Last week, SoFi ( ) reported Q4 2021 and full year 2021 results. As I wrote in “FinTech companies to watch in 2022 and beyond”, it is super exciting to watch Anthony Noto leading the company through a transformation from a student loan lender into a universal consumer bank. In the last few years, the company has been firing on all cylinders: it launched a number of non-lending products, like “SoFi Invest”, acquired two software vendors, Galileo and Technisys, went public via SPAC merger, and got a national bank charter after completing the acquisition of Golden Pacific Bank.

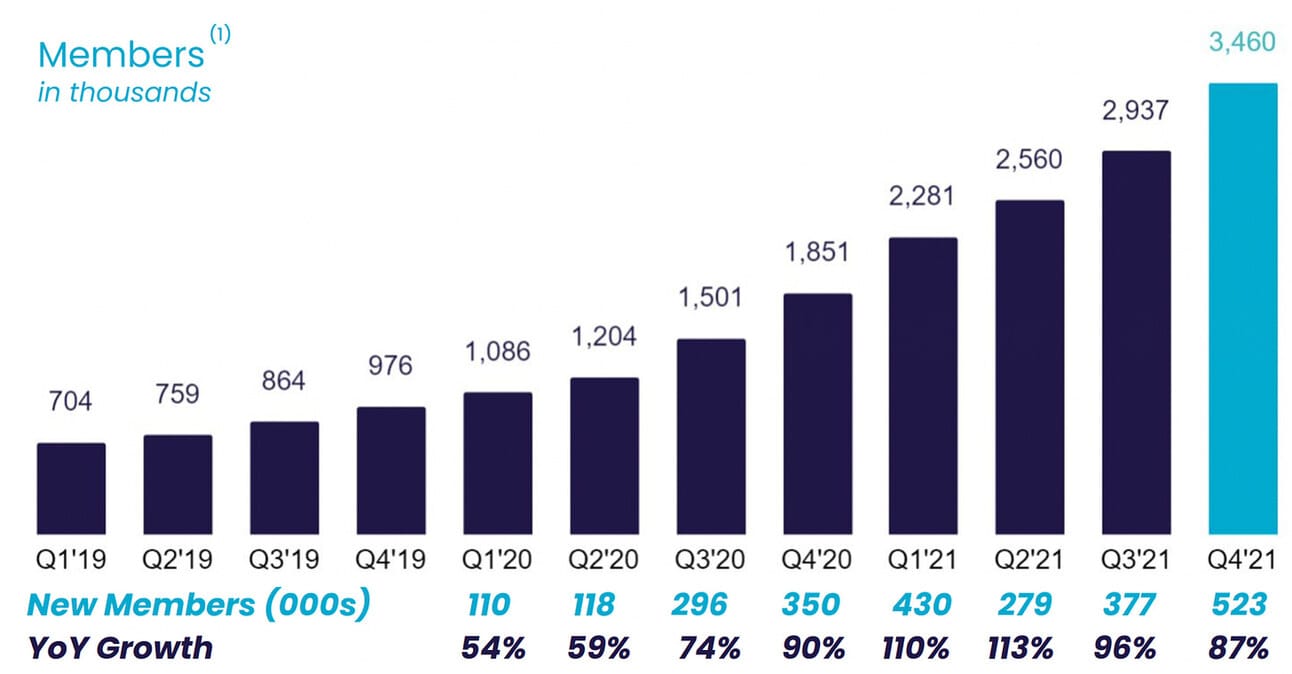

In 2021 alone, the company grew its customer base by 87% YoY, and its revenue by 74% YoY. However, the company has no intentions to slow down and guided for 55% YoY growth in revenue in 2022. Let’s break down what drives SoFi growth.

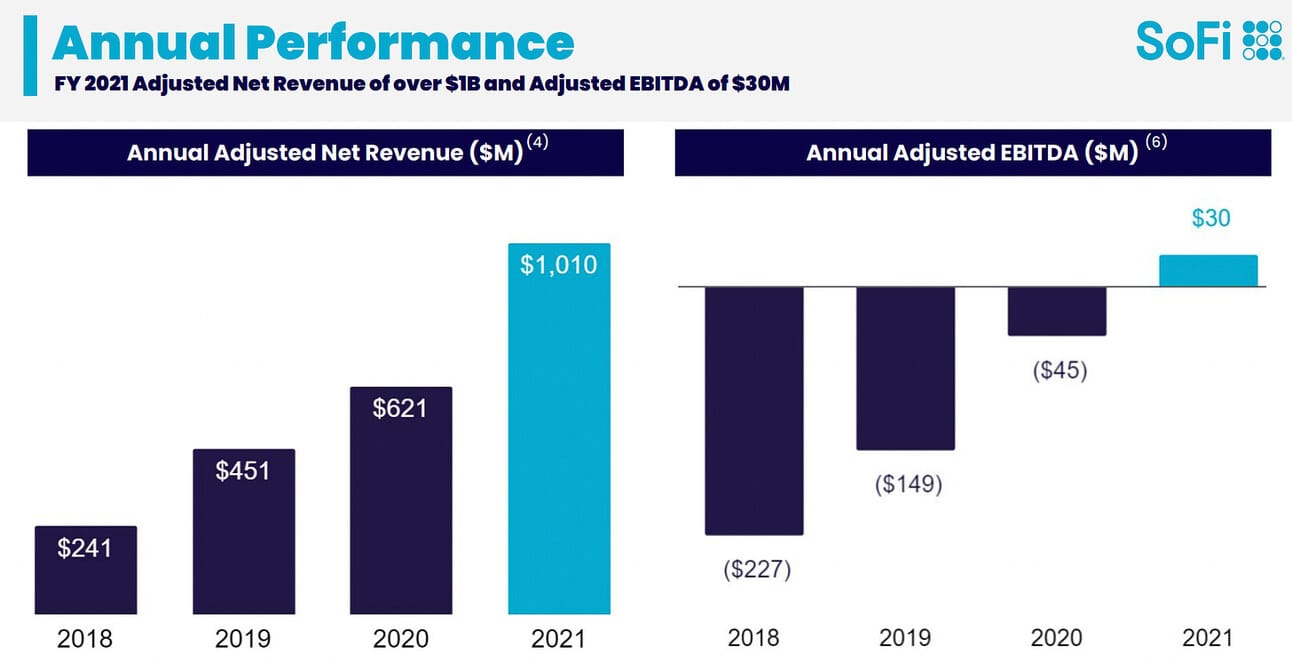

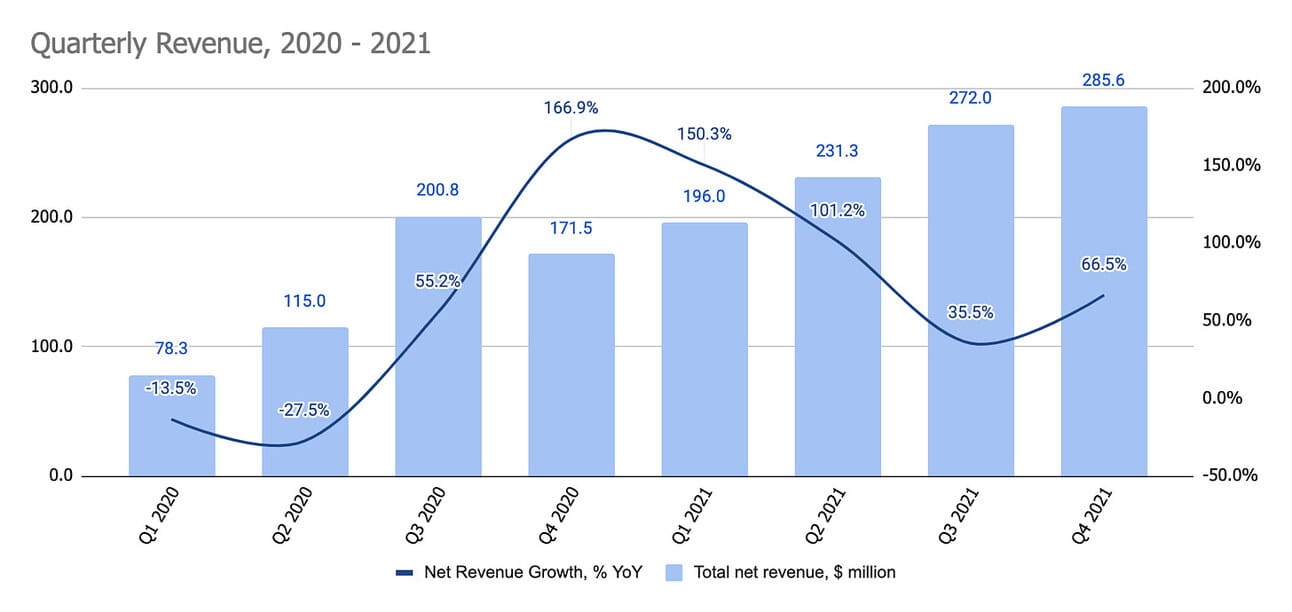

Source: Q4 2021 Investor Presentation

How SoFi makes money

SoFi makes money from two, very distinct, sources: a) it provides various financial services, such as lending, and stock and cryptocurrency trading to its customers (whom they call “members”), and b) it serves other financial institutions by providing technology platform Galileo (and, after completion of the acquisition, will also provide Technisys solutions).

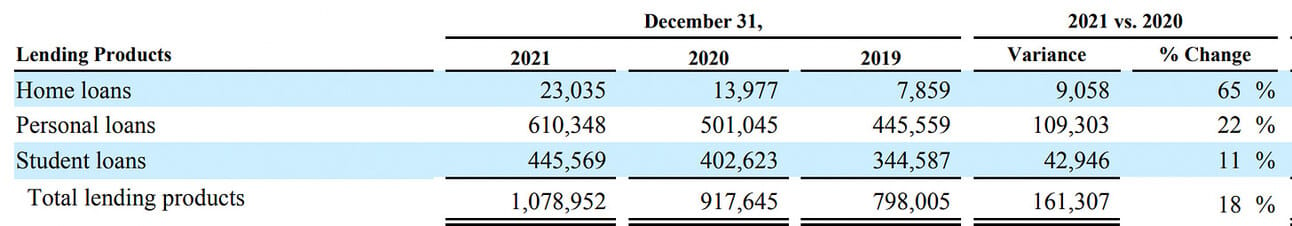

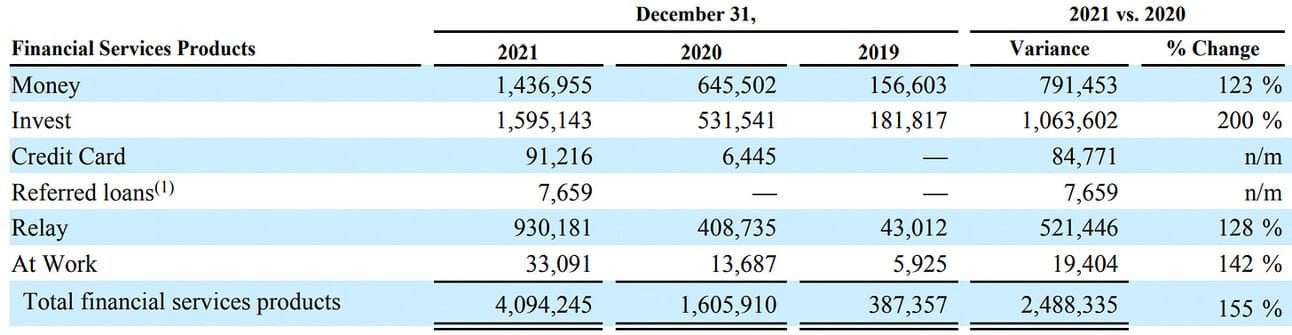

SoFi offers a wide range of financial services (one can call them a “super app”) and boasts 3.46 million customers using their products at the end of 2021. Out of the total customer base, approximately 1.6 million customers use their stock and cryptocurrency trading services (“SoFi Invest”), 1.4 million customers use their cash management account (“SoFi Money”, which will eventually be replaced with “SoFi Checking and Savings”), 1.1 million customers use they lending product (personal loans, student loans, and mortgages), and 0.9 million customers use their account consolidation and budgeting tool (“SoFi Relay”).

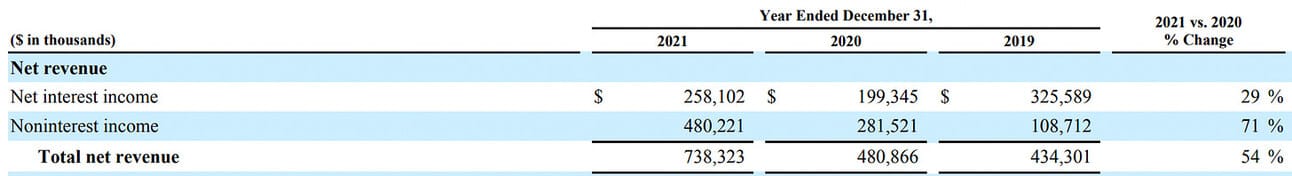

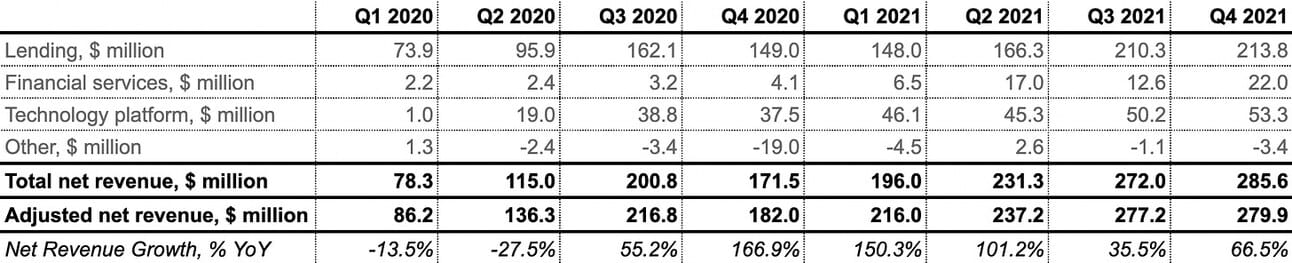

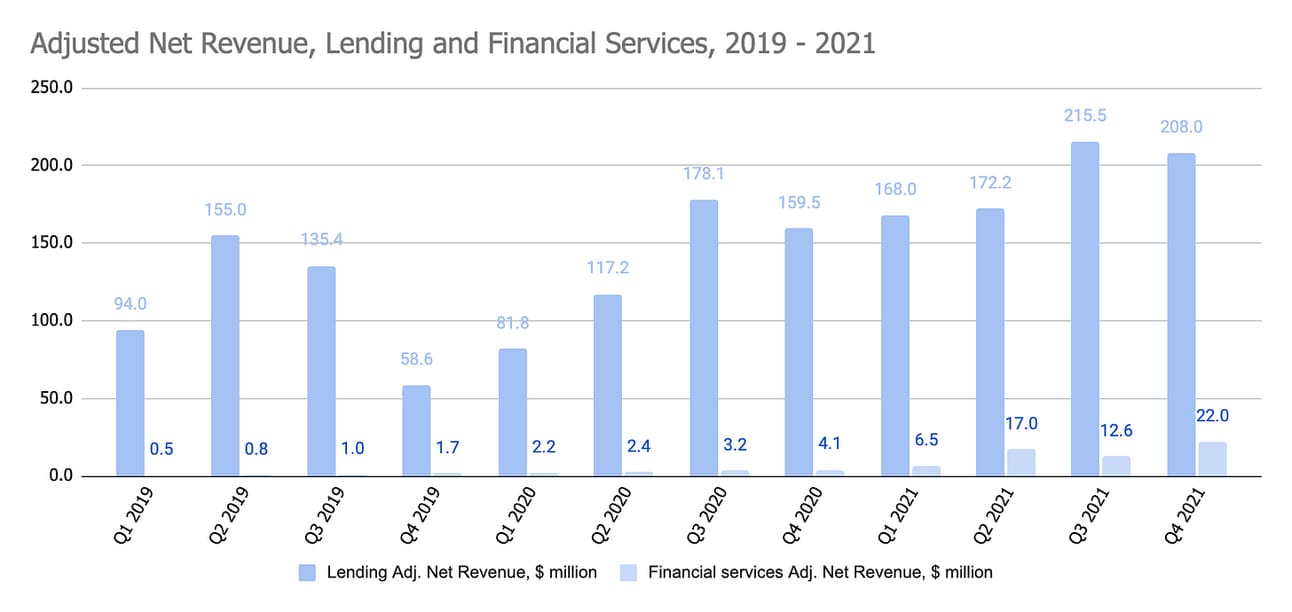

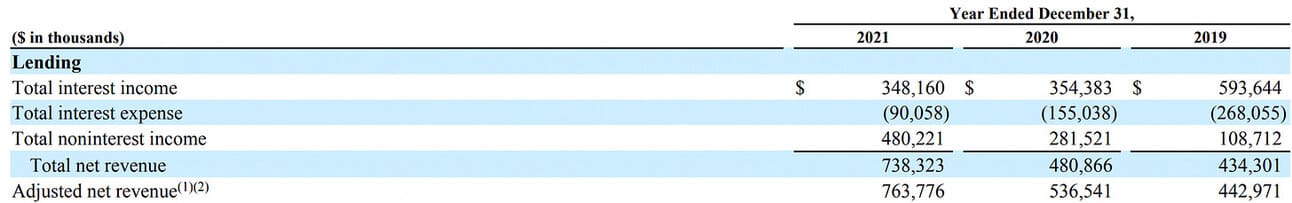

Within their reporting, SoFi splits financial services into two segments, “Lending” and “Financial services”. In total, SoFi generated net revenue of $796.4 million (or 81% of total net revenue) from its financial services in 2021, of which $738.3 million (74% of total net revenue) came from lending (see below),

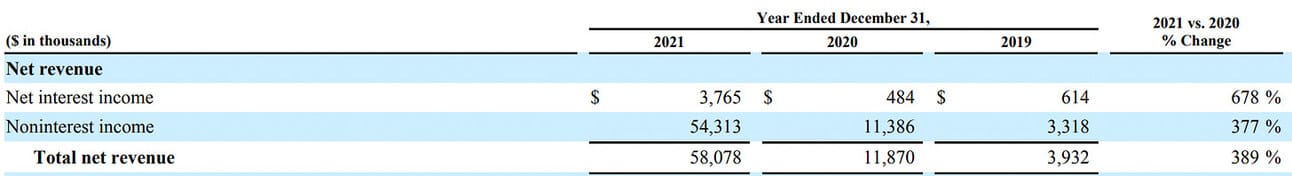

and $58.1 million (or 6% of total net revenue) from other services, such as SoFi Invest, SoFi Relay, etc. (see below)

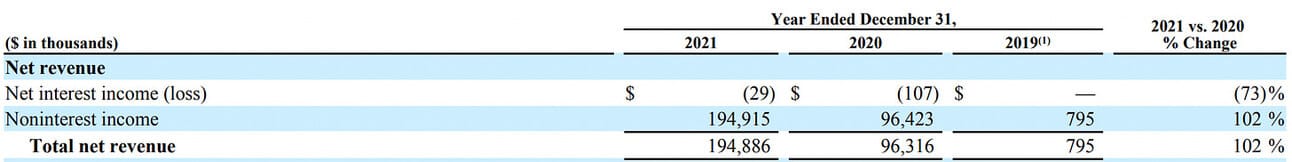

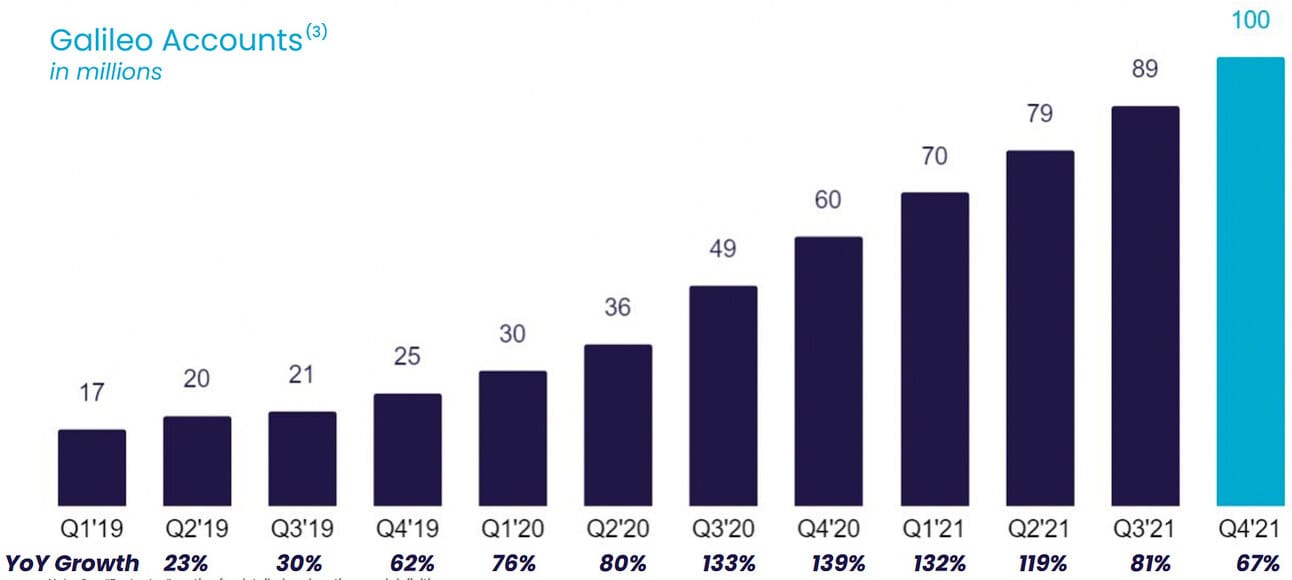

SoFi’s technology arm, Galileo, provides a Software as a Service solution that powers card-issuing of other financial institutions. For example, debit cards issued by such neobanks as Chime, Revolut, MoneyLion, and Dave, are powered by Galileo. SoFi reported that the Galileo platform serves 100+ clients, and that its platform powered 99.7 million customer accounts for its clients (i.e. one MoneyLion debit card would be considered such a “customer account”). SoFi generated net revenue of $194.9 million (or 20%) from its technology arm, Galileo, in 2021 (see below).

Revenue

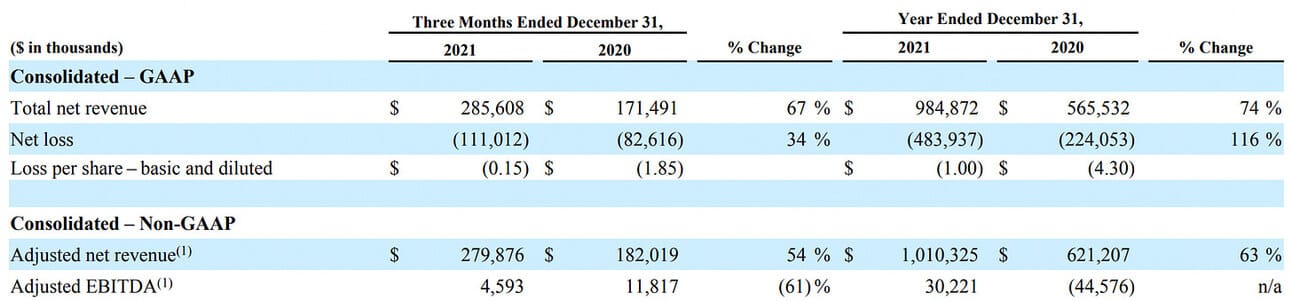

The company reported $285.6 million in net revenue in Q4 2021, and $984.9 million in net revenue for the full year 2021, which represents 66.5% YoY growth for the quarter and 74% for the full year.

Net revenue generated by the Lending segment in the full year 2021 grew 54% YoY compared with 2020, net revenue generated by the Financial Services segment grew 389% YoY, and net revenue generated by Technology platform grew 102% YoY (it should be noted though, that Galileo was acquired in 2020, so part of this “growth” comes from financial consolidation into SoFi statements, rather than the actual growth of Galileo revenue).

The company uses non-GAAP “Adjusted Net Revenue” in its reporting, adjusting the GAAP net revenue of the Lending segment with fluctuations in the fair market value of the servicing rights and residual rights on securitizations. Thus, on an adjusted basis the company reported $279.9 million in net revenue in Q4 2021 and $1,010.3 million for the full year (representing 54% YoY growth for the quarter and 63% YoY growth for the full year).

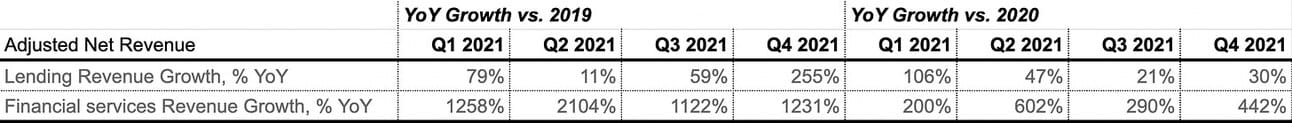

I would like to highlight revenue growth in SoFI’s Lending and Financial Services. Thus, adjusted net revenue from the Lending segment in 2021 grew 42% YoY compared to 2020, and 72% YoY compared to 2019. Adjusted net revenue from the Financial Services segment grew 389% YoY compared to 2020, and 1,377% YoY compared to 2019. The Financial Services segment is a relatively small source of revenue for SoFi; however, it is growing at an insane pace.

The company’s management guided for $280-285 million in adjusted net revenue in Q1 2022, and $1,570 million in adjusted net revenue for the full year 2022. This would represent 30-32% YoY growth for the quarter, and 55% for the full year. SoFi has three levers of growth going forward: a) customer growth, b) growth in loan originations and loan book, and c) technology acquisitions. Let’s go through all three of those.

Growth Lever #1: Customers

SoFi finished 2021 with 3.46 million customers using their lending and financial products, which represents 87% YoY growth in 2021. The company added 0.52 million new customers in Q4 2021, and 1.6 million new customers during the full year 2021. It is impressive, that despite an increased scale of the business, SoFI managed to maintain the growth pace compared to 2020 (90% YoY growth in 2020).

The company operates with a metric “Products” in its reporting and presentations. Although I don’t think it makes much sense to look at the total number of products, the company's breakdowns can help us understand the number of unique customers for a product line. This also gives us an understanding of which products supported the growth in the number of customers.

Thus, the two tables below illustrate that the company went through a modest growth in its Personal and Student loans business (22% and 11% YoY growth respectively), but experienced triple-digit growth in all other financial services, including SoFi Money, SoFi Invest, and SoFi Relay (total number of the non-lending products grew 155% YoY).

As mentioned above, SoFi gives only the approximate number of clients it has for its Galileo business (100+, of which 44 were added in 2021) and instead reports the number of “Galileo Accounts”, which is the number of their clients' customers (i.e. number of Chime debit cards powered by Galileo). Thus, the company finished the year powering 99.7 million customer accounts, which represents 67% YoY growth (up from 59.7 million accounts at the end of 2020).

When discussing Galileo, it should be noted that the growth in customer accounts comes from two sources: a) acquisition of new clients (like H&R Block), and b) growth of their existing customers, which are primarily high growth FinTechs (such as Chime, MoneyLion, Revolut, etc.)

Growth Lever #2: Loan Originations

I highlighted above that lending is the key source of SoFi’s revenue (representing 74% of the non-adjusted net revenue of the company). Thus, it is important to look at the company’s loan origination volumes and the loan book. SoFi a) sells a portion of the originated loans to third parties (i.e. other banks) as whole loans and through securitization, and b) keeps the remaining loans on their book.

In the first case, they earn the origination fee, as well as gain on sale (all part of the “Noninterest income” in the table below), and in the second case, they earn the origination fee (“Noninterest income”) and the interest income during the duration of the loan (“Net interest income”).

This year SoFi has finally secured the national banking charter, which means that they will be able to secure customer deposits (through its “SoFi Checking and Savings” product) and use those to keep a larger portion of the originated loans on their balance sheet. They will forego “gain on sale” income for these loans (and will have to book provision for bad loans), but will start building their loan book and earning interest income. During the earnings call, the management indicated that the company will start originating loans from the bank’s balance sheet starting from May, 2022.

This is a sizeable opportunity for SoFi because a) at the moment they keep a limited volume of originations on their book (so the banking charter will increase the profitability of the current origination volumes), and b) they keep growing their origination volumes in both personal and student loans.

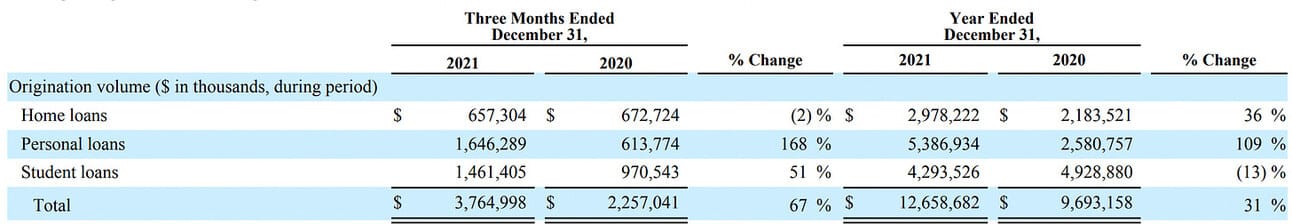

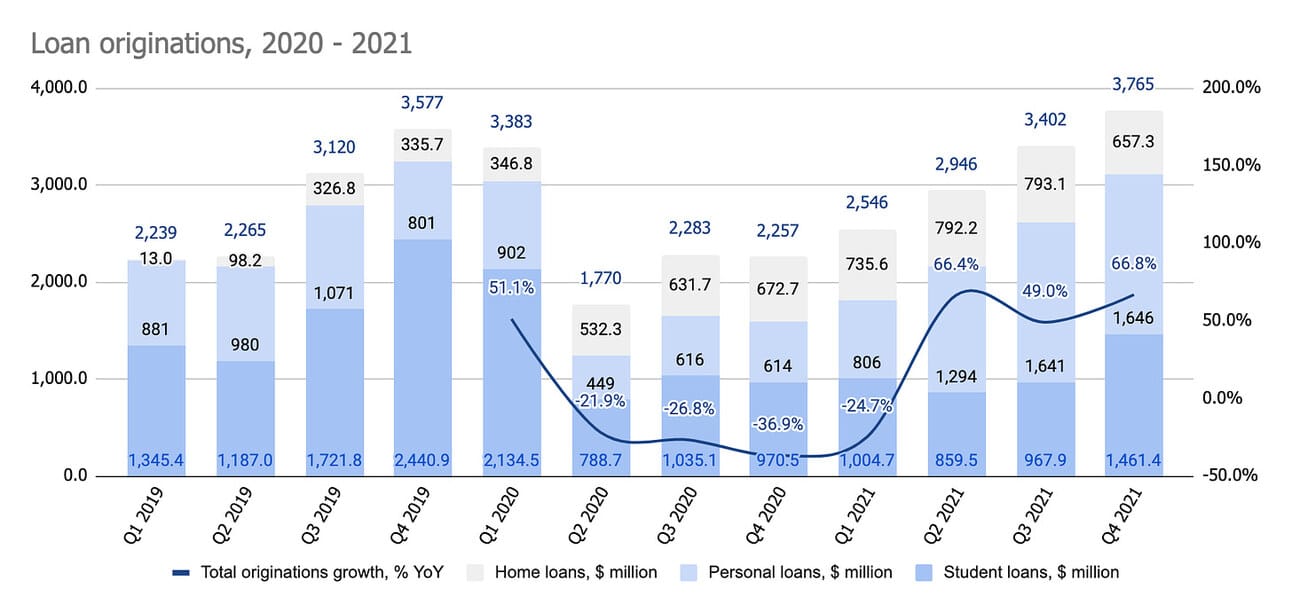

As you can see from the tables below, SoFi originated $3.76 billion in loans in Q4 2021, and $12.7 billion in loans during the full year of 2021. This represents 67% YoY growth for the quarter and 31% YoY growth for the full year 2021. However, their loan book grew by $1.2 billion only (from $4.88 billion in 2020 to $6.07 billion in 2021).

SoFi more than doubled personal loan originations in 2021 (109% YoY growth compared with 2020); however, comparison with 2019 would be more appropriate in this case given artificial slow down in originations in the early days of the pandemic. Thus, SoFi grew personal loan originations by 44% compared with 2019. Home loan originations grew 36% YoY in 2021, and 284% compared with 2019.

Student loan origination decreased by 13% YoY compared with 2020, and by 36% compared with 2019. The decrease in student loan originations was caused by the student loan moratorium introduced in the early days of the pandemic and later extended until May 1, 2021. Moratorium allowed borrowers to pause student debt repayments, which not only cause a decrease in interest income for SoFi, but also negatively impacted their origination volumes because their key value proposition is refinancing of student debt.

In summary, a) SoFi will start originating loans from its bank’s balance sheet in May, 2022, b) student loan moratorium is expected to expire on May 1, 2022 increasing interest income on the existing portfolio and giving a boost to origination volumes, c) SoFi is growing its personal and home loan originations at an unprecedented speed. All these factors should start giving SoFi’s lending business strong support starting from Q2, 2022.

Growth Lever #3: Technology acquisitions

The final growth lever that I see, is acquisitions that would strengthen SoFi’s technology segment. Thus, SoFi acquired Galileo in 2020, and it contributed approximately 20% of the company’s revenues in 2021 ($194.9 million). In February 2022 they announced the acquisition of Technisys for $1.1 billion in an all-stock deal (the deal was closed already in March 2021).

Technisys is a core banking software vendor serving “60 established bank, ntech, and non-financial brands in Latin America and the U.S”, and its offering is complementary to the offering of Galileo. The company’s management stated in the acquisition announcement that Technisys is expected to add “cumulative $500 to $800 million of revenue through YE 2025”.

As per the acquisition announcement, Technisys generated $70 million in revenue in 2021, and the management expects the company to grow its revenue by 20-25% in 2022 (resulting in $84-87 million added to SoFi top line). If we apply similar revenue growth guidance to Galileo’s revenue than we would be looking at $234-244 million in revenue in 2022, or $318 - 331 million in revenue for the Technology segment as a whole (or 63-69% YoY growth).

Given company’s balance sheet strength and the stated ambition to become the “AWS of Fintech”, I would not exclude that SoFi might pursue additional acquisition opportunities in 2022.

Net Income (Loss) and EBITDA

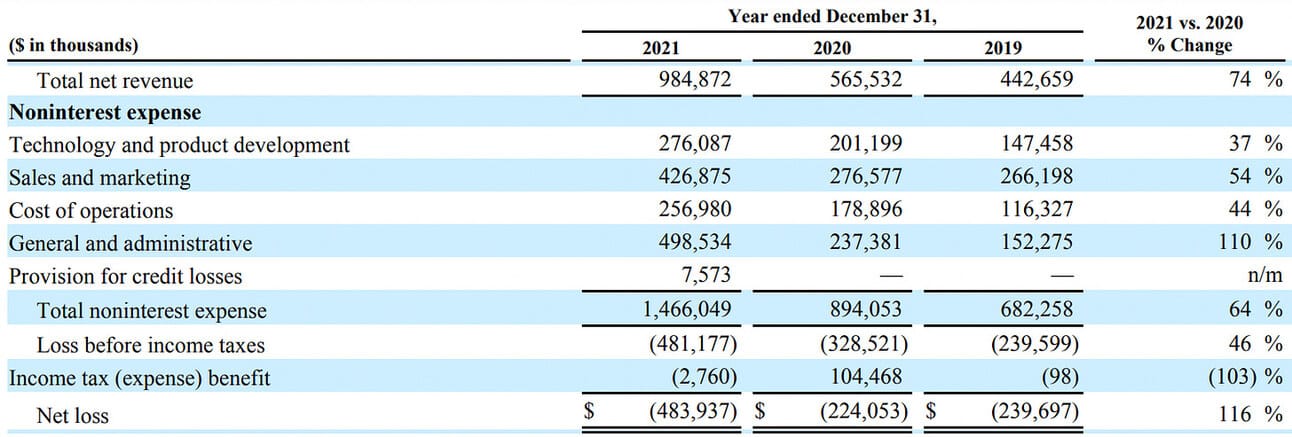

SoFi reported Net loss of $111.0 million in Q4 2021 (an increase from the Net loss of $82.6 million in 2020), and Net loss of $483.9 million for the full year 2021 (an increase from the net loss of $224.1 million in 2020).

As can be seen from the table below, “Total non-interest expense” grew 64% YoY, resulting in a 116% increase in Net loss for the year. “Sales and marketing” expense seems to be elevated compared to other lenders (3.3% of origination volume); however, given SoFi’s investment into promoting Financial services and building general brand awareness (i.e. SoFI Stadium sponsorship), those seem reasonable. “General and administrative” expenses are worrisome, as they constituted 50% of the total net revenue, and grew faster than the revenue in 2021 (110% YoY growth).

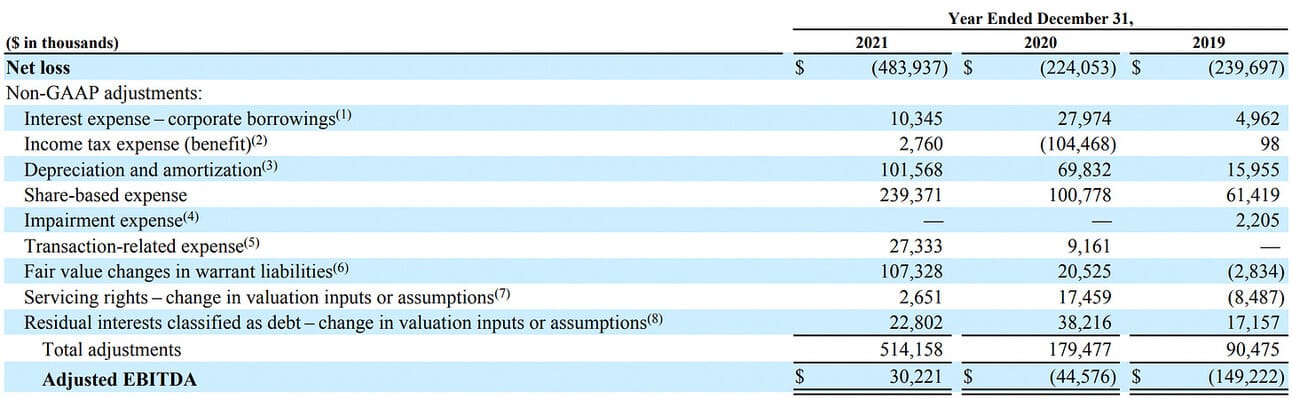

The company reports Adjusted EBITDA as a measure of its profitability. Adjusted EBITDA is calculated through adjustment of Net loss primarily for depreciation and amortization, stock-based compensation, as well as changes in the fair value of warrants, servicing rights and residual interest in securitizations (please see below).

Thus, SoFi reported Adjusted EBITDA of $4.6 million in Q4, 2021 (decrease from $11.8 million in Q4 2020) and $30.2 million for the full year 2021 (an improvement from negative $44.6 million for the full year 2020). Q4, 2021 was the 6th sequential quarter with positive adjusted EBITDA.

“Depreciation and amortization position” above ($101.6 million) includes “primarily … amortization of intangible assets … associated with the Galileo and 8 Limited acquisitions, amortization of purchased and internally-developed software, and depreciation related to SoFi Stadium fixed assets.”

“Transaction-related expenses” ($27.2 million) “included a $21.2 million special payment to the Series 1 preferred stockholders in conjunction with the Business Combination [SoFi going public via SPAC merger] and financial advisory and professional costs associated with transactions that occurred during the period”.

Regarding “Fair value changes in warrant liabilities” in the table above ($107.3 million), the company’s 8K filling mentions that “The vast majority of outstanding … warrants were exercised during the fourth quarter of 2021, and therefore the Company incurred gains and losses associated with fair value changes until the warrant liabilities converted into SoFi common stock. The remaining unexercised warrants were redeemed…on December 6, 2021.”

“Servicing rights…” ($2.7 million) and “Residual interests…” ($22.8 million) are the adjustments to the revenue that were discussed above (Adjusted Net Revenue includes these two adjustments).

The company did not profive a guidance on Net loss, but guided for $0-5 million in Adjusted EBITDA in Q1, 2022, and $180 million in Adjusted EBITDA for the full year 2022. In addition, the company guided for $340 million in stock-based compensation in 2022 (and increase from $239.4 million in 2021).

In summary, SoFi guided for $1,570 million in Adjusted Net Revenue in 2022, which is a $560 million increase compared to 2021. They also guided for $180 million in Adjusted EBITDA, or $150 million increase compared to 2021. They guided for an increase of $100 million in stock-based compensation, but at the same time, in 2022 they will not occur SPAC merger specific costs ($21 million in 2021) and do not have warrants ($107 million in 2021). Therefore, a quick and dirty calculation would lead us to a Net loss of $320-350 million for the full year 2022.

Things to Watch in 2022

Student loan originations after the end of moratorium. The moratorium clearly hindered student loan refinancing volumes for SoFi in 2020 and 2021 (just getting back to 2019 volumes would mean 50-55% growth in originations). The impact will become noticeable starting from Q2, 2022.

Personal and home loan origination volumes. SoFi has been considerably growing its personal and home loan origination volumes. My understanding from the revenue guidance is that the company is expecting to continue growing these two business in high double-digits.

Full rollout of the national banking charter. SoFi is expecting to start issuing loans from its bank’s balance sheet starting from May, 2022. As discussed above, this will allow them to keep large proportion of origination on their books and earn interest income. Until May, 2022 we should watch the volumes of deposits that they collect via “SoFi Checking and Savings” product.

Revenue growth from Technisys and Galileo (and maybe other acquisitions). Looks like Galileo gave a lot of confidence to SoFi team to continue pushing forward the concept of “AWS for Fintech”. I still believe that financial services and software businesses are too different in their nature (and thus should be spun off at some point), but for now let’s see how those contribute to SoFi’s top line.

Growth in “SoFi Invest” and “SoFi Credit Card”. Financial services segment is growing in triple digits and is just so much fun to watch. It is a minor revenue source at the moment (6% of the total revenue), but it clearly gives SoFi a lot of visibility and positive coverage (and if it continues growing at these rates, it might also become a meaningful income stream).

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.