Hey!

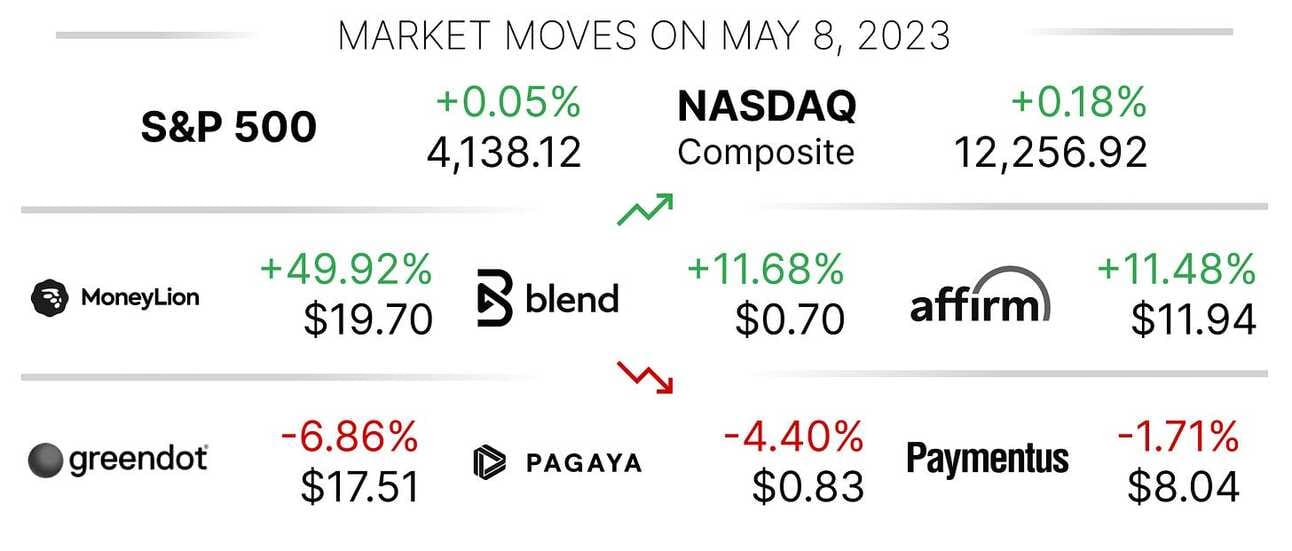

Thirteen Fintech companies will report their earnings today! How exciting is that? You wouldn’t tell it from the moves of the indexes (which were almost flat), but Fintech companies rallied yesterday. Binance halted Bitcoin trading twice, and crypto prices declined sharply. Could that have something to do with the rally in Fintech stocks? In the meantime,

PayPal first quarter earnings disappointed investors,

Brazil’s Inter&Co reported 26 million customers, and

Greed Dot got a downgrade

PayPal Earnings Disappoint

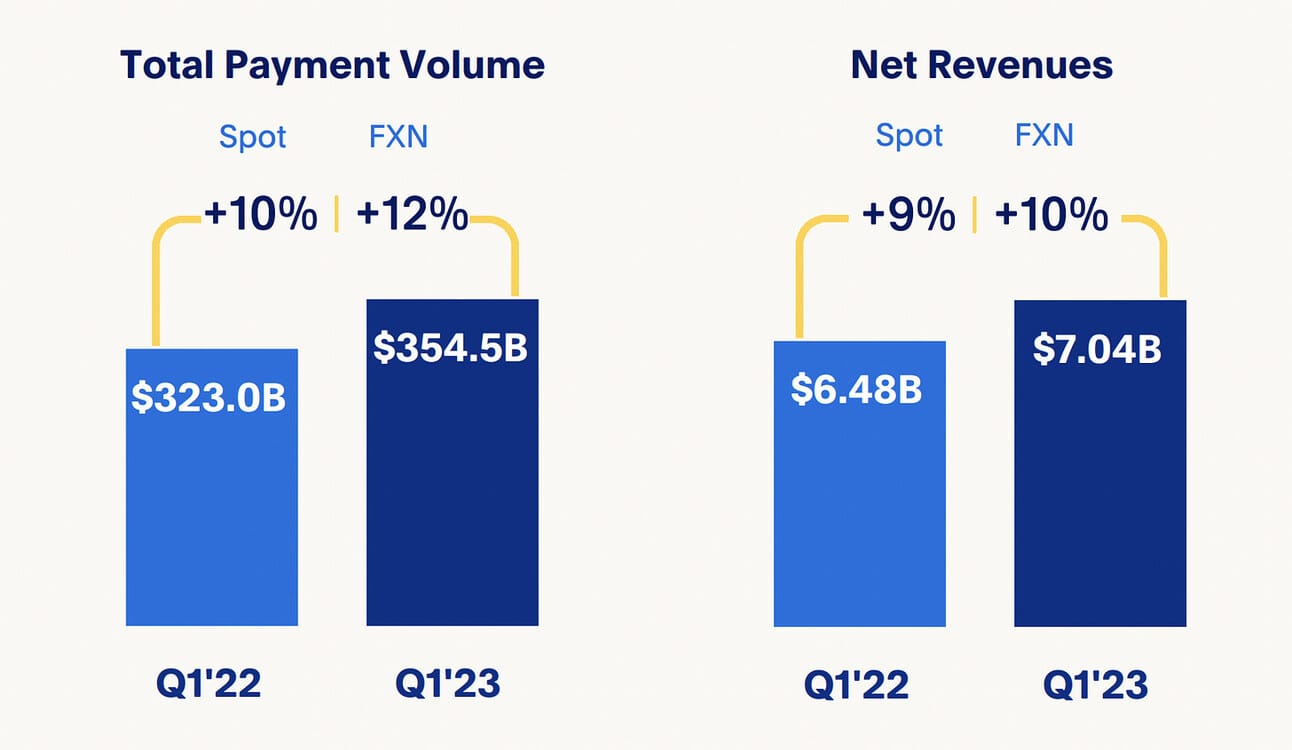

PayPal (NASDAQ: PYPL) reported its first quarter 2023 results yesterday, beating earnings estimates and raising the profit forecast for the year. Nevertheless, the results seem to have disappointed investors, as the stock declined 5.79% in the after-hours trading. Net revenues rose 9% YoY to $7.04 billion, driven by 10% YoY growth in Total Payment Volume. GAAP operating income increased 41% YoY to $1.0 billion, while non-GAAP operating income increased 19% YoY to $1.6B. The company raised full-year 2023 guidance and now expects GAAP EPS to be ~$3.42 per diluted share, a ~64% increase compared to 2022. The company expects non-GAAP EPS to increase ~20% YoY to ~$4.95 per diluted share. PayPal intends to repurchase ~$2 billion of its shares this year.

Visa, Mastercard, as well as other payment processors, such as Fiserv, FIS, and Global Payments, reported better-than-expected results on the back of strong consumer spending. Thus, PayPal beating earnings revenue expectations was not surprising. In addition, PayPal has been aggressively cutting costs since the activist investor Elliott Management took a $2 billion stake in the company last year. This included laying off 2,000 employees, or 7% of the workforce in January. What might have disappointed investors was little progress in finding new CEO or CFO. As a reminder, Dan Schulman, the current company’s CEO, announced his plan to step down at the end of the year. The company also doesn’t have a permanent CFO, as Blake Jorgensen unexpectedly stepped down just a few months after taking the role.

Image source: PayPal First Quarter 2023 Earnings Release

✔️ PayPal adjusted margin forecast cut eclipses higher profit expectations

✔️ After hitting new heights during the pandemic, PayPal has struggled in the market. Here’s what’s killing the company’s stock growth

✔️ PayPal First Quarter 2023 Earnings Release

✔️ PayPal to lay off 2,000 employees in coming weeks, about 7% of workforce

✔️ PayPal shares jump on Elliott's $2 bln stake, annual profit guidance raise

Brazil’s Inter&Co Reports 26 Million Customers

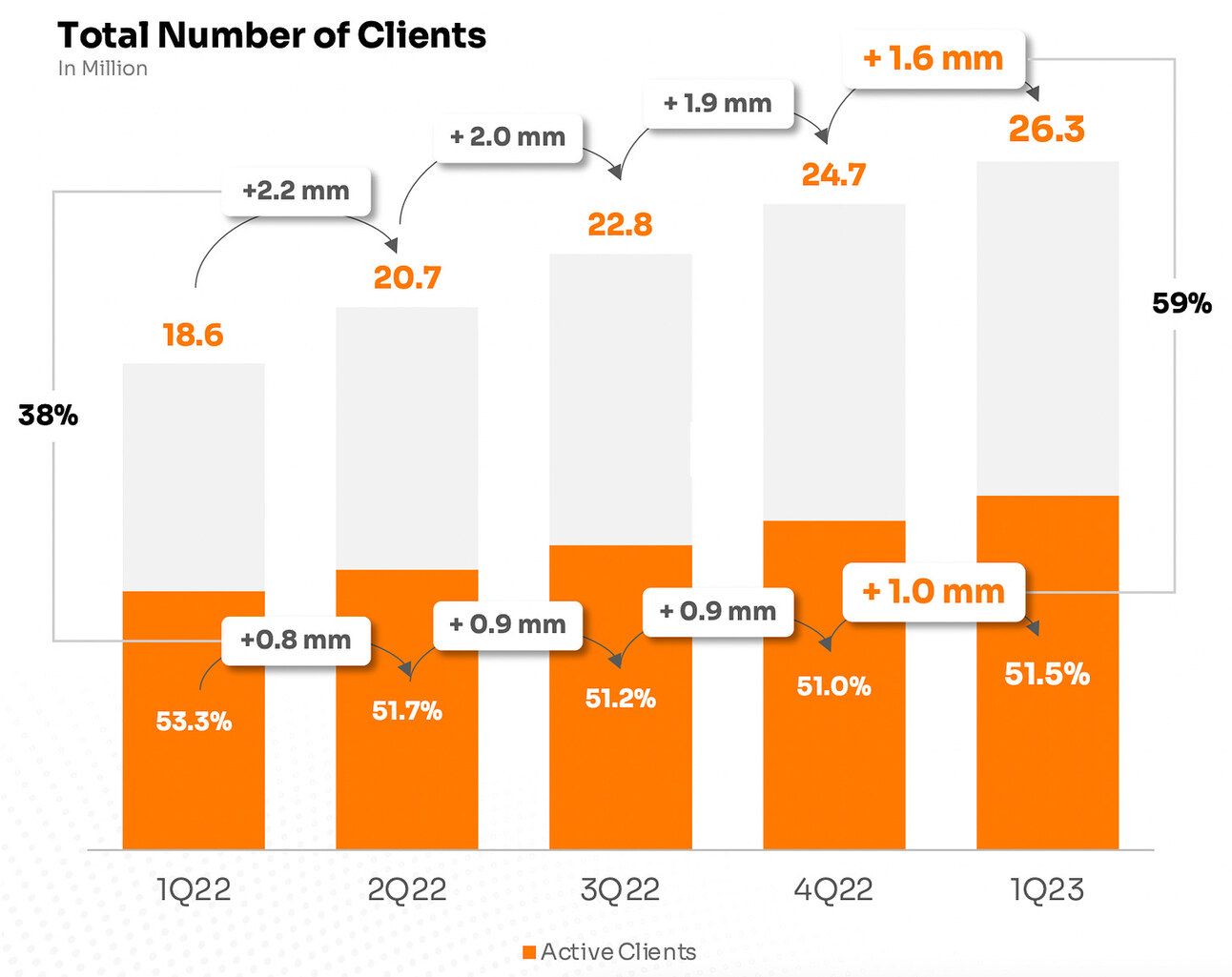

Inter&Co (NASDAQ: INTR), the parent company of Brazil’s Banco Inter, reported its first quarter 2023 results yesterday. Total net revenue increased 23% YoY to R$1.02 billion (approx. $200 million) driven by the 34% YoY growth in Net Interest Income and 39% YoY growth in Net commission income. Other income, which primarily consists of capital and foreign exchange gains and losses, declined 41% Yoy. The company returned to profitability posting a profit of R$24 million (approx. $4.8 million) for the quarter, which compares to the R$29 million loss last year. The company’s total funding increased by 33% YoY to R$30.8 billion (approx. $6.15 billion), driven by 48% YoY growth in time deposits.

Inter&Co reported 26.3 million customers at the end of the quarter, of which 51.5% were active. This number includes 3.3 million active customers using Inter Invest, 2.5 million active customers using Inter Shop, and 1.3 million active customers using Inter Insurance. The company also reported 1.45 million customers for its USEND service in the United States. Brazil, with its population of 214 million people, remains an exciting market for Fintech companies. Thus, just two weeks ago, Nubank reported surpassing the 80 million customer milestone. This week, Revolut, a European neobank serving 29 million customers worldwide, announced finally launching in Brazil, making it the first country on its expansion into Latin America.

Image Source: Inter&Co

✔️ Inter&Co Q1 2023 Earnings Presentation

✔️ Inter&Co, Inc Reports First Quarter 2023 Financial Results

✔️ Nubank reaches the milestone of 80 million customers in Latin America

✔️ Brazil is Revolut’s first country launch in Latin America.

Green Dot Gets a Downgrade

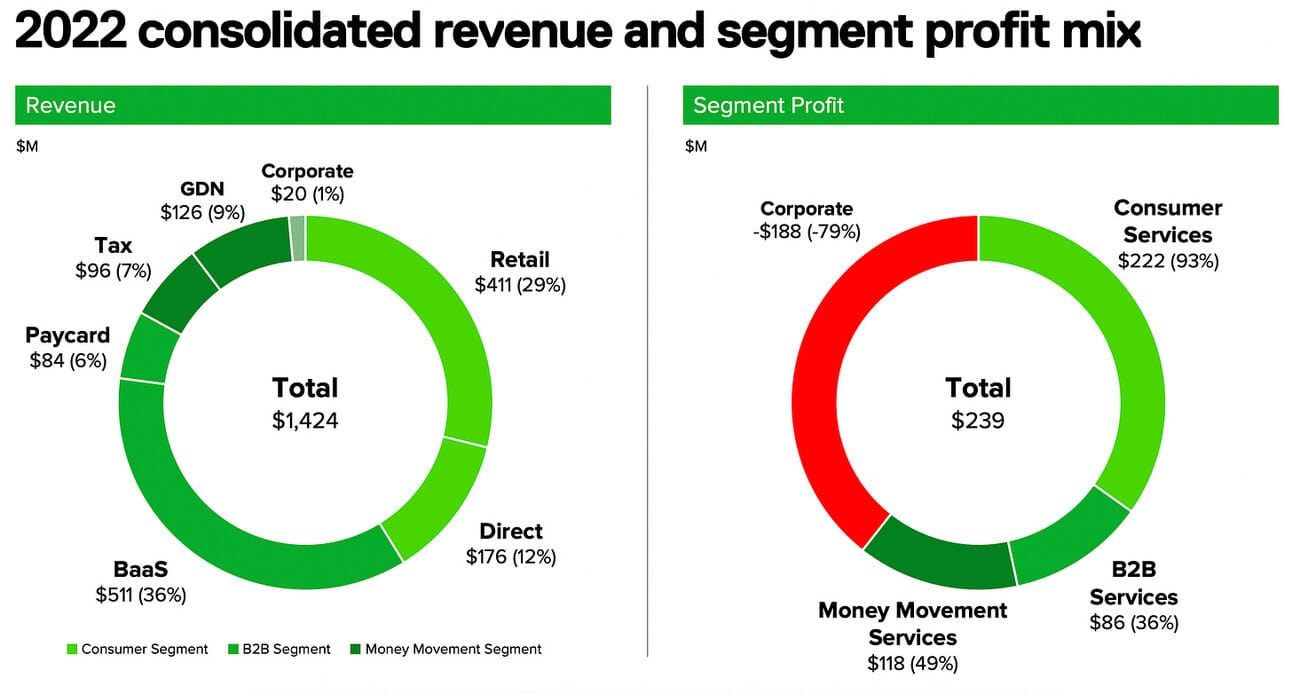

Shares of Green Dot (NYSE: GDOT) declined 6.86% yesterday after Needham & Company downgraded the stock to “Neutral” (from “Buy”), as well as removed the $20 price target. Investment bank analysts cited Banking-as-a-Service customer attrition and the macro headwinds for the company’s direct-to-consumer segment. Green Dot is a financial services provider that offers various products such as debit, credit, prepaid, and payroll cards, as well as money processing, tax refunds, cash deposits and disbursements. The company provides its services directly to consumers through its GO2bank brand, as well as indirectly to customers and employees of its BaaS clients. The company’s clients include Apple and Amazon.

Last week Greed Dot reported its first quarter 2023 results, slightly beating analysts’ expectations. Total revenue for the quarter increased 4% YoY to $416.4 million, and hee company reported a Net income of $36.0 million, or $0.69 per diluted share, which compares to a Net income of $38.6 million, or $0.70 per diluted share a year ago. Greed Dot reported an Adjusted EBITDA of $82.5 million, compared to $90.3 million a year ago. Green Dot reaffirmed its guidance range for the full year 2023. Thus, the company's management expects revenue to be between $1.38 billion and $1.46 billion, with an expected Adjusted EBITDA of $180 million to $190 million.

Source: Greed Dot, Investor Overview

✔️ Needham & Company sees headwinds in Green Dot's future

✔️ Green Dot ekes out growth amid platform overhaul

✔️ Green Dot braces for profit margin pressure

✔️ Green Dot Reports First Quarter 2023 Results

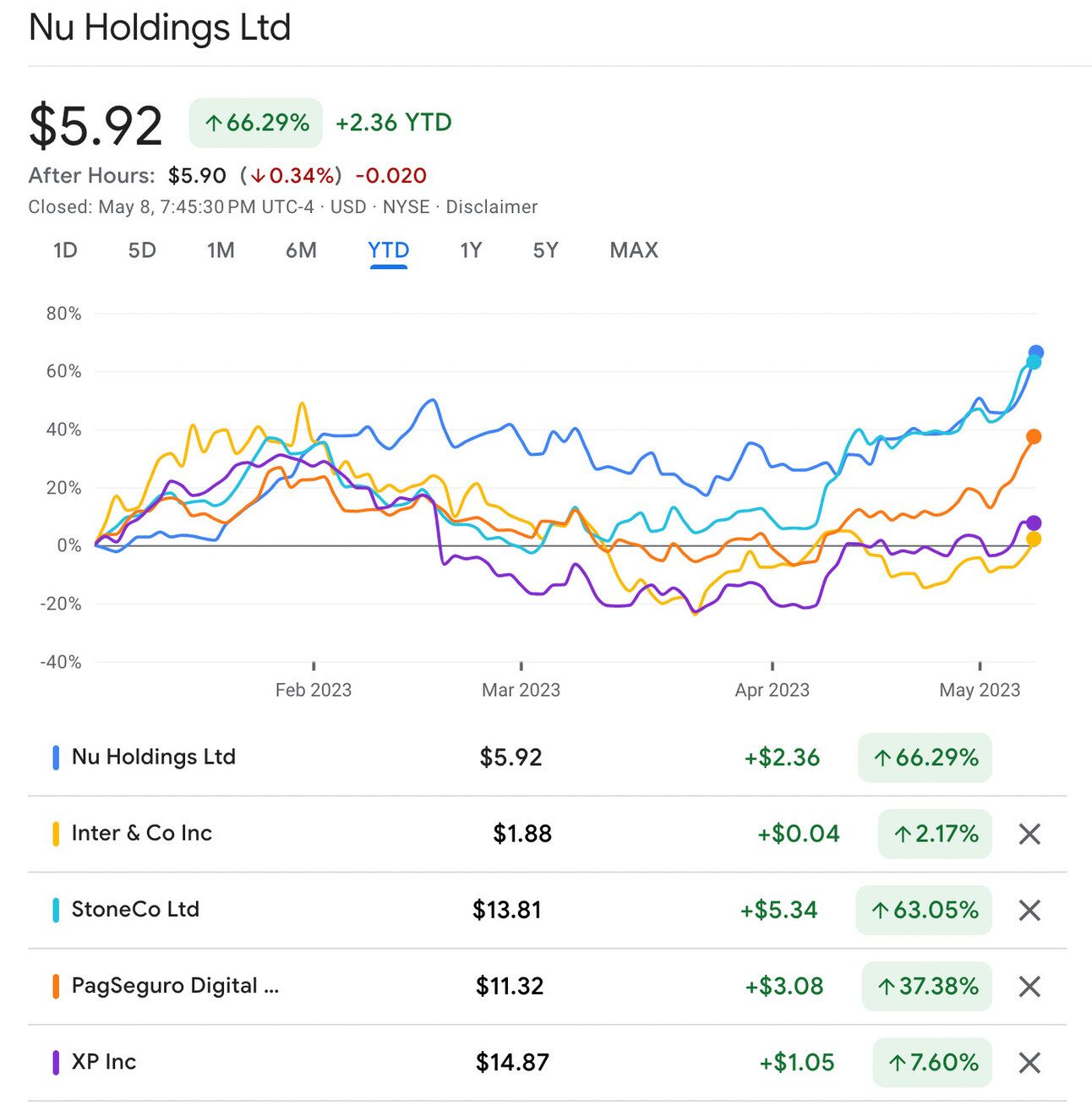

Speaking of Brazilian publicly traded Fintech companies…Inter&Co (NASDAQ: INTR) and XP Inc (NASDAQ: XP) are underperforming NASDAQ, but Nubank (NYSE: NU), Stone (NASDAQ: STNE), and PagSeguro (NYSE: PAGS) are doing really well this year!

Head of Product Data Science, Venmo

@ PayPal

🇺🇸 New York, NY, and San Jose, CA, United StatesHead of Identity Data Science

@ PayPal

🇺🇸 New York, NY, and San Jose, CA, United StatesLead Product Manager

@ Green Dot

🇺🇸 Remote, United StatesSenior Product Designer

@ Nubank

🇲🇽 Mexico City, MexicoTech Manager

@ Nubank

🇧🇷 Sao Paulo, Brazil

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image source: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.