This Week in the Markets

On Wednesday, the U.S. Department of Labor reported that the Producer Price Index (PPI) fell 0.5% in December 2022 (vs. November 2022, on a seasonally adjusted basis). The reading surprised the economists, who expected a 0.1% decline, and was the biggest month-over-month decline since April 2020. PPI advanced 6.2% compared to December 2021. The U.S. Department of Commerce reported that retail sales declined 1.1% in December 2022 (vs. November 2022, on a seasonally adjusted basis), which exceeded the forecast of a 1.0% decline. Retail sales increased by 6.0% compared to December 2021, which was below the inflation of 6.5%.

Looks like the markets are finally treating bad news for the economy, as bad news for the market, so S&P 500 and the Dow Jones Industrial Average finished the week in the red, while Nasdaq Composite posted a weekly gain, driven by a rally in the technology and communication sectors.

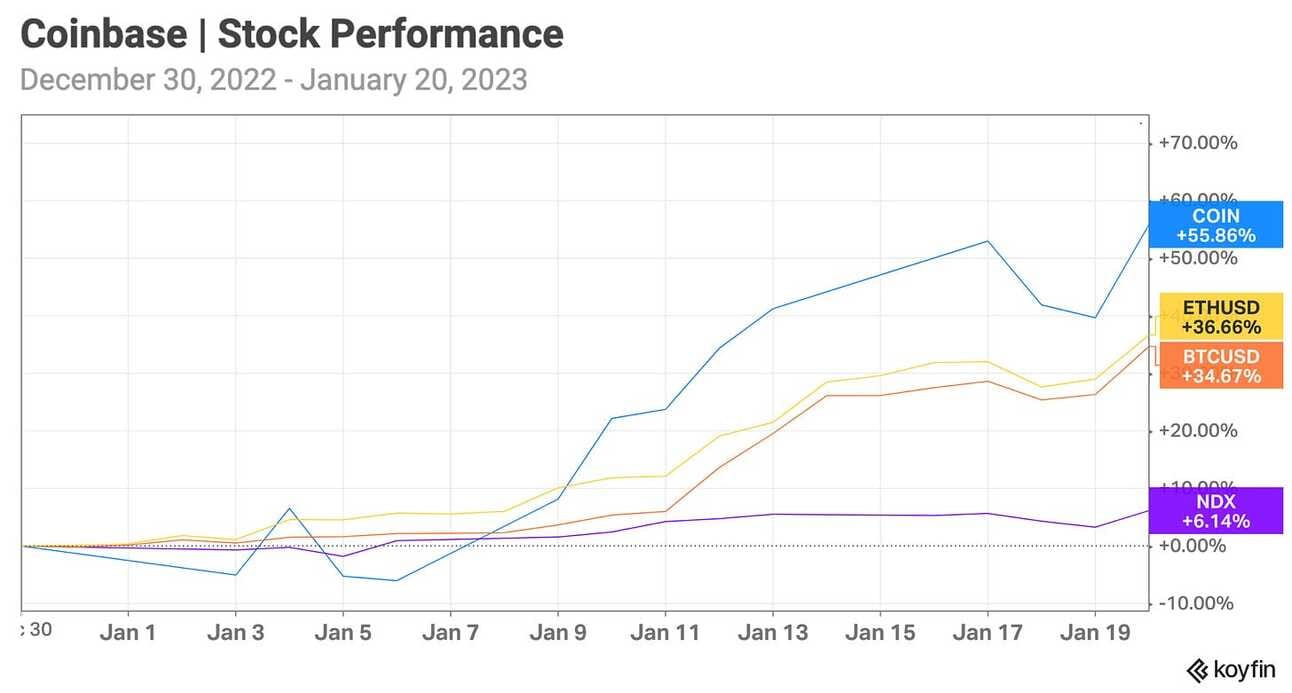

🟢 This week’s biggest gainers are the same companies that lead the Fintech recovery (or bear market rally) this year: thus, shares of Coinbase (NASDAQ: ) are up +55.86% YTD, shares of Paysafe (NYSE: ) are up +53.56% YTD, and shares of Affirm (NASDAQ: ) are up +47.88% YTD.

🔴 Shares of the consumer lender Pagaya (NASDAQ: ) fell 20.97% this week. The company announced a 20% workforce reduction and reiterated its full-year 2022 guidance. Shares of Blend (NYSE: ), a software vendor servicing mortgage lenders, fell 19.59%, most likely on the news of a 25.2% drop in mortgage applications in December 2022 reported by the Mortgage Bankers Association.

Next week, LendingClub (NYSE: ) will report its Q4 2022 results, kicking off the earnings season for Fintech companies. The company has already pre-announced expected results reporting $2.5 billion in originations, $260-263 million in revenue, and $21 to $24 million in Net Income, but it will be interesting to hear the management's view on 2023.

✔️ Wholesale prices fell 0.5% in December, much more than expected✔️ US Producer Price Index Declines by Most Since Start of Pandemic✔️ U.S. Retail Sales Fell 1.1% in December✔️ U.S. weekly jobless claims unexpectedly fall✔️ Top Fed Officials Make Case for High Rates to Cool Inflation

Robinhood Launches a Media Company to Build on the Success of its Newsletter, Robinhood Snacks

Robinhood (NASDAQ: ) is launching a media company Sherwood Media, LLC. Sherwood Media aims to “be a home for news and information about the markets, economics, business, technology, and the culture of money” and will build on the success of Robinhood's daily newsletter, Robinhood Snacks, which boasts tens of millions of subscribers. The company will be led by Joshua Topolsky, founder and former Editor-in-chief of the technology news network The Verge, co-creator of its parent company Vox Media, and former Chief Digital Content Officer at Bloomberg. Sherwood Media will launch a “suite of new editorial offerings throughout 2023, complementing Snacks with more always-on news updates and analysis,” said Robinhood in the press release.

Image source: Robinhood Snacks

Robinhood gets a lot of criticism for the use of payment for order flow, gamification of stock trading, its share price performance, and the losses that the company incurred in 2022. Some even question viability of the company’s business model. However, it is a lot of fun to follow Robinhood, as the company keeps innovating and shipping new products. Over the year alone the company launched and rolled out to all eligible customers Cash Card (March 2022), extended market hours (March 2022), Crypto Wallet (April 2022), fully paid stock lending (May 2022), interest on uninvested brokerage cash (August 2022), advanced charts (August 2022), Web3 Wallet (September 2022), and retirement accounts (December 2022). What has your brokerage launched recently?

✔️ Robinhood Announces Sherwood Media, LLC✔️ Robinhood launching new media arm led by Joshua Topolsky✔️ Robinhood launches Sherwood Media with Vox co-creator at helm✔️ Robinhood must face customers' lawsuit alleging it hid trading costs✔️ Robinhood Rolls Out Its MetaMask Wallet Competitor to 1 Million Users✔️ The Wait(list) is Over - Robinhood Retirement is Now Available to All Customers

Coinbase Stock Stages a Rally, Advances Over 50% in the First Three Weeks of the Year

Coinbase (NASDAQ: ) stock staged a rally during the first three weeks of 2023 advancing 55.86%. During the same period, Nasdaq Composite advanced 6.14%, Bitcoin advanced 34.67% and Ether advanced 36.66%. The company kicked off the year by announcing a new round of layoffs, which will impact 20% of its workforce. The layoffs will help the company to contain losses (Coinbase expects that the layoffs will reduce its Q1 2023 operating expenses by 25%) and stay within the self-imposed guardrails of $500 million in adjusted losses. Nevertheless, the contagion of FTX collapse keeps spreading (i.e. this week, another crypto lender filed for bankruptcy), so the company’s revenue prospects are still unclear.

Coinbase shares are still down 84.57% from their all-time high on November 9, 2021, and Jamie Dimon, the CEO of JPMorgan Chase and a vocal crypto critic, still thinks that Bitcoin is a “hyped-up fraud”. However, if cryptocurrencies and blockchain technology are here to stay, I would expect Coinbase to be a key player in this industry. The company had $5 billion in cash, cash equivalents, and stablecoins at the end of Q3 2022, so it has sufficient financial resources to survive through this crypto winter. In the meantime, the company keeps shipping new products for its retail customers and developers, as well as onboarding corporate customers to its custody services.

✔️ Coinbase Leaders Sharply Slow Their Stock Sales✔️ Coinbase Stock Is Soaring. It Might Be a Haven in a Wild Crypto Market✔️ Coinbase, Marathon Digital Lead 2023 Resurgence in Crypto Stocks✔️ Coinbase to slash 20% of workforce in second major round of job cuts✔️ Moody’s downgrades Coinbase, says outlook is stable✔️ Crypto exchange Coinbase to halt Japan operations

Upstart Introduces Financing Capabilities to its Auto Retail Platform, Aims for a Rollout in Q2 2023

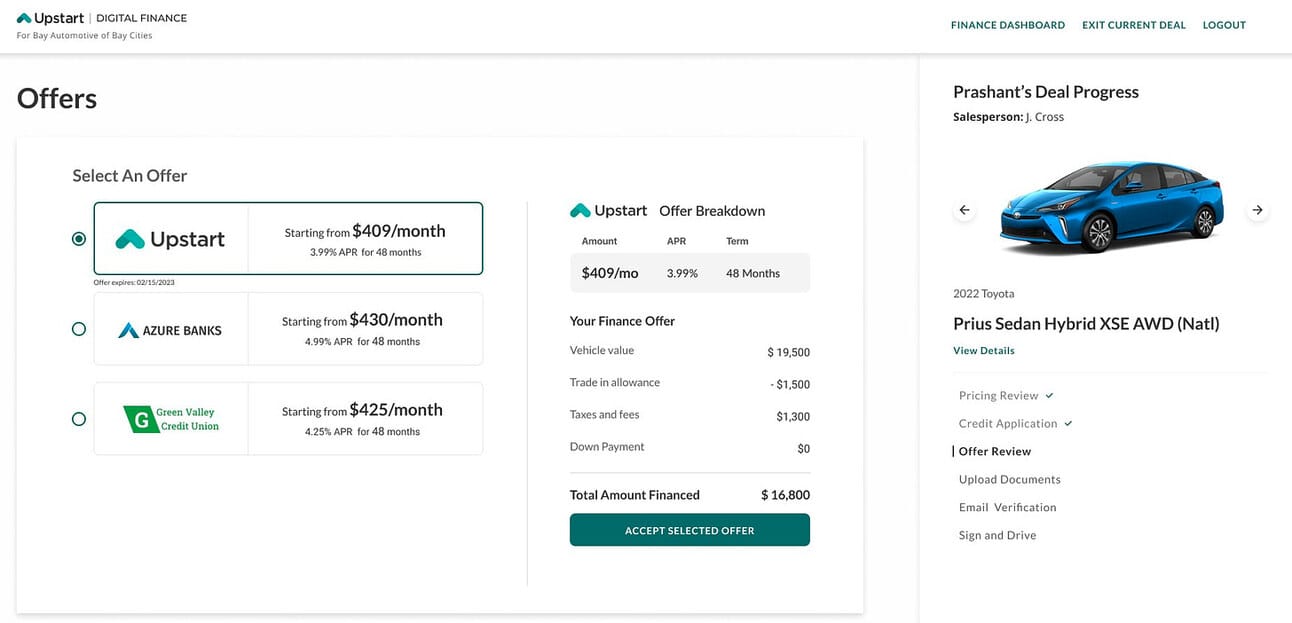

In early 2021, Upstart, which was primarily known for its AI-powered personal loans platform, acquired a provider of automotive retail software Prodigy Software. Prodigy’s solution, which was renamed Upstart Auto Retail after the acquisition, allows car dealerships to digitize buying experience for their customers (think of tablets in the showroom or online stores). The plan was to integrate Prodigy’s software with Upstart’s lending capabilities to give car dealerships an end-to-end solution. For Upstart, this offered an opportunity to enter the auto loans category, which represents a much larger market than personal loans (outstanding auto loan balance in the U.S. was $1.52 trillion at the end of Q3 2022).

Image source: Upstart

At the time of the acquisition, Upstart didn’t know much about auto loans. Thus, the company spent the last two years working with its pilot customers, issuing limited volumes of auto-loans, monitoring their performance, and fine-tuning the credit models (i.e. in Q3 2022 auto loans represented just 3.2% of the total origination volume, or $57 million). This week, Upstart announced the plan to roll out the “Digital Finance” module to its Auto Retail platform, which “enables a frictionless signing and contracting process, with automated verification, more loan approvals, and next-day funding powered by Upstart’s AI.” This launch would finally “close the loop” by adding Upstart loans to the Auto Retail platform. The company aims for a national rollout in Q2 2023.

✔️ Upstart Introduces Digital Finance and Online Sales Applications✔️ Upstart Offers Tools to Promote ‘Omnichannel Car Buying’✔️ Upstart: National rollout of AI auto loans to start in Q2✔️ Upstart Auto Retail Named Fastest Growing Retail Software for Auto Dealerships✔️ Upstart Launches New Mobile-First Auto Retail Online Platform

In Other News

✔️ Affirm to Announce Second Quarter Fiscal Year 2023 Results on February 8, 2023✔️ Upstart to Report Fourth Quarter and Full Year 2022 Earnings on February 14, 2023✔️ Payoneer Announces CFO Transition and Provides Update on 2022 Results✔️ Nubank Secures $150M Credit Line With Second Loan Since April✔️ Silvergate Capital reports net loss of $1 billion for the fourth quarter✔️ After Silvergate and Signature Earnings, the Worst Might Be Over for Crypto Banks✔️ Crypto Lender Genesis Files for Bankruptcy✔️ Ex-FTX US President Harrison Taps Coinbase, Circle for New Crypto Firm✔️ Feds seize almost $700 million of FTX assets in Sam Bankman-Fried criminal case✔️ Lightspeed Commerce Streamlines Operations✔️ Fintech Pagaya to lay off 20% of employees✔️ Capital One Cuts More Than 1,100 Tech Jobs✔️ Inter&Co Unveils Long-Term Growth Targets✔️ Schwab Reports Record Full-year Earnings Per Share✔️ Charles Schwab Stock Gets a Double Downgrade. Blame Interest Rates✔️ Goldman Sachs posts its worst earnings miss in a decade✔️ Morgan Stanley shares jump nearly 6% as bank’s earnings top estimates✔️ Goldman and Morgan Stanley Fortunes Split as Strategies Diverge✔️ Goldman Investors Wanted Hope. The CEO Gave Caution✔️ Federal Reserve Probes Goldman’s Consumer Business✔️ Marqeta Announces New Web Push Provisioning Product✔️ PayPal warns 35,000 customers of exposure following credential stuffing attack✔️ Paymentus Expands Instant Payment Network® with Cash Bill Pay✔️ Brazil antitrust agency to investigate MercadoLibre complaint against Apple

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.