Hi!

Yesterday First Republic Bank finally reported its Q1 2023 results. The results were bad and the company is planning to shrink its balance sheet and lay off people, but the bank does not seem to be collapsing or anything. I wouldn’t typically write about companies like First Republic, but this bank was at the epicenter of the regional banking crisis that we witnessed in March, so I thought it was important. Anyways, let’s dive into yesterday’s news:

First Republic Bank reporting larger-than-expected deposit outflows

Coinbase suing the Securities and Exchange Commission, and

Revolut’s valuation cut (almost) in half by one of its investors

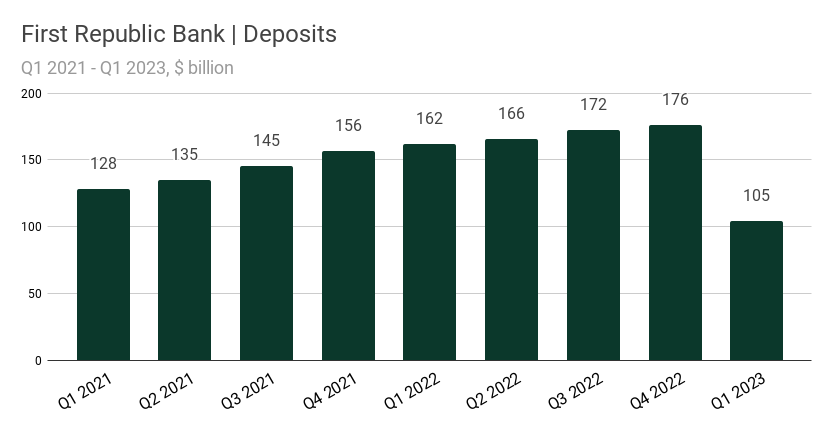

First Republic Bank Reports Larger-Than-Expected Loss of Deposits

First Republic Bank (NYSE: FRC) reported its Q1 2023 results yesterday, after the market close. The bank’s results revealed the devastating impact of the regional-banking crisis that transpired last month. Revenue was down 13.4% YoY, net income was down 32.9% YoY, and the bank reported a larger-than-expected loss of deposits. Deposits totaled $104.5 billion, down 35.5% from a year ago, and down 40.8% from the previous quarter. The deposit figure includes the $30 billion that the company received from the other U.S. banks in the middle of the crisis. The earnings release mentions that “deposit activity began to stabilize beginning the week of March 27, 2023, and [were] down only 1.7% from March 31, 2023.” First Republic Bank intends to reduce the size of its balance sheet and reliance on short-term borrowing (from the Federal Reserve), as well as lay off 20-25% of its workforce. The company’s stock was down more than 20% in the after-hours trading.

✔️ First Republic’s Strains Jar Investors Anew After Weeks of Calm✔️ First Republic Stock Falls After Earnings Show a 41% Drop in Deposits✔️ First Republic says deposits tumbled 40% to $104.5 billion in 1Q

Coinbase is Taking SEC to Court Over Rulemaking Petition

Coinbase (NASDAQ: COIN) is asking the court to force the SEC to respond to a rulemaking petition that it submitted last year. The company argues that the SEC has not provided any clear guidance on the regulatory framework for the cryptocurrency industry and is not responding to the petition “within a reasonable time”, as it is obliged to. “Coinbase is not asking the Court to instruct the agency how to respond. We are simply requesting that the Court order the SEC to respond [to the petition] at all.“ This lawsuit marks a significant step in the ongoing legal battle between cryptocurrency companies and the SEC. The agency has been increasingly aggressive in its enforcement actions against cryptocurrency companies, including Coinbase. In March, the SEC sent Coinbase a formal notice regarding the regulator's intention to take enforcement action against the company.

Chairman of the SEC, Gary Gensler. Image source: Third Way Think Tank on Flickr

✔️ Coinbase takes another formal step to seek regulatory clarity from SEC for the crypto industry✔️ Coinbase Takes Jab at SEC With Lawsuit Over Rule Petition✔️ Coinbase Asks for Court to Force SEC Response to 2022 Rulemaking Petition✔️ Coinbase sues the SEC for answer on rule specific to digital assets

Revolut’s Valuation Cut by Almost 50%

One of its key investors in London-based financial technology firm Revolut slashed the company's value by almost 50%. According to multiple reports, Schroders Plc, one of the company’s investors has written down the value of its Revolut holding, implying a valuation of $17.7 billion, down from the $33 billion valuation of the company’s latest funding round in 2021. The move comes as investors grow increasingly skeptical about the high valuations of tech companies, particularly those in the fintech sector. “Since our last funding round […] Revolut has continued to perform strongly in all its markets, has continued to hire and expand, and reported its first full year of profitability,” - wrote Revolut in a response to Bloomberg. Revolut was founded in 2015 and has quickly become one of the UK's most valuable startups, with a range of digital banking and payment services. The company has over 27 million customers across the globe and reported a first profitable year in 2021.

Image source: Revolut

✔️ Revolut’s Valuation Cut by Schroders as Fintech Funding Wanes✔️ Revolut’s place as UK’s top fintech firm at risk after Schroders writedown✔️ Revolut shareholder slashes firm’s value by nearly half as investors sour on tech

Chart of the Day

In light of the tensions between Coinbase and the SEC, I decided to take a look at the performance of Coinbase stock vs. Bitcoin in 2023. Apparently, the SEC Chairman, Gary Gensler, does not have a problem with Bitcoin (but clearly has a problem with Coinbase and other cryptocurrency exchanges). So, perhaps…Bitcoin might be a better bet on the bright future of crypto?

Chart made with Koyfin

Jobs in Fintech

Deputy Chief Regulatory Officer, Coinbase Derivatives Exchange@ CoinbaseRemote, United States

Head of Emerging Markets, Compliance@ CoinbaseRemote, EMEA

Ireland Chief Risk Officer and Senior Manager of International Enterprise Risk Management@ CoinbaseRemote, Ireland

Head of Product Engineering@ RevolutBerlin, Krakow, London, Madrid, Porto, or Remote

Head of Business Marketing@ RevolutMultiple locations or Remote

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image source: First Republic Bank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.