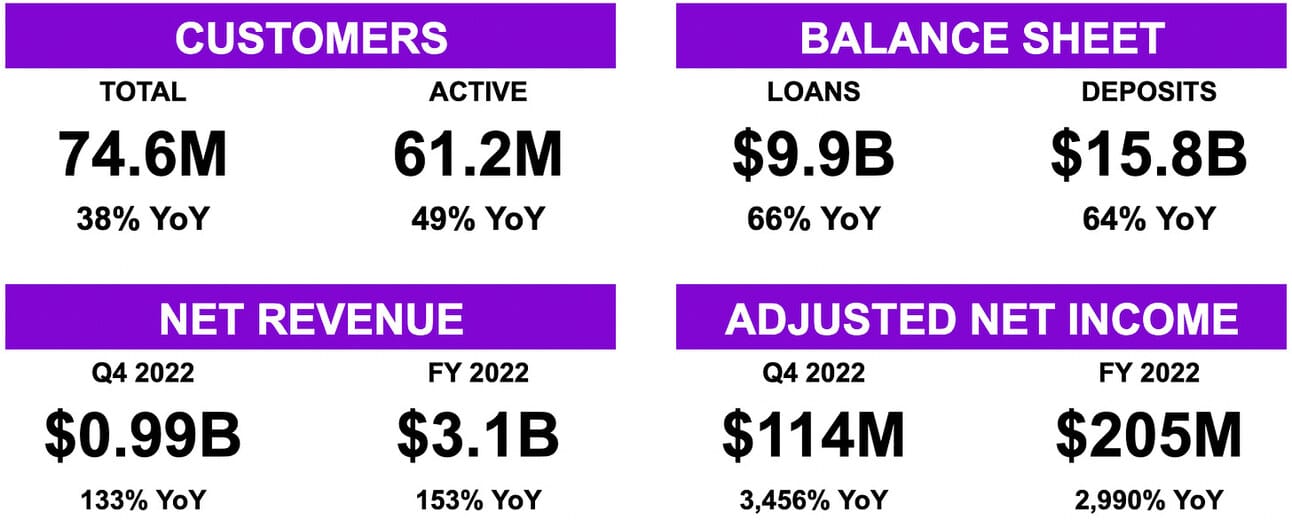

Nubank (NYSE: ) delivered another stellar quarter. In Q4 2022, the company acquired 4.1 million new customers, increased gross revenue by 128% compared to Q4 2021, and posted another profitable quarter. However, the most exciting piece of news was that Nubank started scaling its credit business. Over the last three years, the company’s potential in lending was hindered by the pandemic, inflation, rising interest rates, and uncertain economic prospects. In the meantime, Nubank’s management stayed patient and grew the company’s customer base from 20.1 million in 2019 to 74.6 million at the end of 2022.

Of course, there are challenges and uncertainties ahead (i.e. delinquency rates are still rising, growth outside of Brazil seems to be slowing down, and acquiring new customers became considerably more expensive). Nevertheless, 74.6 million loyal customers, an ample deposit base, and healthy profit margins make me excited about Nubank’s prospects in 2023 (and beyond). I believe we will hear many impressive earnings reports in the future, but in the meantime, let’s break down the company’s Q4 2022 results!

Customers

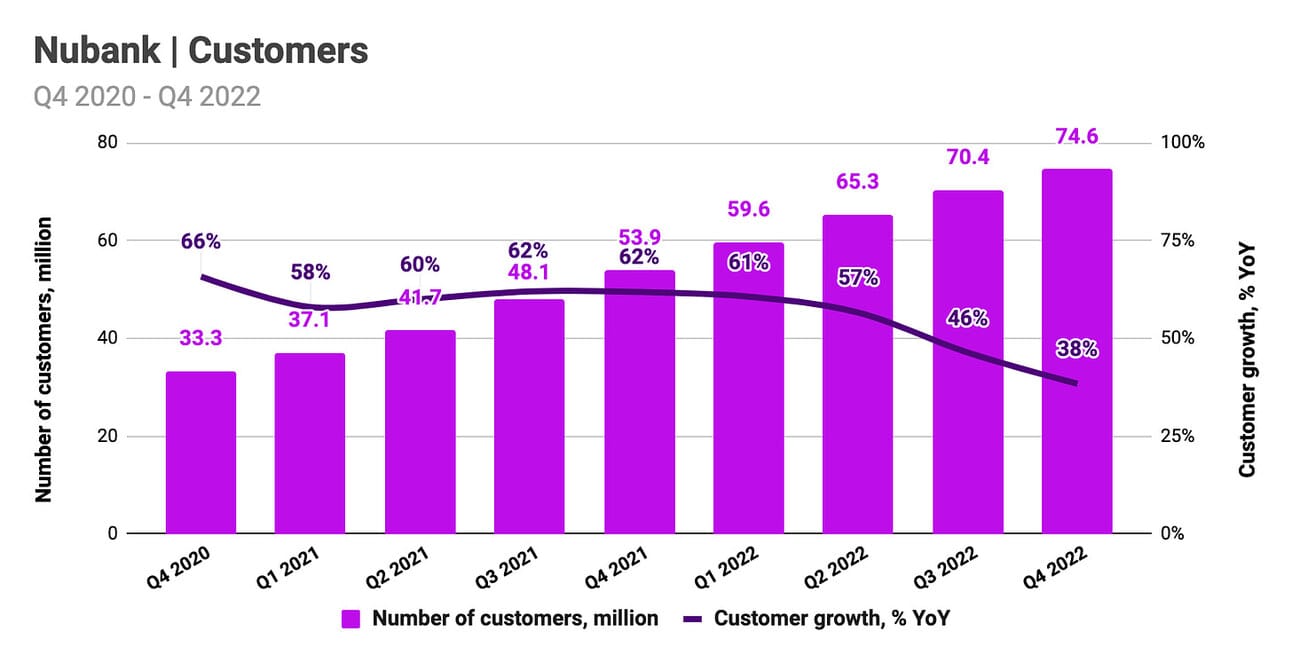

Nubank added 4.1 million customers during Q4 2022 finishing the year with a total of 74.6 million customers, of which 70.9 million were based in Brazil, 3.2 million were based in Mexico, and 0.56 million were based in Colombia. The company’s customer base grew 35% YoY in Brazil, 129% YoY in Mexico, and 392% YoY in Colombia. Last quarter, the company reported 66.9 million customers in Brazil, 3.0 million in Mexico, and 0.44 million in Colombia, which suggests the growth in Mexico and Colombia is slowing down compared to earlier quarters in 2022.

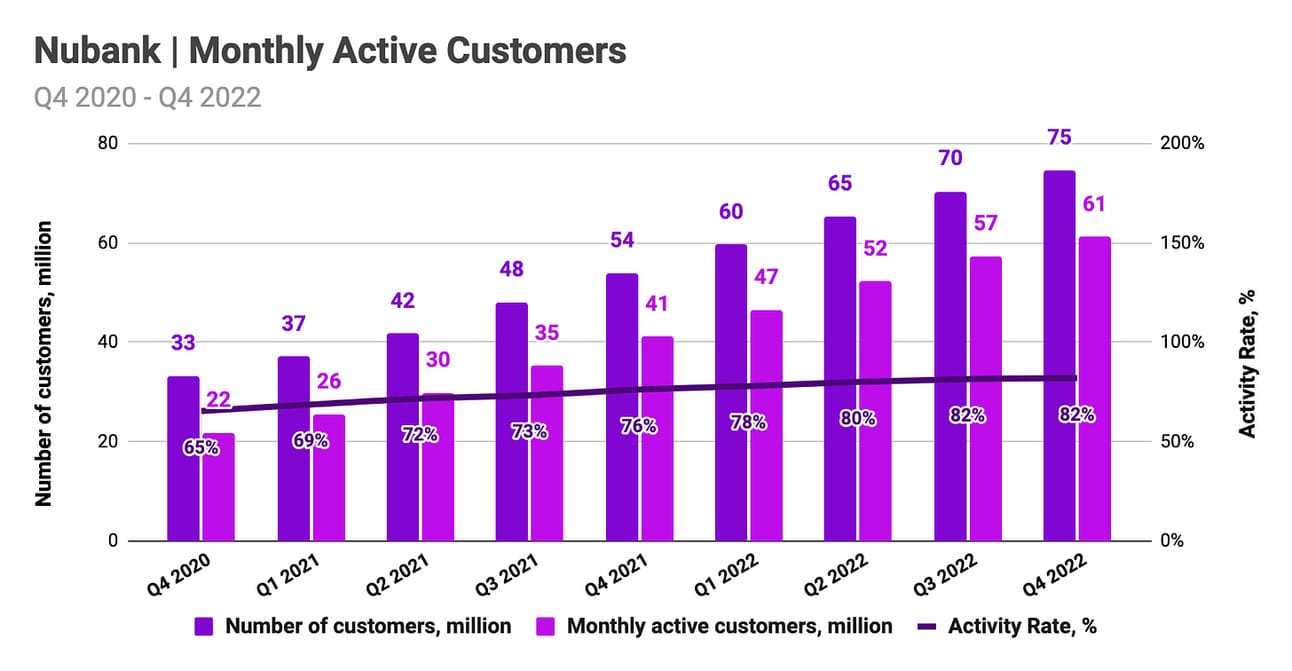

The activity rate, which is the number of monthly active customers expressed as a percentage of the total number of customers, improved only marginally in Q4 2022 compared to the previous quarter and stayed at 82%. Nubank claims to be the primary banking partner for over 58% of its monthly active customers, compared to 55% in the previous quarter. Out of the total of 61.2 million active users, 53 million used digital banking accounts, 34 million used credit cards, and 7 million used NuInvest, which compares to 50 million, 32 million, and 6 million active users for banking accounts, credit cards, and NuInvest respectively in Q3 2024.

In summary, another strong quarter in terms of customer growth. Growth in Brazil should start slowing down sometime soon, as the company already serves 44% of the country’s adult population (compared to 39% in Q3 2022). Nevertheless, the high penetration amongst the adult population was expected to translate into a growth slowdown already in 2022, and yet, Nubank managed to maintain the pace. A slowdown in customer growth in Mexico and Colombia is concerning, but the company continues to extend its offering and secured new funding to support growth in these markets, so, perhaps, let’s just be patient here.

Loan Portfolio and Deposits

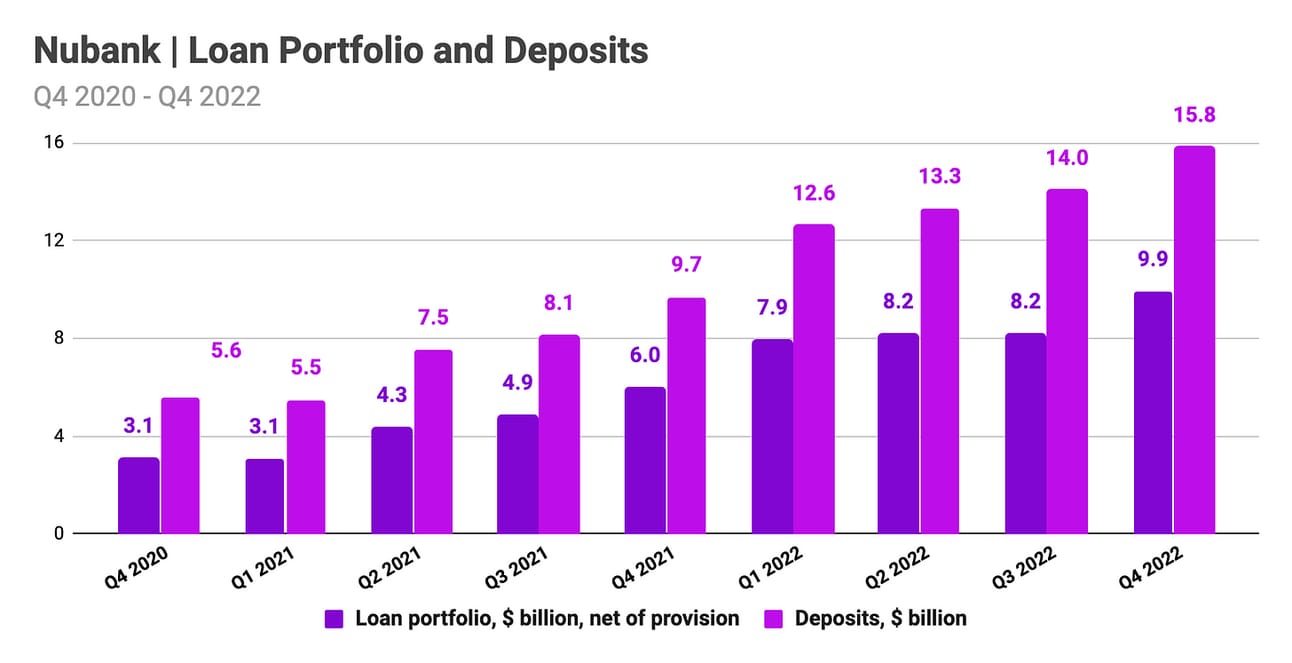

Nubank reported $15.8 billion in deposits at the end of Q4 2022, which represents a 63.5% increase compared to Q4 2021 and a 12.6% increase compared to Q3 2022. $14.3 billion, or 90.3% of the total, were classified as “Bank Receipts of Deposit”, which the company can use for lending purposes. In July 2022, Nubank launched “Money Boxes”, which are a form of savings accounts that provide users with more flexibility, and allow the company to lower its cost of funding below the CDI rate (CDI rate is paid in full only if the funds remained in the “money box” for at least 30 days). Thus, the company’s cost of funding was 78% of CDI in Q4 2022.

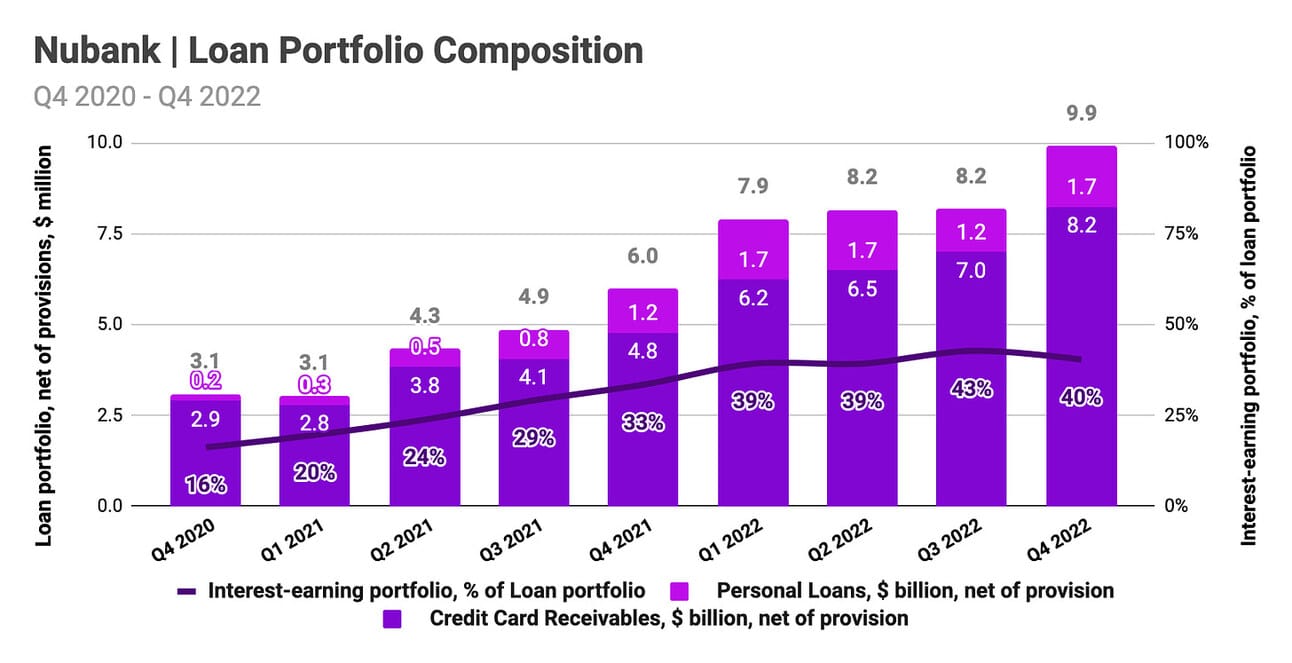

The company reported a loan portfolio of $9.9 billion, net of provisions, at the end of Q4 2022, which represents a 65.8% growth compared to Q4 2021, and a 21.1% growth compared to Q3 2022. After a few quarters of flat to no portfolio growth (see the chart below), Nubank found comfort in loosening credit policies and scaling origination volumes. Thus, credit card receivables increased by $1.2 billion from the previous quarter, and, as per the earnings call, the management expects to start scaling personal loan originations in Q1 2023 as well. The interest-earning portfolio increased from $3.5 billion in Q3 2022 to $4.0 billion in Q4 2022.

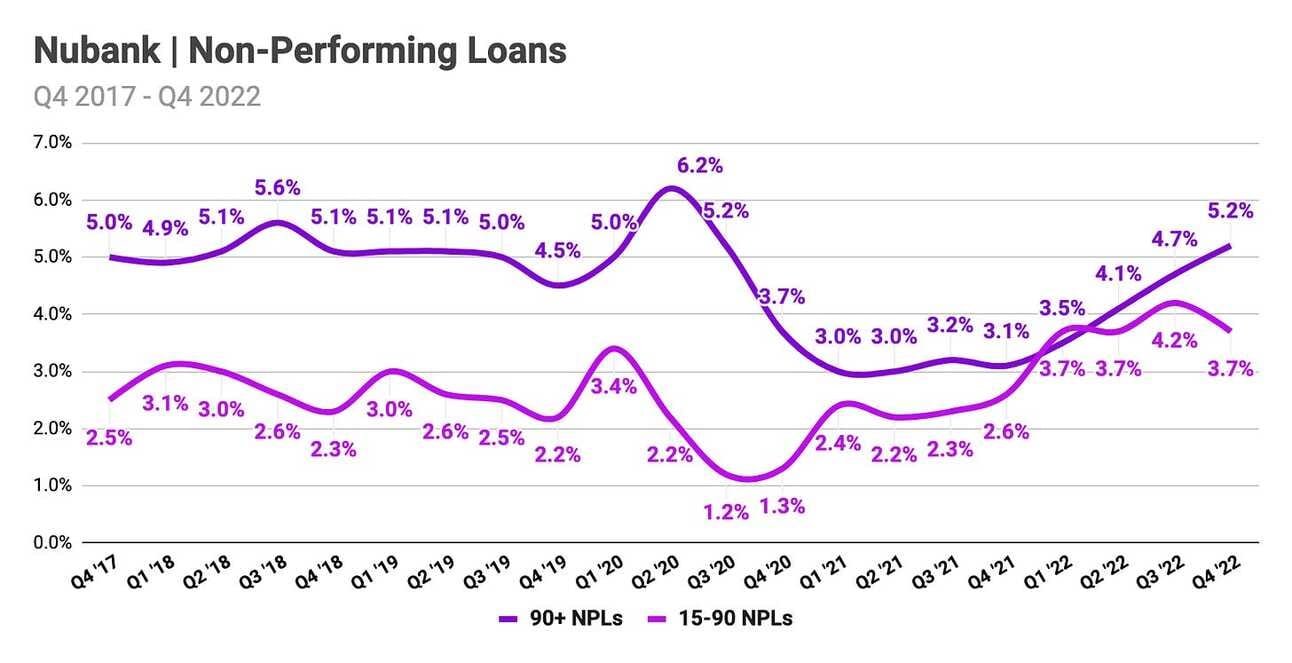

I believe that it is the expanding Net Interest Margin (NIM) that gave Nubank’s management confidence to return to the growth mode in lending. Thus, as you can see from the chart below, the 15-90 day NPL rate, which is an early delinquency indicator, declined from 4.2% in Q3 2022 to 3.7% in Q4 2022; however, the 90+ day NPL rates continued to advance from 4.7% in Q3 2022 to 5.2% in Q4 2022. The improvement in the 15-90 day NPL rate was partially attributed to seasonability and the management expects an uptick in Q1 2023. However, a higher NIM (due to higher interest rates charged to borrowers and lower cost of funding) compensates for higher credit losses. Thus, the risk-adjusted NIM (NIM adjusted for the credit allowance expense) improved from 2.0% in Q4 2021 to 5.4% in Q2 2022.

In summary, Nubank returned to the growth mode in credit card lending, and is expected to start scaling its personal loan business as soon as Q1 2023 (the company also plans to launch new lending products, such as secured lending and auto loans). While the NPL rates might not have stabilized yet, it looks like the company has built a sufficient buffer for error through higher NIM, which allows lending profitably even at higher delinquency rates. I would expect lending portfolio growth to be the main income growth driver in 2023 (and, hopefully, beyond).

Nubank operates with gross revenue and gross profit when reporting its top-line results; however, given the profile of the company, I believe looking at the Net revenue makes more sense and allows for easier comparison with other financial institutions. Thus, I “reorganized” the income statement to calculate Net interest income (interest income less interest expenses) and Net commission income (fee and commission income less transaction expenses).

Net Revenue

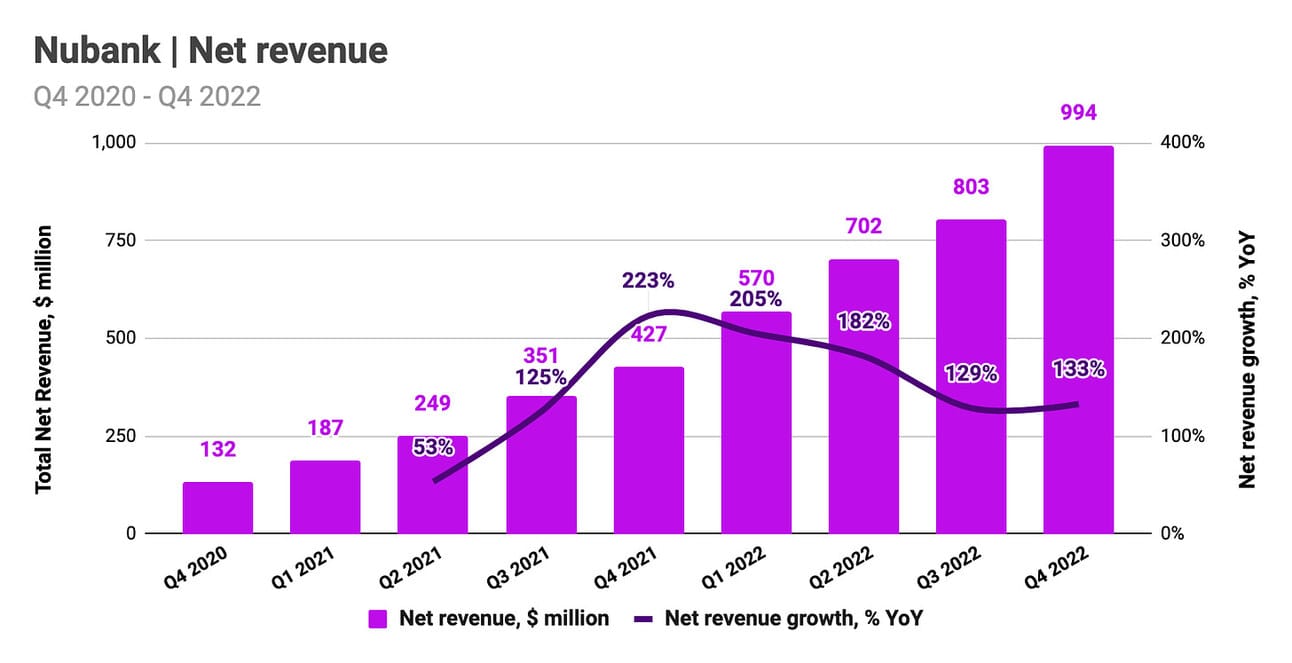

Nubank reported net revenue of $993.6 million in Q4 2022, which represents a 132.9% growth compared to Q4 2021 and a 23.8% growth compared to Q3 2022. Net interest income contributed $688.0 million to total net revenue, and rose 162.0% compared to Q4 2021 and 30.5% compared to Q3 2022, while Net commission income contributed $305.6 million, and rose 86.3% compared to Q4 2021 and 11.1% compared to Q3 2022. The share of NII in the total net revenue increased from 44.1% in Q4 2020, to 61.6% in Q4 2021, to 69.2% in Q4 2022, as the growth of NII outpaced the growth of NCI throughout 201 and 2022.

Nubank returned to growth in Q2-Q3 2021 following a slowdown during 2020 and early 2021, as the company navigated the pandemic and tightened its origination standards. The company’s return to growth coincided with the beginning of the interest rate hiking cycle, as the Central Bank of Brazil took on a fight with rising inflation (ahead of many other central banks). Looking back at Nubank’s performance in 2021 and 2022, it is fair to say that the company’s management navigated the cycle perfectly, staying conservative in lending, and building customer and deposit base. I believe 2023 will be a year when the company will put its assets to work in an attempt to scale its lending operations (read, will focus on NII growth).

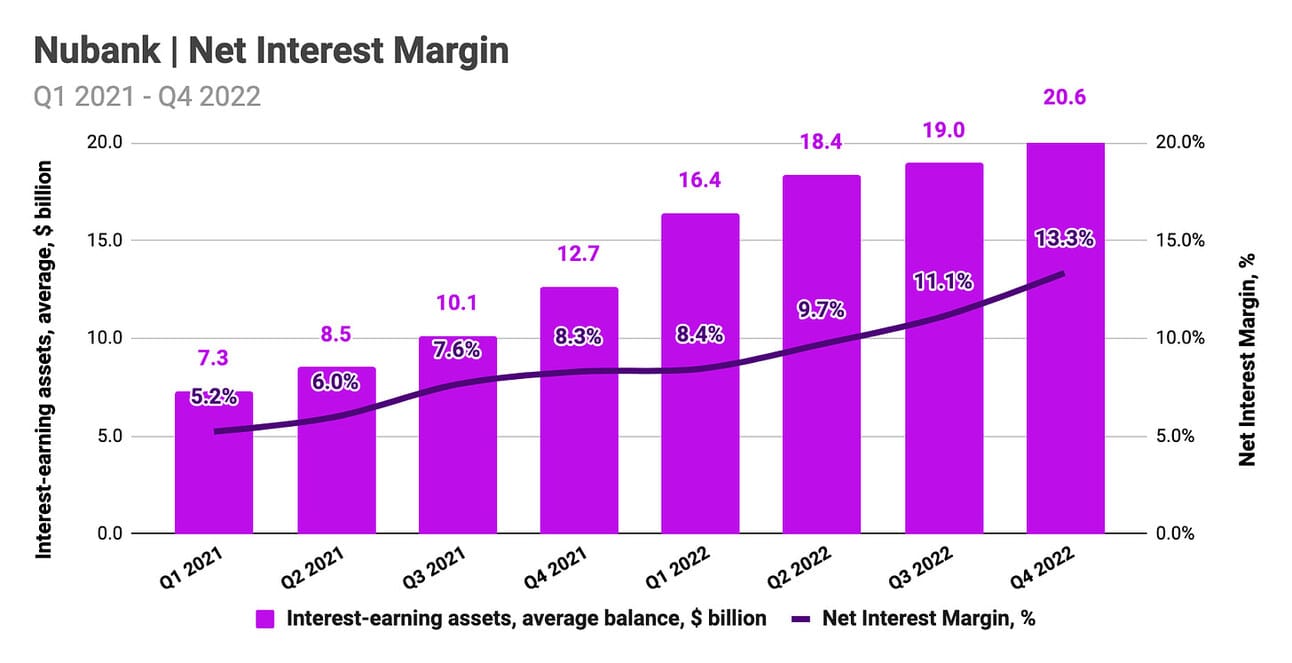

Net interest income is a function of the average interest-earning assets (primarily cash, deposits with central banks, bonds, and interest-earning loan portfolio) and the Net Interest Margin (NIM). Nubank’s average interest-earning assets increased from $12.7 billion in Q4 2021 to $20.6 billion in Q4 2022, while NIM expanded from 8.3% in Q4 2021 to 13.3% in Q4 2022. The company continues to attract new deposits, which will translate into higher interest-earning assets. In addition, the company has multiple levers to further increase NIM: a) by lowering the cost of funding (i.e. through “money boxes” mentioned above), b) by continuing to reprice its new loan originations, and c) by scaling its lending business (which means that larger share of deposits will “convert” into high yielding assets rather than low yielding cash).

A simple sensitivity analysis suggests that a 1% increase in NIM would increase Net Interest Income by approximately $100 million in Q1 2023 (holding interest-earning assets constant at the end-of-the-period level), while an increase in the interest-earning assets by $1 billion would increase the Net Interest Income by approximately $63 million in Q1 2023 at the constant NIM. A combination of the two would yield a $120 increase in Net Interest Income (the combined effect is smaller than the sum of individual parts due to the use of the average balance of interest-earning assets). Given the number of levers, I would expect Nubank to increase NIM by 1.5 - 2.0%, and to increase the interest-earnings assets by at least $1 billion in Q1 2023, which would yield $800 - 830 million in Net Interest Income.

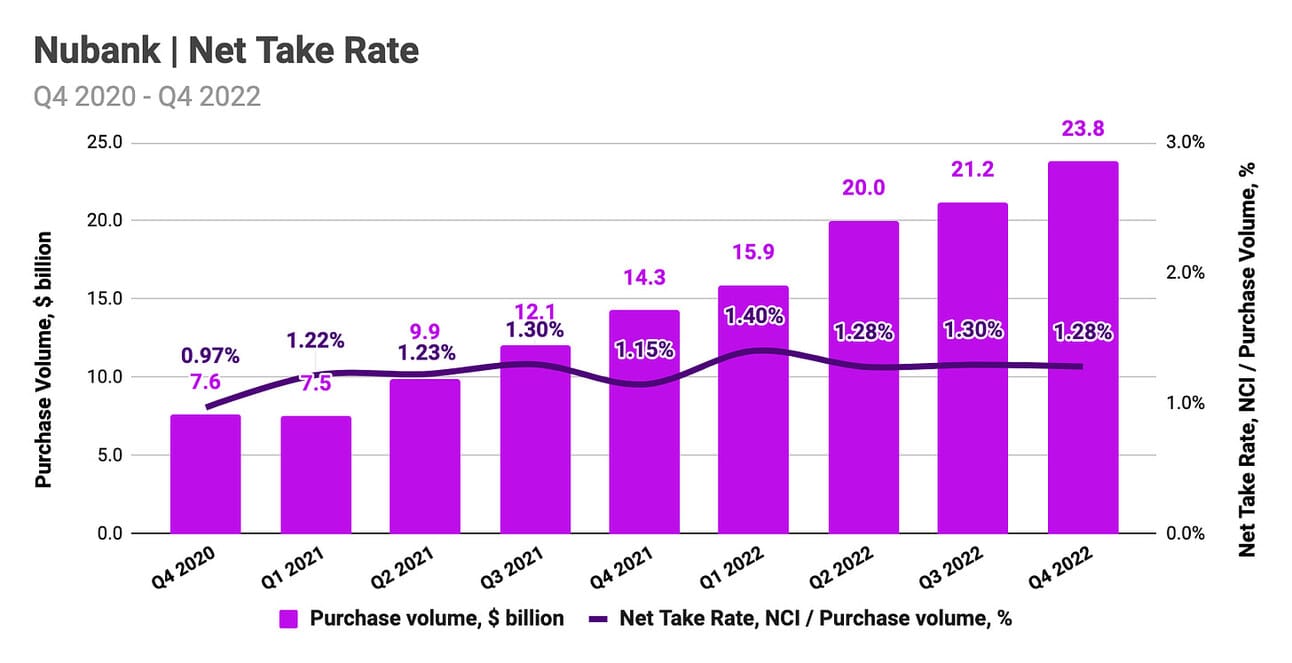

Net Commission Income is a function of the purchase volume and the net Take Rate (commission fee income expressed as a percentage of purchase volume), as the interchange fee remains the key fee income driver (brokerage services, crypto, and insurance services produce only margin contribution to the income at this moment). Nubank reported a Purchase volume of $23.8 billion in Q4 2022, which represents an increase of 66.4% compared to Q4 2021. The net take rate increased from 1.15% in Q4 2021 to 1.28% in Q4 2022; however, as can be seen from the chart below, the net take rate stabilized at around 1.3% in the latest quarters.

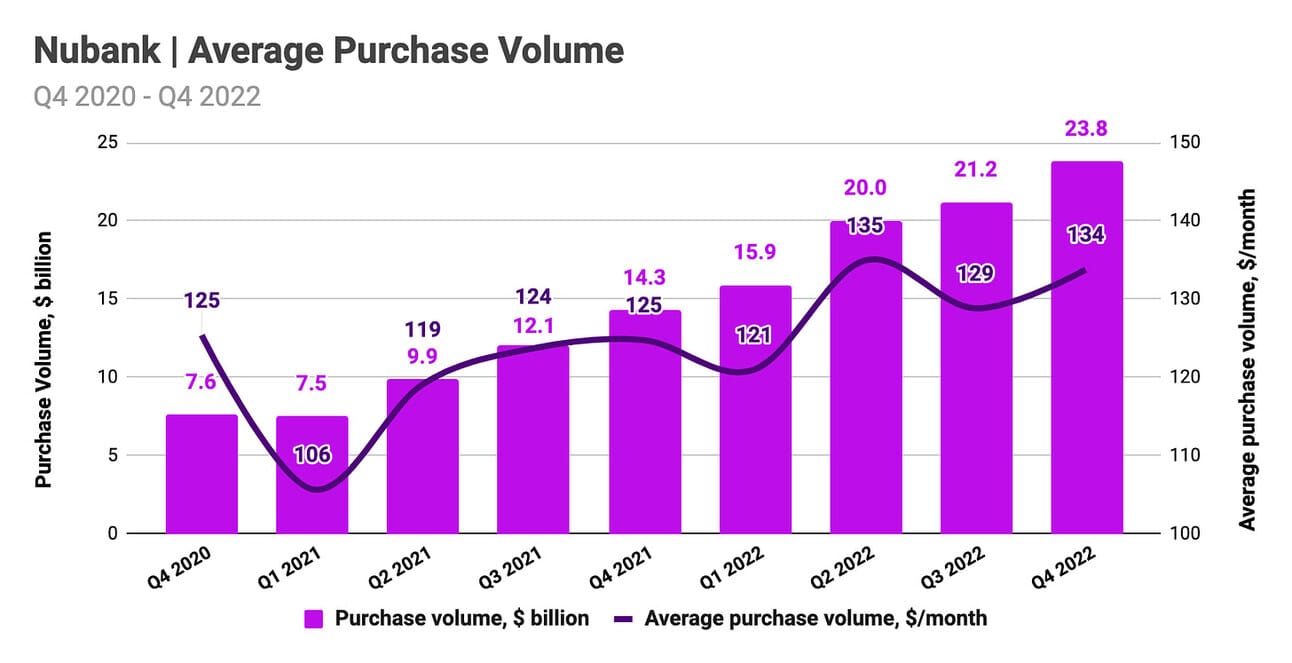

A regulatory cap on the interchange fees for prepaid cards (0.70%) will come into force on April 1, 2023, which should compress the average take rate (prepaid cards contribute 36% of the total purchase volume). However, I would expect it to be at least partially offset by the increase in average purchase volume by active customers. Thus, the average purchase volume by an active Nubank customer continued to increase in 2022 rising from $125 per active customer per month in Q4 2021 to $134 per active customer per month. In its earning call presentation, Nubank illustrated that the average purchase volume in earlier customer cohorts (2017 - 2018) is already surpassing $300 per client per month.

I would expect purchase volume in Q1 2023 to be lower than in Q4 2022 due to seasonality (that will be partially offset by the larger customer base in the period), which would translate into a Net Commission Income of $290 - 300 million for the quarter. I would expect the growth in 2023 to be in line with the growth in active customers (with take rate compression being offset by the increasing average spend by an active customer). Nubank acquired 20 million new customers in both, 2021 and 2022. Let’s assume this will continue in 2023 (and let’s assume the active rate remains at the current 82%). Thus, the number of active customers will increase to 78 million, or a 27% increase compared to 2022.

Operating Expenses

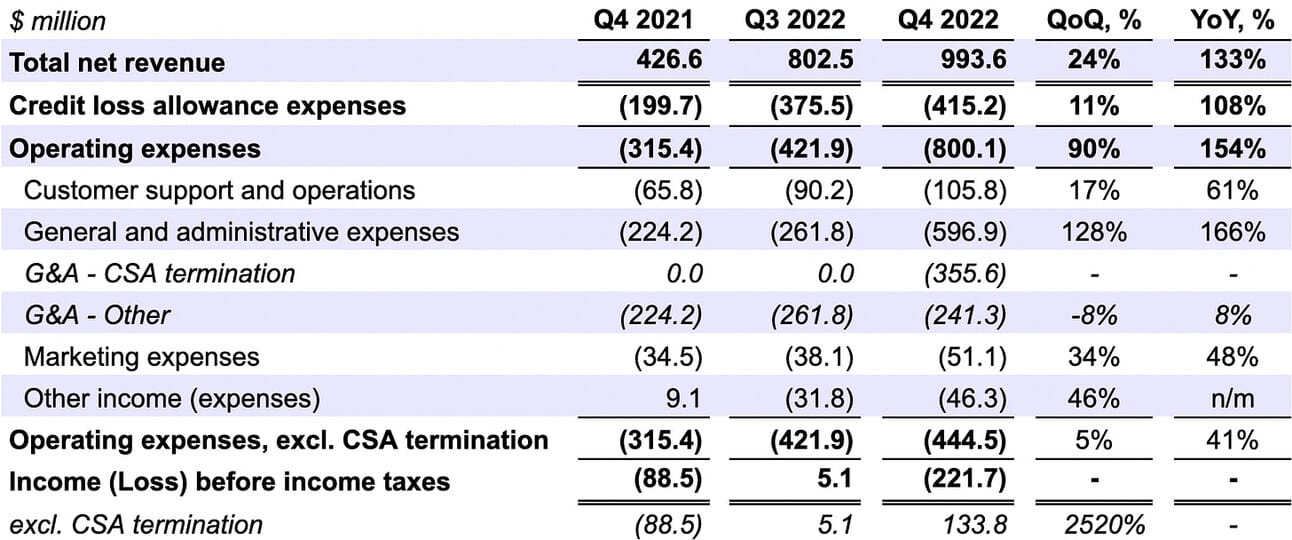

Nubank reported $415.2 million in Credit loss allowance expenses and $800.1 million in Operating expenses for the quarter, which lead to a Loss before income taxes of $221.7 million. The operating expense figure includes the impact of the stock reward termination of $355.6 million (CSA termination in the table below), which is a non-cash charge related to the company’s founder and CEO, David Vélez, giving away his stock compensation package. Excluding CSA termination, total operating expenses were $444.5 million, resulting in an Income before income taxes of $133.8 million.

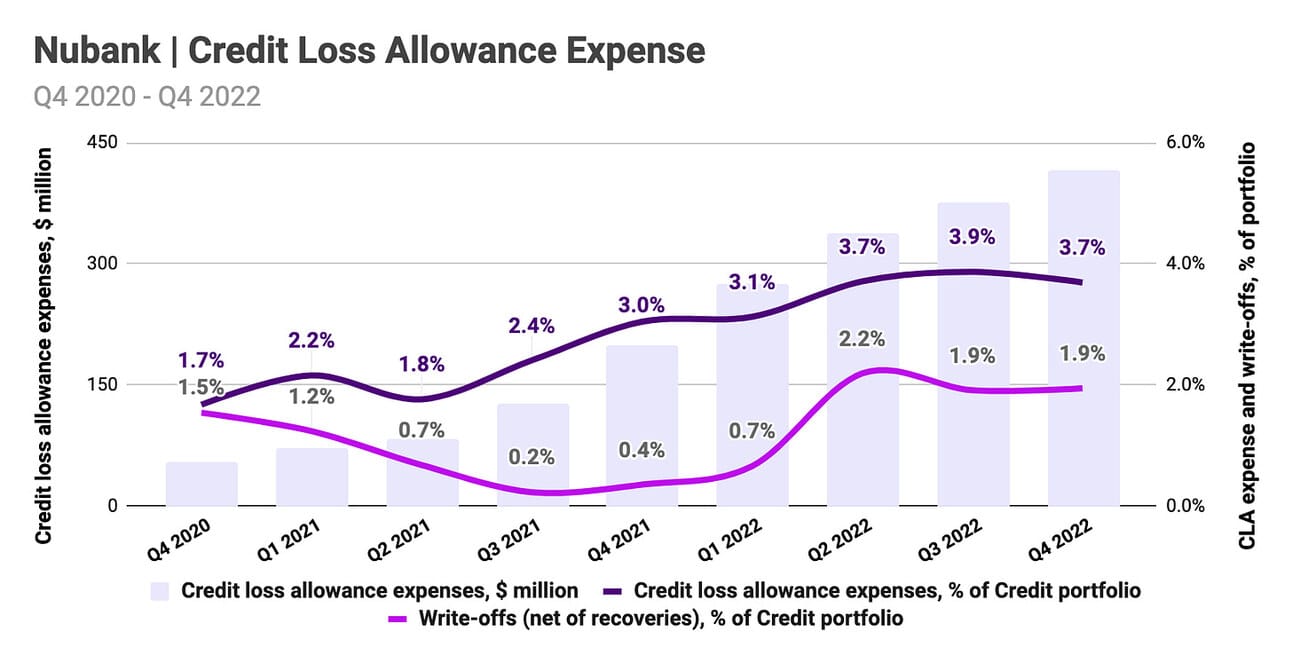

Credit loss allowance expenses increased 107.9% compared to Q4 2021, and 10.6% compared to Q3 2022. Relative to the size of the loan portfolio (gross of ECL provisions), credit loss allowance expenses declined from 3.9% in Q3 2022 to 3.7% in Q4 2022, following a constant increase during 2021 - 2022. Credit loss allowance expenses are calculated based on the expected losses (in both, new originations and the existing portfolio, in case the expectations change). Thus, I believe the decline in the 15-90 day delinquency rates (discussed above), allowed the company’s management to provision less.1 As discussed above, the improvement in delinquency rates in Q4 2022 was a seasonality effect; thus, I would not make a conclusion yet, that we will see a further decline in credit allowance expenses.

Operating expenses (excluding CSA termination) increased 40.9% compared to Q4 2021, and 5.4% compared to Q3 2022. The efficiency ratio (operating expenses divided by net revenue) improved further to 44.7%, compared to 73.9% in Q4 2021, and 52.6% in Q3 2021. As can be seen from the table above, G&A expenses (excluding CSA termination) increased 7.6% compared to a year ago (less than inflation) and declined 7.8% sequentially. Thus, the growth in expenses came from customer support and operations expenses (60.9% YoY and 17.3% QoQ) and marketing (48% YoY and 34.1% QoQ). Other expenses include federal taxes on financial income, taxes related to transfer pricing, and exchange rate variation.

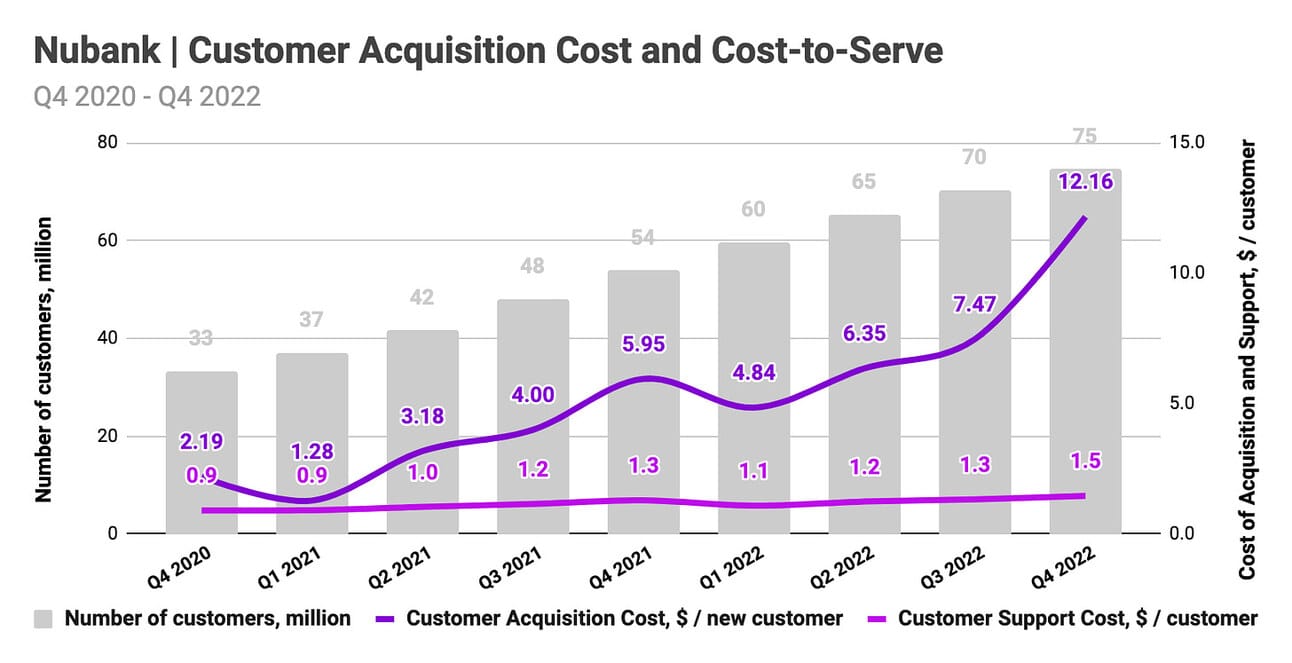

The increase in customer support and operations expenses was primarily driven by the growth in the number of customers (38% YoY), as well as a minor increase in the average cost-to-serve (from $1.29 to $1.46 per quarter)2. However, the increase in marketing expenses seems to be more problematic. Thus, as can be seen from the chart below, the average cost per new customer skyrocketed to $12.16 in Q4 2022, compared to $5.95 in Q4 2021 and $7.47 in Q3 2022. This suggests that the gross is becoming less “organic”, and the company has to spend more to fuel customer growth. At this rate, it will cost Nubank $243 million to acquire the 20 million new customers discussed above, compared to the $153 million it spent on marketing to acquire 20.7 million customers in 2022.

In summary, I believe that credit loss allowance and marketing expenses can provide unpleasant surprises, so this is something to closely monitor. As I argued above, improvements in delinquency rates might be short-lived, and customer acquisition is becoming more expensive. I would expect total operating expenses in Q1 2023 to remain flat compared to Q4 2022 at around $440 - 450 million with a decrease in G&A expenses compensating for increasing support and marketing expenses. Credit loss allowance expenses should increase in Q1 2023 even if we assume similar provision rates due to a larger loan portfolio. I believe assuming $450 - 470 million in credit loss allowance in Q1 2023 would be a safe bet. This would lead to an Income before income taxes of $200 - 210 million.

Net Income

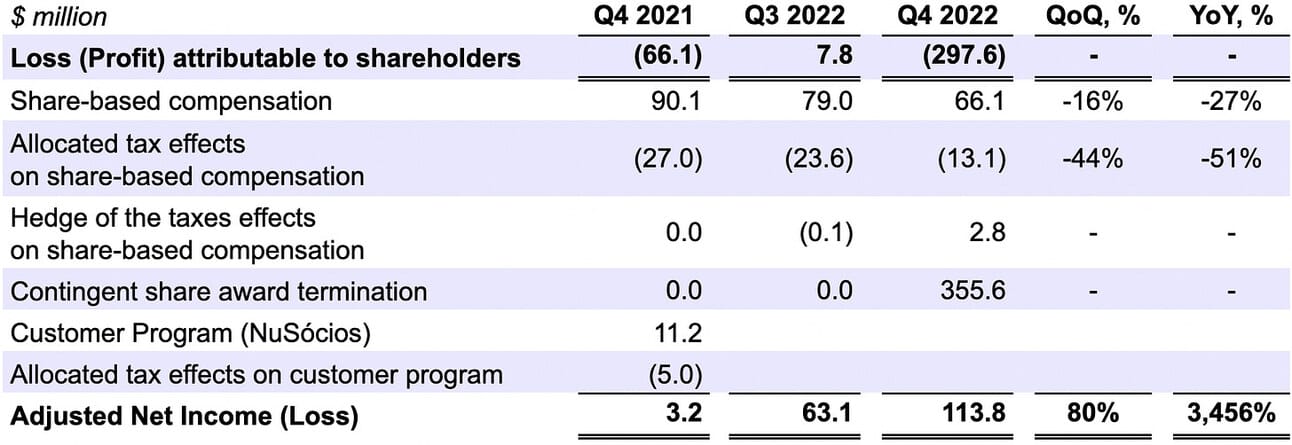

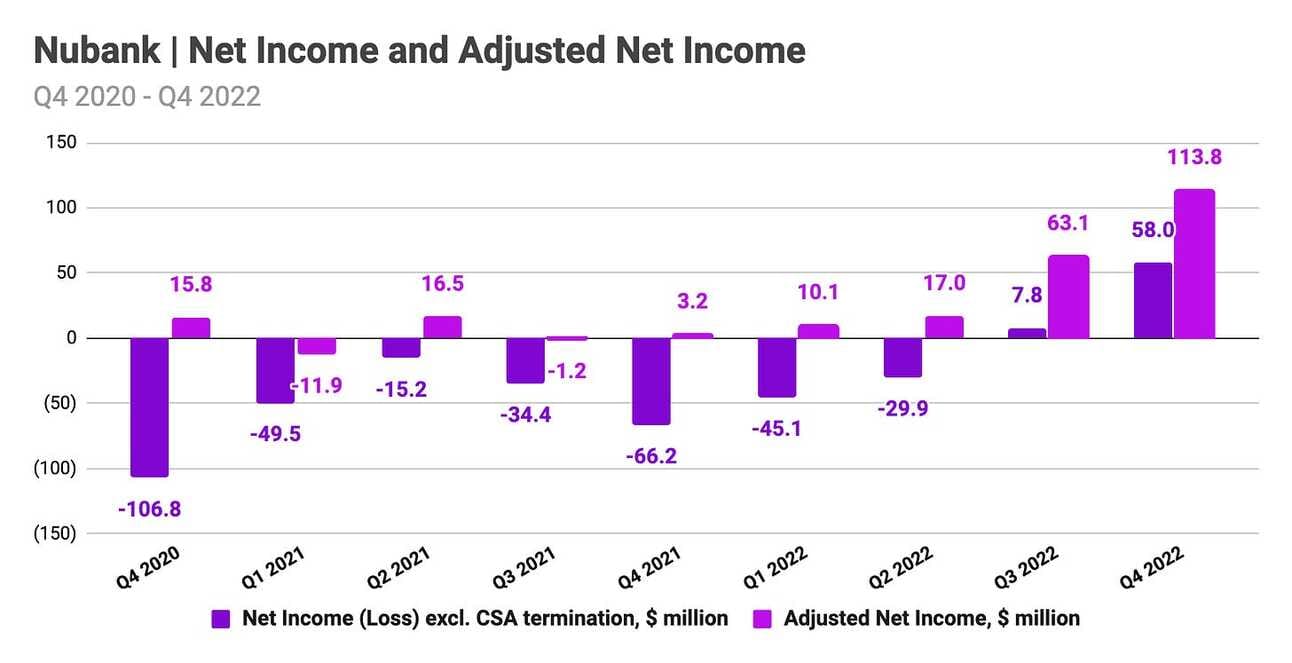

Nubank reported a Loss of $297.6 million in Q4 2022, compared to a loss of $66.1 million in Q4 2021. Excluding the costs associated with stock reward compensation termination, the company reported an Income of $58.0 million. On an adjusted basis, the company reported an Adjusted Net Income of $113.8 million for the quarter, compared to an Adjusted Net Income of $3.2 million in Q4 2021. Main adjustments include the above-mentioned stock reward termination, as well as share-based compensation and related taxes. This was the second consecutive quarter of non-adjusted profitability for the company.

Unless something goes terribly wrong, I would expect Nubank to remain profitable on both an adjusted and non-adjusted basis. As I argued above, the company just needs to continue doing what it is already doing to continue increasing profitability (grow customer base, get deposits, lend profitably). However, what is not clear at this point is whether the company’s management will choose the path of consistently increasing earnings, or decide to reinvest aggressively into future growth (i.e. enter new markets, expand the product offering, acquire competitors, etc.). Perhaps, Nubank will be able to deliver on both, profitability and long-term growth, and this makes it a very exciting company to follow!

Things to Watch in 2023

NPL ratios / Loan originations. Nubank delivered a positive surprise in this quarter reporting a declining 15-90 NPL rate. A combination of declining rates, and, more importantly, Net Interest Margin expansion gave the company’s management confidence to return to the growth mode in its lending business. The growth in Q4 2022 was limited to credit cards, but the company plans to start scaling its personal loans business already in Q1 2023. I see unexpected deterioration in lending as the key risk for the company at the moment (it will negatively impact origination volumes and credit loss allowance expenses).

Net Interest Margin. Nubank’s management has navigated the cycle of rising interest rates with excellence, but there is still potential to improve the Net Interest Margin. Thus, the company continues to lower its funding costs (offering customers higher flexibility on deposits in exchange for lower rates), and it continues to increase the return on its assets by converting a larger share of collected deposits to loans (instead of investing in low-yielding government bonds). As I illustrated above, even a marginal increase in NIM can drive a meaningful increase in the company’s net revenue.

Take Rate / Purchase Volume. A new regulation, coming into force in April 2023, will put a cap on the interchange for prepaid cards. This is expected to be a headwind for Nubank’s commission income (prepaid cards generate a third of the total card transaction volume). However, this impact might be eventually offset by the increasing average spending by the company’s customers. Thus, the company’s mature customer cohorts (2017-2018) spend 2-3 times more than the average customer. As the customer base matures, average spending is expected to increase. We will see the eventual outcome in Q2 or Q3 2023.

Growth outside of Brazil. Nubank continues to acquire customers at scale in Brazil despite an already high penetration rate (44% of the adult population). However, at some point the company will exhaust its growth potential in the country; and thus, will have to find growth in Mexico and Colombia. Nubank acquired over 20 million customers in both 2021 and 2022 (primarily in Brazil). Can the company book a similar year in 2023? I believe this will require meaningful growth in both Mexico and Colombia.

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.