Hi!

Today I am trying something new: I post a lot of charts on Twitter, so I thought, why not pick the most interesting ones and add a bit more context to them in my newsletter? I still plan to publish longer deep dives (like the one on Cash App), but would like to see if I can sneak in a few charts. Without further ado, here are the most interesting charts that I have published lately:

JPMorgan’s credit card loan charge-offs surge,

Visa finds growth in Europe, and

Square lags competition

Hope you find this newsletter format interesting, and please let me know what you think (just reply to this email, or ping me on Twitter)!

Jevgenijs

JPMorgan reported its Q1 2024 results on Friday. The company’s stock was down more than 6% after the earnings release, as, apparently, investors expected the bank to increase its Net Interest Income guidance for the full year (which didn’t happen). The outflow of deposits continues and JPMorgan has to pay more for those that stay.

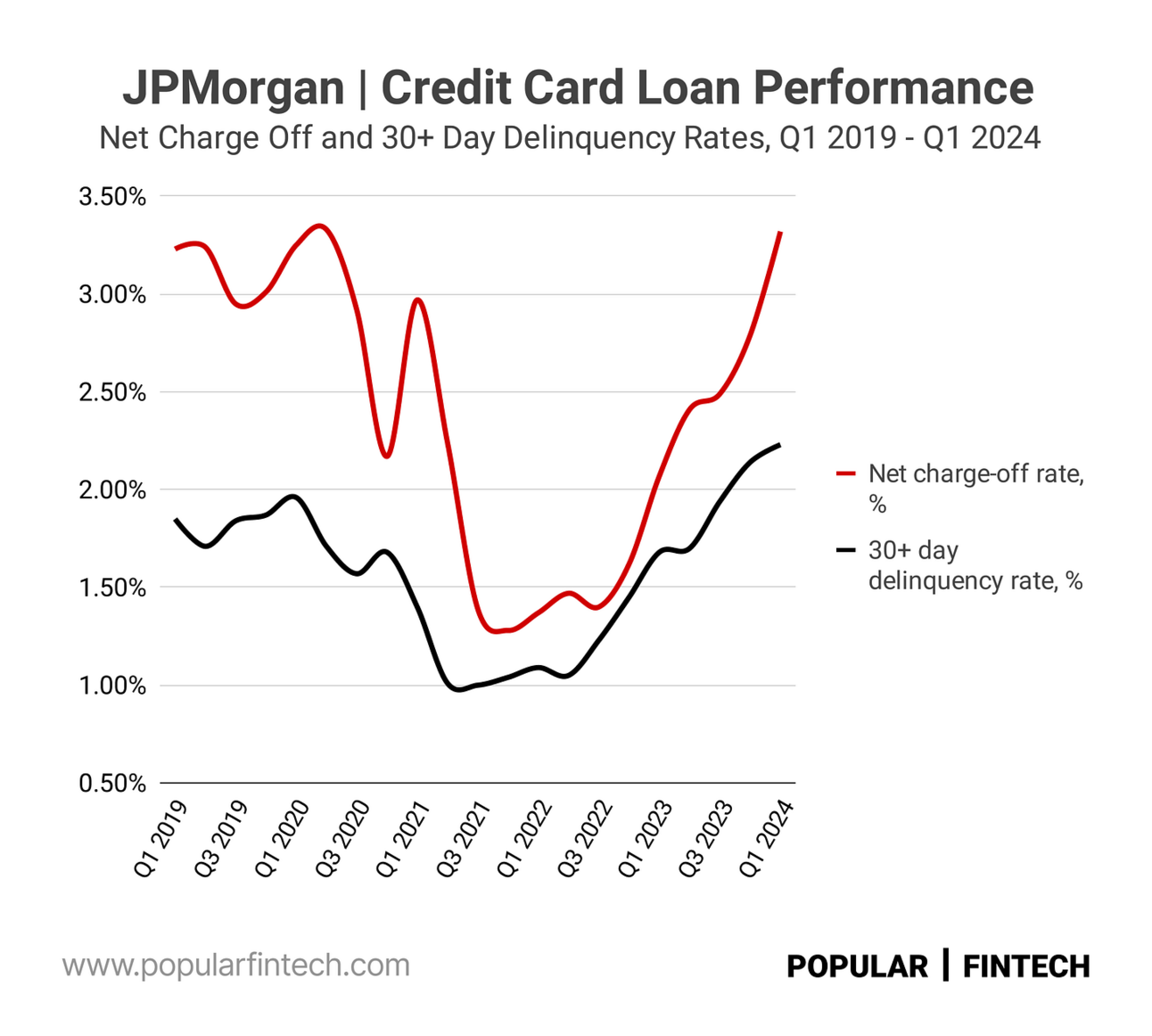

However, what caught my attention was that the company’s management reiterated that it expects the credit card loan charge-off rate to remain below 3.50% for the full year 2024. In Q1 2024, the net charge-off rate reached 3.32%, up from 2.07% a year ago. Both the net charge-off and the 30+ day delinquency rates have now returned to the pre-pandemic levels.

JPMorgan finished the first quarter with $206.8 billion in credit card loans, up 15% from a year ago. The company’s management also expects its credit card loan balances to grow 12% this year. I believe JPMorgan leadership knows what they are doing, but looking purely at the chart it is hard to believe that the red line (net charge-off rate) will hit 3.5% and stop going higher.

Square lags competition

Last week, Morgan Stanley downgraded Block’s stock to “Sell” and assigned it a price target of $60 a share. Analysts argued that “driving durable improvement in Square’s growth will likely be challenging.” In particular, they highlighted that “Square's volume growth has been consistently slowing over the past couple of years, and is now trending similar to that of the incumbent, Global Payments, while peers such as Toast, Shift4, and Fiserv's Clover are growing meaningfully faster.”

Plotting payment volume growth for Square, Toast, Shift4, and Clover on a chart, greatly illustrates Morgan Stanley’s point. Thus, in Q4 2023, Square’s TPV increased 10% YoY, while Clover’s and Toast’s TPV increased 17% YoY and 32% YoY respectively. Morgan Stanley analysts argued that Square’s peers are aggressively launching products that target Square’s market, while Square is struggling to move upmarket due to the price competition (from the same peers).

I believe Jack Dorsey agrees that the speed of product iteration at Square can (and should) be improved. After taking over leadership of Square last September, he noted in his shareholder letter: “I believe there have been a number of things holding Square back, some structural, some cultural, all of which can be addressed through stronger and more opinionated prioritization and week-on-week fast iteration.” I remain bullish on Square’s opportunities and so is Dorsey: “We believe our seller platform will prove to be our superpower, with major unlocks arriving in 2024.”

Visa finds growth in Europe

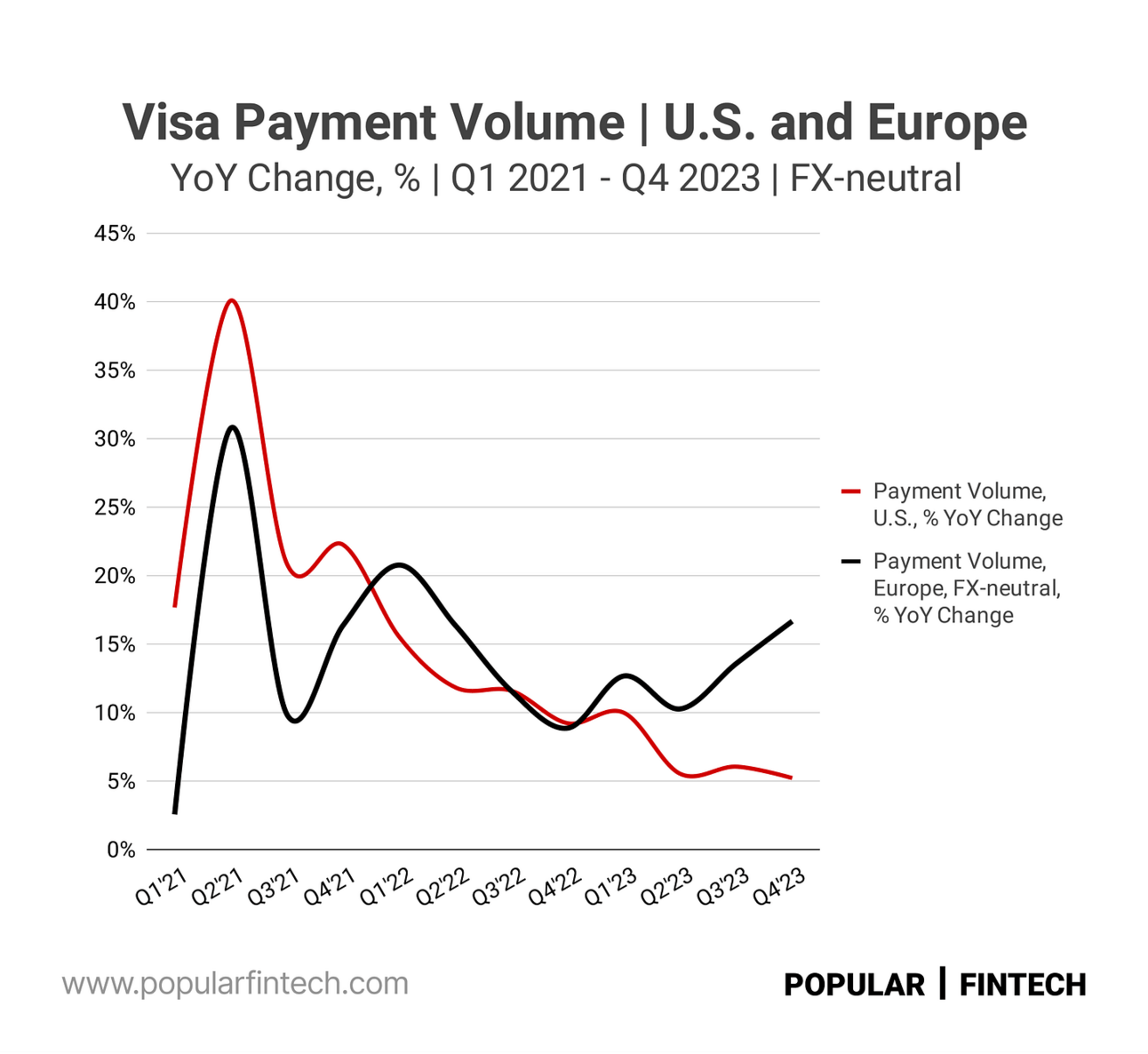

The final chart for today illustrates something that has been puzzling me for quite some time. European economies are objectively doing worse than the U.S., but, nonetheless, Visa’s payment volume is growing much faster in Europe. In Q4 2023 (FY Q1 2024), the latest reported quarter, U.S. payment volume increased 5.3% YoY, while European payment volume increased 16.7% YoY (on an FX-neutral basis, meaning, excluding the impact of exchange rate fluctuation).

Several people on Twitter and LinkedIn suggested that Visa and Mastercard are gaining market share from domestic card schemes like girocard in Germany (Mastercard also sees double-digit growth in Europe). Stripe even published an article about girocard, noting that in 2023, Mastercard ceased supporting girocard's international payment capabilities (previously powered by Maestro) and suggesting that this will most likely result in cardholders (and issuers) migrating to Visa or Mastercard-branded cards.

I once heard a statement from a Wall Street analyst that investing in Visa and Mastercard stocks is essentially betting on the course of the economy. If the economy is strong, consumers and businesses are spending, and card schemes are taking their cuts. However, it seems that Visa and Mastercard can find levers for growth even when the economies are not growing (in the fourth quarter European Union saw a 0.2% YoY GDP growth, while the German economy contracted).

Cover image source: Chase

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.