This Week in the Markets

The U.S. stock markets were closed on Monday making the first trading week of the year a bit shorter. On Wednesday, the Federal Reserve released minutes of the December 13-14, 2022 FOMC meeting. If you recall, the FOMC raised the fed funds rate by 50 basis points to 4.25 - 4.50% at that meeting. The minutes showed central bankers’ commitment to bringing inflation down to the target benchmark of 2%, as well as their frustration with investors that are expecting rate cuts in 2023.

On Friday, the Department of Labor reported that the U.S. economy added 223,000 jobs in December (which, despite being the lowest reading in 2022, was still above the estimated level of 200,000 new jobs) and that the employment rate fell to 3.5% (below the expected 3.7%). The same report showed that the average hourly earnings increased 0.3% MoM (vs. expected 0.4%) and 4.6% YoY (vs. expected 5.0%). The markets rallied on Friday finishing the week in the green.

During the week, shares of the non-bank mortgage lender loanDepot (NYSE: ) advanced 26.38%, while shares of the non-bank consumer lender Pagaya (NASDAQ: ) declined 22.56% on no company-specific news.

✔️ Fed Affirms Inflation Resolve, Pushes Back Against Rate-Cut Bets✔️ Fed officials see higher rates for ‘some time’ ahead✔️ US Hiring Solid While Wages Cool, Giving Fed Room to Slow Hikes✔️ Nonfarm payrolls rose 223,000 in December, as jobs market tops expectations✔️ US Labor Data Surprise as Job Market Runs Hotter Than Forecast✔️ Stocks stage first big rally of 2023 as hope grows that inflation will ease

Crypto Bank Silvergate Experiences a Bank Run

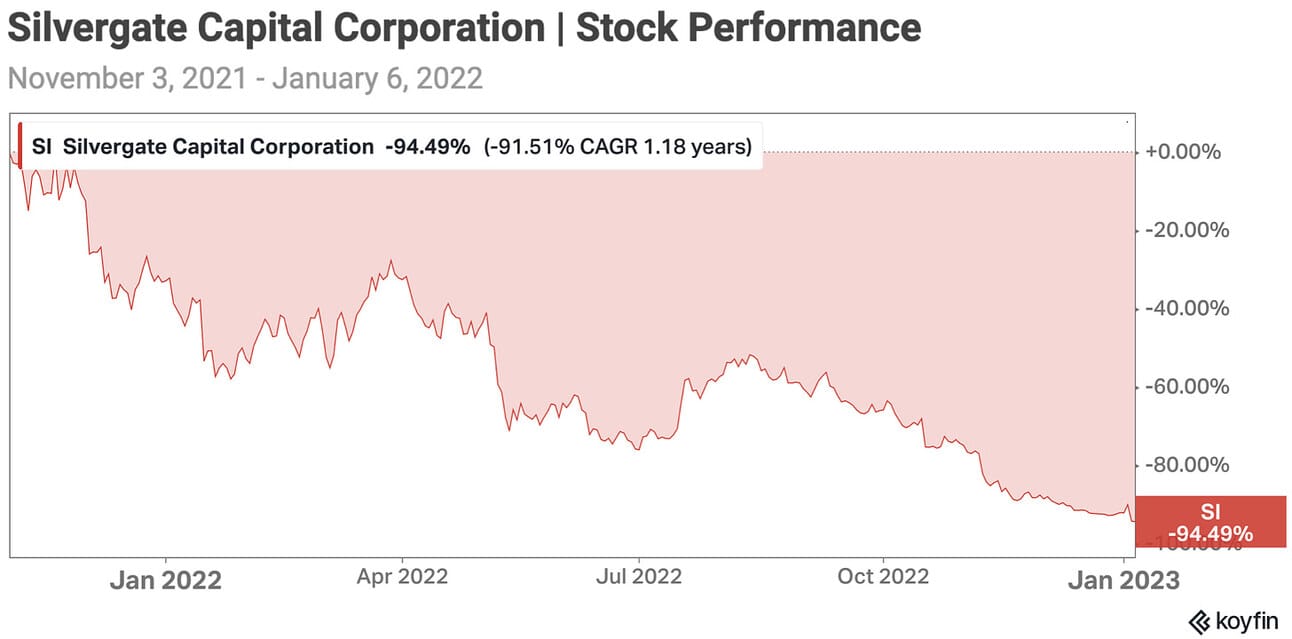

Silvergate Capital Corporation (NYSE: ), also known as Silvergate Bank, a bank that focuses on serving the cryptocurrency industry, reported an $8.1 billion decline in deposits during Q4 2022, from $11.9 billion on September 30, 2022 to $3.8 billion on December 31, 2022. The bank had to fire-sell $5.2 billion worth of securities to meet withdrawal demands, which lead to a $718 million loss (twice as much as the bank earned in the last 7 years). Silvergate became another victim of a roller coaster year in crypto. The company’s share price declined more than 40% following the announcement and is down 94.49% from its all-time high on November 3, 2021 (see the chart below).

Silvergate's history dates back to 1988; however, in 2014 the bank pivoted to serving the cryptocurrency industry, which fueled almost a 10-year growth period. The company went on to create the "Silvergate Exchange Network" (SEN), which allowed institutional and private investors to “send U.S. dollars and euros 24 hours a day, 7 days a week, 365 days a year” between their Silvergate accounts and their accounts with cryptocurrency exchanges. SEN fueled growth in deposits, which peaked at $14.1 billion in Q1 2022. The bank boasted all major players among their clients, including Coinbase, Binance, FTX, Kraken, and Gemini in its presentation in November 2022.

✔️ Silvergate Raced to Cover $8.1 Billion in Withdrawals During Crypto Meltdown✔️ Bank Run at Crypto Lender Silvergate Capital Wipes Out 7 Years of Profits✔️ Silvergate’s ‘Worst-Case Scenario’ Fuels Wider Concern on Crypto✔️ Crypto Bank Silvergate Shares Plunge 46% After $8.1B Withdrawal in Q4✔️ Silvergate Announces Select Preliminary Fourth Quarter 2022 Financial Metrics

Shopify Launches New Product for Large Retailers

Shopify launched Commerce Components, a product that allows enterprise merchants to integrate parts (“components”) of the Shopify e-commerce platform, such as checkout, payments, or fraud protection, into their own stack. Toymaker Mattel became the first customer of the new product, and Shopify aims to onboard its other enterprise clients, such as Glossier, JB Hi-Fi, Coty, Steve Madden, Spanx, and Staples. “Commerce Components by Shopify opens our infrastructure so enterprise retailers don’t have to waste time, engineering power, and money building critical foundations Shopify has already perfected,” commented Harley Finkelstein, President of Shopify, on the launch.

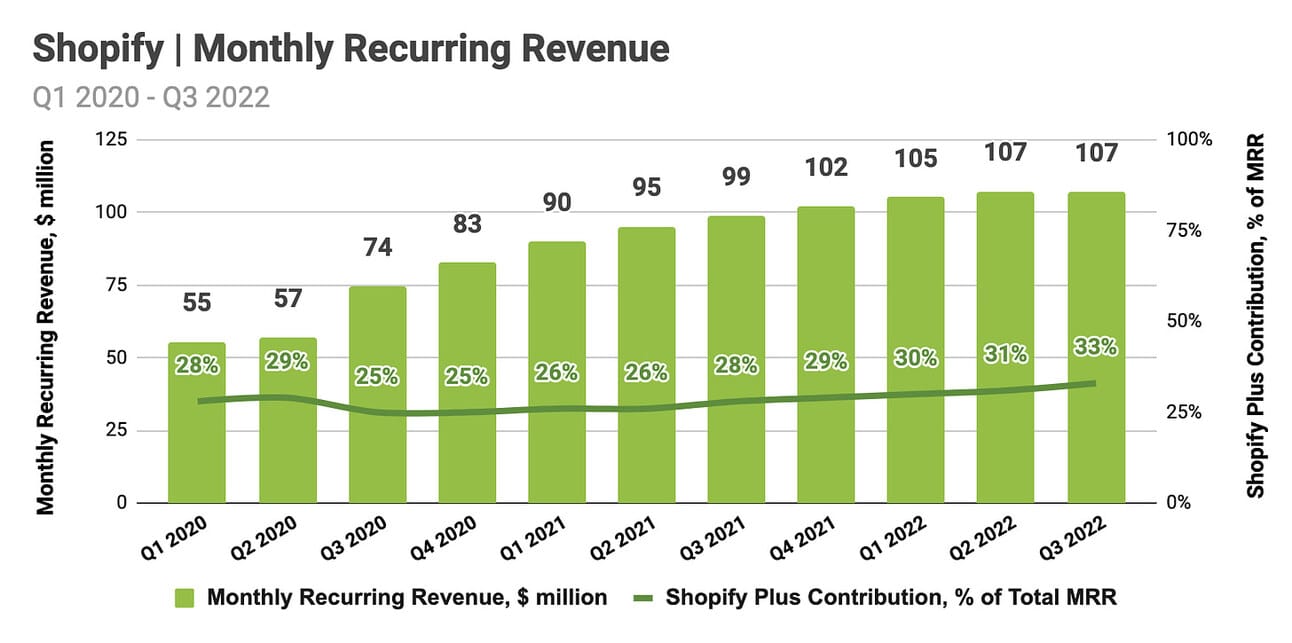

“Commerce Components” is not the first enterprise offering of the company. Thus, in 2014, Shopify, which was mostly known for helping small businesses and individual entrepreneur launch their online stores, introduced Shopify Plus, a product targeted at medium-sized businesses and enterprise retailers. Shopify Plus customers get dedicated account management, negotiated rates for services, priority support, and increased API calls. In Q3 2022, Shopify Plus contributed 33% of Monthly Recurring Revenue. The company does not disclose Shopify Plus's contribution to Gross Merchandise Volume or Gross Payment Volume, limiting disclosures to statements like “GMV growth [ of Shopify Plus merchants ] continues to outpace overall GMV growth.”

✔️ Shopify launches new subscription product to lure big retail clients✔️ Shopify releases enterprise e-commerce system✔️ Introducing Commerce Components by Shopify✔️ Shopify Merchants Can Now Design, Mint and Sell Avalanche NFTs✔️ Shopify Tells Employees to Just Say No to Meetings

The U.S. Government Seizes Sam Bankman-Fried’s Stake in Robinhood

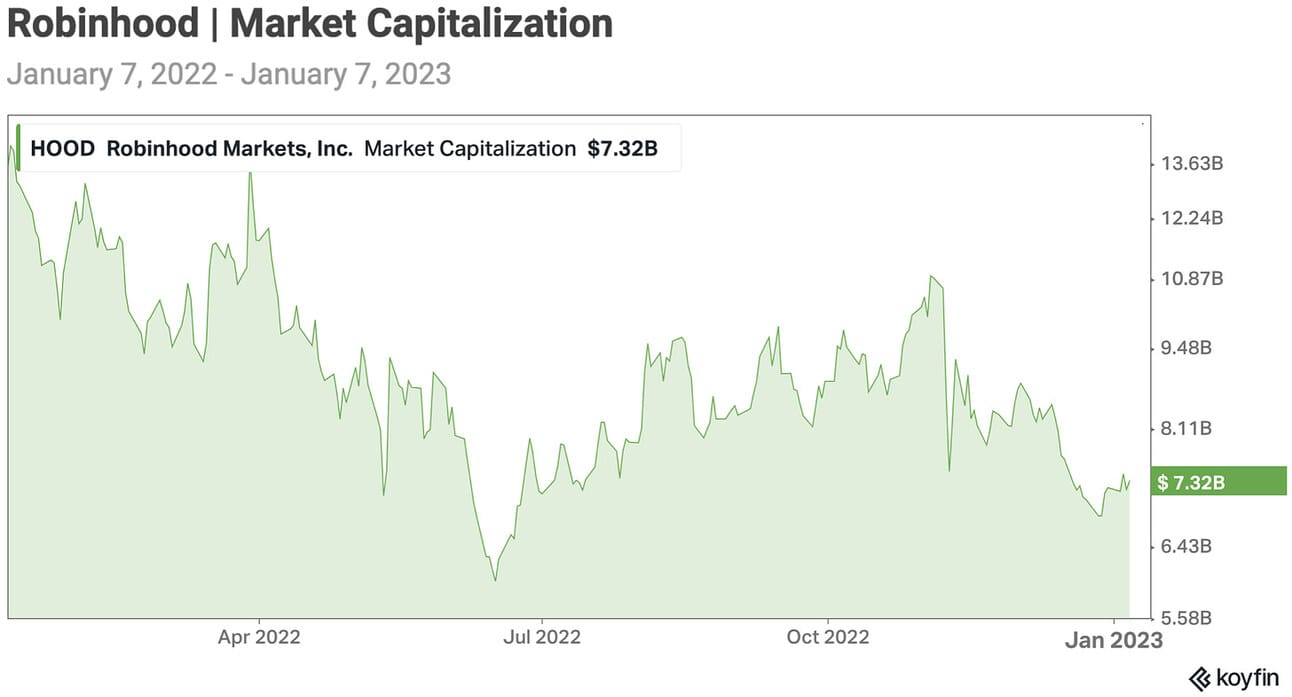

The drama around Sam Bankman-Fried’s stake in Robinhood (NASDAQ: ) continues. As a reminder, back in May 2022, the founder of now-bankrupt cryptocurrency exchange FTX bought 56.3 million shares in Robinhood via a special-purpose vehicle, Emergent Fidelity Technologies Ltd. I wrote earlier that the shares became the subject of claims by also-bankrupt crypto lender BlockFi and liquidators of FTX; however, the story didn’t end there. Thus, during the last week of 2022, the news surfaced that Sam Bankman-Fried borrowed money from his hedge fund Alameda to acquire that stake. Alameda then pledged those shares as collateral to get a loan from BlockFi (hence the claim).

This week the U.S. Department of Justice moved to seize the stake, which is now worth around $464 million, to protect it from the claims of both BlockFi and FTX. The DOJ lawyer said that the destiny of the shares will be determined in a court hearing rather than in the course of bankruptcy proceedings. In the meantime, Lawyers of Sam Bankman-Fried filed a claim with a Delaware court arguing that the shares are not part of the bankruptcy estate and should be returned to Bankman-Fried. “Mr. Bankman-Fried has not been found criminally or civilly liable for fraud, and it is improper for the FTX Debtors to ask the Court to simply assume that everything Mr. Bankman-Fried ever touched is presumptively fraudulent,” stated the filing.

✔️ Alameda Lent Sam Bankman-Fried $546 Million for Robinhood Stake✔️ U.S. DOJ to seize $465 million of Robinhood shares tied to Bankman-Fried✔️ FTX-Linked Robinhood Stake Worth $460 Million Is Seized by US✔️ Bankman-Fried Wants $450 Million Robinhood Stake for Legal Bills✔️ Troubles at Sam Bankman-Fried’s Alameda Began Well Before Crypto Crash

In Other News

✔️ Big Banks Predict Recession, Fed Pivot in 2023✔️ Fintech Stocks Did Worse Than Fin or Tech in 2022✔️ Coinbase Has Been on a Wild Ride This Week Thanks to a ‘Short Squeeze’✔️ Coinbase to Pay $100 Million in Settlement With New York Regulator✔️ Cowen Downgrades Coinbase Stock, Citing Trading Volume Declines✔️ Crypto Lender Genesis Considers Bankruptcy, Lays Off 30% of Staff✔️ What’s Behind Fidelity’s Bitcoin Plans? It May Be Fear of Missing Out✔️ Apple Has Been a Problem for PayPal. This Analyst Says That’s Changing✔️ Truist upgrades PayPal to buy from hold✔️ How PayPal and Block Stock Could Be Comeback Stories✔️ Inflation and rates will be macro tailwinds for Block, says Baird analyst David Koning✔️ Block stock rises after Baird upgrades shares to Outperform✔️ Investors press FIS, Fiserv for divestitures✔️ Credit-Card Rates Poised to Hit a Four-Decade High This Year✔️ LendingClub Named Best Personal Loan for Fair Credit By NerdWallet✔️ Goldman Sachs' consumer banking unit head steps down✔️ Bank of America, JPMorgan Stocks Are Downgraded✔️ FLEETCOR Completes Cross-Border Payments Acquisition✔️ Dave Inc. Announces Reverse Stock Split Effective✔️ Remitly Completes Acquisition of Rewire

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.