Hi!

Hope you had a great weekend! I absolutely love how Brazilians handle earnings calls - less scripted talks, more open discussions about what happened. Last week Nubank, Stone, XP, and Inter reported their second quarter results, so I spent the weekend listening to the earnings calls. More on that in today’s newsletter:

Stone's banking services gain traction,

XP completes the acquisition of Banco Modal, and

Inter adds one million new active clients

Thank you for reading and have a great day!

Jevgenijs

p.s. have feedback? DM me on Twitter

Stone's Banking Services Gain Traction

Brazilian merchant acquirer Stone (NASDAQ: STNE) reported a 28% YoY increase in its second quarter revenue to R$2.96 billion (approx. $0.6 billion), driven by a 32% YoY growth in the company’s financial services segment revenue and a 9% YoY growth in the software segment revenue. The company added almost 204 thousand Micro, Small, and Medium-sized Business clients (MSMB) finishing the quarter with 3 million clients. Net income for the quarter was R$307.2 million (approx. $61 million) and Adjusted EBITDA was R$66.5 million (approx. $13.4 million), compared to a Net loss of R$489.3 million and Adjusted EBITDA of R$39.9 a year ago.

Image source: Stone Q2 2023 Earnings Presentation

The company saw a continued adoption of its banking services. Thus, the number of clients using banking services more than tripled from 0.53 million in the second quarter of 2022, to 1.67 million in the second quarter of 2023. Deposits reached R$3.92 billion (approx. $0.8 billion), representing a 45% YoY increase from R$2.70 billion a year ago. Stone continued to make cautious steps in small business lending disbursing R$26.0 million (approx. $5.2 million) in new credit products to 850 clients, with an outstanding balance of R$23.5 million at quarter-end. As a reminder, the company had to halt its lending in mid-2021 due to mounting losses.

XP Completes Acquisition of Banco Modal

Brazilian digital brokerage XP (NASDAQ: XP) reported a 21% YoY increase in total client assets to R$1.02 trillion (approx. $206 billion), despite a modest increase in the total number of clients of 1% YoY to 4 million. The company’s net revenue increased 13% YoY to R$3.55 billion ($0.71 billion), and the Net income increased 23% YoY to $977 million (approx. $197 million). Despite being a digital-first brokerage, the company continued to expand its network of independent financial advisors (IFAs), which increased from 11.3 thousand in the second quarter of 2022, to 14.1 thousand in the second quarter of 2023.

Image source: XP Q2 2023 Earnings Presentation

The company continued to diversify its income by scaling “New verticals” products, which include digital banking accounts, credit cards, collateralized personal loans, pension plans, and insurance. Thus, in the second quarter, the “New verticals” business contributed 11% of the company’s total revenue, up from 7% a year ago, driven primarily by XP’s cards business. XP also completed the acquisition of its competitor Banco Modal, which it agreed to buy in January 2022. Banco Modal is expected to add approximately 500,000 clients to XP's client base, and its financial contribution will be reported in the next quarter’s earnings.

Inter Adds One Million New Active Clients

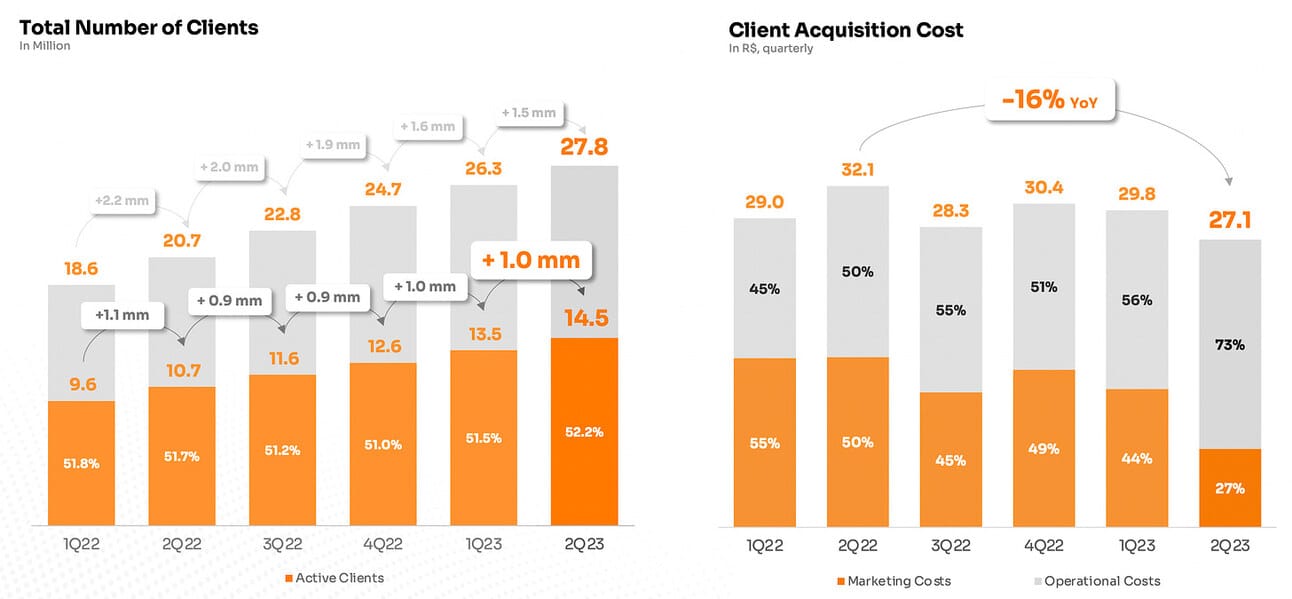

Inter (NASDAQ: INTR) added 1.5 million new clients in the second quarter of 2023, reaching 27.8 million clients in total. 14.5 million clients were active in the quarter (an increase of 1 million QoQ), including 3.6 million clients using Inter Invest, 2.7 million clients using Inter Shop, and 1.5 million clients using Inter Insurance. The company finished the quarter with R$23.5 billion (approx. $4.7 billion) in loans and advances to customers and R$26.3 billion in deposits (approx. $5.3 billion). Inter reported a 31% YoY growth in Net revenue for the quarter to R$1.15 billion (approx. $230 million), and a Net income of R$64 million (approx. $13 million), compared to a Net income of R$16 million (approx. $3.2 million) a year ago.

Image source: Inter Q2 2023 Earnings Presentation

Inter competes with Nubank (NYSE: NU), which also reported its second quarter 2023 results last week. Nubank added 4.6 million customers in the quarter bringing the total number of customers to 83.7 million (of which 68.8 million were active). Nubank is now the fourth-largest financial institution in Brazil in terms of the number of customers. Revenue increased by 61% YoY to $1.87 billion, while gross profit increased 20% YoY to $782 million. Net income for the quarter was $224.9 million compared to a net loss of $29.9 million a year ago. Nubank had an interest-earning loan portfolio of $6.3 billion (up 97% YoY), while the total deposits were $18.0 billion (up 35% YoY).

It's been a good year for Brazilian Fintech companies trading on US stock exchanges! Inter (NASDAQ: INTR) shares are up 84% YTD, Nubank (NYSE: NU) shares are up 77% YTD and XP Investimentos (NASDAQ: XP) shares are up 62% YTD. PagBank (NYSE: PAGS), the only outlier in this group, will report its second-quarter results on Thursday, August 26, 2023.

Tech Manager

@ Nubank

🇧🇷 São Paulo, BrazilSenior Data Scientist

@ Nubank

🇲🇽 Mexico City, Mexico[Capital] Cientista de Dados | Sênior

@ Stone

🇧🇷 Remote, Brazil[Infrastructure] Product Manager | Sênior

@ Stone

🇧🇷 Remote, BrazilHead de Arquitetura de Cloud

@ XP

🇧🇷 São Paulo, Brazil

Cover image source: Stone

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.