Hi!

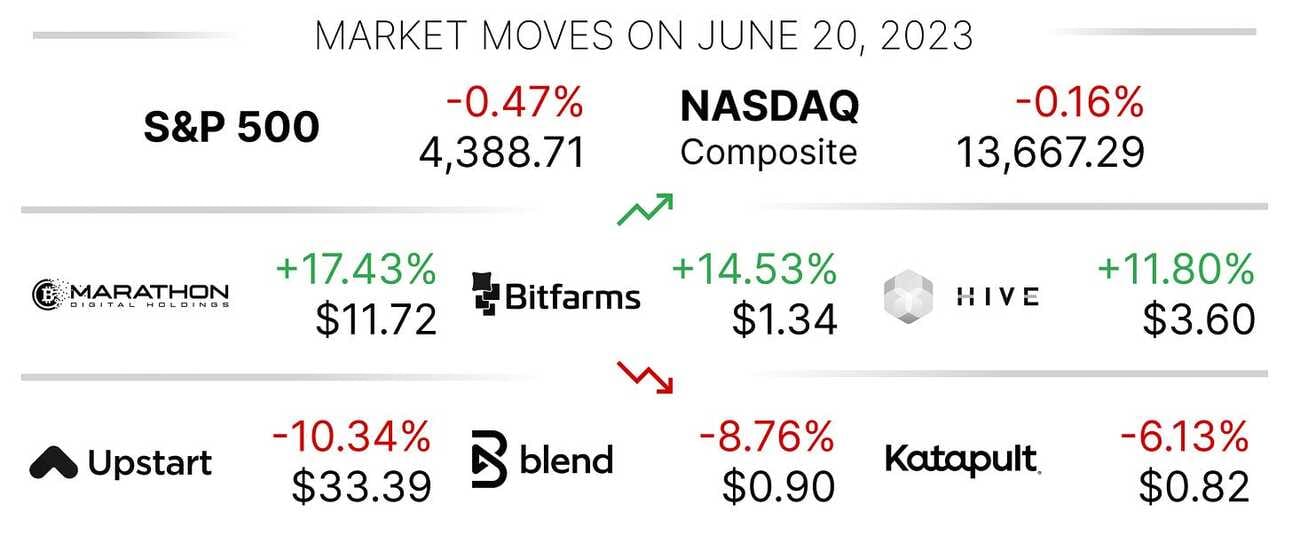

The Wall Street firms a getting serious about cryptocurrencies. BlackRock plans to launch a Bitcoin ETF, while Citadel and Fidelity back a new cryptocurrency exchange that aims to comply with the SEC’s recent demands. That’s bullish, at least for Bitcoin (and mining companies).

More on this and other events in the world of Fintech:

PayPal sells its BNPL portfolio to a private equity firm KKR,

Lightspeed expands its merchant cash advance business to the United Kingdom, Australia, and New Zealand, and

Citadel Securities, Fidelity, and Charles Schwab back a new crypto exchange

As always, thank you for reading, and don’t forget to like, share, and forward this email to a friend (or five)!

Jevgenijs

PayPal Sells Its BNPL Portfolio to Private Equity Firm KKR

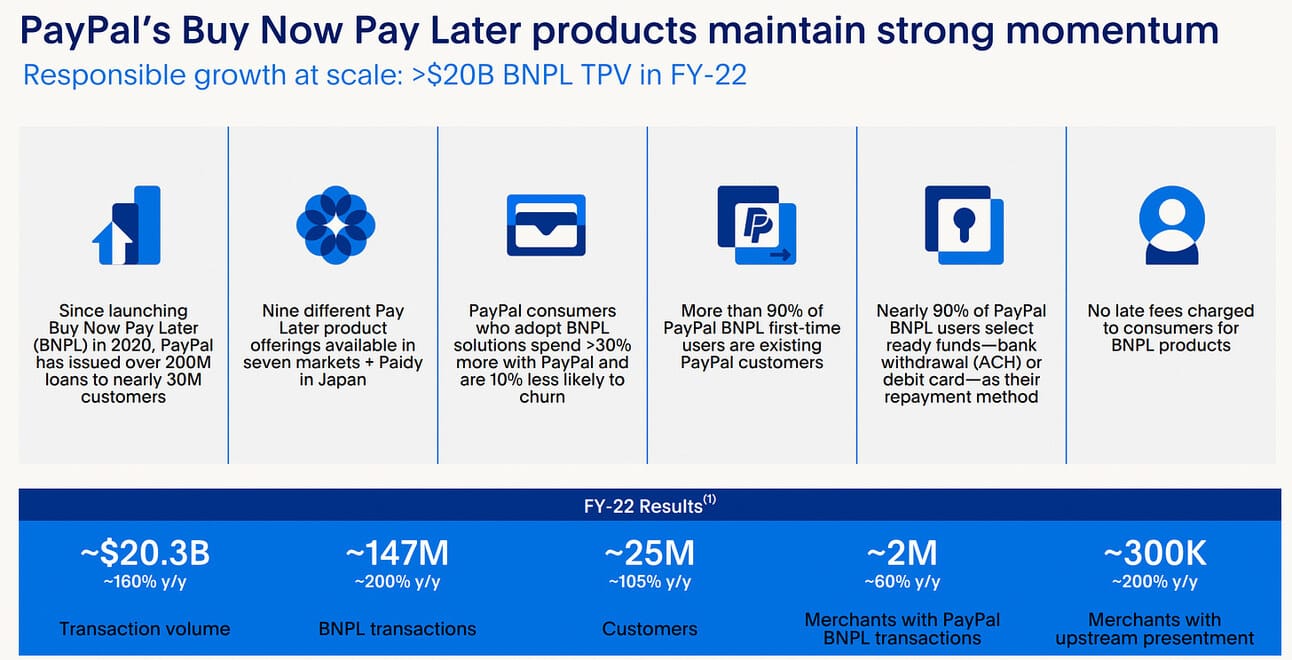

Private equity firm KKR & Co. (NYSE: KKR) has agreed to purchase up to €40 billion ($44 billion) of buy-now-pay-later loan receivables from PayPal (NASDAQ: PYPL), the company announced in a press release yesterday. Under the terms of the agreement, KKR will immediately acquire PayPal’s existing European BNPL portfolio, as well as acquire future originations of eligible loans. PayPal will remain responsible for servicing the loan agreements. The deal is expected to generate $1.8 billion in proceeds at close, and will allow PayPal to free up capital for share repurchases and other strategic initiatives.

Source: PayPal Q4 2022 Investor Update

PayPal is one of leading players in the Buy-Now-Pay-Later market, which has grown significantly in the recent years. PayPal entered this market in 2020 and has issued over 200 million BNPL loans to more than 30 million customers worldwide since then. In 2022, PayPal generated $20.3 billion of BNPL payment volume globally, up approximately 160% from 2021. It should be noted, that the deal with KKR includes PayPal’s loans originated in France, Germany, Italy, Spain, and the United Kingdom. These loans generate interest income, while most of the loans issued by the company in the United States do not (0% APR loans).

✔️ PayPal and KKR Announce Exclusive Multi-Year Relationship for European Pay Later Receivables

✔️ KKR Agrees to Buy Up to €40 Billion of PayPal’s Pay-Later Loans

✔️ PayPal Expects $5 Billion in Buybacks Following Deal With KKR

✔️ KKR set to buy $44 billion of buy now, pay later loans from PayPal

Lightspeed Expands Its Cash Advance Program to the United Kingdom, Australia and New Zealand

Lightspeed Commerce (NYSE: LSPD) announced the expansion of its merchant cash advance program, Lightspeed Capital, to the United Kingdom, Australia and New Zealand. Lightspeed Capital purchases future receivables from retail and hospitality businesses. The amount of the purchase price is not considered a loan but rather an advance, which merchants repay by remitting a percentage of their income from each future sale until the purchase amount is repaid in full. “Lightspeed Capital provides a simple, streamlined opportunity for our merchants to invest in their business,” commented JP Chauvet, Lightspeed CEO, on the expansion.

Image source: Lightspeed

Lightspeed launched its merchant cash advance program in 2020, initially in the United States. In order to launch the service, Lightspeed partnered with Stripe, essentially “packaging” the Stripe Capital product as Lightspeed merchant cash advance program. The offering was initially exclusive to the Lightspeed’s merchants, but the company later expanded it to the clients of the acquired businesses, Upserve, ShopKeep, and Vend. Merchant financing programs are not new to the market, and are offered by most payment companies, including Square, Toast and Shopify.

✔️ Lightspeed expands its Lightspeed Capital merchant cash advance program to the United Kingdom, Australia, New Zealand and Quebec

✔️ Lightspeed and Stripe Partner to Offer U.S. Retailers up to $100,000 to Power Growth

Citadel Securities, Fidelity, and Charles Schwab Back New Crypto Exchange

EDX Markets, a new cryptocurrency exchange backed by Citadel Securities, Fidelity Investments, and Charles Schwab (NYSE: SCHW), announced its official launch. Unlike traditional crypto exchanges, such as Coinbase (NASDAQ: COIN), EDX operates as a "non-custodial" exchange, meaning it doesn't directly handle customers' digital assets. Instead, it facilitates trades between firms, which settle the transactions by moving crypto and cash between each other. EDX plans to launch a clearinghouse later to streamline the clearing process, but it will still rely on third-party banks and a crypto custodian to hold customer assets.

The exchange, apparently, aims to attract brokers and investors who are interested in digital assets, but concerned about recent issues and litigations faced by other exchanges such as FTX, Binance and Coinbase. EDX Markets will initially offer trading in four cryptocurrencies, Bitcoin (BTC), Ether (ETH), Litecoin (LTC), and Bitcoin Cash. All four were not on the list of cryptocurrencies that the SEC considers to be securities (as per the agency’s lawsuits against Coinbase and Binance). In addition to Citadel, Fidelity and Charles Schwab, EDX's backers include Virtu Financial, Sequoia Capital, and Paradigm.

✔️ Digital Asset Platform EDX Markets Begins Trading

✔️ Crypto Exchange Backed by Citadel Securities, Fidelity, Schwab Starts Operations

✔️ Wall Street Is Launching a Crypto Exchange. Why That’s a Threat to Coinbase

✔️ BlackRock Tries for Spot-Bitcoin ETF With Fresh Filing

Brazilian Fintech companies, that are trading on the US stock exchanges, are doing well this year, outperforming both iShares MSCI Brazil ETF and Nasdaq Composite index 👇🏻 Nubank (NYSE: NU) is up 88.70%, XP Investimentos (NASDAQ: XP) is up 53.98% and Stone (NASDAQ: STNE) is up 50.32%.

Director, Product Management - Checkout

@ PayPal

🇺🇸 Austin, TX or Chicago, IL, United StatesDirector of Engineering

@ PayPal

🇸🇪 Stockholm, SwedenDirector of Engineering, Payments

@ Lightspeed

🇨🇦 Ottawa or Toronto, CanadaDirector of Public Relations

@ Lightspeed

🇨🇦 Montreal or Quebec, CanadaLead Infrastructure Engineer

@ EDX Markets

🇺🇸 Chicago, IL, United States

Cover image source: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.