Please note that Stone reports in 🇧🇷 Brazilian reais (denoted below as R$). As of this writing, the exchange rate to the U.S. dollar was $1.00 = R$5.10.

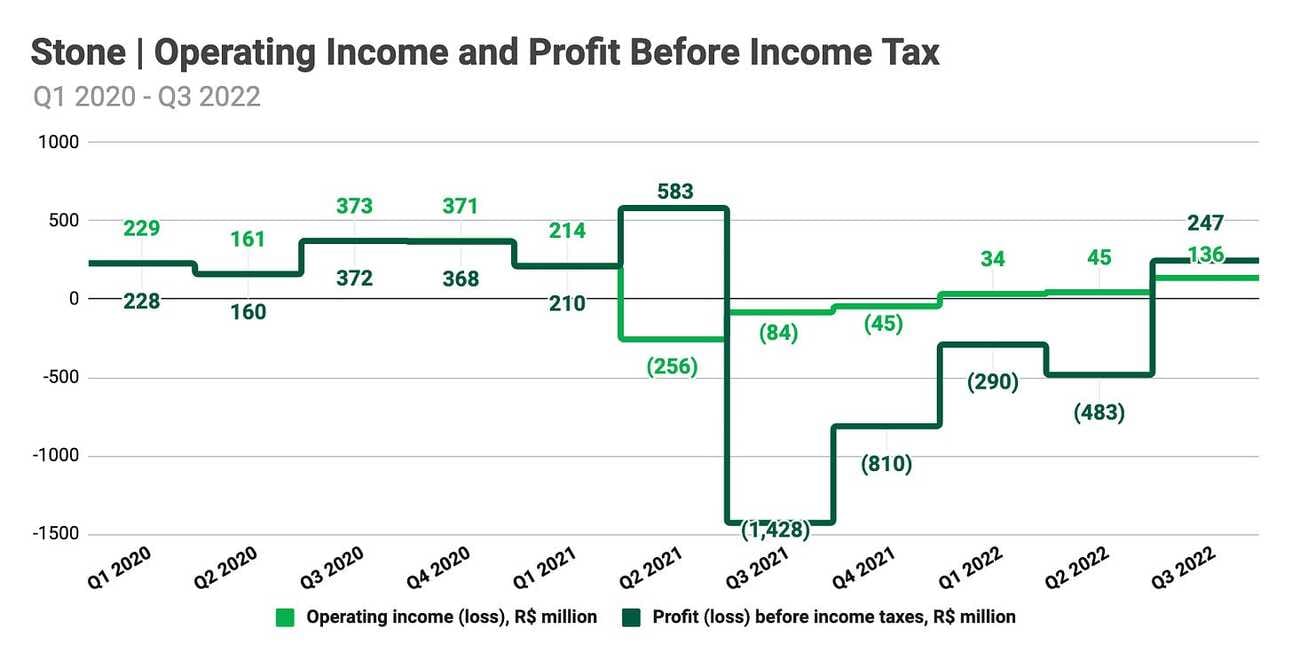

Stone reported a Net Income of R$197.1 million in Q3 2022, ending the four-quarter-long period of losses. A year ago, in Q3 2021, the company reported a Net Loss of R$1.26 billion due to mounting losses in its lending business and markdowns on its investment in Banco Inter. Nevertheless, Stone’s flourishing “MSMB” segment (micro, small, and medium-sized businesses) allowed the company to get back on its feet and leave this difficult period behind. Over the last year, the “MSMB” client base increased from 1.34 million active clients in Q3 2021 to 2.31 million active clients in Q3 2022 (73% YoY), and the segment’s Total Payment Volume grew from R$51.6 billion in Q3 2021 to R$74.7 billion in Q3 2022 (45% YoY).

The company was profitable in 2018, 2019, and 2020, reporting net income margins of 19.3%, 31.2%, and 25.2% respectively. Stone will, most likely, finish 2022 with a Net loss on a full-year basis, but perhaps, Q3 2022 will be a stepping Stone for a profitable 2023. Let’s review the company’s Q3 2022 results!

If you are new to Stone, I suggest reading the company’s review:

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

Customers

Stone added 0.25 million new “MSMB” clients (micro, small and medium-sized businesses) during the quarter, finishing Q3 2022 with 2.31 million “MSMB” clients in total. This represents a 73.2% growth in “MSMB” clients compared to Q3 2021, and an 11.8% growth compared to Q2 2022. In addition, the company reported servicing 64.3 thousand customers in its “Key Accounts” segment, which primarily includes e-commerce platforms, marketplaces, and larger retail customers using Stone for online payment processing (via Pagar.me subsidiary). The number of clients in the “Key Accounts” segment grew 14.6% compared to Q3 2021.

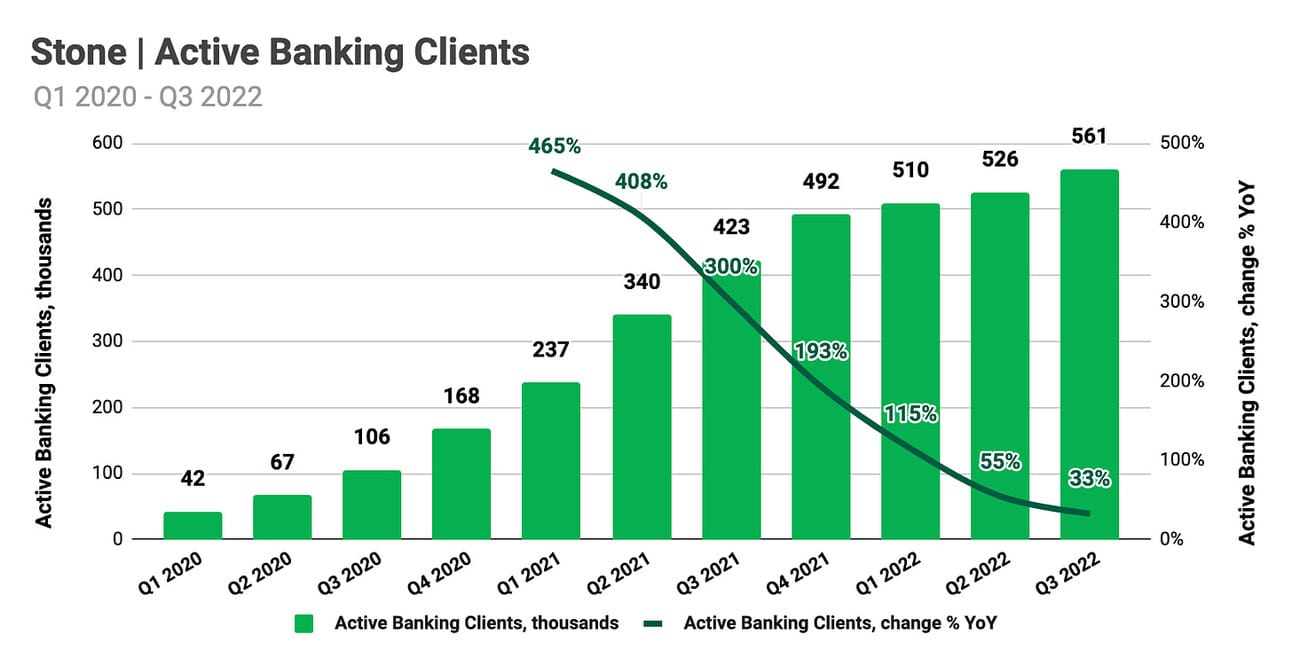

In Q3 2022, Stone also increased its banking client base by 35.1 thousand, finishing the quarter with 0.56 million active banking clients. This represents a 32.8% increase compared to Q3 2021, and a 6.7% increase compared to Q2 2022. Growth in banking customers is rapidly decelerating (see the chart below); however, the management sees potential in upselling its banking services to micro businesses (at the moment, Stone banking services are primarily used by small and medium-sized businesses). At the end of the quarter, Stone’s banking clients held R$2.65 billion in account balances, representing a 106.1% increase compared to Q3 2021, and a 14.5% increase compared to Q2 2022.

As the company halted credit operations in Q2 2021, the number of credit clients has been steadily declining. Thus, Stone finished Q3 2022 with 35.5 thousand credit clients, a decline of 65.3% compared to 102.4 thousand credit clients in Q3 2021, and a decline of 20.6% compared to 44.7 thousand credit clients in Q2 2022. Stone finished the quarter with an outstanding credit portfolio of R$0.52 billion, which represents a 67.2% decline compared to Q3 2021, and a 13.5% decline compared to Q2 2022. The company started cautiously piloting revised credit products (working capital); however, the management does not expect credit products to have a meaningful contribution to the bottom line in 2022 or 2023.

Total Payment Volume

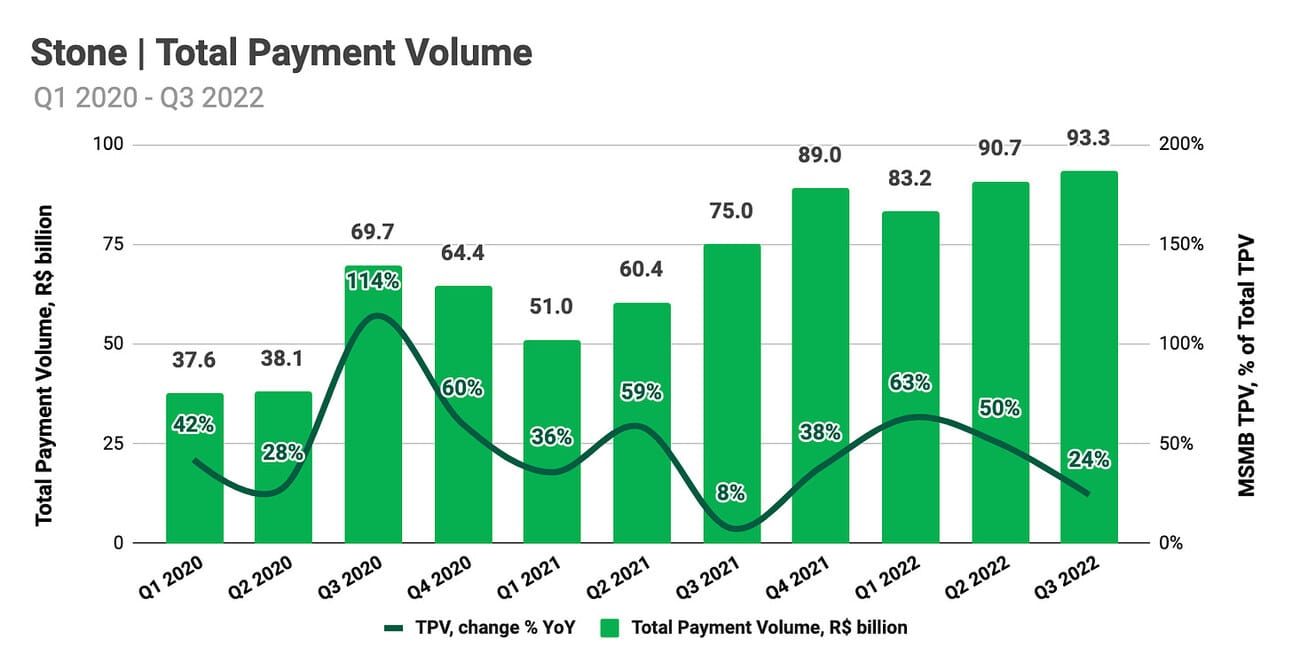

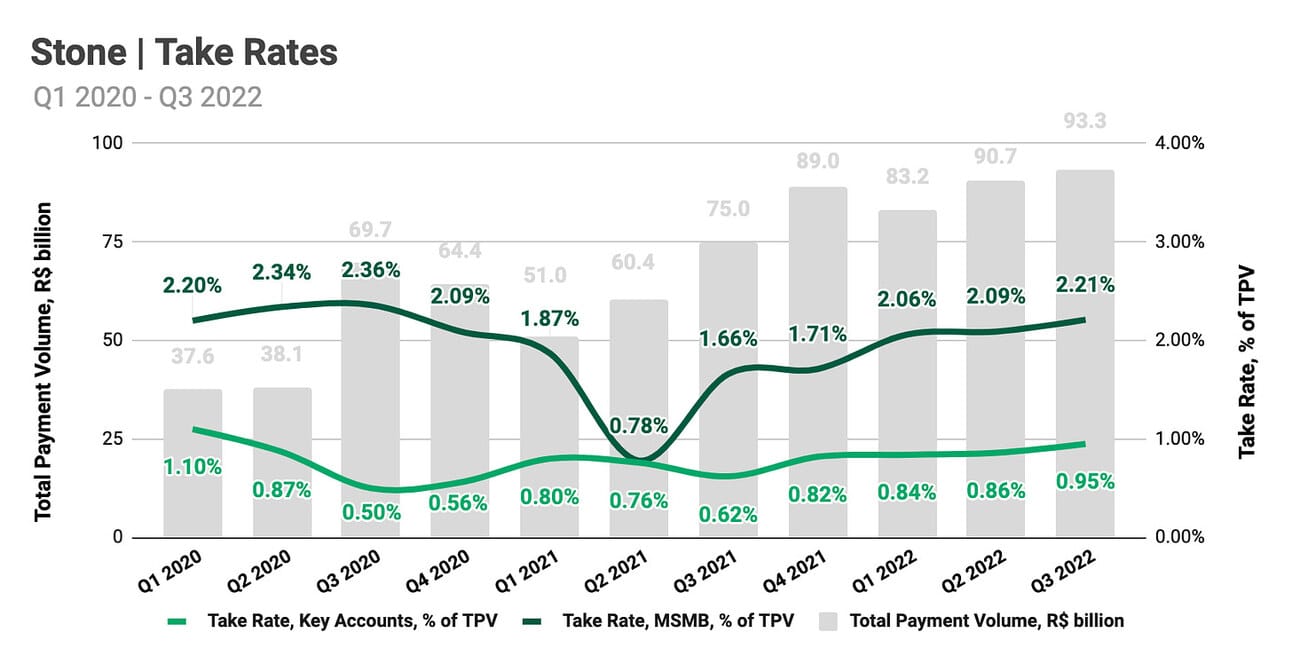

Stone reported R$93.3 billion in Total Payment Volume in Q3 2022, which represents a 24.4% growth compared to Q3 2021, and a 2.9% increase compared to Q2 2022. TPV volume generated by the “MSMB” segment clients was R$74.7 billion, or 80.1% of the total, and TPV volume generated by the “Key Accounts” segment clients was R$18.6 billion, or 19.9% of the total. Inflation in Brazil stood at 10.07% in July, 8.73% in August, and 7.17% in September; thus, Stone’s TPV growth confidently outpaced inflation in the country.

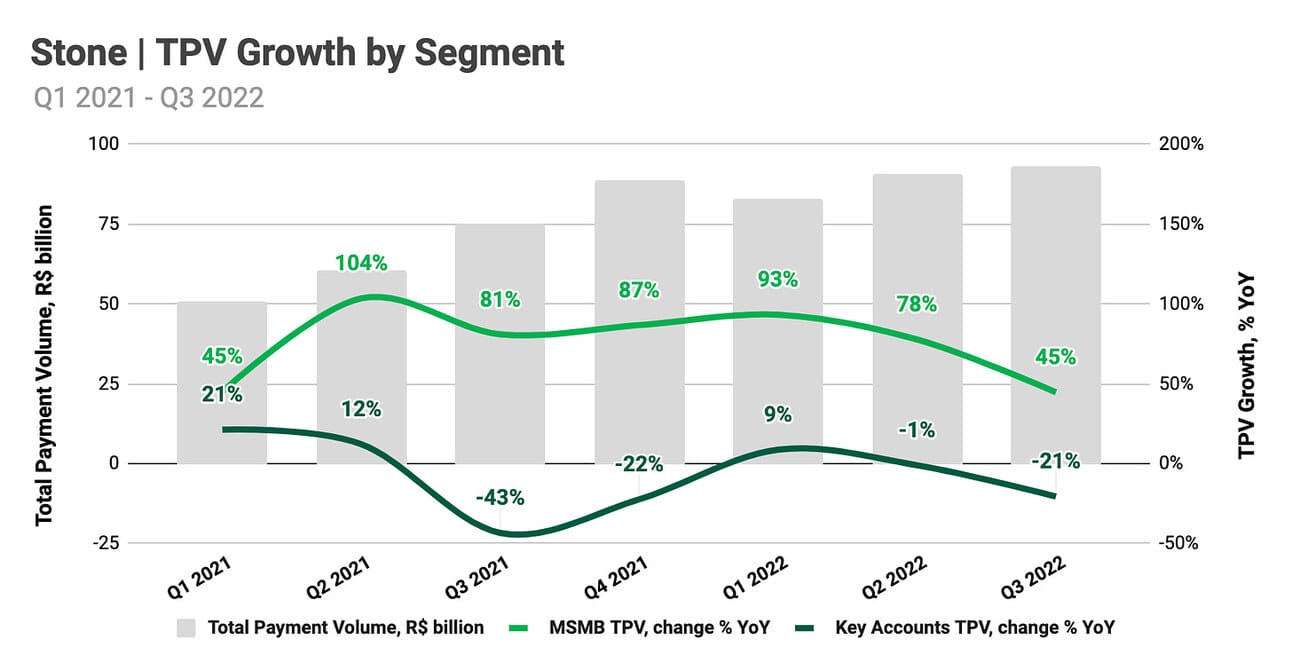

In Q3 2022, TPV generated by the “MSMB” segment clients grew 44.8% compared to Q3 2021, and 6.9% compared to Q2 2022, while TPV generated by the “Key Accounts” segment clients declined 20.5% compared to Q3 2021, and 11.0% compared to Q2 2022. The “Key Accounts” segment’s TPV decline was expected, as Stone continued to offboard sub-acquirers. Thus, TPV generated by sub-acquirers decreased by 56.2% compared to Q3 2021, which was partially offset by a 63.2% growth in TPV generated by platform services (e-commerce platforms, marketplaces, software companies, and omnichannel retailers).

As you might have noticed, Stone’s “MSMB” client base increased by 73.2% compared to Q3 2021, while the segment’s TPV increased by only 44.8%. The “Key Accounts” customer base increased by 14.6% compared to Q3 2021, while the segment’s TPV declined by 20.5%. The reason is twofold: a) in the MSMB segment, Stone is onboarding smaller clients with its “TON” product, and b) and, as mentioned above, Stone is actively offboarding sub-acquirers that generated higher TPV volume than individual clients in the “Key Accounts” segment. As the result, the average TPV per client has been declining across both segments (see the chart below)

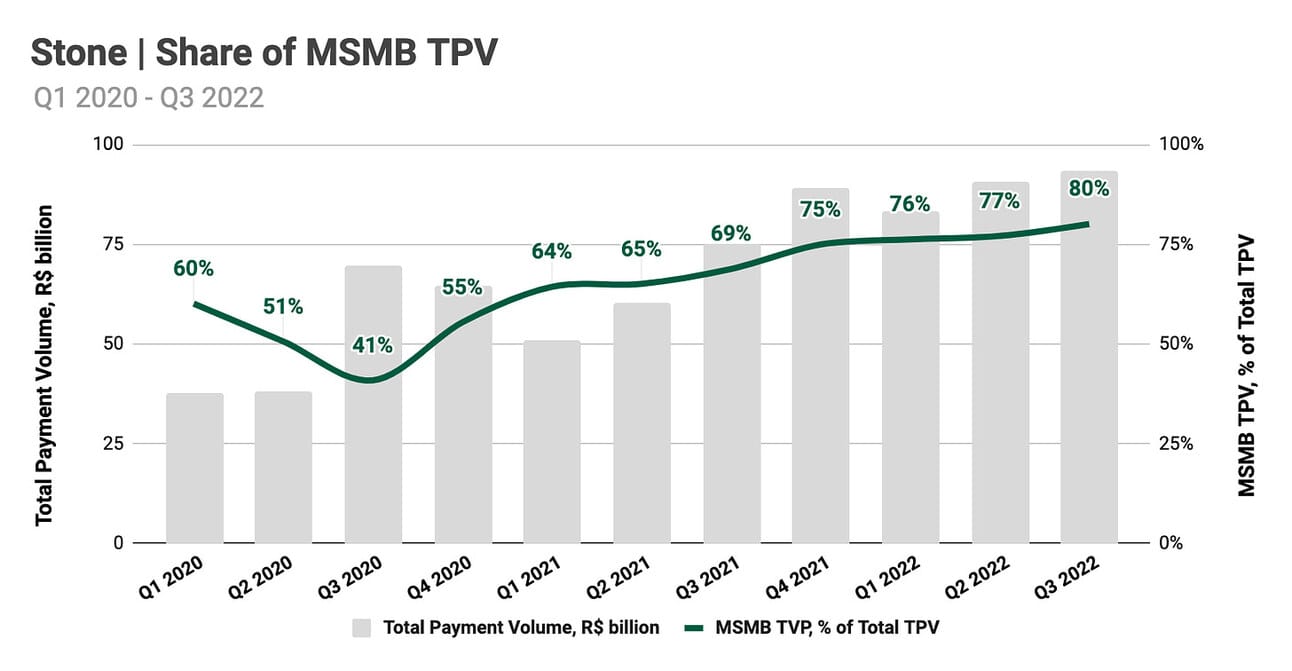

As an outcome of “MSMB” TPV growth outpacing “Key Accounts” TPV growth over several quarters, the share of “MSMB” TPV increased from 60.1% at the onset of the pandemic in Q1 2020 to 80.1% in Q3 2022 (see the chart below). Growth in the “Key Accounts” TPV will, most likely, be muted over the next few quarters (as Stone continues offboarding sub-acquirers), so we can expect the share of “MSBM” TPV to increase even further. Let’s return to these numbers when discussing the company’s revenue and take rates later in the text (hint: Stone’s Take Rate in the “MSMB” segment is much higher than in the “Key Accounts” segment).

The company’s management guided for R$78-79 billion in “MSMB” TPV in Q4 2022, which would represent a 17-18% growth compared to Q4 2021. The guidance would imply “MSMB” TPV of R$286-287 billion for the full year 2022, representing 50-51% growth compared to 2022. The company’s management did not guide for “Key Accounts” segment’s TPV.

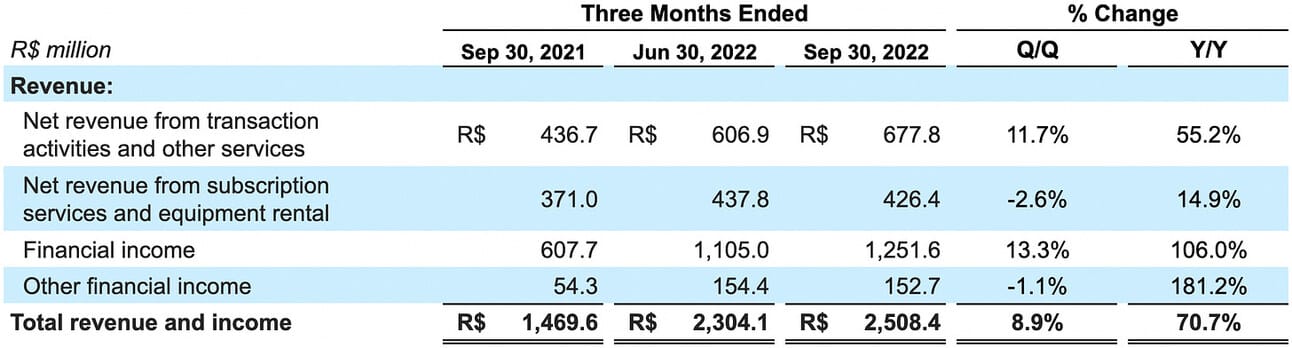

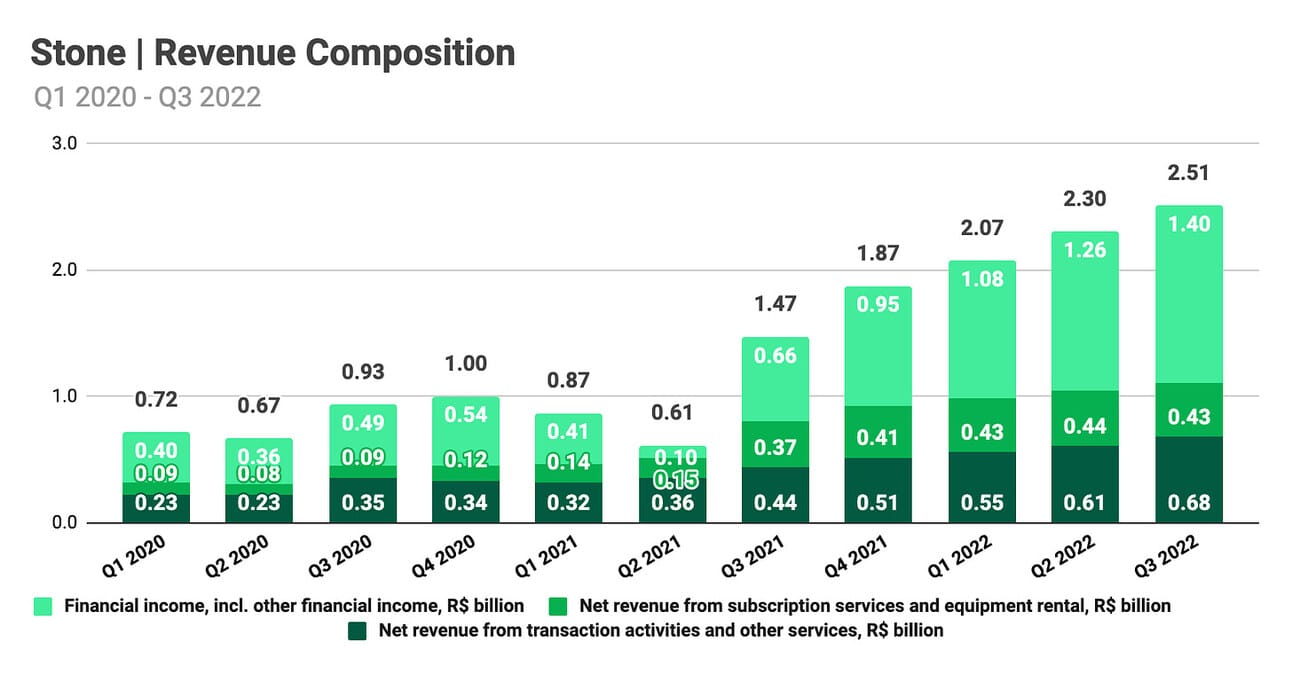

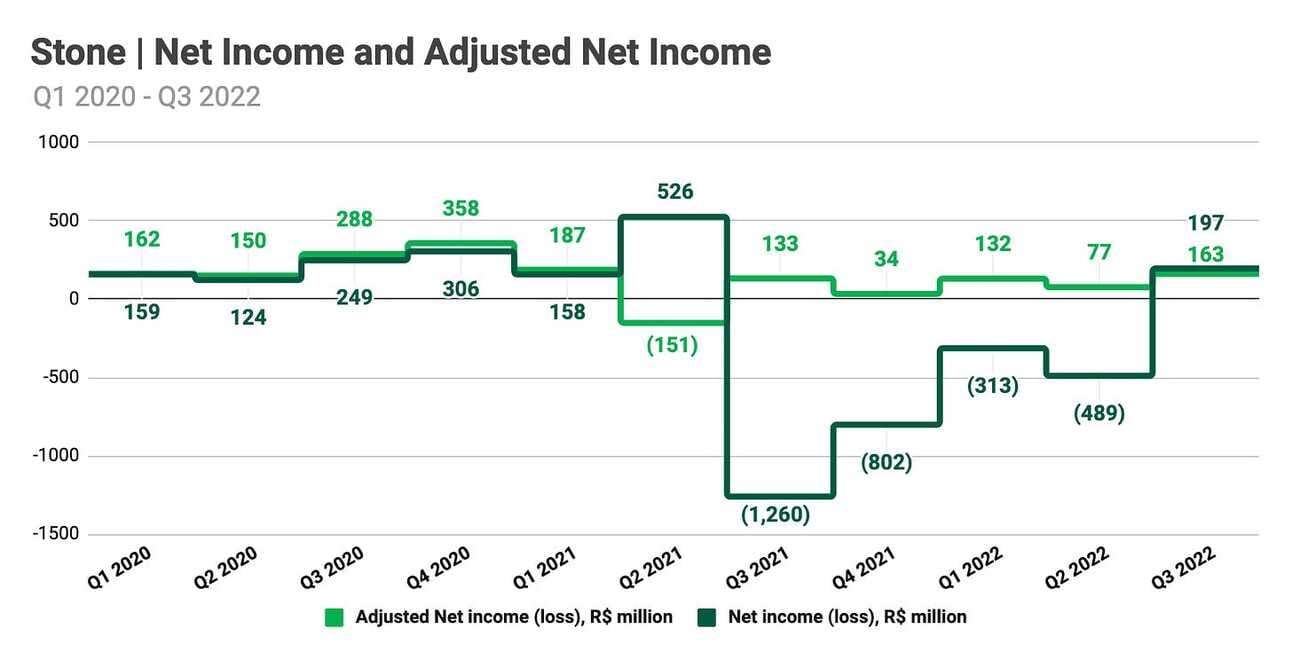

Revenue

Stone reported R$2.51 billion in revenue in Q3 2022, which represents a 70.7% increase compared to Q3 2021, and an 8.9% increase compared to Q2 2022. “Financial income”, which includes revenue from merchant advances, interest income, fair value adjustment of loans to customers, and floating revenue on banking customer balances, contributed 49.9% of total revenue. “Net revenue from transaction activities”, which primarily includes fees for transaction processing, contributed 27.0% of total revenue. “Net revenue from subscription services and equipment rental”, which includes software fees and lease income from payment terminals, contributed 17.0% of total revenue.

The company reflects credit losses in “Financial income” (fair value adjustment of loans to customers), and the mounting defaults lead to the decline in revenue in Q1-Q2 2021 despite the growth in the number of clients and payment volumes (see the chart below). However, by early Q3 2021, the company fully halted loan originations (except for merchant advances). In addition, at the beginning of Q3 2021, Stone completed the acquisition of software vendor Linx (adding R$246 million in revenue). Thus, Q3 2021 represents a relatively “stable” quarter for the year-over-year comparison (while I would ignore the triple-digit YoY growth in Q1-Q2 2022).

“Financial income” increased 106.0% compared to Q3 2021, driven by higher “prepayment” volumes (merchant advances), higher interest rates, and higher floating revenue from banking customer balances. “Revenue from transaction activities” increased 55.2% compared to Q3 2021, driven by TPV growth and an increase in revenue from banking products. “Revenue from subscription services and equipment rental” increased 14.9% compared to Q3 2021, driven by an increase in the number of POS/ERP client locations and average ticket size. Thus, the larger the revenue component, the faster it grew in Q3 2022 (i.e. “Financial income” that represents 49.9% of total revenue grew 106.0% YoY).

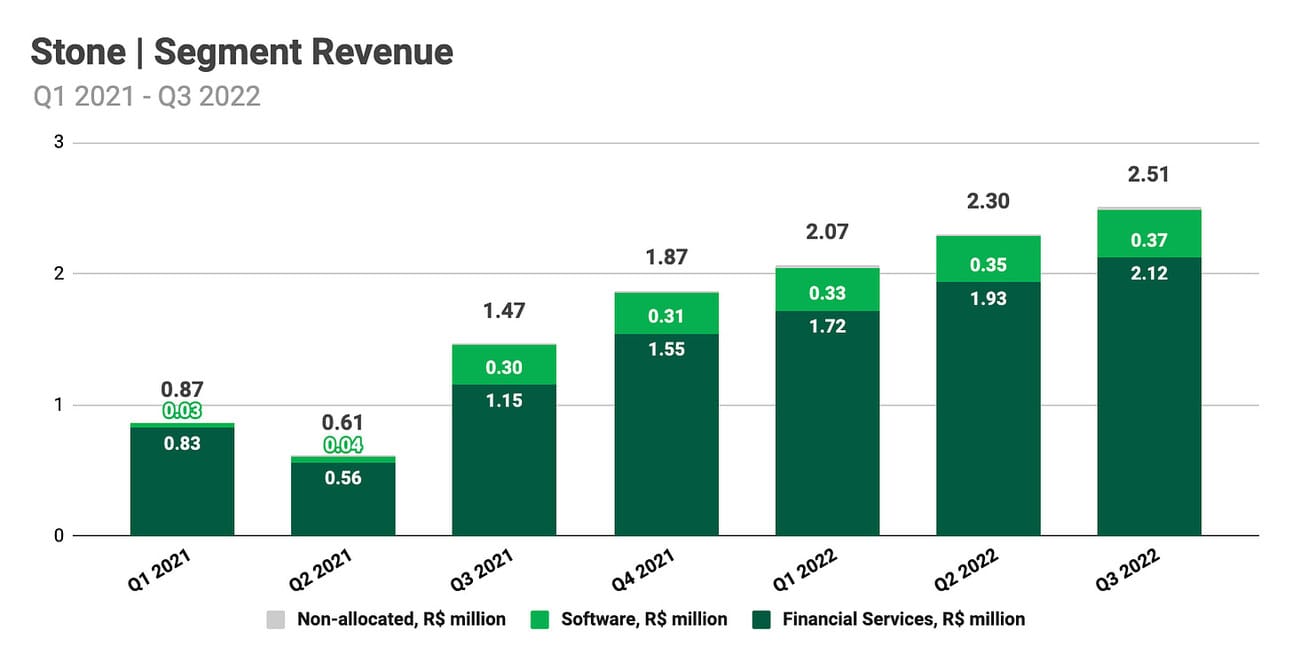

Besides reporting its financial results using client-focused segments (“MSMB” and “Key Accounts”), the company also reports using product-focused segments, “Financial services” and “Software”. Thus, in Q3 2022, the “Financial services” segment contributed R$1.12 billion, or 84.6% of the total revenue, while the “Software” segment contributed R$0.37 billion, or 14.6% of the total revenue (R$0.02 billion in revenue was not allocated to any of the segments).

In Q3 2022, the “Financial services” segment revenue grew 84.1% compared to Q3 2021, while the “Software” segment revenue grew at a more modest rate of 21.6%. The company is actively pursuing further M&A opportunities in the software segment, but for now, “Financial services” are the company’s core revenue component and growth driver.

In Q3 2022, Stone reported an “MSMB” Take Rate of 2.21%, and a “Key Accounts” Take Rate of 0.95%, which represents an improvement from 1.66% and 0.62% for “MSBS” and “Key Accounts” segments respectively in Q3 2021. Take Rate expansion resulted in revenue growth (70.7% compared to Q3 2021) outpacing total TPV growth (24.4% compared to Q3 2021). The company is calculating Take Rates as the revenue from Financial Services (excl. “TON” membership fees and non-allocated costs), divided by Total Payment Volume.

Takes Rates include two components: a) income from payment processing and terminal rentals, and b) income from merchant advances (“prepayments”). Take Rates have been expanding over the last five quarters, as Stone is aggressively repricing its “prepayment” service to reflect a higher interest rate environment, as well as offboarding sub-acquirers that used to pay lower fees for payment processing.

Multiplying the Total Payment Volume of the “Key Accounts” segment with the respective Take Rate (R$18.6 billion * 0.95%) results in R$0.18 billion in segment revenue, compared to (R$74.7 billion * 2.21%=) R$1.65 billion in revenue for the “MSMB” segment (excluding “TON” membership fees). I hope this simple calculus gives a perspective on the importance of the “MSMB” segment on the company’s performance. Thus, I believe it is important to pay close attention to the “MSMB” segment metrics (TPV, active banking clients, MSMB takes rates, etc.).

The company’s management guided for R$2.6 billion in revenue in Q4 2022, representing a 39% increase compared to Q4 2021. The guidance implies revenue of R$9.48 in 2022, representing a 97% growth compared to 2021. As you can see, the management is guiding another quarter of revenue growth outpacing TPV growth, which suggests that the company expects to continue improving its Take Rates.

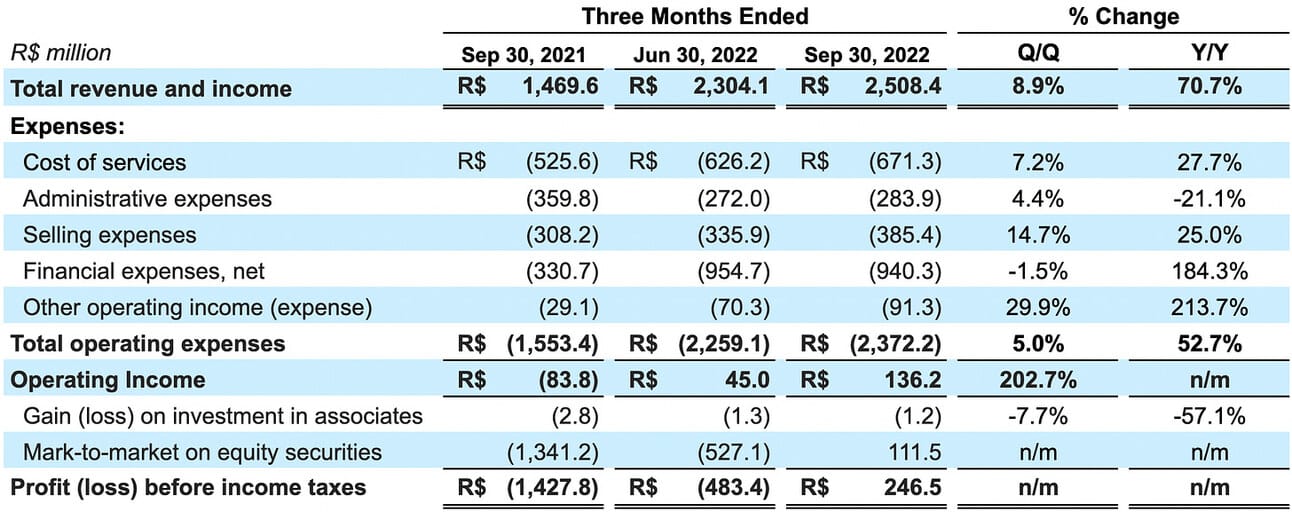

Operating Expenses

Stone reported R$2.26 billion in total expenses in Q3 2022, which represents a 21.9% decline from the total operating expenses of R$2.90 billion in Q3 2021, and an 18.9% decline from the total operating expenses of R$2.79 billion in Q2 2022. However, the company’s total operating expenses include “Gain (loss) on investment in associates” and “Mark-to-market on equity securities (Stone’s stake in Banco Inter), which are not related to the company’s operating activities. Therefore, I suggest looking at Stone’s operating expenses excluding these two items.

Excluding “Gain (loss) on investment in associates” and “Mark-to-market on equity securities”, the company reported R$2.37 billion in operating expenses in Q3 2022, which represents a 52.7% increase compared to Q3 2021, and a 5.0% increase compared to Q2 2022. As can be seen from the chart below, the company’s operating expenses skyrocketed in the middle of 2021, as the Central Bank of Brazil started increasing the rates in an inflation fight. In the last few quarters, the revenue growth outpaced the growth in expenses, and the ratio of operating expenses to revenue declined below 100% (to 94.6% in Q3 2022).

Stone's biggest expense items are “Financial expenses” (39.6% of total operating expenses excluding “Gain (loss) on investment in associates” and “Mark-to-market on equity securities”), “Cost of services” (28.3%), “Selling expenses” (16.2%) and “Administrative expenses” (12.0%). As you can see on the chart, the ratio of these expenses relative to the revenue has been steadily declining over the last several quarters, except for “Financial expenses”. However, the Central Bank of Brazil did not raise the interest rate in Q4 2022, so we could expect the “Financial expenses” to start declining.

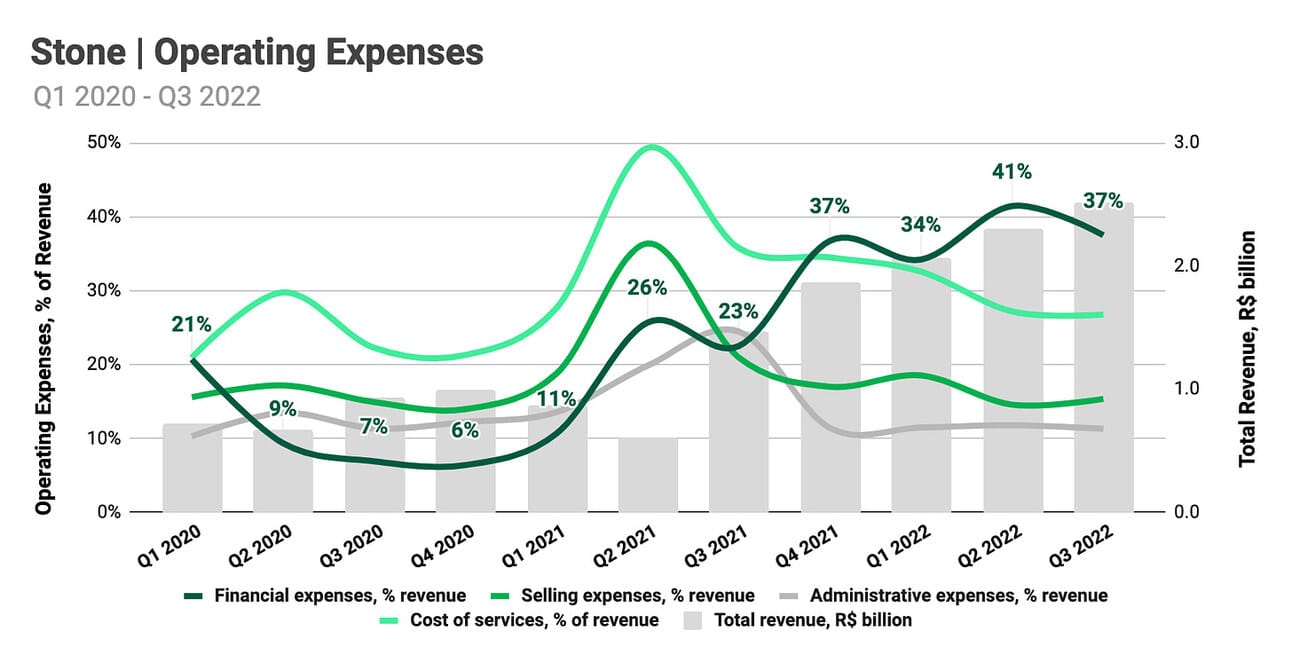

The company’s Operating income for Q3 2022 was R$136.2 million, an improvement from an Operating loss of R$83.8 million in Q3 2021. Profit before income taxes was R$246.5 million, an improvement from Loss before income tax of R$1.43 billion in Q3 2021. In Q3 2021, Stone booked a R$1.34 billion “Mark-to-market loss on equity securities” (as the company marked down the value of Banco Inter shares it owned), while in Q3 2022, the company booked a “Mark-to-market gain on equity securities” of R$112 million. As can be seen from the chart below, the company reported Operating profit in the last three quarters and was able to return to Profit before income taxes in Q3 2022 after four quarters of reporting losses.

Net Income

Stone reported R$197.1 million in Net Income for the quarter, compared to a Net Loss of R$1.26 billion in Q3 2021, and a Net Loss of R$489.3 million in Q2 2022. The company also reported an Adjusted net income of R$162.6 million, compared to an Adjusted net income of R$85.4 million in Q3 2021, and R$76.5 million in Q2 2022. The company calculates Adjusted net income by adjusting for mark-to-market gains (losses), share-based compensation, and amortization of acquired assets. Until Q2 2022, the company was adjusting net income for the interest payment on the bond it issued to acquire Banco Inter shares.

In Q3 2022, the company reported profitability in terms of Operating income, Net income, and Adjusted Income, which, hopefully, marks the end of the dark period. Stone is running down its credit book and is not rushing with scaling its credit operations, so we should not expect to see a negative impact on Financial income in Q4 2022. However, shares of Banco Inter declined 47.3% in Q4 2022 (compared to a 17.7% gain in Q3 2022), so Stone will be booking another mark-to-market loss. Banco Inter’s shares had a book value of R$296.6 at the end of Q3 2022; so, if my math is correct, we should expect a mark-to-market loss of R$140.3 million.

The company’s management guided for R$250 million in Adjusted Profit before income taxes (Adjusted EBT) in Q4 2022. Adjusted EBT can be calculated as Profit before income taxes less the same adjustments (excl. tax) that the company makes to calculate the Adjusted Net Income. Thus, in Q2 2022 Adjusted EBT was R$210.7 million (R$246.5 million in Profit before income taxes + the adjustments of negative R$35.8 million). The company did not guide Net Income or Adjusted Net Income.

Things to Watch in 2023

MSMB segment growth. “MSMB” is the core component of revenue and the key driver of Stone’s growth. Thus, above all, the company needs to succeed in this segment to show continued growth in profitability. Metrics to watch are the growth of active payment customers, MSBM segment TPV, take rate, and active banking customers. Growth in the MSMB segment is outpacing growth in both, the Key Accounts segment, and the company’s software business. Thus, we can expect the weight of the MSMB segment to continue increasing.

Profitability improvement. Stone reported Net income in 2018, 2019, and 2020, with net income margins of 19.3%, 31.2%, and 25.2% respectively. Premature scaling of the lending business derailed the company and lead to a Net loss in 2021 (even without the markdown of the investment in Banco Inter, the company would finish the year with a loss). Stone returned to profitability in Q3 2022 and this time around is being cautious about scaling its lending business. Let’s see if, and how quickly, it can return to the profitability level it achieved in 2018 - 2020.

Expansion of banking services. In Q3 2022, Stone had 2.31 million active MSMB payment clients and 0.56 million active banking clients. Stone also grew its payment client base by 73.2% compared to a year ago. Thus, there is still a lot of potential to cross-sell banking services across the existing (and growing) payment client base. Moreover, the company is evolving its banking offering and improving monetization (Average Revenue per Active Client increased from R$18 per client/month in Q3 2021 to R$44 per client/month in Q3 2022).

Banco Inter shares. It makes little sense to sell shares in Banco Inter after most of their value has been written off through markdowns. However, I am not sure if this partnership is evolving further (the companies never disclosed the true goal of this investment), so don’t see a point in freezing capital in a highly volatile asset. Mark-to-market gains and losses will continue impacting Stone’s Net income, so, if the companies do not plan to expand this partnership, perhaps, it is time to sell the shares and put this story to bed.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.