SoFi ( ) reported Q1 2022 results earlier in the week. It was a terrible week (or rather terrible six months) for the markets and for the Fintech companies in particular. Yet, Anthony Noto and the team delivered another strong quarter and gave reassuring guidance for the remainder of the year. Fintech companies will be fine, even if the ride reminds a rollercoaster.

SoFi finally got a bank charter, and nothing beats a balance sheet in the lending business. SoFi makes their customer happy, customers bring deposits, and deposits mean cheap funding for lending. Seems like a path to a profitable business! Let’s review their Q1 2022 results!

Business Segments

SoFi operates a diversified business serving both consumers (B2C) and other businesses (B2B). On the B2C side, the company offers student, personal, and mortgage loans (further referred to in the text as the “Lending” segment), as well as a set of non-lending financial services, such as savings and checking accounts (SoFI Money), brokerage accounts (SoFi Invest), and account aggregation and budgeting service (SoFi Relay). The company refers to non-lending products as the “Financial Services” segment.

On the consumer side, the company calls its customers “members”, and defines a member “as someone who has a lending relationship with us through the origination and/or ongoing servicing, opened a financial services account, linked an external account to our platform, or signed up for our credit score monitoring service. Once someone becomes a member, they are always considered a member unless they violate our terms of service.”

On the B2B side, the company offers card issuing and management solutions for other fintech companies via its subsidiary Galileo Financial Technologies (acquired in May 2020), and core banking solutions via its subsidiary Technisys (acquired in March 2022). SoFi refers to this business as the “Technology Platform” segment.

The company uses the metric “accounts” in its Technology Platform segment, which refers to the number of end consumer accounts powered by the Galileo platform. For instance, when one of Galileo’s customers, such as the neobank MoneyLion, issues a debit card (to their customer) that is powered by Galileo, this is counted towards the “accounts” metric. The logic comes from the subscription-as-a-service pricing of Galileo services. Technisys charges its clients license fees, and thus, accounts powered by Technisys are not included in this metric.

Customers

In its B2C business, SoFi finished Q1 2022 with 3.87 million members, which represents a 70% growth YoY, and 12% sequentially. The company added more than 400,000 members during the quarter and over 1.5 million members during the last reported year. Please note that “members” refers to the total number of customers that signed up for SoFi products and services since the inception, irrespectively of whether the customer is active at the reporting date.

The company reports the number of “Products” used by its members (i.e. 456,773 student loan “products” means that 456,773 unique “members” took a student loan from SoFi). The number of “products” exceeds the number of “members”, as the company’s customers can use multiple products. Similarly, with members, the products metric is counted since the company’s inception, irrespectively of whether the product is used (or a loan repaid) at the reporting moment.

The “products” metric is super confusing; however, it gives good insights into what components of SoFi offering are driving “member” growth. For instance, the tables below illustrate that during the last year over 44,000 members took a student loan, over 140,000 members took a personal loan, over 800,000 customers opened a savings and checking account, and over 950,000 members signed up for SoFi Invest. Going forward you can think of these numbers like this: SoFi Money customers bring deposits, lending customers drive loan originations, and SoFi Invest customers contribute towards non-interest fee income.

In its B2B business (Galileo and Technisys), the company reported a 58% YoY increase in Galileo-powered accounts, which grew from 69.6 million at the end of Q1 2021 to 109.7 million at the end of Q1 2022.

As I mentioned above, the “accounts” metric refers to Galileo business only and was a reasonable proxy for the performance of the Technology Platform segment before the acquisition of Technisys. However, I hope that SoFi starts providing more disclosures about this segment going forward (i.e. number of customers, Net Retention Rate, customer concentration - I mean, all the metrics that software vendors usually report).

Loan Originations

SoFi originated $3.32 billion in loans in Q1 2022, which represents 30.5% YoY growth, and a 12% decline sequentially. SoFi is not a “mono-liner” lender, like LendingClub or Upstart, and originates different types of loans including student loans, personal loans, and mortgages.

Few notes on loan originations. First, personal loan originations grew 151% YoY, and 23% sequentially. Personal loans are now the major source of SoFi loan originations (61% of total originations in Q1 2022), which was not the case a year ago. The last few quarters were very good for consumer lenders, with all of them posting record numbers. However, given the rising interest rates, historic levels of inflation, and increasing probability of an economic recession, there are concerns over delinquency rates and a slowdown in lending volumes. SoFi management believes they will benefit from the high-interest rate environment, as the company’s customers use personal loans to refinance expensive credit card debt. However, the deteriorating demand for personal loans is clearly a risk for the company.

Second, earlier in the year SoFi completed the acquisition of Golden Pacific Bancorp, and got a national banking charter (SoFi Bank). As per the management’s comments on the earnings call, the company is now originating all loans from SoFi Bank. This acquisition allows SoFi to retain originated loans on the balance sheet by funding them with customer deposits. So far SoFi would primarily make money from “gain on sale”, meaning the premium they earn on originating loans and selling them to institutional investors. Thus, to grow the revenue, the company constantly had to increase origination volumes. As SoFi starts building its own loan book, its revenues will shift towards interest income and will become less dependent on quarterly origination volumes.

Finally, during the quarter the student loan moratorium was extended (again) until August 31, 2022. Due to the moratorium, the demand for refinancing of student loans, SoFi’s key strength, is suppressed. Before the moratorium (Q4 2019 and Q1 2020), SoFi used to originate over $2 billion in student loans per quarter, in Q1 2022 the company originated less than $1 billion. It is still not clear when and how the moratorium will end (another extension is possible), but once it does….expect SoFi to have a huge boost in originations.

Loan Portfolio and Deposits

As SoFi starts retaining loans on its books (and starts looking more like a bank in terms of its financial reporting), its balance sheet will become a better indicator of the company’s health and growth prospects (i.e. how big is the loan book, how this loan book is financed, what yield this book is producing, etc). I will spend more time on the company’s balance sheet in the future reviews, but today I wanted to highlight just two things: deposits and the existing loan book.

SoFi started collecting deposits in late February 2021 following the approval of the Golden Pacific Bancorp acquisition, and by the end of the quarter (5 weeks since the launch) deposits reached $1.16 billion. The company’s management mentioned on the earnings call, that currently, the deposits grow at $100 million a week (or a $1.2- 1.3 billion / quarter run rate). It should be noted, that in order to grow deposits quickly, SoFi is offering a 1.25% APY for members that use direct deposits, and 0.70% APY for members that are not using direct deposits. Such APY significantly exceeds the market rate, so these deposits are not cheap for the company.

If we look at the assets side, we will notice $7.22 billion in loans, which grew from $5.95 billion at the end of 2021 (proportionally to deposits increase). SoFi is not yet in a position to fully fund originated loans with deposits, so they depend on the lending facility and equity capital and continue selling loans to institutional investors. As per the management’s comments, the increase in the loan book was driven by a longer retention period; thus, SoFi now holds loans for 6 months (instead of 3) before selling or securitizing them.

Going forward, it is important to follow the strategy that SoFi will pursue with respect to retaining loans on its balance sheet. As they do not have sufficient deposits yet to fully fund originations, a decision will have to be made on what types of loans to retain and in what proportion. For instance, LendingClub, after getting its banking license, decided to retain 15-25% of total loan originations. SoFi can use the same approach or can decide to retain a specific type of loans (i.e. personal loans only). This choice will impact the yield generated by the loan book, as well as provisions.

Revenue

Let’s get to financial results. SoFi reported $330.3 million in net revenue for the quarter, a 68.6% YoY increase. As explained above, SoFi operates within three business segments. Thus, the Lending segment generated $253 million in net revenue (or 76.6% of the total net revenue), the Financial Services segment generated $23.5 million in net revenue (7%), and the Technology platform segment generated $60.8 million in net revenue (18.4%). Percentages don’t add up to 100% because SoFi also posted negative revenue of $7 million in the “other” category (not attributable to any of the segments).

Looking at the composition of the revenue (above), you can see that Net Interest Income has been growing at a faster pace than the total Net revenue (most likely because of the above-mentioned decision to hold loans on the balance sheet for a longer period). As SoFi starts accumulating loans on its balance, Net Interest income will start growing faster than the loan origination volumes (compounding effect). We can draw a lot of parallels to LendingClub which started accumulating loans a year ago.

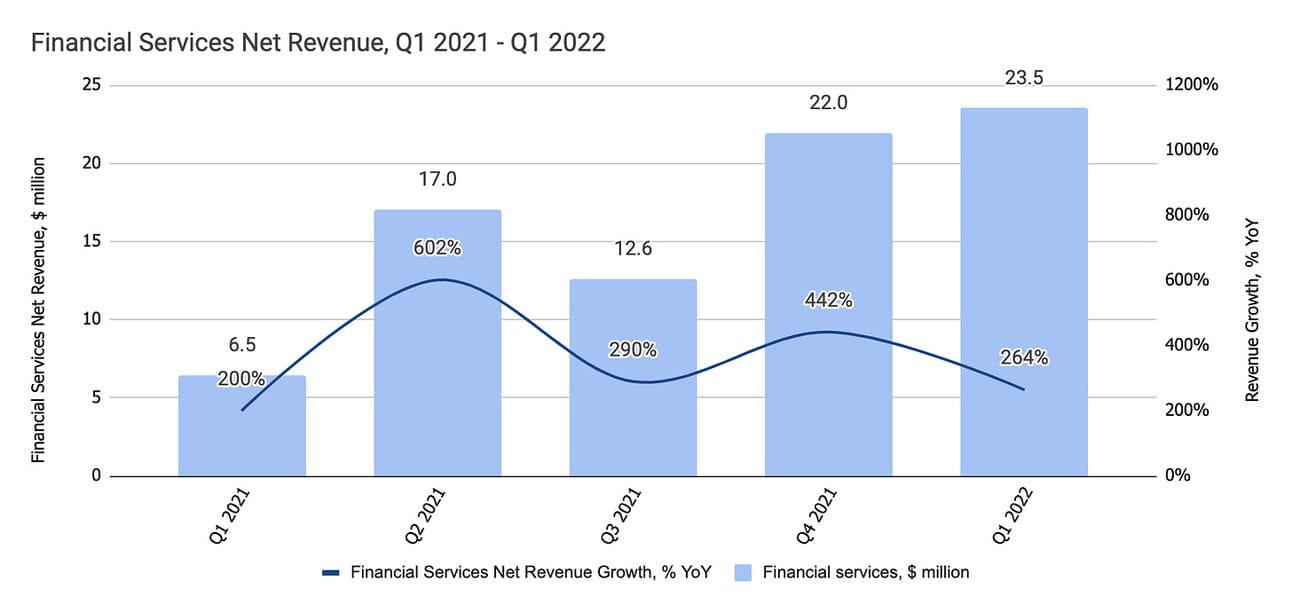

I would like to highlight the growth in the Financial Services revenue. It contributes a small proportion of the revenue at the moment, but it has been consistently growing at a triple-digit growth rate. There are three components of this revenue: 1) brokerage fees (SoFi Invest), 2) interchange fees (cards), and 3) referral fees (sales of rejected borrower leads). SoFi invests heavily into scaling SoFi Invest and SoFi Credit Card, let’s see if this continues translating into revenue growth.

The Technology Platform segment revenue grew 32% YoY, and primarily consisted of revenues generated by the Galileo business. The growth might not look impressive, but one should take into account the difficult comps (consumers got stimulus checks in Q1 2021, which translated into higher card spending, and a consequent one-time boost to Galileo’s revenues). In March 2022, SoFI consolidated Technisys, so this should bring an extra $18-20 million to the segment's revenue starting from the next quarter.

SoFi guided for $330-340 million in Adjusted Net Revenue in Q2 2022, and $1.50 - 1.51 billion in Adjusted Net Revenue for the full year of 2022. Adjusted Revenue is the Net revenue adjusted for the change in the value of Servicing Rights and Residual interest in securitizations. Adjusted Net Revenue stood at $237 million in Q2 2021 and $322 million in Q1 2022.

Operating Expenses

SoFi reported $440 million in non-interest expenses (interest expenses are included in the net interest income), which represents 18% YoY growth (and 14.6% YoY growth if we exclude provisions for credit losses). These expenses include $77 million in share-based compensation.

Non-interest expenses grew at a slower pace than Net Revenue (18% vs. 68% YoY), however, those still exceed the Revenue leading to Net Loss for the period. Few notes from the company’s 10Q filing:

General and administrative expenses (kind of) decreased YoY; however, one should take into account that Q1 2021 expenses included an “$89.9 million of expense associated with the fair value increase of our warrant liabilities”. Excluding this one-time item, G&A expenses grew 90% YoY.

Sales and marketing expenses increased by 58% YoY growth, driven by higher marketing spend. Advertising spend increased by $20.5 million, and lead generated spend increased by $14.9 million. Sponsorship of the SoFi Stadium added an extra $2.3 million.

Provision for credit losses includes “the expected credit losses of $12.0 million associated with our credit card loans”, and $1.0 million in provisions for the loans “inherited” from the acquired bank.

The rest of the increase came primarily from an increase in compensation.

As SoFi starts accumulating loans on its balance sheet, we will start seeing growth in Provisions for credit losses. As you can see above, most of the loans are booked “at fair value”, meaning they are classified as “Loans held for sale”. Thus, provisions for credit losses are kind of hidden in the Non-interest income. Provisions for credit losses are a function of the size, composition, and quality of the loan portfolio, and thus, should be looked at separately from operating expenses (which I will do in the future reviews).

Net Income and Adjusted EBITDA

SoFi reported $110.4 million in Net Loss for the quarter, an improvement from a Net Loss of $177.6 million in Q1 2021. However, Q1 2021 included a one-time loss of $89.9 million from the change in fair value of warrant liabilities (mentioned above). Excluding this loss, Net Loss for the quarter actually increased YoY.

Nevertheless, the company delivered another consecutive quarter of Adjusted EBITDA profitability. Thus, SoFi reported an Adjusted EBITDA of $8.7 million, an improvement from $4.1 million in Q1 2021. Major adjustments included share-based compensation ($77 million), depreciation and amortization ($30.7 million), and one-time expenses related to the acquisitions of Golden Pacific Bancorp and Technisys.

SoFi guided for $5-15 million in Adjusted EBITDA in Q2 2022, and $100-105 million in Adjusted EBITDA for the full year of 2022.

As can be seen from the full-year guidance, the company guides for a ramp-up of the Adjusted EBITDA in the second half of the year (annual guidance of $100-105 million less $8.7 million from Q1 and less $5-15 million guidance for Q2 = $76.3-91.3 million in Adjusted EBITDA in H2 2022). On the earnings call, the management explained that this will be the result of the growing loan book (and the growth in Net interest income) and higher contribution from the Galileo entering Banking-as-a-Service business.

If I understood correctly, Galileo is working on launching a Banking-as-a-Service business, where they would act not only as a technology provider, but also as a BIN sponsor for the cards that their customers issue (another benefit of having a banking charter).

Things to watch in 2022

Loan origination volumes. As I mentioned above, student lending might experience some headwinds in case of an economic recession; however, this might potentially be countered by the boost in student lending if the student loan moratorium is lifted. The worst-case scenario would be an economic recession and another extension of the moratorium.

The build-up of the loan book. Curious to see how quickly SoFi ramps up its loan book. Keeping the loans till maturity (or at least longer) will increase the profitability of originations. If we draw parallels to LendingClub, then the growth in Net Interest Income can be a game-changer for the company (LendingClub became GAAP profitable in less than a year after acquiring a bank).

Growth in Financial Services segment revenue. SoFi has delivered triple-digit growth in this segment for multiple quarters, but the growth is decelerating. SoFi Invest continues delivering higher revenues, but SoFi credit card so far has seen moderate success. Curious to see if SoFi manages to deliver meaningful growth in its credit card business.

Technology Platform segment. SoFi aims to turn its technology arm (Galileo and Technisys) into “AWS of Fintech”. It looks like the banking charter gives SoFi a path to the “Banking-as-a-Service” play. The management mentioned BIN sponsorship already this year, and I don’t think they will stop at that. An interesting turn of events would be if they partner with Upstart and start buying their loans (alongside Cross River Bank and FinWise).

In summary, it was a strong quarter. I am super excited about SoFi finally getting a bank charter (I think it played well for LendingClub), and it looks like they are serious about building “AWS of Fintech”. Cannot wait for the next earnings call!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter (including SoFi), as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.