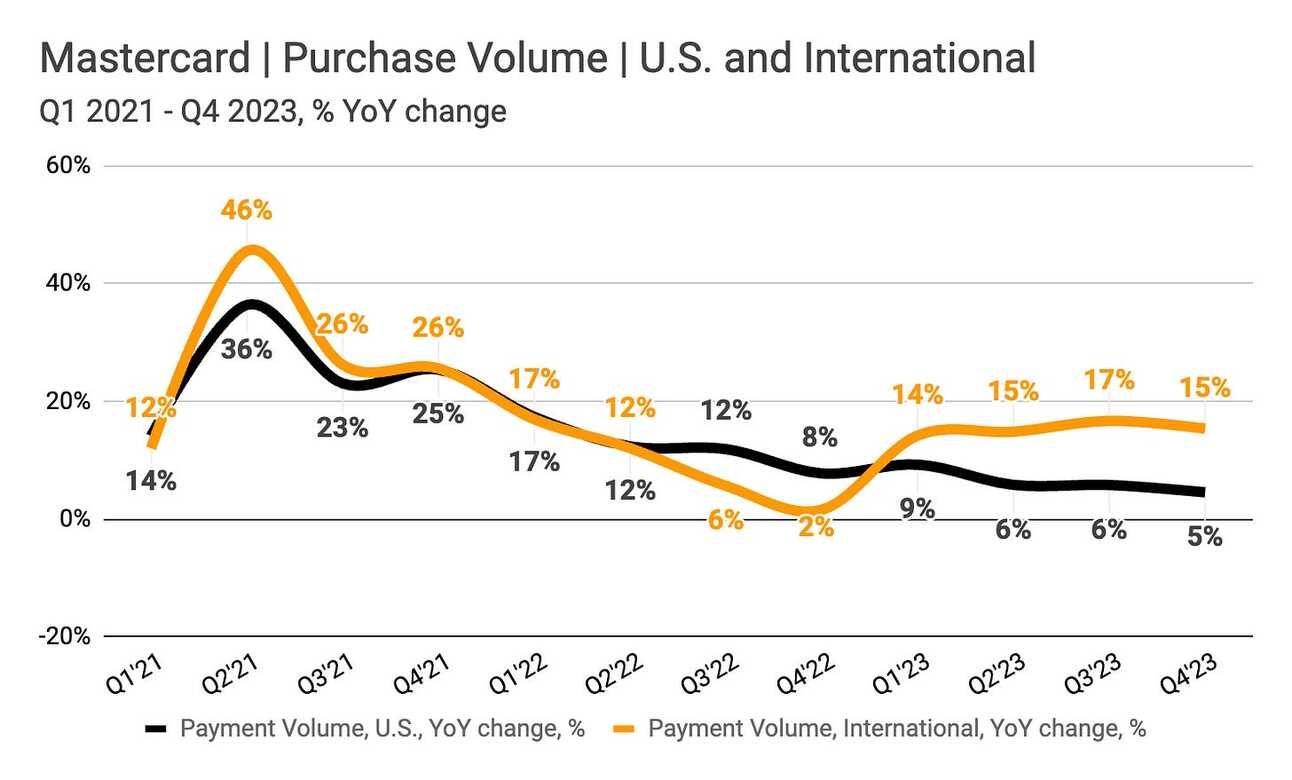

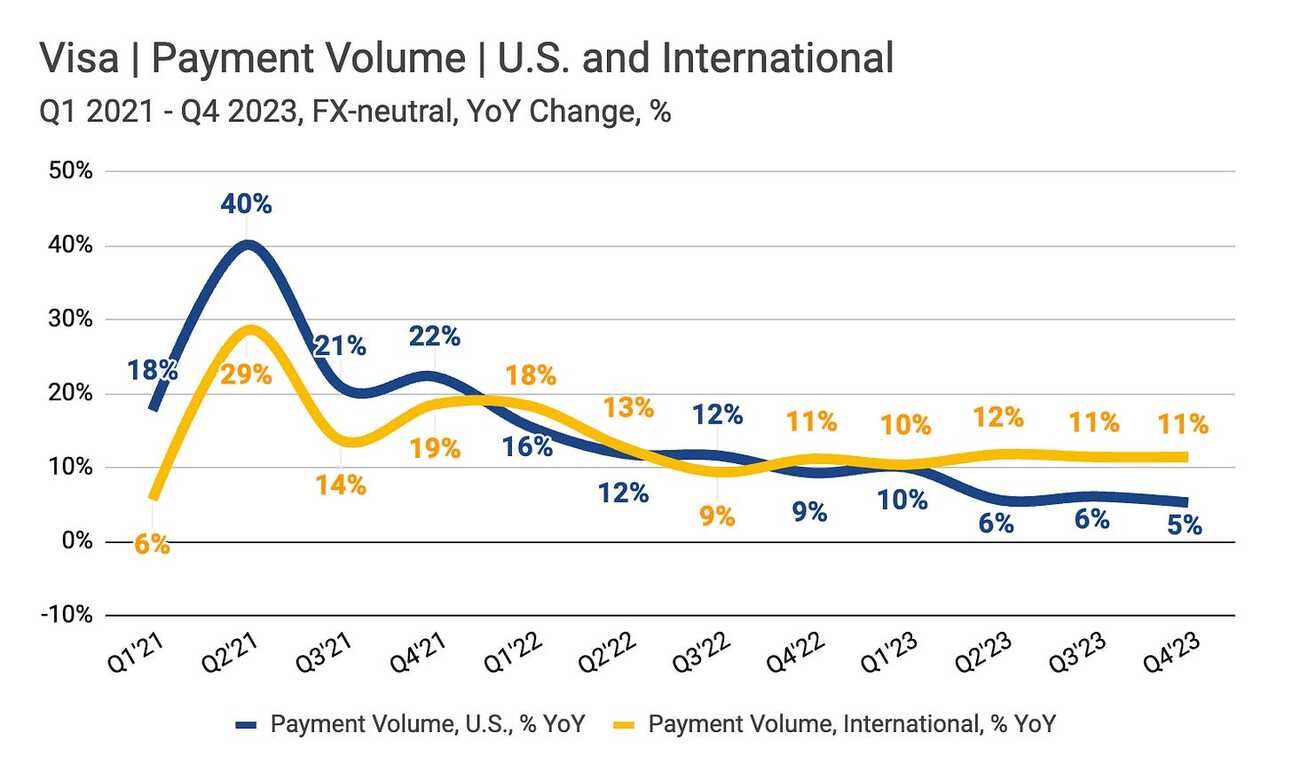

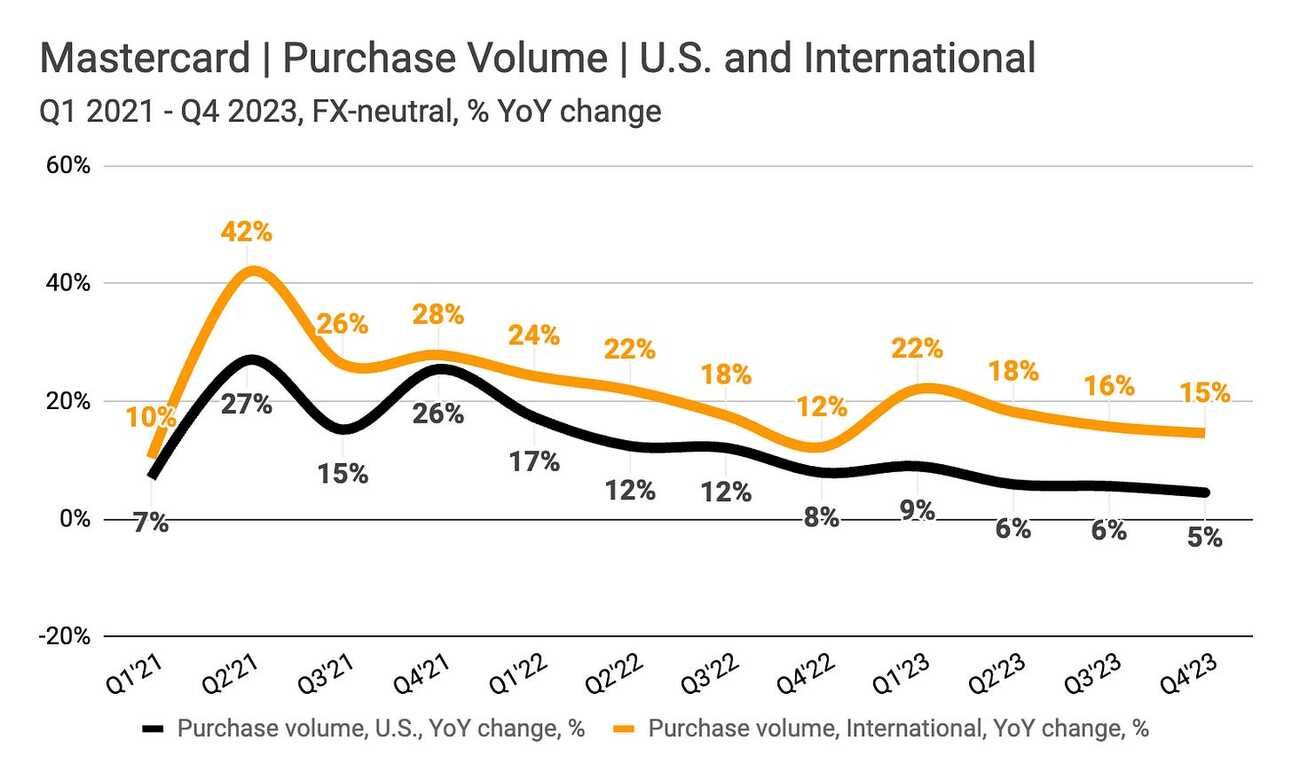

Quite the opposite, Visa’s growth in the U.S. has been decelerating for a while now. It is the international volume that keeps the growth momentum going. And, this was not specific to Visa! Mastercard reported a similar trend. Could we be at the end of the secular growth trend in the U.S. for the card schemes? Let’s dive into the numbers!

In Q4 2023, Visa processed $3.28 trillion in payment volume bringing the total payment volume processed for the full year to $12.59 trillion. This represents 8.6% YoY growth for the quarter (Q4 2023 vs. Q4 2022) and 8.0% YoY growth for the year (2023 vs. 2022).

However, if you decompose the payment volume by the region, you’ll notice a deceleration in the U.S. volume growth to 5.3% YoY and an acceleration of international volume growth to 12.2% YoY in Q4 2023. In Q4 2023, the U.S. volume represented 48.9% of the total payment volume processed by Visa.

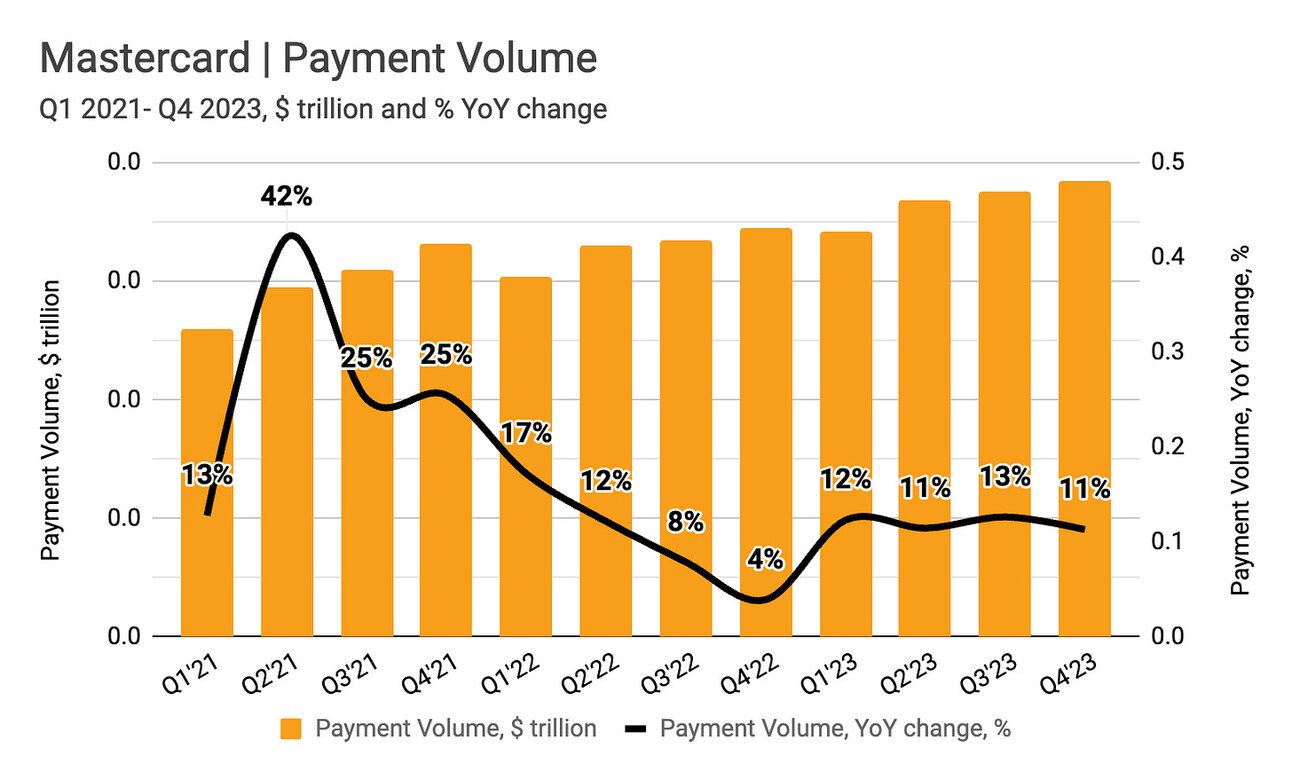

Mastercard reported a total payment volume of $1.92 trillion for the quarter and an 11% YoY growth. The total payment volume processed in 2023 was $7.35 trillion, which represents an 11.9% increase compared to 2022.

Similarly to Visa, decomposing Mastercard’s payment volume by region reveals that growth in the U.S. has been decelerating, while growth internationally has been accelerating. In Q4 2023, U.S. volume represented 34.7% of the total payment volume processed by Mastercard.

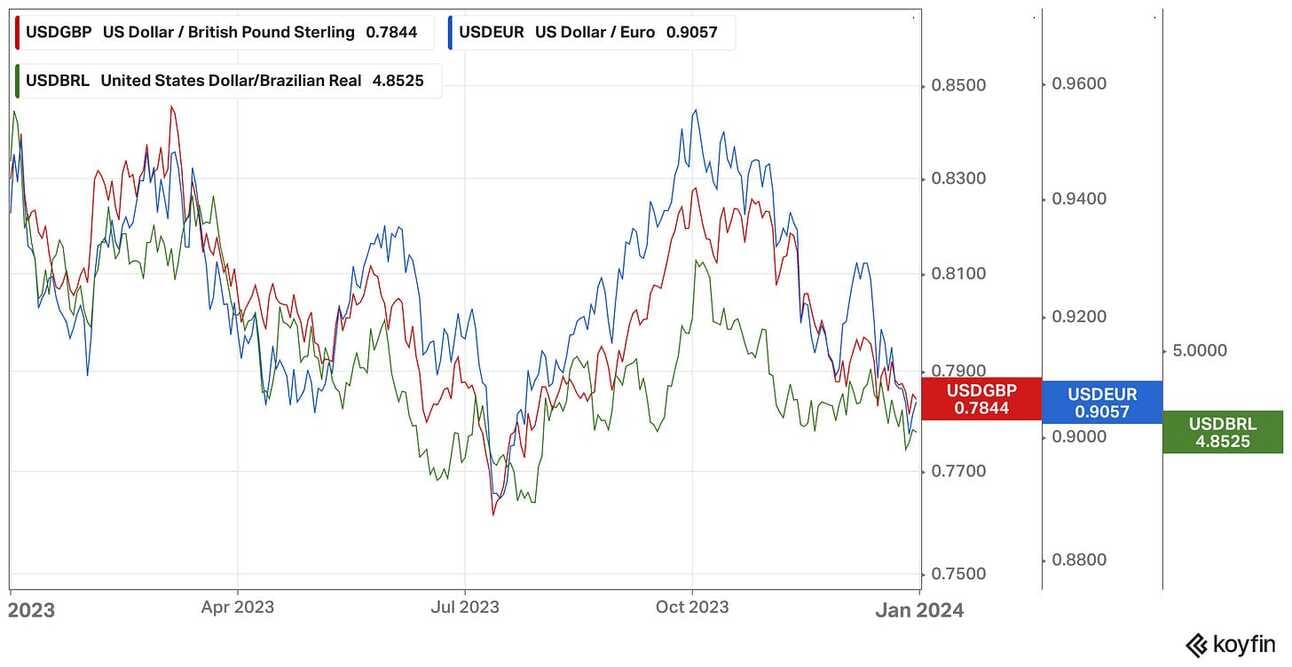

One obvious explanation could be the weakening of the U.S. dollar (Visa and Mastercard report their results in U.S. dollars, but are paid in local currencies). As the chart below illustrates, the U.S. dollar depreciated in Q4 2023 against the British Pound, Euro, and Brazilian Real. However, the opposite trend was in place in the previous quarter. Thus, there’s got to be more than the exchange rate.

Therefore, it is worth looking at the regional growth on an FX-neutral basis, meaning excluding the impact of currency rate fluctuation. What the chart below illustrates, is that on an FX-neutral basis, Visa’s payment volume outside of the U.S. has been growing at a higher rate than the U.S. volume for over a year now. Or rather two years if we exclude Q3 2022.

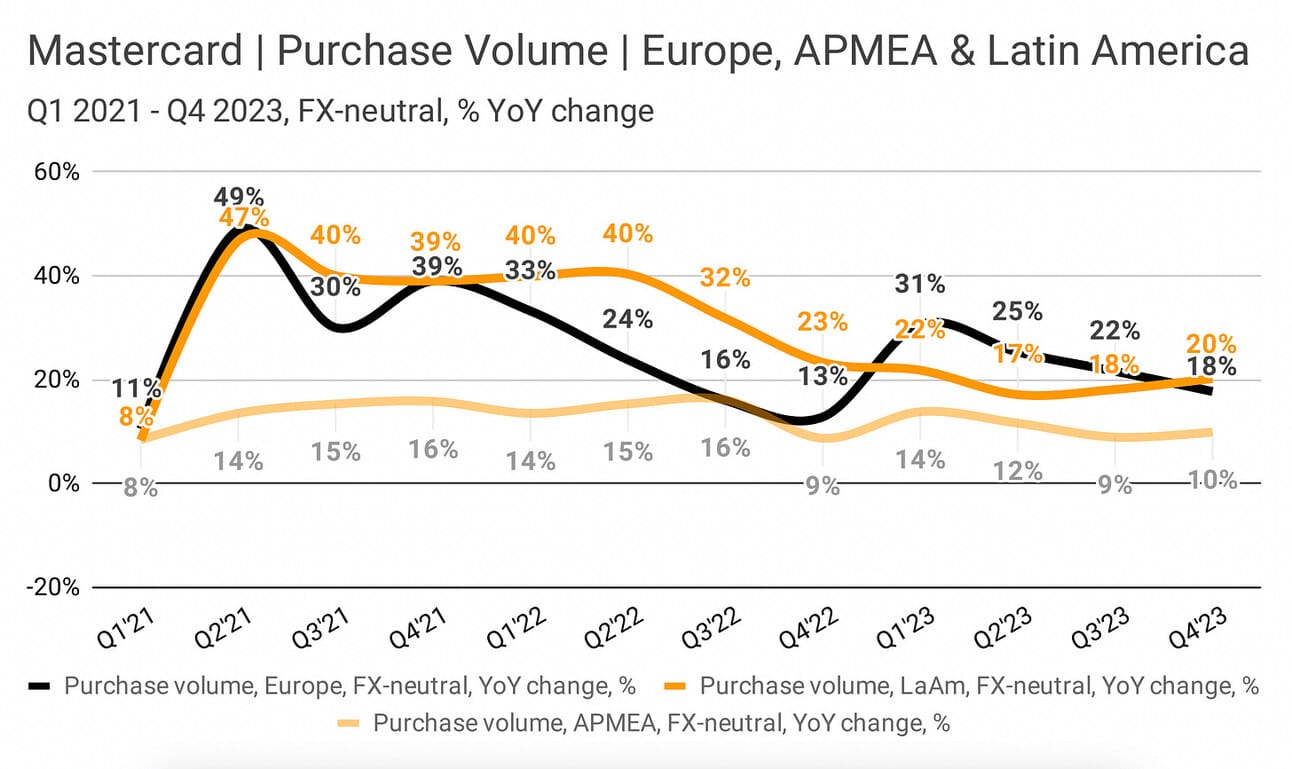

In the case of Mastercard, the contribution of international payment volumes to overall growth is even more visible if you adjust for currency impact. Thus, on an FX-neutral basis, Mastercard payment volume growth outside of the U.S. has been higher than in the U.S. in every single quarter over the past three years. And not marginally, but meaningfully higher.

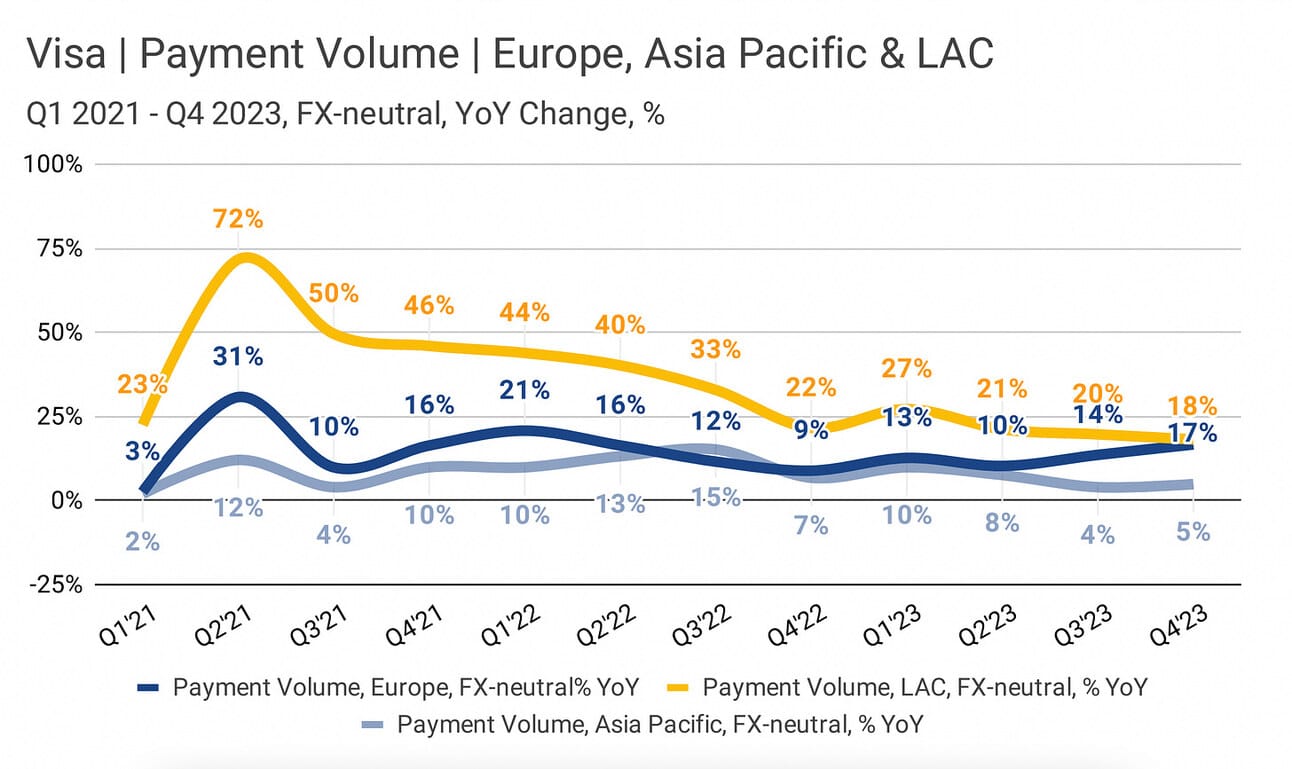

Alright, so where does the growth come from? Visa’s largest markets outside of the U.S. are Europe (19.4% of payment volume in Q4 2023), Asia Pacific (16.0%), as well as Latin America and the Caribbean (7.0%). You can see FX-neutral volume growth across these regions in the chart below.

For Mastercard, the largest regions outside of the U.S. are Europe (31.4% of payment volume in Q4 2023), Asia Pacific, Middle East and Africa (22.7%), as well as Latin America (7.7%). Europe and Latin America continue delivering double-digit growth.

The key question is whether this trend (the trend of international growth outpacing growth in the U.S.) will continue into 2024 and beyond. Mastercard’s leadership was asked this question on the Q4 2023 earnings call. Their response was “the secular opportunity is greater outside of the U.S. than in the U.S.”

….broadly speaking, the secular opportunity is greater outside of the U.S. than in the U.S. There's a good news, bad news story there. And the good news is that, that means we've been quite successful in driving the secular shift opportunity in the U.S., which is what you're seeing in the results come through. And again, from a bad news standpoint is there's a lower remaining opportunity on the volume side in the U.S.

Sachin Mehra, Mastercard CFO, Q4 2023 Earnings Call

Over the last 5 years (2019-2023), Visa’s payment volume in the U.S. increased by 68%, while international volume grew by 34% (Mastercard grew equally in the U.S. and internationally). However, over the next 5 years, we might see the trend reverse with international growth outpacing growth in the U.S. Visa is still a bet on the economy, but in the next 5 years, it might not be the U.S. economy.

Thank you for reading!

Jevgenijs

p.s. while I was writing this I remembered Warren Buffett’s phrase “Never bet against America”. Let’s see if the GOAT is still right.

Cover image source: Visa

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.