This Week in the Markets

In an interview on Tuesday, the U.S. Federal Reserve Chairman, Jerome Powell, acknowledged that the inflation started cooling down, but reiterated the intention to keep the interest rates elevated into 2024. “If we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in,” commented the Chairman. It looks like investors started questioning their bet on the Federal Reserve cutting rates in 2023, so S&P 500 and Nasdaq posted their worst week since December 2022.

🔴 Affirm (NASDAQ: ): shares of the Buy Now Pay Later lender declined 31.02% after the company reported Q4 2022 (Fiscal Year Q2 2023) results missing on volume and gross profit guidance. The company also announced laying off 19% of its workforce to contain mounting losses (more on that below).

🔴 Coinbase (NASDAQ: ): shares of the cryptocurrency exchange declined 23.5%, as apparently, the SEC is staging a crackdown on the staking service, which is the company’s key bet on diversifying its revenue away from trading fees. Kraken will shut down its staking service in the U.S. following a $30 million fine.

Five Fintech companies will report their Q4 2022 results next week: Nubank (NYSE: ) and Upstart (NASDAQ: ) on Tuesday (February 14), Shopify (NYSE: ) and Pagaya (NASDAQ: ) on Wednesday (February 15), and Toast (NYSE: ) on Thursday (February 16).

Recommended reading material before the upcoming earnings:

Adyen Reports H2 2022 Results, Share Price Plummets on Increased Hiring

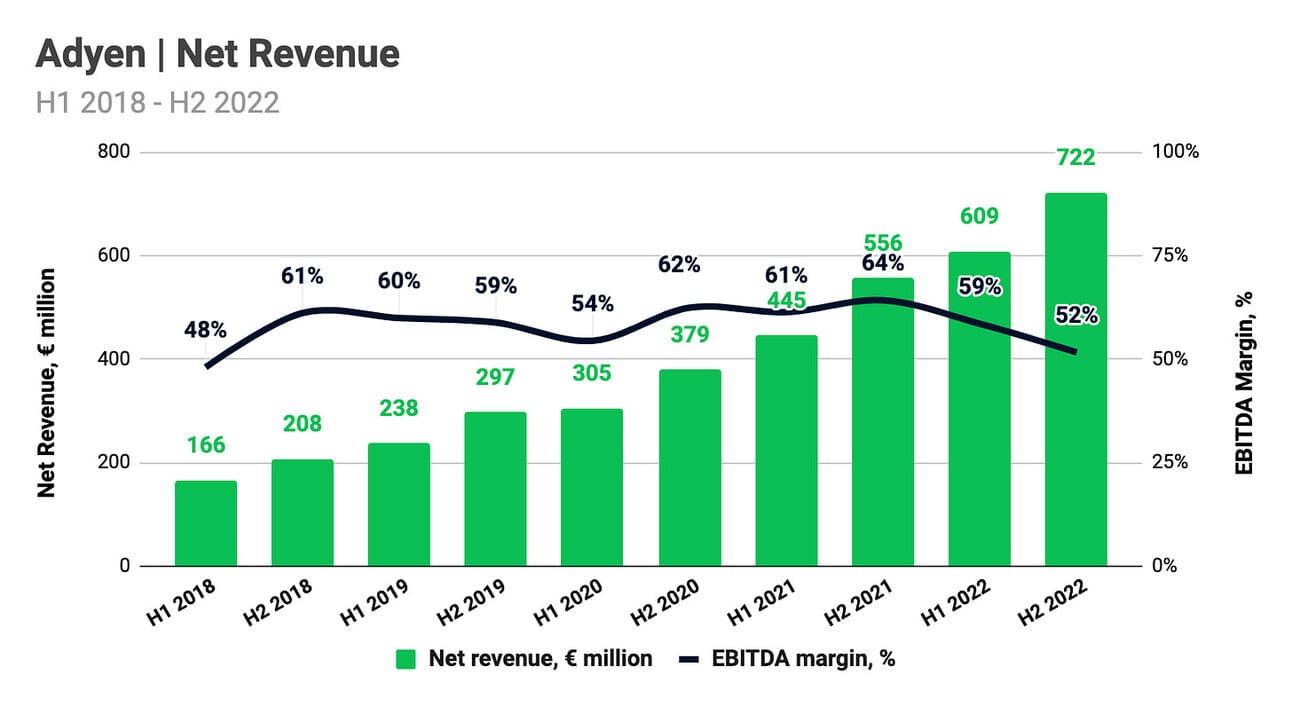

Adyen (AMS: ADYEN), the European payments giant, reported its H2 2022 results on Wednesday (the company reports its results twice a year). Processed volume grew 40.6% YoY to €421.7 billion, net revenue grew 29.7% YoY to €721.7 million, and EBITDA grew 4.1% YoY to €372.0 million. However, the shares of the company plummeted more than 15% following the report, as the company missed analysts’ estimates for EBITDA margin on increased hiring. The company’s CEO, Pieter van der Does, commented that the company is using the opportunity to hire talent and staff its numerous growth initiatives, but plans to slow the hiring pace in 2024 and return to EBITDA margin “levels above 65% in the long term.”

✔️ Adyen H2 2022 Shareholder Letter✔️ Adyen Plunges After Margin Miss as Hiring Push Defies Rivals✔️ Hiring spree dents profits at payments group Adyen

PayPal Reports Further Slowdown in Payments Volume Growth, Announces CEO Retirement

PayPal (NASDAQ: ) reported its Q4 2022 on Thursday. Total Payment Volume (TPV) grew 5.3% YoY to $357.4 billion, revenue grew 6.7% YoY to $7.38 billion, and GAAP operating income rose 18.5% YoY to $1.24 billion. PayPal progressed well on its commitment to improving operating efficiency, which was reflected in increasing operating margin; however, both TPV and revenue growth continued to slow down, reaching their lowers levels in the company’s recent history. The company’s management refrained from giving the full year 2023 revenue guidance but guided for a 7.5% revenue growth in Q1 2023. PayPal also announced that its CEO and President, Dan Schulman, will retire at the end of the year.

✔️ PayPal Says Volume Growth Slowed; CEO Schulman to Retire✔️ PayPal's spending warning casts pall over upbeat forecast✔️ PayPal Needs to Show It Can Play Defense and Offense✔️ PayPal CEO Dan Schulman to Retire✔️ PayPal Stock Is Downgraded as Payments Market Changes

Robinhood Posts Another Quarter of Adjusted EBITDA growth, Aims to Launch in the UK in 2023

Robinhood (NASDAQ: ) reported its Q4 2022 results on Wednesday. Revenue increased 4.7% YoY to $380 million and total operating expenses declined 31.8% YoY to $534 million, resulting in a Net Loss of $166 million and Adjusted EBITDA of $82 million. Robinhood returned to profitability on an Adjusted EBITDA basis in Q3 2022 after executing two rounds of layoffs and implementing other cost optimization measures. The company’s management said on the earnings call that setting a timeline for GAAP profitability might be challenging given the backdrop in trading volumes. The company also announced the intention to launch brokerage services in the UK by year-end, as well as the board’s authorization to buy back shares previously owned by FTX founder, Sam Bankman-Fried.

✔️ Robinhood Earnings Have a Lot to Like. But Not If You Own Coinbase Stock✔️ Robinhood’s monthly active users, EBITDA readings ’look very strong’✔️ Robinhood Will Try to Buy Back Sam Bankman-Fried’s Shares✔️ Robinhood Hits Back at SEC, Warns of Threat to Zero-Commission Trading✔️ Robinhood Needs More Arrows to Fire✔️ How a Trading Error Cost Robinhood $57 Million

Affirm Misses Its Own Q4 2022 Guidance, Lays Off 19% of Its Workforce

Shares of the BNPL lender Affirm (NASDAQ: ) plummeted after the company reported its Q4 2022 (Fiscal Year Q2 2023) results. Gross Merchandise Volume (GMV) grew 27.9% YoY to $5.7 billion and revenue rose 10.7% YoY to $399.6 million, but the Revenue Less Transaction Costs (RLTC), the company’s measure of gross profitability, declined 21.4% YoY to $144.2 million. The company missed its own gross profitability (RLTC) guidance, reporting a further increase in the Operating Loss to $359.5 million, compared to an Operating Loss of $196.2 million in Q4 2022 (FY Q2 2022). Affirm announced layoffs impacting 19% of its workforce to address weakening fundamentals.

✔️ Affirm cuts 19% of workforce; shares tank on earnings miss✔️ Affirm Slashes 19% of Jobs After Earnings Miss✔️ Affirm Cuts 500 Employees, 19% of Its Workforce✔️ Affirm’s Big Problem Is Buying Now, Not Paying Later

In Other News

✔️ Coinbase CEO Decries Rumors of Possible US SEC Ban on Crypto Staking✔️ PayPal Pauses Stablecoin Work Amid Regulatory Scrutiny of Crypto✔️ Shopify Bulks Up Online Fulfillment Logistics Services✔️ Toast Teams Up with Google to Launch a New Ordering Channel✔️ Buy Toast Stock. It’s More Than Just Restaurant Payments✔️ Merchants frustrated with fees, tech issues✔️ Apple Expands Testing of ‘Buy Now, Pay Later’ Service to Retail Employees✔️ Balances Are on the Rise - So Who Is Taking on More Credit Card Debt?✔️ Even well-funded fintech companies are laying off workers✔️ Inter&Co Acquires YellowFi to Expand its Product Offering in the US✔️ FLEETCOR Reports Fourth Quarter and Full Year 2022 Financial Results✔️ Paymentus to Report Fourth Quarter 2022 Earnings Results on February 23, 2023✔️ Payments giant FIS prepares to break up-sources✔️ Global Payments sells gaming unit for $415M

Cover image: Photo by Clay Banks on Unsplash

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.