Hello!

For a long time, I thought of vertically integrated software businesses, that generate most of their revenue from processing payments, as pure payment companies. Mister Marker is not stupid and will not price low-margin cyclical payments revenue in the same way as software revenue, I thought. Thus, I expected a company, that generates most of its revenue from payment acceptance, to be eventually priced as a payments company, regardless of the software aspect of the business.

However, in 2023, Shopify illustrated the true value of software in a vertically integrated software business. The company sold its logistics business to go all in on its platform. It raised the subscription fees for its commerce platform and saw little customer churn. It continued to successfully convert its commerce platform customers into Shopify Payments customers, proving that its platform gives it the right to win in payments and other financial services.

Improvements in the financial results followed. Free cash flow increased from $90 million in Q4 2022 to $446 million in Q4 2023, and the stock has more than doubled from January 2022 lows. So looking at Shopify’s trajectory in 2023, I started thinking if other vertically integrated software vendors, like Toast, can pull off similar magic. There are a lot of fundamental similarities between Shopify and Toast, but does it mean they have the same moat? Let’s explore this.

Let’s start by looking at Shopify's financials. Shopify generates most of its revenue from payments and other financial services, such as lending and currency conversion. The chart below illustrates that “Merchant solutions” revenue has been consistently contributing over 70% of the company’s total revenue during the 2021 - 2023 period.

We principally generate merchant solutions revenues from payment processing fees and currency conversion fees from Shopify Payments, referral fees from partners, Shopify Capital, and transaction fees. In addition, we generate merchant solutions revenue from the sale of shipping labels, the sale of POS hardware, advertising on the Shopify App Store, and Shop Campaigns, our buyer acquisition product for merchants.

Shopify, Form 40-F

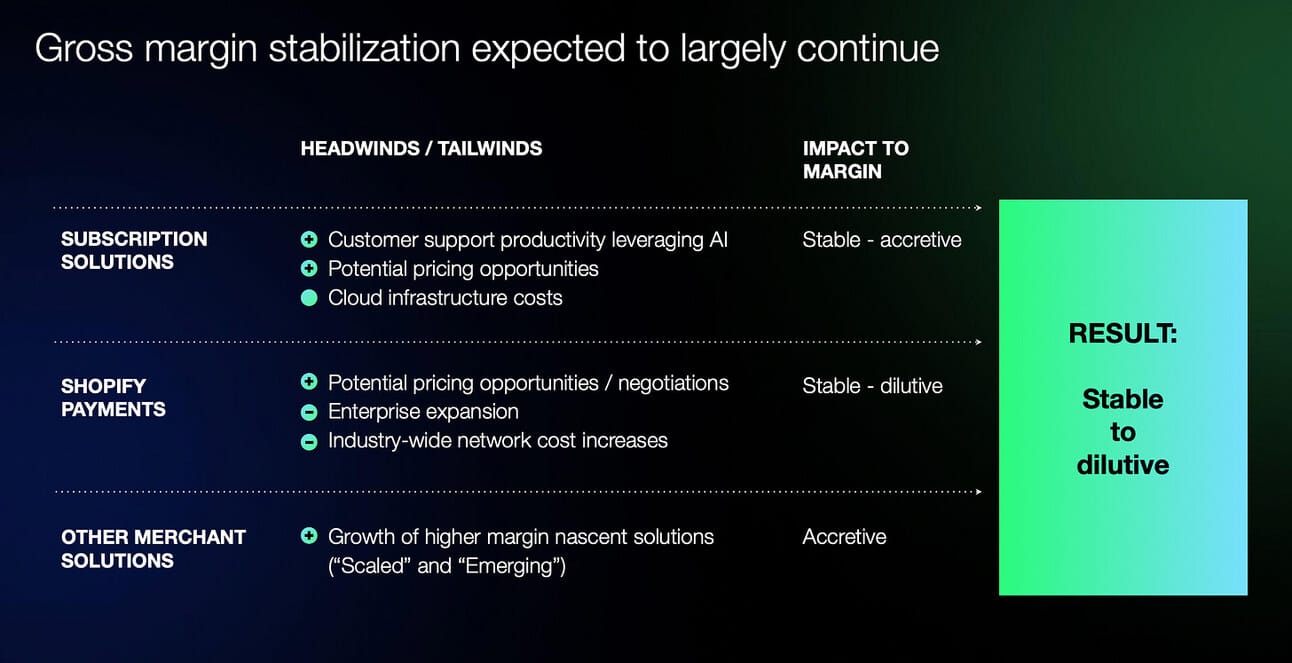

Financial services have a lower gross profit margin than software (“Subscription solutions”), so their contribution to the company’s gross profit is smaller than their contribution to revenue. Shopify has an 80%+ gross profit margin in its “Subscription solutions” revenue and a sub-40% gross profit margin in its “Merchant solutions” revenue. Nevertheless, despite lower margins, financial services still contribute more than half of gross profit.

However, Shopify’s performance in 2023 showed that the software component of their business is more than just a sidekick to financial services. First, Shopify announced an increase in the subscription prices for its platform in January 2023 (the price increased by more than 30%). According to the company’s management, this price increase faced very little pushback from the merchants, which can be seen, as an uptick in “Subscription solutions revenue” in Q2-Q4 in the chart below (new pricing came into force in April). A 30% price increase is an example of pricing power you don’t get to see in pure payment acceptance.

That was the first time we increased pricing, since I got to Shopify, like 14 years ago. We went from $29 to $39. It was a 33% increase. We didn't see much pushback from our merchants.

Harley Finkelstein, President, Shopify Investor Day 2023

Second, Shopify continued to convert more merchants to Shopify Payments. Thus, “payments penetration” (or share of GMV processed via Shopify Payments) increased from 46% in Q1 2021 to 60% in Q4 2023. I would argue, that this illustrates that the software component of the business gives Shopify the right to win in payments. It should be easier to switch the payment provider than the commerce platform, so I would not exclude a scenario, in which Shopify makes Shopify payments the sole payment gateway on its platform.

Finally, Shopify continued to scale and launch new financial services that have higher gross profit margins than payment processing, such as Shopify Capital, currency conversion (Markets), Shopify Installments, etc. These products offset margin dilution that comes from the growth in lower margin payments revenue. Again, I would argue that Shopify’s wins in these products should be credited to its platform, as it provides the ability to embed and closely integrate financial products into the checkout process (installments, currency conversion) and the operations of merchants (lending, Shopify Balance).

As a result, 2023 was an example of the magic that a vertically integrated software vendor can pull off. Shopify free cash flow increased from $90 million in Q4 2022 to $446 million in Q4 2023. Shopify management also expects free cash flow to be in the high-single digits of revenue in Q1 2024 “with sequential improvement every quarter throughout the year.”

This brings me to Toast…Shopify operates online, while Toast operates primarily in-person, but they are, fundamentally, very similar businesses. You can think of a POS terminal as the checkout in an online store. Both companies make money through software subscriptions and payment processing, and both are constantly building new software solutions and extending their offering of financial services beyond payments (Shopify Capital vs. Toast Capital).

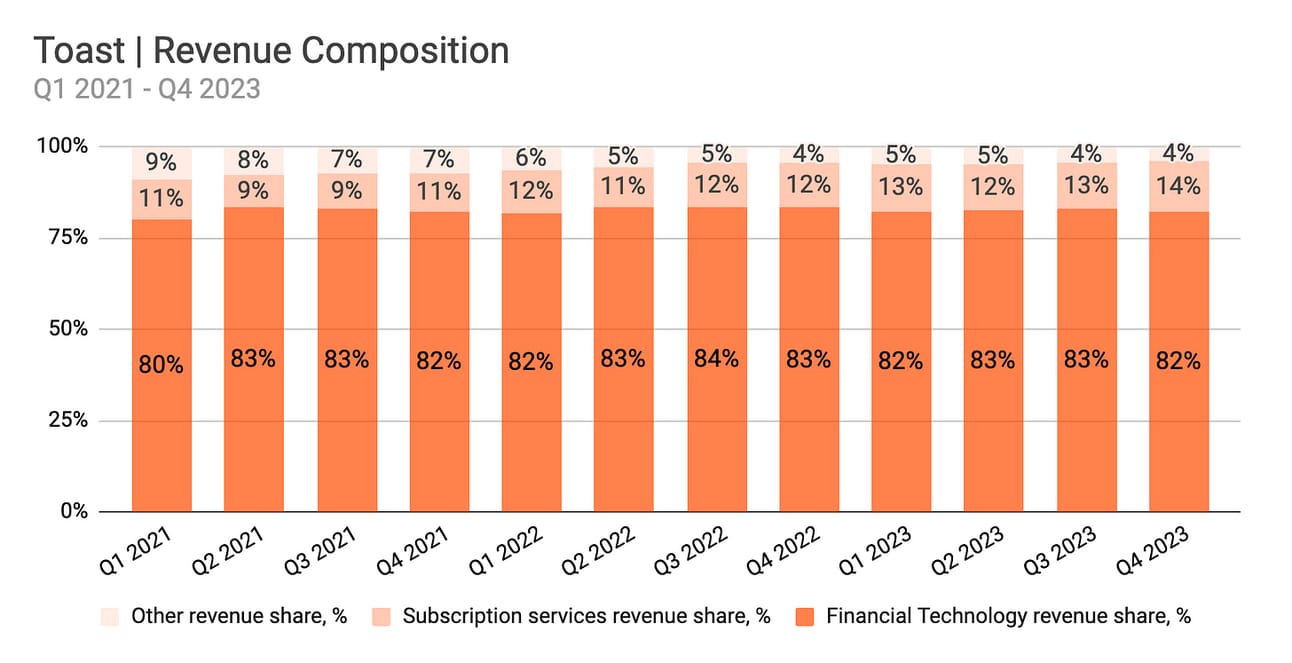

Similarly to Shopify, Financial services revenue (payments, lending) is the largest component of Toast’s total revenue. As the chart below illustrates, the share of financial services has been consistently above 80% of the total revenue. I would also add POS sales (included in “Other revenue” in the chart below) to the Financial services revenue (I mean, merchants are paying for terminals to accept payments after all).

On multiple occasions, Toast’s management claimed that they see growth coming not only from winning new clients (growth in “locations”), but also from increasing average SaaS and Fintech revenue per client. The company expects to achieve it through pricing and selling more software products and financial services products.

We believe there is runway in our existing markets to continue to scale locations while also increasing both SaaS and Fintech ARR to product innovation, pricing and our continued investment in upselling existing customers through our growth sales team. High product attach rates is an important driver of ARPU. Many of our existing products have plenty of runway to scale.

Aman Narang, Toast CEO, Q4 2023 earnings call

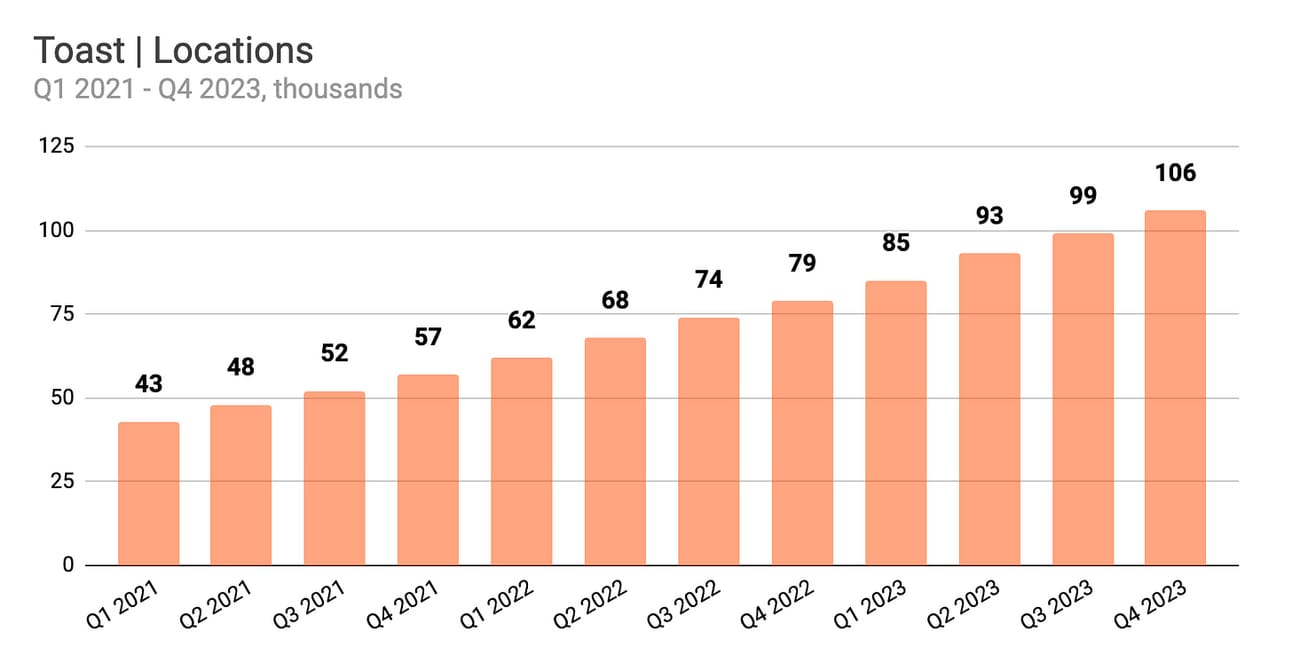

Toast management has proven that they know how to consistently grow the client base. As you can see from the chart below, Toast increased the number of restaurant “locations” that it services from 43,000 in Q1 2021 to 106,000 in Q4 2023. Toast estimates that there are 860,000 restaurant locations in the U.S., and the company expanded to Canada, the U.K., and Ireland to expand its addressable market. So I don’t think anyone doubts that they can scale locations for years to come.

However, Toast’s gross profit margins are much lower than the margins reported by Shopify. The difference in the gross profit margins for financial services might be explained by Shopify’s payments being primarily online. Online payment processing typically enjoys higher margins. However, there is no reason for the software margins to be lower. So, if Toast indeed has the pricing power like Shopify, it should be able to raise prices for its software products driving gross profit margins up.

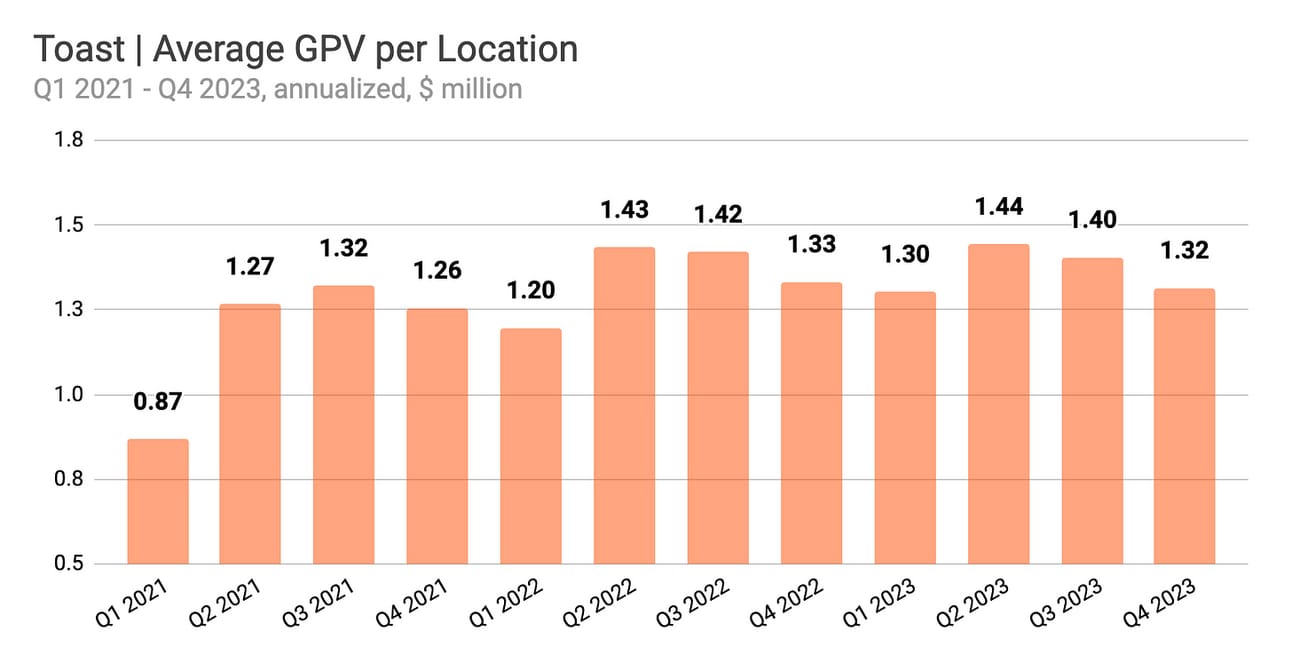

Toast already processes all payments for its merchants, so there is no opportunity to increase payment penetration like in the case of Shopify. However, Toast has a wide range of software products and continues to launch new ones (“Toast Kitchen Display”, “Toast Tables”, etc.). Thus, there is an opportunity to sell more high-margin software products to customers. In a way, cross-selling more software products would be somewhat similar to Shopify cross-selling Shopify payments and replacing other vendors. So far cross-selling might have stalled, as the chart below suggests, but the opportunity is certainly there.

Finally, similarly to Shopify, Toast has an opportunity to launch higher-margin financial services. So far the company’s range of financial services products is limited to payments and lending (Toast Capital). However, there are certainly opportunities to extend the offering by launching lending at point-of-sale for consumers (e.g. by partnering with Affirm as Shopify did), or extending the “Toast Payroll” product by embedding accelerated wage access from Marqeta.

A combination of selling more software products, repricing software products, and launching more higher-margin financial services, should help Toast get to a much higher gross profit margin. They might not get to Shopify’s 50%+ gross profit margin, but Square’s 40%+ gross profit margin should be achievable. Toast can compete with Square in getting restaurants as its clients, so it should be able to use Square's blueprint to improve its margins (wider range of software products, broader financial services offering).

For now, most of the above opportunities remain hypothetical, and Toast finds itself in a position, where the average Gross Payment Volume (or “GPV”) per restaurant location stalled…

…and, as Toast mostly makes money from payment processing, revenue per restaurant location stalled too. Making growth in restaurant locations the only level that the company can pull.

However, the question remains if Toast can pull off the same magic that Shopify pulled off in 2023. I don’t have an answer, but I hope I gave a framework on how to think about it (look for repricing efforts, new software product launches, and more high-margin financial services). At least, I have finally formulated for myself how to think about Toast’s potential.

Thank you for reading and have a great day!

Jevgenijs

Cover image: Toast

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.