Hi!

Welcome to the “Popular Fintech” newsletter! Hope you managed to get some rest during the weekend, as we have one busy week ahead of us:

U.S. regulators are looking for a buyer of the troubled First Republic Bank, with FDIC most likely taking over the bank if no offer is found,

Federal Reserve is expected to raise the federal funds rate by another 25 basis points

Block, Shopify, Global Payments, Coinbase, and many other Fintech companies will report their Q1 2023 earnings

Regulators are Looking for a Buyer of Troubled First Republic Bank

According to Bloomberg, the U.S. regulators worked through the weekend to find buyers for the troubled First Republic Bank. Thus, Federal Deposit Insurance Corporation invited JPMorgan, PNC Financial Services, and Citizens Financial, Bank of America, and US Bancorp to submit their acquisition offers by the end of the day on Sunday. Bank of America and US Bancorp decided not to participate in the bidding, according to the publication. If no suitable offer is found, the FDIC could seize First Republic and take ownership of the bank, as they did with Silicon Valley Bank and Signature Bank in March.

The bank’s share price declined 75.39% during last week, as the company reported a $100 billion deposit outflow on its earnings call on Monday, as well as announced the intention to shrink its balances to shore up capital. In March, eleven largest U.S. banks tried to stabilize First Republic Bank by pledging $30 billion in deposits, but that did little help. At the end of the first quarter, First Republic Bank had $173.3 billion in loans on its balance sheet, backed by $104.5 billion in deposits and $106.7 billion in short-term borrowing. The company’s stock price is down 97.11% since the beginning of the year.

Image source: First Republic Bank

✔️ First Republic Talks Extend Into Night After Banks Place Bids

✔️ JPMorgan, PNC Submit Bids to Buy First Republic in Government-Led Sale

✔️ FDIC Needs ‘Lowest-Cost’ First Republic Option, Khanna Says

✔️ First Republic’s Options May Be Dwindling. What’s Ahead for the Troubled Bank

Federal Reserve is Expected to Raise Fed Funds Rate by Another 25 Basis Points

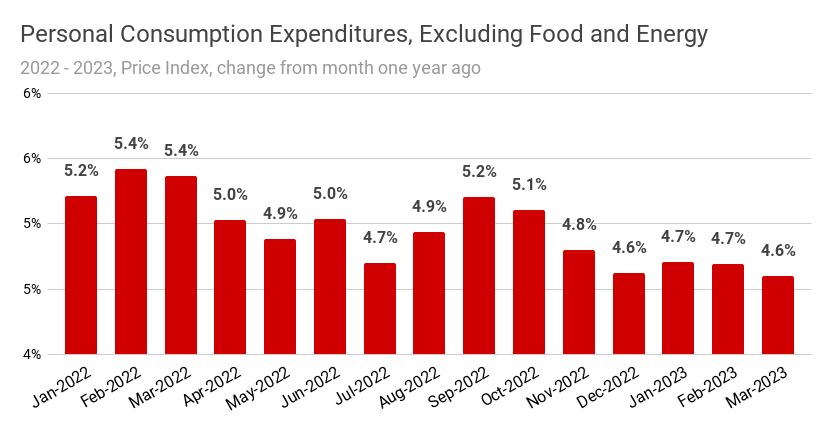

The Federal Open Market Committee (FOMC) is meeting on Tuesday and Wednesday (May 2-3) and, according to the CME FedWatch Tool, is expected to raise the federal funds rate by another 25 basis points. Inflation is on the decline, but it is still far away from the Federal Reserve’s target of 2%, hence, investors expect more hikes. The Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred measure of inflation, increased 0.1% MoM and 4.2% YoY in March (0.3% MoM and 4.6% YoY excluding food and energy). This compares to the 0.3% MoM and 5.1% YoY increase in February, and 0.6% MoM and 5.4% YoY increase in January.

This hike is expected to be the last in this cycle, as the rising rates have already introduced turbulence into the banking sector, and started to meaningfully impact the U.S. economy. Last week, the Department of Commerce reported that in the first quarter of 2023, U.S. Real Gross Domestic Product increased at an annual rate of 1.1%, well below the expected 2% in a sign that the economy is slowing fast. In the fourth quarter of 2022, GDP increased at an annual rate of 2.6%. On Friday, the Department of Labor will report unemployment data for April 2023. The Federal Reserve can maintain its rate hikes as long as the job market remains robust; however, indications of fragility could compel it to pause.

Data source: Federal Reserve Bank of St. Louis

✔️ Powell Could Face More Opposition as Fed Choices Get Tougher

✔️ The Fed Has No Good Options. The Risk of a Misstep Is Growing

✔️ US Inflation Pressures Persist, Reinforcing Case for Fed Hike

✔️ GDP Growth Is Slowing. Recession Remains a Threat

✔️ Top Fed Official Signals Support for May Interest-Rate Increase

Block, Shopify, Global Payments, and Coinbase to Report Their Q1 2023 Earning

Many Fintech companies will report their first quarter 2023 results this week. SoFi and Global Payments will report on Monday (May 1), followed by MercadoLibre, Remitly, and Alkami on Wednesday (May 3), and Shopify, Block, Coinbase, BILL, and Shift4 Payments on Thursday (May 4). While the valuations of publicly traded Fintech companies were hit hard by rising rates last year, many have rebounded in 2023, with Coinbase and MercadoLibre seeing year-to-date gains of more than 50% despite economic uncertainty and recession fears. Big banks and card schemes have already reported their results and set the stage for the Fintech companies.

Thus, Visa and Mastercard beat earnings expectations last week. The outperformance came from the unexpectedly strong payment volume growth, both in the U.S. and internationally. Visa reported a 6.4% YoY increase in payments volume (10.1% YoY on a currency-neutral basis), while Mastercard reported an increase of 12.3% YoY (17.0% YoY on a currency-neutral basis). Nevertheless, despite a robust first-quarter performance, consumer lenders like American Express and Capital One reported an uptick in delinquencies and charge-offs, prompting them to increase provisions in preparation for possible defaults.

✔️ Visa's payments business helps profit exceed Wall Street estimates

✔️ Mastercard Beat Shows Households Are Spending More on Travel

✔️ American Express Earnings Reveal Record Revenue. Why the Stock Is Falling

✔️ Capital One posts worse-than-feared quarterly profit on provisions

Consumer lender SoFi (NASDAQ: SOFI) will report its Q1 2023 results today before markets open. One of the key metrics to watch is loan origination volume, as the company’s income is heavily geared to interest income and gain on loan sales. In Q4 2022, the company originated $2.98 billion in mortgages, student and personal loans, down from $3.77 billion in Q4 2021 and $3.48 billion in Q3 2022.

Senior Technology Analyst, FOMC Secretariat

@ Federal Reserve

🇺🇸 Washington, DC, United StatesSenior Director, Business Lead, Invest

@ SoFi

🇺🇸 UT, CA, NY, or TX, United StatesVice President, Product and Customer Marketing

@ BILL

🇺🇸 San Jose, CA, United StatesEU Leader of Payment Partnerships

@ Square

🇮🇪 Dublin, IrelandDirector Product Management, Content and Messaging Platforms

@ Remitly

🇬🇧 London, United Kingdom

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image source: First Republic Bank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.