Hi!

Hope you had a fantastic weekend! I read two stories on Friday: one about Goldman Sachs trying to exit its partnership with Apple (which essentially means a full retreat from consumer business), and the second about the consumer lender SoFi going mainstream and aiming to become a “top 10 financial institution in the US.”

If SoFi succeeds in its mission, it will make for an amazing case study on how startups succeed where big corporations fail. More on that in today’s newsletter:

Goldman Sachs seeks to exit its partnership with Apple,

Supreme Court decision brings clarity for SoFi, and

Private equity firms eye majority stake in FIS-owned Worldpay

Thank you for reading and have a great week!

Jevgenijs

Goldman Sachs Seeks to Exit Apple Partnership

Goldman Sachs (NYSE: GS) is seeking to end its partnership with Apple and is in talks with American Express (NYSE: AXP) to take over the Apple credit card and other ventures with the tech giant, according to the Wall Street Journal. While Goldman had previously announced plans to scale back its consumer business, it had shown commitment to its partnership with Apple. However, the recent discussions indicate a desire to offload these businesses and transfer the credit-card partnership to Amex. The deal is not imminent, and Apple must agree to the transfer.

Source: Apple

The company is also discussing transferring its card partnership with General Motors to American Express or another issuer. Exiting the Apple and GM partnerships would effectively end Goldman's consumer-lending business and its ambitions to become a full-service bank. Goldman has already stopped issuing personal loans and is trying to sell GreenSky, a home-improvement lender it acquired last year. If Goldman exits the credit-card business and sells GreenSky, its consumer business would be reduced to its original product, the Marcus savings account.

Goldman entered the consumer banking arena in 2016 with the introduction of its brand "Marcus by Goldman Sachs”. Initially focusing on high-yield savings accounts and personal loans, the company expanded its offerings in 2019 by venturing into the credit card business. This expansion included a partnership with Apple on the launch of the Apple Card and the acquisition of General Motors' card portfolio. In 2022, Goldman Sachs acquired GreenSky. Most recently, in April 2023, Goldman strengthened its collaboration with Apple by becoming the designated banking partner for Apple Savings accounts.

✔️ Goldman Is Looking for a Way Out of Its Partnership With Apple

✔️ Goldman in talks to offload Apple credit card to American Express

✔️ Goldman may be trying to bail on Apple Card

Supreme Court Decision Brings Clarity for SoFi

The US Supreme Court rejected President Biden's proposal to cancel student debt for over 40 million individuals, stating that it exceeds his authority. The court argued that the administration was overstepping its boundaries by attempting to cancel such a large amount of student debt. The plan, estimated to cost $400 billion over 30 years, would have been one of Biden's key initiatives. The student loan payments are set to resume in late August after a three-year pause, which raises concerns that many individuals may struggle to keep up with their debt obligations.

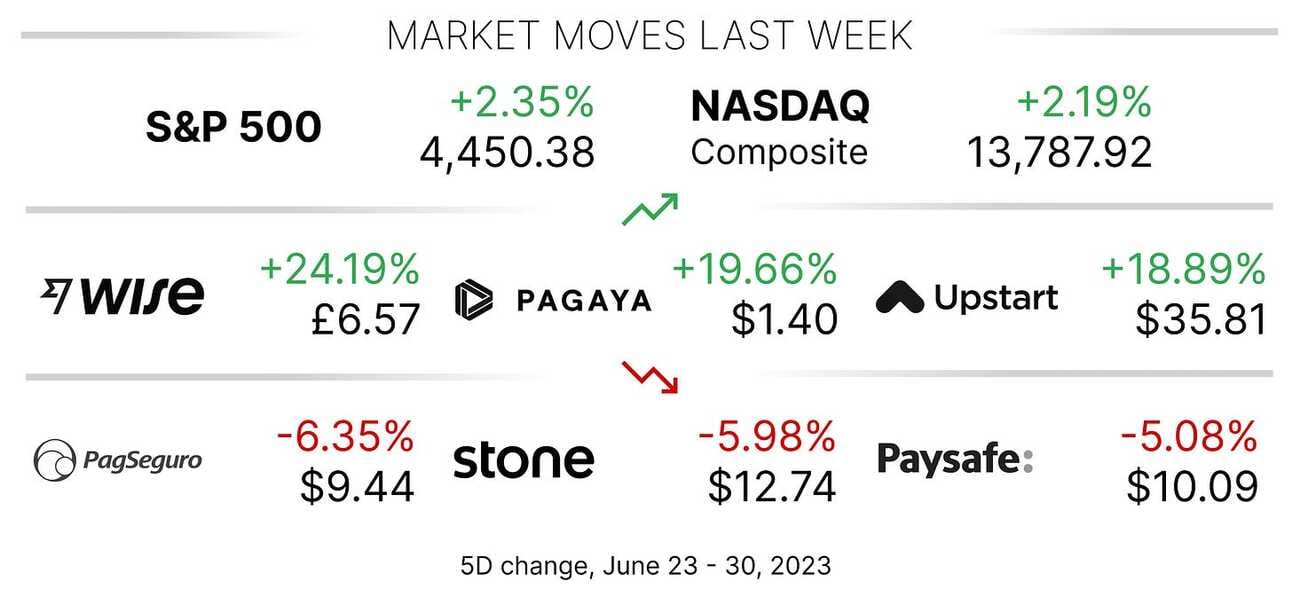

The Supreme Court's ruling has brought much-needed clarity for the consumer lender SoFi (NASDAQ: SOFI), which witnessed a significant decline in its student loan origination volumes. At its peak in the fourth quarter of 2019, the company originated loans worth $2.4 billion, but this figure plummeted to $0.5 billion in the first quarter of 2023, as borrowers awaited the court’s decision before refinancing their loans. Last month, the US debt-ceiling deal, struck by the White House and House Republican leadership, put an end to the freeze on student loan payments, which was introduced at the onset of the COVID-19 pandemic.

Nevertheless, investors believe that the outcome was anticipated, according to Barron’s, which might explain the stock's decline following the court’s decision. In addition, analysts from J.P. Morgan expressed concerns about SoFi's optimistic expectations for a refinancing windfall, suggesting that the stock may be overvalued. SoFi management estimates that the potential refinancing opportunity over the next several years is valued at approximately $200 billion. However, J.P. Morgan has a more conservative estimate, expecting it to be closer to $90 billion, approximately half of SoFi's projection.

✔️ Supreme Court Throws Out Biden’s Student-Loan Relief Plan

✔️ Why SoFi Stock Is Falling After Supreme Court Rules Against Student-Loan Forgiveness

✔️ SoFi Once Billed Itself as the Anti-Bank. Now It’s Going Mainstream

Private Equity Firms Eye Majority Stake in Worldpay

According to the Financial Times, private equity firms, including Advent and GTCR, are considering making bids for a majority stake in the payments provider Worldpay, which is currently owned by FIS (NYSE: FIS). The deal, which values Worldpay at over $15 billion, would be one of the largest corporate carve-outs ever. FIS had earlier announced plans to spin off Worldpay as a publicly traded business, as well as reported “making meaningful progress with the spin-off” during its first quarter earnings call. Thus, this potential buyout would represent a shift in strategy.

Advent is not new to Worldpay. Thus, in 2010 the company partnered with Bain Capital to acquire a majority stake in Worldpay from the Royal Bank of Scotland. By 2013, Advent had gained full control of the company. In 2017, Worldpay was sold to Vantiv, and two years later, FIS acquired the combined entity. Charles Drucker, who previously led Worldpay during its ownership by Advent and Bain, joined FIS in February as a strategic advisor to assist with the separation process and was subsequently appointed as the CEO of the planned merchant business spin-off.

FIS acquired Worldpay for more than $30 billion with the goal of creating a diversified financial technology company offering payment processing services to large banks and retailers. However, after pressure from the activist investors DE Shaw and Jana Partners, the company’s management initiated a review of its business structure and eventually agreed to spin off its merchant business as a separate publicly traded company. The company announced the decision in February this year, and plans to complete the spin-off “within a year.”

✔️ Buyout groups weigh bids for majority stake in FIS-owned Worldpay

✔️ FIS Could Sell Majority Stake of Worldpay in $15 Billion Deal

✔️ FIS Announces Plans to Spin Off Merchant Business

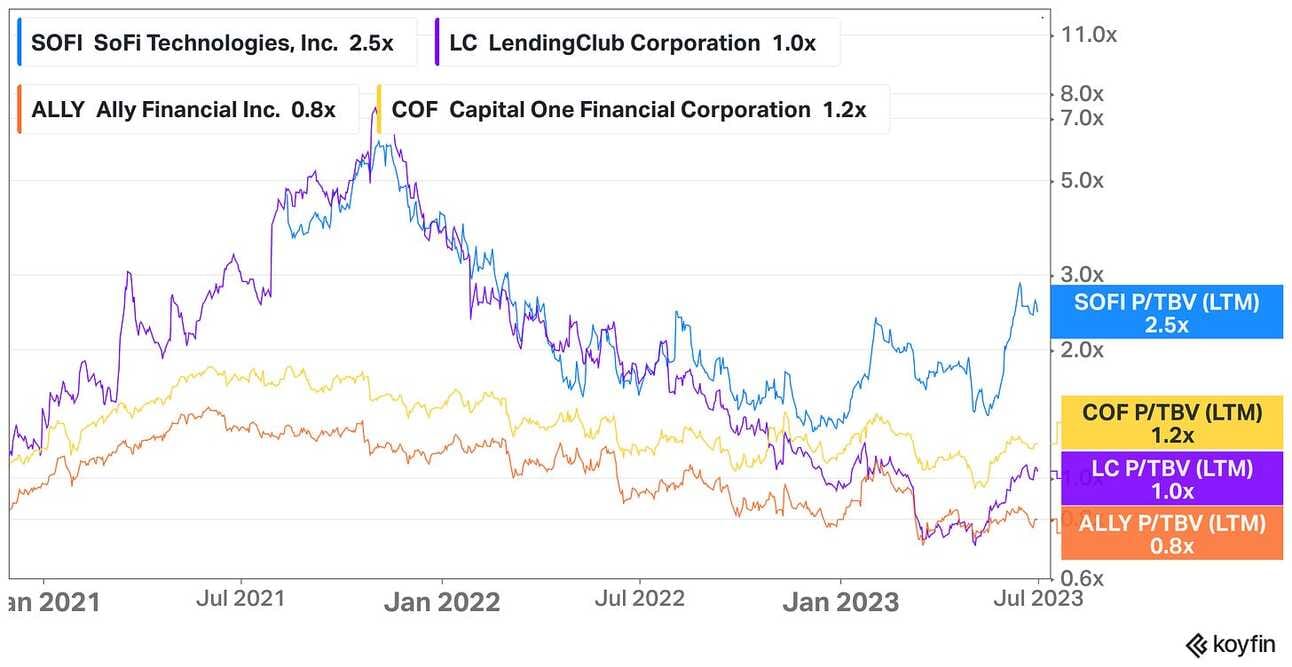

Continuing the discussion on SoFi’s valuation… After the recent rally (+85% YTD), the company trades at a Price-to-Book (P/B) multiple of 1.5x, way above LendingClub’s 0.9x, Capital One’s 0.8x, and Ally’s 0.7x multiples.

…and the difference is even starker when we look at the Price to Tangible Book Value (P/TBV) multiples. Interestingly, LendingClub is trading at a similar multiples, as more mature lenders.

Director, Product Management - Credit Card

@ SoFi

🇺🇸 Seattle, WA or San Francisco, CA, United StatesPrincipal Product Manager, SoFi Money

@ SoFi

🇺🇸 Seattle, WA or Remote, United StatesPrincipal Product Manager, Member Experience

@ SoFi

🇺🇸 San Francisco, CA or Remote, United StatesSoftware Security Engineer, Apple Pay

@ Apple

🇺🇸 Cupertino, CA, United StatesCloud DevOps Engineer, Apple Pay

@ Apple

🇺🇸 Raleigh, NC, United States

Cover image source: Apple

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.