Hi!

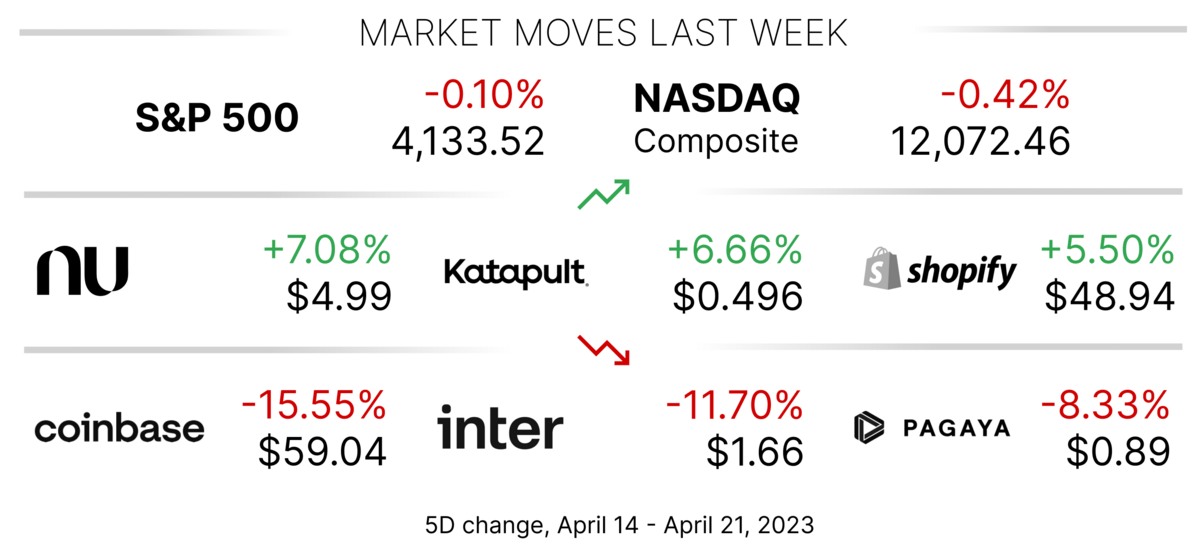

Welcome to the sixth issue of the “Popular Fintech” newsletter! We have a busy week ahead with Visa, Mastercard, Fiserv, FIS, and LendingClub reporting their Q1 2023 results. In the meantime, let’s look into:

Gemini (and Coinbase) joining the bidding for the bankrupt crypto lender Celsius Network

MoneyLion announcing a 1-for-30 reverse stock split of its Class A common shares, and

First Republic Bank reporting its Q1 2023 earnings after markets close

Gemini (and Coinbase) Join Bidding for the Bankrupt Crypto Lender Celsius

Celsius Network, a cryptocurrency lending and borrowing platform, is set to be auctioned off on Tuesday. The bankrupt firm has attracted bids from prominent cryptocurrency exchanges Gemini and Coinbase (NASDAQ: COIN), among others. Coinbase is rumored to be participating in the bid indirectly by backing Fahrenheit, a company led by well-known venture capitalist Michael Arrington along with the former CEO of the blockchain project Algorand. The bidding war highlights the growing interest of established crypto firms in acquiring new assets to expand their offerings and gain a competitive edge in the rapidly-evolving industry. Celsius Network, founded in 2017, has grown to become one of the top crypto lending platforms, with over $20 billion in assets under management. However, the company faced financial difficulties and filed for bankruptcy in the summer of 2022.

Image source: Forbes

✔️ Celsius auction set for Tuesday, Coinbase and Gemini join bidding for bankrupt firm✔️ Celsius auction has Gemini and Coinbase as new bidders✔️ Celsius Network Files for Chapter 11 Bankruptcy✔️ Celsius Network Assets are officially over $20 billion

MoneyLion Announces 1-for-30 Reverse Stock Split

MoneyLion (NYSE: ML), a financial services platform targeting America’s middle class, has announced a 1-for-30 reverse stock split of its Class A common stock, which means that for every 30 shares of Class A common stock, shareholders will receive one share. The reverse stock split aims to increase the per-share price of the company's Class A common stock and meet the listing requirements of the NYSE. MoneyLion's shares will begin trading on a reverse split-adjusted basis on April 25, 2023. MoneyLion offers 0% APR cash advances and monetizes its customer base through subscription and interchange fees. In 2021, the company acquired a content agency Malka Media and an affiliate marketplace EVEN Financial, which became the foundation of the company’s Enterprise segment. MoneyLion went public by merging with Fusion Acquisition Corp in September 2021.

Data source: MoneyLion Investor Relations

✔️ MoneyLion Announces 1-for-30 Reverse Stock Split✔️ MoneyLion Rebrands Embedded Finance Tool✔️ MoneyLion to Start Trading After SPAC Merger

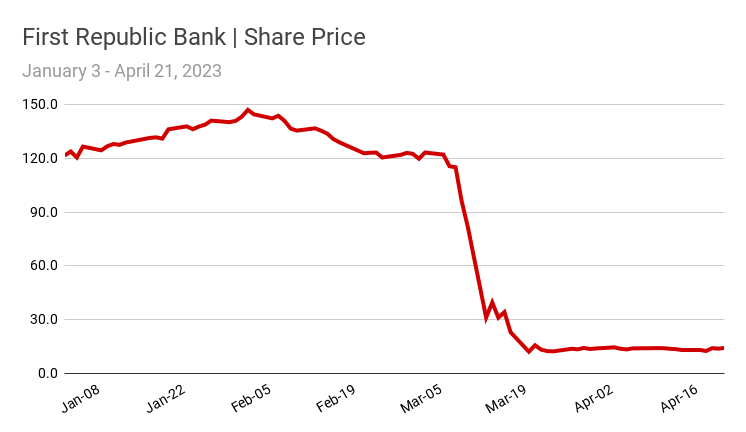

First Republic Earnings Will Reveal Damages Caused by Deposits Outflows

First Republic Bank (NYSE: FRC) is scheduled to report its Q1 2023 results today (April 24, 2023) after markets close. First Republic was at the epicenter of the crisis of confidence in the regional U.S. banks, which was triggered by the collapse of Silicon Valley Bank in March. The company had to be rescued by JPMorgan and other banks, who deposited $30 billion in order to stop the panic and prevent further deposit outflows. The earnings report is expected to reveal the extent of the damage that the deposit outflows have caused to the lender, as well as guide investors on the near-term profitability prospects. In Q4 2022, First Republic reported a Net Income of $386 million on $1.4 billion in revenue. The bank finished the fourth quarter of 2022 with $166.9 billion in loans and $176.4 billion in deposits.

✔️ First Republic Earnings Report to Shed Light on Depth of Bank Crisis✔️ First Republic Worked Hard to Woo Rich Clients. It Was the Bank’s Undoing✔️ Eleven Banks Deposit $30 Billion in First Republic Bank

Chart of the Day

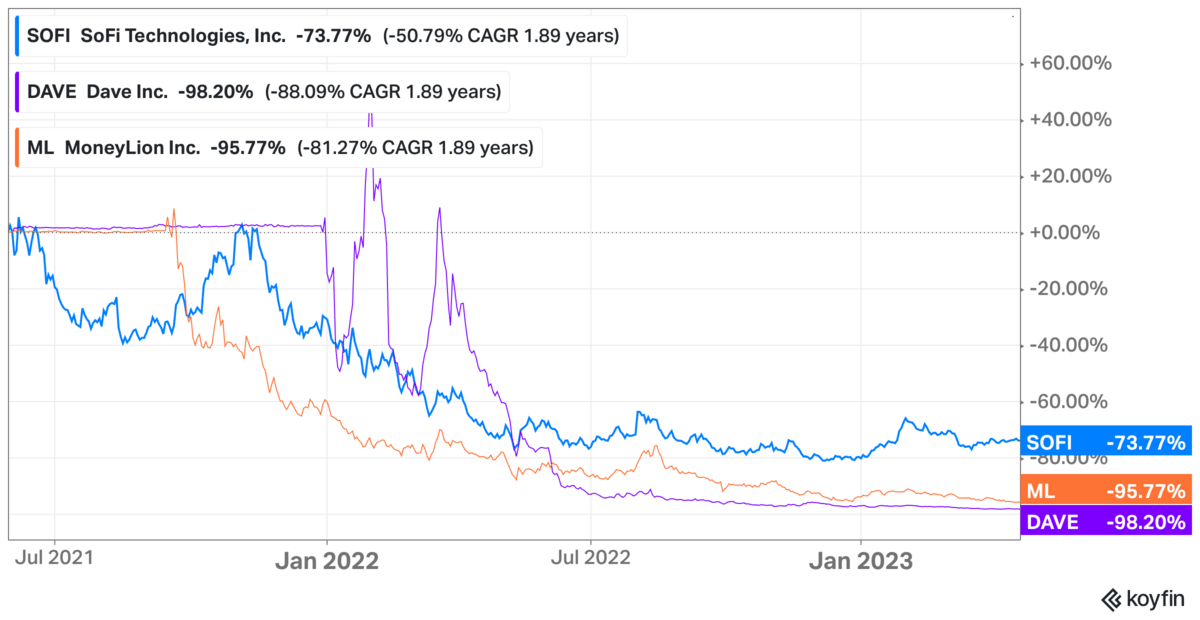

Three neobanks went public in the 2021-2022 period: SoFi (NASDAQ: SOFI), MoneyLion (NYSE: ML), and Dave (NASDAQ: DAVE). All three went public by merging with SPACs. Chime also planned to go public but shelved its plans for a better future. Given the performance of SoFi (-73.77%), MoneyLion (-95.77%), and Dave (-98.20%), Chime executives might have made a genius decision to delay the IPO.

Chart made with Koyfin

Jobs in Fintech

Senior Product Manager, Financing@ CoinbaseRemote, United States and United Kingdom

Senior Manager, Policy Communications@ CoinbaseRemote, United States

Principal Product Manager@ GeminiGurgaon, India

Director of Engineering@ MoneyLionKuala Lumpur, Malaysia

Director of Product@ MoneyLionKuala Lumpur, Malaysia

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image source: Coinbase

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.