Hey!

Block’s fourth-quarter shareholder letter was disappointing. Square has fallen behind the competition in terms of growth. Cash App’s user growth has stalled. Yet, Jack Dorsey prioritized building open-source software, mining hardware, and the non-custodial wallet.

However, it seems that the rest of the Block’s team is working hard at reigniting growth in Block’s $XYZ ( ▲ 1.45% ) existing businesses. Square is doubling down on its growth in the mid-market seller segment, and Cash App is doubling down on lending. These plans are real and are expected to start changing the company’s growth trajectory as soon as the second half of this year.

Will this turnaround happen while Block’s chief is focused elsewhere? I hope so. I hope Dorsey’s quest for the next big thing doesn’t distract the rest of the team. I hope Square and Cash App get the resources they need to execute their plans. Maybe that’s a lot to hope for, but hope seems to be a necessary trait for any Block shareholder.

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

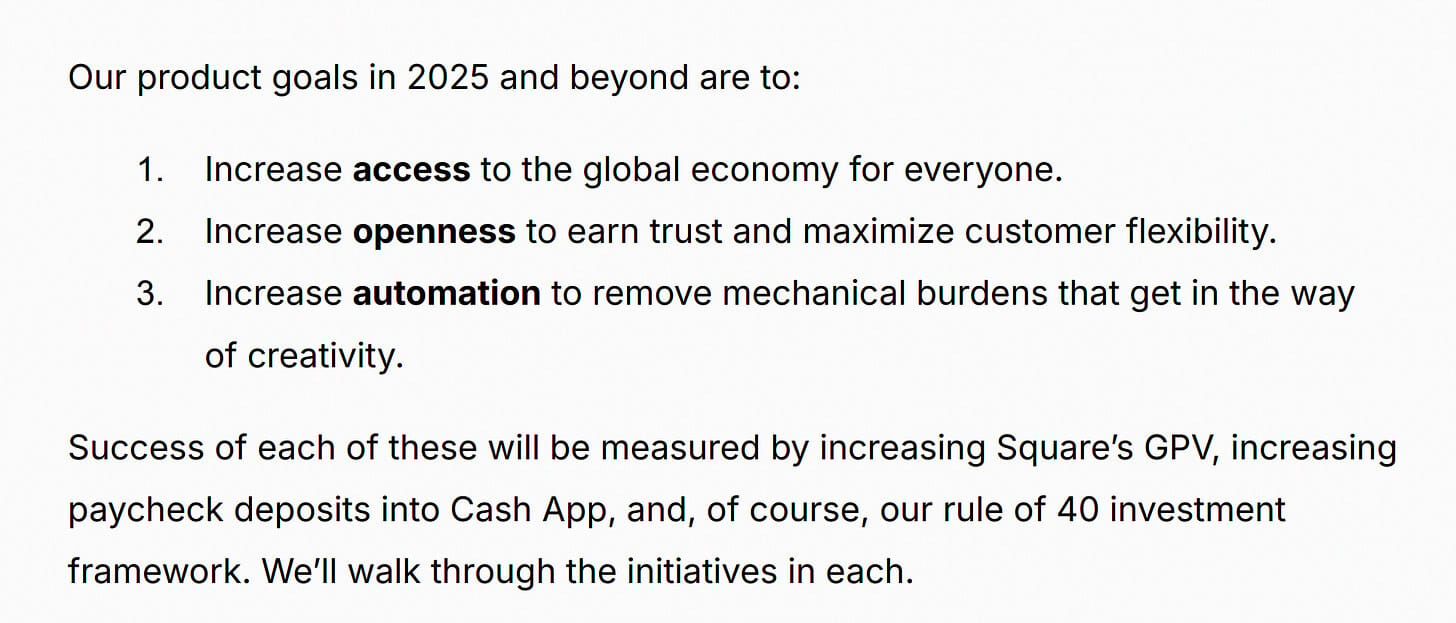

Block reported its Q4 and full-year 2024 results this week. Jack Dorsey dedicates each shareholder letter to a specific topic and previous letters covered Square, Cash App, Bitcoin, and lending. This quarter’s letter was dedicated to Block’s product goals for 2025…and it was SUPER WEIRD.

Image source: Block Q4 2024 Shareholder Letter

If you follow Block, then you know that the company’s founder and CEO, Jack Dorsey, is considered to be a wild card. Some see him as a visionary, while others are convinced he'll eventually mess things up. The main criticism against him is that he is not the greatest allocator of capital, and tends to throw money at things that have questionable benefits to the shareholders.

I think the Q4 2024 shareholder letter made many people switch to the “he will mess things up” side. Square has fallen behind the competition in terms of growth, Cash App seems to have maxed out its TAM, but Jack Dorsey wants to build open-source protocols, mining hardware, and the non-custodial wallet. How all of this will help Square or Cash App is unclear.

Openness.

We believe that by building for and on open-source systems and protocols we will increase trust, customer flexibility, and global adoption. This will underlie all of our work, but will show up most obviously in our platform and bitcoin initiatives, our bitkey non-custodial wallet, and Proto, our open bitcoin mining system.

Block Q4 2024 Shareholder Letter

My first reaction was “That’s enough, I’m done with this nonsense!” But then I decided to calm down and take a more objective look at what was happening. Because some things work well at Block. And my thesis is that Block is doubling down on these growth areas despite Dorsey being mentally somewhere else.

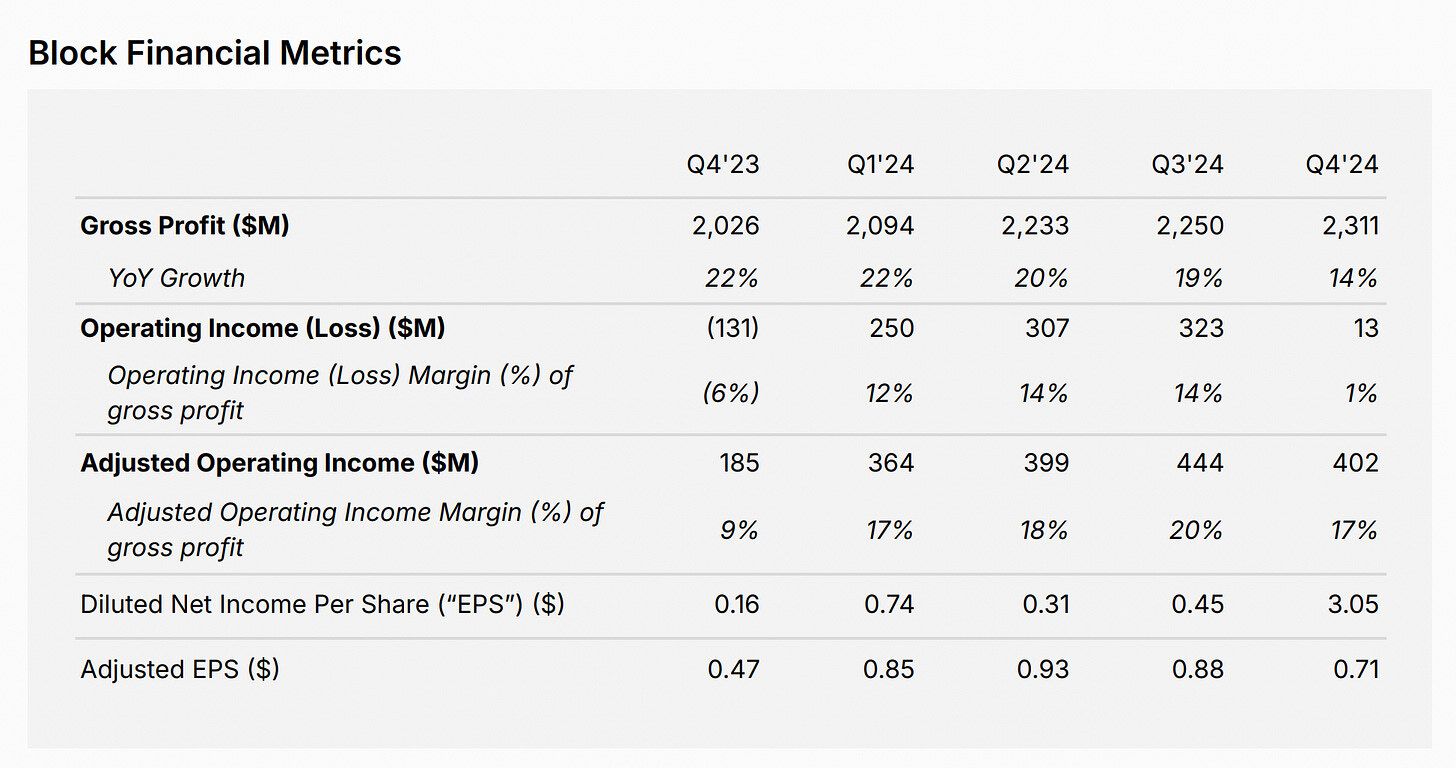

So what’s working? Block reported $2.31 billion in gross profit for the quarter and $8.89 billion for the year (up 18% YoY). Adjusted Operating Income came in at $402 million for the quarter and $1.61 billion for the year (up 358% YoY).

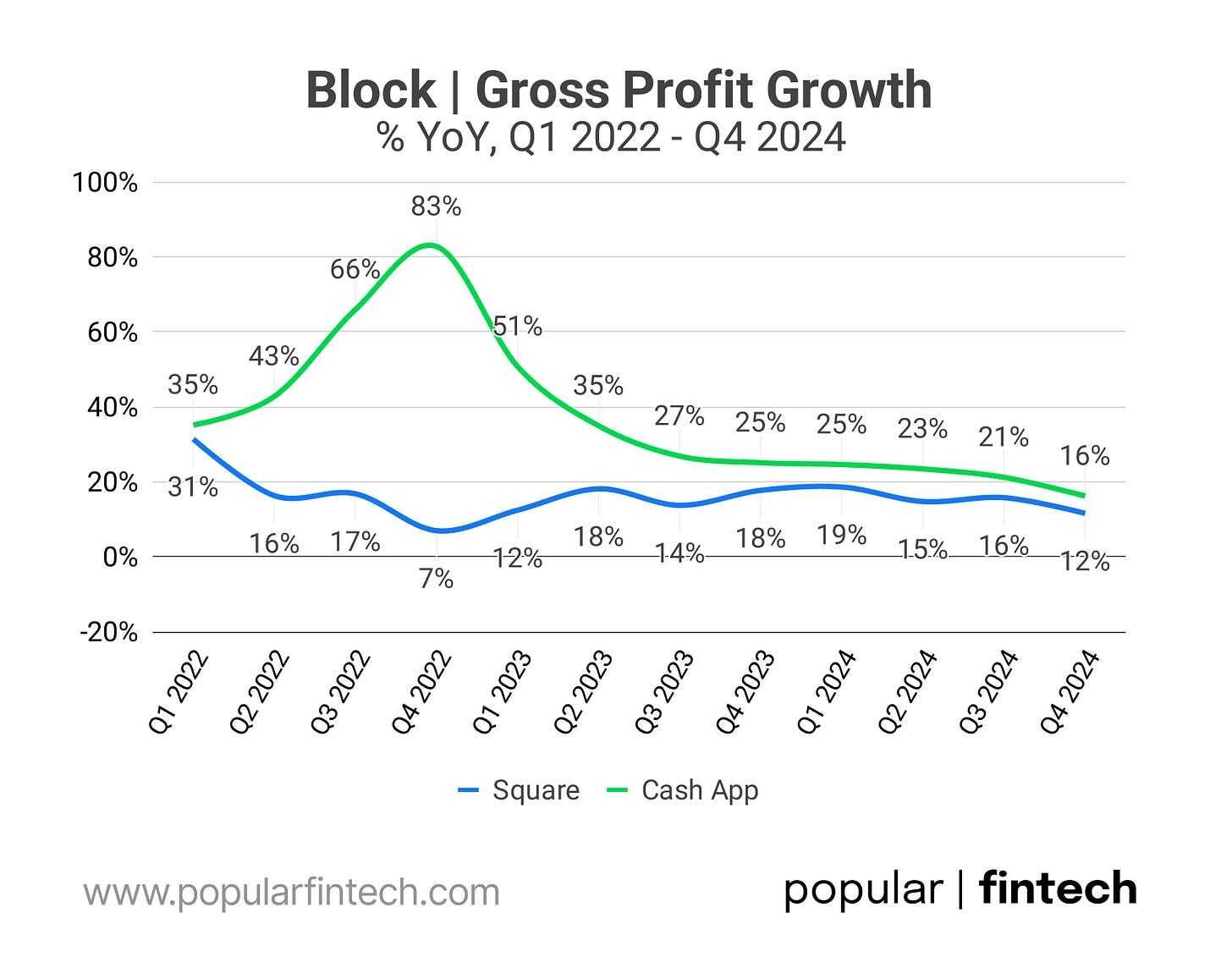

Gross profit growth is clearly decelerating on both the Square and Cash App side. Thus, in Q4 2024, Square’s gross profit grew 12% YoY (compared to 18% YoY a year ago), while Cash App's gross profit grew 16% YoY (compared to 25% YoY a year ago).

Block’s management guided for gross profit growth of 11% in Q1 2025 and 15% YoY for the full year 2025, meaning that the gross profit growth will decelerate further before accelerating in the second half of the year.

So where would the acceleration in the second half of 2025 come from? Block is doubling down on things that already work. Square is doubling down on the mid-market seller segment, and Cash App is doubling down on lending. This will, eventually, help offset the sluggish growth in Square’s U.S. small business and micro merchant category and the stalled Cash App user growth.

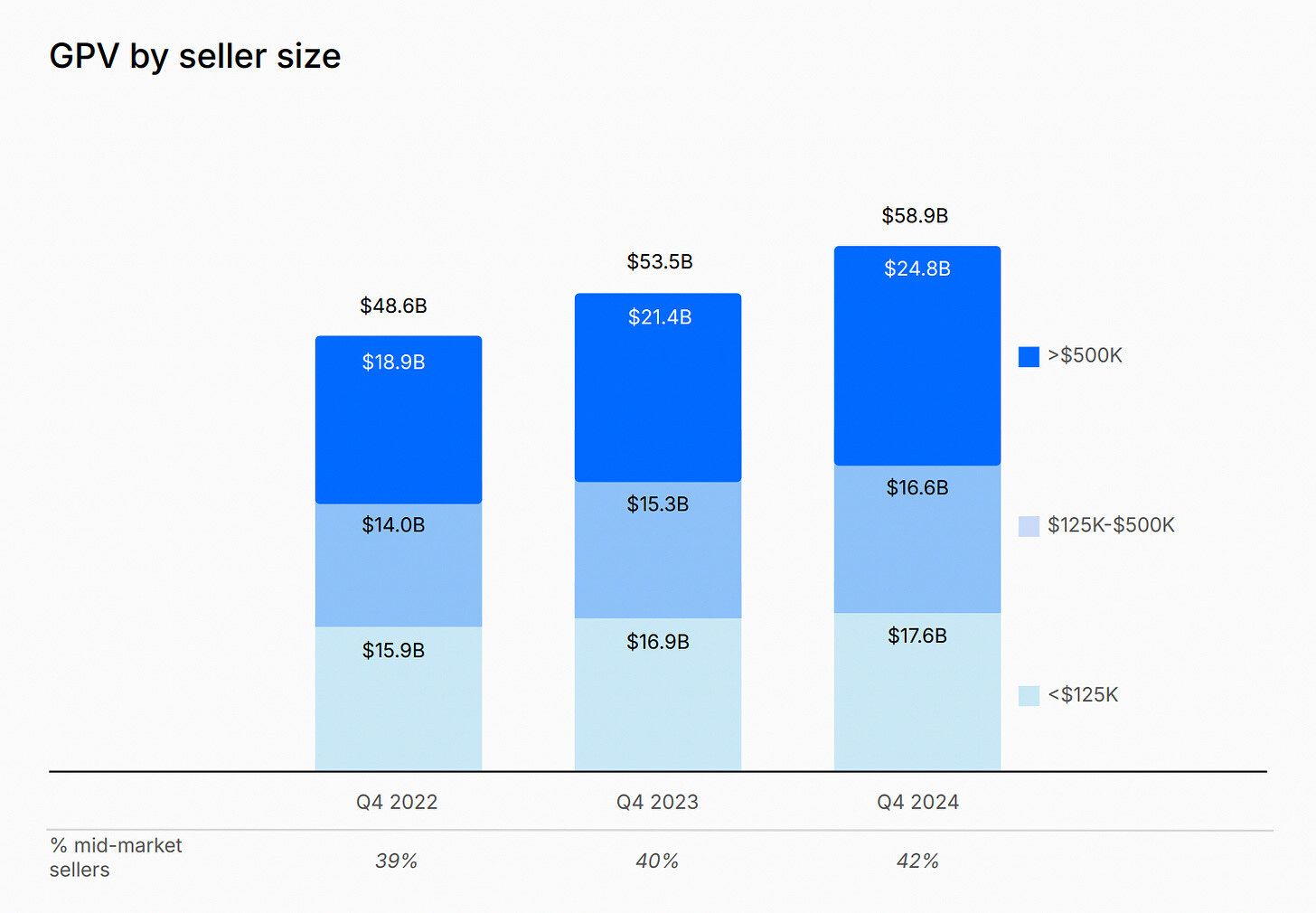

Let’s start with Square. In Q4 2024, Square’s mid-market seller segment GPV grew 15.9% YoY, compared to 8.5% YoY growth in the SMB, and 4.1% YoY growth in the micro merchant segment. These are smaller merchants that hold Square back.

Image source: Block Q4 2024 Investor Presentation

Mid-market sellers have quietly become the largest merchant segment for Square in terms of GPV (see the chart below), and now Block is sharpening its focus on this segment by hiring field sales. Hiring field sales was, in my opinion, a fundamental shift for Square, and gives them a chance to compete with Toast and Shift4.

“We are growing our field sales presence so we can serve more upmarket sellers. We hired our first dedicated field sales cohort in November and have continued to hire field sales representatives in the first quarter of 2025.”

Block Q4 2024 Shareholder Letter

By the way, Square also prioritizes two sub-segments: Food & Drink and Retail. These two segments represent half of Square’s GPV. Square is building new features to address the needs of more sophisticated merchants. Are they at par with Toast’s and Shift4’s offerings? I don’t know, but I believe the ambition is to become a viable alternative.

Image source: Block Q4 2024 Investor Presentation

“That acceleration in the fourth quarter was driven primarily by two key metrics, same-store growth across our verticals as well as improved seller retention. The two verticals that I would call out in particular driving the acceleration are the two that we're most focused on, which is Food & Beverage and Retail.”

Amrita Ahuja, Block CFO

Block Q4 2024 earnings call

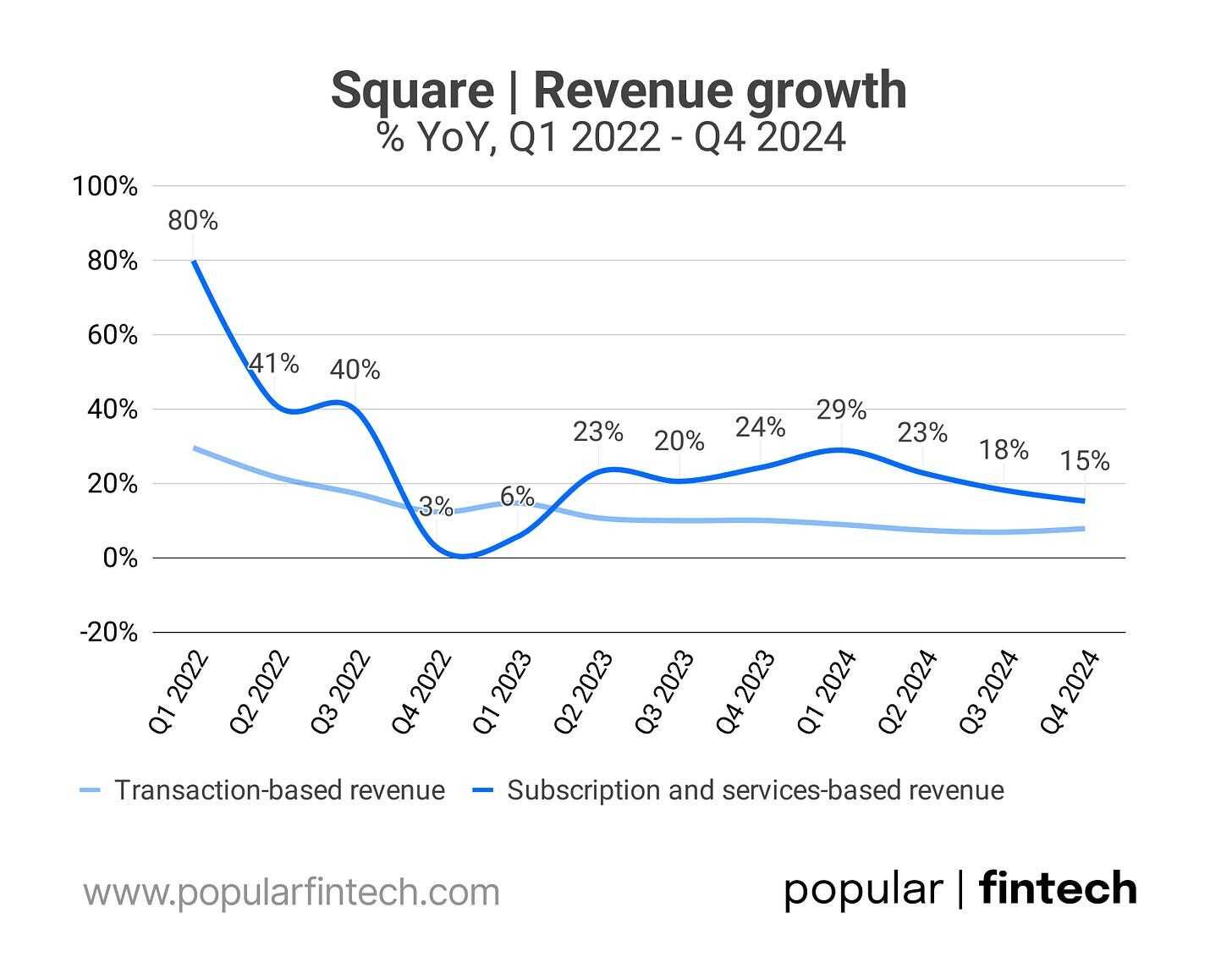

Focusing on the larger merchants allows Block to sell more software and Square Banking products. Transaction-based revenue closely follows GPV growth, but the subscription and services-based revenue is growing in double-digits. Needless to say, that software has a much higher gross profit margin than payment processing.

“We rolled out Scan The Pay functionality, introduced house accounts, launched other features to bolster our food and beverage offerings, which is a big focus for us. And we rolled out Instant Payouts for marketplace delivery orders, which is helping customers with the task of managing their cash flow. But the net of it is we have a much stronger go-to-market.”

Jack Dorsey

Block Q4 2024 earnings call

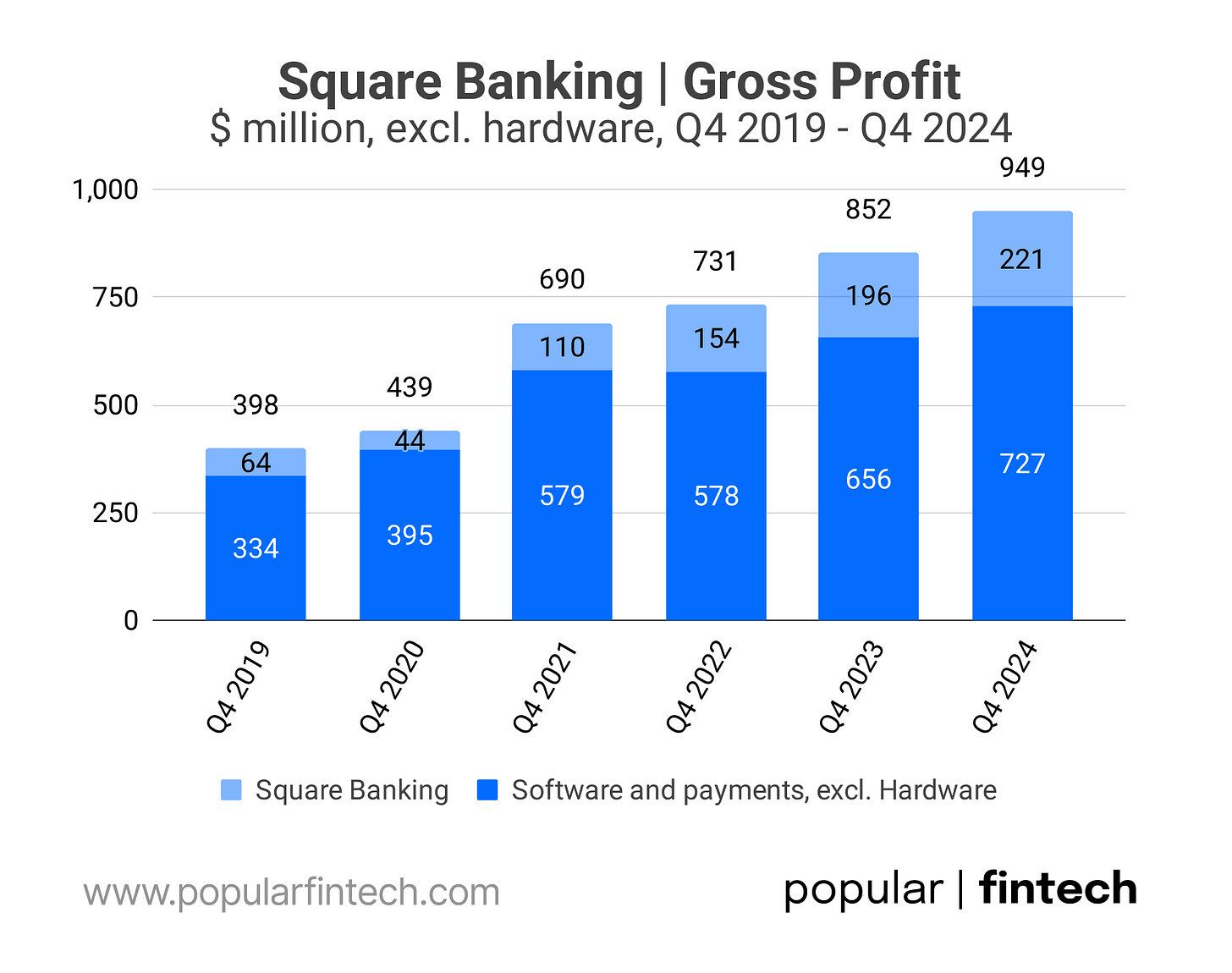

Square Banking (lending, accounts, cards, and instant payouts) drives both revenue and gross profit while also serving as a customer retention tool. In Q4 2024, Square Banking's gross profit growth decelerated to 13% YoY (compared to 28% YoY a year ago), but is still growing nicely.

“In 2023, we saw a 15% improvement in retention of sellers who adopted a full suite of banking products (3 or more) compared with sellers that did not. Lending also improves our ability to cross sell other products.”

Block Q3 2024 Shareholder Letter

In summary, Square is trying to “graduate” from its original segment, small and micro merchants. Serving larger merchants opens many doors for Square, including selling more software and Square Banking products. Yes, selling to larger merchants requires having a salesforce, but luckily Square has finally realized that.

Moving on to Cash App. In its Q3 2024 Shareholder Letter, Block promised to “transform 24 million Cash App Cards into a better alternative to credit cards” by launching Afterpay on Cash App Card.

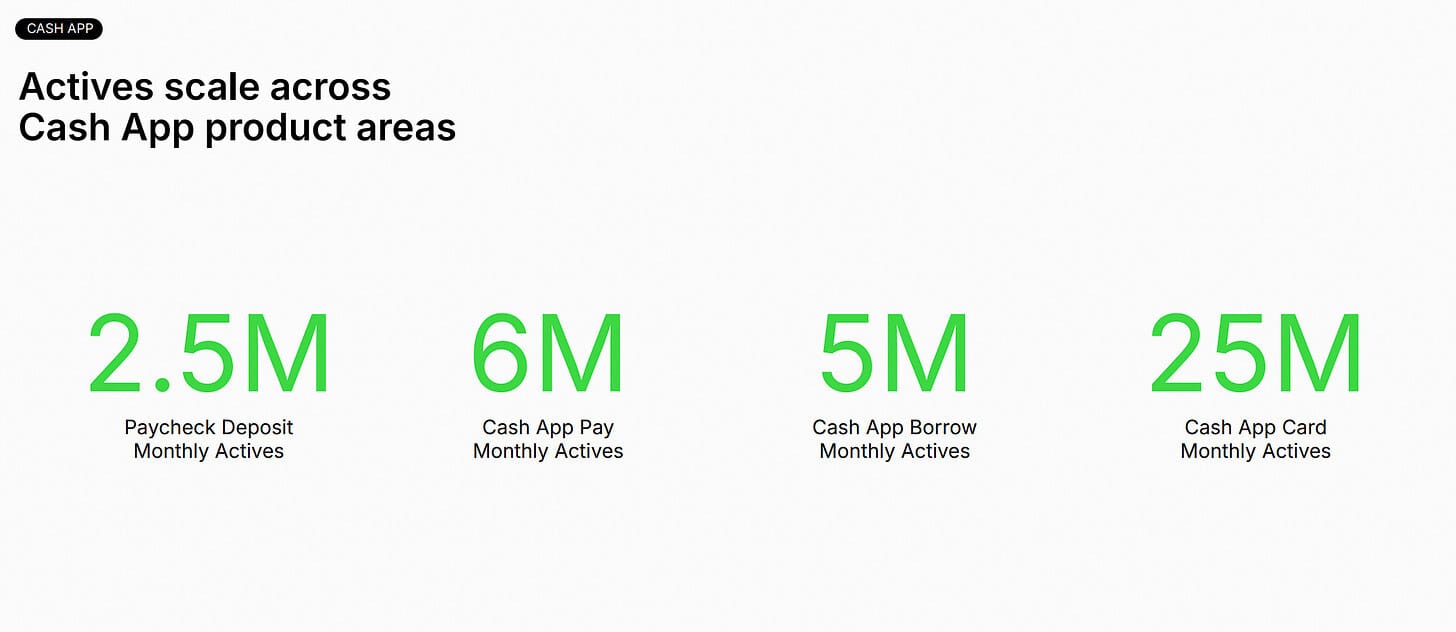

A quarter later, Block reported having 25 million Cash App Cards. However, it seems that Cash App has maxed out its TAM at 57 million monthly active users and $70-71 billion in quarterly inflows.

The key revenue drivers for Cash App are the interchange from the Cash App Card spend and the fees for its instant deposit product, and both are heavily dependent on the inflows. Thus, doubling down on lending is the only viable path, at least in the short term, to grow revenue and gross profit.

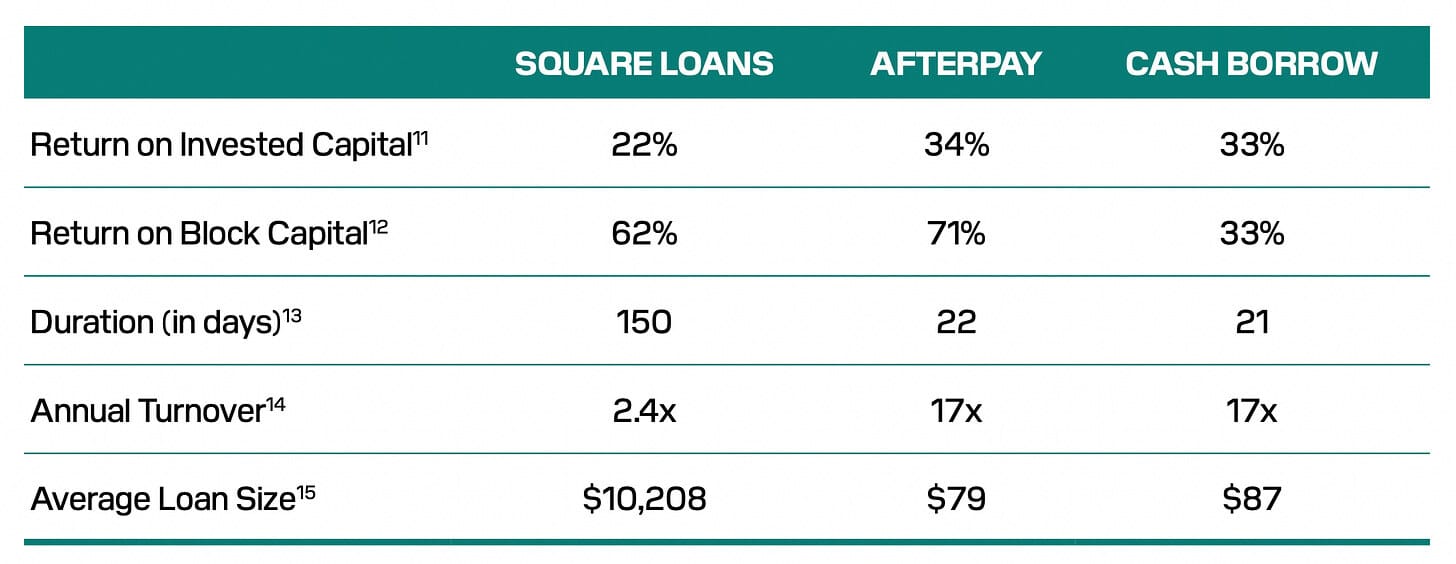

Block offers two consumer lending products: Cash App Borrow, a cash advance service, and Afterpay, a Buy Now, Pay Later (BNPL) financing option. Cash App Borrow and Afterpay loans are very similar in their duration and amount (see the table below), but serve different purposes.

Image source: Block Q3 2024 Shareholder Letter

“With the success of Square Loans for sellers, we decided to build for consumers, and the vast untapped market of 45 million U.S. adults unable to access credit through traditional means. We did this in two ways: acquiring Afterpay and launching Cash App Borrow.”

Block Q3 2024 Shareholder Letter

In December 2024, Cash App Borrow reached 5 million monthly active users, which represents less than 9% of Cash App’s total active user base. In 2024, Cash App Borrow originated “nearly $9 billion” in loans.

“This year, we plan to expand to additional customers and offer higher limits by improving underwriting, refining unit economics, expanding to more states, and integrating [Cash App ] Borrow with Direct Deposit.”

Amrita Ahuja, Block CFO

Block Q4 2024 earnings call

Afterpay originated $10.3 billion in Q4 2024, and $33.3 billion in the full year of 2024. This represents a 19% YoY growth in origination volume for the quarter and 22% YoY growth for the year.

Afterpay has the same scale as Affirm and PayPal. Affirm originated $31.2 billion in 2024 (up 34% YoY) and PayPal originated $33 billion (up 21% YoY). And now, Block is finally moving forward with integrating Afterpay into the Cash App ecosystem.

Thus, this month (February 2025), Block “began rolling out a new offering that integrates Afterpay with Cash App Card, enabling eligible customers to retroactively pay over time for their purchases.”

What’s interesting is that Cash App also has Cash App Pay, which in a sense, competes with Afterpay as a payment method at checkout. In December 2024, Cash App Pay reached 6 million monthly active users. A year ago, Block disclosed 3 million monthly Cash App Pay users and $2.5 billion in annualized payment volume.

I don’t understand why Block would want to invest in two checkout buttons, Afterpay and Cash App Pay (will Afterpay be merged into Cash App Pay?), but I guess this is a topic for another day.

“Our full year guidance implies a meaningful inflection in growth during the year... We expect a more pronounced acceleration in Cash App as we broaden access to Cash App Borrow, launch and scale Afterpay on Cash App Card and invest in marketing.”

Amrija Ahuja, Block CFO

Block Q4 2024 earnings call

In summary, Block owns one of the largest BNPL lenders in Afterpay, which grows originations at around 20% YoY. It has scaled Cash App Borrow to meaningful origination volumes with more potential for growth within the existing customer base. And now it is bringing Afterpay to the Cash App customers. Sounds like we will be hearing a lot about Cash App lending businesses in the coming years.

Did the above get you excited about what's coming next for Block? Jack Dorsey might be looking for the next big thing, but the rest of Block’s team seems to be focused on reigniting Square and Cash App growth. 2025 should be a big year for Block and this is super exciting!

I mean, I hope it will be a big year.

Cover image source: Afterpay

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.