Hey!

On his very first earnings call as the CEO of PayPal $PYPL ( ▲ 3.1% ), Alex Chriss raised a concern: “We are doing a lot of things, but are we focused enough with our resource allocation?” PayPal just held its investor day, and it was a great and insightful event. But one thing was missing - focus.

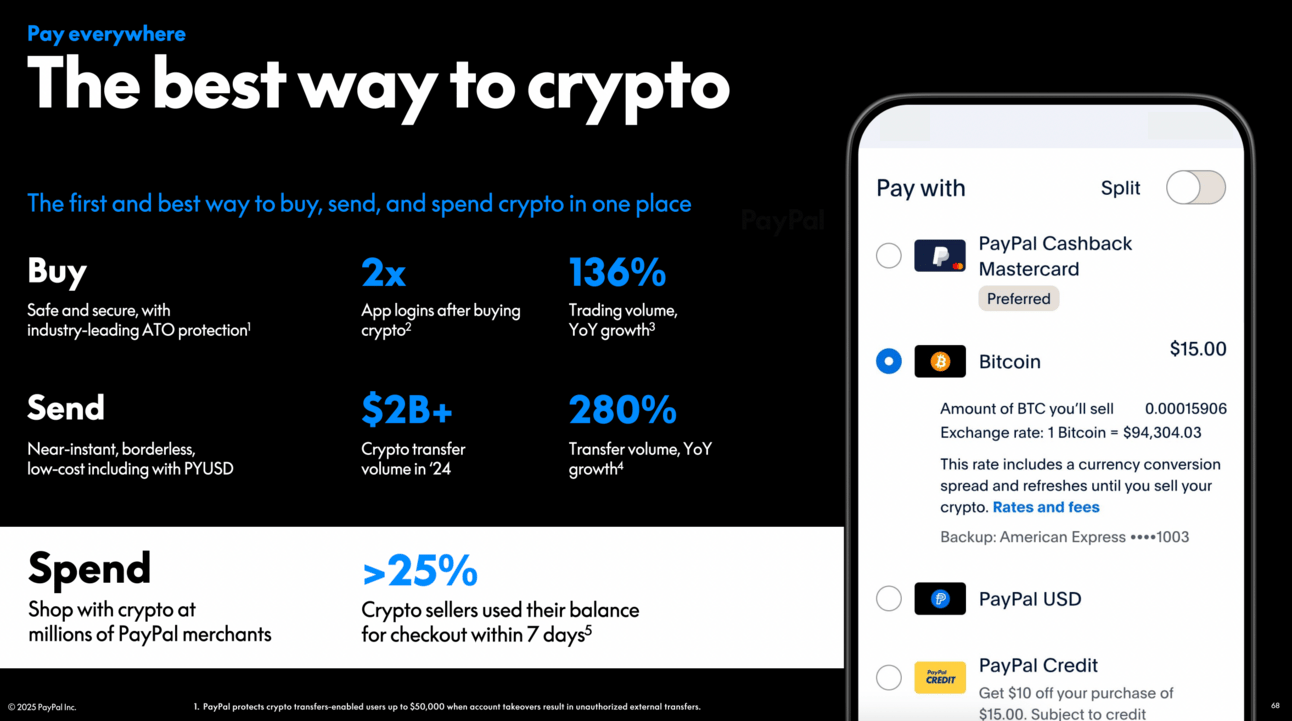

A few weeks ago, I wrote about my concerns that PayPal was trying to do too much. Turns out, they want to do even more. The new management hasn’t cut a single product or service - if anything, they are adding more. Even crypto is back.

Many stars need to align right for PayPal to achieve its targets. However, I think the complexity of PayPal’s strategy and the execution risk are already reflected in the stock price. So this is not what I want to write about. What excites me is the company’s longer-term ambition.

PayPal wants to become a commerce platform. They actually have to, as they are falling behind the competition in payments. It’s a long shot and will take years to materialize, but if they manage to pull this off…

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

All screenshots and quotes in this article are from PayPal Investor Day 2025

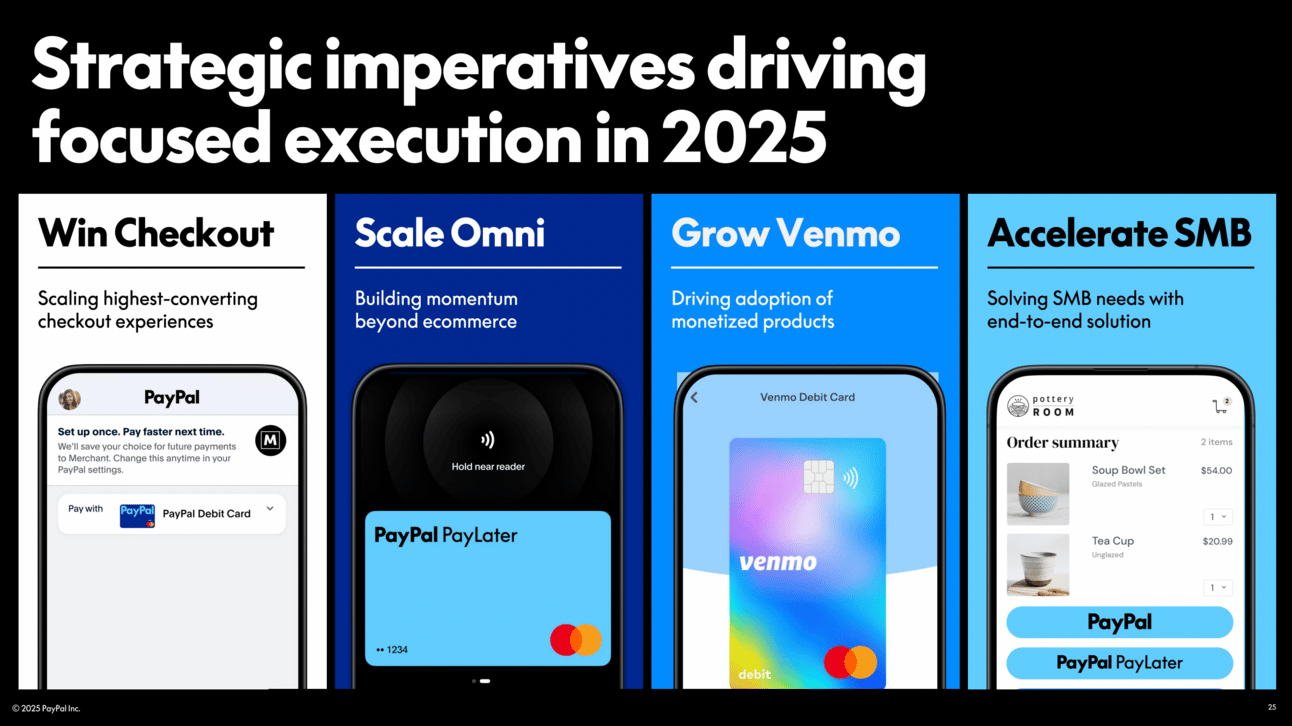

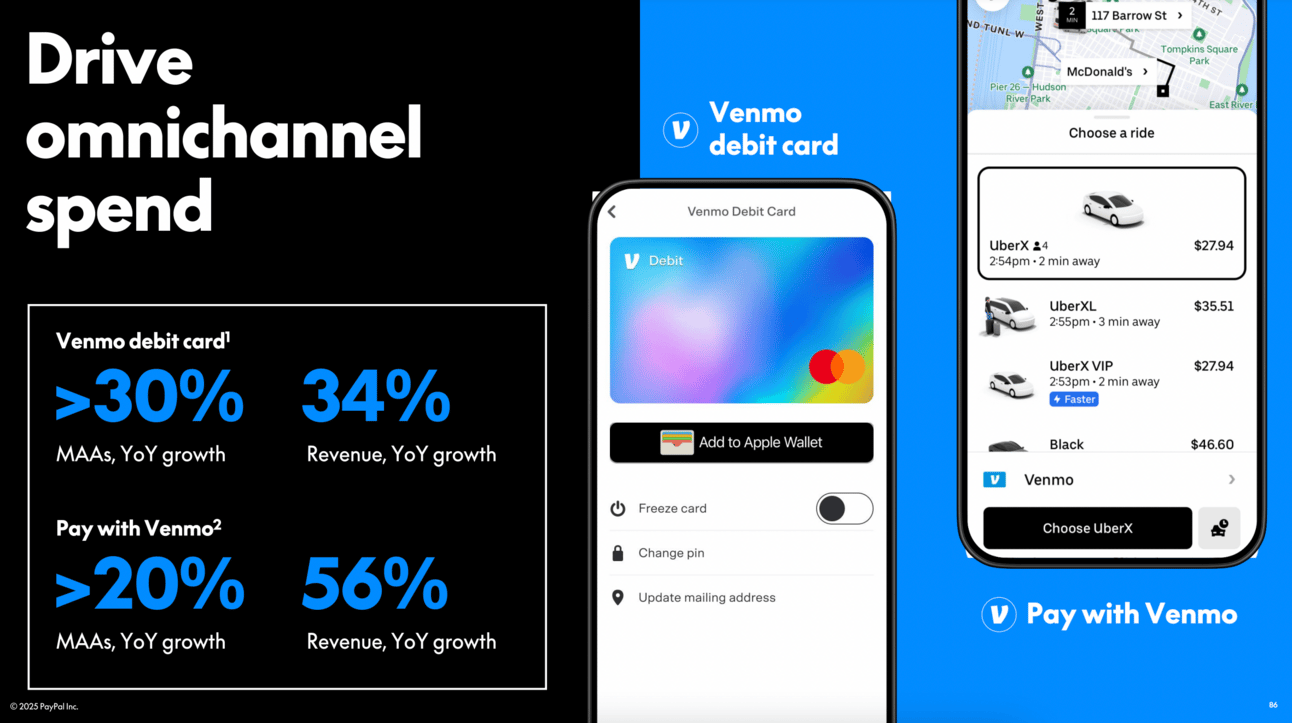

Let me first recap why I think PayPal is trying to do too much at the same. They want to reignite growth in branded checkout (the PayPal button) by improving the checkout experience, scaling BNPL lending, and expanding to the Venmo user base. They want to expand their reach into in-store commerce with PayPal and Venmo debit cards. And they want to “accelerate” the small business segment.

Thus, PayPal expects to re-accelerate branded checkout growth from 6% YoY in 2024 to 8-10% YoY by 2027. This requires rolling the new checkout experience to 80% of the customers globally, and growing Pay with Venmo at a CAGR of over 40% and BNPL lending volume at a CAGR of over 20% over the next three years.

Our goal is to nearly double the size of our pay later business over the next 3 years, to grow at more than a 20% CAGR…we will nearly triple pay with Venmo volume over the next 3 years. We expect to grow at more than a 40% CAGR over -- to over $22 billion

In the omnichannel push, PayPal expects Venmo debit card TPV to grow at a CAGR of over 20%, and PayPal debit card TPV to grow at a CAGR of 30%, reaching the total debit card TPV of $50 billion by 2027.

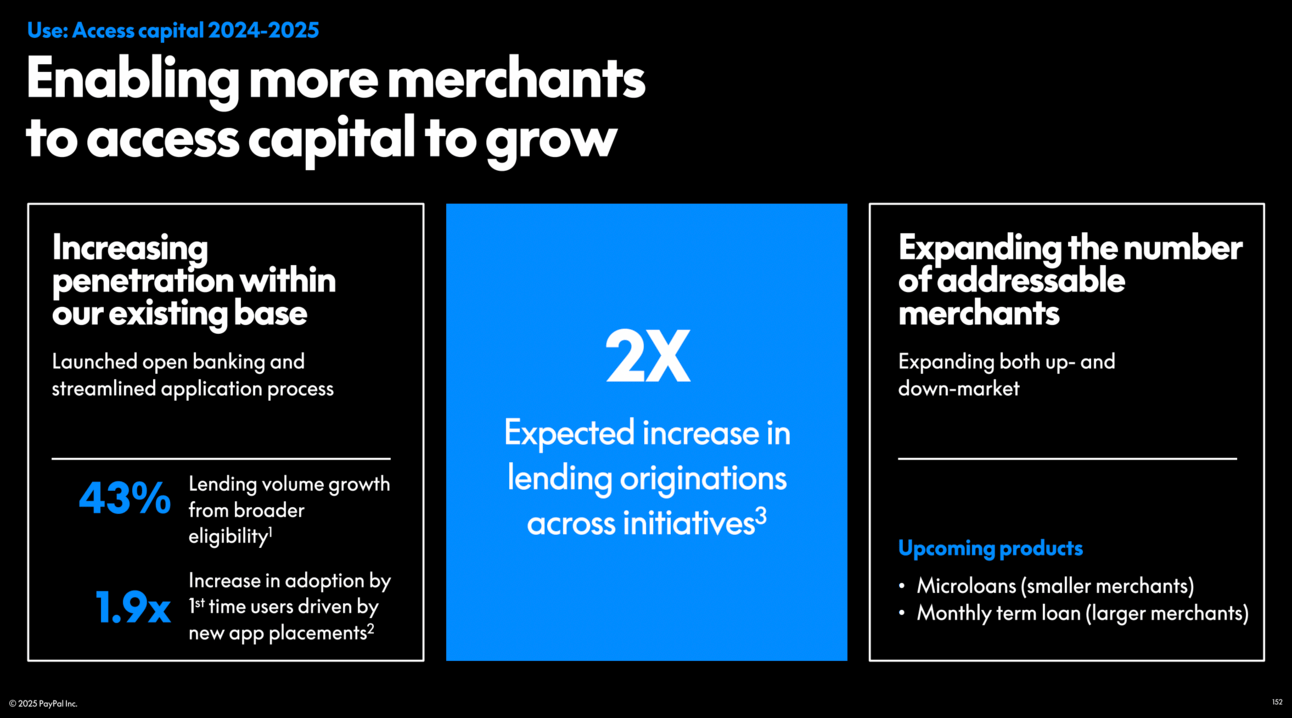

In the small business segment, PayPal is overhauling its go-to-market strategy and doubling down on distribution through the partner network, expanding to 550 actively managed partners (think Shopify, Big Commerce, WooCommerce, etc.). And they plan to double the lending origination volume.

What we've seen is that when we actively manage a partner relative to not actively managing them, a 20% increase in total payment volume. So we made the decision that in 2025, we're going to increase the number of actively managed partners by 2.5x.

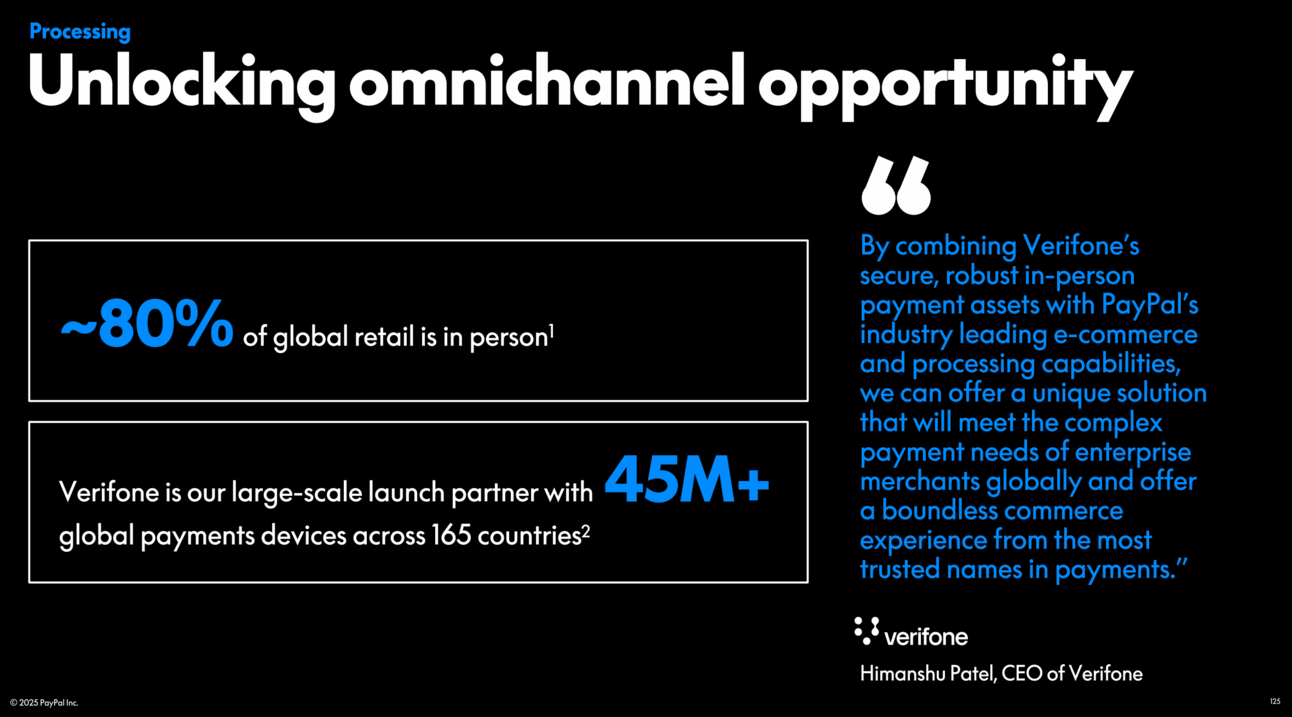

But, wait, there is more…PayPal has also partnered with Verifone to bring Braintree into stores. And they want to expand Braintree’s geographical footprint in search of higher profit margins. PayPal has also added another distribution partner for its accelerated checkout solution, Fastlane. JPMorgan Payments will offer Fastlane to its customers in Europe.

In addition, we're laser-focused on geographic and vertical expansion. 70% of our business is currently concentrated in North America. Thus, we have a massive opportunity to grow internationally where we see higher margins. To do so, we're strengthening our localized capabilities and our localized go-to-market.

…and, finally, the company has resurrected its ambition to be “the first and best way to buy, send and spend crypto.” I actually didn’t know that PayPal users can pay merchants using their crypto balance (with PayPal seamlessly handling the conversion to fiat).

PayPal was the company that brought the world from offline to online. And now we are the ones taking it from online to on-chain.

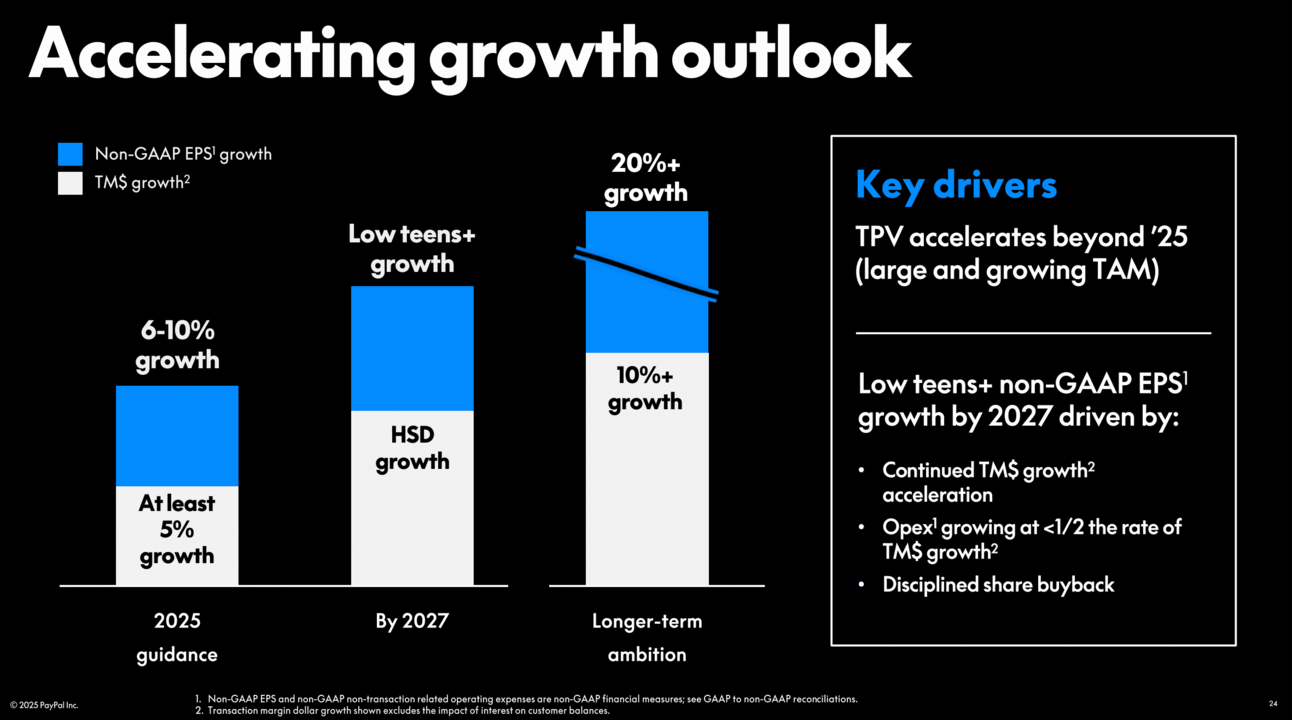

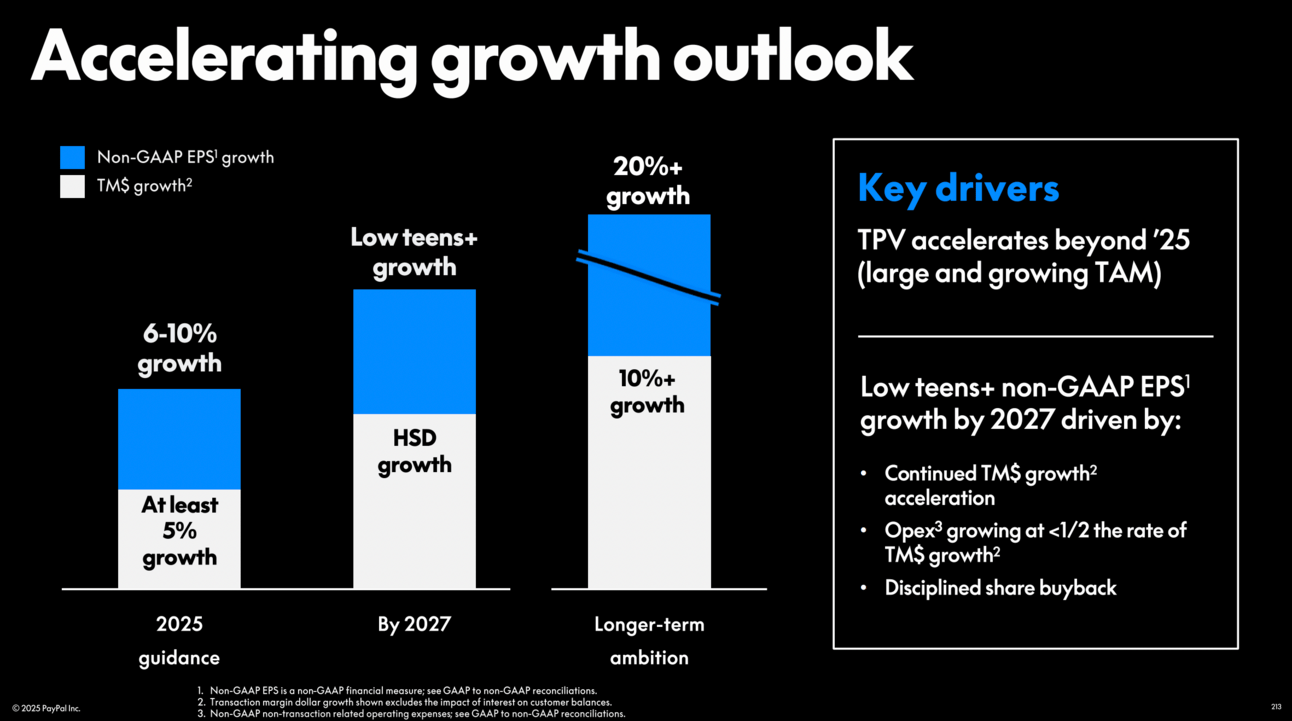

As you can see, PayPal is trying to do a lot of things…just to deliver “high single-digit” growth in gross profit and “low teens” growth in EPS by 2027. I mean, in the same period, Visa is expected to grow non-GAAP EPS by 12-13%, and Fiserv is expected to grow non-GAAP EPS by 15-17%. So why take the risk with PayPal?

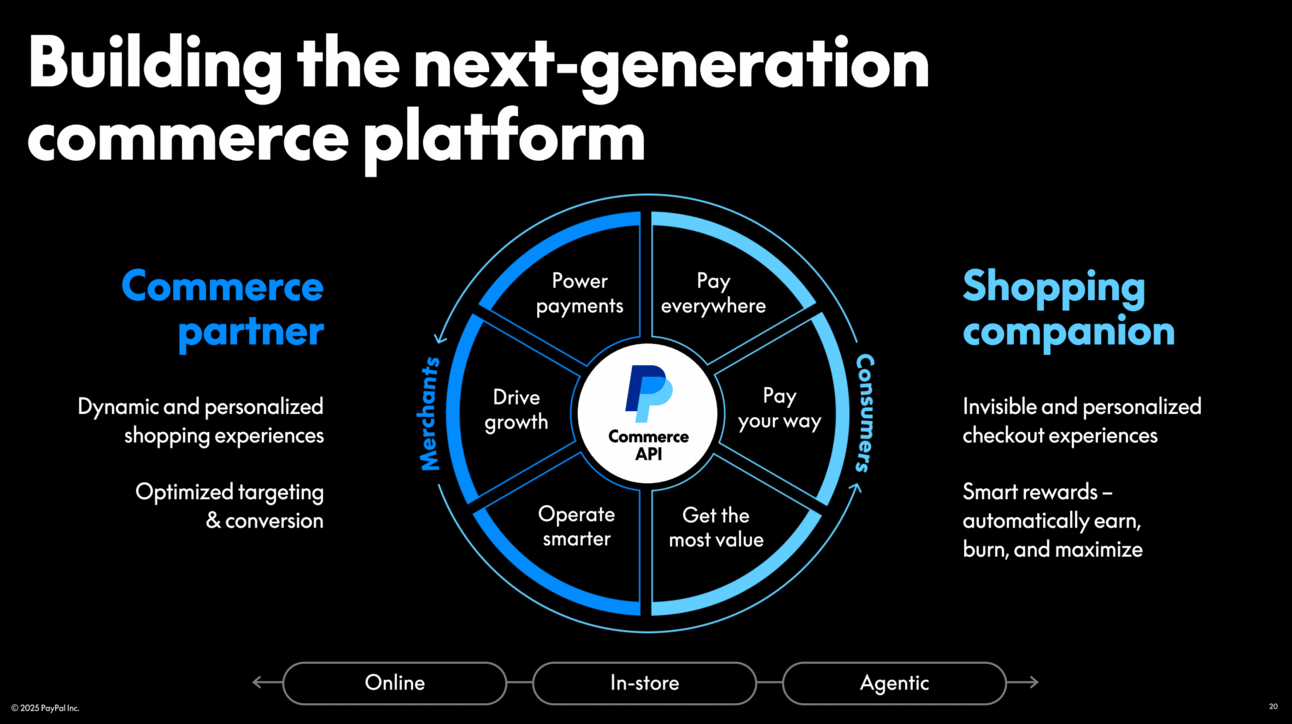

However, the longer-term guidance of 10%+ gross profit and 20%+ non-GAAP EPS growth is more exciting. Acceleration comes from PayPal’s ambition to transform into a “commerce platform powering the global economy”. And having this in mind, many of the efforts described above start to make sense.

So what does it mean exactly? PayPal scale is not unique anymore. PayPal is already smaller than Adyen and Stripe in terms of payment volume. Thus, in 2024, PayPal’s payment volume (excl. P2P) was $1.26 trillion, which compares to $1.4 and $1.34 trillion for Stripe and Adyen respectively. However, PayPal has something few others have: its two-sided network of consumers and merchants.

This is a new PayPal, call it PayPal 2.0, call it the next chapter, but we are transforming from a payments company into a commerce platform.

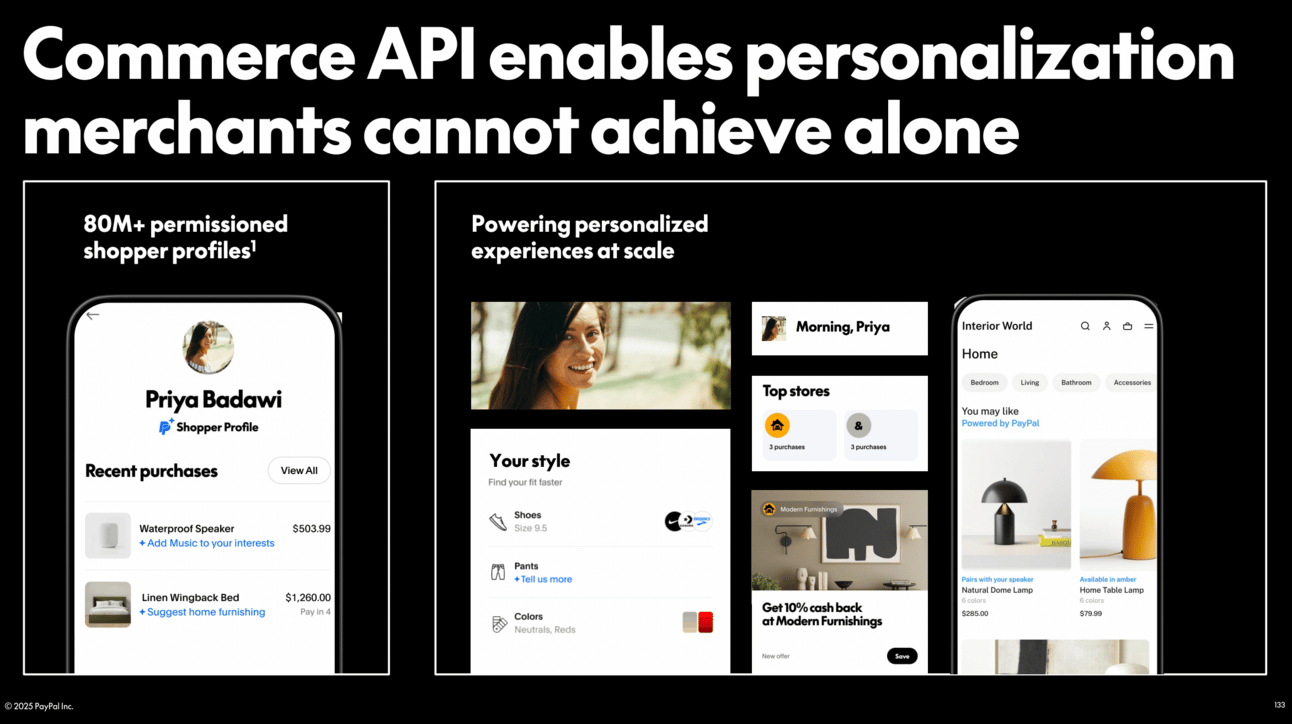

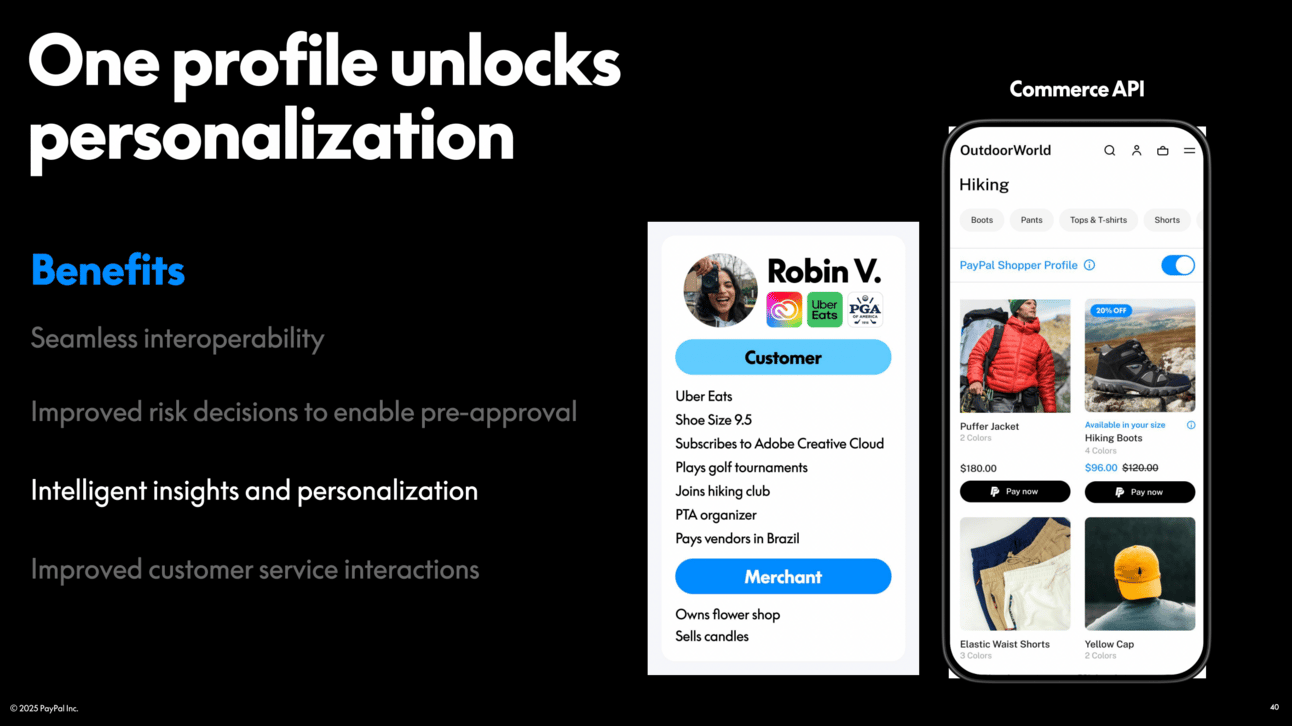

PayPal's two-sided network will enable personalized shopping experiences for merchants. The company claims to have over 80 million “permissioned shopper profiles,” allowing merchants to tailor their websites using the Commerce API. This includes details like shoe size, favorite color, and shopping preferences.

Consumers have always entrusted us with their financial information. So it's no leap of faith that they also entrust us with their shopping preferences. And with the PayPal Commerce API, we provide merchants with relevant product recommendations, and deals to personalize their experiences.

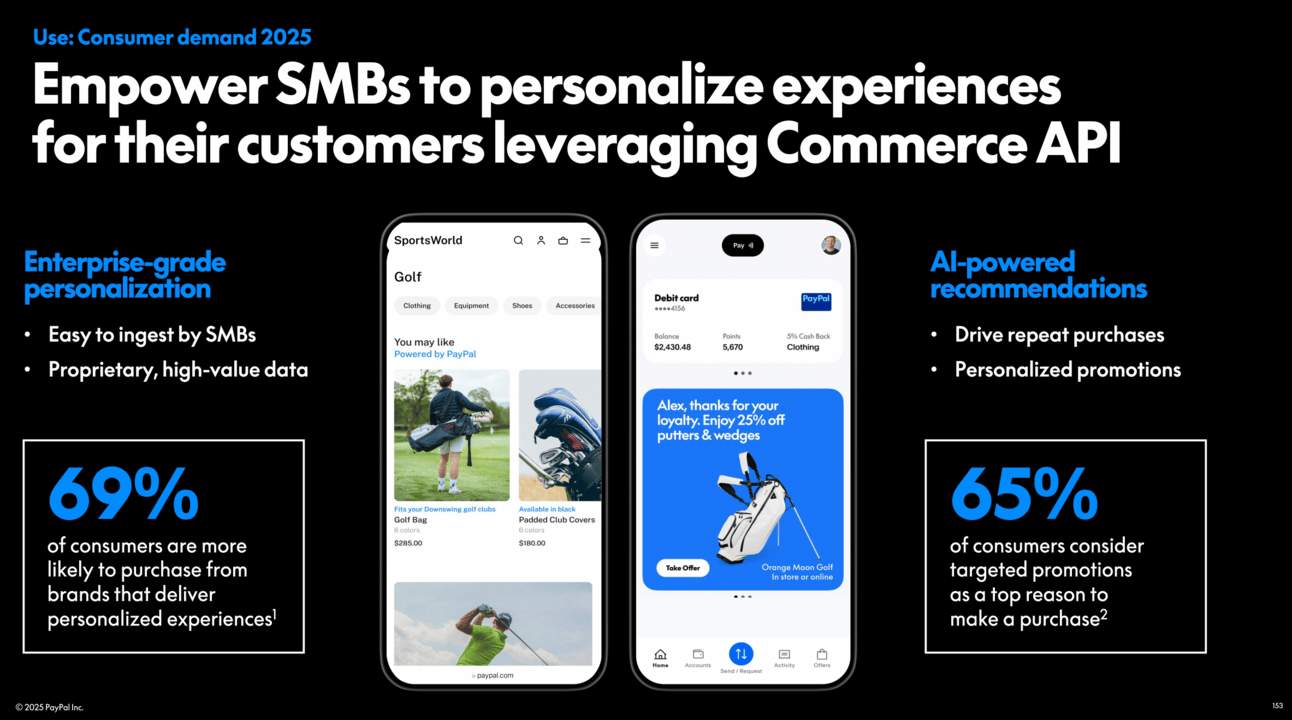

And let’s not forget that PayPal serves more than 20 million small businesses, which don’t have the technology and resources of larger merchants. Yet, they will also be able to utilize PayPal’s Commerce API.

Adyen and JPMorgan Payments are enterprise-focused, so in the small business segment PayPal competes with Stripe and Shopify, and much smaller players that don’t have PayPal’s scale.

In this context, PayPal’s expansion into ads and merchant offers becomes more logical. If PayPal can personalize merchant websites, why not customize its own mobile app with relevant offers from those merchants? Merchant discovery and lead generation are already meaningful contributors to Klarna’s and Afterpay’s businesses.

…if you look at that commerce API, we can provide the merchant with the information to personalize the experience for that consumer and drive loyalty into the consumer's wallet because the consumer is engaging with us on a daily basis.

PayPal’s push into in-store commerce also starts making more sense. PayPal will collect more information about their customers and will be able to personalize not only online, but also in-person experiences.

As we get into an omnichannel world, we believe we'll be able to share that same information, that shopper profile should exist no matter where you are, online, in-store, agentic, that is your profile, that is your data, that is your information, and we should be able to enable that on a device, online, anywhere you are.

…and PayPal partnering with Adyen, Fiserv, Global Payments, and now, JPMorgan Payments, for the distribution of Fastlane seems like a genius move…Again, more shopping touchpoints, and more personalization surfaces. PayPal wins checkout experience personalization opportunity, leaving payment processing to its competitors.

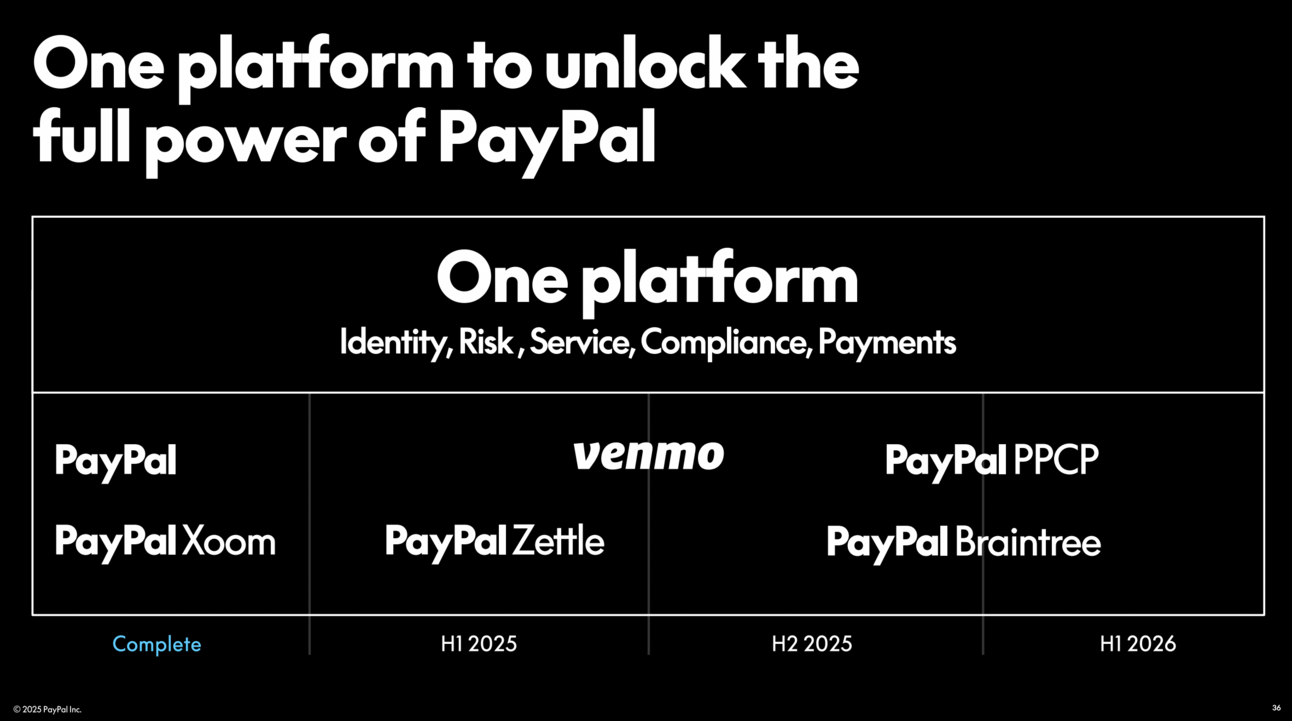

Of course, in order to deliver on its vision PayPal needs to transform its technology stack, starting with unifying customer profiles across its many properties (PayPal, Venmo, Zettle, Braintree, etc.).

We are moving to a one single view of our customer. Today, we capture customers activity and preferences across each product. With One profile, we are combining these insights to reach our customers in a powerful, delightful way.

As well as unifying its merchant solutions under the PayPal Open umbrella. This technological transformation will take years, and clearly, as any big transformation is subject to potential delays.

PayPal Open is not just a rebranding. It's not like we're just saying, hey, let's throw everything under one roof. And put it all together and somehow magically it's going to work. Instead, we're actually bringing all of these brands together architecturally.

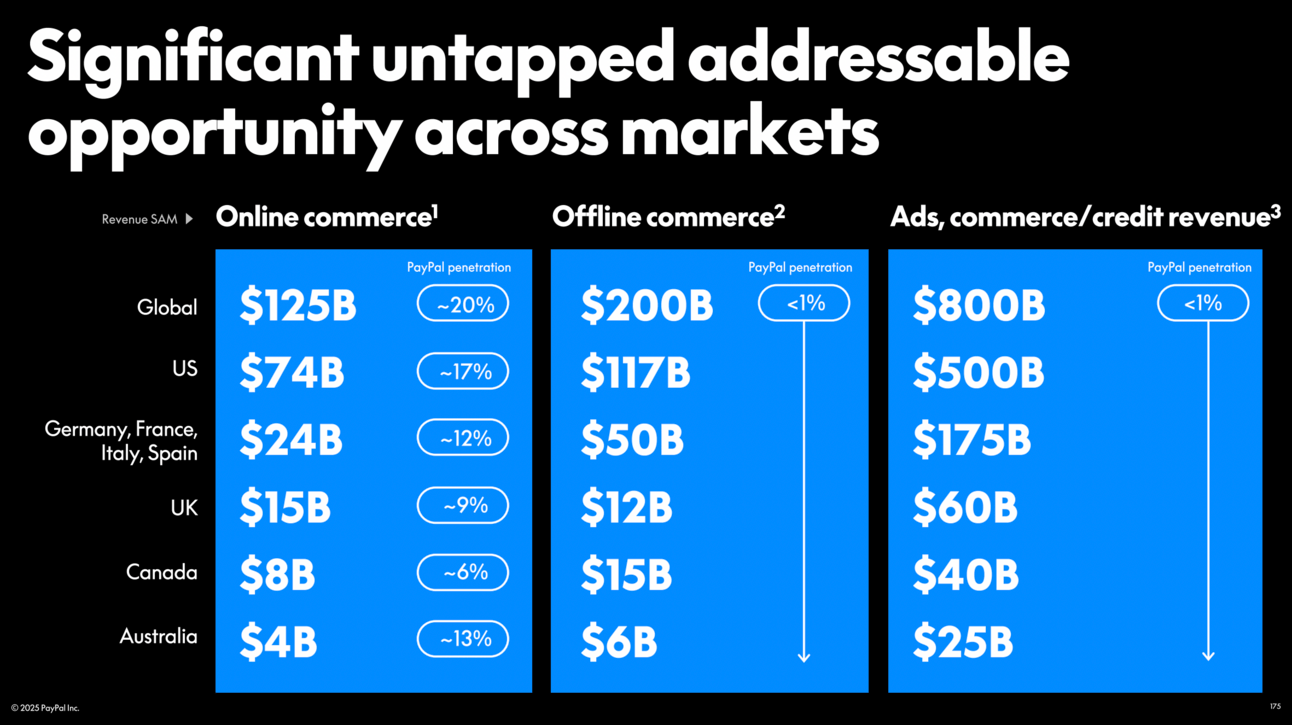

However, becoming a commerce platform expands PayPal’s addressable market. Thus, PayPal’s management estimates the revenue opportunity in ads and commerce to be $800 billion with PayPal currently having less than 1% penetration.

So while the near to mid-term growth opportunities for PayPal lie in re-accelerating growth in checkout, growing omnichannel footprint and Venmo, as well as improving the profitability profile of Braintree. The long-term growth is expected to be driven by personalization, ads, and the Commerce Platform.

…as we think about all the levers for growth that we have into the future and this transformation into a commerce platform, we believe and have our ambition that we will deliver double-digit transaction margin growth into the future and deliver it responsibly with 20% plus non-GAAP EPS growth.

So if I try to summarize the key message from PayPal Investor Day: the company set an ambitious target of transforming from a payments company into an e-commerce platform. Management believes this strategy can fundamentally change its long-term growth trajectory and has set an appealing goal of 20%+ EPS growth as the financial outcome.

The market reaction following the Investor Day suggests that investors don’t believe PayPal will manage to pull it off. But what if they will? After all, they have to in order to stay relevant.

Cover image source: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.