Hi!

It seems that the PayPal drama might be coming to an end: the company found a new CEO, and the activist investor, Elliott Investment Management, left the company alone. More on that in today’s newsletter:

Nubank reports record profitability,

PayPal names new CEO,

Marqeta jumps on the AI bandwagon, and

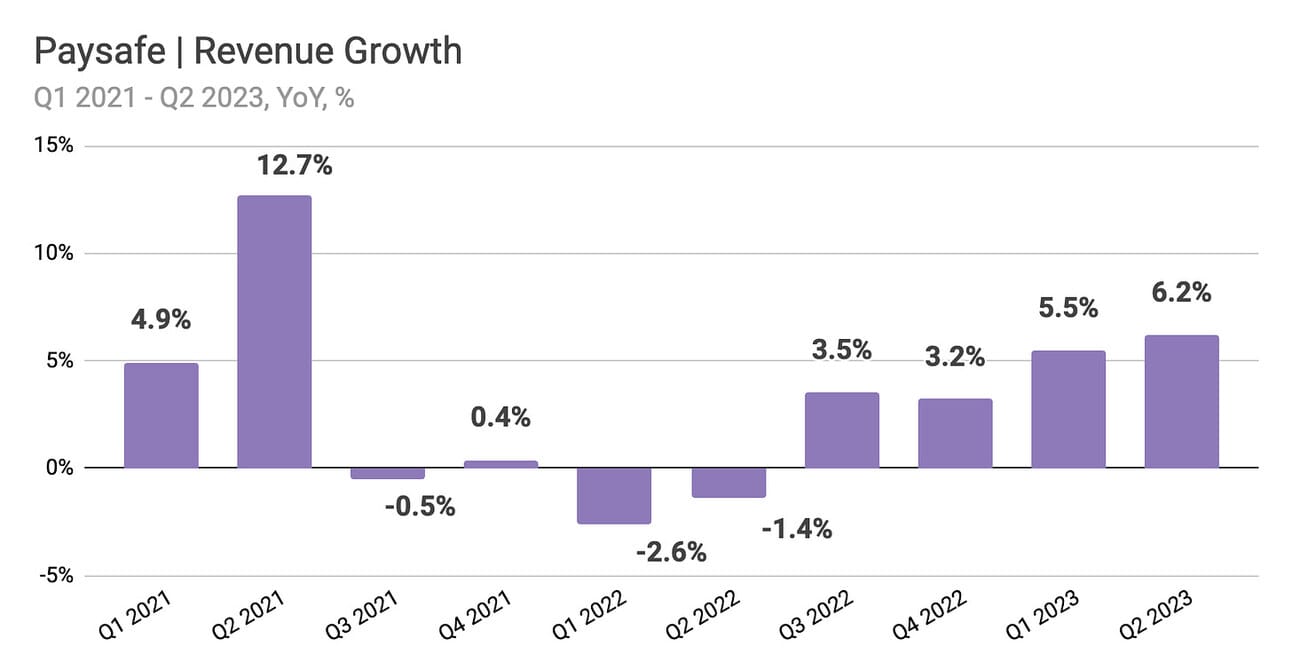

Paysafe stock rallies on earnings results

Thank you for reading and have a great day!

Jevgenijs

p.s. have feedback? DM me on Twitter

Nubank Reports Record Profitability

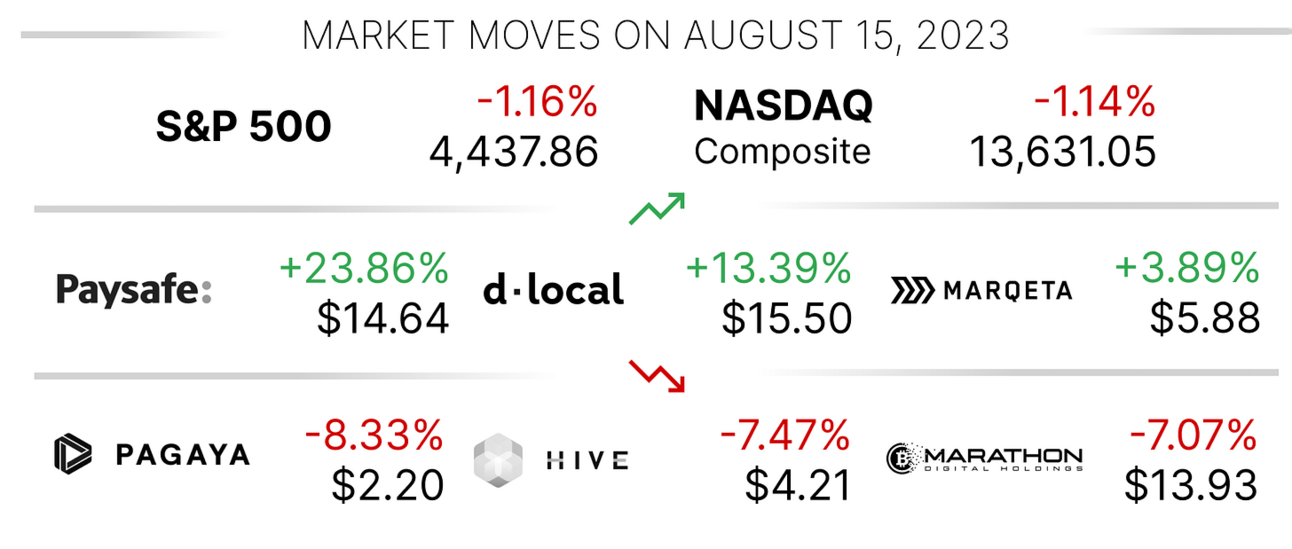

Nubank (NYSE: NU), the world’s largest neobank, reported its second quarter 2023 results yesterday. The company added 4.6 million customers in the quarter bringing the total number of customers to 83.7 million. Nubank is now the fourth-largest financial institution in Brazil in terms of the number of customers. Revenue increased by 61% YoY to $1.87 billion, while gross profit increased 20% YoY to $782 million. Net income for the quarter was $224.9 million compared to a net loss of $29.9 million a year ago. Nubank had an interest-earning loan portfolio of $6.3 billion (up 97% YoY), while the total deposits were $18.0 billion (up 35% YoY).

“Nu continued to expand its customer base, engagement, and monetization, increasing ARPAC [average revenue per active client] above $9 for the first time, while keeping cost to serve stable below the dollar level,” commented David Vélez, founder and CEO of Nubank on the results. Thus, the company reported an average revenue per active customer of $9.3, up from $7.8 a year ago, and an average cost to serve an active customer of $0.8, flat compared to the previous year. During the quarter the company executed a round of layoffs in Brazil, as well as stroke a number of partnerships, including retail giant Amazon, Uber, and travel platform Hopper.

✔️ Nu Holdings Ltd. Reports Second Quarter 2023 Financial Results

✔️ Buffett-backed Nubank posts record revenue on strong user growth

PayPal Names New CEO

Alex Chriss, who currently leads Intuit's Small Business and Self-Employed Group, was announced as the new CEO of PayPal (NASDAQ: PYPL). He is set to take over from Dan Schulman, PayPal's longstanding CEO, starting from September 27. Schulman, who had previously announced his plan to step down by the end of the year, will continue serving on the board until May 2024. Chriss was selected after a search process that began in February and involved evaluating nine candidates. The selection process included discussions with over 20 investors, including the activist investors Elliott Investment Management.

Image source: PayPal

Interestingly, Elliott Investment Management, which may have played a role in influencing Dan Schulman's decision to step down, sold its stake in PayPal during the second quarter, according to a recent filing with the SEC. Elliot announced taking a $2 billion stake in the company last August, which was followed by PayPal embarking on an aggressive cost-cutting program and increasing the return of the capital to shareholders through share repurchases. At the same time, Elliott revealed a new investment in Fidelity National Information Services (NYSE: FIS) with approximately 1.1 million shares worth $60 million.

✔️ PayPal Names Alex Chriss as Next President and CEO

✔️ Intuit’s Alex Chriss named new PayPal CEO

✔️ PayPal's stock pulls back as Elliott reveals it dumped its stake last quarter

Marqeta Jumps on the AI Bandwagon

Marqeta (NASDAQ: MQ) introduced Marqeta Docs AI, an AI-powered tool designed to assist customers in efficiently navigating the company’s documentation. Marqeta Docs AI employs OpenAI's Large Language Models and aims at simplifying integration with Marqeta’s card-issuing platform APIs. The tool is currently in beta and is expected to be available to the public later in the current quarter. The company also shared promising results from an internal code generation tool that reduced coding and testing time by up to 75%. The company’s stock was up 3.89% on this “news” despite a bad day in the markets.

Image source: Marqeta

As a reminder, last week, Marqeta announced that it had signed a four-year extension with Block (NYSE: SQ) to continue powering the company’s Cash App card product. This extended deal will become effective on July 1, 2023, and will continue through June 30, 2027. The new agreement includes reduced pricing, as well as a transfer of responsibility for managing the card network relationship, including financial terms and choice of card brand, from Marqeta to Block. Marqeta powers both Cash App and Square cards and generated 78% of its net revenue from managing Block’s card programs in the second quarter.

Paysafe Stock Rallies on Earnings Results

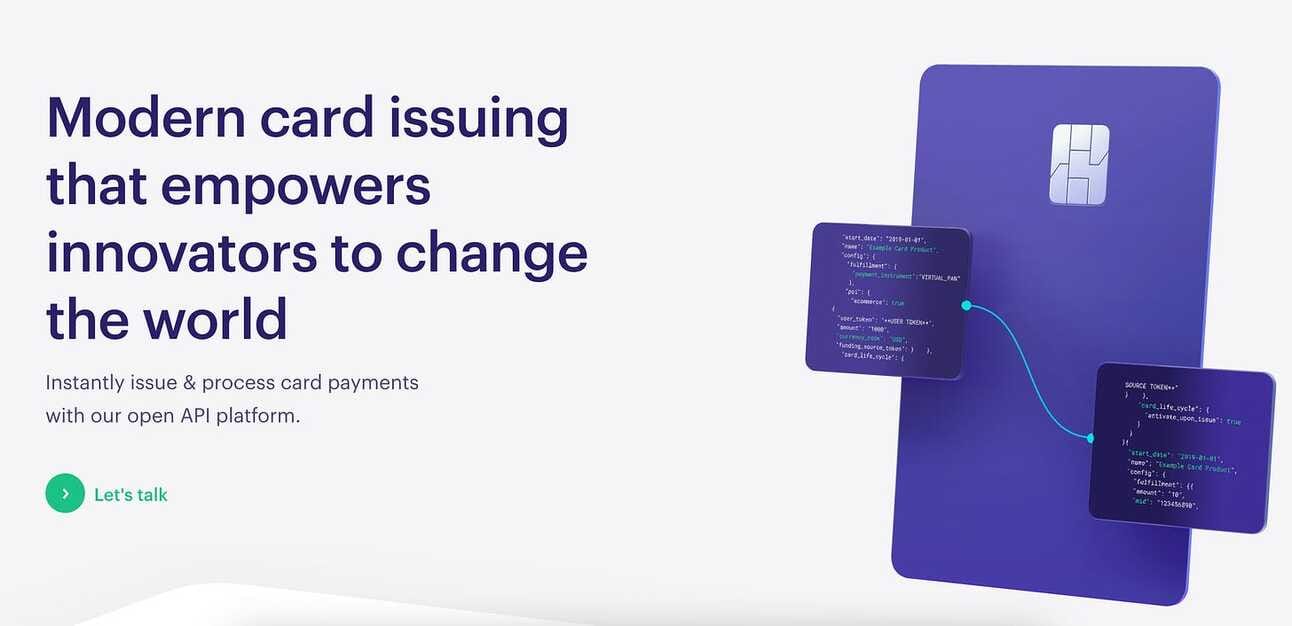

Paysafe (NYSE: PSFE) reported its second quarter 2023 results yesterday, posting a 6% YoY growth in Total Payment Volume to $35.5 billion, and a 6% YoY growth in revenue to $402.3 million. The net loss attributable to Paysafe amounted to $1.8 million, compared to a net loss of $658.7 million loss in the prior year period, which included an impairment charge of $676.5 million. The company's Adjusted EBITDA reached $113.0 million, representing a 9.7% growth compared to the previous year. Adjusted EBITDA margin for the second quarter was 28.1%, compared to 27.2% in the prior year period.

The company slightly raised its full-year guidance and now expects $1.59 - $1.60 billion in revenue, and $454 - $462 million in Adjusted EBITDA, which implies a 7% YoY growth in revenue and 12% YoY growth in Adjust EBITDA. A year ago, the company’s Board hired a new CEO, Bruce Lowthers, with the goal of reigniting growth. Lowethers, who came from FIS, reorganized the company into two segments, as well as rebuilt his C-suite, including hiring a new Chief Financial Officer, Chief Revenue Officer, and Chief Strategy and Innovation Officer. The company stock advanced more than 23% for the earnings release.

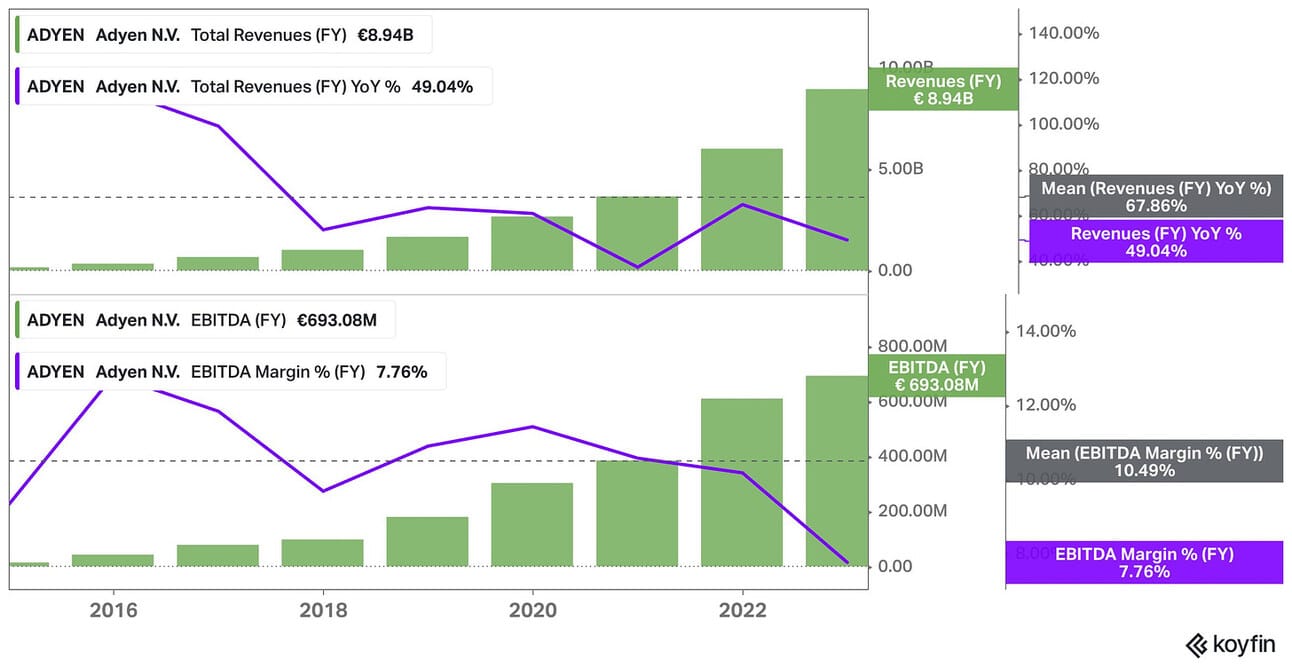

Adyen (AMS: ADYEN) will report its H1 2023 results on Thursday, August 17, 2023, so I will just leave this impressive chart here:

Director and Head of BCDC FP&A

@ PayPal

🇺🇸 San Jose, CA or New York, NY, United StatesSenior Director, Deputy to the GM of Venmo

@ PayPal

🇺🇸 San Jose, CA, United StatesCompliance Officer and MLRO (UK)

@ Marqeta

🇬🇧 Remote, United KingdomDirector, Enterprise Sales

@ Marqeta

🇺🇸 Remote, United StatesTech Manager

@ Nubank

🇧🇷 Sao Paulo, Brazil

Cover image source: Nubank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.