Hey!

When we were working on “The State of Fintech 2025” with Simon, we kept coming back to the question: who’s going to become the Nubank of the U.S.? One of the frontrunners, Chime, went public in June.

Chime is one of America’s largest neobanks, serving over 8 million customers, most of whom earn up to $100,000 a year and are often overlooked by traditional banks. It offers checking and savings accounts, overdraft protection, a credit-builder card, cash advances, and more, all through a mobile-only platform.

The company just reported its first quarter as a public company. It was a strong set of results, but the stock dropped sharply and is now trading close to its IPO price. In other words, we didn’t miss much, but we now have a clearer view of what’s ahead.

I’m working on a longer write-up on Chime, but in the meantime, here’s an intro to this fascinating company! Enjoy!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Chime is one of America’s largest neobanks, serving people who earn up to $100,000 a year, a group often overlooked by traditional banks. What started as a mobile-first checking account has grown into a financial services hub for millions of Americans who want banking that feels more like an app than a branch.

Image source: Chime

“We created Chime to help everyday people, starting with those earning up to $100,000 a year, who've been overlooked by traditional banks, not the unbanked, but the unhappily banked. Today, we're already the primary financial partner for millions, but our ambition is much bolder, to become the largest provider of primary account relationships in the U.S.”

Chime now offers checking and savings accounts, overdraft protection, a credit-builder card, cash advances, and more, all through a slick mobile app. With no branches and legacy systems to maintain, it can deliver these services at a fraction of the cost of a traditional bank, a key premise behind the digital banking model.

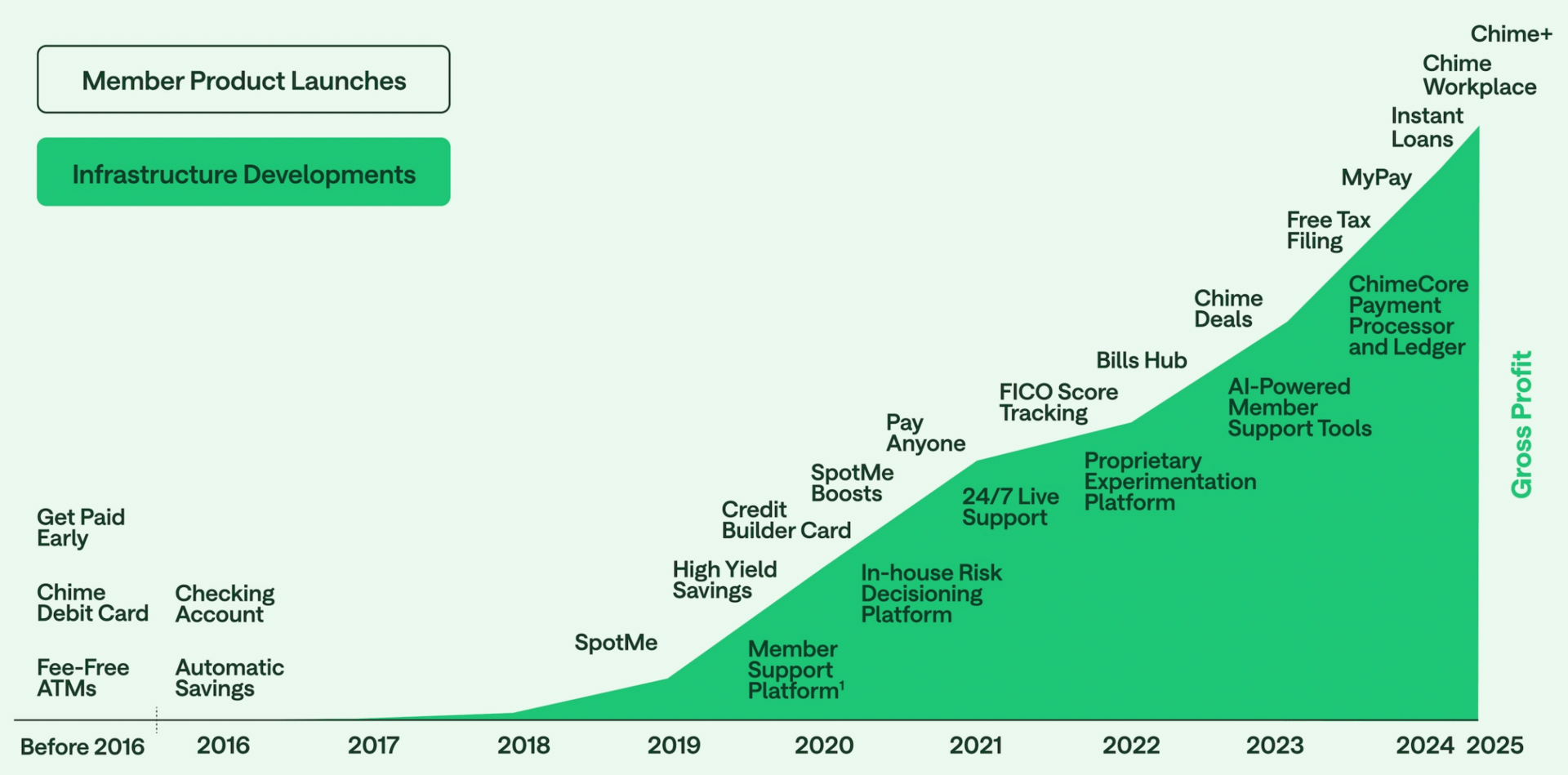

Image source: Chime, Form S-1

“We've earned the trust of our members and will support them in all areas of their financial lives across spending, saving, building credit, borrowing, investing and more. With our modern tech stack and radical cost-to-serve advantage, we can deliver innovative, personalized experiences to address each of these needs for free or low cost.”

The company went public in June at $27 per share, valuing it at $11.6 billion. The stock briefly hit $40, but reality set in, and now it’s hovering just above its IPO price. If you missed the IPO hype, you didn’t miss much, except a few roller-coaster weeks.

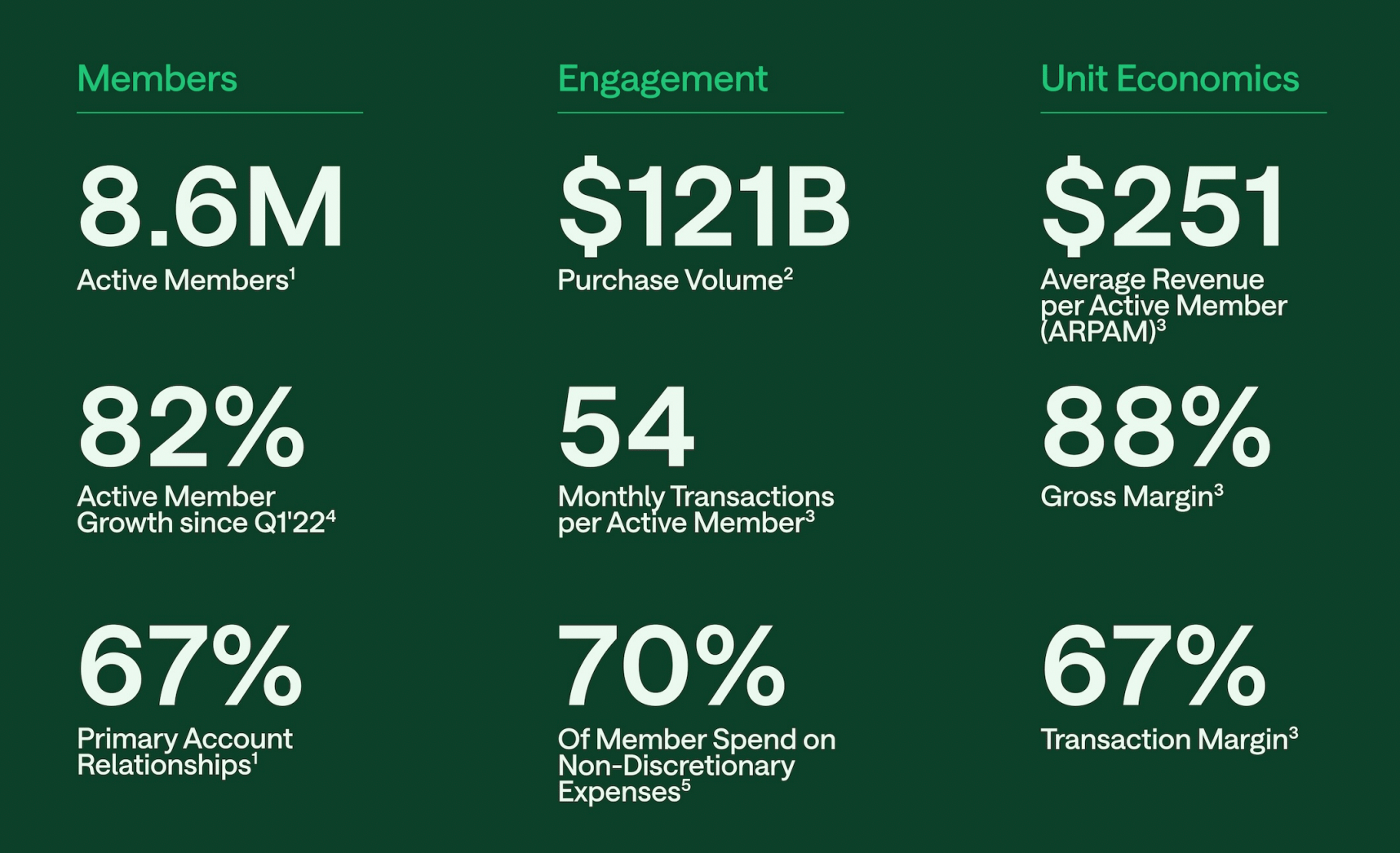

Image source: Chime, Form S-1

“Despite our scale, with less than 5% penetration, we're barely scratching the surface of the opportunity to serve nearly 200 million everyday Americans earning up to $100,000.”

Chime now serves more than 8 million people, and generated $1.6 billion in revenue in 2024 (up 31% YoY) and $1.46 billion in gross profit (up 38%), while reporting negative adjusted EBITDA and a net loss. The company is at a magical moment where it is about to hit profitability, on an adjusted basis, for now.

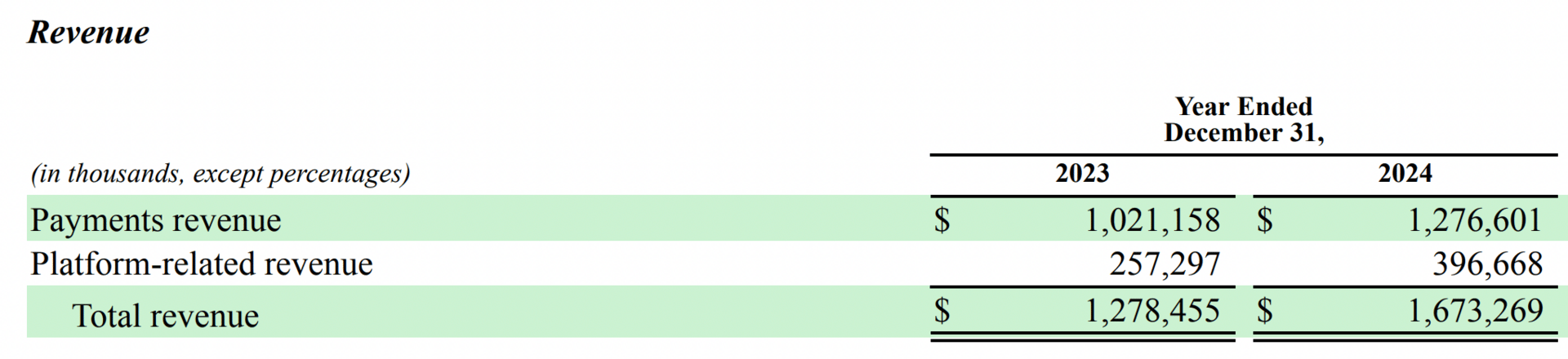

Image source: Chime, Form S-1

“We believe we have an $86 billion annual revenue opportunity with our current products alone, and we have penetrated less than 3% of this opportunity today. We believe that our opportunity can grow to $426 billion as we continue to expand our platform, allowing us to meet more needs of our current members, and serve a wider audience of Americans.”

Investors should be watching three metrics closely: active users, average revenue per user, and transaction margin (gross profit after credit and transaction losses). For now, the company is improving profitability and targets a 35% adjusted EBITDA margin in the steady state, though there is still a long road ahead to get there.

Image source: Chime, Form S-1

“Our early progress has been fueled by four distinct competitive advantages: our low cost structure, our track record of product innovation, our primary account relationships, and our beloved brand.”

Chime is not a bank and earns most of its revenue from interchange fees (reported under “Payments revenue”). Its reliance on interchange, and the Durbin exemption that lets it earn higher rates, is a common criticism of the company’s business model.

The company is starting to diversify with credit products (reported under “Platform-related revenue”), such as the MyPay cash advance, but these are still in the early stages. Investors may also question how scalable lending can be, given Chime’s focus on a lower-income customer segment.

Image source: Chime, Form S-1

“We primarily generate revenue when members spend using a Chime-branded debit or credit card, based on fees paid via the card networks, rather than fees paid to us by our members. Recurring paycheck deposits also provide us with an advantage to offer our members access to valuable, short-term credit and liquidity products.”

Chime aims to become the primary financial partner for its customers, a role traditionally played by banks. This strategic focus on being the main account is Chime’s key differentiator from other neobanks and wallets, such as Venmo, which are often used for payments, but not as a customer’s primary banking relationship.

In banking, Chime competes with giants like Chase, Bank of America, and Wells Fargo, each serving tens of millions of retail customers. However, it’s arguably better positioned against community banks, which lack the scale and resources to invest heavily in modernizing their digital infrastructure.

Data source: JPMorgan, Bank of America, Wells Fargo, and Citigroup

“We're now a clear leader with unaided brand awareness of 40%, rivaling the 2 largest traditional banks in the U.S. and the go-to brand for the most critical financial needs of everyday Americans.”

However, Chime also faces competition from scaled Fintech rivals that have the same ambition. Cash App, for example, has 57 million monthly active users and is increasingly becoming the “primary financial relationship” for its customers. On its latest earnings call, Cash App reported 11 million “banking actives”, users spending at least $200 a month or making 15 or more transactions, compared to Chime’s 5.8 million.

“…if we count anyone who deposits $200+ in paychecks or transacts 15+ times a month, we’d have ended June with 11 million banking actives, adding over 1 million actives in the past year.”

Having more primary banking relationships means Chime can earn more from each customer, without carrying millions of low-value active users. With 67% of its users in this category versus just 20% for Cash App, Chime generates substantially higher revenue per customer. In Q2 2025, Chime’s average annualized revenue per user reached $245, more than double Cash App’s $119.

Data source: Block, Chime

It’s important to highlight that Chime focuses solely on banking, while Block splits its attention between Cash App and other businesses like Square and Proto. Venmo, meanwhile, is just one of many businesses under PayPal’s umbrella. Even SoFi, one of Chime’s closest fintech competitors, has its tech arm, Galileo and Technisys, to focus on alongside its consumer offerings.

In its first earnings report as a public company, Chime posted strong results: members grew 23% YoY, ARPAM rose 12% YoY, and credit losses on its newest product, MyPay, declined, boosting the transaction margin. As a result, revenue increased 37% YoY, transaction profit grew 21% YoY, and the adjusted EBITDA margin reached 3%.

Image source: Chime, Q2 2025 earnings presentation

“Our Q2 financial performance was strong across the board. Payments revenue was $366 million, up 19% YoY. Platform revenue totaled $162 million, up 113% YoY, as we continued to see very strong MyPay performance. Transaction profit, which is gross profit less transaction and risk loss, was $363 million, yielding a 69% transaction margin, driven in part by faster-than-planned progress on MyPay loss rates.”

Guidance for 2025 points to 28-29% revenue growth and $84-94 million in adjusted EBITDA, which would make this Chime’s first profitable year on an adjusted basis.

Image source: Chime, Q2 2025 earnings presentation

“For fiscal year 2025, we expect revenue between $2.135 billion and $2.155 billion, resulting in year-over-year revenue growth between 28% and 29%, and adjusted EBITDA between $84 million and $94 million, an adjusted EBITDA margin of 4%.”

Still, the market wasn’t exactly blown away. Shares dropped nearly 15% after the earnings release, even with the upbeat guidance. Chime is still above its IPO price, and now investors have something they didn’t have in June: a clearer picture of the road ahead.

Image source: Koyfin

Wall Street analysts now see revenue surpassing $3 billion by 2027, with adjusted EBITDA hitting $441 million and the first GAAP-profitable year arriving that same year. In other words, the long-promised profits might finally show up, if growth keeps compounding.

Data source: Chime, Koyfin

There will likely be years of debate over how to value Chime. With no GAAP profitability, there’s no P/E ratio to anchor on, and traditional price-to-book multiples used for banks don’t quite fit, as Chime isn’t a bank in the regulatory or balance sheet sense.

Data source: Chime, Koyfin

“We think that on a more steady state basis, our adjusted EBITDA margin should approach 35% over time.”

So what’s the investment thesis?

✔️ Chime will continue taking market share from banks. Its low-cost structure and lighter regulatory oversight make it hard for banks to do anything about it.

✔️ Unlike other Fintech companies, Chime focuses only on consumer banking. Block has Square, and PayPal has merchant acquiring, which also need investments and management attention.

✔️ Over time, Chime will diversify its revenue streams away from interchange, most likely by expanding into lending products like cash advances, BNPL, and credit cards.

Chime is arguably the cleanest bet on the neobanking thesis in the U.S., mirroring how the model has played out in other markets like Brazil with Nubank. It combines rapid customer growth, a mobile-only cost structure, and a focus on becoming the primary account, the same ingredients that have driven neobank success abroad.

So will Chime become the Nubank of the U.S.?

Cover image source: Chime

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.