Hey!

Klarna is finally going public, and a lot has changed since it first began exploring an IPO. While the company was preparing to make its public debut, it appears to have fallen behind its major peers on growth.

As a result, investment bankers are pricing the IPO using multiples of smaller competitors like Sezzle and Zip, rather than its closest rival, Affirm. This suggests that despite being a pioneer in the BNPL space, Klarna may now be viewed as a follower rather than a leader.

However, Klarna still has a clear path to re-accelerate growth by pushing into cards and everyday banking. I'd argue that Klarna is already more of a payments company than a traditional lender, which is its key advantage. While a return to growth isn't guaranteed, it feels like this is their game to lose.

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Klarna is finally going public. As soon as next week. I wrote about Klarna’s IPO when the company confidentially filed its prospectus with the SEC about a year ago. A lot has changed since then, so with the full and updated Form F-1 now available, I decided it was time to revisit the topic.

“The initial public offering price is currently expected to be between $35 and $37 per ordinary share. Klarna has been approved to list its ordinary shares on the New York Stock Exchange under the symbol “KLAR.”

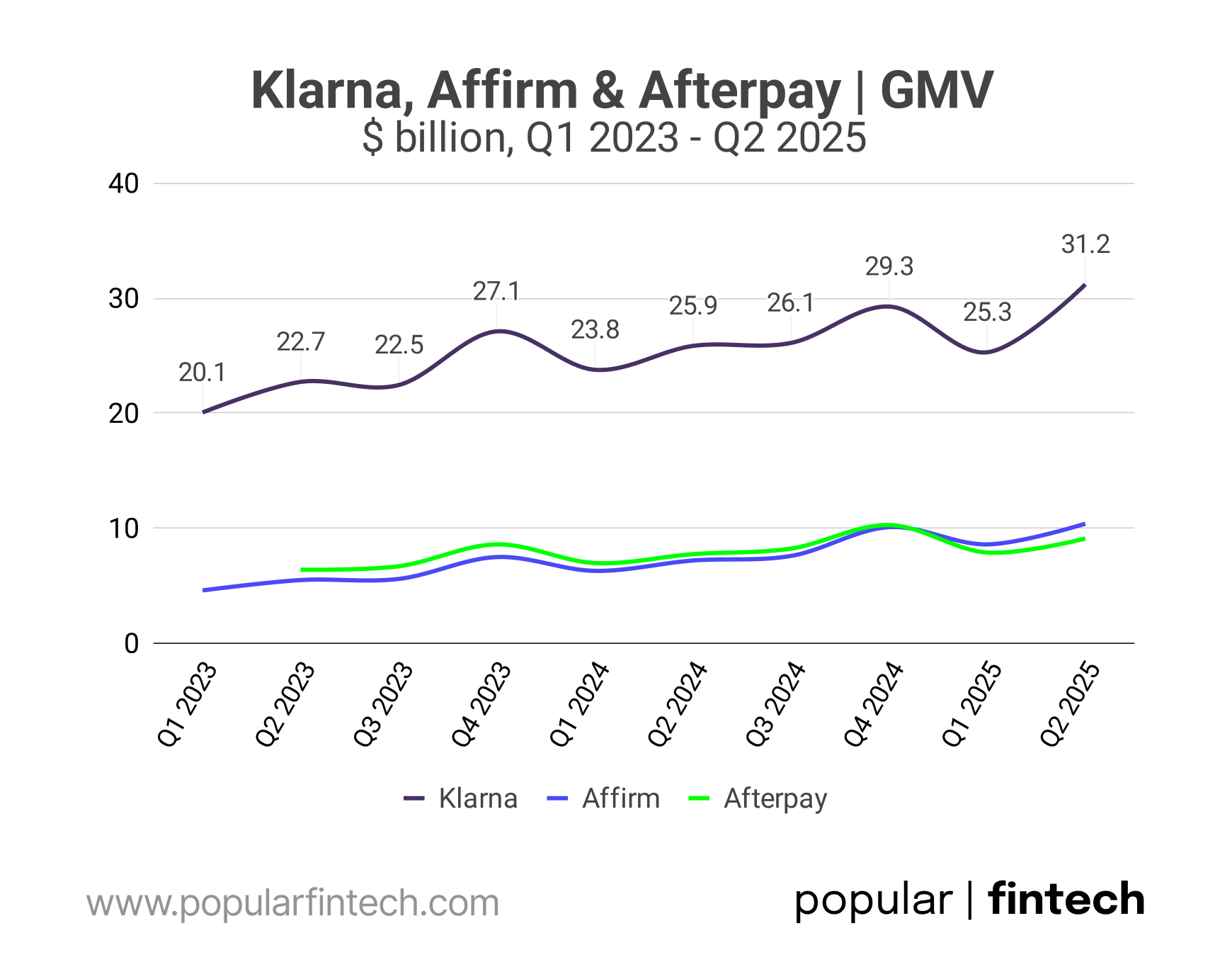

Klarna is one of the biggest players in the Buy Now, Pay Later space. The “Big 4” are Klarna, Affirm, PayPal, and Block’s Afterpay. When it comes to finding a public company to compare to Klarna, Affirm is the closest match. If you buy Block stock, you also own Square, Cash App, and now Proto Mining. Similarly, BNPL is just one piece of the larger PayPal business. Affirm and Klarna are “pure” BNPL plays.

“We have built one of the largest commerce networks in the world, measured by the number of consumers and merchants, serving approximately 111 million active Klarna consumers and approximately 790,000 merchants in 26 countries as of June 30, 2025, and facilitating $112 billion of GMV in the last twelve months ended June 30, 2025.”

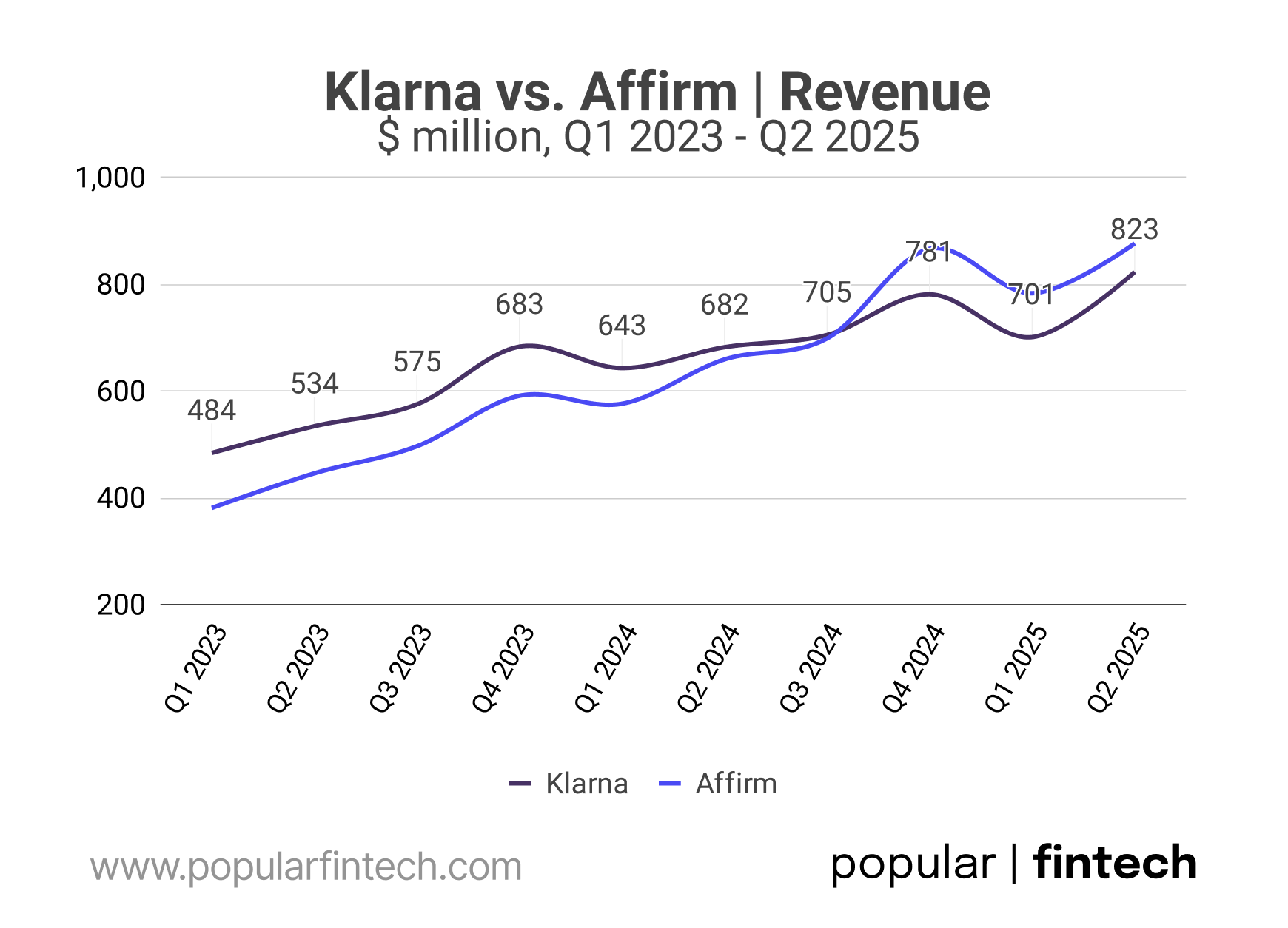

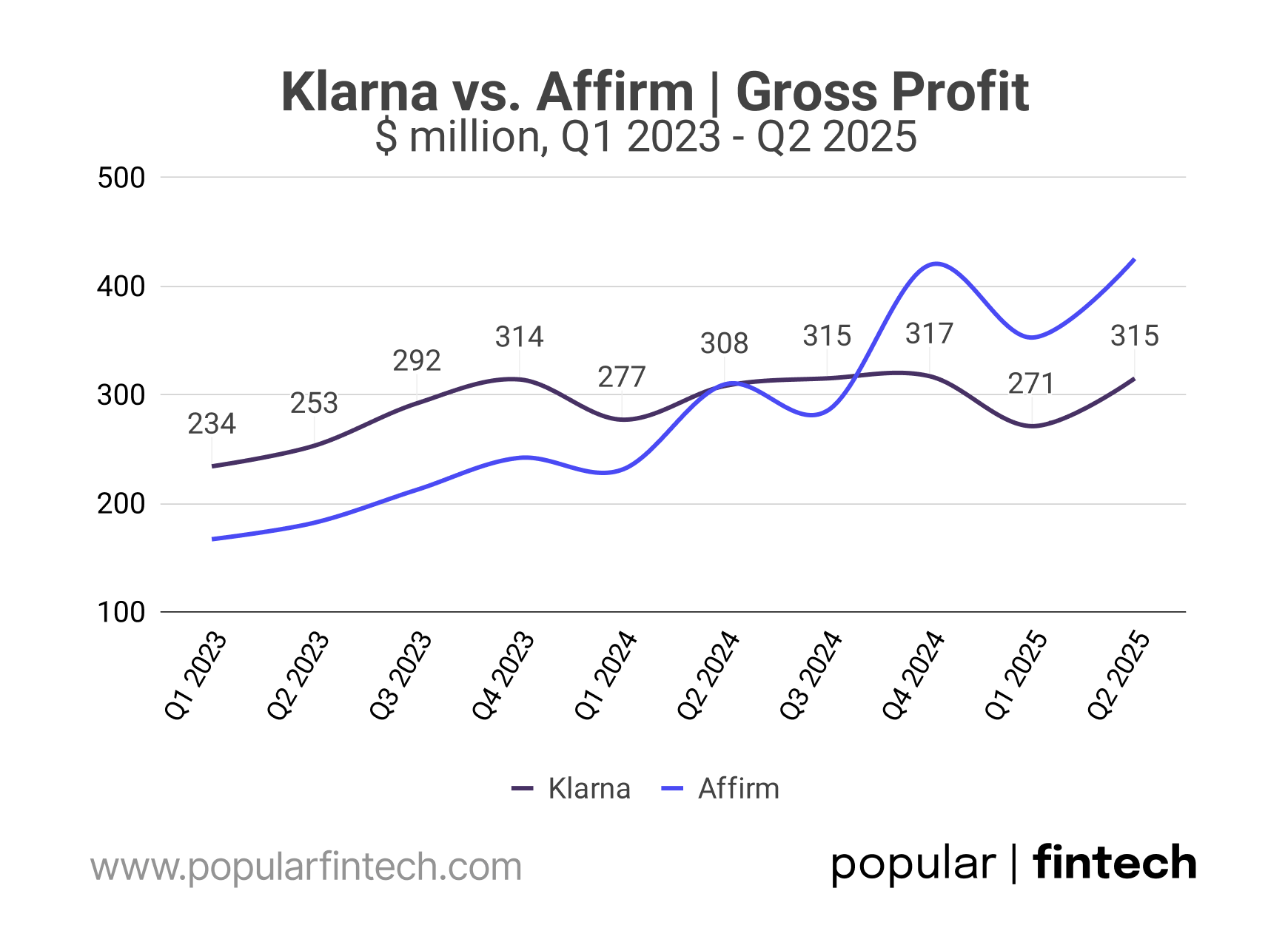

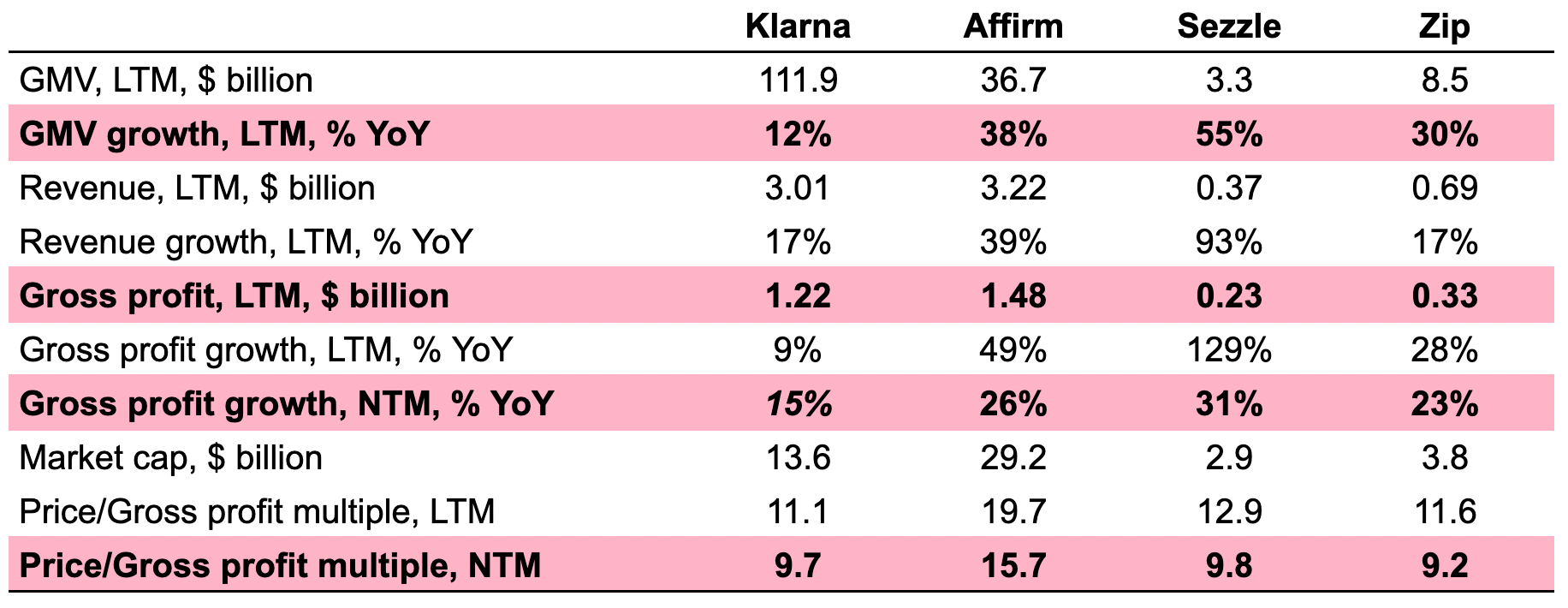

Affirm has posted a few stellar quarters, and while Klarna was preparing for its public offering, Affirm actually surpassed it in both revenue and gross profit. Both companies have their own specific definitions of “gross profit” to account for credit losses: Affirm uses “Revenue Less Transaction Costs”, and Klarna uses “Transaction margin dollars”.

Data source: Klarna, Affirm

“We define transaction margin dollars as total revenue less total transaction costs, which consist of processing and servicing costs, provision for credit losses and funding costs.”

Over the last four reported quarters (Q3 2024 - Q2 2025), Affirm’s “gross profit” came in at $1.48 billion, growing 49% YoY. Meanwhile, Klarna generated $1.22 billion in “gross profit,” with a much slower 9% growth rate. In short, Affirm is now bigger and growing much faster than its Swedish rival.

Data source: Klarna, Affirm

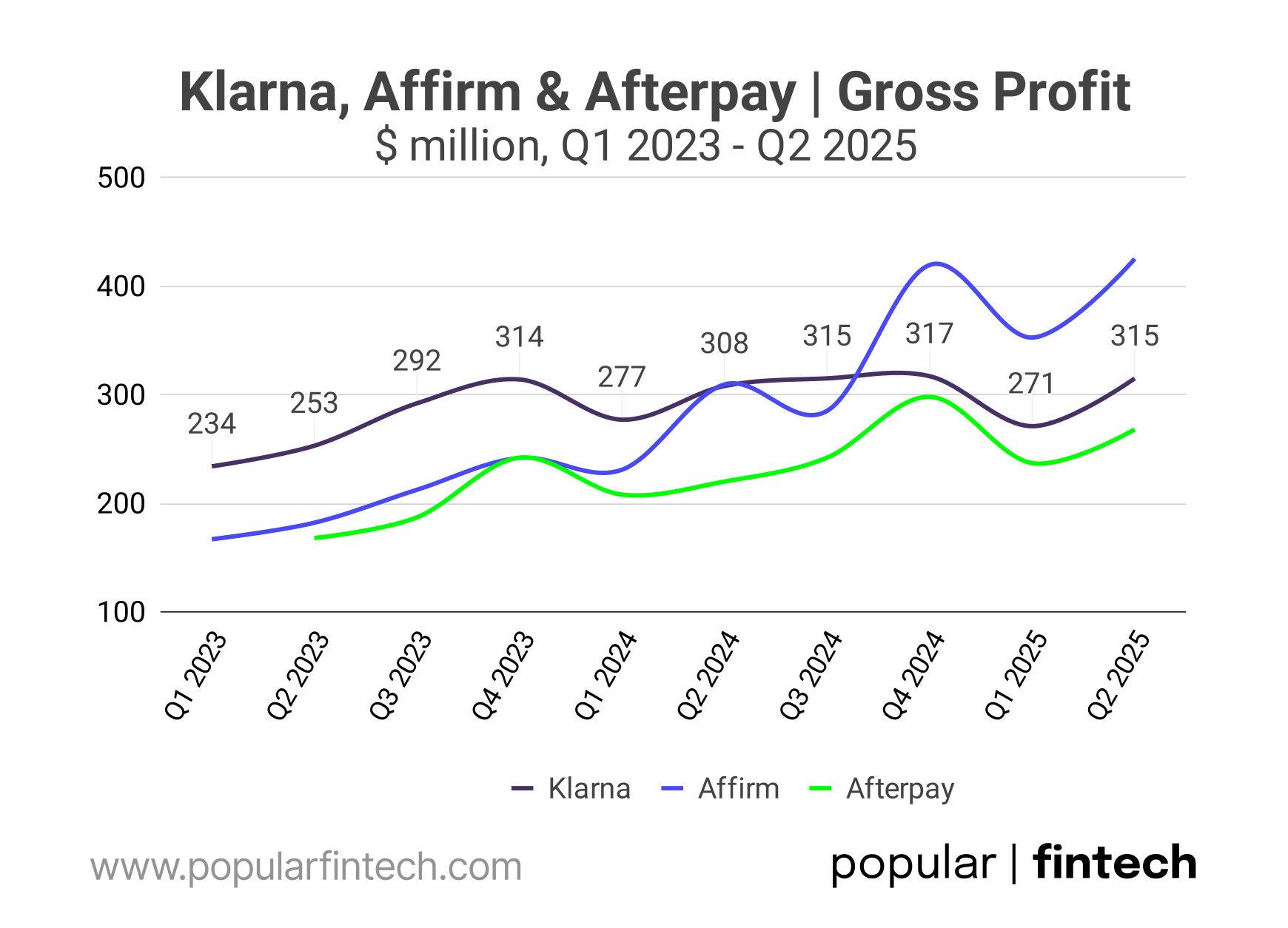

Even Block’s Afterpay is catching up with Klarna, posting $1.05 billion in “gross profit” and growing at a solid 22% YoY. Perhaps, Klarna was trying to prioritize profitability over growth as it prepared for the IPO, or maybe it was trying to lower its default rates to calm future investors. Whatever the reason, the outcome is clear: Klarna is falling behind in the most important aspect of a growth company, growth itself.

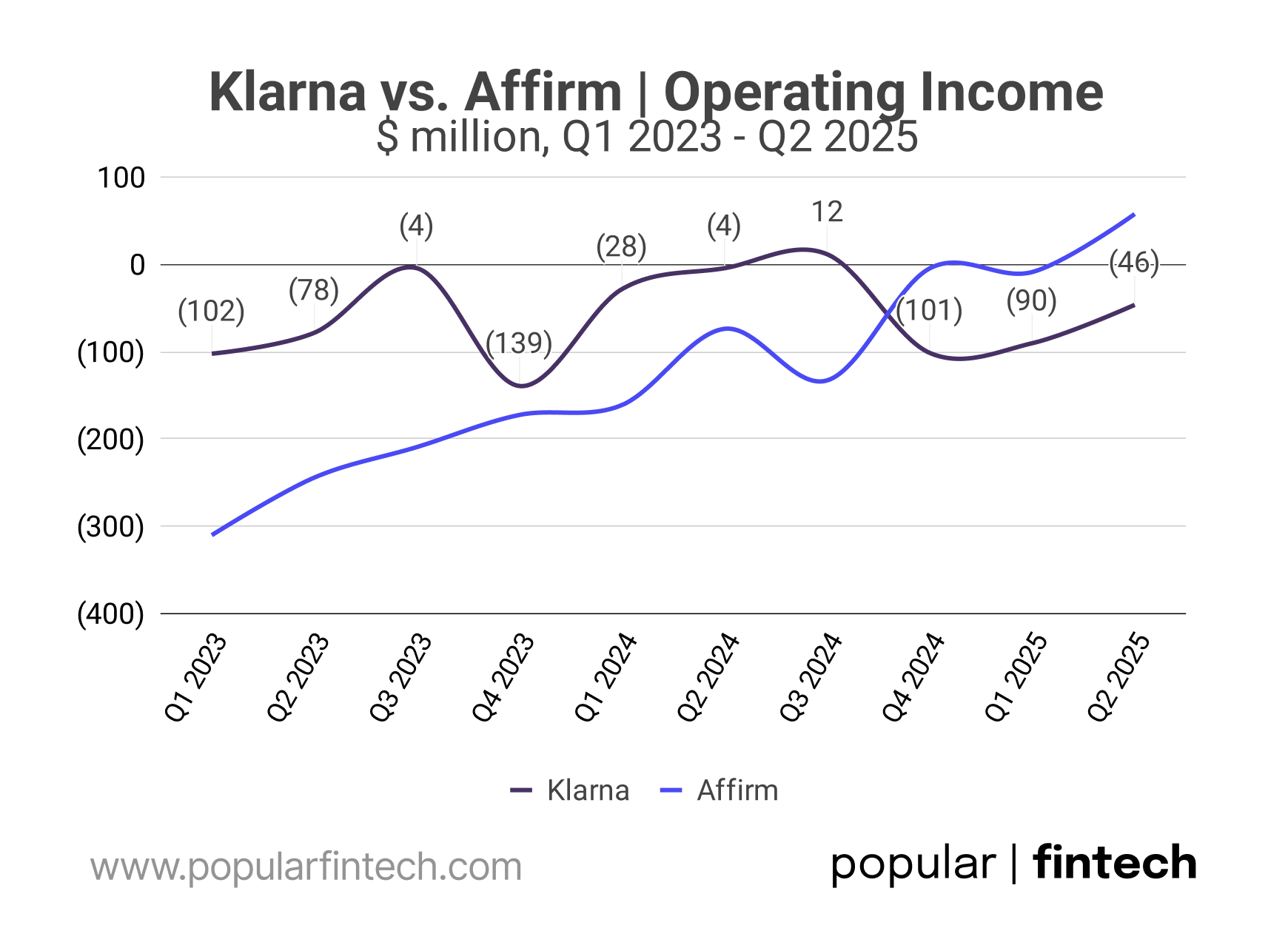

Now, I think the company is in a tricky situation. It's turned into a laggard when it comes to growth, but it has yet to prove it can operate profitably. The company even seemed to pull back on its big thesis that AI could replace its support staff, returning to hiring instead. In the meantime, Affirm managed to become GAAP profitable without hurting its growth one bit.

Data source: Klarna, Affirm

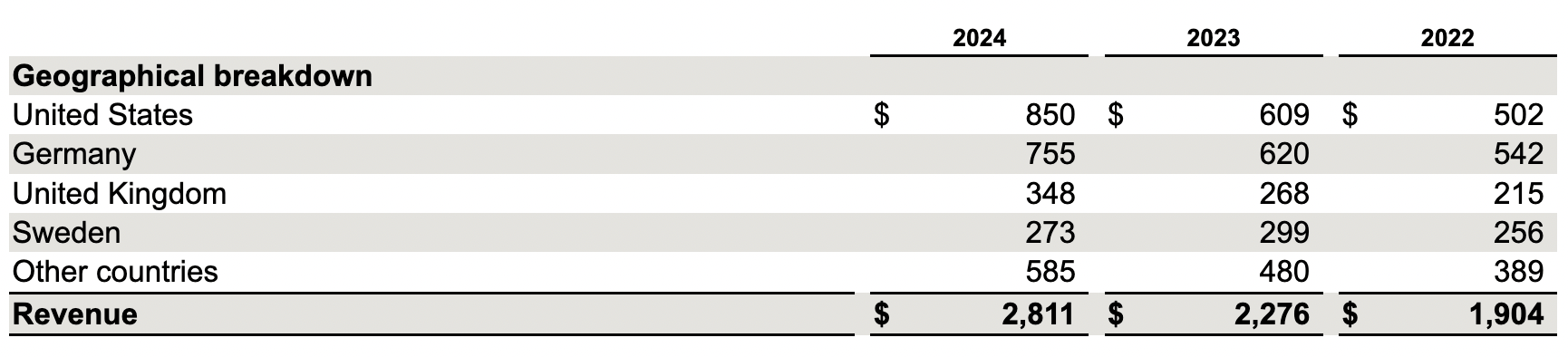

Besides Affirm now being bigger than Klarna and growing faster, there are other key differences. For one, Klarna is more geographically diverse, with strong roots in Sweden, Germany, and the UK, in addition to the U.S. Klarna also primarily focuses on the "true" BNPL loans, like their "Pay in 4" option, while Affirm can issue longer-duration, interest-bearing loans. And perhaps the biggest difference of all: Klarna is a bank, while Affirm is not.

Image source: Form F-1

“Our banking license enables us to maintain a low-cost, stable funding model based on consumer deposits. We currently offer savings accounts directly to residents of Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Spain and Sweden. We are also able to collect deposits in Germany, the Netherlands, France, Spain and Ireland pursuant to a partnership with a third-party deposit-taking platform operated by Raisin.”

Here’s where it gets interesting: investment bankers are pricing Klarna using the multiples of Sezzle and Zip, not Affirm’s. Sezzle and Zip are much smaller players than the “Big 4”. They both went through some rough times during COVID, but are now showing solid growth and profitability.

With Affirm having just reached GAAP profitability and Klarna's profitability numbers fluctuating, a P/E multiple isn't a useful comparison. It’s tough to figure out what a "normal" level of profitability is for these businesses. So, instead, I will be using the Price/Gross profit multiple (or rather Price/"Revenue Less Transaction Costs" for Affirm and Price/"Transaction Margin dollars" for Klarna to account for credit losses).

Affirm currently trades at 19.7x LTM and 15.7x NTM Price/Gross profit multiples. Analysts expect its Revenue Less Transaction Costs to grow by 26%.

Data source: Klarna, Affirm, Sezzle, Zip, Koyfin

Klarna is expected to price its stock at $35-$37 per share, which, using the midpoint of $36, implies a $13.6 billion market cap. This means Klarna would IPO at an 11.1x LTM Price/Gross profit multiple.

Assuming an optimistic 15% gross profit growth for the next twelve months, we get to a 9.7x NTM Price/Gross profit multiple. At 10% gross profit growth, we would be looking at a 10.1x NTM Price/Gross profit multiple. This is very similar to Sezzle and Zip and a long way from Affirm's multiples.

I think scale in this business matters. It's what gives you the ability to secure prime placement at checkout and to land massive merchants like Amazon and Walmart. It also helps with everything else: marketing, cost of funding, operational efficiency…you name it. This is why Affirm and Klarna have more flexibility in what they can do, both now and in the future, than smaller players like Sezzle or Zip.

“We continued onboarding some of the world’s largest merchants. As announced earlier this year, we launched OnePay Later Powered by Klarna at Walmart, bringing installment loans to millions of U.S. consumers.”

Klarna is being compared to smaller players for a simple reason: it's falling behind on growth. Don't get me wrong, I still think Affirm is a much stronger company. But I believe there’s an opportunity for Klarna to earn a better multiple if they can prove they can re-accelerate growth and, finally, reach consistent profitability. The question is: where would this growth come from?

The push into cards might be Klarna’s most important move. It’s not just about a new product; it’s a strategic ambition to become the primary banking relationship for its customers, similar to what we’ve seen with Cash App, Chime, and Revolut. These companies used simple, easy-to-use debit cards and apps to attract millions of users, building a strong base and then layering on additional products and services.

Image source: Klarna

New opportunities are opening up for BNPL lenders like Affirm and Klarna thanks to Visa Flexible Credential. This new card tupe allows a single card to combine the features of both a credit and debit card. Users of Affirm and Klarna, which are for now the only issuers of Visa Flex in the U.S., can use their cards as standard debit cards or access financing right in the payment flow, a big step up from needing a pre-approval beforehand.

It's not like Klarna's competitors are sleeping. Block has already integrated Afterpay directly into Cash App, which boasts 26 million active cardholders. Meanwhile, cards and BNPL are core tools for PayPal to drive engagement in both its main app and Venmo. And Affirm has surpassed 2.3 million cardholders with the Affirm Card, all with hardly any marketing. Let’s also not forget about Chime, with its more than 8 million active users, and Revolut with over 60 million customers.

Image source: Affirm

“A version of the Affirm card future is 10 million cardholders and something along the lines of $7,500-plus transaction GMV per year. The current trailing 12 months of the cardholder is about $4,700.”

However, this is where Klarna’s unique position might really pay off. Klarna serves five times the number of consumers and does three times the GMV that Affirm does, making it more of a payments company than a pure lender. Given that, cross-selling the Klarna Card should be a no-brainer at its scale. At this point, it feels like this is Klarna’s opportunity to lose.

Data source: Affirm, Klarna, Block

But back to the IPO. As other fintech IPOs have shown, the stock will most likely pop on its first day, especially since the round is oversubscribed. After that, we’ll probably see a long, hard grind as the company tries to prove it can re-accelerate growth. Klarna's success in cards and everyday banking, or its ability to return to growth through other means, isn't a given, but writing it off as a player would be a risky bet.

Congrats and good luck, Klarna team!

Cover image source: Klarna

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.