Hey!

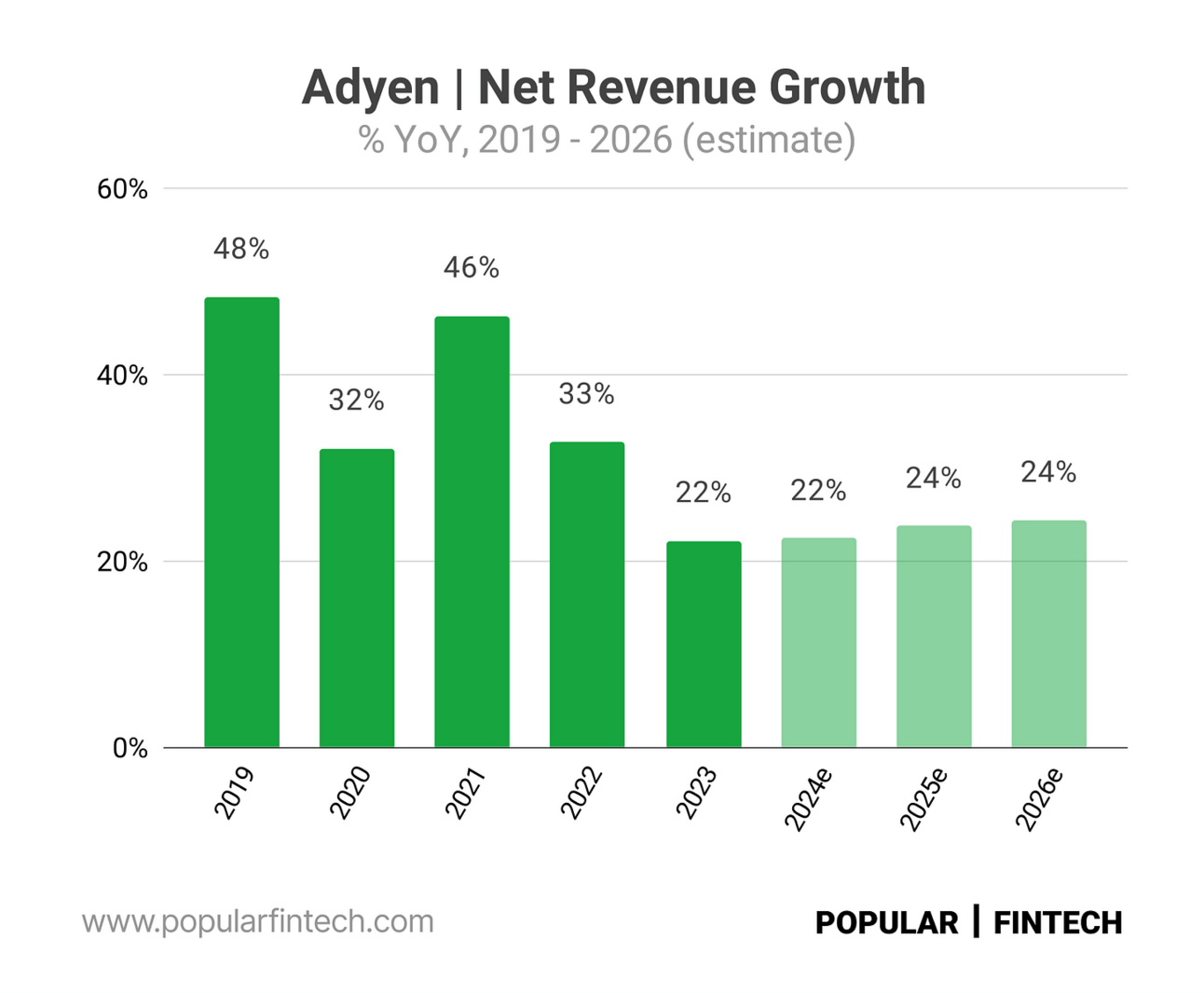

In August 2023, Adyen’s stock lost 40% of its value in a single day after the company reported its first-half 2023 results. Growth was slowing down, and EBITDA margin was compressing. This event sparked many conversations, including claims that “payments is a commodity” and “payment businesses are races to the bottom.”

However, a more likely reason for this was that Adyen overestimated the power of its platform and underinvested in sales and account management teams. In today’s essay, I returned to the company’s 2023 Investor Day, where Adyen’s management explained the plan to scale their sales teams.

It took them two years of investment, and, given the long sales cycles, it will take even longer to see the results. However, Adyen managed to persuade the investor community, that slower growth and margin compression had temporary, not structural, reasons behind them.

Enjoy, and as always, happy to hear your feedback!

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

Last summer Adyen’s stock plummeted, losing more than 40% of its value in a single day, after the company reported its H1 2023 results. The stock continued to decline in the months that followed, bottoming at less than half of what it traded before the earnings report.

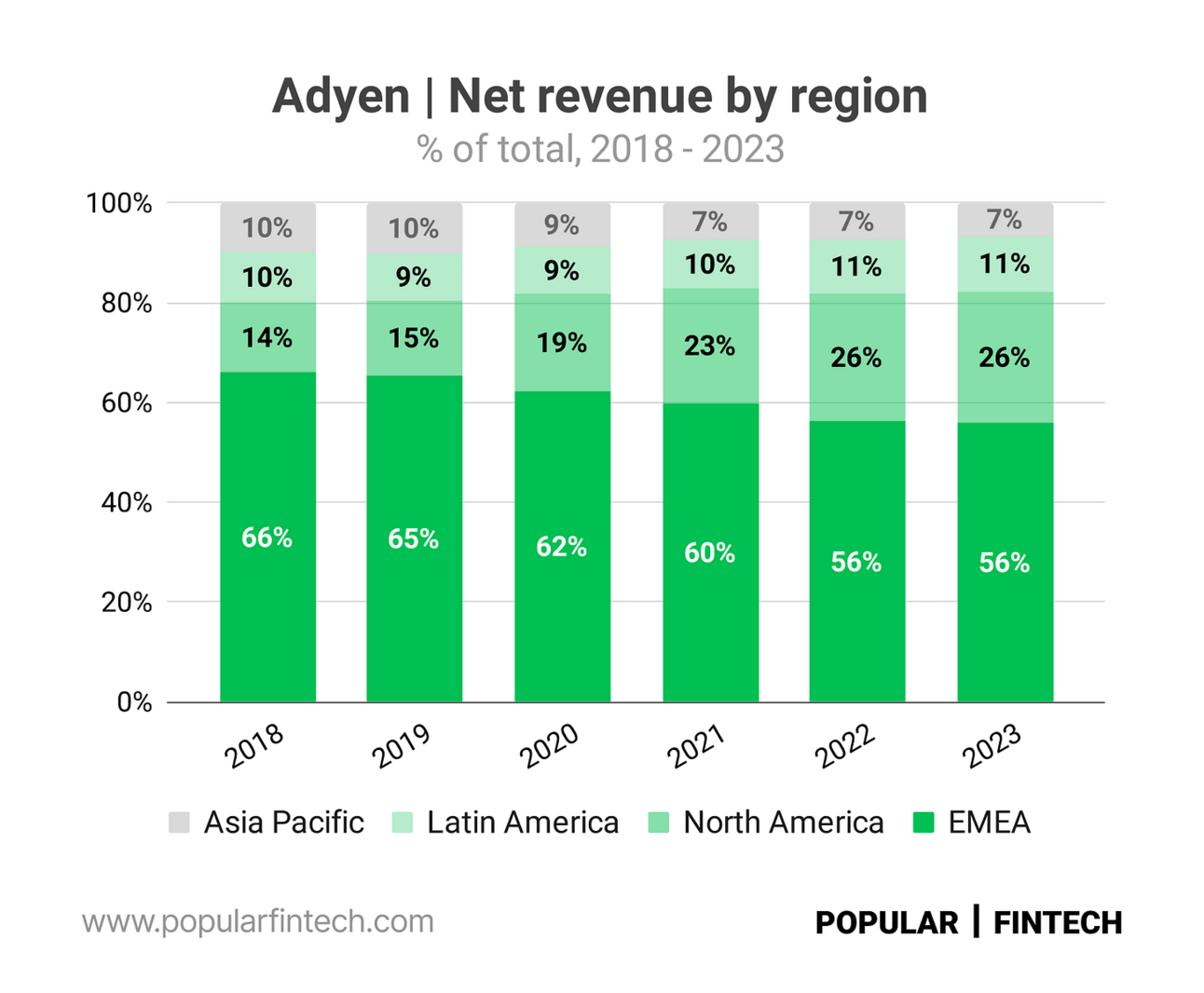

One of the key concerns was the slowdown of Adyen's growth in the U.S. and Canada. Thus, North America is Adyen’s largest market after Europe, representing 26% of the company’s net revenues. It’s also the company’s fastest-growing market.

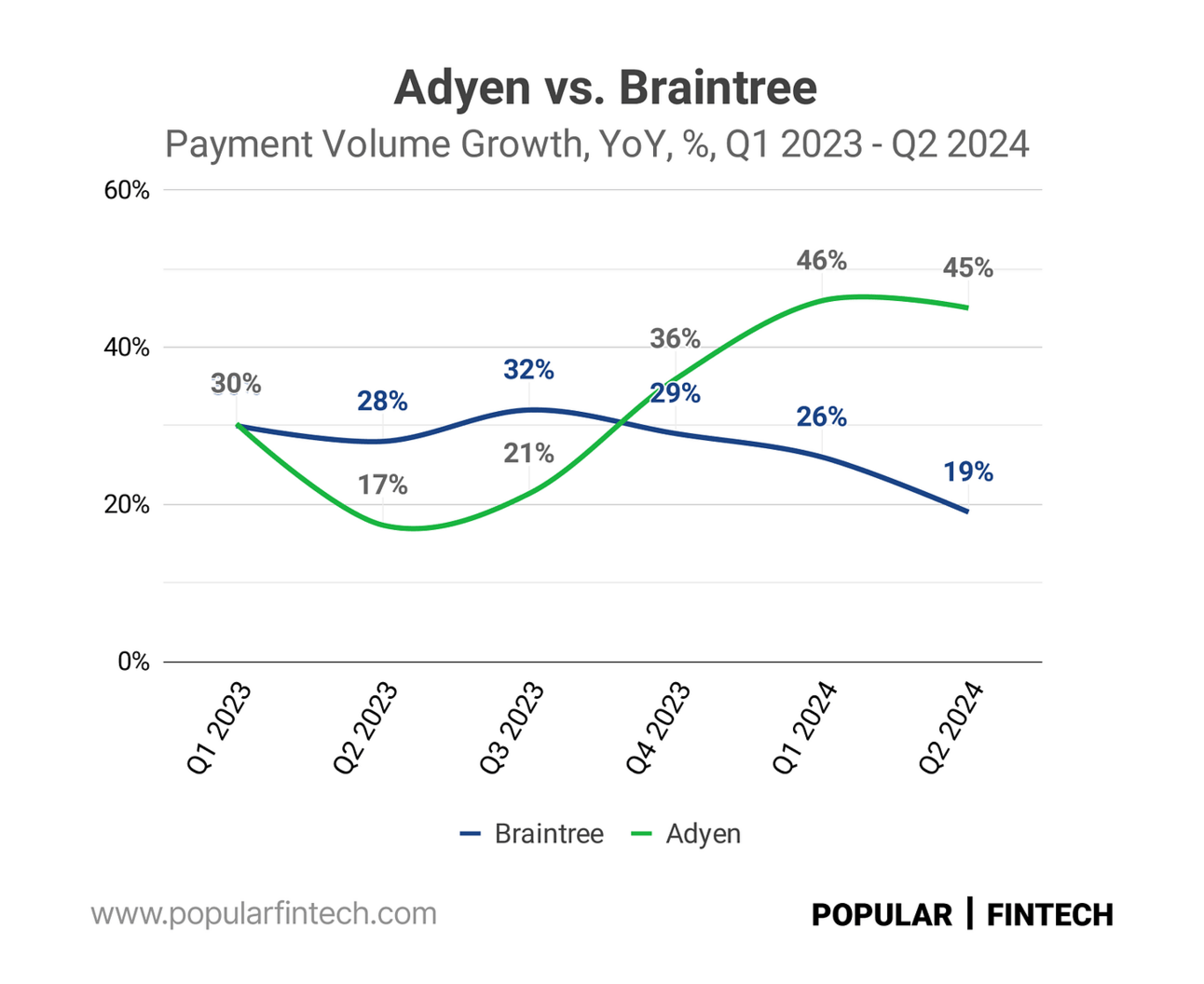

One of the narratives that floated around that time was that Adyen struggled to compete with PayPal-owned Braintree. At the time, Braintree was (allegedly) trying to win the market share at any cost, which was a problem for Adyen that is famous for not competing on price.

However, the new PayPal CEO, Alex Chriss, who took the reigns in September 2023, started turning things around, prioritizing profitability over volume growth. A year later, in Q2 2024, Alex Chriss reported that “Braintree is now meaningfully contributing to transaction margin” (the company’s measure of gross profitability).

“We set out this year to really reorient the team with Braintree around profitable growth. And as we've done that, we've had just a number of conversations with customers, both around contract renewal, but also just around our holistic relationship and….we're willing to accept a lower share of revenue in exchange for a higher margin contract.”

Alex Chriss, PayPal CEO, Q2 2024 Earnings Call

Getting back to profitability required sacrificing growth. Thus, in Q2 2024, Braintree’s volume growth slowed to 19% YoY, down from 28% YoY in Q2 2023. Adyen’s processed volume, in turn, increased 45% YoY, compared to 17% YoY in Q2 2024. As can be seen from the chart below, H1 2023 was the bottom for Adyen payment volume growth.

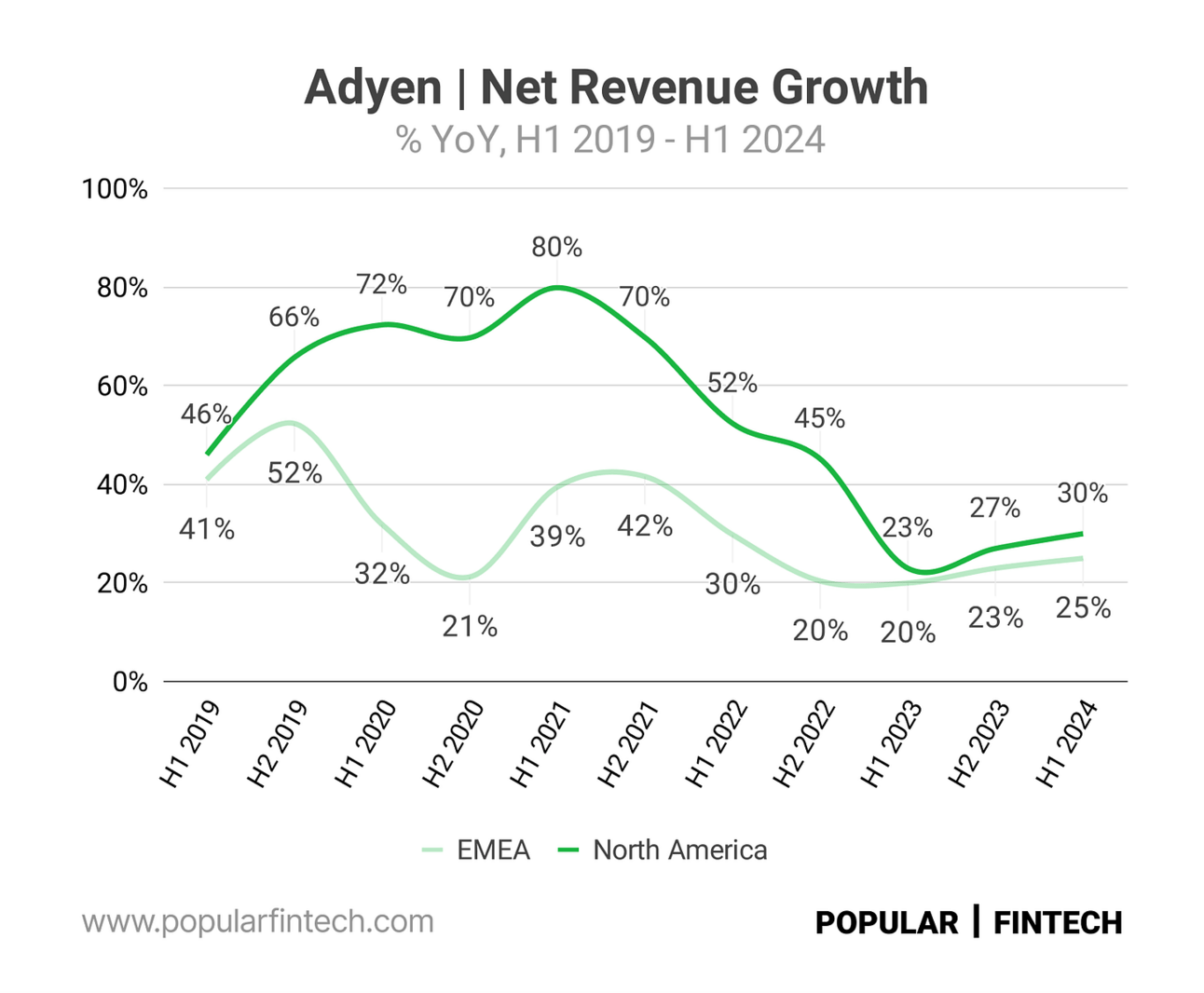

Adyen’s net revenue growth (Adyen does not disclose information about payment volumes by region), both in Europe and in North America, also bottomed in H1 2023 at 20% YoY and 23% YoY respectively, and started accelerating after that.

However, I started thinking that there was more to that story than the competition with Braintree. Adyen stock started recovering in November 2023, after the company held its Investor Day. So I went back to that presentation to dive into other discussed topics.

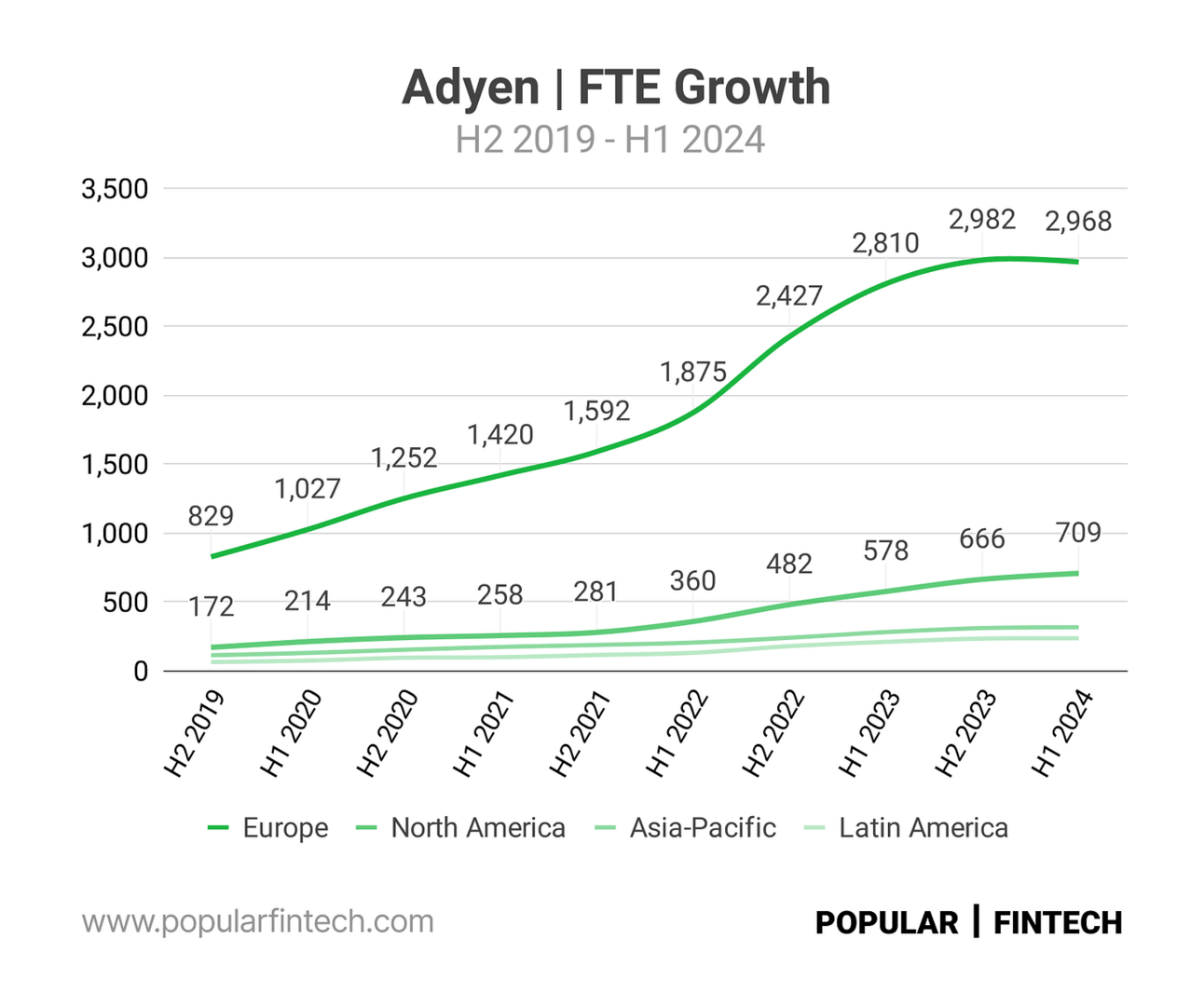

During the Investor Day, Adyen addressed another investor concern: the hiring spree. Thus, Adyen increased its staff from 2,180 people at the end of 2021 to 4,196 people at the end of 2023. The number of employees in Europe increased by 87% in that period, and in the U.S. and Canada by 137%.

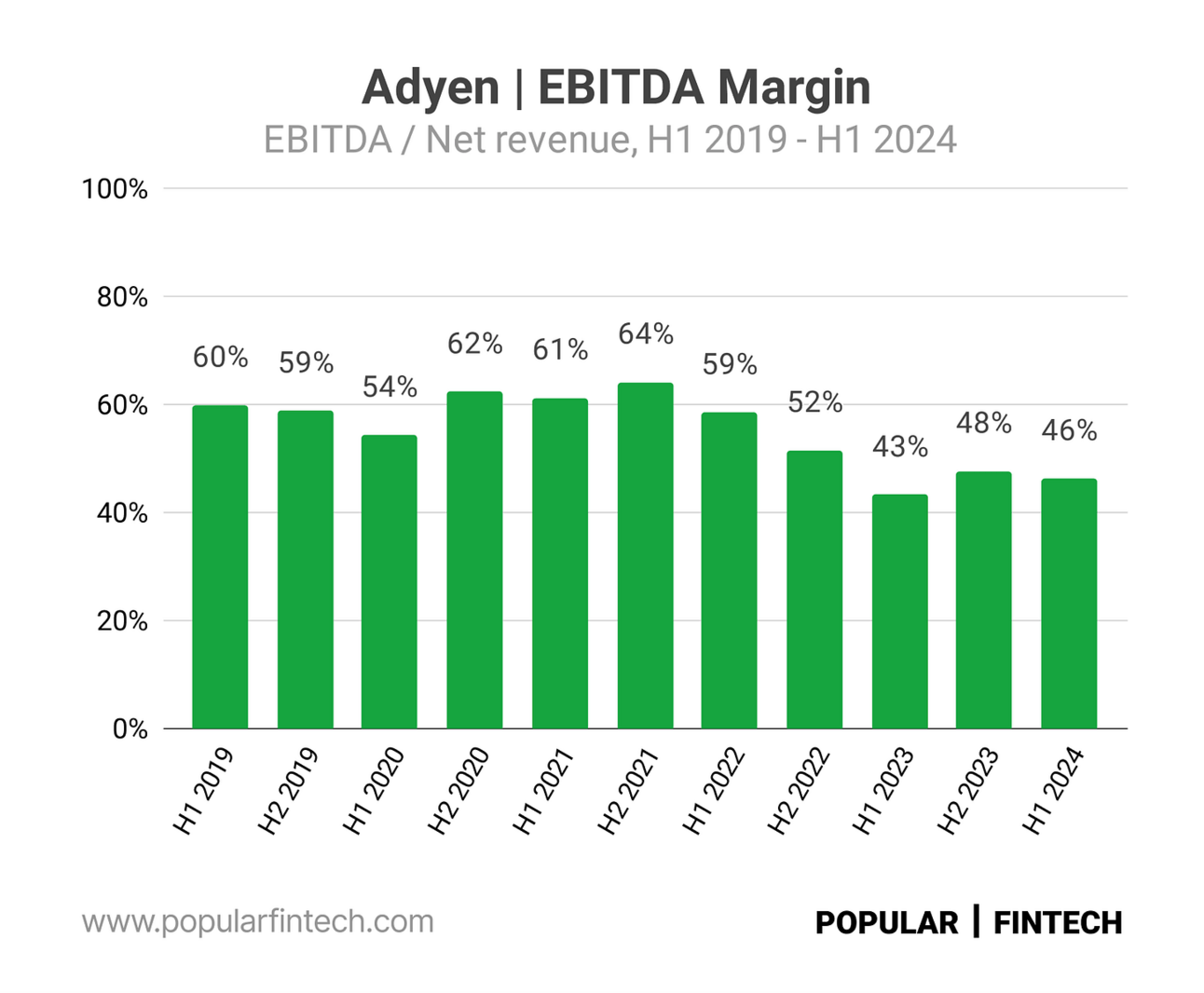

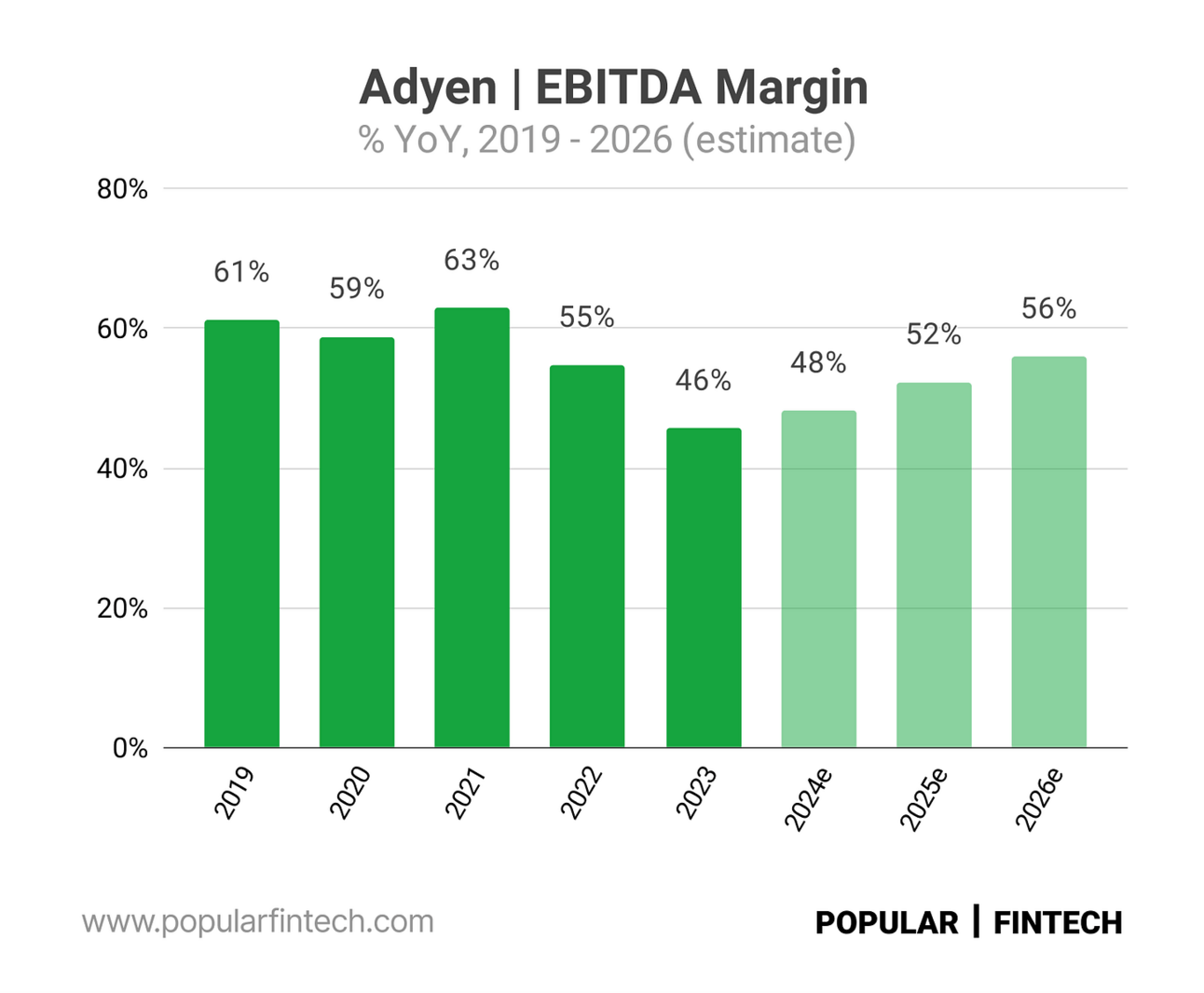

If you recall, hiring was not popular amongst Fintech companies in that period. Moreover, hiring started negatively impacting Adyen’s EBITDA margin (please note that Adyen calculates EBITDA margin as EBITDA divided by net revenue. Thus, EBITDA margin might look very high compared to their U.S. peers).

So during 2023 Investor Day, Adyen told investors that the hiring spree was a time-boxed two-year exercise that would be completed after 2023 (and later delivered on this promise)…

“[ H2 2023 ] concluded a two-year project dedicated to growing our global team. With H2 2023 marking the final stretch of this initiative, we intentionally slowed hiring as this accelerated investment period closed. The majority of our H2 hires sat in tech and commercial roles located in offices outside of Amsterdam.”

Adyen H2 2023 Shareholder Letter

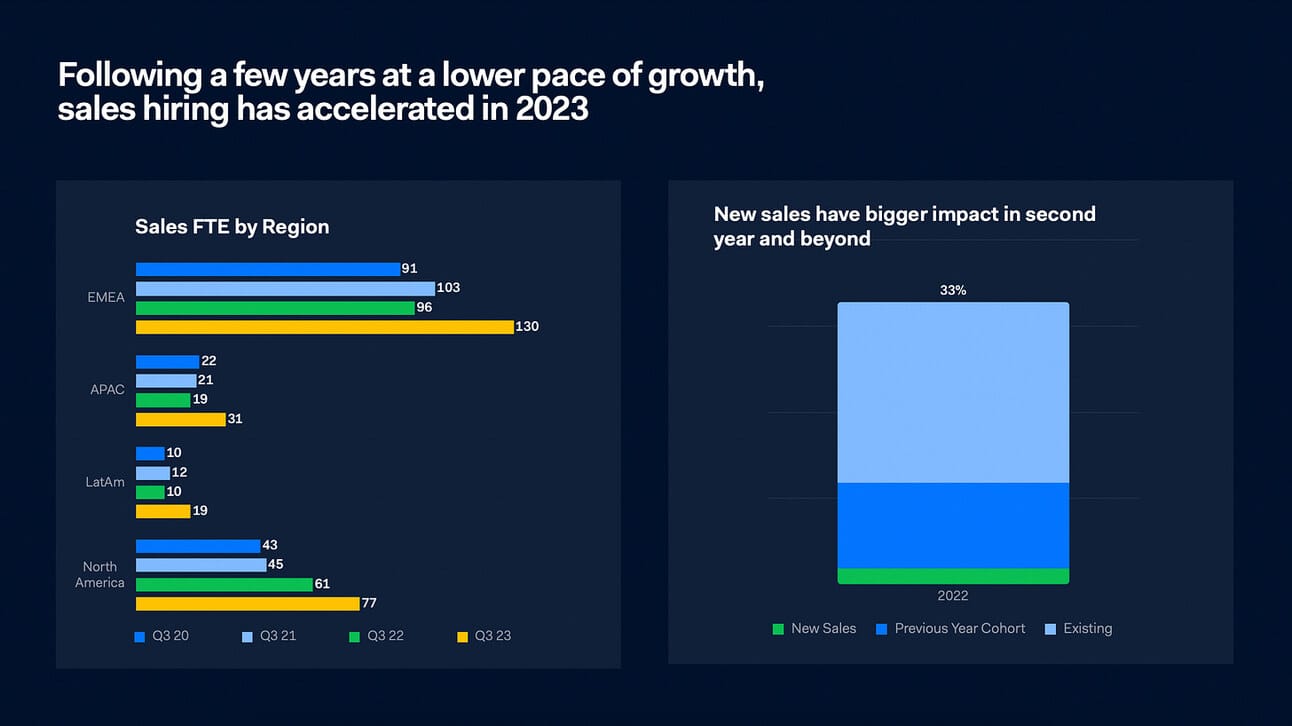

…but, most importantly, Adyen told investors that they are hiring “commercial teams”, which are the sales representatives and account managers. Moreover, they have a special focus on hiring sales reps and account managers in the U.S. Thus, commercial team size in North America (which is primarily the U.S.) increased from 139 people at the end of 2021 to 284 people at the end of Q3 2023.

“At the end of 2021, where, in total, we had about 800 people in the [ Commercial ] team. If we go to September 30 this year, you see that the total number is 1,255. And specifically in North America and Europe, we've grown significantly, more than doubling the team in the U.S.”

Adyen 2023 Investor Day Day

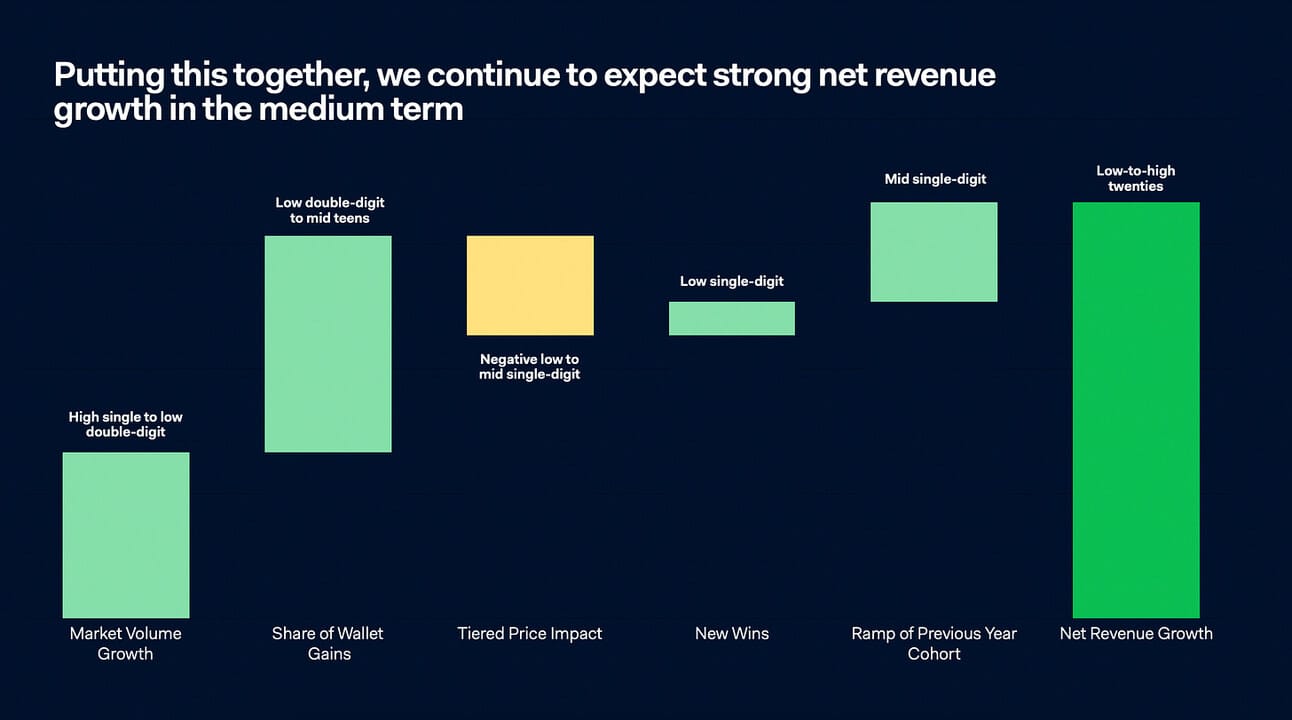

The “commercial teams” that Adyen was scaling will help the company deliver on its “low-to-high twenties” revenue growth ambition during 2024-2026. Adyen’s management illustrated that the company’s growth is based on three components: 1) their clients grow, 2) their clients process a larger share of their volumes with Adyen (“wallet share”), and 3) Adyen wins and ramps up new clients.

The commercial teams that Adyen was hiring will drive wallet share gains (account managers) and new customer wins (sales representatives). And the new customers that those sales reps win, will take a couple of years to ramp up (contribution from new wins is “low single-digit”, while ramp of previous year cohort is expected to contribute “mid single-digit” to the company’s growth target).

“On the sales team in the past 18 months, we've quite accelerated the teams. It's going to take quite a bit of time for the impact, given that the sales cycles are long, people need to be onboarded and once we sign merchants, it also takes quite some time before these merchants really ramp up their volumes with us.”

Adyen 2023 Investor Day

Adyen’s management also highlighted that in 2023, the hiring of sales representatives accelerated across all regions, not only North America. If you follow the waterfall chart above, the sales reps hired in 2023 will start bringing new clients in 2024, and this would contribute “low single-digit” to Adyen’s net revenue growth. However, the same customers will contribute “mid single-digit” growth in 2025.

So, what I think, Adyen’s management achieved at 2023 Investor Day is explaining to the investors that the slowdown in their growth in early 2023 and the decline in the EBITDA margin were the same problem. Adyen overestimated the power of its product and underinvested in its sales and account management capacity.

However, they had already realized that and started investing in their “commercial teams” in 2022, doubling down on this investment in 2023. Long sales cycles and the time it takes to ramp up new clients might mean that their 2022 investment might start paying off only in 2024 or even 2025.

However, on the positive side, the same factors provide for multiple-year visibility into their growth trajectory. Current analysts’ estimates for net revenue growth in 2024-2026 are aligned with Adyen’s guidance of “low to high twenties” net revenue growth that the company provided during its investor day.

Moreover, what Adyen managed to achieve is explaining to the investor community that their EBITDA margin pressure is temporary and not structural. Their EBITDA margin was pressured because they needed to scale up their sales and account management team quickly, and not because the “payments business is a race to the bottom”.

Fast forward to today. Adyen is delivering on its promise and analysts’ estimates are aligned with the company’s guidance. So is there a way for Adyen to overdeliver in 2025-2026? One deviation from what Adyen’s management told investors during the Investor Day that I noticed, is that hiring in North America still continues despite the promise of the hiring spree to end in 2023.

“We continue to invest in our team, albeit at a lower pace than the past 2 years, but that's also something that we planned for. We continue to hire in specifically North America in sales and engineering roles. And for the remainder of the year, we still expect to hire a couple of hundreds of people.”

Adyen H1 2024 Earnings Call

Did Adyen underestimate (again) the sales and account management capacity that they need to grow in the U.S.? Or, perhaps the opposite, they underestimated the opportunity that they have in the U.S.?…especially when some of its competitors are focusing on profitability and are “willing to accept a lower share of revenue in exchange for a higher margin contract”?

I guess we will find out over the next few years.

Cover image source: Adyen

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.