SoFi’s CEO defends use of fair value accounting

SoFi’s CEO, Anthony Noto, defends the use of fair value accounting, PagSeguro rebrands into PagBank, and Klarna launches a credit “opt-out” feature

Hi!

I was listening to Anthony Noto, SoFi CEO, speak at the J.P.Morgan conference, and the following thought crossed my mind: Fintech non-believers argued for years that the very first economic crisis will wipe out this new breed of financial institutions. Yet, SoFi and LendingClub are doing fine, while Credit Suisse and First Republic Bank are gone.

Let’s wrap this week with stories from three continents:

🇺🇸 SoFi’s CEO defends the use of fair value accounting,

🇧🇷 Brazil’s PagSeguro rebrands into PagBank, and

🇸🇪 Klarna launches a credit “opt-out” feature

Thank you for reading and have a great weekend!

Jevgenijs

SoFi’s CEO Defends Use of Fair Value Accounting

Last week, Wedbush analysts downgraded SoFi stock (NASDAQ: SOFI) from Neutral to Underperform and slashed the price target by half to $2.50 per share. Wedbush analysts raised concerns about the company’s use of fair value accounting, arguing that SoFi’s "capital levels may be overstated” (SoFi marks its loans as “loans for sale”, and reports them at fair value). Wedbush thinks that SoFi may have to raise capital later this year to support growth. Therefore, it was not a surprise, that SoFi’s CEO, Anthony Noto, spent some time defending SoFi’s use of fair value accounting while speaking at the J.P. Morgan Annual Technology, Media and Communications Conference earlier this week.

Noto pointed out that SoFi used fair value accounting since he joined the company in 2018, and argued that fair value accounting is “the best way to account for a balance sheet company that's using loans because those loans have to be marked to market.” SoFi marks to market its loan portfolio each quarter, and writes down 35% of loan value if a loan reaches 10-day delinquency, another 35% if a loan reaches 30-day delinquency, and writes down the loan completely after the 120-day delinquency mark. In the first quarter of 2023, the company reported an annualized loss rate of 2.97%, however, it assumed a 4.5-4.6% loss ratio, when marking its loans, commented Anthony Noto.

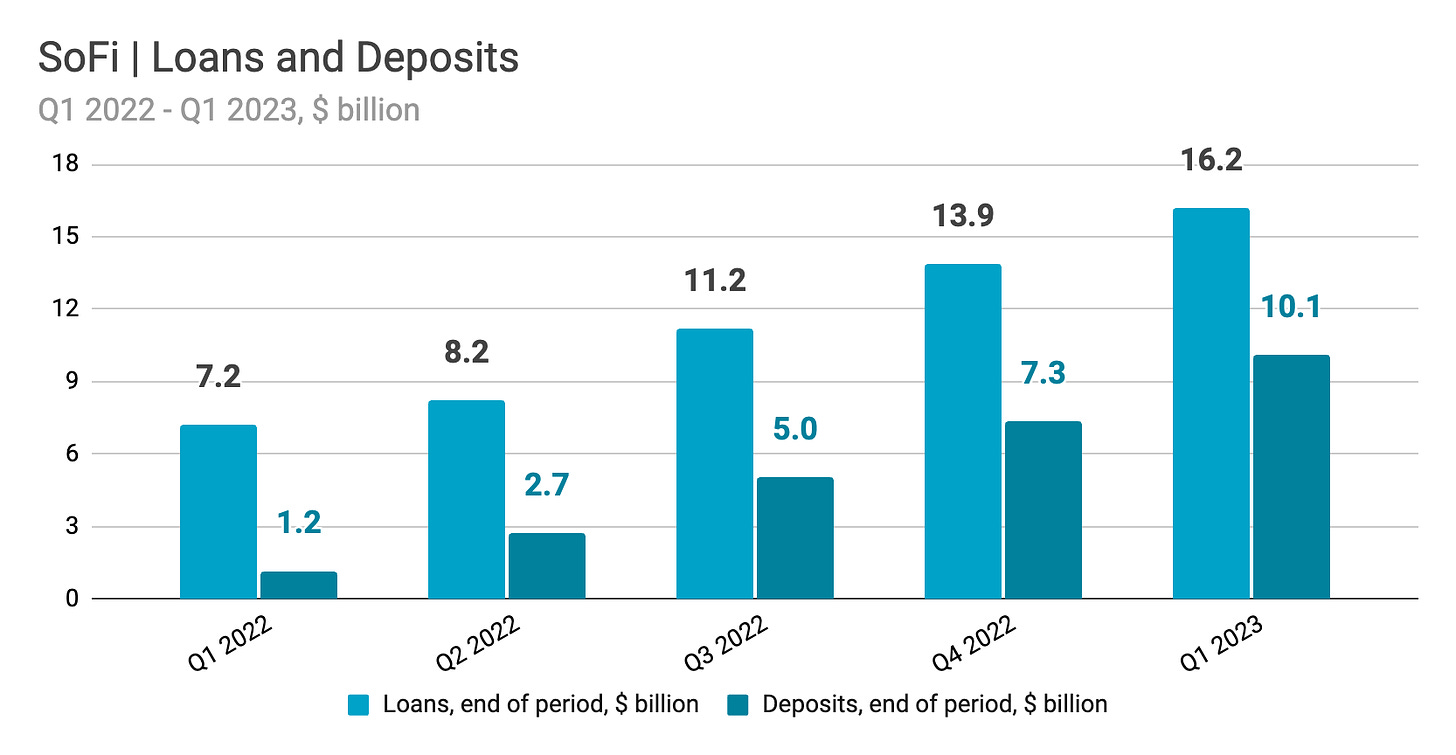

“At cost accounting, companies could report an equity balance that's positive $18 billion on a Monday and a week later, actually be taken into a receivership, because they don't record the unrealized loss on their balance sheet or their income statement,” said Anthony Noto, hinting at First Republic Bank. At the end of the first quarter 2023, SoFi had $16.2 billion in loans on its balance sheet, of which $15.86 billion were marked as “loans held for sale” and booked on a fair value basis. The only credit category that SoFi books as “held for investment” is credit card balances.

✔️ SoFi at JP Morgan Technology, Media and Communications Conference

✔️ SoFi Technologies shares tumble as Wedbush downgrades due to potential headwinds

✔️ SoFi Technologies, Inc. Reports First Quarter 2023 Results

✔️ SoFi Saw Personal Loans Soar This Quarter. Why That Might Not Be A Good Thing

Brazil’s PagSeguro Rebrands into PagBank

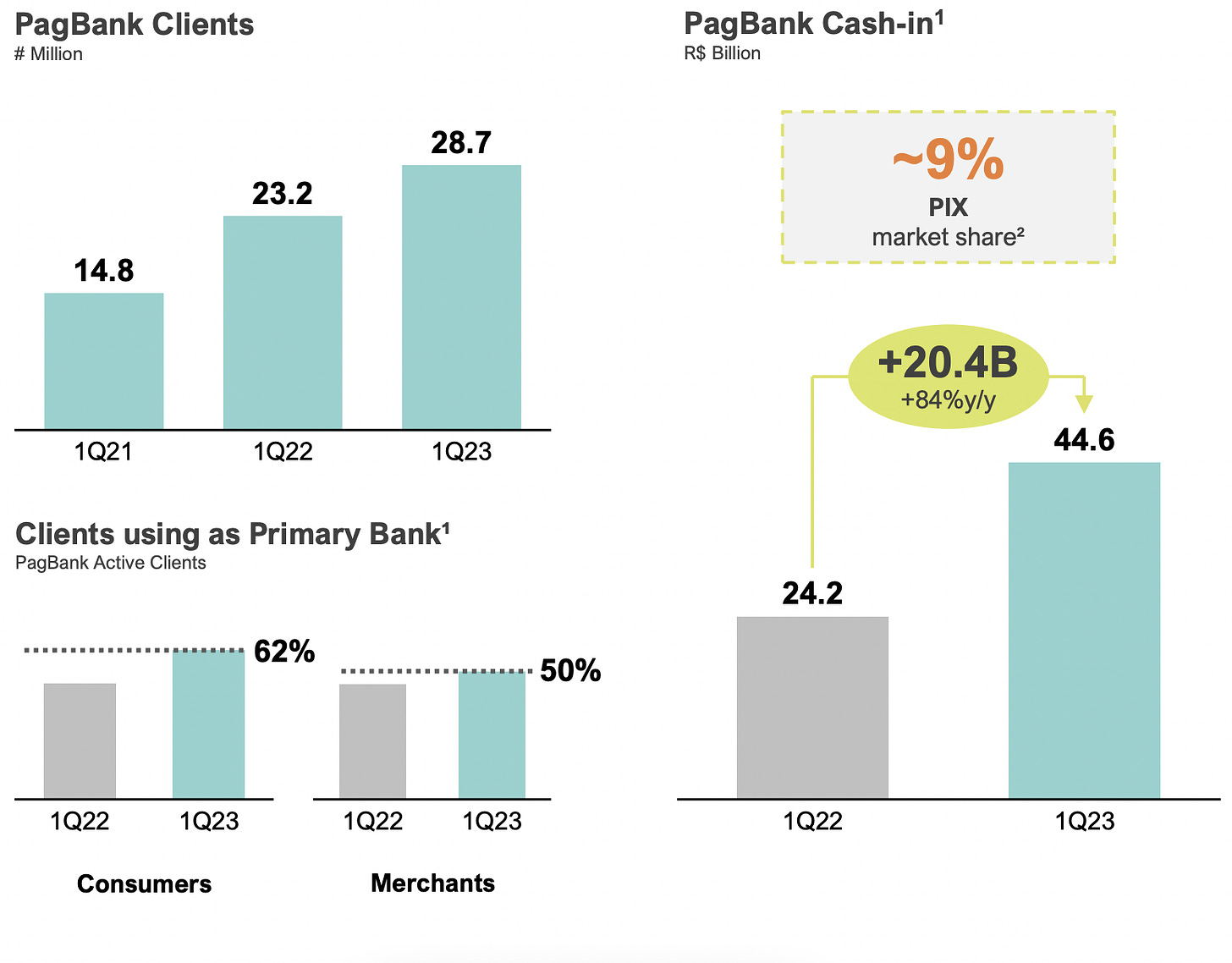

Brazil’s PagSeguro (NYSE: PAGS) reported its first quarter 2023 results yesterday, posting a 9% YoY growth in revenue to R$3.75 billion (approx. $740 million), and a 6% YoY growth in Net income to R$392 million (approx. $78 million). The company also announced that it will be merging its merchant acquiring and banking business under a single brand, PagBank, to simplify communication and “increase the awareness of the company’s services beyond payments.” Previously, the company operated under the brands PagSeguro, which comprised merchant acquiring, and PagBank, which included banking services for consumers and merchants.

PagBank served 28.7 million customers at the end of the first quarter and had R$18.6 billion in deposits (approx. $3.7 billion) and R$2.7 billion in loans (approx. $0.54 billion) on its balance sheet. On the payments side, PagSeguro reported serving 6.9 million active merchants, as well as processing R$88.1 billion (approx. $17.5 billion) in payment transactions during the quarter. The company also claims to have a 9% market share in PIX transactions, Brazil’s instant payment network, and recently received a brokerage license from the Brazilian Securities and Exchange Commission, which enables it to provide a complete set of investment products.

✔️ PagBank Q1 2023 Earnings Release

✔️ Brazil's PagSeguro posts $74 mln quarterly profit, beats forecast

Klarna Launches Credit “Opt-Out” Feature

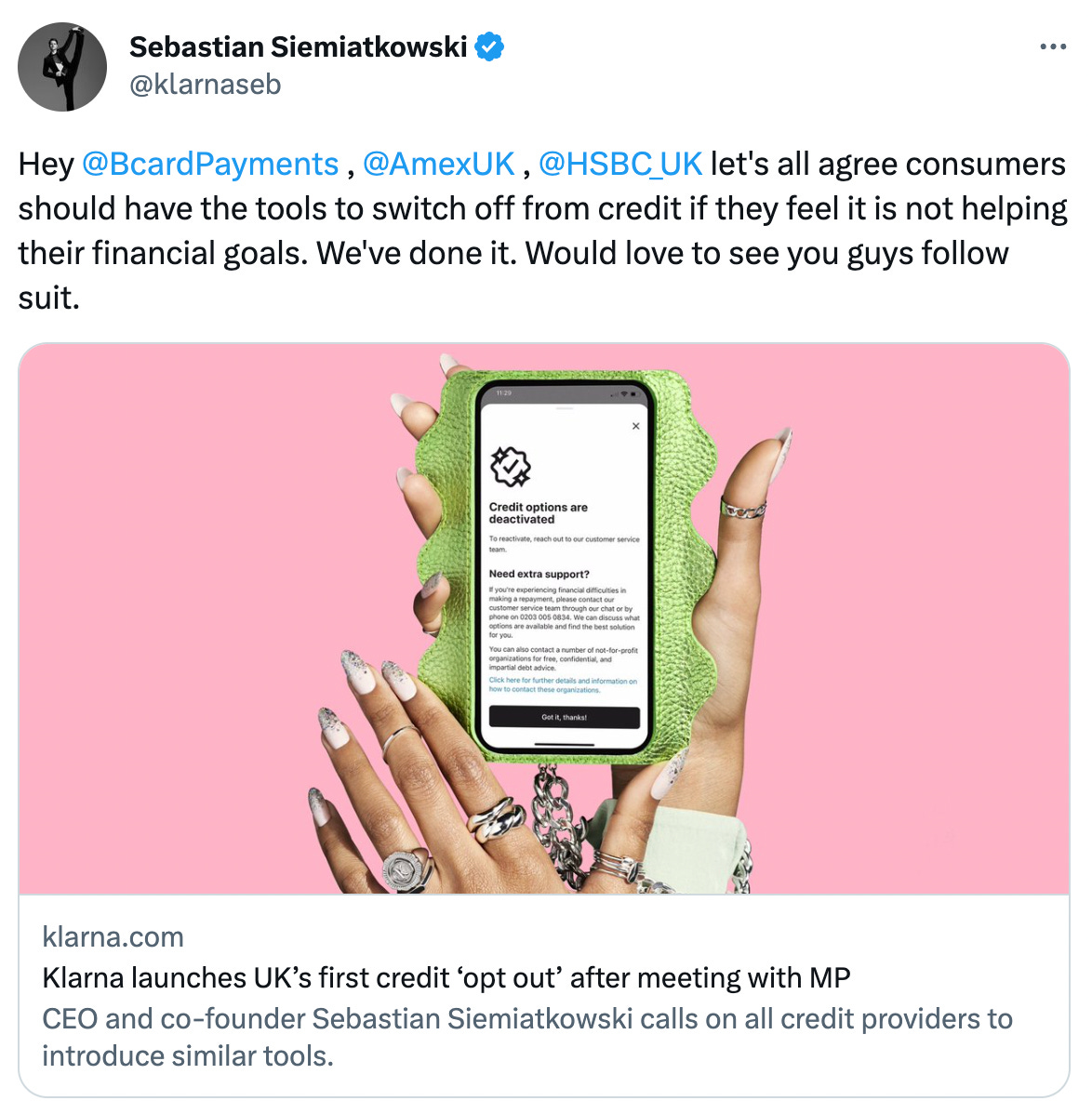

Klarna, the world’s leading Buy Now Pay Later lender, launched a credit “opt-out” feature in the United Kingdom. Once enabled, the feature prevents consumers from using Klarna’s lending products such as “Pay in 3 installments” or “Pay in 30 days” to give them better control over their finances and help them achieve their financial goals. The idea for the feature was suggested by Andrew Griffith MP, UK Economic Secretary to the Treasury, during a meeting with Klarna's CEO and co-founder, Sebastian Siemiatkowski. Consumers, who choose to opt out of Klarna’s credit products will be taken to a page of resources for dealing with indebtedness and will have to call Klarna’s customer service to re-enable credit options.

Sebastian Siemiatkowski expressed his enthusiasm for the voluntary credit 'opt out', emphasizing Klarna's commitment to customer interests and responsible credit practices. “Unlike credit card companies, who push you to put all your purchases on credit, we believe that consumers should only use credit when it makes sense for them,” commented Siemiatkowski on the launch. He also called on traditional credit providers, such as Barclaycard, American Express, and HSBC, to follow Klarna's lead in providing consumers with tools to control their credit usage via a tweet. Klarna generated SEK16.70 billion (approx. $1.65 billion) in total operating income for 2022, of which SEK3.37 billion ($0.33 billion), or 20%, came from net interest income.

✔️ Klarna launches UK’s first credit ‘opt out’ after meeting with MP

✔️ Klarna adds credit opt-out feature as UK BNPL debt grows

✔️ Klarna CEO on the Future of AI-Powered Shopping

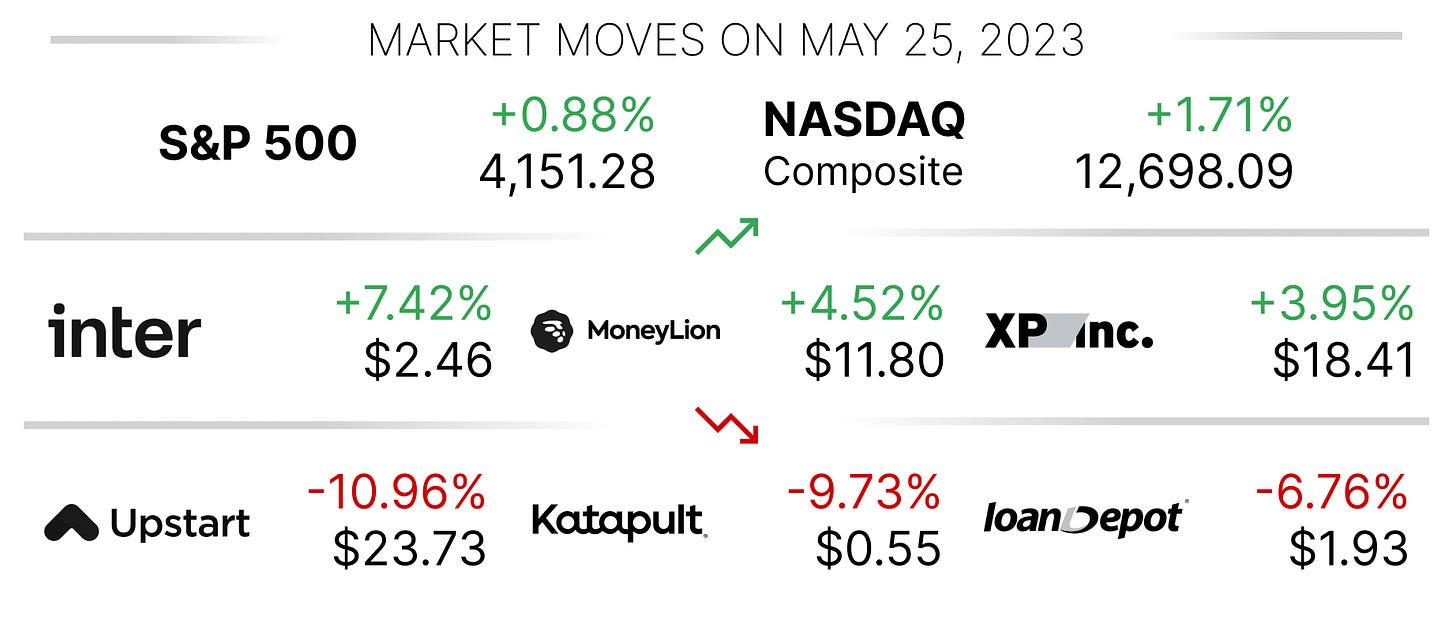

SoFi shares (NASDAQ: SOFI) are down 16.37% since the company reported its first quarter 2023 financial results. The stock is up 15.78% this year, but still underperforms the NASDAQ Composite index. I guess investors are still concerned about the “fairness” of SoFi’s accounting. Could the market be wrong?

Principal Product Manager, SoFi Money

@ SoFi

Seattle, WA, San Francisco, CA, or Remote, United States

Director, Product Management - Credit Card

@ SoFiSeattle, WA, or San Francisco, CA

Product Director - User Account Group

@ KlarnaStockholm, Sweden

@ Klarna

Stockholm, Sweden

Lead Product Designer

@ KlarnaStockholm, Sweden, or Berlin, Germany

Cover image: Microsoft Bing Image Creator, Powered by DALL·E, prompt “CEO shouts "it's not fair", pop art style” (a bit adjusted in Figma)

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.