Hey!

Nubank just applied for a U.S. banking charter, taking its first step to expand beyond Latin America. It’s a bold move…and one that many international neobanks have tried before. Revolut, Europe’s largest neobank, entered the U.S. in 2020, but has struggled to gain traction.

Despite being lumped together as “neobanks,” Revolut and Nubank are very different. Revolut rose to prominence in Europe with a sleek app and a free debit card with no FX fees, a formula that worked well at home, but failed to stand out in a market dominated by Cash App and Chime.

Nubank, meanwhile, built its business around credit. It started by offering credit cards to underserved Brazilians, and lending remains its core engine today. Revolut still makes most of its money from interchange and FX fees; Nubank earns it from loans.

Nubank also has something Revolut didn’t: a built-in customer base. The company already serves Latin Americans living in the U.S.

Will Nubank succeed in the U.S.? Hard to say. But if I had to bet, I’m more bullish on Nubank than on Revolut. Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Nubank’s investments in Jupiter (India) and Tyme (South Africa and the Philippines) suggested the company might expand into emerging markets similar to its home region. Instead, Nubank has surprised many by applying for a national bank charter with the U.S. Office of the Comptroller of the Currency, choosing to pursue the most lucrative, and arguably the most competitive, market in the world.

Nubank is arguably the most successful neobank outside of Asia. It now serves over 60% of Brazil’s adult population and is rapidly scaling in Mexico and Colombia. Yet, Nubank isn’t the first to set its sights on the U.S. market. Nearly every major European neobank has tried to expand there, with limited success. Revolut, for example, launched in the U.S. in 2020, but has made little visible progress since.

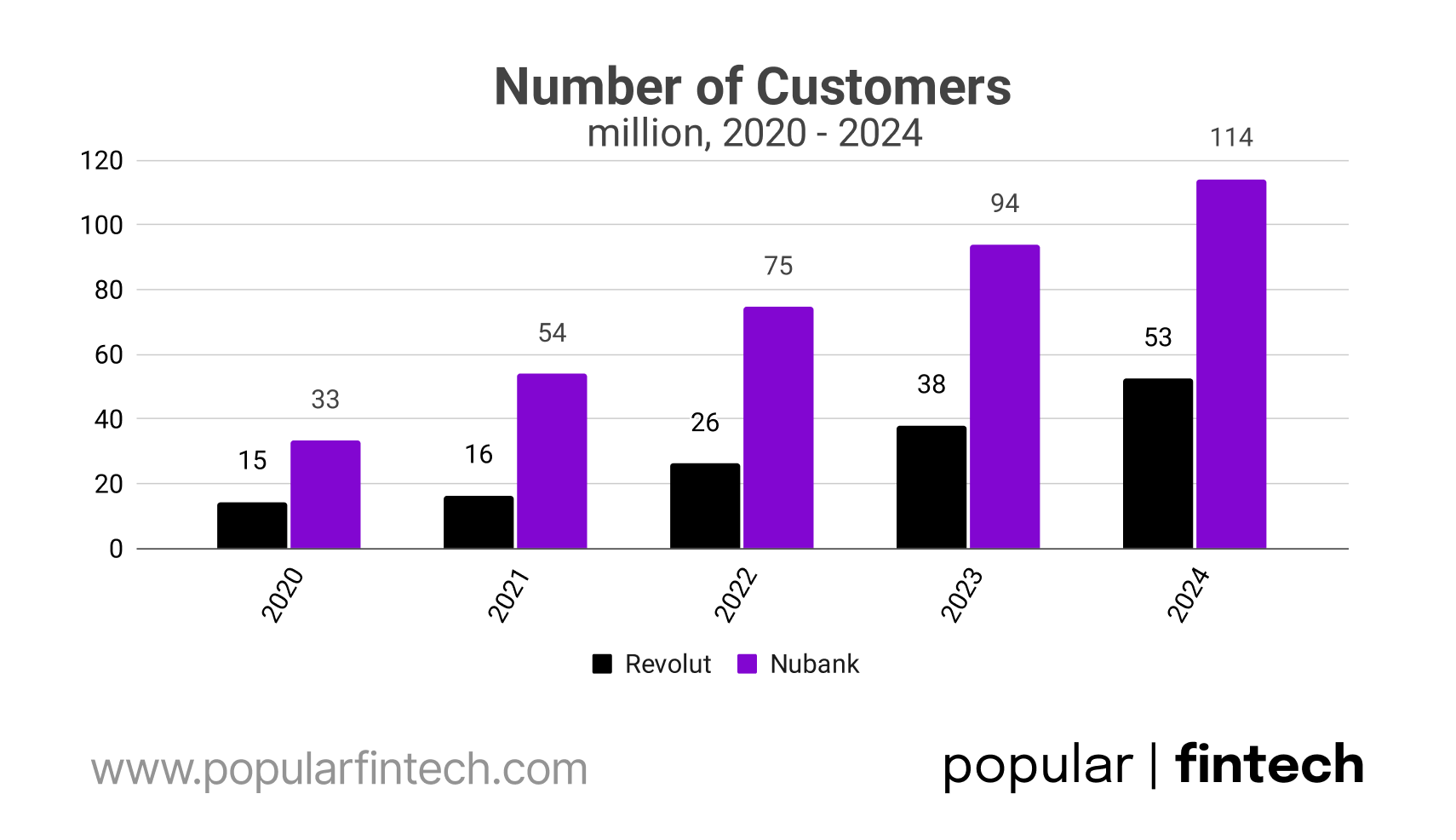

Data source: Revolut annual reports, Nubank IR website

And Revolut is no lightweight. In Europe, they have done what many tried, but no one else managed - building a truly pan-European retail banking franchise. The company is now expanding aggressively beyond Europe, aiming to reach 100 million customers by 2027, with operations spanning the U.S., India, Brazil, Mexico, the UAE, Japan, Singapore, Australia, and New Zealand.

Image source: Revolut Annual Report 2024

“The company has also announced a firm timeline for its goal of serving 100 million customers, aiming to reach this milestone by mid 2027, as well as aiming to enter more than 30 new markets by 2030.”

Revolut finished 2024 with 52 million retail customers, £30 billion ($38 billion) in customer balances, £3.1 billion ($3.9 billion) in revenue, and £790 million ($1 billion) in net profit. By mid-2025, the company had passed the 60 million customers milestone, and is reportedly on track to deliver £4.1 billion ($5.2 billion) in revenue in 2025.

Data source: Revolut annual reports, Nubank IR website

“The fintech notched £1.01 billion ($1.4 billion) in revenue in the second quarter, up from £694 million in the same period in 2024…Those results put the firm on track to deliver more than £4.1 billion in annual revenue.”

A quick look at Revolut’s journey: the company launched in the UK in 2015 and secured a banking license in Lithuania in 2018, which it passported across the EU. It began expanding beyond Europe in 2019 (Singapore and Australia), followed by the U.S. in 2020, and Brazil and New Zealand in 2023. In 2024, Revolut finally obtained a long-awaited UK banking license, though it has yet to make it operational.

Image source: Revolut Annual Report 2024

Like Nubank, Revolut began by solving a specific local pain point: banks overcharging customers when they traveled abroad. It launched as a travel card with a sleek mobile app and zero foreign transaction fees. Since then, Revolut has expanded far beyond travel, now offering multi-currency accounts and FX, free physical, virtual, and one-time debit cards, as well as stock and crypto trading.

Image source: Revolut UK

Revolut has also started opening local branches across Europe to provide customers with domestic account numbers. It offers paid subscription plans with perks such as metal cards, free trades, and access to digital service bundles, alongside its loyalty program, RevPoints. More recently, Revolut has entered the lending space, rolling out credit cards and even mortgages.

Image source: Revolut

Just like its consumer business, Revolut has steadily expanded its offering for small businesses, evolving into a full-service banking platform. Having served business customers since its early days, Revolut now provides multi-currency accounts, FX services, and corporate cards, alongside newer features like bill payments, Revolut Terminal (for in-person payments), Revolut Pay (for online checkout), savings products under Flexible Cash Funds, and even an HR platform called Revolut People.

Image source: Revolut UK

Revolut’s core markets include the UK and Ireland, France, Spain, Poland, Romania, and Italy. Historically, the company found its strongest traction in Central and Eastern Europe, particularly in Poland, Romania, and Hungary (European countries outside of the euro area), but in recent years, it has made an aggressive push into Western Europe, expanding rapidly in France, Spain, and Italy.

Image source: Max Karpis on X

“2024 set a new record as 14.5 million new customer accounts were opened with Revolut. We extended our competitive dominance beyond our historic strongholds in the UK and Ireland, as well as Eastern Europe, to encompass all European markets, with particularly robust momentum building in key markets such as France, Italy, Spain, and the Nordics.”

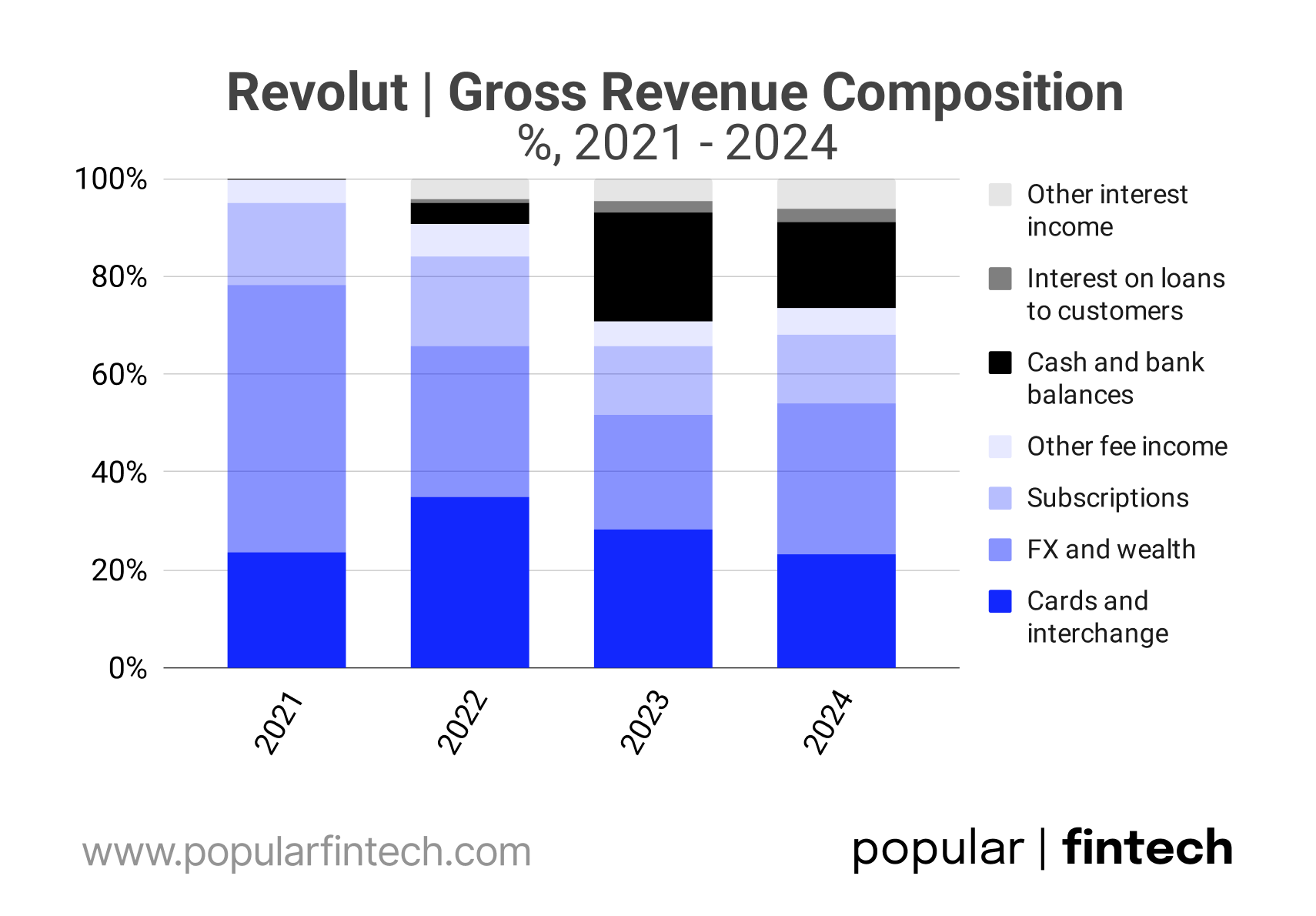

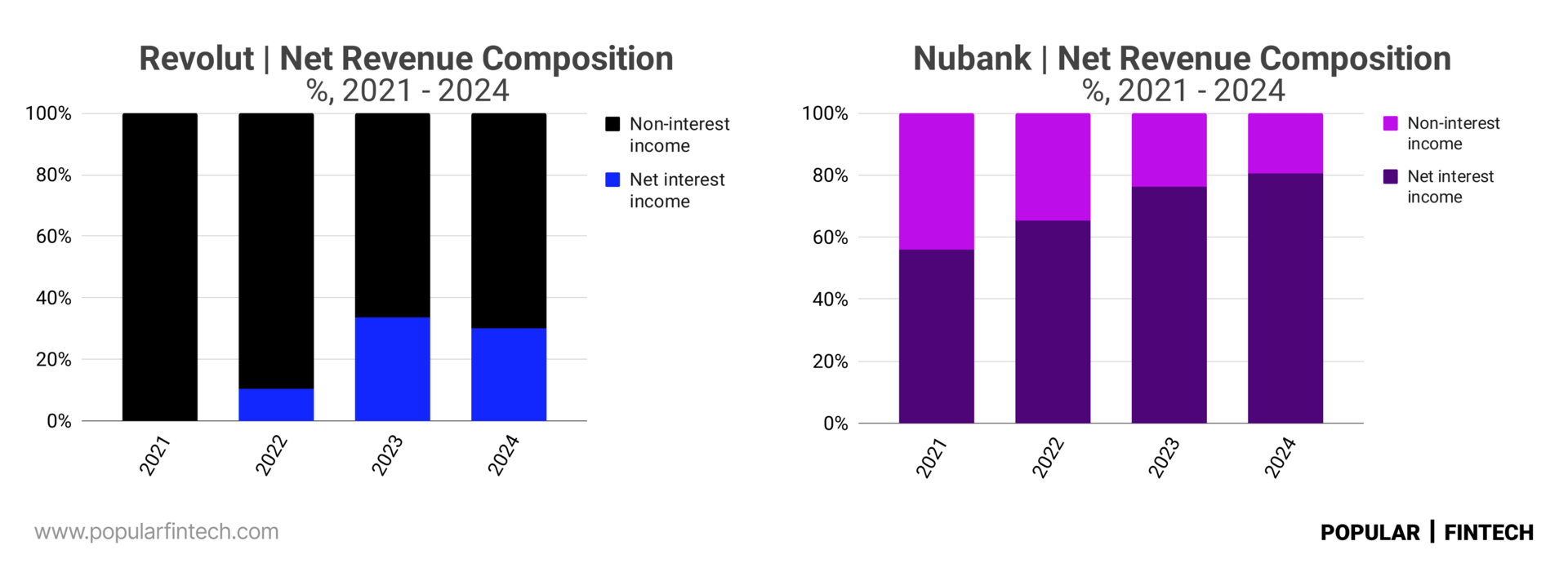

Nubank and Revolut take fundamentally different approaches to making money. Revolut’s business model is fee-driven. Its gross revenue primarily comes from card and interchange fees, foreign exchange services, wealth products like stock trading, and paid subscriptions.

Nubank, by contrast, earns most of its revenue from interest on credit card balances and consumer loans. As mentioned earlier, Revolut began with a free travel debit card, while Nubank started by offering credit cards to customers overlooked by traditional banks. Although both companies have since diversified their offerings, their origins are still clearly reflected in how they make money.

If I were to draw U.S. comparisons, Revolut’s business model most closely resembles that of Cash App or Chime, which also rely heavily on fees and interchange. Nubank, on the other hand, is more comparable to SoFi, or even Affirm, which seems to be evolving from a BNPL player into a credit card–driven neobank.

Data source: Revolut annual reports, Nubank IR website

Surprisingly, or perhaps not, Nubank generates higher revenue per customer than Revolut. Despite Revolut operating in wealthier markets, Nubank’s lending-driven model and the large share of customers who treat it as their primary financial institution enable it to earn more per user.

Data source: Revolut annual reports, Nubank IR website

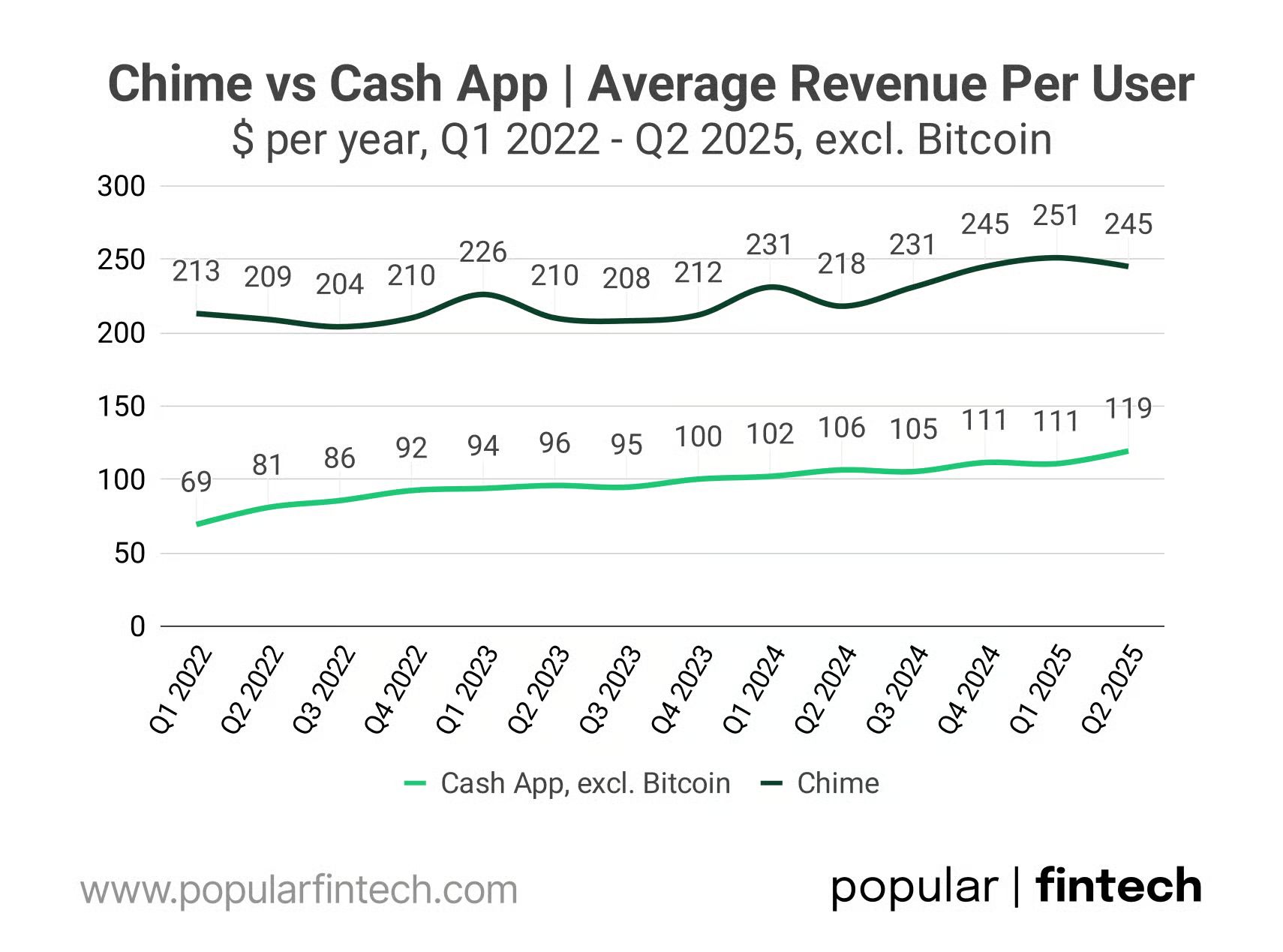

Nubank’s average revenue per customer is roughly on par with Cash App’s, an impressive feat considering that Brazil’s GDP per capita is about ten times lower than the U.S. on a nominal basis, and four times lower when adjusted for purchasing power.

Data source: Block, Chime

A quick note on the balance sheets differences: at the end of 2024, Revolut reported around $39 billion in “customer balances”, compared to $29 billion in customer deposits at Nubank.

Data source: Revolut annual reports, Nubank IR website

However, Revolut’s reported “customer balances” include $10.1 billion held off-balance sheet with partner banks and $9.6 billion in e-money accounts, customer funds that cannot be used for lending. This means Revolut’s actual bank deposits amounted to about $18.9 billion.

“Our balance sheet expanded to £25.8 billion in total assets driven by increased customer deposits. Including savings accounts with partners and Flexible Cash Funds (which are held off balance sheet), customers now manage over £30 billion of total customer balances within Revolut - a 66% increase compared to the previous year.”

When it comes to lending, Nubank dwarfs Revolut. By the end of 2024, Nubank’s loan portfolio totaled $17.6 billion, with $11.2 billion in interest-bearing loans. Revolut, by comparison, had just $1.3 billion. As noted earlier, lending is a new venture for Revolut, but it has been Nubank’s core business from day one.

Data source: Revolut annual reports, Nubank IR website

Finally, Nubank is also more profitable than Revolut. In 2024, Nubank reported nearly $2 billion in net income, compared to $1 billion for Revolut. Interestingly, Revolut, still a private company, is reportedly conducting a secondary share sale at a $75 billion valuation, roughly in line with Nubank’s public market capitalization of $72 billion.

…But back to where we started…Nubank entering the U.S. market, where Revolut has struggled to gain meaningful traction. Revolut’s challenge likely stemmed from bringing its European playbook to the U.S.: a sleek mobile app, a free debit card, and stock trading. Those features faced stiff competition from established players like Cash App, Chime, and Robinhood.

If Nubank were to take the same approach, it would probably meet a similar fate. However, Nubank’s core strength lies in credit card lending, and that could prove to be a key advantage in a credit card-driven market like the U.S.

Moreover, Nubank also has something Revolut didn’t: an existing customer base of Latin Americans living in the U.S. According to the company’s press release, its application for a U.S. banking charter aims to “better serve existing customers in the country.”

“At the same time, applying for a U.S. national charter helps us better serve our existing customers based in the country and, in the future, connect with those who share similar financial needs and could benefit from our products and services.”

This could be Nubank’s blueprint for expansion: start by serving an underserved segment with credit products rather than free debit cards, build scale, and then broaden to the wider market. They did exactly that in Brazil. Will they be able to do the same in the U.S.?

Don’t get me wrong, Nubank’s success in the U.S. is far from guaranteed. Credit underwriting doesn’t easily translate across markets. Still, I’m more optimistic about Nubank’s chances of succeeding than Revolut’s.

Cover image source: Nubank

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.