Hey!

I have been planning to research Fiserv for a while. My perception was that the market loved this company purely because of Clover, a modern POS solution for small businesses. Clover has been delivering impressive growth, successfully competing with the likes of Square.

I’m glad I finally did this research. What I found is that two-thirds of Fiserv’s business is hardly at risk of disruption. It competes with other incumbents, like FIS, but faces little competition from the new generation of fintech companies. At least for now.

In the meantime, the company continues to improve its operating efficiency and buy back its stock, which turns single-digit revenue growth into consistent double-digit growth in earnings per share. So Fiserv should be fine, even if Clover can’t maintain its strong momentum.

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

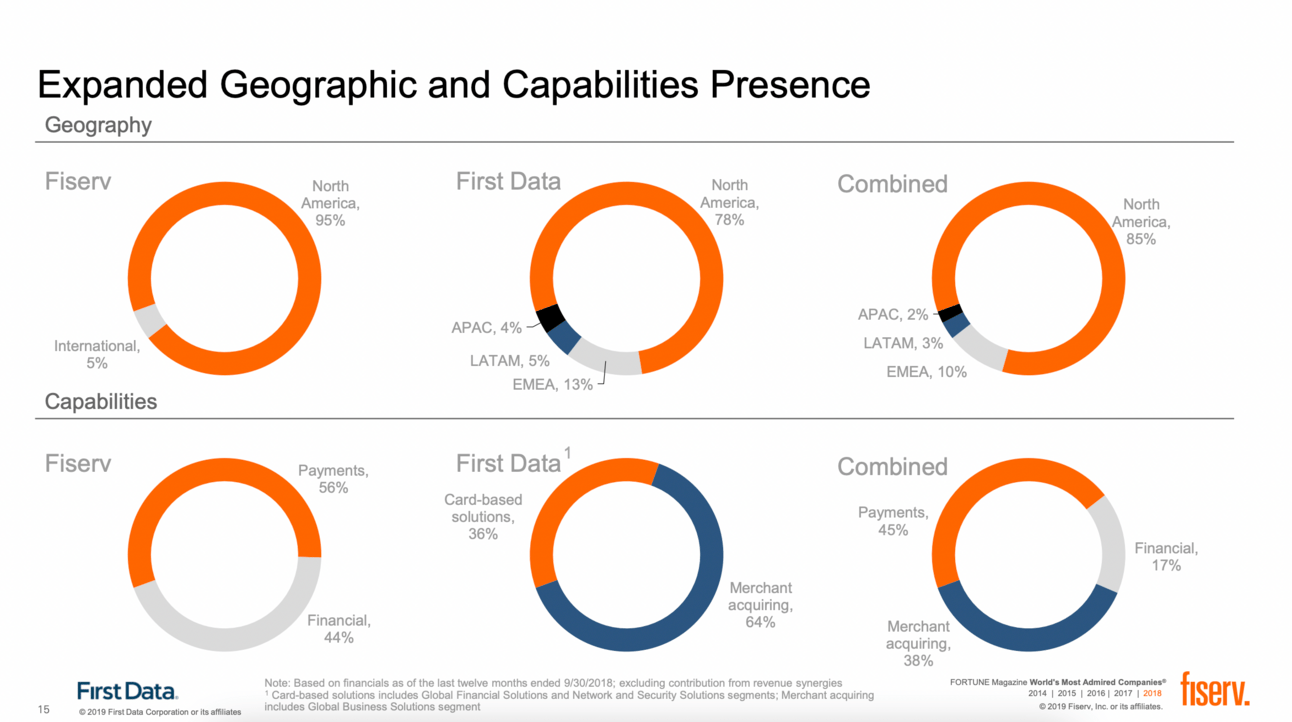

In 2019, Fiserv acquired First Data, creating one of the largest Fintech companies globally. The merger combined Fiserv’s core banking and payment technology with First Data’s merchant acquiring and issuer processing businesses. As of this writing, Fiserv $FI ( ▲ 4.19% ) has a market cap of $92 billion, larger than PayPal, Adyen, and Block.

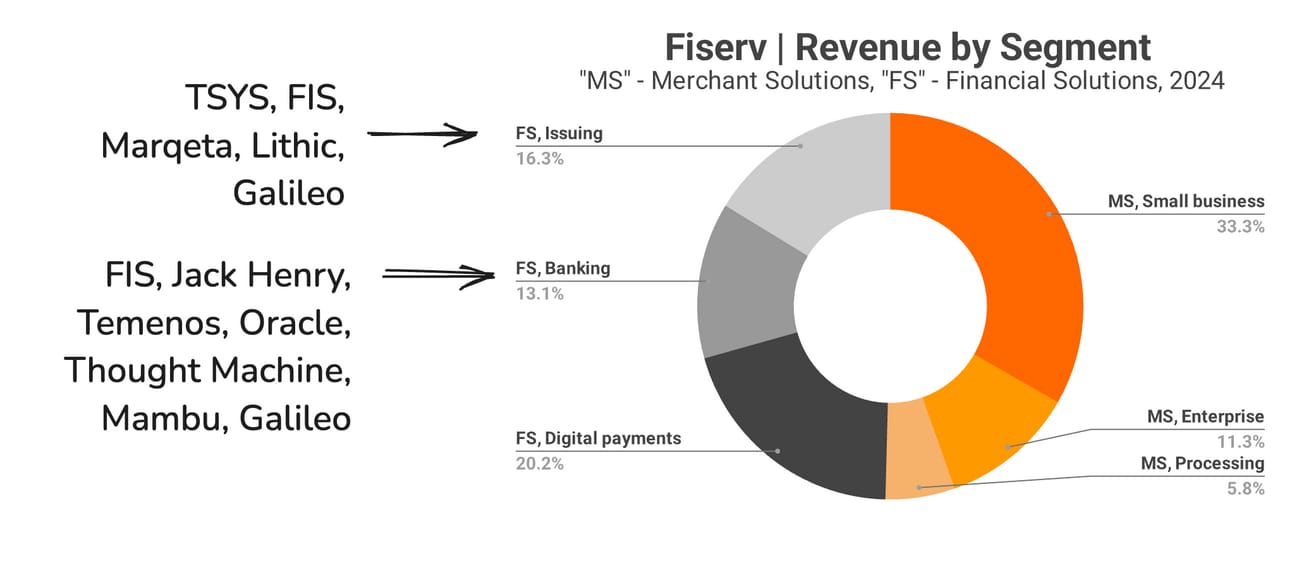

Image source: Fiserv to Combine with First Data

Fiserv’s revenue is equally split between its “Merchant Solutions” and “Financial Services” segments. The “Merchant Solutions” segment covers Fiserv’s payment acceptance business for both small businesses and large enterprises. The “Financial Solutions” segment includes core and digital banking, digital payments, and issuer processing.

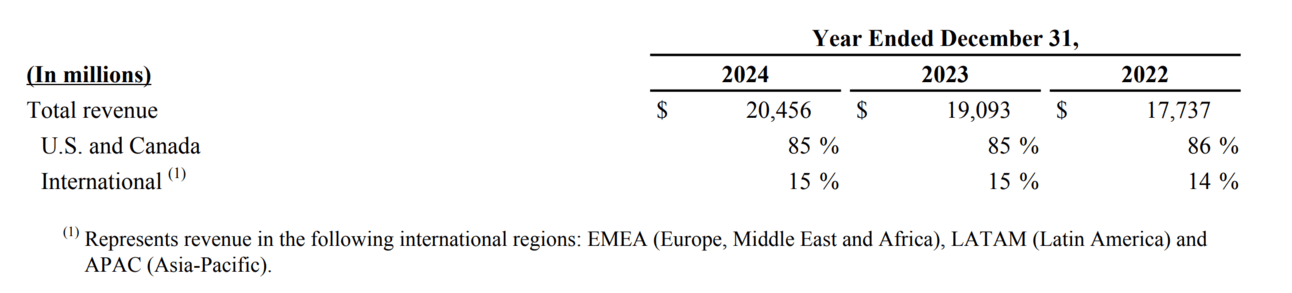

Fiserv’s geographic footprint has remained largely unchanged since the merger, with the U.S. still accounting for the majority of its revenue. International markets (EMEA, LatAm, and APAC) contribute just 15%.

Image source: Fiserv 2024 annual report

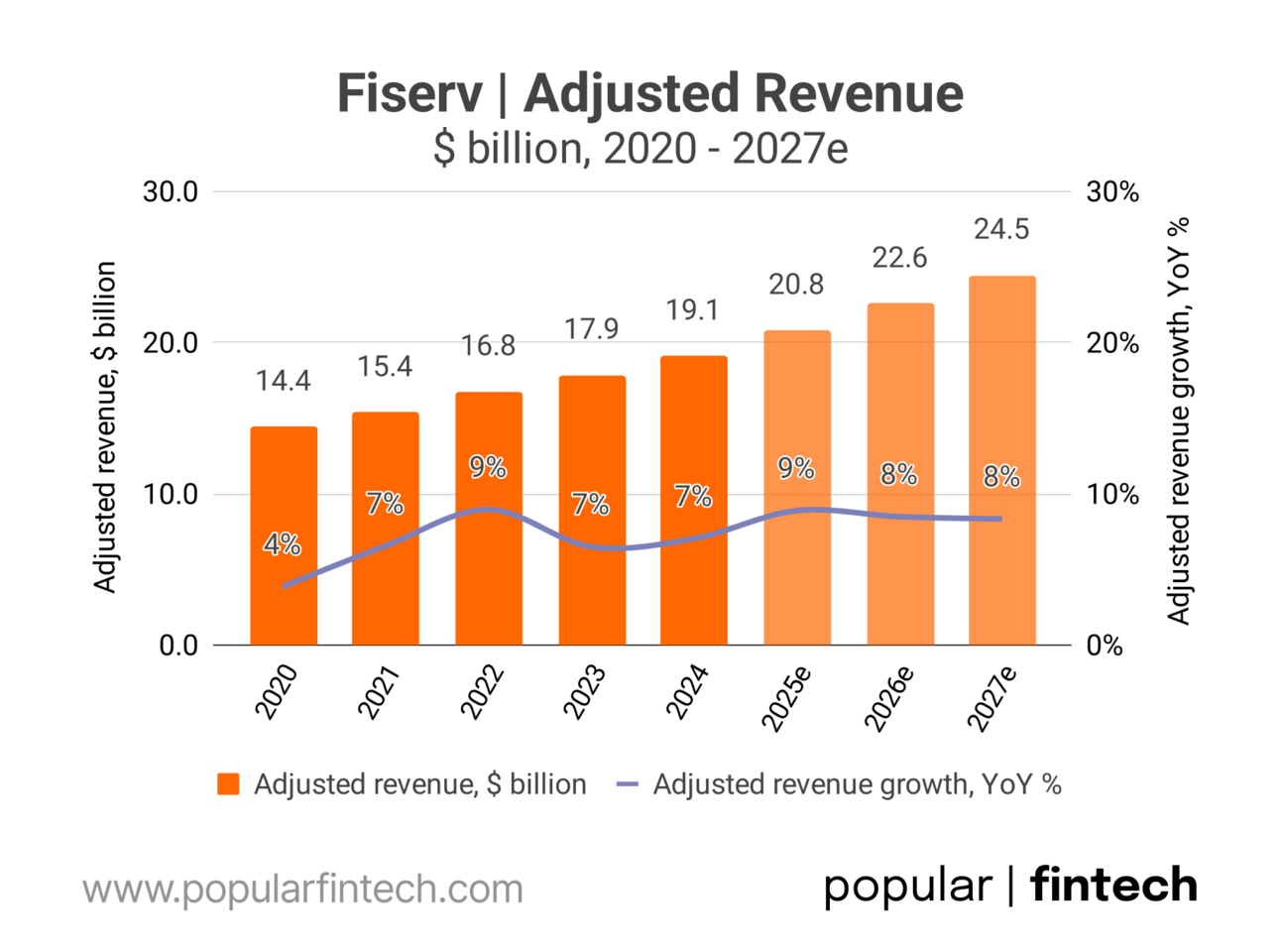

If there is one word to describe Fiserv’s financial performance, this would be “predictability”. The company has consistently delivered high single-digit adjusted revenue growth, a trend Wall Street analysts expect to continue in the years ahead.

Data source: Koyfin, company reports

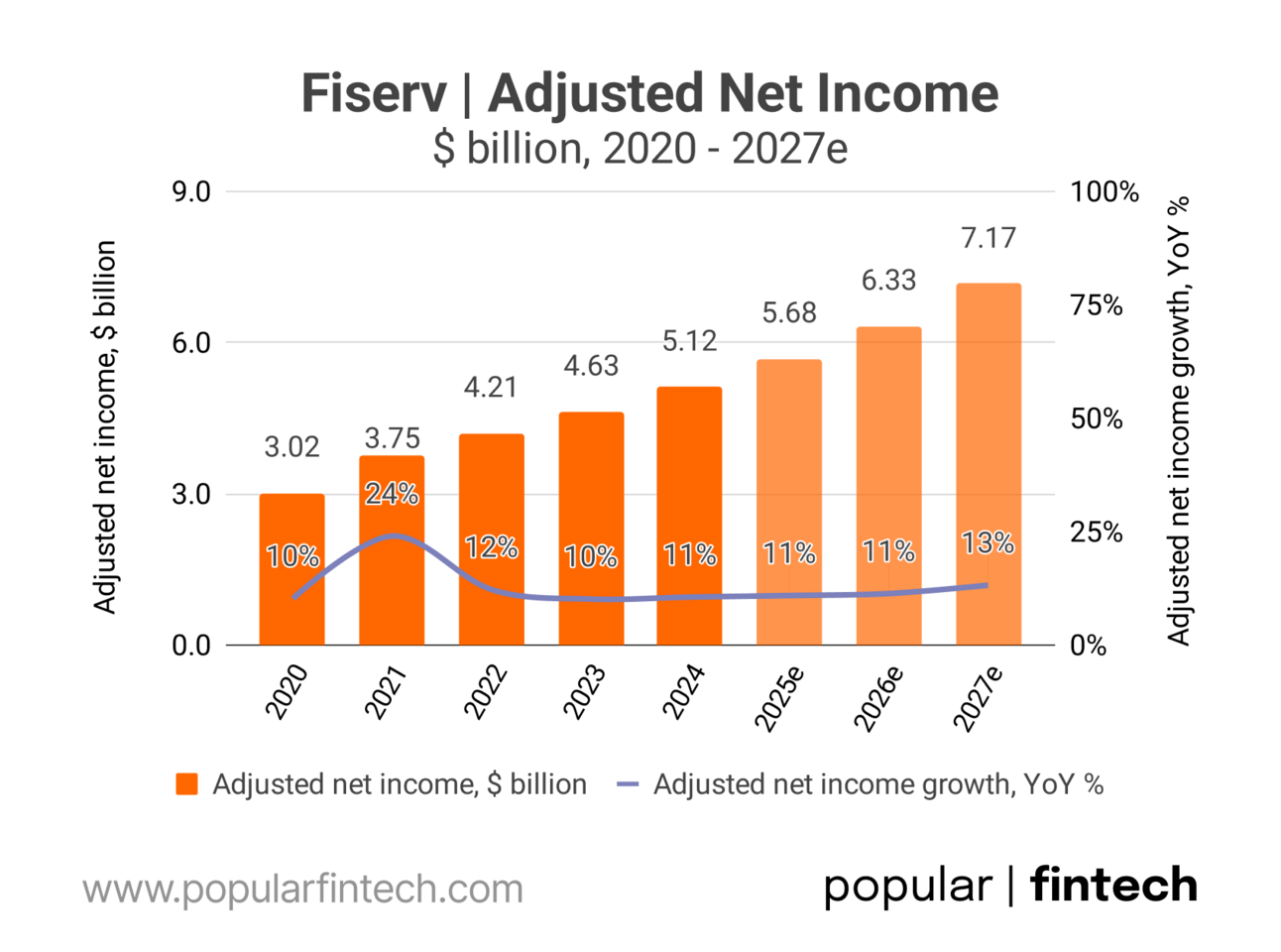

Fiserv has also been improving its operational efficiency, delivering low double-digit growth in adjusted net income. The company adjusts its revenue for “postage reimbursements”, which are the pass-through costs associated with customer account statement printing and posting. Fiserv also adjusts its net income for the amortization of acquired intangible assets and one-off acquisition and merger-related costs.

Data source: Koyfin, company reports

In addition, Fiserv uses its free cash flow for stock buybacks, further boosting its adjusted EPS growth. The company does not pay dividends. The chart below probably explains why the market loves Fiserv: consistent double-digit adjusted EPS growth.

Data source: Koyfin, company reports

“For the full year 2024, we returned value to shareholders in the form of share repurchases worth $5.5 billion or 34 million shares, contributing to a nearly 5% decline in average shares outstanding for the year.”

Fiserv is guiding for 10-12% “organic” revenue growth and 15-17% adjusted EPS growth in 2025. The “organic” revenue is essentially adjusted revenue less the impact of exchange fluctuations. In recent years, “organic” revenue growth greatly exceeded adjusted revenue growth due to the devaluation of the Argentine Peso.

Image source: Fiserv Q4 2024 earnings presentation

“For 2025, we are guiding the 10% to 12% organic revenue growth, greater than 125 basis points of adjusted operating margin expansion; 15% to 17% adjusted EPS growth; and roughly $5.5 billion of free cash flow.”

In 2023, Fiserv held an Investor Day, and guided for 9-12% “organic” revenue and 14-18% adjusted EPS growth in 2025-2026. As you might have noticed from the charts above, Wall Street analysts expect this growth rate to continue into 2027.

Image source: Fiserv Investor Conference 2023

“…we expect continued strong free cash flow, generating $4.5 billion next year and $5 billion to $5.5 billion in the medium term. That performance leads to $23 billion in adjusted revenue in 2026 with an adjusted EPS of approximately $11.60, a compound annual growth rate of 16% from 2023 to 2026.”

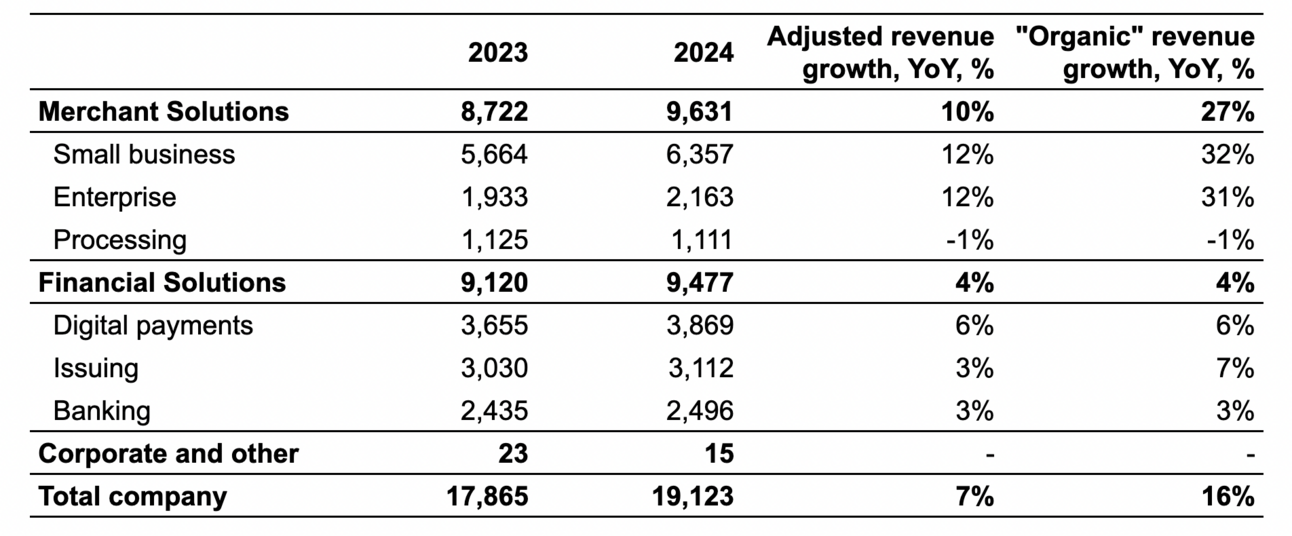

So, where does growth come from? In 2024, the “Merchant Solutions” segment’s adjusted revenue grew 10% YoY, and the “Financial Solutions” segment’s adjusted revenue grew 4% YoY. A large client migration between the “Enterprise” and “Processing” segments resulted in an acceleration of the revenue growth in the former and a decline in revenue in the latter. Combined, these segments’ revenue grew 7% YoY.

As you can see, the key driver for the company’s adjusted revenue is the “Small business” sub-segment (and to a lesser degree, the “Enterprise” sub-segment). Without growth in the “Small business” (which contributes a third of the revenue), the company’s revenue would grow in the low to mid-single-digit range.

“Above-average enterprise growth also reflects the ramping of a large PayFac from a processing customer to a direct client, which started in earnest in Q3. For the full year, enterprise growth of 31% organic and 12% adjusted includes the impact of ramping growth from the large PayFac client we mentioned last quarter as well as the transitory effects from Argentina.”

Let’s take a closer look at Fiserv’s businesses. Fiserv’s key “platforms” are Clover (small business payment acceptance), Carat (enterprise merchant acceptance), “strategic cores” and Finxact (core banking), as well as Optis and FirstVision (issue processing). Fiserv also owns two debit networks, STAR and Accel.

Image source: Fiserv Investor Conference 2023

Clover is Fiserv’s cloud-based point-of-sale platform designed for small and mid-sized businesses to accept payments, manage operations, and run their businesses more efficiently. First Data acquired Clover for $56 million in 2012, and unlike many similar deals, the platform thrived under its corporate ownership.

Image source: Fiserv Investor Conference 2023

“Our global point-of-sale and business management platform, Clover , includes hardware and software technology necessary to enable small business merchants to accept payments; take orders; schedule pick-up and delivery services; and provide vertical specific business management tools.”

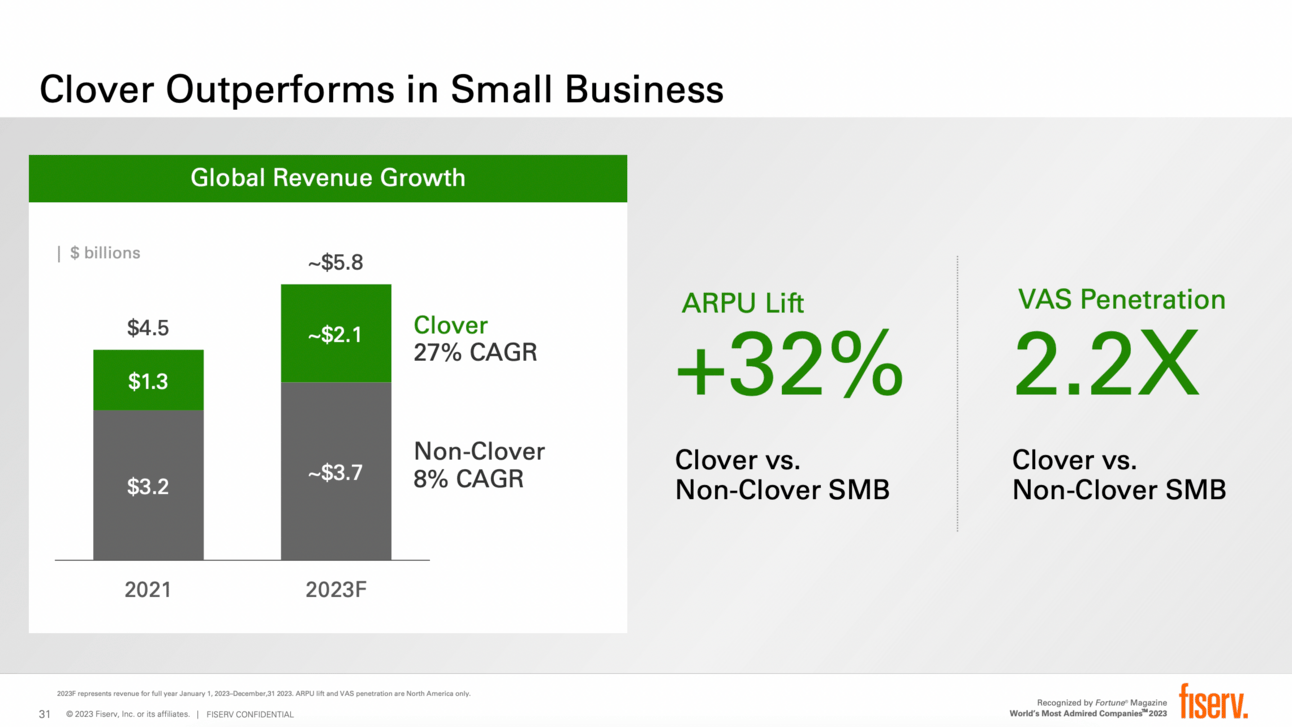

Clover represents only a portion of Fiserv’s “Small business” segment. Thus, in 2024, Clover contributed $2.7 billion or 42% of the “Small business” segment’s revenue (and 28% of the “Merchant Solutions” segment). Clover’s revenue grew 28% YoY, while the remaining segment’s revenue grew 3% YoY. It should be noted that this was partially a result of Fiserv migrating its small business merchants from legacy systems to Clover.

Image source: Fiserv Investor Conference 2023

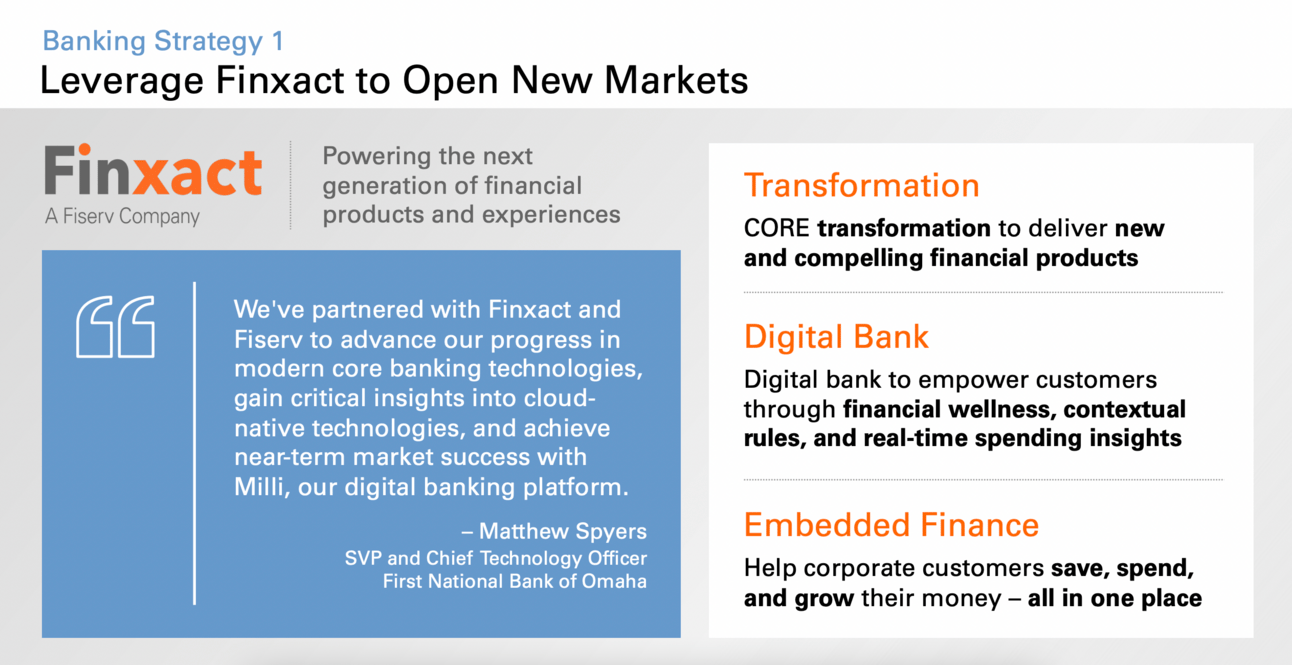

Fiserv has essentially used its customer base of thousands of financial institutions to distribute Clover to small businesses. Now, it is trying to repeat Clover’s success with CashFlow Central, an accounts receivable / accounts payable solution for small businesses. CashFlow Central is a white-labeled solution from Melio. Fiserv led Melio’s latest funding round, so if CashFlow Central proves successful, an acquisition wouldn’t be surprising.

Image source: Fiserv Investor Conference 2023

“We launched our first client on CashFlow Central in the first quarter. We've got 53 more clients to ramp on to that already in backlog and obviously continue to sell more. Again, part of that small business integrated suite that leads with Clover, can lead with CashFlow Central.”

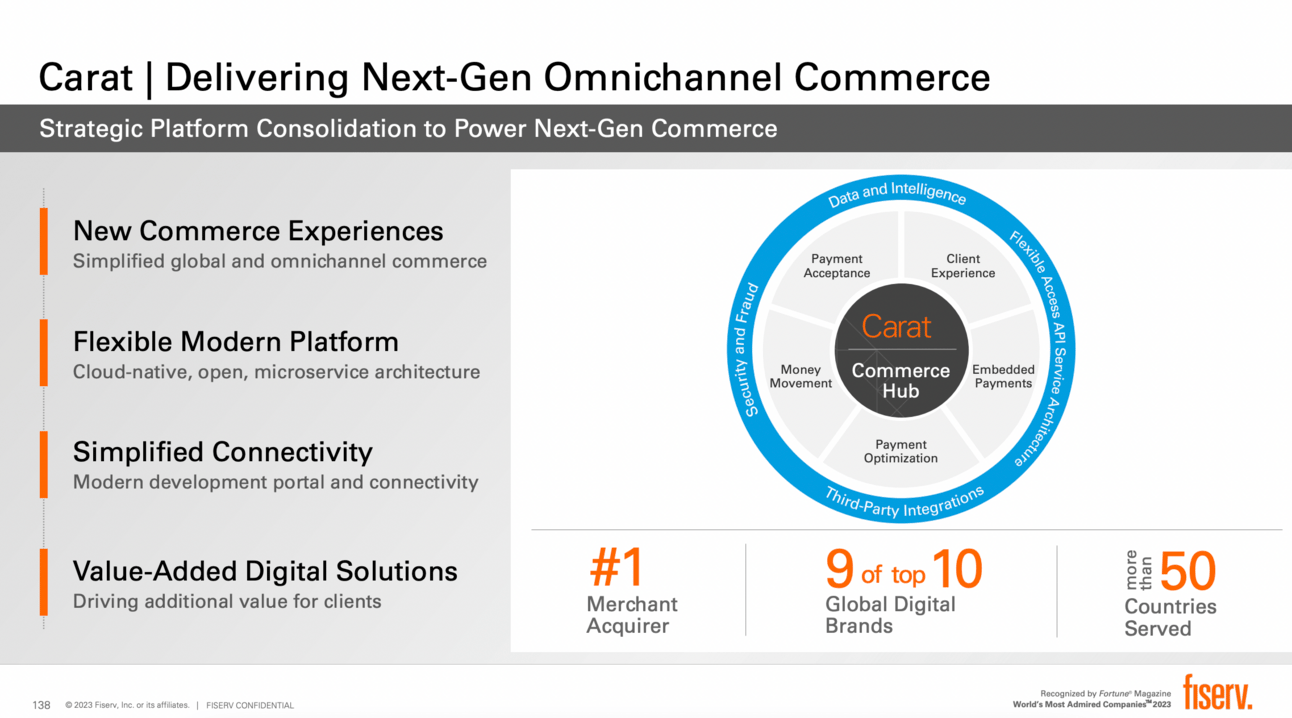

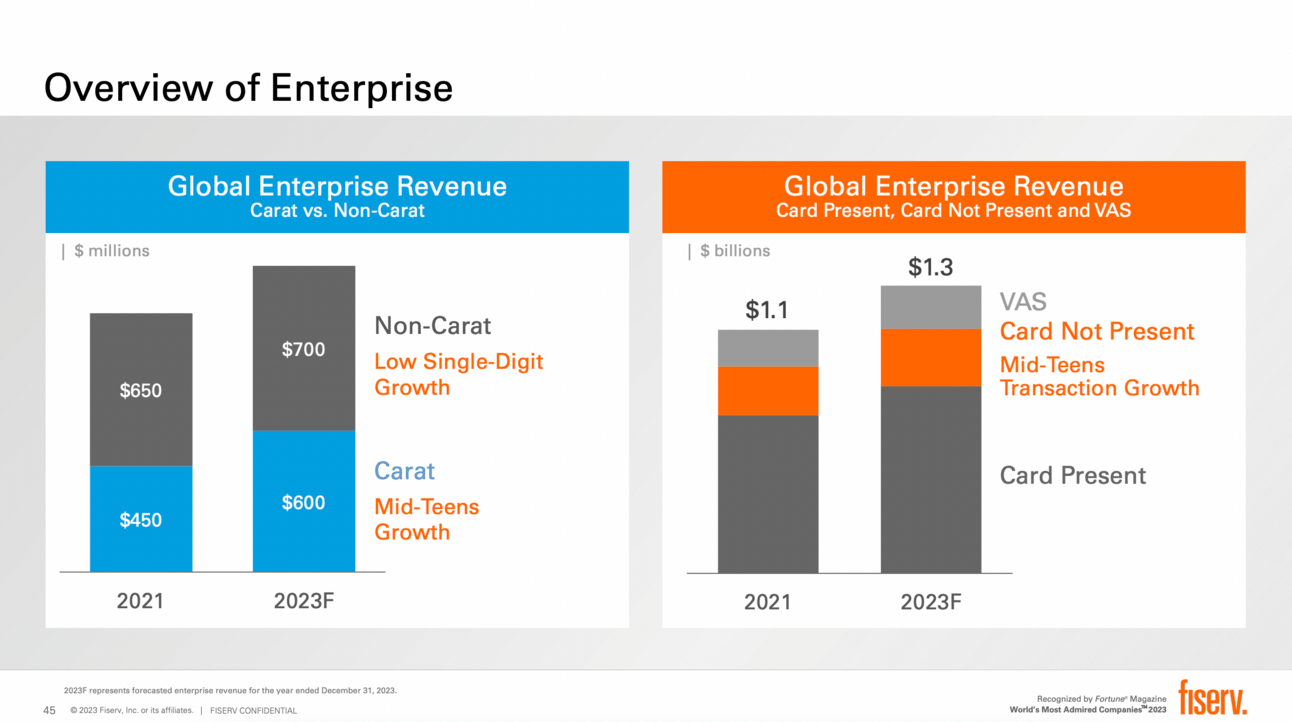

In the enterprise segment, Fiserv’s platform is Carat. My research suggests that Fiserv built a modern gateway and orchestration layer, Commerce Hub, but continues to use legacy mainframe-based processing systems, like “Nashville” and “OmniPay”, in the background. The gateway, the processing systems, and the value-added services are referred to as “Carat”.

Image source: Fiserv Investor Conference 2023

“Clients can access our enterprise services through Commerce Hub™, our next generation gateway and orchestration layer that provides full-function e-commerce, omnichannel and multiacquirer solutions that ease development effort and maintenance.”

Similar to Clover generating just a fraction of the “Small business” segment revenue, Carat generates only a fraction of the “Enterprise” segment revenue. My understanding is that the rest comes from merchants directly connected to Fiserv’s legacy systems. Please note that Fiserv’s Enterprise segment is heavily skewed to “Card Present” merchants.

Image source: Fiserv Investor Conference 2023

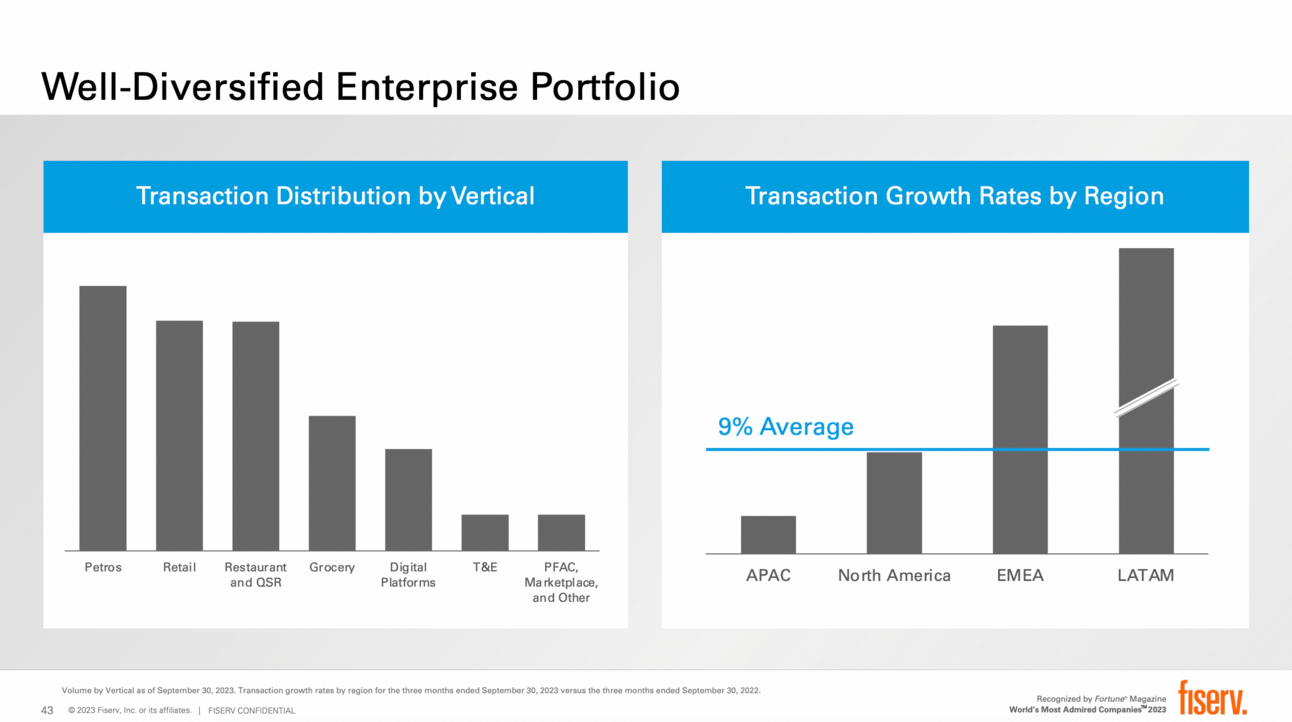

Further, Fiserv’s merchant base is dominated by petrol stations and retail customers. Fiserv’s marquee enterprise customers are Walmart and ExxonMobil. These are not the type of customers that the new generation of merchant acquirers, such as Adyen and Stripe, are going after (at least for now).

Image source: Fiserv Investor Conference 2023

Fiserv expects its “Merchant Solutions” segment revenue to reach “nearly $12 billion” by 2026, with Clover’s revenue reaching $4.5 billion. Thus, for 2025–2026, the company expects an 11% compound annual growth rate (CAGR) for its “Merchant Solutions” segment and a 29% CAGR for Clover revenue.

Image source: Fiserv Investor Conference 2023

“For Merchant Solutions, we see organic revenue growth of 12% to 15% in 2025, driven mostly by strong growth in Clover as we reach our $3.5 billion revenue target. Our ability to achieve these goals is supported by opportunities we advanced in 2024 with 5 new hardware rollouts, new features and functionality; and 3 new geographies: Brazil, Mexico and Australia.”

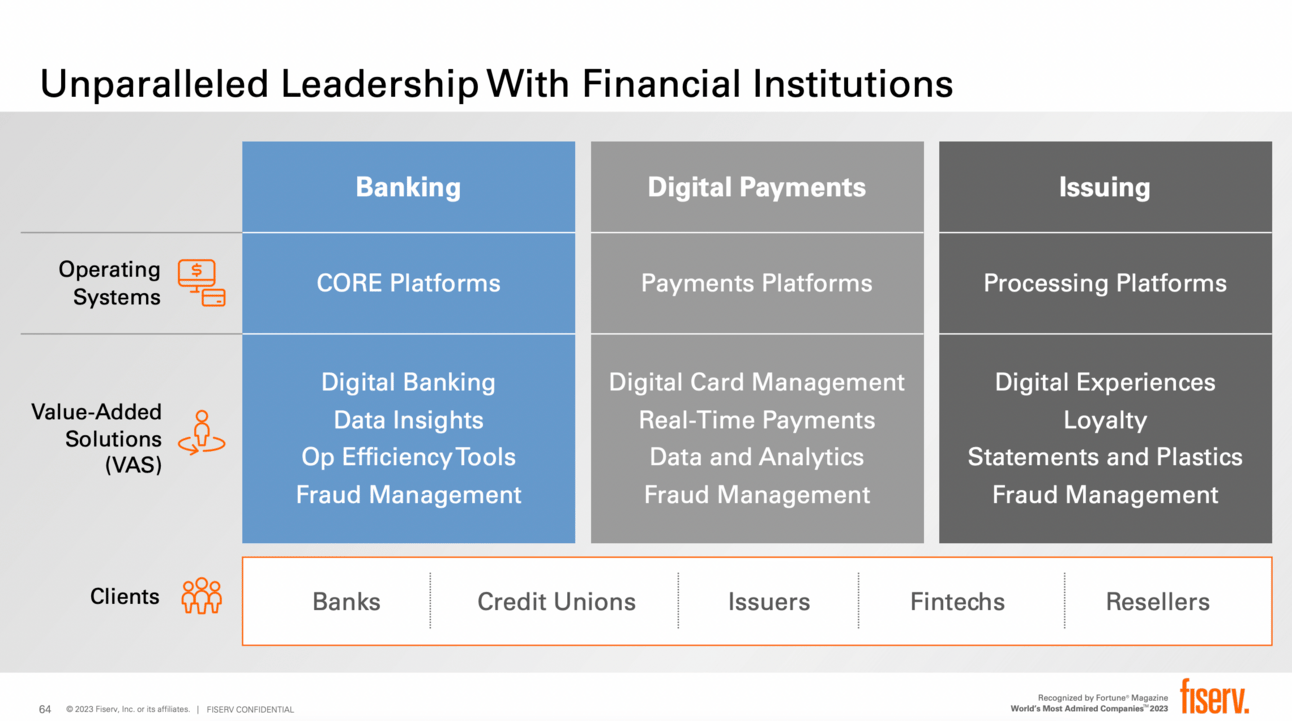

Fiserv’s “Financial Services” segment has three “sub-segments”: banking, digital payments, and issuing. The “banking” sub-segment generates revenue from Fiserv’s core banking and digital banking solutions that the company licenses to or operates on behalf of its customers.

Image source: Fiserv Investor Conference 2023

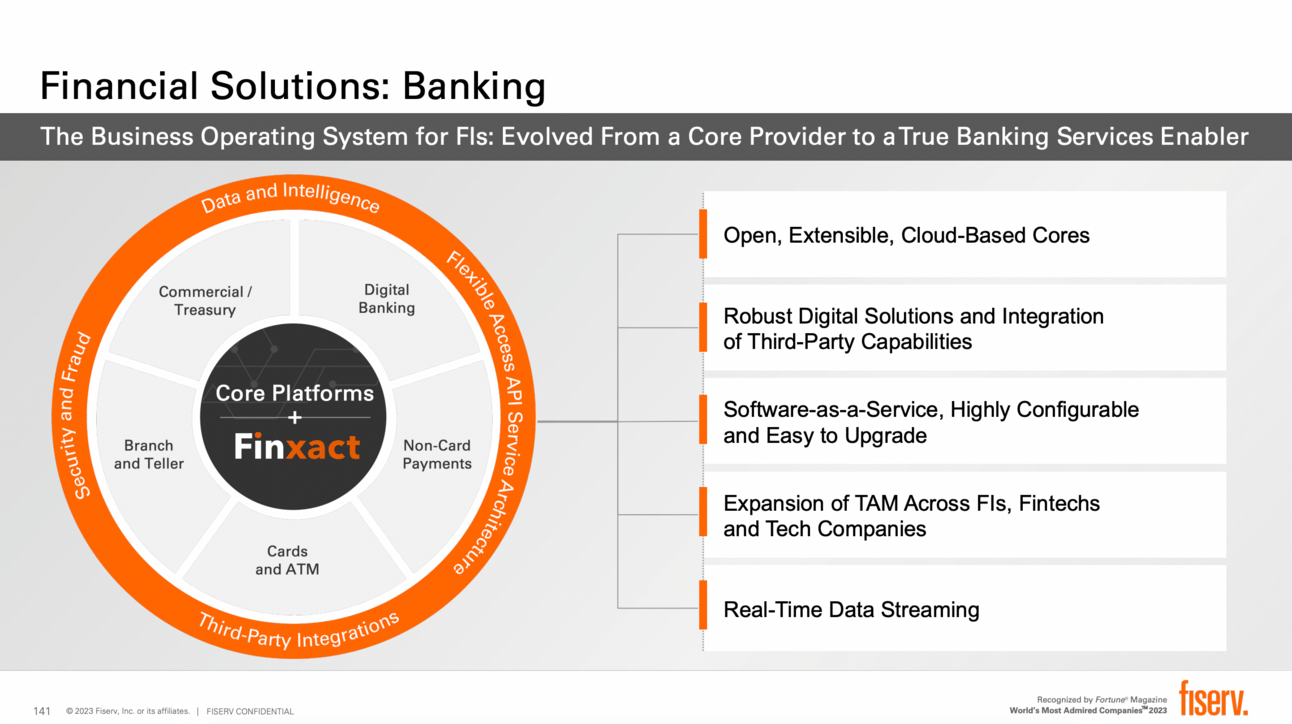

In 2013, Fiserv acquired Open Solution, adding DNA, a real-time core banking system, to its product portfolio. In 2022, Fiserv acquired Finxact, the provider of a cloud-native core banking platform that shares its name. These two platforms are essentially the “present” and the “future” of Fiserv’s core banking offering. Nonetheless, the company still operates a number of legacy platforms such as Signature, Premier, and Cleartouch.

Image source: Fiserv Investor Conference 2023

“We continue to invest in our core account processing systems, including DNA®, which today are used by over 3,200 financial institutions. Our newest “core,” Finxact, is a cloud-native system that has emerged as the most widely adopted modern core platform, according to a prominent global consulting firm.“

If you are a banker, the last thing you want to do is replace your core banking system. There are many headaches (reconnecting other systems, migrating data), while it brings little benefit to your customers. This is why the migration off the mainframes took decades (and is still not completed). Similarly, migration to the cloud will take a few more decades. Fiserv was set for the first wave of migration (DNA), and seems to be set for the next wave (Finxact).

“This Finxact momentum is clearly building. According to analysis performed by a prominent global consulting firm, Finxact has more accounts in production and clients in the U.S. than all other next-generation competitors combined.”

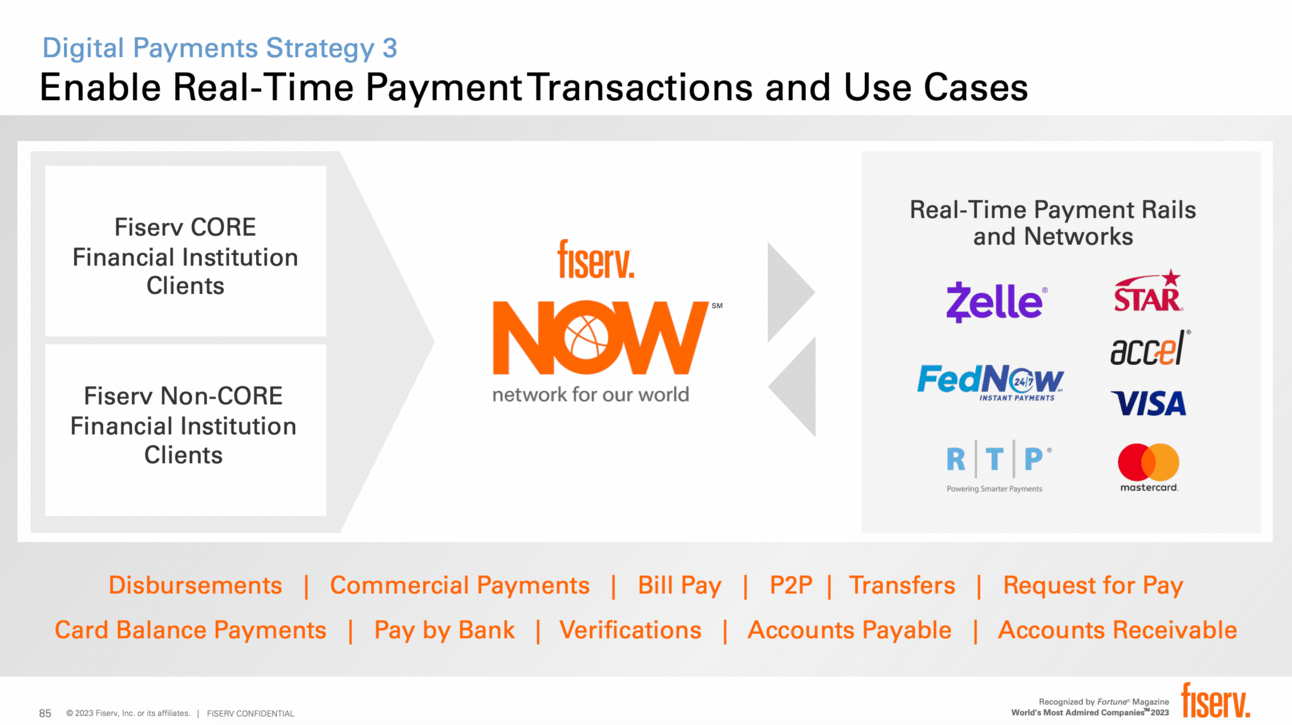

When many financial institutions use your core banking systems, it is relatively easy to upsell them on digital payment processing. Thus, Fiserv helps its customers process ACH and real-time payments, debit card payments, as well as access the Zelle peer-to-peer payments network.

Image source: Fiserv Investor Conference 2023

“We are a leading enabler of digital payment capabilities to financial institutions of all sizes, including solutions that help clients enable debit card processing services, peer-to-peer payments, account-to-account transfers, bill payment capabilities, and Automated Clearing House (“ACH”) and real-time payments.”

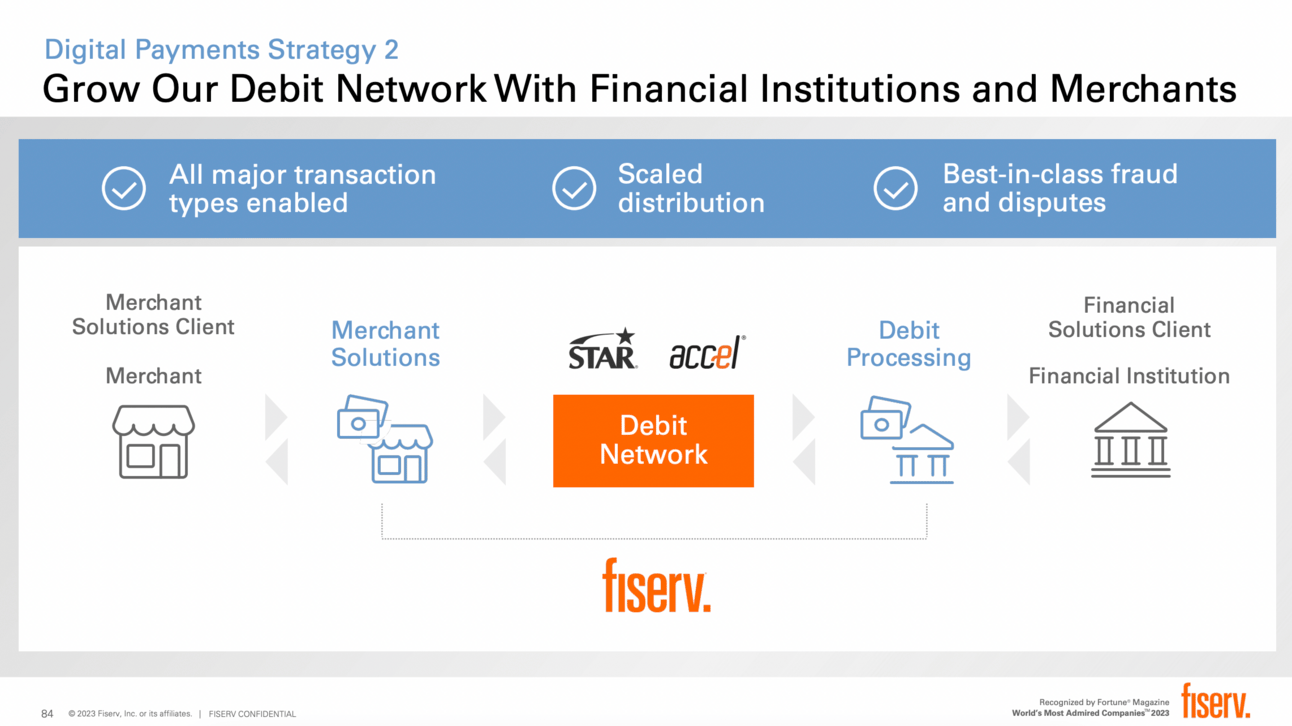

Fiserv also owns two debit card networks, STAR and Accel. Fiserv built Accel and got STAR together with First Data. Debit card issuers are required by U.S. regulation (Durbin Amendment) to support at least two unaffiliated networks to ensure merchants have routing choice. Fiserv has a solution for that.

Image source: Fiserv Investor Conference 2023

“We provide debit card processing services, which include tokenization, loyalty and reward programs; customized authorization processing; gateway processing to payment networks; ATM managed services and cash and logistics management; and risk management products.”

Fiserv and FIS are the two largest core banking providers in the U.S. Fiserv banking solutions are used by thousands of banks and credit unions. There are modern core banking providers (Thought Machine, Mambu), but it would be fair to say that they mostly serve Fintech companies and neobanks, while banks and credit unions turn to incumbent vendors.

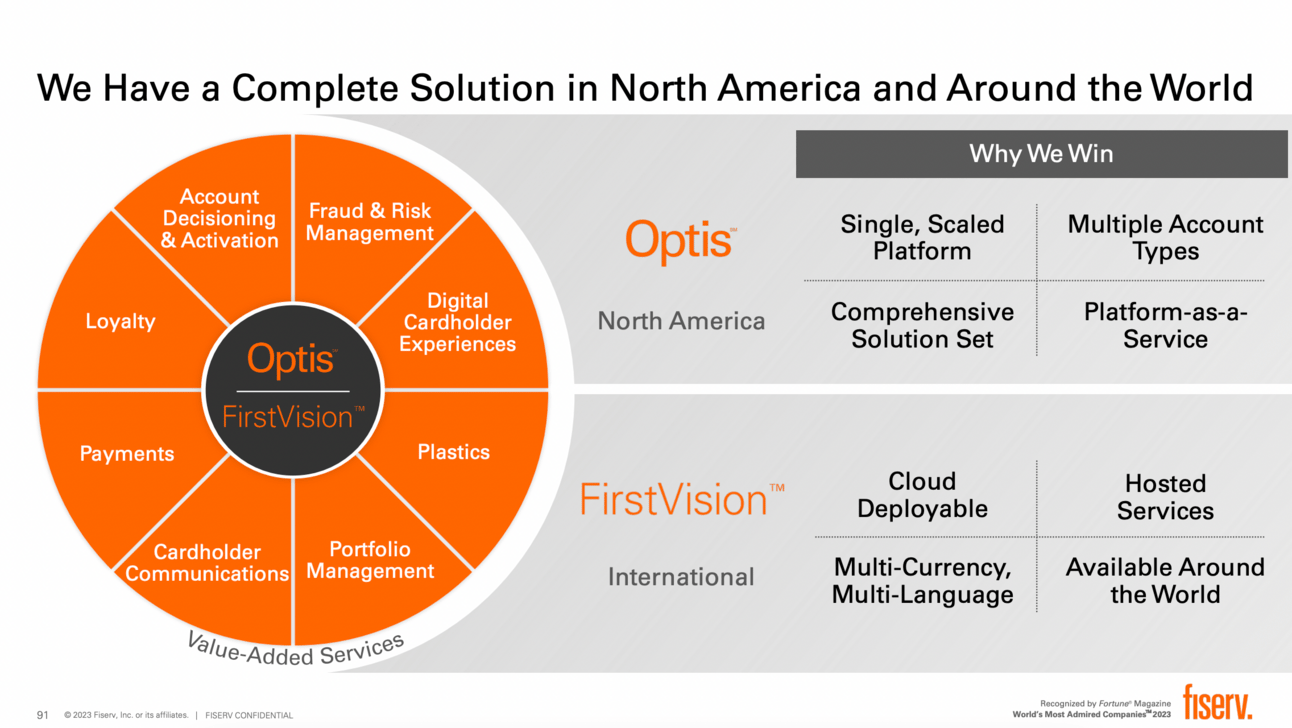

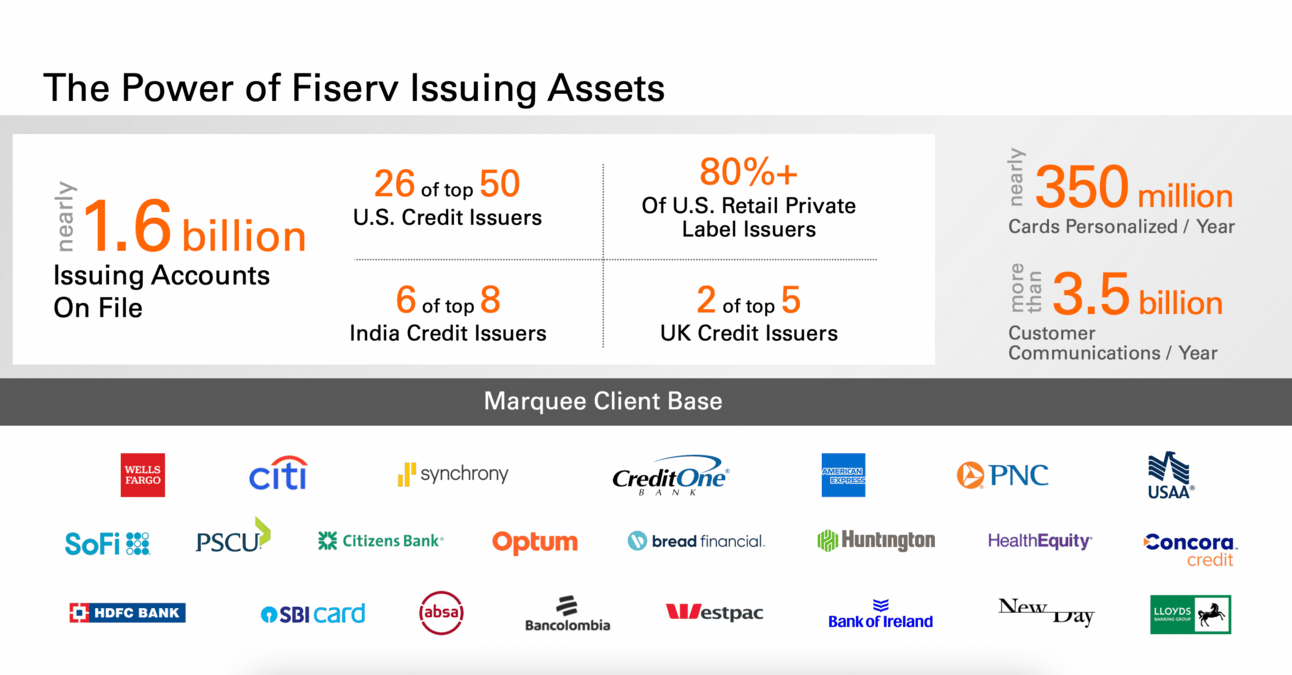

Finally, in issuing, Fiserv’s key platforms are Optis (targeted at the U.S. market) and FirstVision (targeted at the rest of the world). My research suggests that Optis is a rebranded “Omaha FDR” system, the first commercial card processor certified by Visa and Mastercard…in 1973. Fiserv is super early in migrating its issuing systems to the cloud.

Image source: Fiserv Investor Conference 2023

“Our solutions in North America primarily use our Optis platform to provide transaction authorization and posting, account maintenance and settlement. Our FirstVision and VisionPLUS products are used globally to provide transaction processing services or are licensed to enable clients to process transactions on their own.”

However, relying on mainframe-based systems hasn’t stopped the company from becoming the world’s largest issuer processor, with 1.7 billion card accounts on file. Most banks would either operate an in-house system (like Chase), or rely on a solution from Fiserv, Global Payments’ TSYS, or FIS (more on that later).

Image source: Fiserv Investor Conference 2023

“These early renewals and multiyear extensions are a testament to the strength of our relationships, offerings and product road map and the direct result of our prior and planned investments. With over 1.7 billion accounts on file, we are now nearly twice as large as our closest competitor.”

Now let’s discuss competition, and in particular, if Fiserv faces any disruption to its businesses that might negatively impact its future growth.

Let’s start with…Global Payments and FIS deal. Global Payments and FIS recently announced a transaction where Global Payments will acquire Worldpay from FIS and GTCR, while FIS will take over Global Payments’ issuing business (TSYS).

The FIS and Global Payments deal will turn FIS into an even bigger competitor for Fiserv’s issuing business. As noted earlier, FIS is already Fiserv’s largest competitor in the banking and payments businesses. Thus, Fiserv’s “Financial Solutions” segment will face competition primarily from FIS.

Last week, I wrote about Marqeta and why I believe it has a bright future. I also pointed out that winning big banks from Fiserv and TSYS is years ahead. Marqeta will continue to dominate the Fintech sector, and I expect them to start winning new co-brand programs. However, it is fair to say that Fiserv’s issuing business is safe, at least for now. Fiserv and FIS/TSYS will continue competing with each other, but disruption from new generation processors is years away.

Similarly, I don’t expect disruption to Fiserv’s banking (and payments) businesses. As noted earlier, replacement of core banking systems is a multi-decade process, and so far, there are no signs that Fiserv (or FIS) would be losing customers due to this process. Again, Fiserv and FIS will continue competing with each other, with limited disruption from new generation core banking providers.

Image source: FIS Investor Day 2023

“We do think we'll eventually penetrate the bank business, but that's many years away. So embedded finance is sort of the next big growth wave for us.”

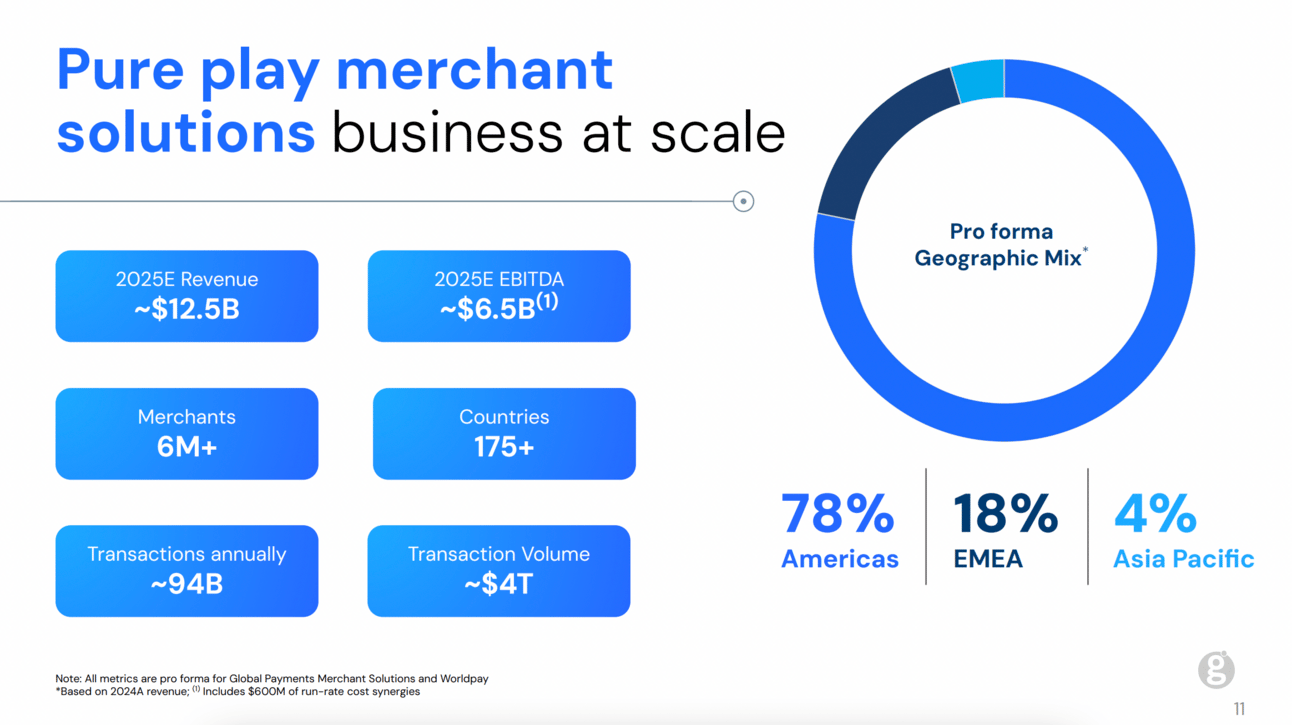

The FIS and Global Payments deal will also create a larger competitor to Fiserv’s “Merchant Solutions” business. Thus, the combination of Global Payments and Worldpay will create a merchant acquirer equal to Fiserv in size and segment span. Global Payments brings small business capabilities, while Worldpay brings an enterprise footprint.

“Bringing together Global Payments' differentiated merchant solutions focused on SMB customers with Worldpay's world-class capabilities for e-commerce and enterprise clients positions the combined business to deliver end-to-end payment solutions for leading customer experiences for merchants of all types and sizes globally.”

The deal most likely doesn't change much for Fiserv’s “Small business” segment (Global Payments was a competitor and will remain a competitor). There could be, however, an impact on its “Enterprise” (and “Processing”) segments. Worldpay was underinvested under FIS ownership, and Global Payments will try to revive its growth.

However, as noted earlier, I don’t see much of a disruption from the new generation of acquirers such as Adyen and Stripe. Worldpay might be interested in competing for Fiserv’s clients, but I wouldn’t expect such interest from Adyen and Stripe (at least, until they have more room for growth in online and omnichannel commerce).

Image source: Global Payments

And this, finally, brings me to the “Small business” segment, and in particular, Clover. So far, Clover has managed to successfully compete. As shown in the chart, Clover has been growing revenue at around 30%, significantly outpacing its main competitor, Square, which has been growing at about 10%.

Clover is a modern POS solution and matches the capabilities of its competitors. Moreover, Fiserv put its distribution muscle to work (the thousands of financial institutions it serves across all its segments). Clover has clearly thrived under Fiserv’s leadership, the kind of corporate acquisition success most companies hope for, but few actually achieve.

“Our bank channel, 1,000 banks have chosen to sign up with us to help us distribute Clover and our merchant solutions. We have a tremendous ISO partnership. We have a, quite honestly, still relatively new and growing direct channel.”

However, in Q1 2025, Clover’s payment volume decelerated to 8%. The company’s management explained that Clover still achieved its revenue growth target, and the deceleration of payment volume growth was mostly due to difficult comps. However, the stock market reaction suggests that investors started questioning whether Clover can continue its crusade.

“We remain confident in delivering on the $3.5 billion of revenue by the end of the year. First quarter was in line with our expectations, 27% in the quarter gets us in the right path to deliver on that $3.5 billion and what we see in terms of international expansion.”

Investors might be right in questioning if Fiserv can sustain its growth rate. After all, Clover's growth heavily relies on international expansion. Thus, the company launched Clover in Brazil, Australia, Mexico, and Singapore. However, Fiserv distribution is much weaker outside of the U.S. And, for instance, Brazil is probably one of the most competitive markets when it comes to merchant acceptance. Brazil has Stone, PagBank, Mercado Pago, as well as bank-owned Rede, Getnet, and Cielo.

“Brazil will add good growth for us. and I think it is going to be a tremendous capability for us over time. And same with Australia, same with Mexico, same with Singapore, 4 of the 5 countries, all launched in some fashion in the first quarter.”

Moreover, Clover’s main competitor, Square, is becoming more aggressive in an attempt to accelerate growth. Thus, the company started hiring salespeople, partnering with ISOs, and spending more on marketing. It is also accelerating its product development velocity after years of work on improving system stability.

Image source: Square

“Square may have stumbled, but you never count them out. I'm not going to bet against Jack. I'm going to compete with them.”

I believe investor concerns about Clover’s growth are legitimate, but we have yet to see what really happens. However, even if Clover’s growth decelerates…it is not the end of the world Fiserv!

As I pointed out, 2/3s of Fiserv’s revenue faces hardly any risk of disruption. It’s a bit of oversimplification, but Fiserv has one major competitor in the “Financial Solutions” (FIS) and very few in the Enterprise segment of “Merchant Solutions”.

However, the company definitely has many opportunities to further cut costs and improve operating efficiency, given the number of legacy systems it operates at the moment. And it will, most likely, continue buying back its stock, supporting growth in EPS.

So maybe, as a resume, perhaps, Fiserv will not be able to deliver a 14-18% EPS growth going forward. If Clover growth decelerates, it would be more like 10-14%. But this growth is hardly challenged in the short term. There’s literally nobody disrupting the largest part of Fiserv’s empire. Thus, the only question is…”How much should the market pay for such growth?”

Cover image source: Fiserv

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.