Hey!

FIS is buying Global Payments’ issuing business for $13.5 billion, which will make it the second-largest issuer processor after Fiserv. Based on the deal’s valuation multiples, Fiserv’s issuing business should be worth around $20 billion on a stand-alone basis.

And that brings me to Marqeta, a modern issuer processor with a $2 billion market cap, nearly $1 billion in cash, and no debt. The company went through a challenging period in 2022–2024, but I think it’s back on track and has what it takes to go after giants like Fiserv and FIS.

Adyen and Stripe are catching up to the big merchant acquirers by outgrowing them. I think Marqeta can do the same in issuer processing.

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Last month (April 2025), FIS $FIS ( ▼ 3.52% ) and Global Payments $GPN ( ▼ 1.2% ) announced a historic deal: Global Payments will acquire Worldpay (which is jointly owned by FIS and the private equity firm GTCR), while FIS will take over Global Payments’ Issuer Solutions business. This deal will make FIS one of the largest issuer processors, and Global Payments one of the largest merchant acquirers globally.

Image source: Global Payments Invetor Day 2024

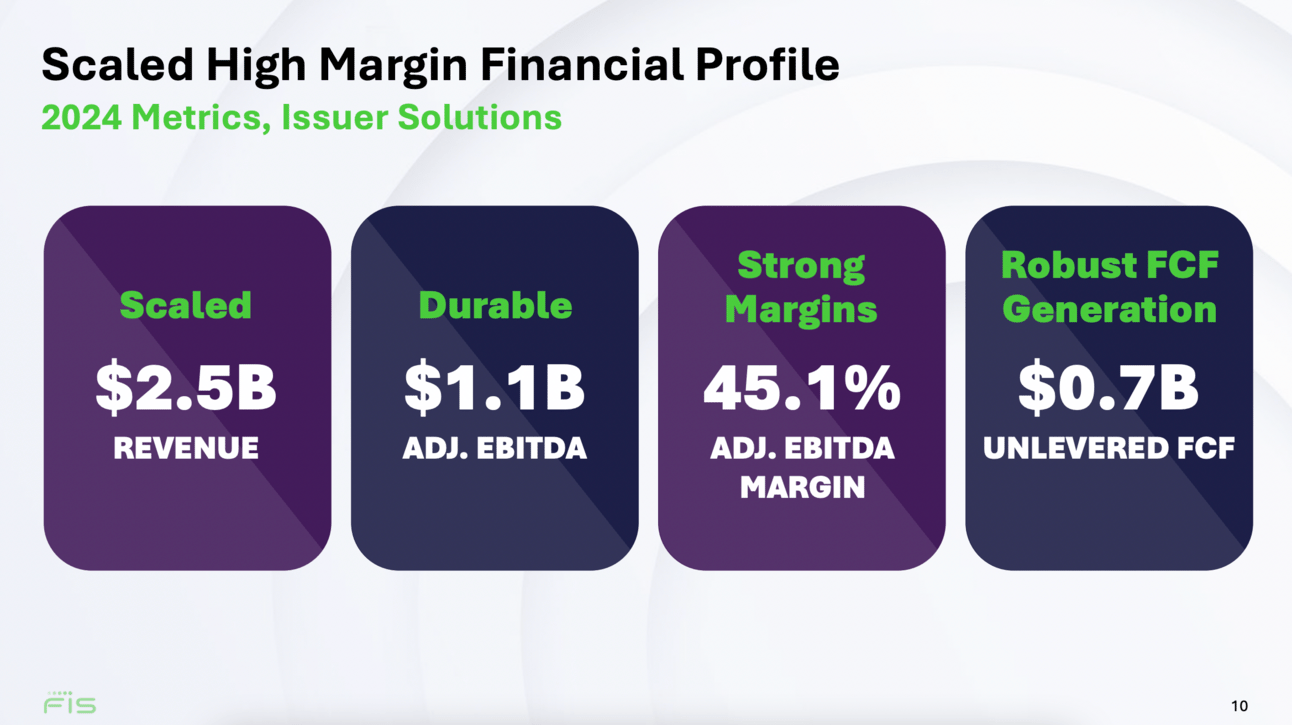

FIS agreed to pay $13.5 billion for Global Payments’ Issuer Solution business, which represents a roughly 12× 2024 EV/EBITDA multiple, and a 10× 2025 EV/EBITDA multiple based on FIS’s estimates of “synergized EBITDA” in 2025.

Image source: FIS

“FIS is selling our remaining Worldpay stakes to Global Payments, allowing us to monetize this asset at an attractive valuation. Second, FIS is acquiring the Issuer Solutions business, giving us access to a global credit processor, strengthening our payments offering and further enhancing our value proposition to financial institutions and corporates.”

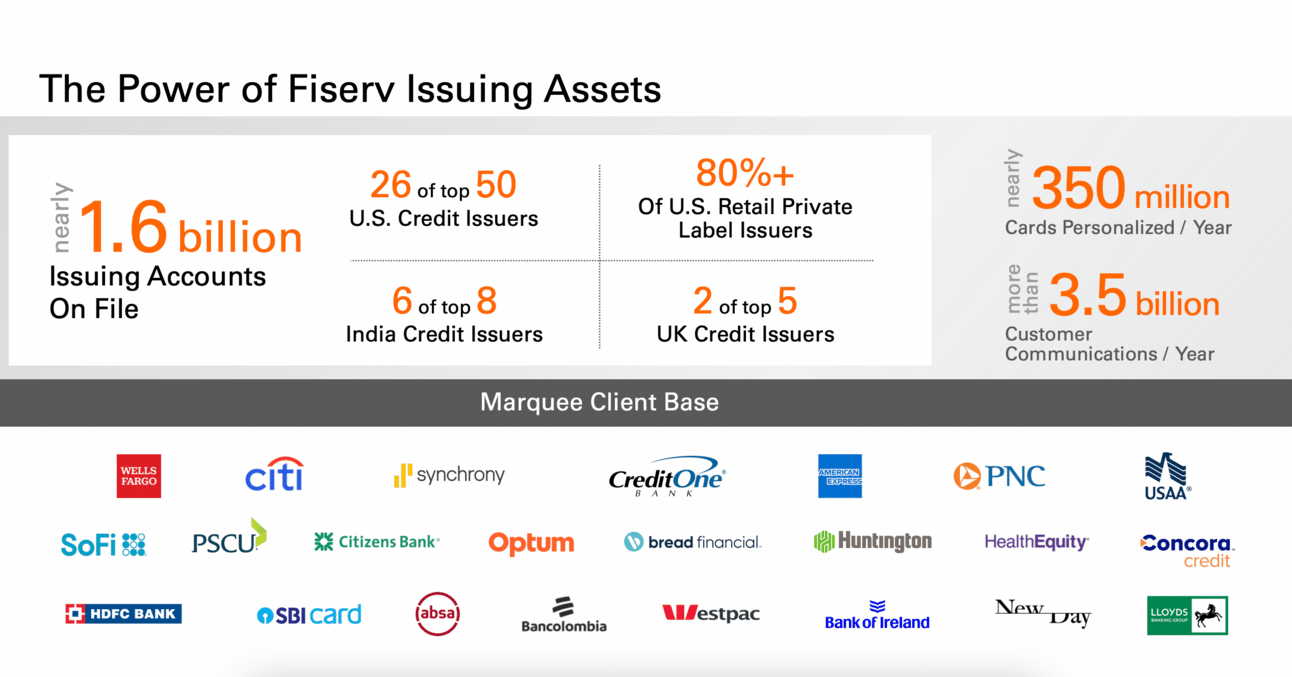

A week later, Fiserv held Q1 2025 earnings call, and the company’s execs didn’t miss the opportunity to remind everyone that Fiserv’s issuer processing business is “nearly twice as large” as its closest competitor. This “competitor” is Global Payments’ Issuer Solutions.

Image source: Fiserv 2023 Investor Day

“These early renewals and multiyear extensions are a testament to the strength of our relationships, offerings and product road map and the direct result of our prior and planned investments. With over 1.7 billion accounts on file, we are now nearly twice as large as our closest competitor.”

Fiserv’s issuer processing business is “nearly twice as large” as Global Payments’ Issuer Solutions business when it comes to the number of cards on file (1.7 billion for Fiserv vs. 0.89 billion for Global Payments). However, in terms of revenue, the difference is not so stark.

Thus, in 2024, Fiserv’s issuing business generated $3.1 billion in revenue (representing 3% YoY growth), while Global Payments’ issuing business generated $2.5 billion in GAAP and $2.1 billion in adjusted revenue (also representing 3% YoY growth).

Image source: Global Payments Q4 2024 earnings presentation

Image source: Fiserv Q4 2024 earnings presentation

Fiserv does not disclose EBITDA numbers for its issuing business, but we can use Price / Sales multiple (yes, I know this is lame, but what else can I do here?). So FIS is acquiring Global Payments’ issuing business at a 6.4x P/S multiple ( $13.5 billion / $2.1 billion). This would value Fiserv’s issuing business at $19.8 billion.

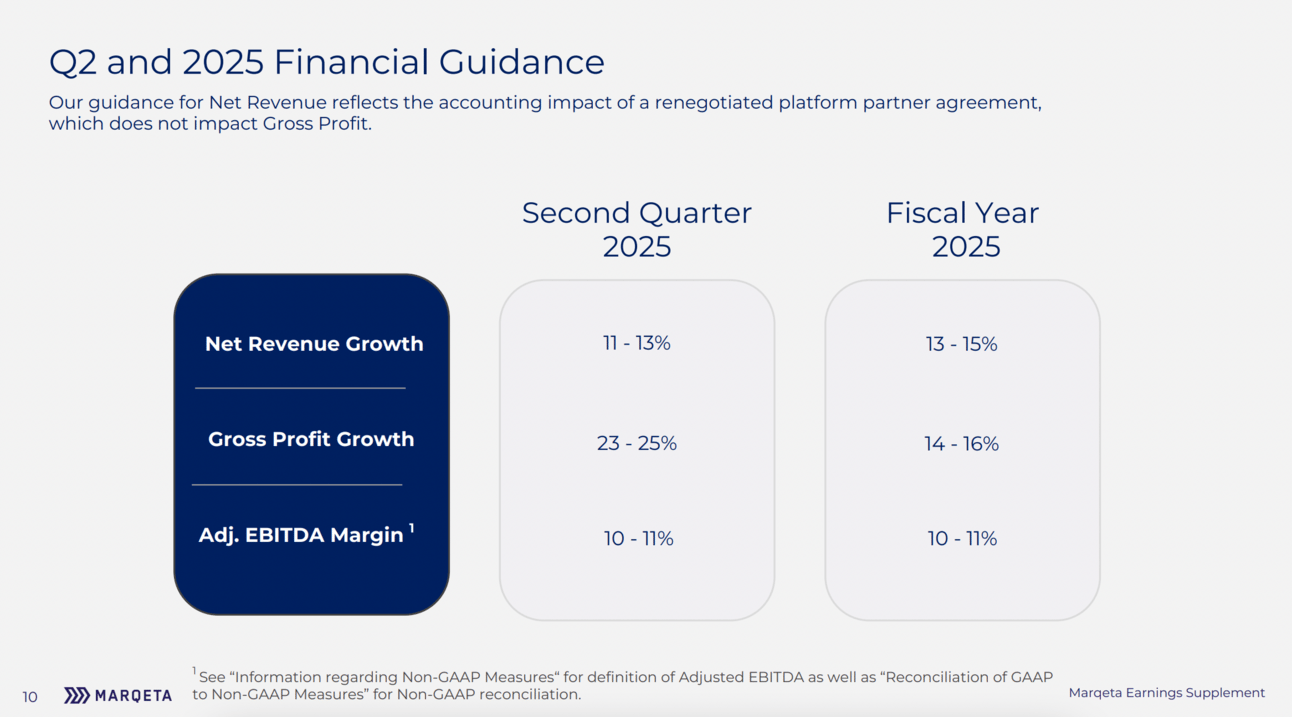

…and this brings me to Marqeta, which, as of this writing, has a market cap of $2.15 billion and an Enterprise Value of $1.17 billion (no debt and almost a billion in cash). In 2024, the company generated $0.5 billion in revenue and expects 13-15% revenue growth in 2025.

Marqeta $MQ ( ▼ 2.9% ) went through hell in 2022-2024, but I think the company is back on track and has all the prerequisites to challenge Fiserv and FIS in the issuer processing business. Adyen and Stripe are catching up to the largest merchant acquirers by growing faster than them, and I believe Marqeta will follow a similar path in issuer processing. Needless to say, I believe this should eventually translate into growth in Marqeta’s stock price (not financial advice, please read the disclaimer).

So let’s start with what Marqeta is. Marqeta is a modern card issuer processor. Every card payment has a seller (merchant) and a buyer (cardholder), and, respectively, a merchant processor and an issuer processor. An issuer processor handles the authorization, clearing, and settlement of card transactions on behalf of the cardholder's bank.

Image source: Marqeta 2023 Investor Day

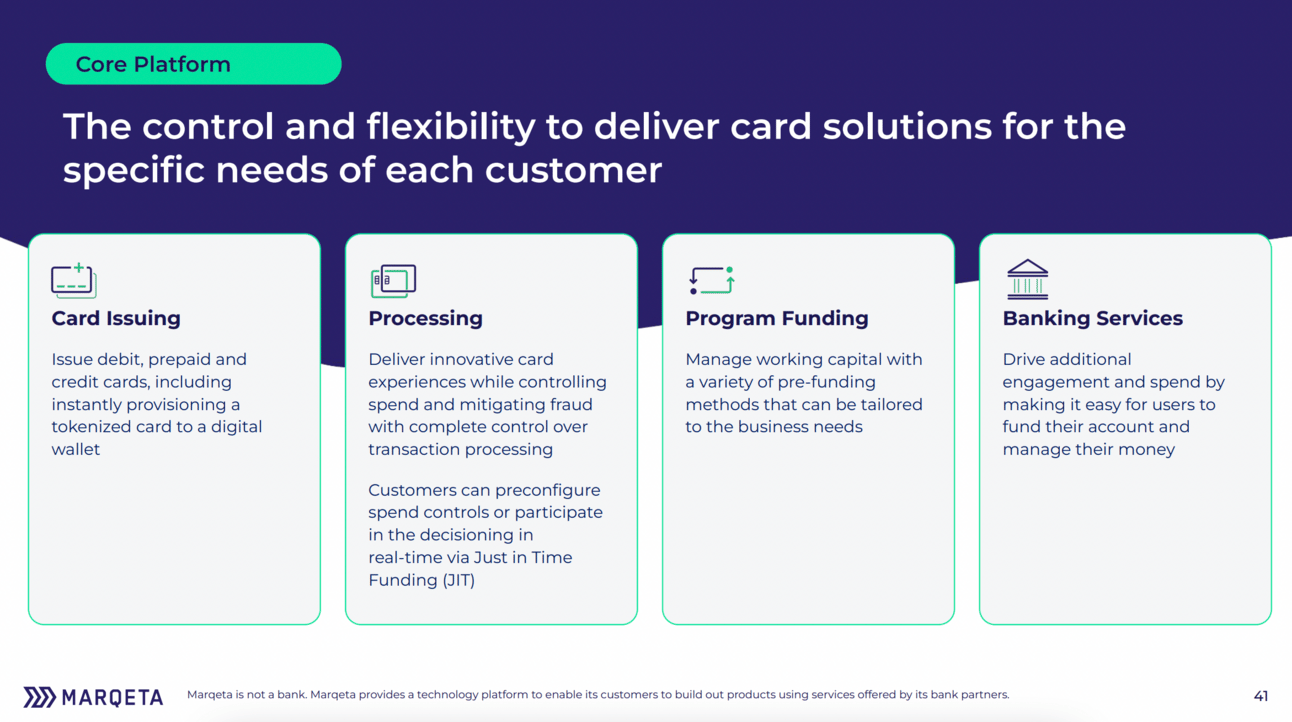

Marqeta's services have three key elements. The “core platform” processes transactions, handles clearing and settlement, stores card records, and maintains the credit card transaction ledgers.

Image source: Marqeta 2023 Investor Day

Similar to other issuer (and acquirer) processors, Marqeta offers several “value-added” services to its clients, including fraud prevention solutions, dispute handling, rewards engine, KYC and compliance tools, and others.

Image source: Marqeta 2023 Investor Day

Finally, Marqeta provides “program management”, which involves registering and certifying cards with the card schemes, selecting a partner bank, personalization and delivery of physical cards, handling compliance, and customer support.

Image source: Marqeta 2023 Investor Day

Marqeta has an impressive list of clients, which primarily includes Fintech and tech companies. The company serves Block’s Cash App, Square and Afterpay, Affirm, Klarna, Ramp, Coinbase, Uber, DoorDash, and many others.

Image source: Marqeta 2023 Investor Day

In contrast to Marqeta, the incumbent issuer processors, Fiserv and Global Payments, primarily serve banks, which are the largest issuers of both debit and credit cards. It’s hardly an exaggeration to say that most large banks either process cards in-house (like JPMorgan Chase) or rely on one of these two processors.

Image source: The Nilson Report

The situation in Europe isn’t much different. The largest card issuers are banks, and they rely either on in-house capabilities or incumbent issuer processors. Fiserv and Global Payments also operate in Europe, while European players Nexi and Worldline have strong issuer processing businesses of their own.

Image source: The Nilson Report

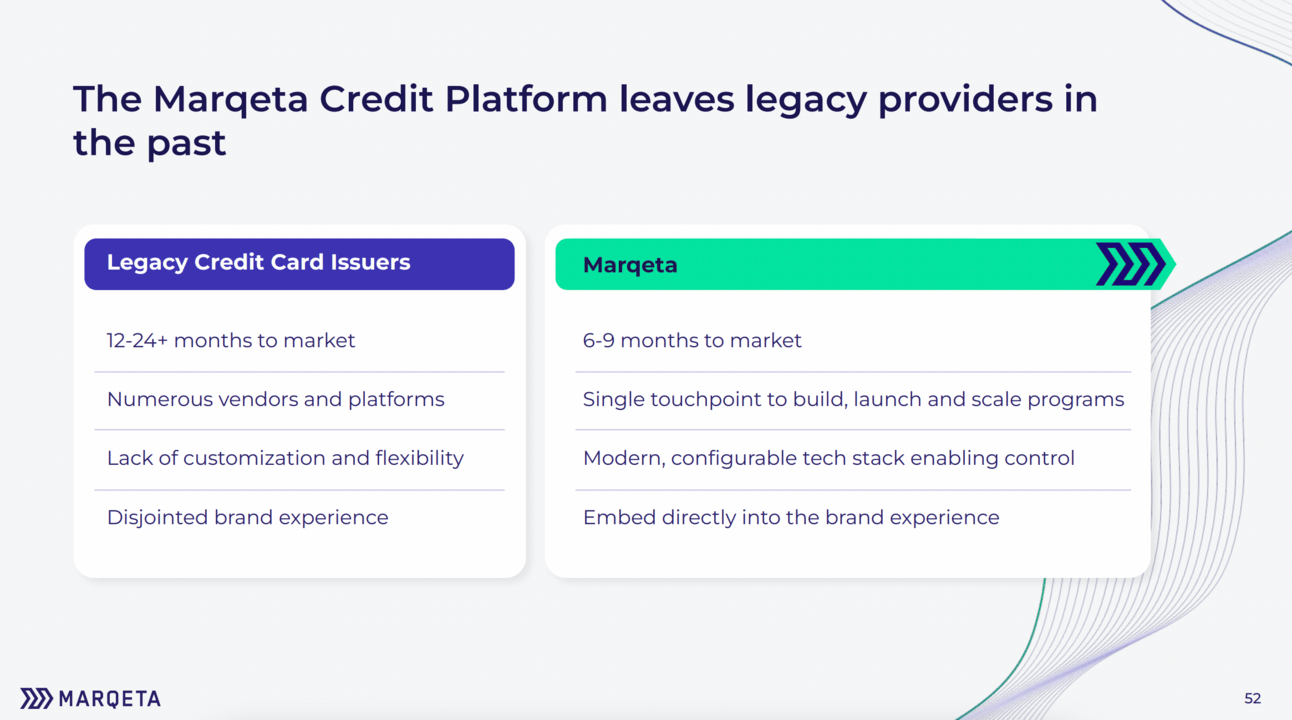

So why do Fintech companies choose Marqeta over the incumbents? Let’s start with Marqeta delivering unprecedented speed in launching new card programs. On the recent earnings call, Marqeta’s execs mentioned signing a new client and launching a card program for them in 26 countries…all within the same quarter.

Image source: Marqeta 2023 Investor Day

“Our commitment and willingness to work quickly was also a key reason for Bitpanda to choose Marqeta. Not only did we sign and launch the full program in the same quarter, but the launch was executed simultaneously in 26 countries and 10 currencies.”

When card schemes launch new features, Marqeta’s agility enables it to rapidly roll out these features to its clients. Thus, Marqeta was the first issuer processor to support Visa Flexible Credential. Visa Flexible Credential is a new card type that lets a single card dynamically access multiple funding sources, like debit, credit, or rewards.

Image source: Affirm

“Many processors [ supporting Visa Flexible Credential ] have been announced, but we're the only one who have a live program out there in the U.S., which was with Affirm. We partnered with Affirm and Visa to get off the ground.”

Marqeta’s focus on innovation also enables it to support new and unique card types. For instance, just-in-time funding (this is when a card balance is topped up right before the transaction), allowed Marqeta to support crypto-based cards (crypto is converted into fiat right before the transaction), as well as cards for Dashers (the Dasher card is topped up with the order value).

Image source: Marqeta

“We have been powering cards that allow consumers to spend their cryptocurrency via card for several years. Our early innovations with just-in-time funding allow fiat currency to be spent at the point of sale using a crypto wallet.”

Finally, Marqeta’s modern tech stack positions it well for emerging trends, such as agentic commerce. Probably, it’s important to mention that both Fiserv and Global Payments are still in the process of moving their platforms to the cloud.

“ [ Agentic commerce ] is exactly the kind of innovation that we have a track record of enabling and giving people dynamic capabilities where they can make decisions in real time. So, this is exactly the kind of innovations that we think we're well positioned to enable for people.”

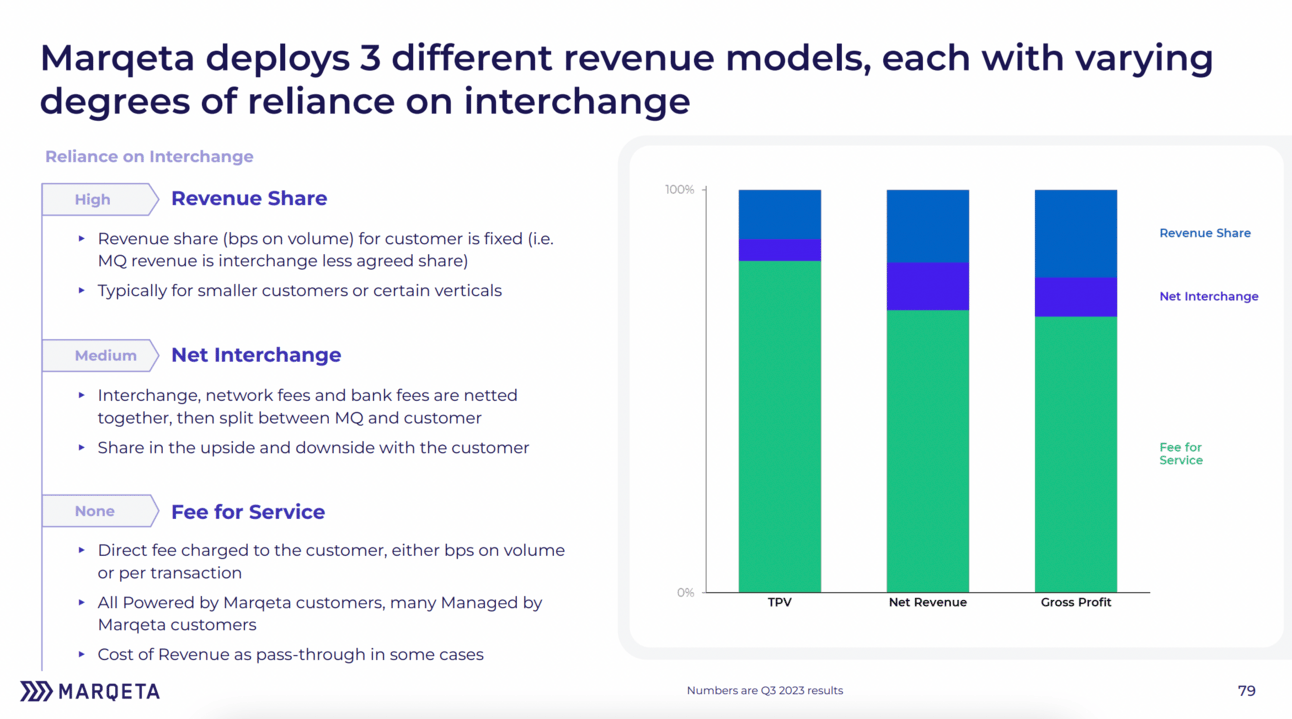

While Fiserv and Global Payments mainly charge based on the number of cards issued, Marqeta uses a transaction-based pricing model. For larger clients, Marqeta charges a fee per transaction (or a percentage of the transaction value), while for smaller clients, it typically shares in the interchange revenue. Therefore, the key revenue driver for Marqeta is processed volume, rather than “cards on file”.

Image source: Marqeta 2023 Investor Day

Marqeta went through a number of challenges during the 2022-2024 period. A difficult funding environment in 2022 forced many of its Fintech clients to refocus from growth to profitability. In 2024, regulatory scrutiny related to sponsoring banks following the Synapse collapse resulted in delays with new program launches. And, most importantly, in 2023, Block’s agreement came up for renewal.

Image source: Marqeta 2023 Investor Day

Block’s agreement was renewed in 2023. Prior to the renewal, Block (Cash App, Square, Afterpay) accounted for 78% of Marqeta’s revenue. As part of the renegotiation, Block got better terms from Marqeta and took the relationship with card schemes in-house. As can be seen from the chart below, this had a massive impact on Marqeta’s revenue. In Q1 2025, Block contributed 45% of Marqeta’s revenue.

Image source: Marqeta Q4 2023 earnings supplement

“First, we renewed our agreement for the Square debit card for 5 years to run through June 2028. Second, in parallel, we extended our deal with Cash App so that, that deal also extends through June 2028. Finally, we agreed with Block that Marqeta will be the default provider of issuing processing and related services in current or future markets outside of the U.S.”

However, neither Block, nor other customers left Marqeta. And, despite all the challenges over the past 3 years, it continued to consistently grow processed volumes. Over the past 5 years, Marqeta's quarterly processing volume increased 9.4x, from $9 billion in Q1 2020 to $84.5 billion in Q1 2025. Even Klarna, which moved one of its programs to another processor in 2022, came back, migrating its European volumes to Marqeta.

“We recently completed the successful migration of millions of Klarna cards across Sweden, Germany, and the U.K. in October after starting the project earlier this year. The transition provided Klarna with greater resilience and stability, meeting Klarna's needs ahead of the holiday season.”

The net take rate (gross profit over processed volume) has also stabilized, which means that the growth in the processed volume now translates into gross profit growth. Thus, in Q1 2025, gross profit grew 17% YoY.

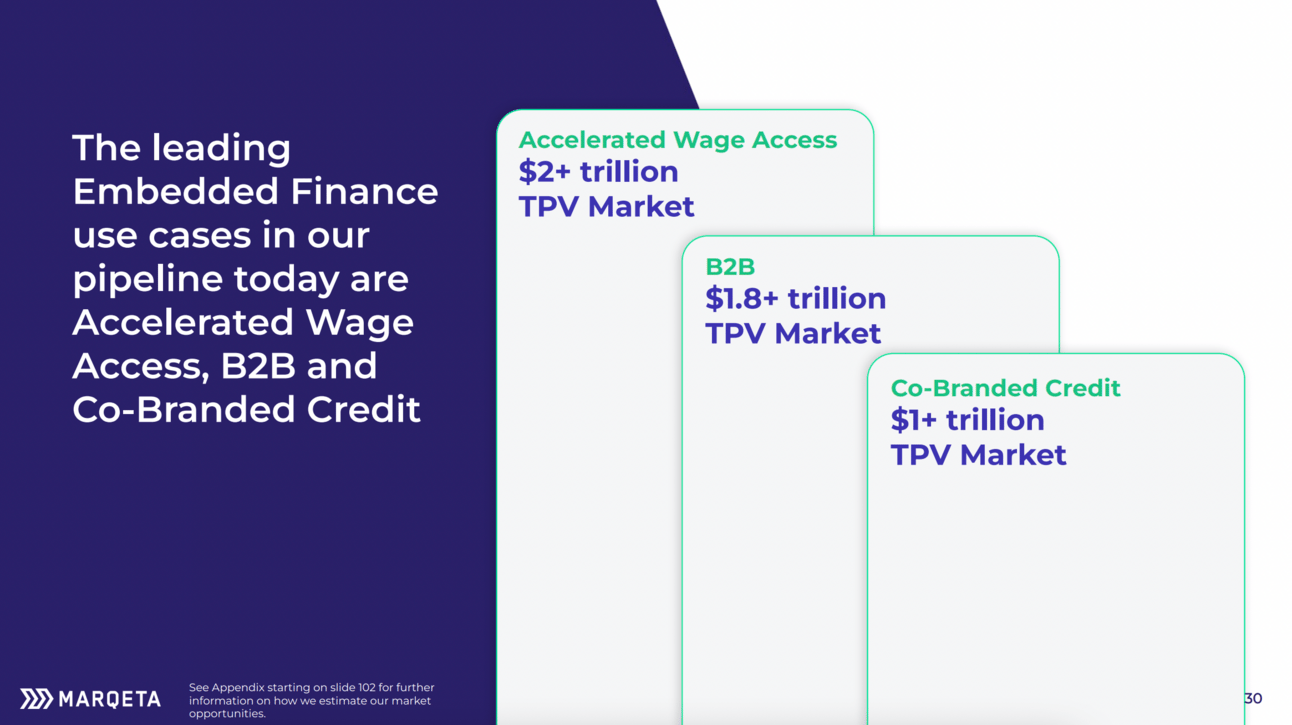

Marqeta is not yet in a position to serve big banks. Or, or would say, big banks are still fine with their in-house processing capabilities and incumbent processors. Therefore, the next leg of growth for Marqeta will come from “embedded finance”.

Image source: Marqeta 2023 Investor Day

“We do think we'll eventually penetrate the bank business, but that's many years away. So embedded finance is sort of the next big growth wave for us.”

Marqeta’s volume continues to grow thanks to its existing fintech clients, but its new customer pipeline is increasingly driven by embedded finance programs. These are card programs that are run by companies whose core business isn’t financial services.

“So if you go back to 2023 and 2024, we said roughly about a third of the new sales that we were booking were embedded finance customers and use cases. And right now, our pipeline is about two thirds embedded finance. So we see a lot of momentum going in that direction. We are uniquely situated to help embedded finance customers because of our modern platform, pure API based.”

An example of an “embedded finance” card program is a co-branded credit card (think of airlines, retailers, etc). In 2023, Marqeta acquired Power Finance, giving it full credit card capabilities, including both processing and program management.

Image source: Marqeta 2023 Investor Day

“We started to make some progress in credit. We are purposely going a little bit slow because anytime you rush in credit, you can make some pretty painful mistakes. We've launched our first commercial use case, so we have a customer up and running, and we just signed our first consumer use case, which is an airline co brand.”

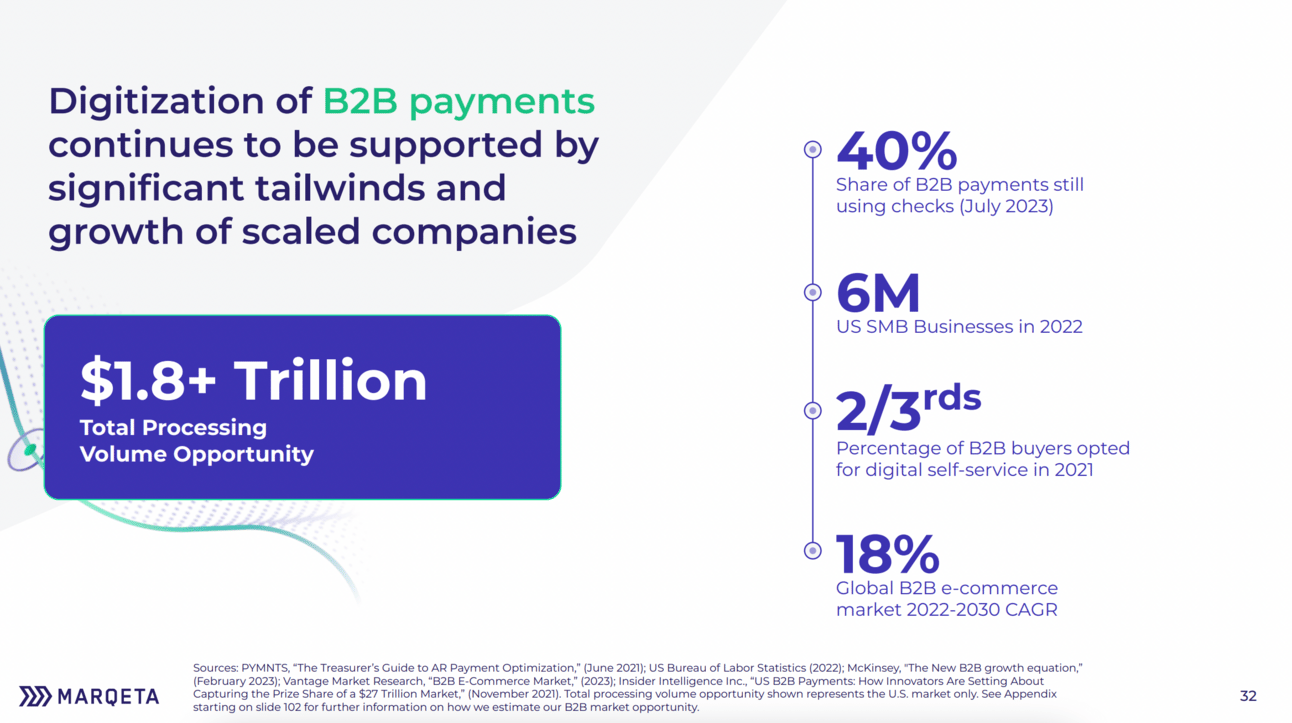

Marqeta already supports modern expense management platforms like Bill and Ramp, and has now partnered with American Express to expand in the SME space. For context, over 40% of U.S. small business’ spending goes through Amex cards. And, as I wrote in my “Adyen’s platform play” essay, the best way to reach SMBs is by embedding financial services into software that powers their businesses.

“We're excited to add American Express. It's the last major network. We have the other three major networks that are already on our platform. And Amex has very strong leadership in SMB lending and in the consumer co-brand space. Those are areas of great strength for them. And so we started finding ourselves deals a lot together.”

Finally, Marqeta is gaining traction in Europe. Currently, only 10% of its processed volume comes from outside the U.S., and, I believe, a large part of that comes from Afterpay. In Europe, it faces the same incumbent processors as in the U.S., and much weaker European processors.

Image source: Marqeta 2023 Investor Day

“Our Europe business is doing incredibly well. Our volume there is growing well over 100%. It's now over 10% of our TPV. So it's growing really quickly.”

In order to strengthen its offering in Europe, Marqeta is acquiring TransactPay. TransactPay holds Electronic Money Institution (EMI) licenses in the European Union and the U.K. Thus, the acquisition of TransactPay will enable Marqeta to handle card programs end-to-end, including connectivity to the card schemes.

“The big difference is that when in the U.S. the [ sponsoring ] bank owns the BINs and is the member of the network. The bank is a big part of the value proposition. We have to work very closely with them because of the fact that they own the BINs. The way it works in Europe is quite different as the EMI license holder, which is what TransactPay is, you actually are the owner of the BINs and you are the member of the network.

As you can see, there are many exciting things ahead for Marqeta. And all this comes at a pivotal moment, when the company has reached profitability (for now, on an adjusted basis). It is that magical moment, when a company that continues growing fast begins to see this growth translate into profit and cash flow growth.

“We've built a large team so we can make a lot of improvements without necessarily growing the expenses quite a bit. So even this year, what we've said is our gross profit in 2025, we expect it to grow between 14% and 16%. And our expenses to grow sort of mid- to high single digits.“

The company guided for 14-16% gross profit growth in 2025, and expects to deliver a 10-11% Adjusted EBITDA margin. In absolute terms, this would be $578-588 million in gross profit and $58-65 million in Adjusted EBITDA.

Image source: Marqeta Q1 2025 earnings supplement

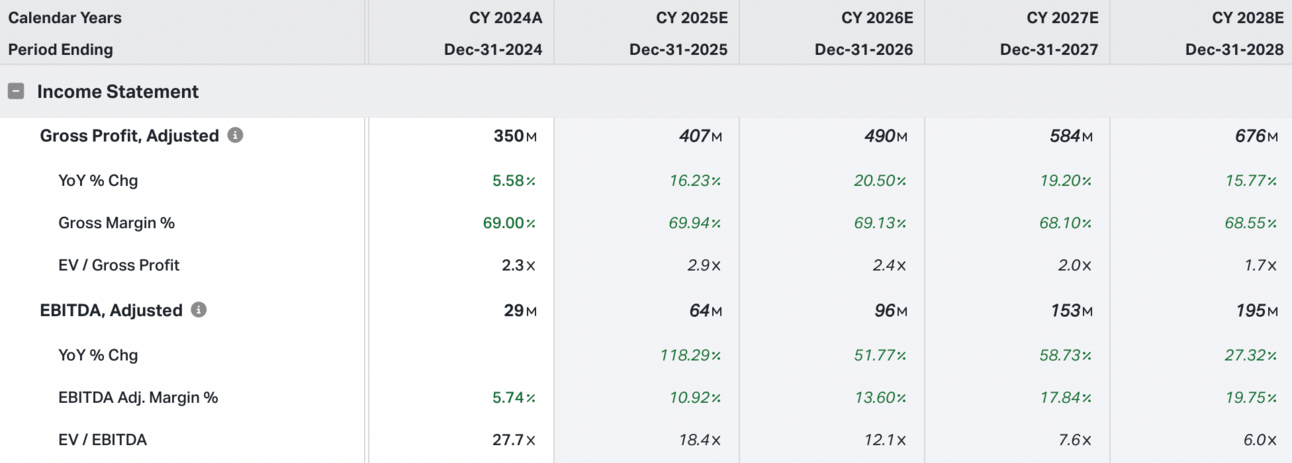

Wall Street analysts expect the company to achieve its 2025 guidance. They also expect gross profit growth to accelerate to 20% in 2026 and 2027, with continued improvement to profitability.

Image source: Koyfin

One might argue that the 2025-2027 results are already in the price. However, I would argue that what’s not in the price is Marqeta’s runway. There is absolutely no reason for Marqeta’s growth to slow past 2027.

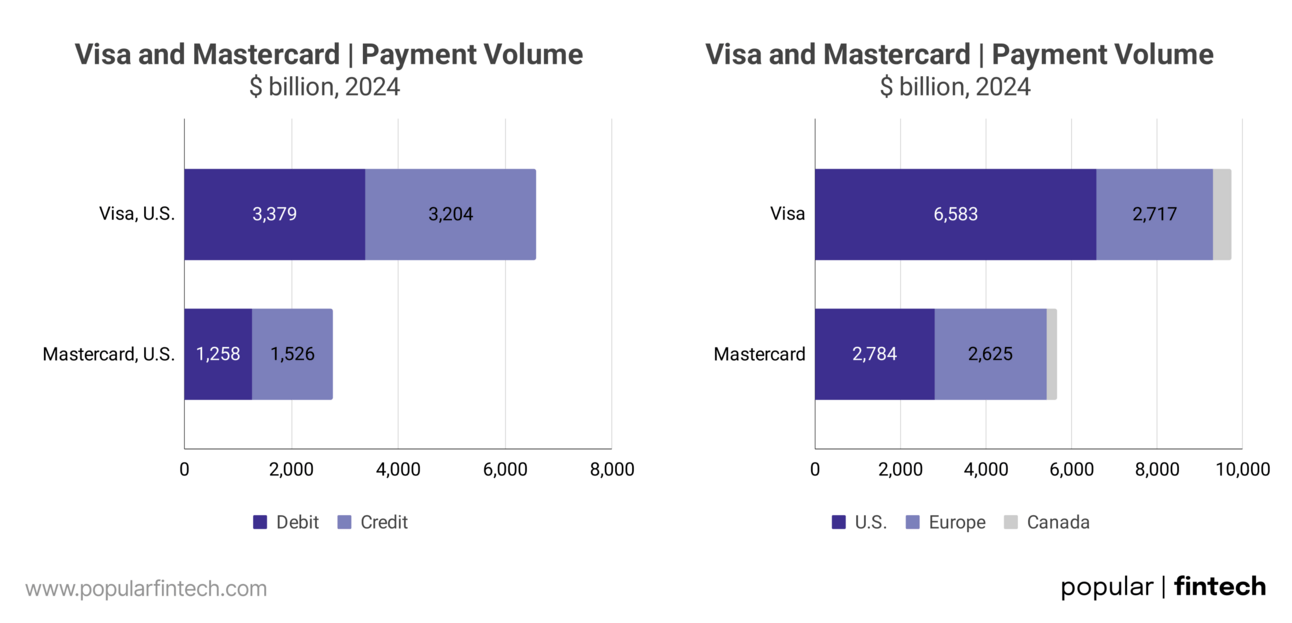

In 2024, Marqeta processed $291 billion in card payments. Visa debit volume in the U.S. alone was $3.4 trillion. Mastercard debit volume in the U.S. was $1.3 trillion. And, as discussed above, Marqeta is rapidly expanding into credit cards and building its footprint in Europe.

Can something stop Marqeta? Probably yes, but I don’t think these will be Fiserv and FIS. There are several modern issuer processors out there (Lithic, Galileo, to name a few). Stripe and Adyen are building their issuing capabilities too. However, I believe Marqeta has reached the scale and momentum that will make it difficult for others to compete with. Let’s see!

Cover image source: Marqeta

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.