Hi!

That’s been a busy week so far! Goldman is desperately trying to exit its consumer business, Wise partnered with Swift, the payments network it was supposed to disrupt, and Square’s CEO leaves the company. More on that in today’s newsletter:

Square’s CEO leaves, Jack Dorsey to take over,

Wise teams up with Swift on cross-border payments, and

Goldman Sachs is closing in on the sale of GreenSky

Thank you for reading and have a great day!

Jevgenijs

Square’s CEO Leaves, Jack Dorsey to Take Over

Alyssa Henry, CEO of Block’s Square (NYSE: SQ), will step down from her position on October 2, 2023, after spending nine years with the company. She will be succeeded by Jack Dorsey, the current head and chairperson of Block, who will also take on the role of Square's CEO. The company praised Henry for her “significant contributions”, but did not provide further details. Prior to joining Square, Henry was a vice president at Amazon Web Services Storage Services overseeing software development, operations, and product management. This announcement follows an investigation into a recent payment platform outage, that the company experienced last week.

Thus, Square experienced a daylong outage that disrupted its services and affected small business owners' ability to process payments. The outage began on September 7 and continued until the following day when engineers implemented a fix. The outage impacted the company’s Domain Name System (DNS), causing communication problems between multiple systems and rendering many internal tools for troubleshooting and support temporarily unavailable. Square claims that “there is no evidence that this was a cybersecurity event or that any seller or buyer data was compromised by the outage.”

✔️ CEO of Block’s Square business Alyssa Henry to leave company

✔️ Block CEO Alyssa Henry to Exit on Oct. 2

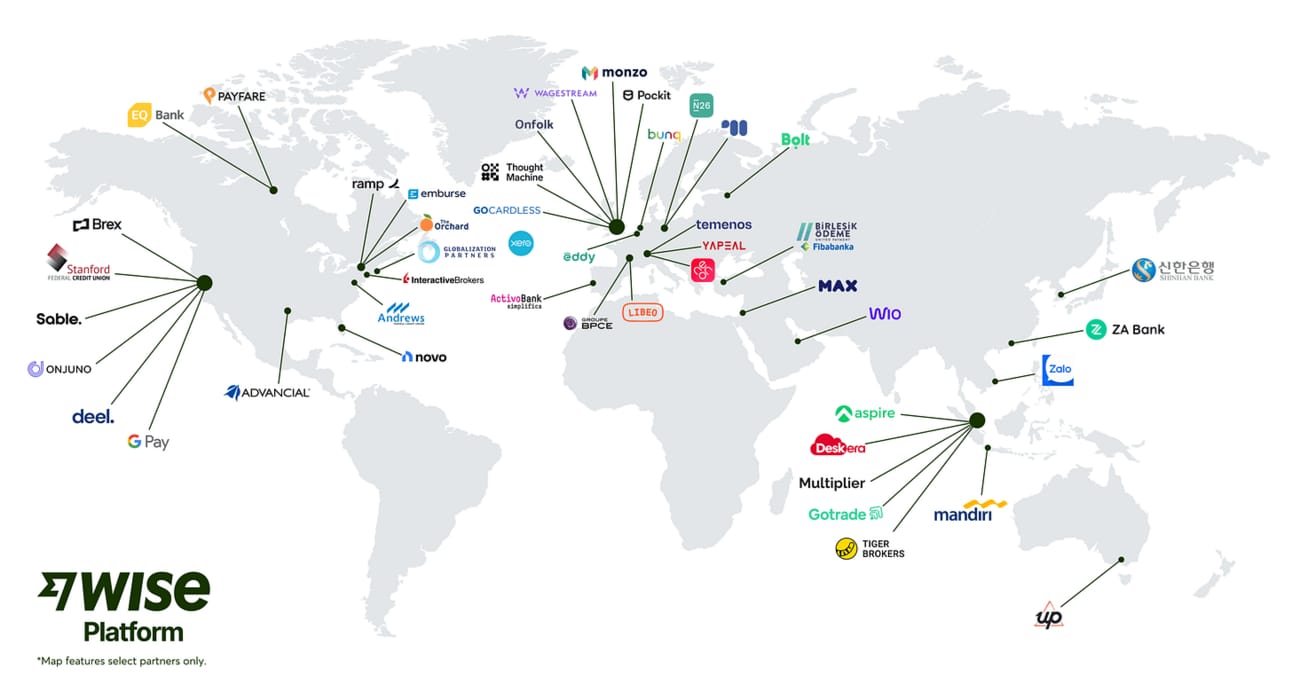

Wise Partners with Swift On Cross-Border Payments

Swift and Wise (LON: WISE) have formed a strategic partnership to offer cross-border payment infrastructure for banks. Through this partnership, banks can send Swift payment messages directly to the Wise Platform, allowing their customers to benefit from Wise's speed and convenience, but without the need for significant IT changes. Wise Platform incorporates Swift's advanced capabilities, including cloud and API connectivity, payment pre-validation, and tracking. “Our network, combined with Swift’s extensive reach, will make international payments more convenient, faster, and lower cost for banks, without necessitating a major tech build,” commented Steve Naudé, Managing Director of Wise Platform on the partnership.

Image source: Wise Platform

In the first quarter of its fiscal year 2024, Wise reported a 33% YoY increase in quarterly active customers, reaching 6.7 million, and a 16% YoY increase in transfer volume to £28.2 billion. Total income for the quarter increased by 66% YoY to £310.9 driven by a 29% YoY increase in transaction revenue and a 5800% YoY increase in interest income. Wise earned a gross interest income yield of 3.4% on its customer account balances, which grew to £11.5 billion. Wise expects a compound annual income growth rate (CAGR) to be more than 20% over the medium term, and aims to maintain an adjusted EBITDA margin of at least 20% with Fiscal 2024 potentially exceeding the target due to a higher interest income.

✔️ Swift and Wise Join Forces to Expand Cross-Border Payment Options Globally

✔️ Swift and Wise Team to Offer FIs More Cross-Border Options

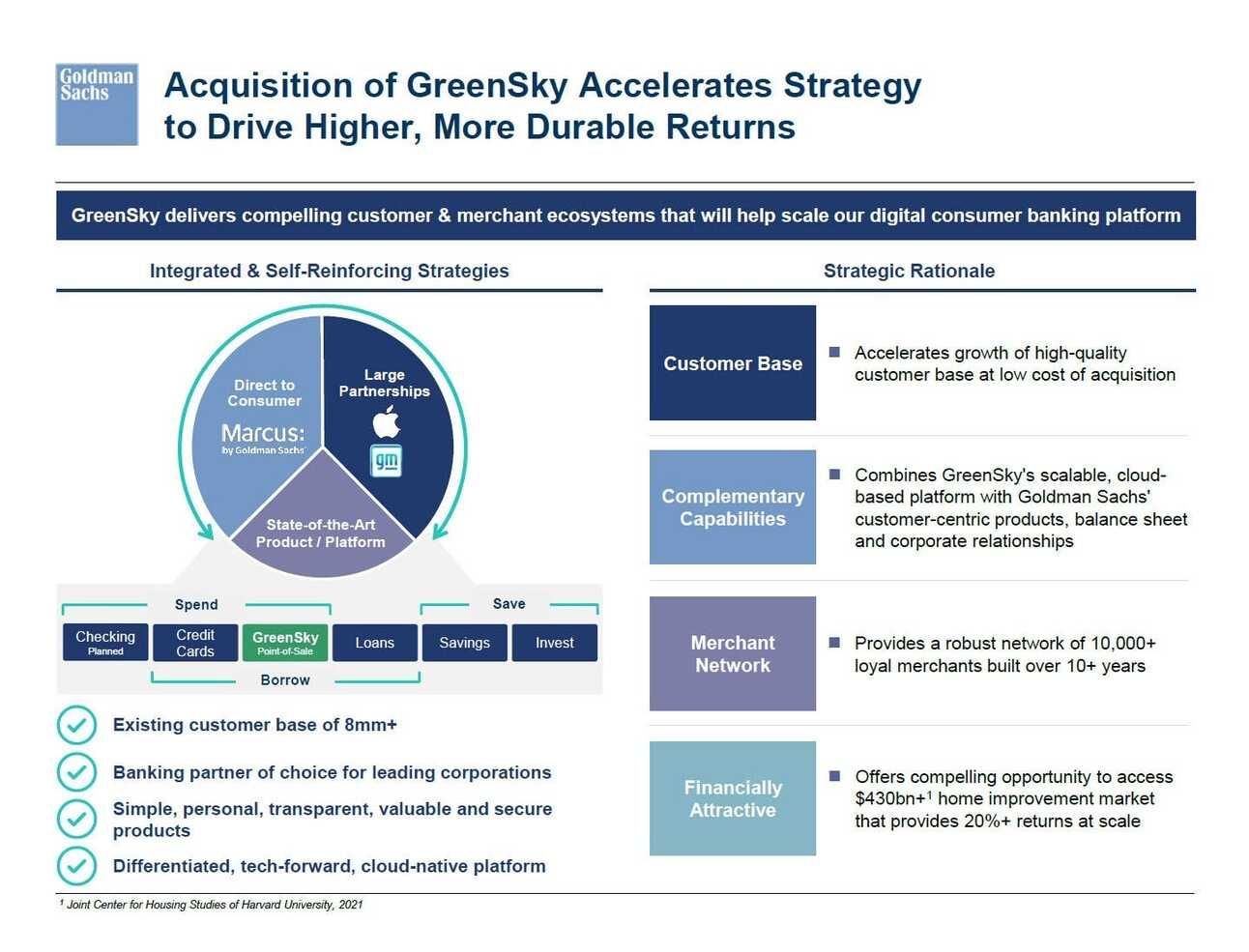

Goldman Sachs is Closing In on Sale of GreenSky

Goldman Sachs (NYSE: GS) is in advanced discussions to sell its specialty lender, GreenSky, to a group of investment firms, according to The Wall Street Journal. The group of bidders includes Sixth Street, Pacific Investment Management, and KKR. The potential deal is valued at about $500 million, significantly less than the approximately $1.7 billion Goldman paid for GreenSky just a year and a half ago. This marks a major shift away from Goldman's consumer lending ambitions, which had been championed by CEO David Solomon but ultimately faced internal opposition and financial challenges. Goldman Sachs previously sold personal loans originated by its Marcus consumer unit to Varde Partners and Rithm Capital Corp.

Image source: Goldman Sachs

Previously, The Wall Street Journal reported that Goldman Sachs is seeking to end its partnership with Apple and is in talks with American Express (NYSE: AXP) to take over the Apple credit card and other ventures with the tech giant. While Goldman had previously announced plans to scale back its consumer business, it had shown commitment to its partnership with Apple. The deal is not imminent, and Apple must agree to the transfer. The company is also discussing transferring its card partnership with General Motors to American Express or another issuer. Exiting the Apple and GM partnerships would effectively end Goldman's consumer-lending business and its ambitions to become a full-service bank.

✔️ Goldman Sachs in Advanced Talks to Sell GreenSky

✔️ Goldman Nears Deal to Sell Greensky to Sixth Street Group

Remitly stock (NASDAQ: RELY) has outperformed Wise (LON: WISE) this year (+129% vs. +19%) on what seems to be an Enterprise Value /Sales multiple expansion (2.0x at the beginning of the year vs. 4.4x now).

Head of Design, Square Banking

@ Square

🇺🇸 Remote, United StatesProduct Manager, Square Banking Platform

@ Square

🇺🇸 Remote, United StatesGroup Product Manager, North America

@ Wise

🇺🇸 Austin, TX, United StatesGroup Product Manager, Wise Platform

@ Wise

🇬🇧 London, United KingdomMarcus by Goldman Sachs, Product Manager

@ Goldman Sachs

🇺🇸 New York, NY, United States

Cover image source: Mark Warner

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.