Hey!

PayPal spent $5.3 billion to acquire Zettle, Hyperwallet, and Paidy businesses, and now hardly mentions them on the earnings calls or in the company’s filings with the SEC. However, these businesses contributed around 10% of the company’s total payment volume in the last twelve months.

Out of curiosity, I decided to learn more about these businesses and realized that Zettle and Hyperwallet perfectly fit PayPal’s digital and omnichannel ambitions. These businesses give PayPal the tools to compete with Stripe and Adyen, and, at least one of them, is growing really fast. Thus, I think we might start hearing more about them. And maybe, the $5.3 billion will eventually turn into money well spent.

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

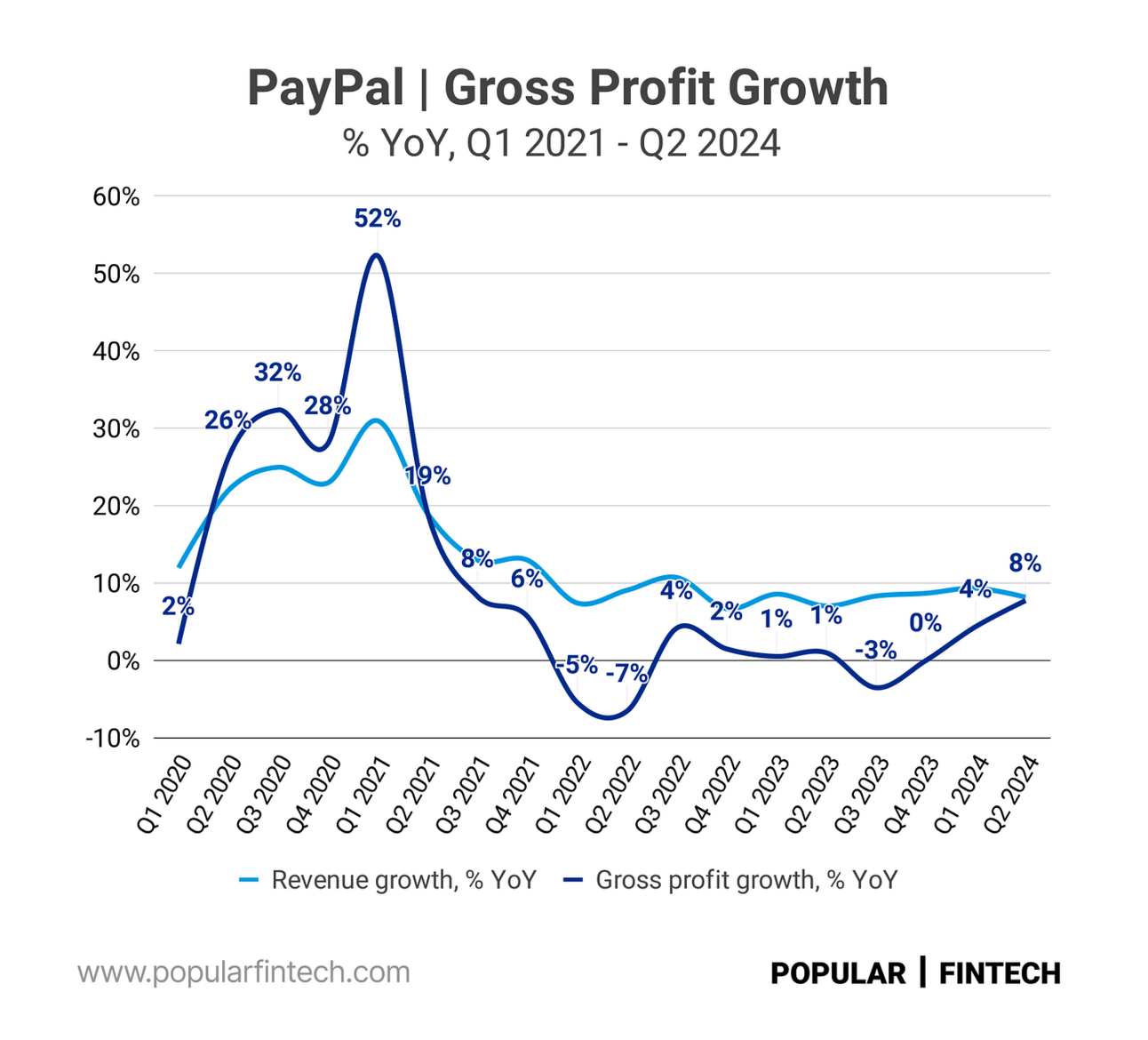

As you might have noticed, I am closely following PayPal’s story and remain cautiously optimistic about the company’s prospects. At the end of July, the company reported its Q2 2024 results, and one of the highlights was the acceleration of gross profit growth (PayPal reports gross profit as “transaction margin dollars”).

One of the reasons for gross profit growth acceleration was PayPal repricing Braintree’s processing services, “willing to accept a lower share of revenue in exchange for a higher margin contract.” Under previous leadership, Braintree delivered impressive payment volume growth, but, it looks like this growth was only marginally (if at all) contributing to gross profit.

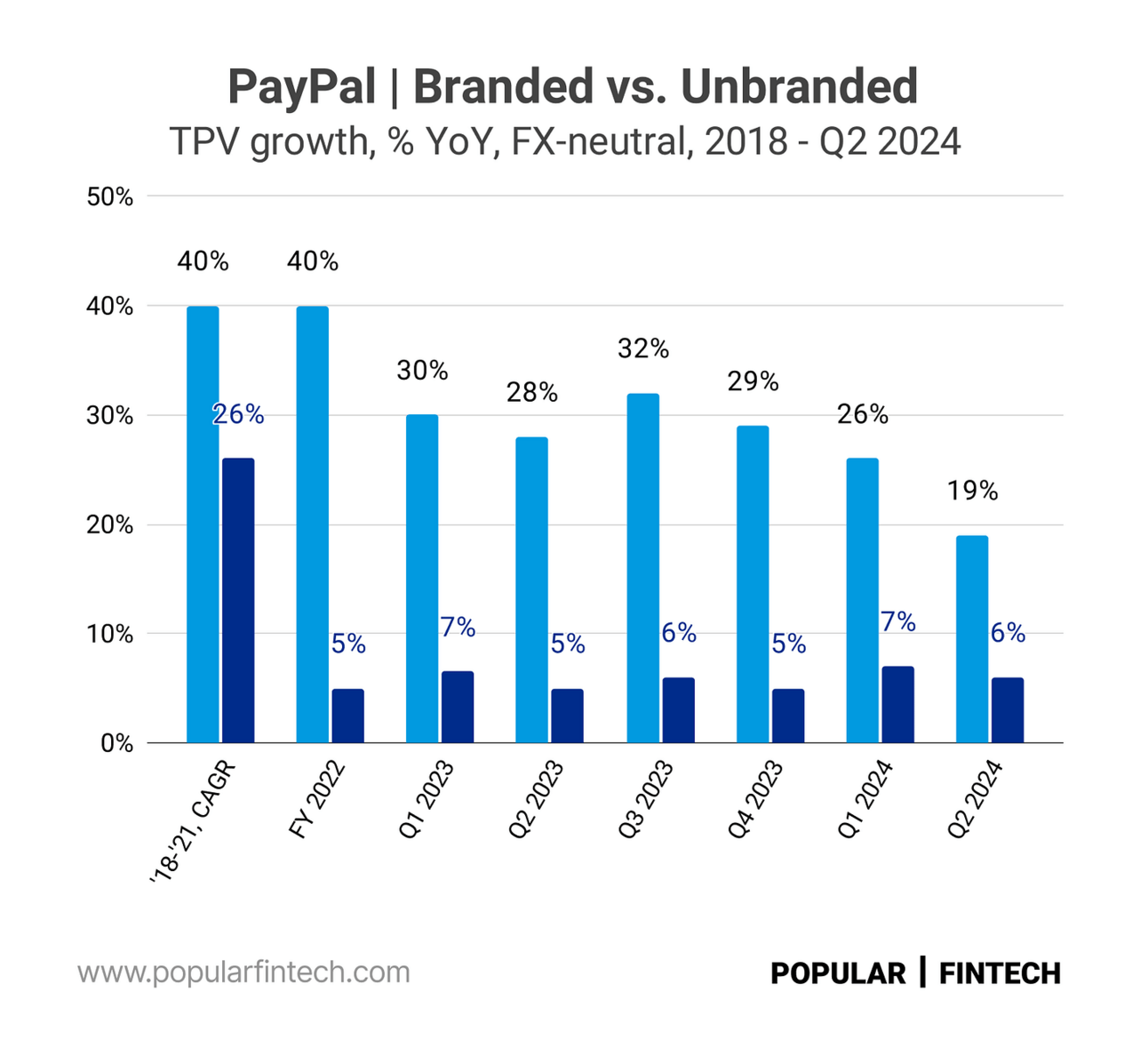

Braintree’s payment volume growth slowed down from 28% YoY in Q2 2023 to 19% YoY in Q2 2024 (see “Unbranded” on the chart below), and we are yet to see if PayPal manages to maintain this growth level with new pricing. However, this is still impressive growth, and the stock price reaction suggests that investors were fine with this tradeoff.

“Branded checkout continues to grow profitably. Braintree is now meaningfully contributing to transaction margin dollar growth for the first time in over 2 years. Venmo momentum continues to build and monthly active accounts increased across both PayPal and Venmo.”

Alex Chriss, PayPal Q2 2024 earnings call

So PayPal’s new leadership addressed the most pressing concern, Braintree’s profitability. At the same time, Branded checkout volume (the “PayPal button”), which is the company’s core profitability driver, continues to consistently grow in single digits, suggesting that Apple might not be that good at “stealing PayPal’s launch”.

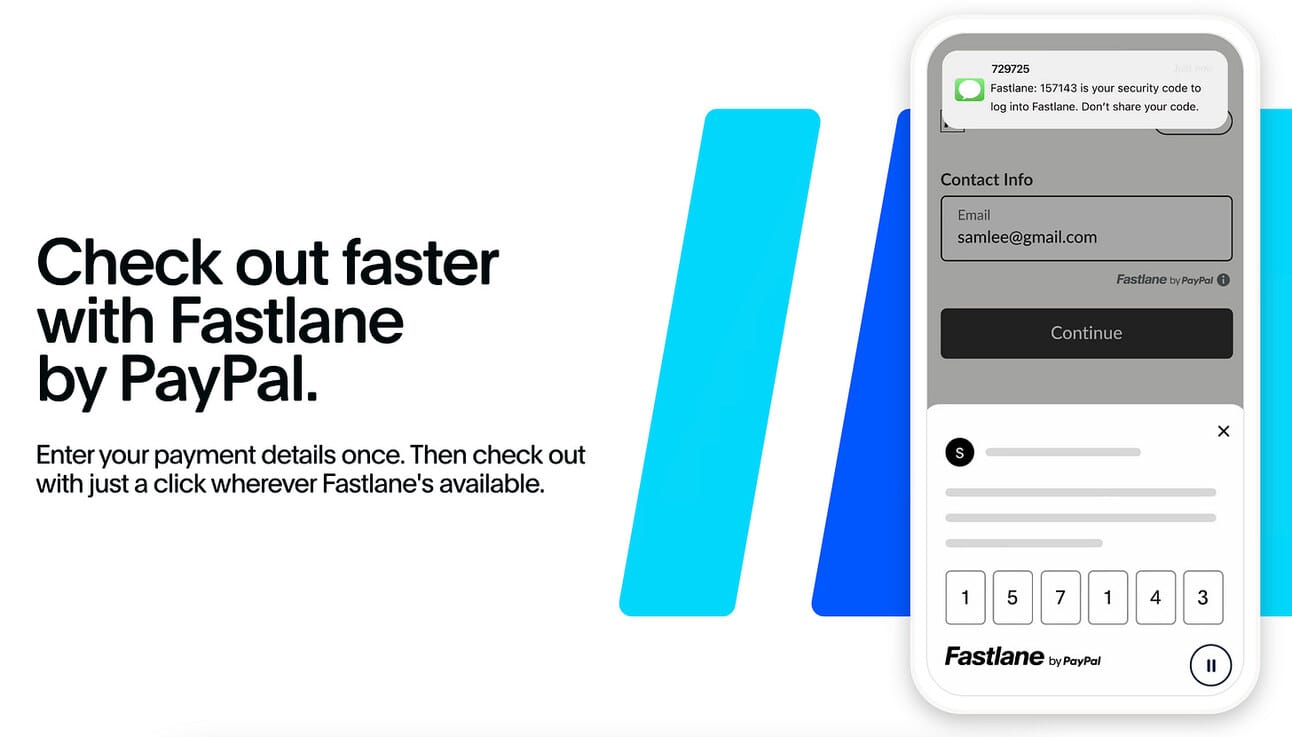

PayPal also rolled out Fastlane, its accelerated checkout solution, to all U.S. merchants to compete with Shopify’s Shop Pay and Stripe’s Link. And it even partnered with Adyen to distribute Fastlane and reach more merchants (I certainly didn’t see this coming). In short, things are certainly improving and improving fast.

“Adyen will offer Fastlane by PayPal to accelerate guest checkout flows for its enterprise and marketplace customers in the U.S., with plans to extend this offering globally in the future. Together, the companies expect Fastlane by PayPal to improve consumer shopping experiences and enhance conversion for businesses leveraging Adyen's platform.”

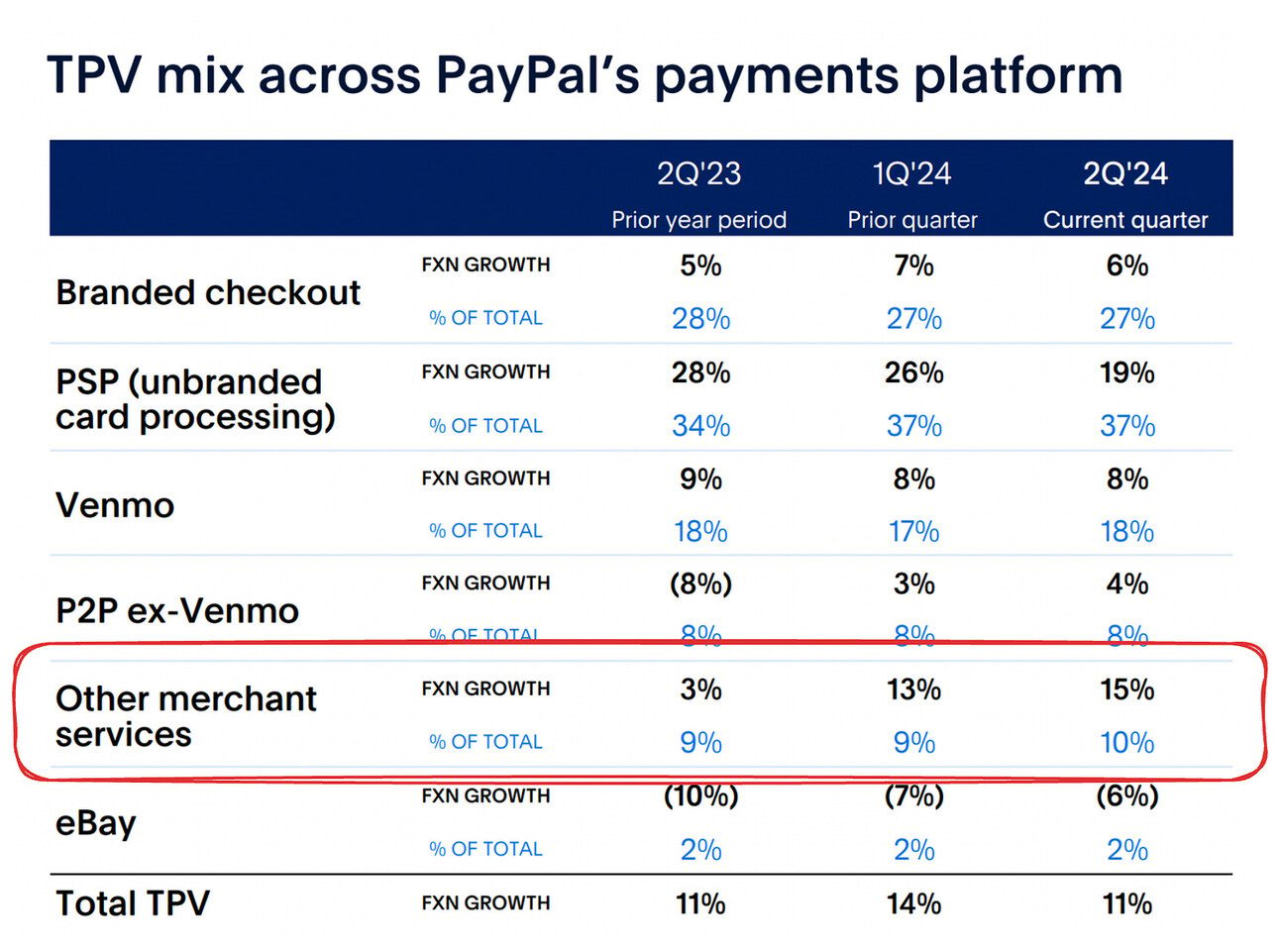

So today I wanted to focus on “Other merchant services”, which PayPal management rarely talks about. Thus, in Q2 2024, “Other merchant services” contributed 10% of the company’s Total Payment Volume. In absolute terms, that’s $41.7 billion in payment volume in Q2 2024, and approximately $150 billion in the last 12 months. “Other merchant services” TPV also grew 15% YoY on a currency-neutral business.

The “Definitions” page of the earnings presentation sheds light on what is included in this volume: “Other merchant services TPV includes volumes associated with invoicing, Paidy, payouts (including Hyperwallet), point-of-sale solutions (including Zettle), QR code, etc.” You rarely hear Zettle, Paidy or Hyperwallet mentioned on the earnings calls.

In the process of my research, I realized that there are $5.3 billion in acquisitions under the line “Other merchant services”. This includes the $2.2 billion that PayPal paid for iZettle (2018), a Swedish competitor to Square; the $400 million that PayPal paid for Hyperwallet (2018), a payouts solution; and the $2.7 billion that PayPal paid for Plaidy (2021), a Japanese BNPL lender.

Zettle (which was called iZettle at the time of the acquisition) “offers a card acceptance service that enables small businesses to take credit and debit card payments, as well as a software solution to record, manage and analyze sales.” It’s essentially Square or Clover equivalent. The company operates in 13 countries, including the U.S, the U.K., France, Germany, Italy, Brazil and Mexico. For some reason, it took PayPal 3 years to bring Zettle to the U.S. market.

“We believe that our recent acquisition of iZettle will enable us to further expand our in-store presence and strengthen our Payments Platform to help small businesses around the world grow and thrive in an omnichannel retail environment. iZettle provides in-store capabilities in eleven countries, as well as near-term, in-store expansion opportunities into other existing PayPal markets.”

PayPal 2018 10-K

Alex Chriss, the company’s CEO, talks a lot about bringing PayPal into the world of in-person payments. I would previously think that this would take the form of PayPal enabling NFC payments through its mobile app (creating an alternative to Apple Pay), or Venmo creating a strong card offering similar to Cash App Card. However, I started to think that Zettle can also play an important role in PayPal’s omnichannel efforts.

PayPal might have neglected it after the acquisition, but looks like it re-started investing in developing the service. Thus, just recently PayPal launched Tap to Pay on iPhone for Venmo and Zettle merchants. So PayPal could replicate the efforts of Shopify and Stripe in following their online merchants into the in-person world. Shopify has the Shopify POS offering, Stripe has Shopify Terminals, and PayPal has Zettle.

“As we think about our strategy, to make sure that PayPal is available everywhere for every purchase, every time, that includes being able to be available in an omnichannel solution, whether it's e-commerce or whether it's in person. And with some of the changes coming, particularly in Europe around NFC, that opens up the opportunity for us, and we will be prepared shortly to be able to play in that space.”

Alex Chriss, PayPal Q2 2024 earnings call

Let’s move on to Hyperwallet. Hyperwallet enables businesses to make payouts in “50 currencies, to 200+ markets.” Think of airlines paying out compensation to customers, insurers paying out claims, streaming services paying royalties to artists, and marketplaces paying money to sellers. Hyperwallet is PayPal’s equivalent to Stripe’s Connect, and Adyen’s Payouts.

“We acquired Hyperwallet to enhance our payout capabilities and improve our ability to provide an integrated suite of payment solutions to ecommerce platforms and marketplaces around the world.”

PayPal 2018 10-K

At the time of the acquisition, PayPal expected Hyperwallet to enhance its offering for “e-commerce platforms and marketplaces.” PayPal then proceeded with gloriously losing eBay to Adyen. However, since then, PayPal launched PayPal Complete Payments (or PPCP), the successor to the PayPal Checkout solution, and now Fastlane, the accelerated checkout.

Of course, PayPal Complete Payments is early in its rollout, and Fastlane just launched. However, the combination of PPCP, Hyperwallet, and Fastlane, at least in theory, brings PayPal’s offering closer to Stripe’s.

Shopify recently added Adyen, as an alternative to Shopify Payments (powered by Stripe) for enterprise merchants. And I thought that the days of Shopify’s partnership with PayPal were numbered. Now I think that PayPal might stay in the game for longer. And perhaps, even win eBay back?

“…we're in early days right now. PPCP really is just rolling out. We're excited about the progress and the growth, but there's a lot more to play here. Live in 30 markets and through 40 partner channels, but I think we're just getting started.”

Alex Chriss, PayPal Q2 2024 earnings call

Finally, Paidy. In 2021, PayPal acquired a Japanese Buy Now Pay Later lender, Paidy. The city legend is that PayPal also competed with Block to acquire Afterpay, but Jack Dorsey sealed the deal, and PayPal went with Paidy. This was the peak of the ZIRP era, and the last PayPal’s major acquisition.

“In October 2021, we completed the acquisition of Paidy, Inc. (“Paidy”) for approximately $2.7 billion. Paidy is a two-sided payments platform thatprimarily provides buy now, pay later solutions (installment credit offerings) in Japan. With the acquisition of Paidy, we intend to expand our capabilities and relevance in Japan.”

PayPal 2021 10-K

I must admit I know nothing about the BNPL market in Japan, and PayPal’s lack of disclosures doesn’t help. At the time of the acquisition, it was reported that Paidy had 6 million registered users; however, PayPal’s annual report had a footnote that the acquisition of Paidy added 3.2 million active users. Comparing Paidy to Affirm (at the time it had 3 million users), I’d think that Paidy does well under $10 billion in originations a year.

Which means…that out of the $150 billion of TPV reported under “Other merchant services”, around $140 billion was contributed by Hyperwallet and Zettle (and smaller services such as invoicing). So one of these businesses, or both, are pretty scaled businesses.

And, as a reminder, “Other merchant services” TPV grew 15% YoY, second only to Braintree. So one of these businesses, or both, are growing pretty fast. However, what’s more important, is that it looks like both Zettle and Hyperwallet are critical elements for PayPal to compete with Stripe and Adyen. So I would expect to start hearing more about Zettle or Hyperwallet on PayPal’s earnings calls.

Hope you learned something new today, and if you have any thoughts on where to find more information about Zettle, Hyperwallet, or Paidy, that would be highly appreciated!

Cover image source: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.