Hi!

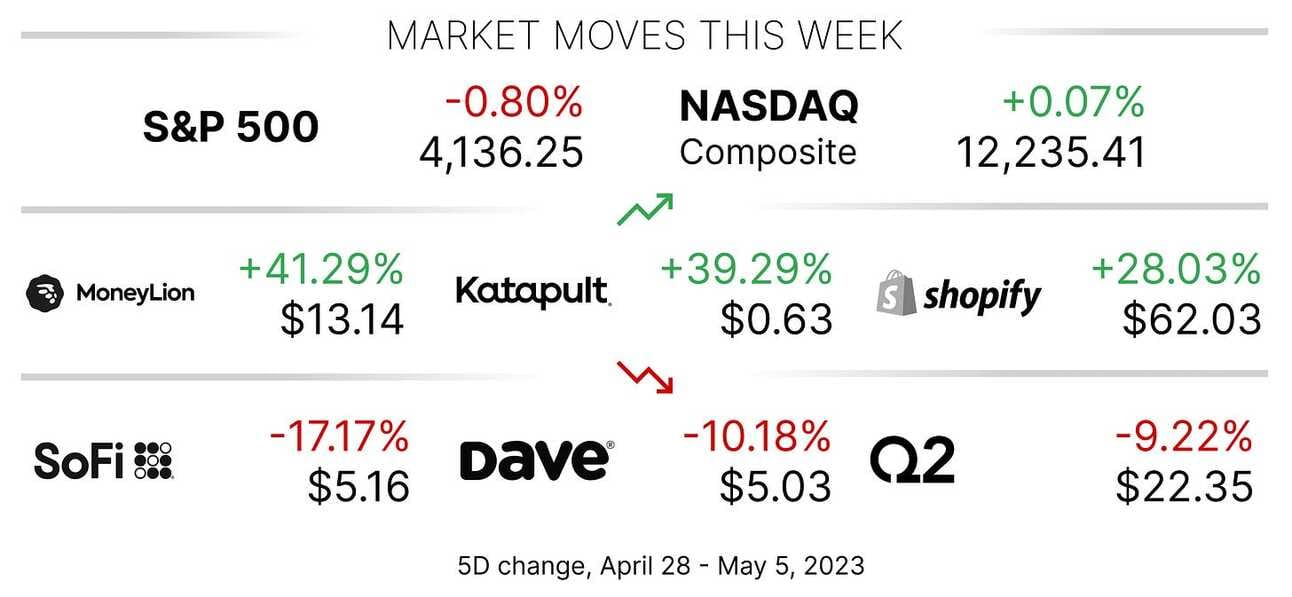

Hope you’re having a fantastic weekend! It was a busy week in the world of finance. It started with the Federal Deposit Insurance Corporation seizing and selling First Republic Bank to JPMorgan, continued with the Federal Reserve raising federal funds rate by another 25 basis points, and finished with a market rally on Friday, after the U.S. Labor Department reported that the U.S. employers added 253,000 jobs in April, way above economists’ estimate of 180,000.

The Federal Reserve and the struggling U.S. regional banks were in the spotlight this week (the problems didn’t stop with the acquisition of First Republic Bank), but Fintech companies were quite busy too:

Shopify (NYSE: ) agreed to sell its logistics business, “Shopify Fulfilment Network”,

Coinbase (NASDAQ: ) launched International Exchange, offering perpetual futures to institutional clients from “jurisdictions outside of the U.S.”

Block (NYSE: ) reported 53 million monthly transacting users and $61 billion of inflows in the quarter for its Cash App service, and

Klarna partnered with Airbnb (NASDAQ: ) to enable paying for stays over time.

Shopify to Sell Its Logistics Business

When Shopify (NYSE: ) rescheduled its earnings call, it became apparent that the company intends to make an important announcement. Thus, Shopify announced that it has entered into a definitive agreement to sell its logistics business, also known as “Shopify Fulfillment Network”, ”including the people, technology, and services related to these operations” to Flexport. As per the terms of the transaction, Shopify will receive a 13% equity stake in the company, and Flexport will become the official logistics partner for Shopify. As a result of the transaction, Shopify will lay off 20% of its workforce, which is the second round of layoffs after the company reduced its global workforce by 10% last year.

Shopify started experimenting with shipping and delivery in 2015, when the company launched Shopify Shipping, a service offering merchants discounted shipping with local postal services, such as UPS and DHL. In 2019, the company made a bigger bet on the logistics business by launching the Shopify Fulfillment Network, a network of partner-operated and fully-owned fulfillment centers across the US. Shopify then acquired a warehouse robotics company 6 River Systems for $450 million in 2019, and a fulfillment technology provider Deliverr for $2.1 billion in 2022, as well as planned to invest an additional $1 billion in the development of the fulfillment service.

Image source: Shopify Q1 2022 Earnings Call Presentation

✔️ Shopify offloads logistics business to Flexport

✔️ Shopify Announces First-Quarter 2023 Financial Results; Agrees to Sell Shopify Logistics to Flexport

✔️ Shopify to Lay Off 20% of Its Workforce as It Sells Logistics Business to Flexport

✔️ Shopify Cuts Jobs Again, Sells Most of Logistics Business to Flexport

Coinbase Launches International Exchange

Coinbase (NASDAQ: ) announced the launch of its Coinbase International Exchange, which will allow institutional users “in eligible jurisdictions outside of the US” to trade Bitcoin and Ethereum perpetual futures. A perpetual futures contract is a type of cryptocurrency derivative product that allows traders to speculate on the future price of a particular cryptocurrency asset. Unlike traditional futures contracts, perpetual futures do not have a predetermined expiry date and operate on a rolling basis, with each contract renewing automatically at regular intervals. This perpetual nature allows traders to hold positions for as long as they wish, without being required to roll over or close out their positions.

According to Coinbase, in 2021, perpetual futures accounted for almost 75% of the total cryptocurrency trading volume worldwide, resulting in exceptionally liquid markets and providing traders with greater flexibility in their trading tactics. Coinbase has not yet received regulatory approval to offer futures in the United States, so the exchange will operate under a license from the Bermuda Monetary Authority, which Coinbase received just two weeks ago. The company will not engage in proprietary trading, and the liquidity on the exchange will be provided by external market markets. The exchange will initially offer up to 5x leverage, and all trades will be settled in USDC. The company also reported its first quarter 2023 results on Thursday, posting a narrower-than-expected loss.

Image source: Coinbase

✔️ Introducing Coinbase International Exchange

✔️ Coinbase Launches International Exchange as Tensions With US Regulators Grow

✔️ Coinbase Q1 2023 Revenue Beats Estimates As Markets Rebound

✔️ Crypto Exchange Coinbase Posts Loss, but Beats Expectations

✔️ Coinbase Is Facing an ‘Existential Risk’ as SEC Reins In Crypto

Cash App Continues to Drive Block’s Growth

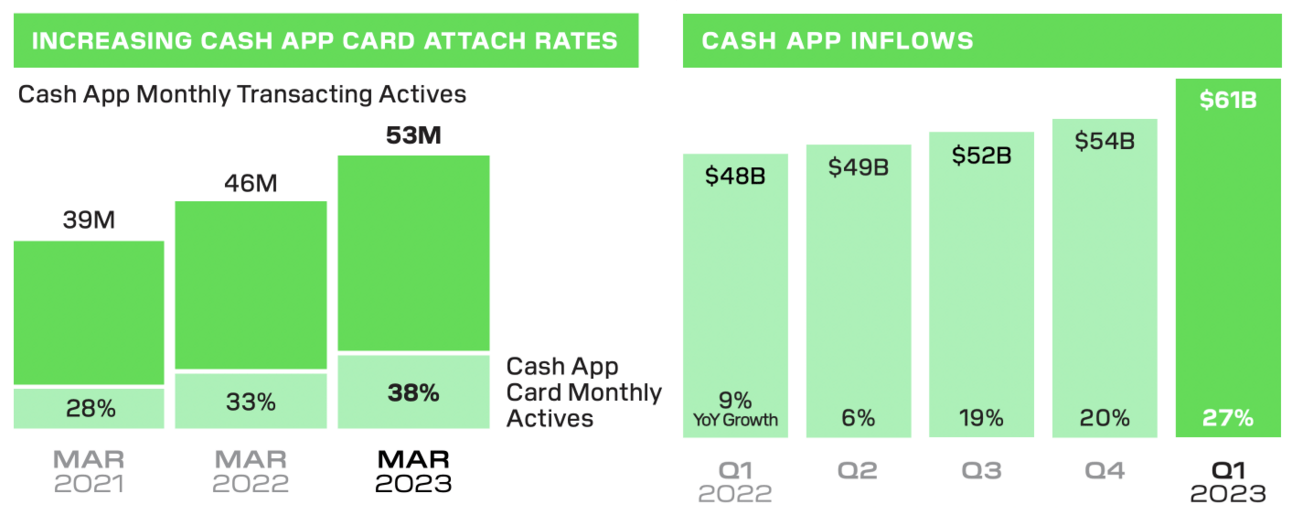

Block, Inc (NYSE: ) the parent company of Square and Cash App, reported strong first quarter 2023 results, driven by continued growth in its Cash App business. Total company’s net revenue for the quarter was $4.99 billion, up 26% YoY, and gross profit was $1.71 billion, up 32% YoY. Cash App contributed $931 million in gross profit, which represents an increase of 49% YoY, and Square contributed $770 million, which represents an increase of 16% YoY. The company reported a net loss of $17 million and an Adjusted EBITDA of $368 million. Cash App users deposited $61 billion to their Cash App accounts during the quarter, up from $48 billion a year ago. Cash App had 53 million monthly transacting users in March, up from 46 million a year ago.

Last month, Hindenburg Research, a short seller famous for its bets against the EV manufacturer Nikola, and Indian conglomerate Adani Group, published an investigation into Block. Hindenburg, which, simultaneously with the publication disclosed a short position, accused Block of inflating Cash App user growth, understating customer acquisition costs, facilitating fraudulent and criminal transactions, as well as “disregarding Anti Money Laundering rules.” Hindenburg’s research involved “dozens of interviews with former employees”, as well as listening to a lot of hip-hop music (the company even made a video compilation of Cash App mentioned in hip-hop songs, which, they argued, proves criminal usage).

Image source: Block’s Q1 2023 Shareholder Letter

✔️ Dorsey’s Block Boosts Full-Year Outlook After Jump in Use of Its Cash App

✔️ Block beats earnings expectations, shakes off short seller report

✔️ Block’s Earnings Beat Expectations, Driven by Cash App

Airbnb Partners with Klarna to Offer Paying for Stays Over Time

Airbnb (NASDAQ: ) launched a new category called "Airbnb Rooms," which allows guests to stay in a private room within a host's home. The idea is to provide affordable accommodation given the current economic environment, while also giving guests an opportunity to connect with locals and have authentic experiences. Each Airbnb Room comes with a "Host Passport," allowing guests to learn more about their host before booking. The new category includes over 1 million listings, redesigned filters, and new privacy features. Airbnb hopes that Airbnb Rooms will help more people feel comfortable staying with a host and will appeal to those looking for affordable travel options and authentic experiences.

The company is also partnering with the Swedish Buy Now Pay Later lender, Klarna, to allow guests in the United States and Canada to pay for their stays in four interest-free installments. If the booking costs more than $500, guests in the US can apply to pay for it monthly. This option will be expanded to other countries later in the year. In February, Klarna reported a 71% YoY growth in GMV in its US operations. With 34 million consumers, the US became Klarna's largest revenue market as of December 2022. This growth has been fueled by high demand for the Klarna App, which was recently named Forbes' Best Overall BNPL App of 2023. The app currently boasts over 8 million monthly active users and 30 million downloads.

Image source: Klarna on Twitter

✔️ Airbnb to allow guests to pay in four parts, brings in more price transparency

✔️ Airbnb launches new Rooms category with more details about hosts

✔️ Introducing Airbnb Rooms, an all-new take on the original Airbnb

✔️ Stripe, a longtime partner of Lyft, signs a big deal with UberThe payments giant Stripe announced an extension of its “strategic payments partnership” with the ride-hailing company, Uber (NYSE: ). Stripe will now process payments for Uber Rides and Uber Eats services in the United States, Canada, the United Kingdom, France, Malta, Mexico, Brazil, Australia, and Japan.

✔️ SoFi Remains Optimistic Profitability Is Possible by End of YearFintech lender SoFI (NASDAQ: ) reported its first quarter 2023 results and reaffirmed its plans to reach GAAP profitability by the end of the year. The company reported a Net Loss of $34.4 million and an Adjusted EBITDA of $75.7 million for the quarter.

✔️ Global Payments Announces CEO Succession PlanJeff Sloan is stepping down as the Chief Executive Officer of the payments processor Global Payments (NYSE: ), effective June 1, 2023. Sloan will be succeeded by Cameron M. Bready, currently President and Chief Operating Officer.

✔️ MercadoLibre Profit Jumps, Filling Vacuum Left by AmericanasMercadoLibre (NASDAQ: ), the LatAm e-commerce giant, posted better-than-expected results for the first quarter of 2023. Net income more than tripled from a year ago, as the company's fintech arm continued to deliver double-digit growth.

✔️ Toast Brings Digital Restaurant Technology Platform to the UKToast (NYSE: ), a provider of the all-in-one digital platform for restaurants, announced its expansion to the UK. This is the third new market for the company, as it launched operations in Canada and Ireland earlier in the year.

That’s it for today! Thank you for reading and don’t forget to subscribe if you haven’t done so yet 👇🏻

Cover image source: Shopify

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.