Hi!

Hope you had a fantastic weekend! Before we start a new week, let's take a look back at what happened last week:

Nasdaq agreed to acquire a financial software firm Adenza,

SoFi stock received three downgrades in a single week, and

Robinhood reported operating results for May (those were good!).

As always, thank you for reading!

Jevgenijs

p.s. I will be posting less frequently during the summer. Summers are short where I live, need to enjoy them while they last

Nasdaq to Acquire a Financial Software Firm Adenza

Nasdaq (NASDAQ: NDAQ), a US corporation that owns and operates three stock exchanges in the United States, including the Nasdaq stock exchange, as well as seven stock exchanges in Europe, has agreed to acquire a financial software firm Adenza in a $10.5 billion cash-and-stock deal, the Wall Street Journal reported on Monday. This represents the largest acquisition in Nasdaq's history and is part of CEO Adena Friedman's efforts to transform the company into a more tech-centric organization. The seller in the transaction, private-equity firm Thoma Bravo, will receive 14.9% of Nasdaq's outstanding shares, which will make it one of the largest shareholders of Nasdaq.

Image source: Adenza

Adenza provides software for banks and brokerages to manage trading, risk management, post-trade processing, and regulatory reporting. According to the press release, in 2023, Adenza is expected to deliver approximately $590 million in revenue with an adjusted EBITDA margin of 58%. The company boasts a 115% net revenue retention rate, and a “durable mix of approximately 80% recurring revenue.” The deal will allow Nasdaq to expand its offerings and serve a broader array of banks. While investors have generally supported Nasdaq's diversification efforts, the market reacted negatively to the high price tag, with Nasdaq's shares dropping 11%. The transaction is expected to close in six to nine months, subject to regulatory approval.

✔️ Nasdaq to Acquire Financial-Software Firm Adenza for $10.5 Billion

✔️ Nasdaq accelerates its transformation as a leading technology provider to the global financial system with the acquisition of Adenza

✔️ Nasdaq CEO Adena Friedman Pursues a Black Belt in Deal Making

✔️ Forget What You Think You Know About Exchange Stocks

SoFi Receives Three Downgrades in a Week

SoFi (NASDAQ: SOFI) rallied on Monday after receiving a price target increase from Truist analysts, who believe the company has significant growth potential. Truist Securities analysts increased their price target on SoFi's shares from $8 to $11, as well as maintained a Buy rating, per Barron’s. The stock climbed 11.98% in Monday trading. Truist analysts believe that SoFi's efforts to educate investors about its strategy, use of fair value accounting, and quality of loan portfolio are paying off, and they see the stock's performance as a sign of growing appreciation for its opportunities. Truist analysts are also confident that SoFi will achieve its GAAP profitability target in the fourth quarter of this year.

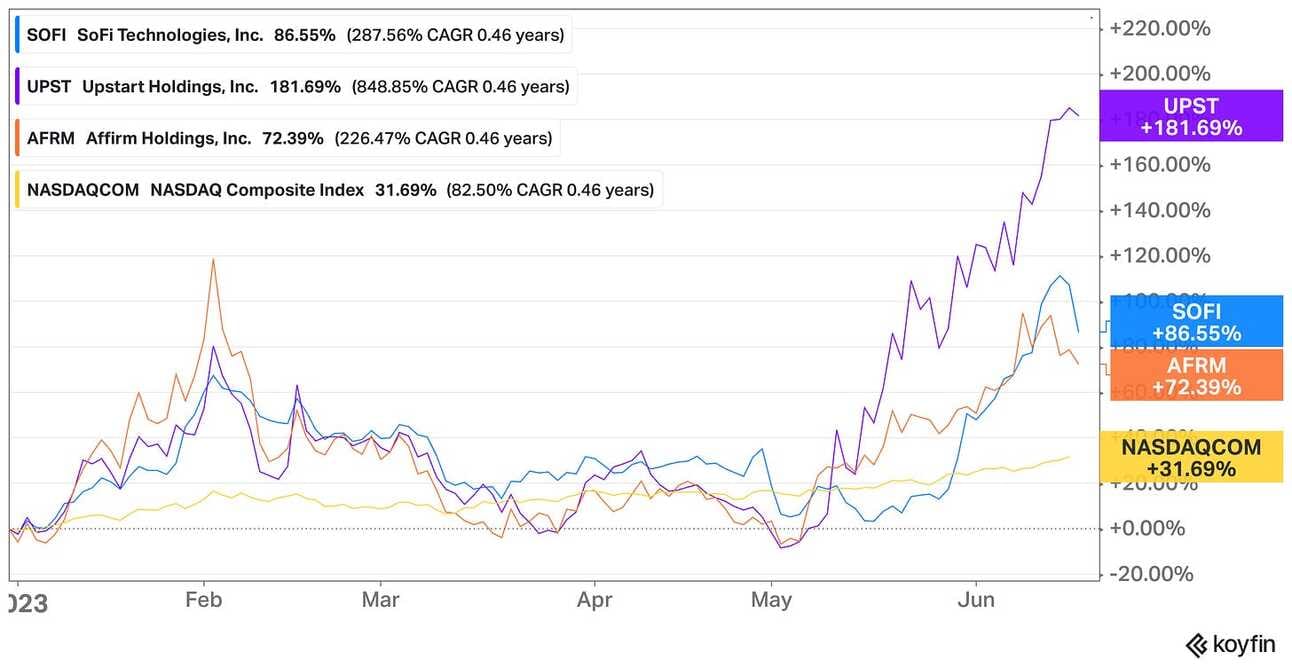

However, in the second half of the week, analysts from Piper Sandler, Oppenheimer and BofA downgraded the stock citing the recent price rally that to led to an extended valuation. At the same time, the analysts reiterated strong long-term potential of the company. “We continue to believe SOFI will be a long-term winner with the company generating outsized growth within a valuable customer cohort,” commented Piper Sandler analyst Kevin Barker, according to Bloomberg. The stock declined on Thursday and Friday, while still advancing 5.13% during the week. SoFI stock is now up 86.55% since the beginning of the year.

✔️ SoFi Is Just Getting Going. The Stock Is Rising.

✔️ SoFi stock drops on analyst downgrades, student loan payment concerns

✔️ SoFi Falls as Trio of Bullish Analysts Retreat After Rally

✔️ SoFi Technologies, Inc. Reports First Quarter 2023 Results

Robinhood Reports Operating Results for May

Robinhood (NASDAQ: HOOD) released its operating data for May, 2023. Compared to April, trading volumes in May were higher for equities and options and lower for cryptocurrencies. Equity trading volumes increased 27% MoM to $49.4 billion, volume of traded options contracts increased 29% MoM to 97.5 million, and Crypto trading volumes declined 43% to $2.1 billion. Assets Under Custody increased 6% from April to $81.8 billion, while the Net Cumulative Funded Accounts were almost unchanged at 23.1 million. The company’s clients added $1.6 billion in net deposits, bringing the total net deposits over the last twelve months to $16.5 billion .

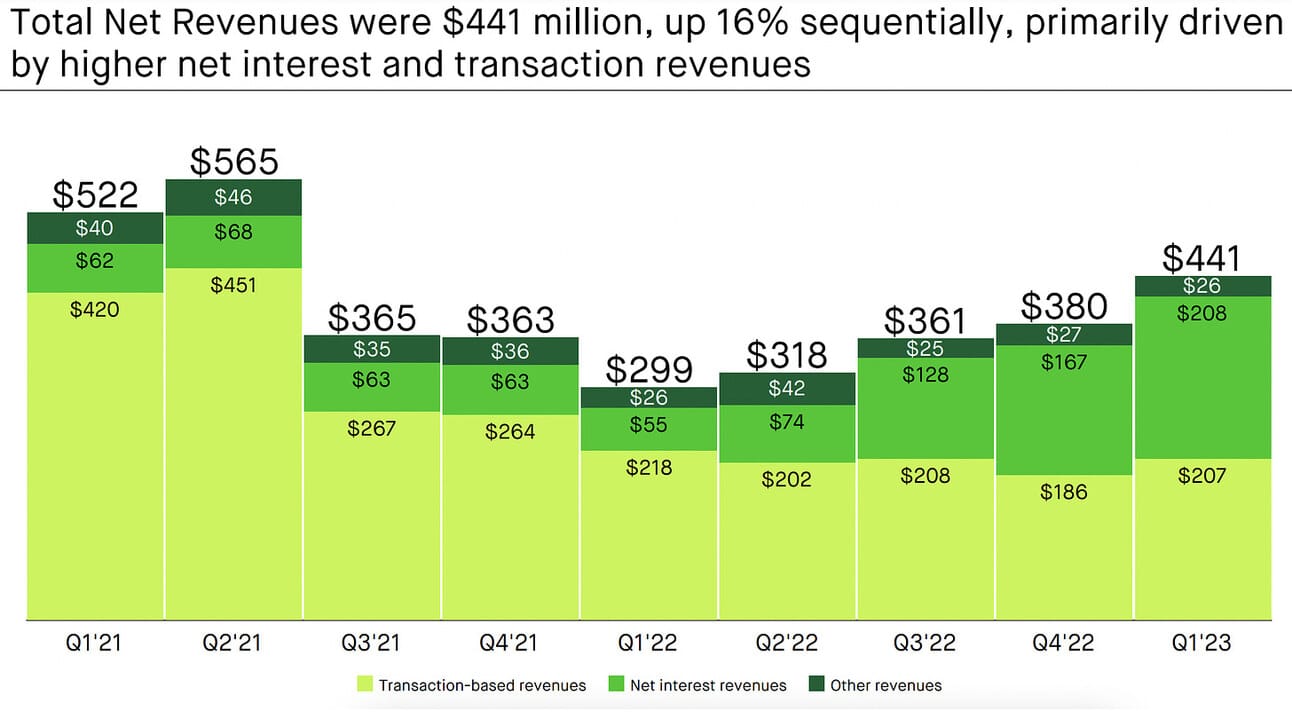

Robinhood’s revenue sources changed considerably since the meme stock trading days. Thus, in the first quarter of 2023, net interest income surpassed transaction-based revenues driven by higher interest rates and increasing balances of uninvested cash. Transaction-based revenue, nowadays driven primarily by option contracts and equity trading, has been stable over the last few quarters. Hence, seeing sequential growth in the equity and option trading volumes, suggests that the company will deliver a strong second quarter. Analysts estimate Robinhood to post $472 million in revenue in the second quarter quarter (+48% YoY), and $1.85 billion for the full year of 2023 (+36% YoY).

✔️ Robinhood Markets, Inc. Reports May 2023 Operating Data

✔️ Here’s why retail traders are moving away from Coinbase and into Robinhood

✔️ Coinbase Is Losing Crypto Market Share to Robinhood, Analyst Says

✔️ Coinbase’s Problems May Be Aiding Robinhood

This week, SoFi (NASDAQ: SOFI) briefly overtook Ally Financial (NYSE: ALLY) in terms of the market cap. For comparison, Ally Financial had $196 billion in assets, and reported $319 million in Net Income in the first quarter of 2023, while SoFi had $22.5 billion in total assets and reported a Net Loss of $34 million.

Interestingly, this was not the first time, when investors valued SoFi higher then Ally Financial. This happened before in November, 2021, when SoFi stock traded above $22 a share (the stock closed at $8.60 on Friday).

Strategic Planning Specialist, Office of the CEO

@ Nasdaq

🇺🇸 New York, NY, United StatesDirector, Product Marketing

@ Robinhood

🇺🇸 Menlo Park, CA or New York, NY, United StatesSenior Product Designer, Crypto

@ Robinhood

🇺🇸 Menlo Park, CA or New York, NY, United StatesDirector, Product Management - Member Programs

@ SoFi

🇺🇸 Multiple locations in the United StatesDirector, Product Management - Credit Card

@ SoFi

🇺🇸 Seattle, WA or San Francisco, CA, United States

Cover image source: Nasdaq

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.