Hey!

Nubank is objectively one of the most successful Fintech companies out there. In Brazil, they have reached the scale of the incumbents and yet maintain the growth rates of a startup. Innovative, highly profitable, and deeply loved by its customers.

However, on the recent earnings call, David Velez, the company’s co-founder and CEO, said that it is still Day 1 for Nubank. He’s set ambitious goals for the company, so ambitious that, if achieved, Nubank’s accomplishments to date could seem like a footnote.

Nubank wants to become the largest financial institution in Latin America, expand beyond financial services, and…wait for it…become a global player. I believe it was the first time that they had explicitly told investors that they are working on expansion beyond Latin America.

Let’s dive in because this is super exciting!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

A lot has been written about the Brazilian Fintech miracle Nubank $NU ( ▲ 3.51% ). It is a truly fascinating company that has already achieved a lot. So, before we dive into why it is still Day 1 for Nubank, let's quickly recap how far they've come.

Nubank launched in 2014 with a fee-free credit card, a mobile-first experience, and an ambition to create a bank that consumers love. At the end of 2024, 40 million people used Nubank’s credit cards. In Brazil alone.

“In 2013, we began with a small team and in 2014 we introduced our first product in Brazil, the Nu Credit Card, a purple Mastercard-branded credit card. Our new credit card marked Brazil’s first foray into annual fee-free credit cards, and was coupled with a digital, mobile-first customer experience.”

Three years into the journey, in 2017, Nubank launched a fee-free checking account, NuAccount, aiming to become the primary bank for its customers. At the end of 2024, 79 million people in Brazil were using NuAccount. Nubank has also managed to become the primary bank for 61% of its active customers.

“In 2017 we introduced NuAccount. This fully digital banking solution revolutionized the market with free deposits, transfers, and payments, alongside nominal-fee cash withdrawals at partner ATMs. Additionally, we incorporated a competitive-yield savings feature. This expansion enabled us to become the primary banking choice for many customers.”

Nubank launched unsecured consumer lending in 2019 and expanded into secured consumer lending in 2023. Secured consumer lending in Brazil means loans backed by salary, pension, or unemployment benefits.

In 2024, interest income from credit cards and consumer loans, as well as NuAccount balances (which Nubank invests primarily into government treasuries), contributed $9.6 billion, or 84% of the company’s total gross revenue.

“In 2019, we launched a personal loan feature within our mobile app, allowing customers to apply, run repayment simulations, and manage balances easily. In 2023, we announced the expansion of our lending products in Brazil into secured lines, such as public payroll loans for federal public servants; secured loans for retired persons, and [ loans backed by ] the Brazilian Severance Pay Fund.”

Fast forward to today (or rather 2024)…Nubank serves 102 million people in Brazil (which represents 58% of the country’s adult population) and has become the third-largest financial institution in terms of the number of customers it serves.

“We now serve over 114 million customers with 20.4 million net addition this year alone. Our active customer base grew 22% year-over-year to nearly 95 million. In Brazil, we continued adding over 1 million customers per month, serving 58% of the population.”

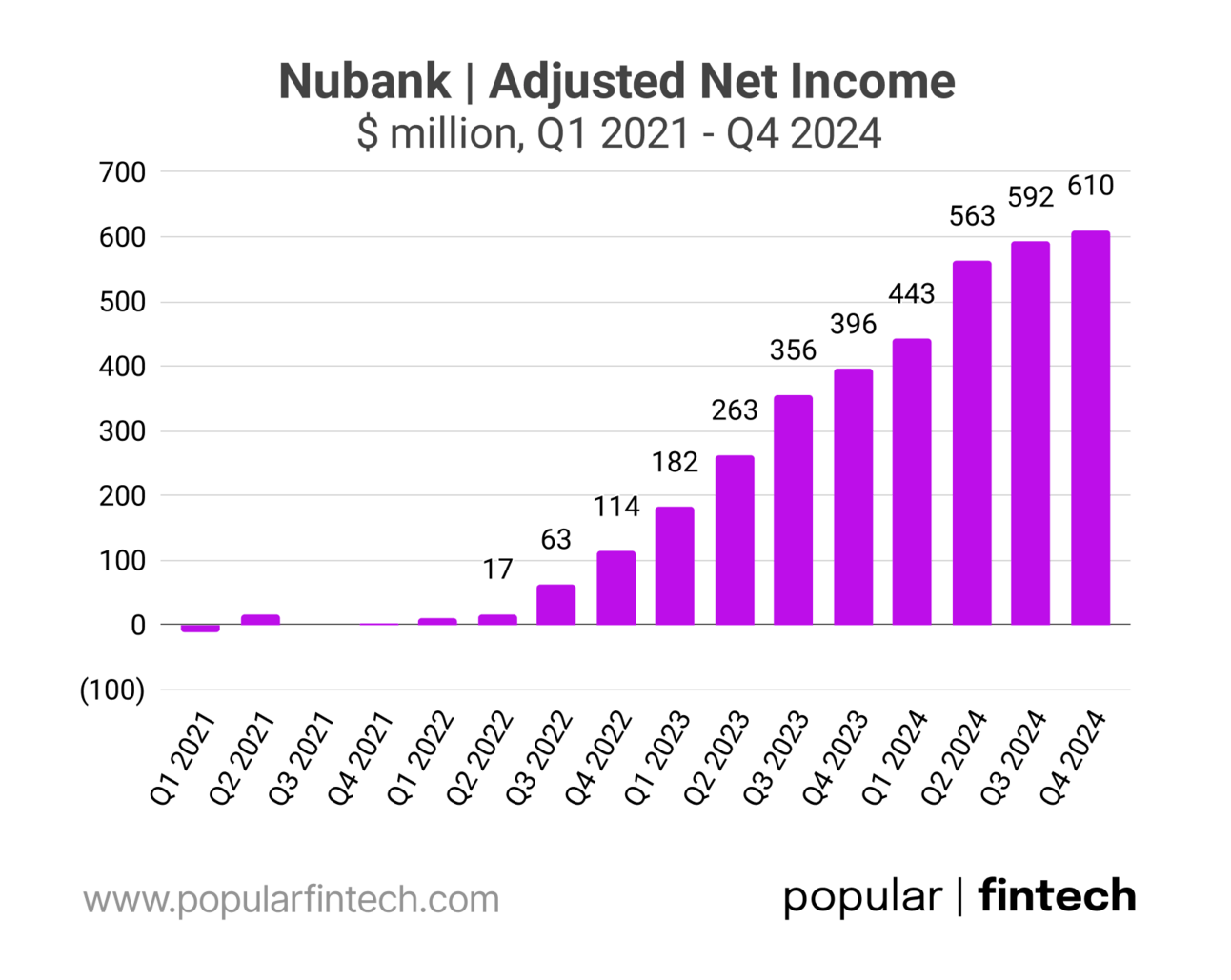

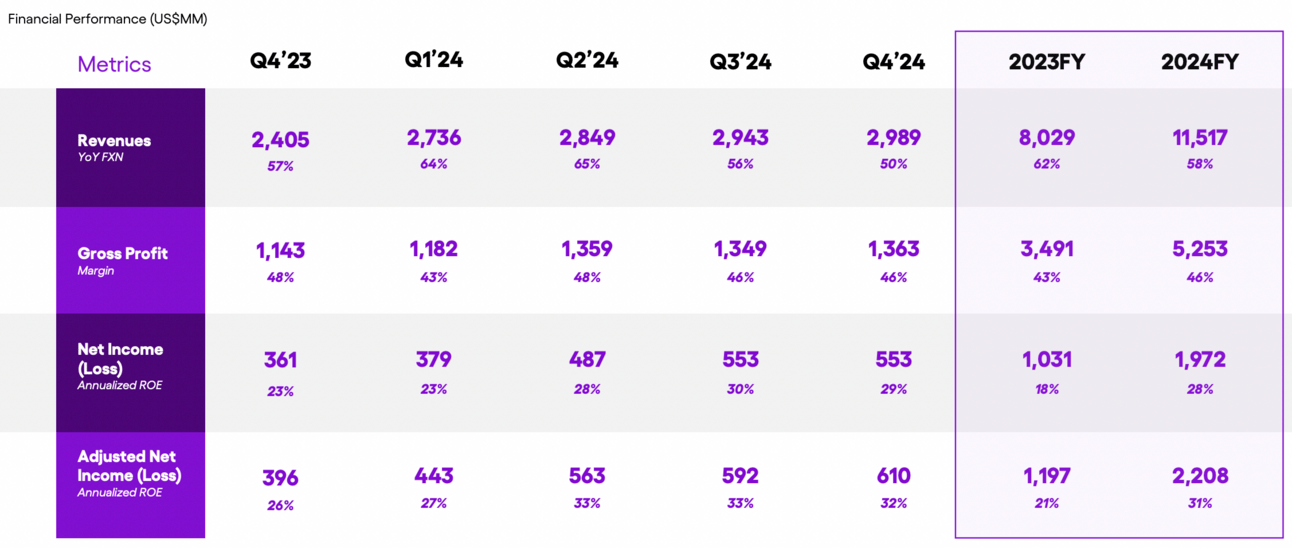

Financial success followed, with revenue reaching $11.5 billion and net income reaching $1.97 billion in 2024. The company’s mobile-first approach translated into unprecedented efficiency levels, delivering 28% ROE.

Nubank has also become the most valuable bank in Latin America by market cap (Itau retook the leadership in March, but I do not expect this to last for long).

Nubank started by focusing on the underserved, less affluent, customers and has successfully become the primary bank for many of them. However, they are now quickly expanding into the affluent segment with their Ultravioleta offering.

Being a primary bank and successfully competing in the affluent segment is something that very few neobanks in other regions have succeeded with.

Image source: Nubank

In short, Nubank is probably what every Fintech company (at least a neobank) wanted to be. Nubank is now big enough to compete with incumbents, it’s highly profitable, and it’s still growing fast. So why is it Day 1, you might ask.

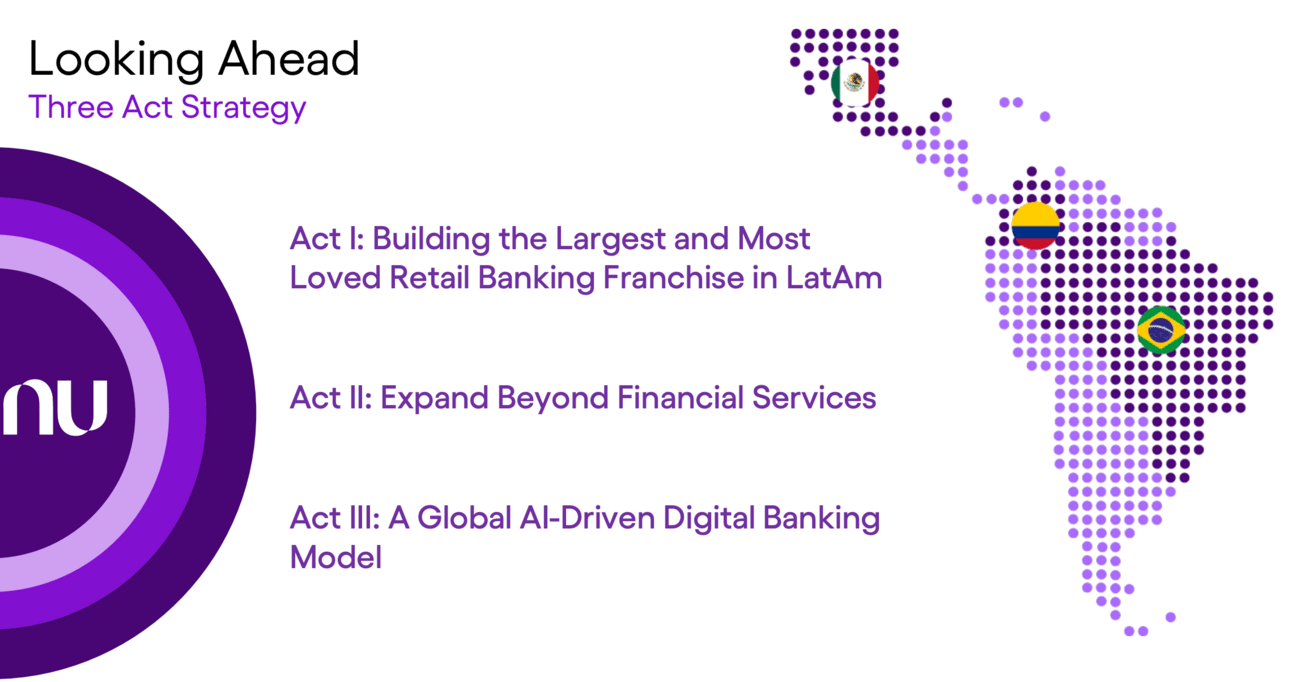

During the Q4 2024 earnings call, David Velez, Nubank’s co-founder and CEO, outlined three priorities for 2025: 1) build the largest banking franchise in LatAm, 2) expand beyond financial services, and 3) “take critical steps to turn the vision" of a global AI-driven digital bank into reality. Nubank is early in all three.

Image source: Nubank Q4 2024 earnings presentation

“While we have achieved significant scale, our market share still represents less than 4% in revenue terms, only a fraction of its full potential. In this growth phase, we will continue nurturing customer love, scaling our credit operations and increasing principality in Brazil, Mexico and Colombia, all while delivering a seamless, fast and globally reliable app experience.”

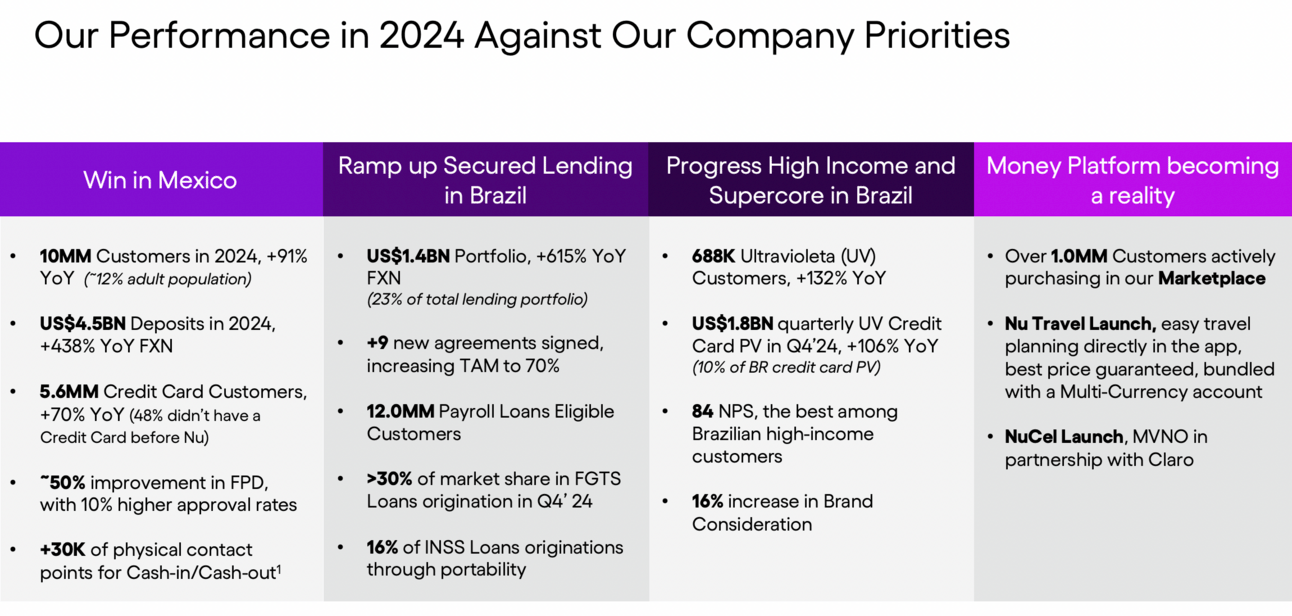

Let’s start with Nubank’s ambition to become the largest retail banking franchise in Latin America. Nubank expanded into Mexico and Colombia between 2019 and 2020, and by the end of 2024, it had already surpassed 10 million customers in Mexico and 2.5 million in Colombia.

“Between 2019 and 2020, our international expansion took us to Mexico and Colombia, following a strategy similar to the one that we had applied in Brazil. Our operations in both countries were launched with our flagship credit card product, and we believe we became the top credit card issuer in Mexico within two years.”

However, compared to Brazil, Nubank’s customer base in Mexico and Colombia is still small (12% of the total). Of course, Mexico and Colombia are smaller countries than Brazil. In 2024, Brazil had a population of 212 million, while Mexico and Colombia had populations of 132 million and 53 million, respectively. But still…there is clearly lots of room for Nubank to grow in these markets.

“In Mexico, we reached an exciting milestone of 10 million customers, up 91% year-over-year, now serving 12% of the country's adult population. Deposits grew significantly, increasing 438% from 2023 to $4.5 billion, reflecting our position as a trusted financial institution.”

Mexico and Colombia also represent just 20% of Nubank’s total deposits. Deposits are growing at a neck-breaking speed both in Mexico and Colombia, so this proportion will certainly change very quickly (especially given that Nubank is paying premium rates to customers now).

“….our performance in Colombia exceeded our expectations. Deposits reached $1.3 billion, just 2 quarters after launching checking account and placing us among the country's top 5 financial institutions based on demand deposits for individuals.”

…and Mexico and Colombia contribute less than 10% of Nubank’s revenue. As I illustrated above, Nubank generates most of its revenue from lending (credit cards and personal loans) and interest earned on customer deposits. Loan portfolios in Mexico and Colombia will take time to build.

During its Q1 2024 earnings call, Nubank compared its performance in Mexico and Brazil, highlighting that Mexico is growing faster than Brazil did at a similar stage. If this trend continues, we should see the same exponential growth in Mexico and Colombia, that we saw in Brazil in the 2021-2024 period.

Image source: Nubank Q1 2024 earnings presentation

“Mexico is already surpassing Brazil in terms of time to achieve different key KPIs for the business. When looking into deposits, we have just crossed the mark of $2.3 billion of retail deposits, more than double the amount at the end of 2023 and representing 1.2% share of total deposits in Mexico compared to the 0.5% we had in Brazil at the same time.”

In summary, Nubank is still early when it comes to monetization of its operations outside of Brazil. They have done the groundwork, but we are yet to see that translating into revenue and profit. Now, let’s discuss Nubank’s ambition to expand beyond financial services.

However, let’s start with Nubank’s non-lending services. Nubank has a successful track record of launching and scaling non-lending services. Thus, in 2020, Nubank expanded into investments through the acquisition of Easynvest (which became NuInvest). It also partnered with Chubb to launch life insurance, NuLife.

“In 2020, diversifying further, we ventured into insurance and investments, by launching NuLife, a life insurance product seamlessly integrated and distributed through our mobile app in partnership with Chubb Limited, a leading global policy underwriter, and by acquiring Easynvest, a leading retail investments platform in Brazil, later rebranded as NuInvest.”

More recently, in 2022, Nubank launched NuPay - its own branded checkout button with BNPL capabilities. Using NuPay, Nubank customers can pay online using their account balance or convert the payment into interest-free installments. I haven’t seen Nubank disclose any statistics about NuPay. However, they did sign a number of prominent partners, such as Uber.

Image source: Nubank

“In 2022, we launched NuPay, a new and disruptive way to pay for online purchases with just a few clicks within the Nubank app, offering a more practical and secure experience that enables customers to pay with their account balances or interest-free installments offered by retailers.”

Now, Nubank uses its customer base and product development muscle to expand beyond financial services. The company launched Nu Shopping (referred to as Nu Marketplace in investor materials), a curated e-commerce platform within its mobile app; Nu Travel, a service for booking flights and hotels; and NuCel, a mobile phone plan offered in partnership with Claro.

Image source: Nubank Q4 2024 earnings presentation

“The strategic expansion of our ecosystem has continued with the launch of NuCel in Brazil's massive telecom services market and the build-out Nu Marketplace. What's particularly exciting is that these are entirely new and significant avenues of growth for us, along with Nu Travel and NuPay.”

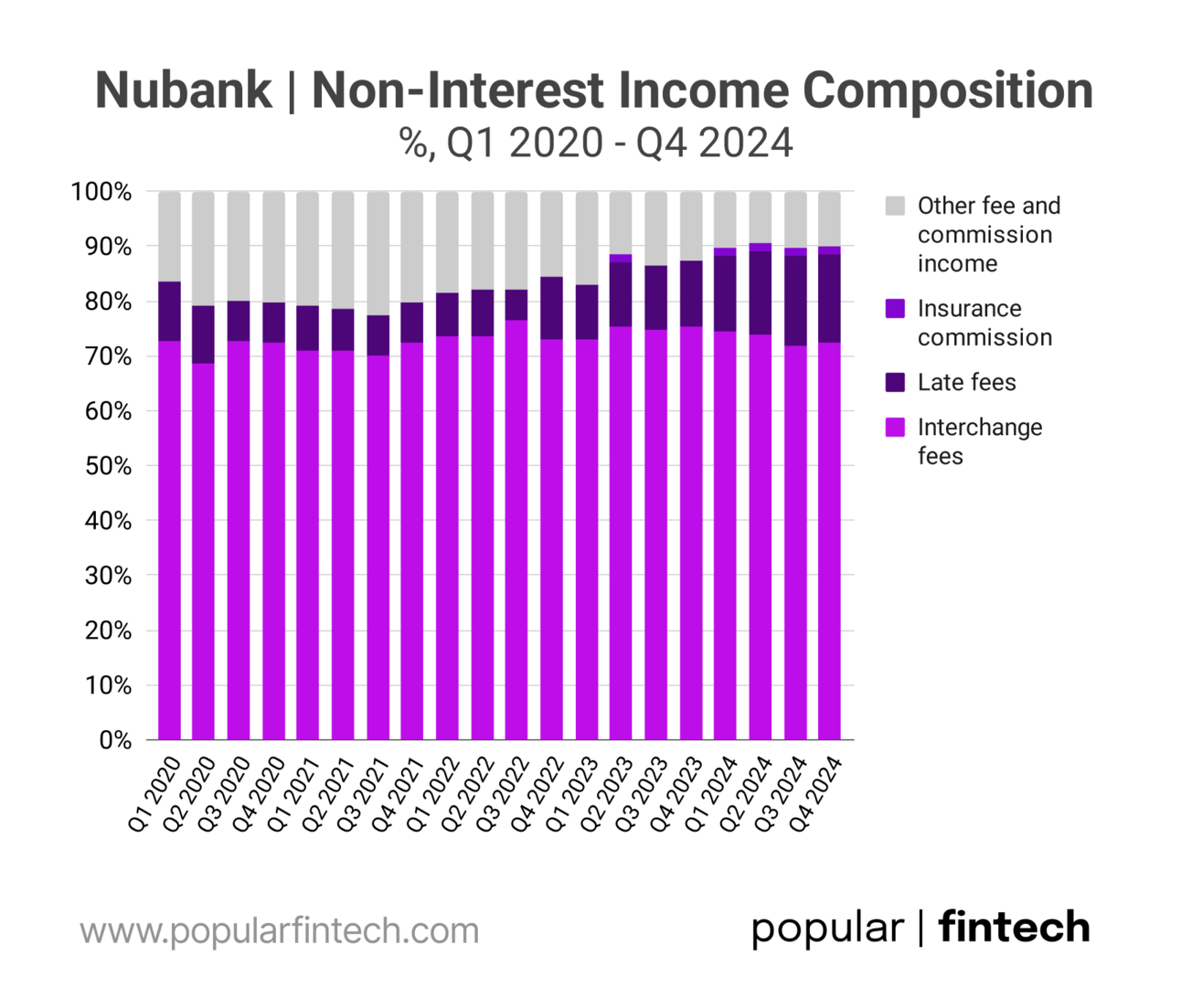

Despite many launches and early traction, Nubank still makes most of its non-interest revenue from interchange and late fees. The revenue from non-lending products (credit cards and consumer loans) represents about 10% of non-interest income (and as I mentioned above, total non-interest income represents just 14% of the company’s gross revenue).

“We've mentioned last year that 30% to 40% of our employees today are building products that are generating no revenue. So we're investing significantly for these next 10 years of evolution already.”

In summary, Nubank has a track record of launching and scaling non-lending products, but it is super early in monetizing those. Now, let’s discuss the company’s vision of becoming “a global AI-driven digital bank.”

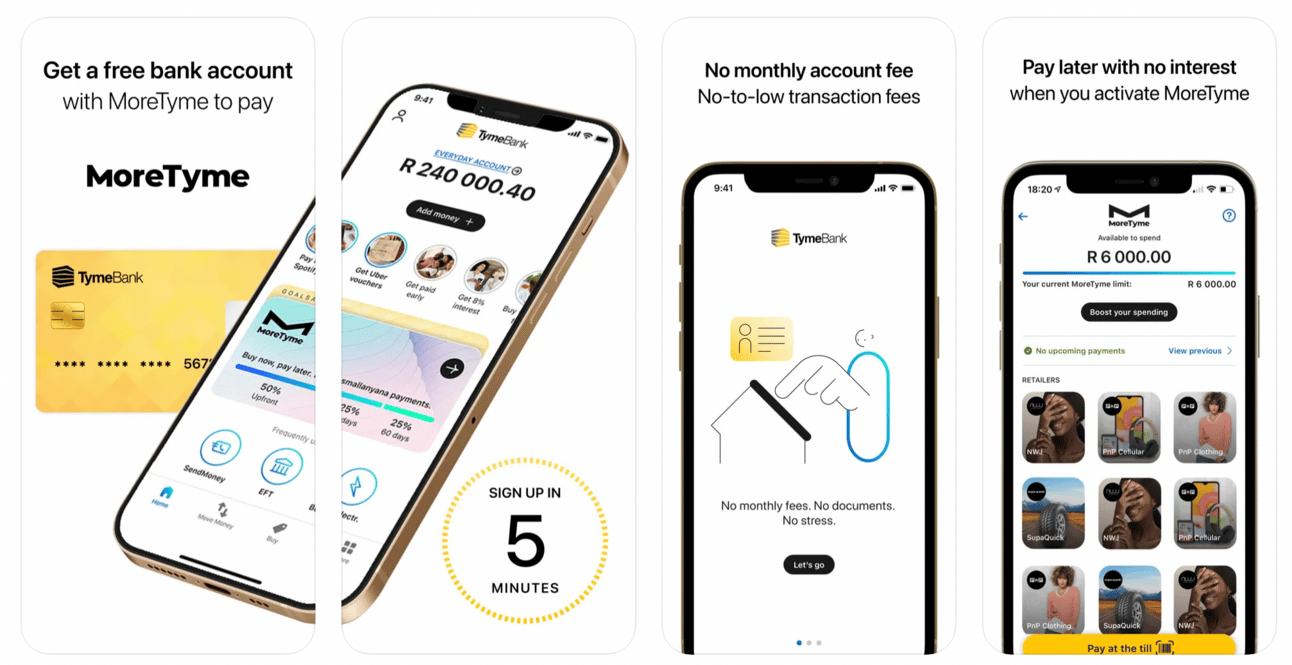

I believe it was the first time Nubank explicitly said they are planning to expand beyond Latin America. They made a number of strategic investments in neobanks operating in other parts of the world. Thus, they invested in Jupiter, operating in India, and Tyme, operating in South Africa and the Philippines.

Image source: TymeBank in the App Store

“Founded in 2019 in South Africa, Tyme Group specializes in emerging markets populations and, besides South Africa and the Philippines, it has a Global Headquarters in Singapore and a development hub in Vietnam, where it plans to open its next operation. With the objective of offering an affordable banking solution and maintaining a lower cost structure than traditional banks, Tyme Group has reached more than 15 million customers.”

However, David Velez’s comments during the Q4 2024 earnings call suggest that they are preparing to expand to other markets directly. Thus, he spoke about building technical capabilities to quickly expand into new geographies. And, apparently, they have already been working on it for the past “18 to 24 months.”

“A big part of that speed of the internationalization has to do with our technology platform. No other global consumer retail bank, has been able to build a multi-country platform that is extremely efficient, that has one core base, once code base, that ultimately could give them a significant advantage in expanding. And we've actually been building this already for about 18 months and probably have another 18 to 24 months.”

Last year, Nubank also acquired an AI company, Hyperplane, which specialized in enabling financial institutions to train their own machine learning models used across risk management, collections, and marketing departments.

At the time of the acquisition, it felt like Nubank was trying to improve its AI capabilities. However, the ambition of a “global AI-driven digital bank” adds a new perspective to this acquisition.

Image source: Techcrunch

“Hyperplane’s AI technology will seamlessly integrate into our systems, enhancing our ability to analyze vast datasets and personalize our services on a granular level. This is a significant milestone in our journey towards a smarter, AI-first banking ecosystem.”

So where will they expand? While working on the “State of Fintech 2025” report, Simon Taylor and I debated who might become the “Nubank of the U.S.”. Could it be Cash App, Chime, or maybe even PayPal, if it manages to expand Venmo beyond peer-to-peer payments? But what if “the Nubank of the U.S.” will actually be Nubank?

Image source: State of Fintech 2025

I would think that acquiring Jupiter or Tyme, and trying to replicate its blueprint in India or Africa, would make more sense for Nubank. After all, they made those investments for some reason. However, I cannot exclude the option of Nubank pursuing the opportunity in the United States. After all, if any non-US neobank can succeed in the U.S., this probably would be Nubank.

“Reflecting on 2024, we're very pleased with the progress we've made across our strategic priorities, and we see several early indicators confirming that we remain on the right path. Nevertheless, our perspective is that it's still just day 1. We remain focused, ambitious and excited about what's ahead.”

Needless to say, none of the above is happening overnight. The opportunity in LatAm is probably more concrete. Expanding into non-financial services is still not a given. And going global is just a call option. But, oh my…this sounds super exciting!

Cover image source: Nubank

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.