Stone's profitable streak continues

Brazil’s Stone posted another profitable quarter, expects to continue growing, dLocal quadrupled its revenue outside of Latin America, and Robinhood reported a decline in trading activity in April

Hi!

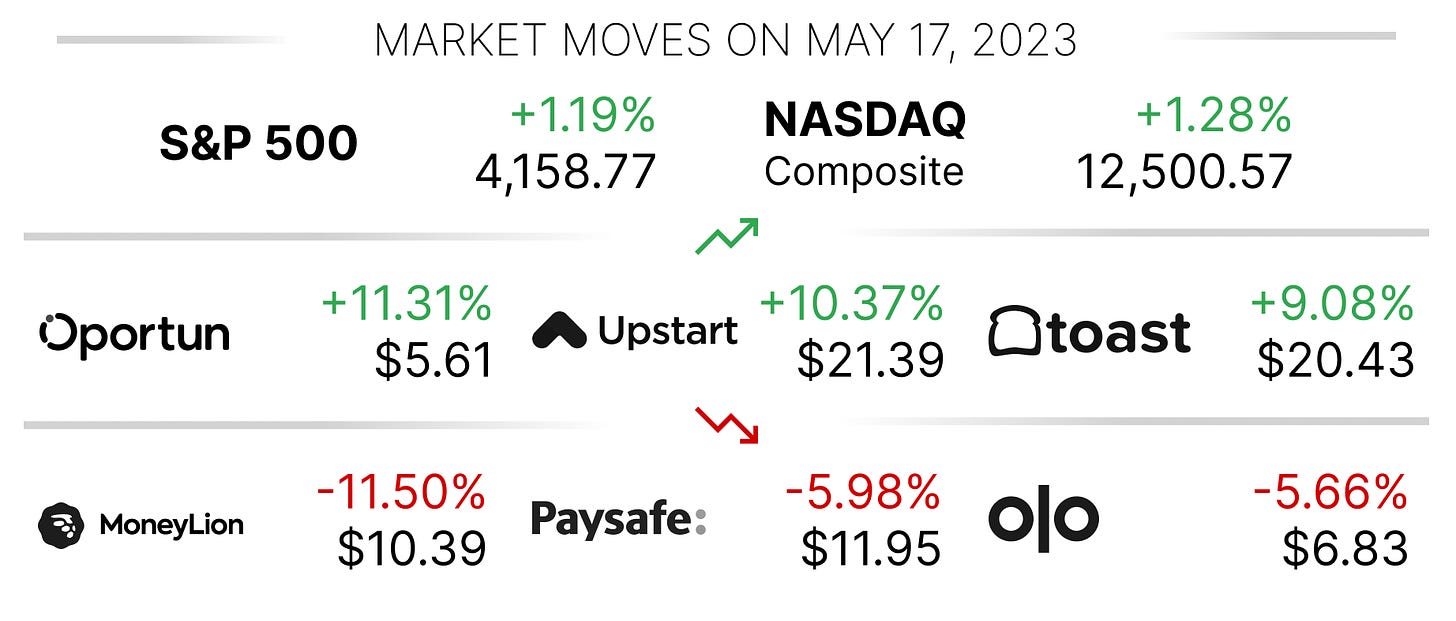

Markets rallied yesterday after US politicians signaled progress in the talks about raising the debt ceiling. If you missed the drama: the US government is about to run out of money, but it cannot borrow more (by issuing bonds) due to a limit set during World War I (“debt ceiling”).

This ceiling was raised multiple times (i.e. in 2021), as a default of the US government would probably cause a collapse of the global financial system. However, raising the debt ceiling requires bipartisan approval, so every time it comes to that, politicians try to get something good (for them) out of this situation.

Anyways, back to the Fintech world:

Brazil’s Stone posted another profitable quarter,

dLocal quadrupled its revenue outside of Latin America, and

Robinhood reported a decline in trading activity in April

Thank you for reading and see you tomorrow!

Jevgenijs

Stone's Profitable Streak Continues

Brazil’s Stone (NASDAQ: STNE) reported better-than-expected first-quarter results, posting another profitable quarter. Revenue increased 30.9% YoY to R$2.71 billion (approx. $550 million), driven by the 35.7% YoY revenue growth in the Financial Services segment, and a 9.7% YoY revenue growth in the Software segment. The company reported a third consecutive profitable quarter, posting a Net income of R$225.7 million ($46 million) and an Adjusted EBITDA of R$1.25 billion ($253 million) for the quarter. This compares to a Net loss of R$313.0 million and an Adjusted EBITDA of R$803.6 million in the first quarter of 2022. The company guided for a 25% YoY growth in revenue in the second quarter of 2023.

Stone was profitable in 2018, 2019, and 2020, achieving net income margins of 19.3%, 31.2%, and 25.2% respectively. However, the company’s fortunes turned in 2021 as it started facing mounting losses in its lending business and had to mark down the value of its stake in Banco Inter. In February 2023, the company sold its remaining stake in Banco Inter for R$218 million (approx. $45 million) and announced its plans to return to growth in its lending business in the second half of 2023. With three profitable quarters in the books (and the Banco Inter mishap behind it), I believe investors will now be looking for the company’s second attempt to build a profitable lending franchise.

✔️ StoneCo Reports First Quarter 2023 Results

✔️ Brazil's StoneCo beats profit expectations, sees further revenue growth

What to learn more about Stone? I published a deep dive last year 👇🏻

dLocal Quadruples its Revenue Outside of Latin America

dLocal (NASDAQ: DLO), an Uruguayan Fintech company that helps enterprise merchants, such as Amazon, Shopify, and Microsoft, process payments in emerging markets, reported its first quarter results yesterday evening. Total Payment Volume for the quarter rose 70% YoY to $3.6 billion, while revenue increased 57% YoY to $137.3 million. The company reported an Adjusted EBITDA of $45.5 million and a Net income of $35.5 million, compared to an Adjusted EBITDA of $32.9 million and a Net income of $26.3 million in the first quarter of 2022. The company’s revenue outside of its home market, Latin America, almost quadrupled during the year and represented 28% of the total revenue for the quarter.

The end of last year was challenging for the company. Thus, it had to deal with the allegations of fraud by the short-seller Muddy Waters Research, as well as had to book a $5.6 million loss related to the funds that were locked at the bankrupt cryptocurrency exchange FTX. Allegations from Muddy Waters were particularly painful, as the company’s stock price was cut in half and has not recovered since then despite dLocal’s rebuttals. The short-seller accused the company of inflating reported payment volume numbers, booking conflicting inter-company transactions, and back-dating accounting entries to reflect stock transactions by the founders.

✔️ dLocal Reports 2023 First Quarter Financial Results

✔️ Uruguayan fintech Dlocal posts 35% rise in Q1 profit

✔️ LatAm’s dLocal Shares Drop 50% After Muddy Waters Questions Disclosures

✔️ Muddy Waters doubles down on allegations of dLocal balance sheet discrepancies

Robinhood Reports a Decline in Trading Volumes in April

In between earnings calls, Robinhood (NASDAQ: HOOD) reports operating metrics, such as monthly active users, trading volumes, etc. The company published its April data yesterday, reporting a sequential decline in trading volumes across all asset classes. Thus, equity notional trading volumes were down 32% MoM to $38.9 billion, and crypto notional trading volumes were down 6% MoM to $3.7 billion. Robinhood customers traded 75.3 million options contracts, representing a 25% decline compared to March. To put this into perspective, in the first quarter of 2023, transaction-based revenue contributed $207 million, or 47% of the total revenue, of which $133 million, or 30% of the total revenue, came from options trading.

On the positive side, Robinhood customers continued depositing money, adding $1.2 billion in net deposits to their accounts in April. At the end of the month, cash sweep balances were $9.6 billion, up $0.7 billion from the end of March 2023, and margin balances were $3.1 billion, unchanged since March 2023. In the first quarter of 2023, Robinhood earned $208 million in net interest income, of which $53 million, or 25% came from margin interest, and $22 million, or 11% came from Cash Sweep. Net Cumulative Funded Accounts increased by 30 thousand to 23.1 million, and Monthly Active Users were 11.5 million, down 300 thousand from March 2023.

✔️ Robinhood Markets, Inc. Reports April 2023 Operating Data

✔️ Robinhood Reports First Quarter 2023 Results

✔️ Robinhood beats revenue estimates as rate hikes bolster interest income

✔️ Robinhood launches 24-hour trading

The chart below shows dLocal’s stock price over the last twelve months. Can you spot when Muddy Waters accused dLocal of fraud and disclosed their short position?

Country Manager - Thailand

@ dLocalRemote, Thailand

Country Manager - Saudia Arabia

@ dLocal

Riyadh, Saudi Arabia

Head of Operations - Africa

@ dLocalLagos, Nigeria

Senior Product Designer, Brokerage

@ Robinhood

Menlo Park, CA, or New York, NY, United States

Senior Product Designer, Crypto

@ Robinhood

Menlo Park, CA, or New York, NY, United States

Cover image source: Stone

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.