Hi!

Yesterday seemed like a regular day…until the SEC filed a lawsuit against Binance, calling into question the future of crypto in the United States:

SEC sues cryptocurrency exchange Binance,

Online banks (think SoFi and LendingClub) see inflows of deposits, and

Wall Street analysts remain optimistic about PayPal

Thank you for reading and see you tomorrow!

Jevgenijs

SEC Sues Cryptocurrency Exchange Binance

The Securities and Exchange Commission has filed a lawsuit against Binance, the world's largest cryptocurrency exchange, and its founder and CEO, Changpeng Zhao, alleging multiple violations of securities rules. The SEC accuses Binance of offering unregistered securities to the general public, operating an unregistered securities exchange, mishandling customer funds, misleading investors and regulators, and opening accounts without proper know-your-customer (KYC) procedures. The SEC is seeking to freeze Binance's assets and appoint a receiver.

Among other allegations, the SEC claims that Binance illegally offered and sold two tokens, BNB and BUSD, which the agency considers to be securities. In this offering, Binance and its affiliated companies operated as an exchange, broker-dealer, and a clearing agency, which is illegal under the current securities laws. The lawsuit also claimed that several other tokens, including SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI, traded on Binance.com and Binance.US, were sold as securities (ETH was not mentioned).

Image source: The Block

In March, Coinbase (NASDAQ: COIN) received a Wells Notice from the SEC, which indicates that the agency is planning to bring enforcement actions against the company. While the detailed scope of such enforcement actions are not clear at the moment, Coinbase revealed that the Wells Notice is related to the SEC’s investigation into the “undefined portion” of assets listed on the platform, as well as the company’s staking service, Coinbase Earn. Coinbase issued a response arguing that it has not broken any securities laws, does not list securities, and is prepared to go to court to defend its position.

✔️ SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao

✔️ SEC Sues Binance and CEO Zhao for Breaking Securities Rules

✔️ Binance SEC Lawsuit Could be Preview of What Coinbase May Face

✔️ SEC Plans Lawsuit Against Coinbase, According to Exchange

Online Banks See Inflows of Deposits

Online banks, such as Capital One (NYSE: COF), Ally (NYSE: ALLY), and Goldman Sachs's Marcus, as well as credit card companies, such as American Express (NYSE: AXP), Synchrony Financial (NYSE: SYF), and Discover Financial (NYSE: DFS), experienced inflow of deposits in the first quarter, benefiting from the recent regional banking crisis, reports The Wall Street Journal. In contrast, regional banks like U.S. Bank, Truist Financial, Citizens Financial, and even big banks like Bank of America and Wells Fargo have experienced a decline.

The Federal Reserve's push for higher interest rates and the consecutive turbulence amongst regional banks, have led customers to seek alternatives, including investing in treasuries, and moving savings to money-market funds. The absence of physical branches allows online banks and credit card companies to offer higher interest rates, attracting customers who are seeking better returns on their money. The authors argue that traditional banks may need to adjust their models, as the shift towards online banks is challenging the value of physical branches.

Image source: The Wall Street Journal

Surprisingly, the article did not mention Fintech lenders SoFI (NASDAQ: SOFI) and LendingClub (NYSE: LC), which saw a 37% and a 13% quarter-over-quarter increases in deposits in the first quarter of 2023 respectively. This would put SoFi at the top of the chart above, and LendingClub right next to it. SoFi’s CEO, Anthony Noto, pointed that out on Twitter, and someone even “fixed” the chart by adding SoFi. As of this writing, SoFi and LendingClub offered up to 4.20% and 4.25% APY on deposits and high-yield savings accounts respectively.

✔️ Online Banks Are Winning the Deposit War

✔️ Regional banking crisis is attracting deposits for digital services, says Truist

✔️ SoFi Technologies, Inc. Reports First Quarter 2023 Results

✔️ LendingClub Reports First Quarter 2023 Results

Wall Street Analysts Remain Optimistic About PayPal

PayPal (NASDAQ: PYPL) has experienced an 80% stock plunge, losing nearly $300 billion in value since its peak in 2021. Despite this decline, most Wall Street analysts remain optimistic about the company, reports Bloomberg. Thus, around two-thirds of the more than 50 firms covering PayPal have a “buy” or equivalent rating on the stock, with none giving it a “sell” rating. This differs from other major tech companies like Apple, Microsoft, and Nvidia, which have received sell ratings. The average price target for PayPal’s stock was $96.83, according to TipRanks.

Investors have become skeptical of Fintech names in the current economic climate. Although PayPal's stock is trading at a record-low valuation and is cheaper than most companies in the Nasdaq 100, some analysts believe that being cheap is not enough reason to buy the stock. They doubt that PayPal will regain its peak price-to-earnings multiples seen during the pandemic due to changing interest dynamics and slowing growth. The company's focus on its largest core accounts may drive volume growth but at lower margins, raising questions about how long PayPal can offset margin pressures with cost control.

In the first quarter of 2023, PayPal’s revenue increased 9% YoY to $7.04 billion, driven by a 10% YoY growth in Total Payment Volume. GAAP operating income increased 41% YoY to $1.0 billion, while non-GAAP operating income increased 19% YoY to $1.6B. The company raised its full-year 2023 guidance and now expects GAAP EPS to be ~$3.42 per diluted share, a ~64% increase compared to 2022. The company expects non-GAAP EPS to increase ~20% YoY to ~$4.95 per share.

✔️ PayPal’s 80% Stock Plunge Hasn’t Soured Wall Street

✔️ PayPal adjusted margin forecast cut eclipses higher profit expectations

✔️ PayPal First Quarter 2023 Earnings Release

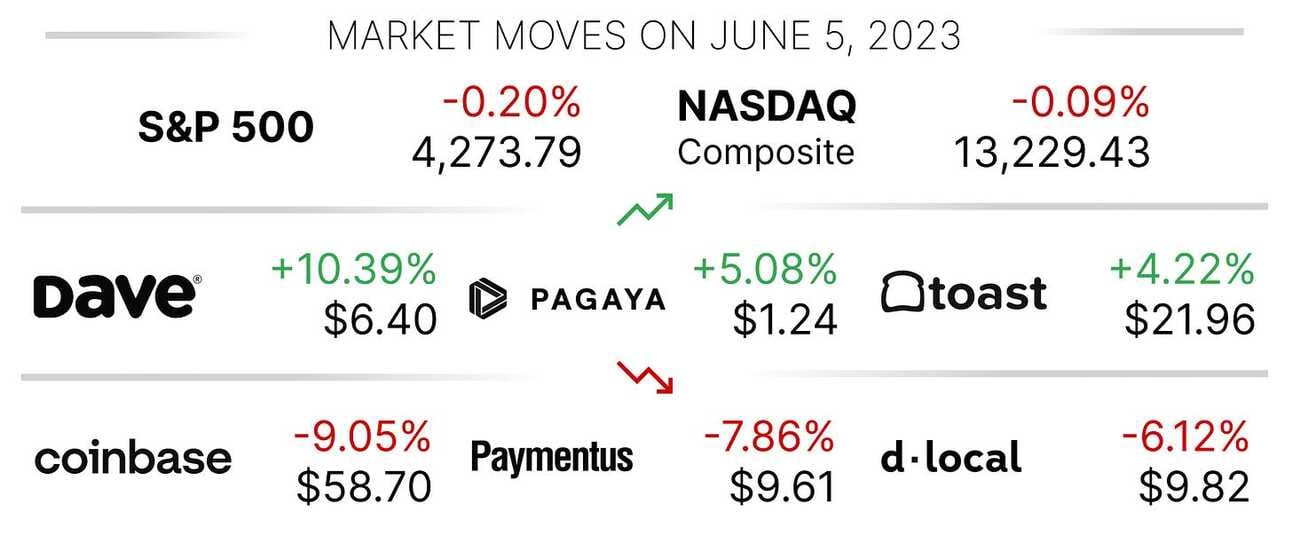

Coinbase stock (NASDAQ: COIN) declined 9.05% yesterday on the news of the SEC suing Binance. Nevertheless, the stock is still up 74.72% this year, outperforming both the Nasdaq Composite index and Bitcoin. Will the price hold?

Principal Product Manager, SoFi Money

@ SoFi

🇺🇸 Multiple locations in the United StatesConsumer Deposits Pricing and Strategy Lead

@ SoFi

🇺🇸 Multiple locations in the United StatesPrime & Member Segment Management

@ SoFi

🇺🇸 Multiple locations in the United StatesFair Lending Director

@ LendingClub

🇺🇸 Lehi, UT, Boston, MA, or San Francisco, CA, United StatesSenior Manager, Technology Risk

@ LendingClub

🇺🇸 San Francisco, CA or Lehi, UT, United States

Cover image: Binance

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.