Hi!

US markets were closed yesterday, so I used the opportunity to take a break from the news and take a look at the performance of Fintech stocks this year. Fintech stocks are rallying this year with Upstart, Shopify, and Nubank leading the pack in terms of the year-to-date performance.

So far so good, but…could it be a “Sell in May and Go Away” kind of situation?

Thank you for reading and see you tomorrow!

Jevgenijs

p.s. I excluded the stocks of miners from this list (they did even better)

Please help me spread the word about the “Popular Fintech” newsletter 👇🏻

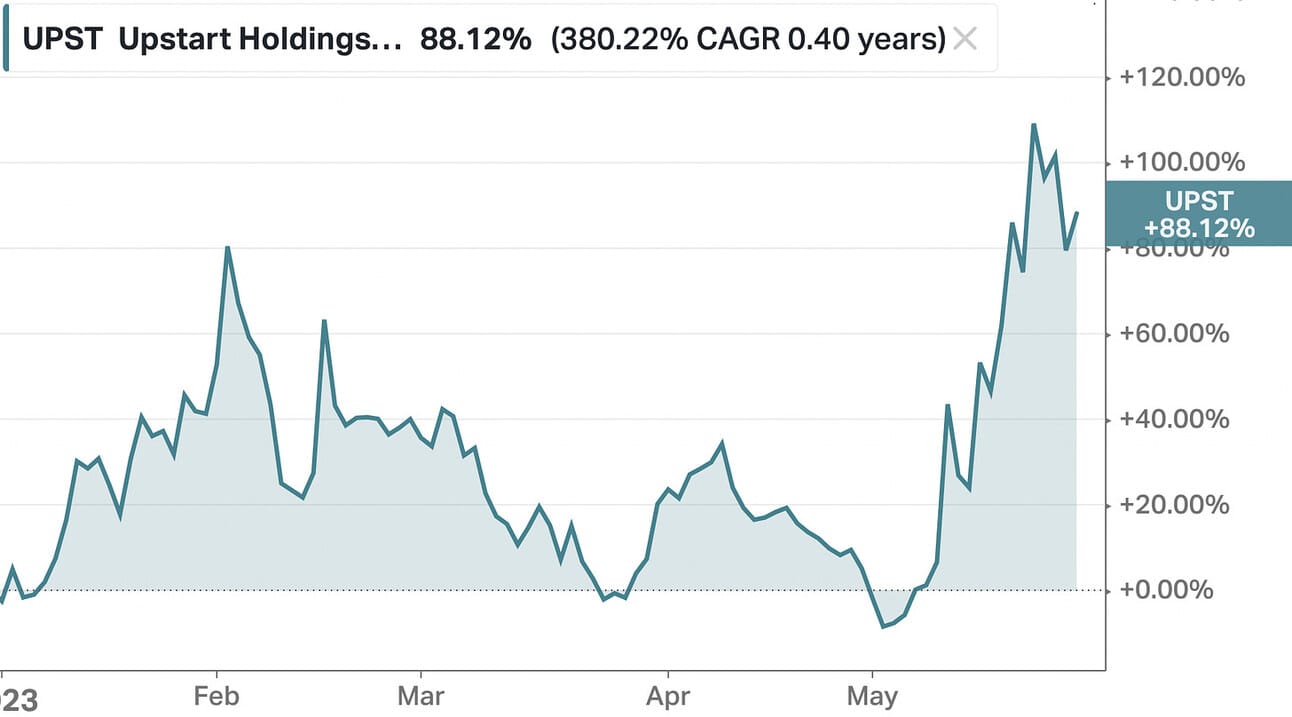

Upstart (NASDAQ: UPST)

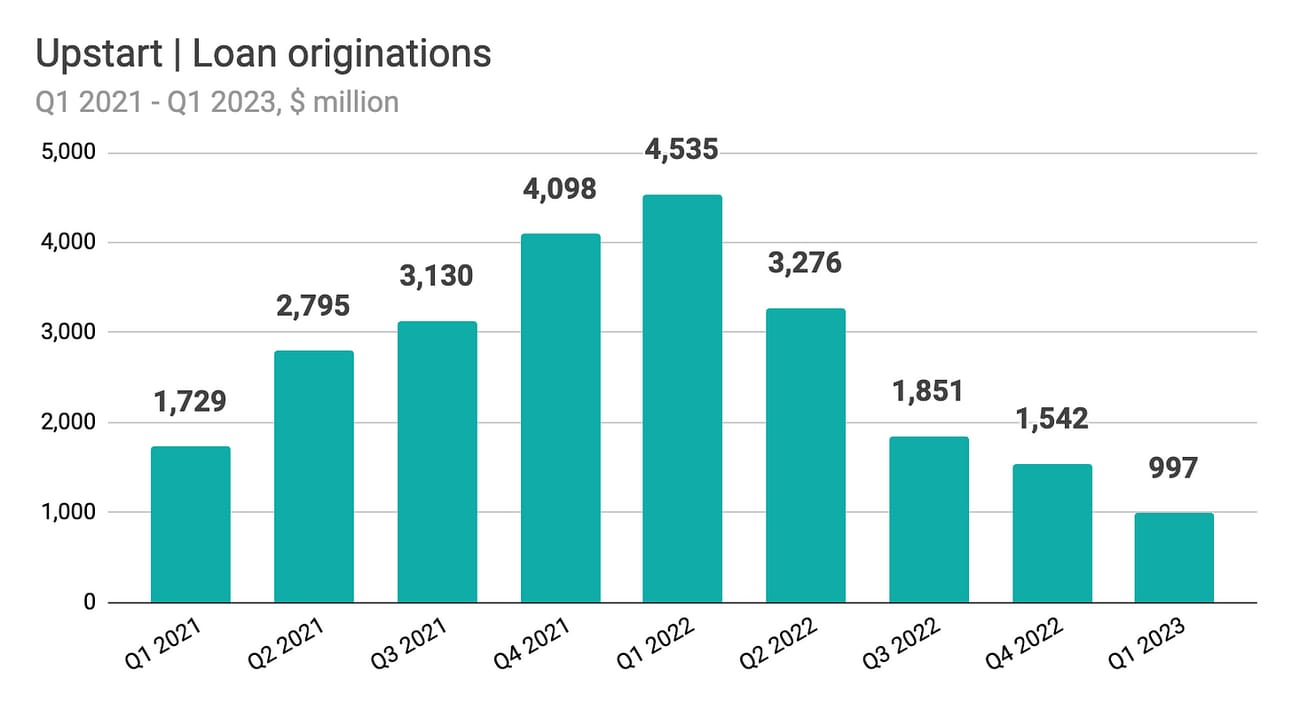

The Fintech lender Upstart (NASDAQ: UPST) is leading the pack of the best-performing Fintech stocks this year. The stock was left for dead last year, as investor demand for subprime loans evaporated and the company’s loan originations plummeted. Upstart relies on third-party investors to fund its loans, and generates most of its revenue from origination and servicing fees.

In the first quarter of 2023, Upstart’s loan originations were down 78% from $4.54 billion a year ago. Total revenue declined 67% YoY to $103 million, and the company reported a net loss of $129.3 million, compared to a net income of $32.7 million a year ago. Adjusted EBITDA was negative $31.1 million, compared to a positive Adjusted EBITDA of $62.6 million in the prior year.

Nevertheless, after executing a series of layoffs, Upstart guided for improved profitability, as well as announced securing a number of long-term funding commitments. For instance, Castlelake LP, a global alternative investment firm with approximately $20 billion in assets under management, agreed to acquire consumer installment loans worth up to $4 billion.

Castlelake will purchase an existing portfolio of loans that Upstart has already originated and will invest in future loan origination through a forward-flow agreement. Funding commitments are expected to help Upstart boost its origination volumes, as the company doesn’t see a lack of demand. For the full year 2023, analysts now expect Upstart to report $544 million in revenue and a negative EPS of $2.70.

✔️ Upstart Announces First Quarter 2023 Results

✔️ Upstart stock soars 40% after earnings outlook positively surprises

✔️ Private Credit Shop Castlelake Joins Consumer-Debt Push

✔️ AI lending fintech Upstart to lay off 20% of workforce

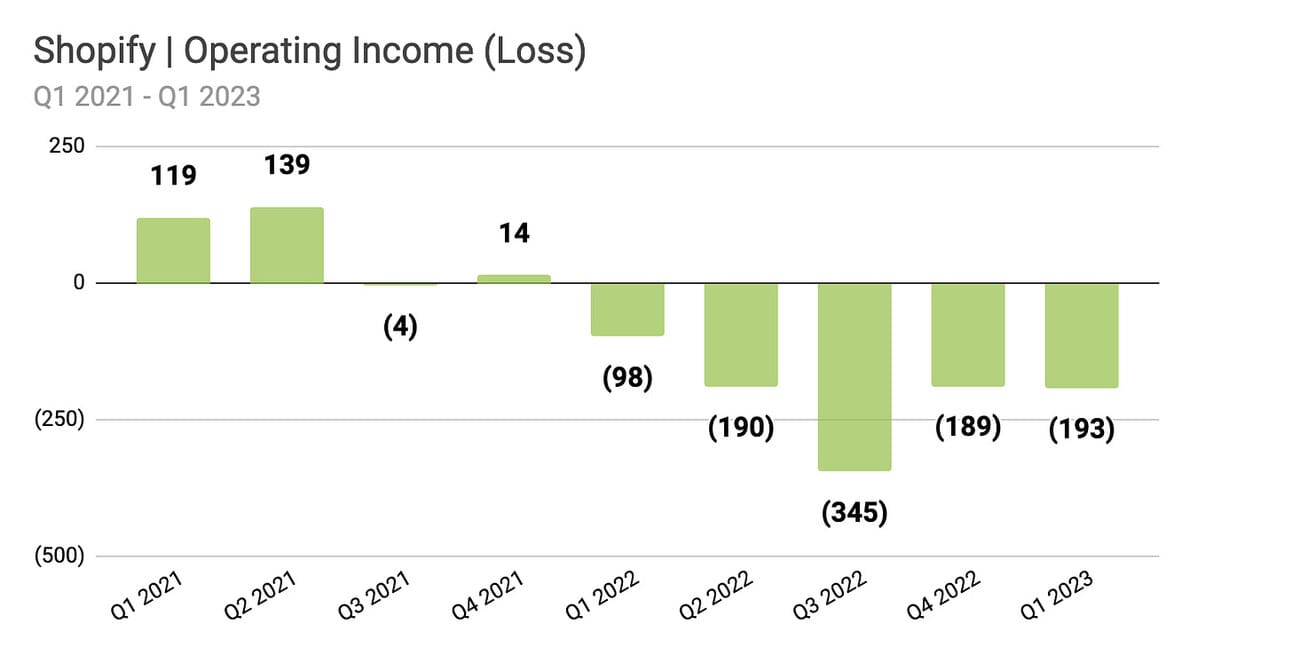

Shopify (NYSE: SHOP)

When Shopify (NYSE: SHOP) rescheduled its first quarter earnings call, it became apparent that the company intends to make an important announcement. Thus, Shopify announced that it entered into a definitive agreement to sell its logistics business, also known as “Shopify Fulfillment Network”, ”including the people, technology, and services related to these operations” to Flexport.

As per the terms of the transaction, Shopify will receive a 13% equity stake in the company, and Flexport will become the official logistics partner for Shopify. As a result of the transaction, Shopify will lay off 20% of its workforce, which is the second round of layoffs after the company reduced its global workforce by 10% last year.

Investors clearly welcomed the sale (and I’d assume, the layoffs), so the stock rallied after the announcement. Following the sale, Shopify will generate most of its revenue from payment processing and software subscription fees, which it reports under the Merchant Solutions and Subscription Solutions segments respectively.

In the first quarter of 2023, the company’s total revenue increased 25% YoY to $1.5 billion. Merchant Solutions revenue increased 31% YoY to $1.1 billion, and Subscription Solutions revenue increased 11% YoY to $382 million. For the full year 2023, analysts expect $6.7 billion in revenue and a negative EPS of $0.34.

✔️ Shopify Announces First-Quarter 2023 Financial Results

✔️ Shopify Cuts Jobs Again, Sells Most of Logistics Business to Flexport

✔️ Shopify to Lay Off 20% of Its Workforce as It Sells Logistics Business to Flexport

✔️ Shopify’s stock heads for best day yet as company gets set for ‘significant pivot’

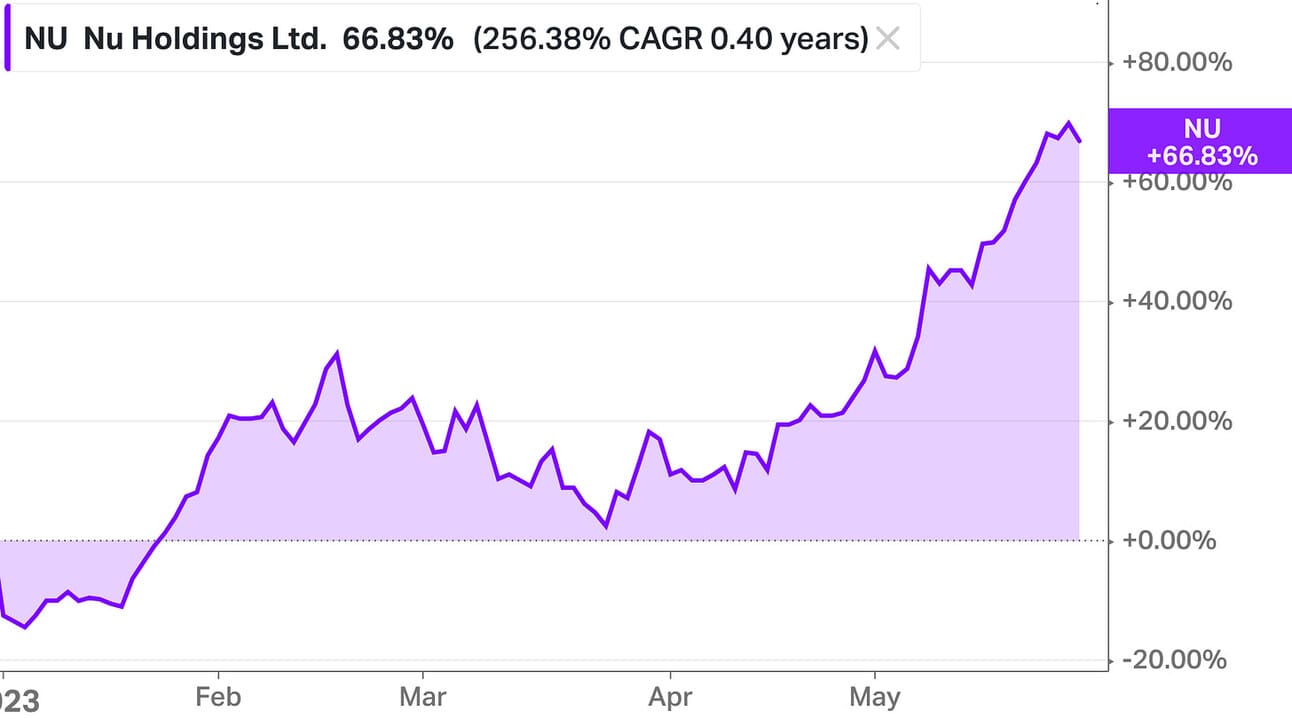

Nubank (NYSE: NU)

Nubank (NYSE: NU), the world’s largest neobank that boasts Berkshire Hathaway among its investors, is defying the macro environment challenges and continues to grow at a breakneck speed. Thus, in the first quarter of 2023, the company’s gross revenue increased 85% YoY to $1.62 billion, driven by a 103% YoY growth in interest income, and a 41% YoY growth in commission income.

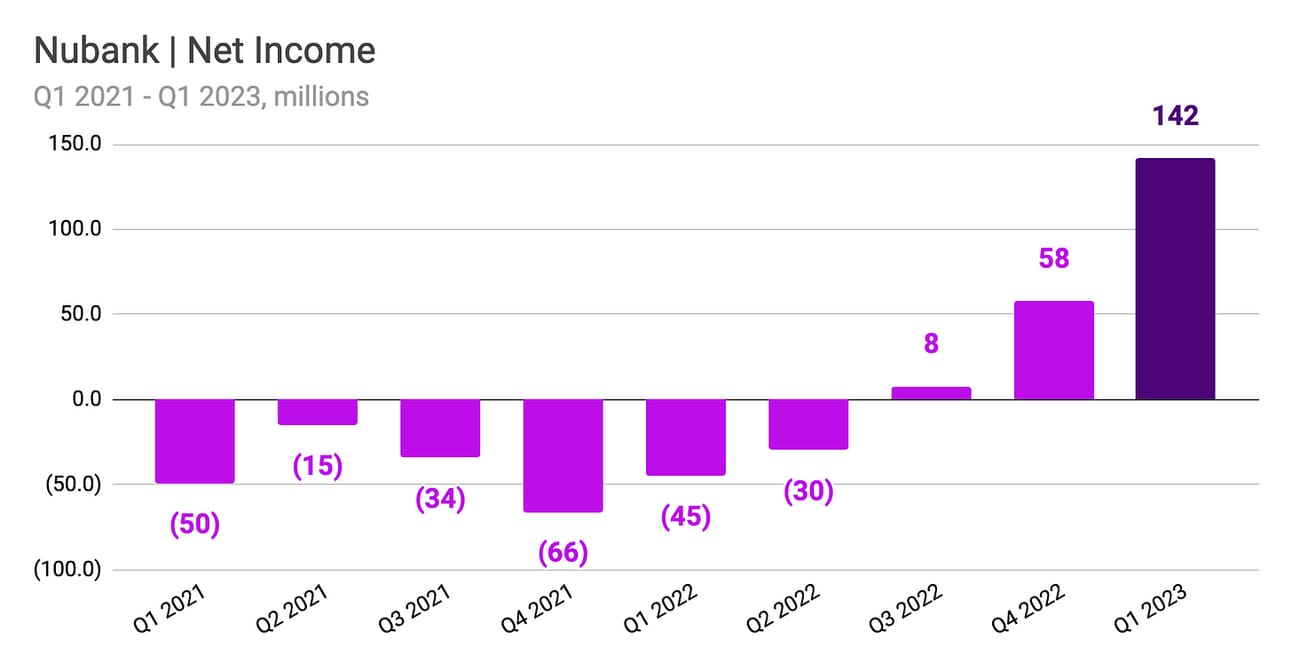

The company’s loan portfolio increased 54% YoY to $12.8 billion, and deposits increased 25% YoY to $15.8 billion. Net income for the quarter was $141.8 million, compared to a net loss of $44.6 million a year ago. Nubank added 4.5 million customers, finishing the quarter with 79.1 million customers across Brazil, Mexico, and Colombia.

During the company’s earnings call, David Vélez, the company’s co-founder and CEO, pointed out “a tremendous opportunity for growth” that the company sees outside of its home market, Brazil. The company raised $330 million for expanding its operations in Mexico, and $150 million to support growth in Colombia, and thus far, sees faster growth in its new markets compared to its early days of operating in Brazil.

In the first quarter, Nubank’s customer base in Mexico increased 52% YoY to 3.2 million, and the company claims to be the largest credit card issuer in the country. For the full year 2023, analysts expect the company to generate $7.35 billion in revenue and report an EPS of $0.11.

✔️ Nubank reaches the milestone of 80 million customers in Latin America

✔️ Nu Mexico celebrates four years and is now one of the largest issuers of credit cards in the country

✔️ Nu Holdings Ltd. Reports First Quarter 2023 Financial Results

✔️ Buffett-backed Nubank reports record revenue on steady user growth

Principal Product Manager, Lending Partnerships

@ Upstart

🇺🇸 Remote, United StatesManager, Machine Learning

@ Upstart

🇺🇸 Remote, United StatesSenior Marketing Lead, Japan

@ Shopify

🇯🇵 Remote, AsiaChannel Marketing Manager

@ Shopify

🇺🇸 Remote, AmericasTech Manager

@ Nubank

🇧🇷 Sao Paulo, Brazil

Cover image: Upstart

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.